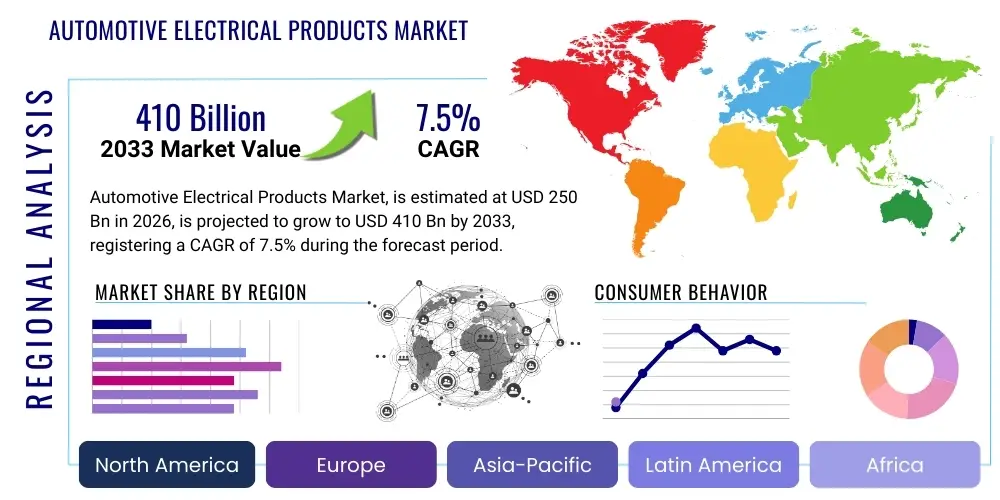

Automotive Electrical Products Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431505 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Automotive Electrical Products Market Size

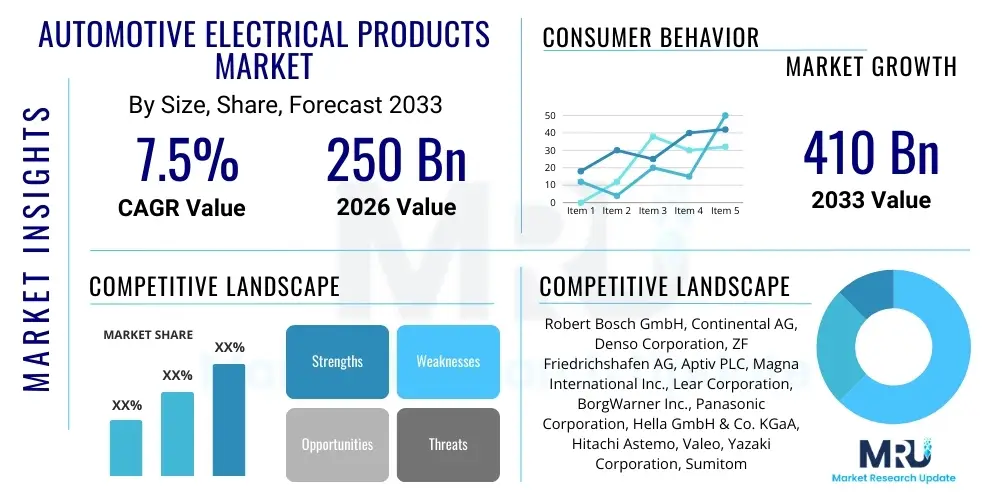

The Automotive Electrical Products Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 250 Billion in 2026 and is projected to reach USD 410 Billion by the end of the forecast period in 2033. This substantial growth is fundamentally driven by the accelerated global shift towards vehicle electrification and the increasing implementation of advanced safety and connectivity systems, which require complex electronic control units (ECUs), sophisticated sensors, and intricate wiring harnesses. Furthermore, the persistent demand for enhanced vehicle performance, fuel efficiency improvements, and rigorous emission standards imposed by international regulatory bodies necessitate the integration of high-performance electrical systems across all vehicle segments.

Automotive Electrical Products Market introduction

The Automotive Electrical Products Market encompasses a wide range of essential components and systems crucial for the operational functionality, safety, and comfort of modern vehicles. These products include core power generation and storage components such as alternators, starters, and batteries, alongside sophisticated control and signaling units like sensors, relays, switches, wiring harnesses, and advanced electronic control units (ECUs). The product landscape is rapidly transforming due to the proliferation of electric and hybrid vehicles, demanding entirely new architectures based on high-voltage components and integrated power electronics. These electrical systems are the backbone of critical vehicle functions, ranging from engine management and lighting to braking, steering, and the increasingly complex infotainment and Advanced Driver-Assistance Systems (ADAS).

Major applications of these electrical products span across powertrain electrification, which includes inverters and converters necessary for managing battery power; vehicle safety systems, integrating sensors for ABS, ESC, and airbag deployment; and driver information systems, requiring complex wiring and ECUs to manage displays and telematics. The primary benefits derived from these advanced electrical systems include significant improvements in vehicle efficiency through optimized power consumption, enhanced safety due to the reliability of ADAS technologies, and superior driver and passenger convenience offered by sophisticated connectivity and infotainment features. The integration of high-reliability, fault-tolerant electrical architecture is paramount as vehicles evolve into connected, autonomous platforms, necessitating robust communication between thousands of individual electrical components.

The market’s strong growth trajectory is propelled by several key driving factors, notably the stringent enforcement of automotive safety regulations globally, which mandate features such as electronic stability control and mandatory rear-view cameras, all relying heavily on electrical products. Equally significant is the tremendous investment flowing into the research and development of electric vehicle (EV) technologies. The shift from 12V traditional architectures to higher voltage systems (48V mild hybrids and 400V/800V EVs) is fundamentally restructuring the demand profile for electrical components. Moreover, the increasing adoption rate of luxury and mid-segment vehicles in emerging economies, coupled with consumer demand for premium features like complex lighting systems and connected services, further fuels the expansion of the Automotive Electrical Products Market.

Automotive Electrical Products Market Executive Summary

The Automotive Electrical Products Market is undergoing a rapid technological convergence, characterized by the dominance of electrification, connectivity, and autonomy trends. Key business trends indicate a strategic focus among manufacturers on developing integrated power modules that combine multiple functions—such as charging, inversion, and DC/DC conversion—into a single, compact unit, thereby reducing weight and complexity. Supply chain resilience has become a critical strategic pillar, particularly in sourcing semiconductor chips and specialized high-voltage materials necessary for modern EV architectures. Furthermore, partnerships between traditional Tier 1 suppliers and software developers are accelerating, reflecting the shift towards software-defined vehicles (SDVs), where the electrical architecture must support frequent over-the-air (OTA) updates and complex sensor fusion algorithms. Competition is intensifying in the sensor and ECU segments, driven by the race to achieve higher levels of autonomous driving capability.

Regional trends highlight the Asia Pacific (APAC) region as the undisputed leader in both production and consumption, primarily fueled by massive vehicle manufacturing output in China, India, and South Korea, coupled with aggressive governmental policies promoting EV adoption. China, in particular, sets the pace for EV component innovation and scale. Europe is demonstrating robust growth, driven by stringent CO2 emission standards and significant regulatory support for hybrid and electric vehicles, focusing heavily on safety and efficiency innovations. North America, while experiencing a rapid transition, benefits from large investments by major automakers into domestic battery and electrical component manufacturing, catalyzed by governmental incentives aimed at securing the local supply chain and fostering technological leadership in autonomous vehicle development.

Segment trends underscore the phenomenal growth of the High-Voltage Components segment, directly proportional to the increased penetration of pure electric vehicles. Within the component segment, Electronic Control Units (ECUs) and sensors, especially those for radar, LiDAR, and cameras, are seeing the highest value increase due to their essential role in ADAS and autonomy. The aftermarket segment is also evolving, moving beyond simple replacements (like batteries and alternators) to include diagnostics and repair services for complex integrated electronic modules, necessitating specialized tools and highly trained technicians. Vehicle type analysis confirms that Passenger Vehicles (including SUVs and Sedans) remain the largest revenue generator, although the Commercial Vehicle segment is increasingly adopting sophisticated electrical systems for fleet management, telematics, and potential future electrification of last-mile delivery vehicles.

AI Impact Analysis on Automotive Electrical Products Market

User inquiries regarding AI's influence in the Automotive Electrical Products Market predominantly revolve around three core themes: first, how AI enhances the safety and reliability of complex electrical systems, particularly in autonomous driving contexts; second, the utilization of AI for optimizing energy management and battery performance in EVs; and third, the role of predictive diagnostics and maintenance facilitated by AI algorithms. Users are keen to understand the specific components—ECUs, sensors, and wiring—that must be redesigned or augmented to handle AI workloads, such as sensor fusion and real-time decision-making. Concerns often center on the computational power requirements, data security within the vehicle network, and the potential for AI-induced failure modes in highly integrated electrical architectures. The general expectation is that AI will transform electrical products from simple hardware components into intelligent, adaptive modules capable of self-diagnosis and dynamic performance optimization, pushing the market towards greater integration of edge computing capabilities directly into ECUs and sensors.

The integration of Artificial Intelligence fundamentally redefines the scope and capability of automotive electrical products, moving them beyond traditional control functions toward cognitive decision-making systems. AI algorithms are crucial for processing the massive data streams generated by the proliferation of ADAS sensors (radar, LiDAR, cameras), enabling real-time interpretation necessary for autonomous navigation and collision avoidance. This necessitates the development of high-performance electrical architectures, including specialized domain controllers and centralized computing units, which must reliably handle extreme computational loads while maintaining strict safety standards (ISO 26262). The quality and bandwidth of wiring harnesses and connectors must also be significantly upgraded to support high-speed data transmission required for AI processing. Furthermore, AI contributes significantly to optimizing power electronics by minimizing energy loss during conversion, thereby maximizing EV range and battery life, a critical performance metric for consumers.

AI's impact extends profoundly into the manufacturing and maintenance lifecycle of electrical products. In production, machine learning models are deployed for advanced quality control, identifying micro-defects in complex wiring harnesses or semiconductor soldering that human inspection might miss, thereby increasing component reliability. Post-sale, AI-driven predictive maintenance utilizes real-time vehicle data to forecast potential failures in electrical components, such as alternators, relays, or high-voltage battery management systems (BMS). This capability shifts maintenance from reactive repair to proactive intervention, reducing vehicle downtime and maintenance costs. The transition towards software-defined vehicles, heavily reliant on AI for new feature deployment and system tuning, ensures that electrical products must be future-proofed with sufficient processing headroom and modular design to accommodate continuous software upgrades throughout the vehicle’s operational lifetime, maximizing component longevity and functionality.

- AI enables advanced sensor fusion and real-time processing necessary for Level 4 and Level 5 autonomous driving systems.

- Predictive diagnostics utilizing AI analyze sensor data to anticipate electrical component failures (e.g., battery degradation, wiring faults).

- Optimized Power Electronics Management: AI algorithms enhance EV efficiency by dynamically managing power flow through inverters, converters, and the BMS.

- Development of AI-Enabled ECUs (AECUs): Specialized electronic control units designed with integrated AI acceleration hardware for edge computing.

- Enhanced Manufacturing Quality Control: Machine learning used for defect detection in wiring harnesses and semiconductor production, improving component reliability.

- Facilitation of Over-The-Air (OTA) Updates: AI enables the robust management and deployment of complex software updates across the vehicle’s electrical architecture.

DRO & Impact Forces Of Automotive Electrical Products Market

The Automotive Electrical Products Market is shaped by a powerful interplay of drivers, restraints, and opportunities that collectively determine its expansion and strategic direction. The primary driver is the pervasive global trend toward vehicle electrification, which mandates the integration of high-voltage systems and sophisticated battery management components, fundamentally increasing the electrical content per vehicle. Simultaneously, increasingly stringent global safety and environmental regulations, such as mandatory installation of ADAS features like Lane Keep Assist and Automatic Emergency Braking, necessitate more complex sensor systems and centralized electronic control units (ECUs). These factors create a high-growth environment for specialized electrical components. However, this growth is tempered by significant restraints, particularly the escalating cost of raw materials crucial for battery and wiring production (like copper, lithium, and rare earth elements), alongside the persistent and acute shortage of semiconductor chips, which bottlenecks the production of critical ECUs and microcontrollers. The overall impact force matrix suggests a strong upward pressure driven by technological advancement and regulatory necessity, despite the structural supply chain and cost challenges inherent in the industry's rapid transformation.

Opportunities within this market are immense, primarily centered on the transition to next-generation vehicle architectures. The shift toward zonal and domain-controlled architectures, replacing traditional distributed networks, presents significant opportunities for suppliers capable of providing highly integrated, centralized processing units. Furthermore, the burgeoning demand for Vehicle-to-Everything (V2X) communication technologies creates a new market segment for electrical products such as dedicated short-range communication (DSRC) and cellular V2X modules, enhancing connectivity and traffic efficiency. Another key opportunity lies in the aftermarket sector, where the complexity of modern vehicle electronics necessitates specialized diagnostic tools, replacement parts, and highly skilled service technicians, driving value growth beyond the initial OEM sale. Strategic partnerships focusing on vertical integration—combining hardware and software expertise—are critical for capitalizing on the opportunity presented by the software-defined vehicle evolution.

The market also faces inherent risks that act as impact forces. Cybersecurity threats targeting the vehicle's electrical network and ECUs are becoming more pronounced, demanding substantial investment in secure hardware and robust intrusion detection systems, adding complexity and cost to product development. Moreover, the long development cycles and high capital expenditure required for establishing production lines for advanced high-voltage components create high barriers to entry, concentrating market power among a few large Tier 1 suppliers. Failure to comply with global interoperability standards or regional mandates (like those concerning charging infrastructure in different geographic zones) can severely restrict market access. Overall, the impact forces are highly concentrated on technological innovation and regulatory compliance, making adaptability and R&D investment the most crucial determinants of success in this dynamic market.

- Drivers:

- Accelerated global adoption of Electric Vehicles (EVs) and Hybrid Electric Vehicles (HEVs).

- Strict governmental regulations mandating advanced safety features (ADAS, ABS, ESC).

- Increasing consumer demand for vehicle connectivity, infotainment, and personalized experiences.

- Shift towards higher voltage architectures (48V, 400V, 800V) requiring new electrical components.

- Restraints:

- Volatility and shortage of critical raw materials (e.g., copper, semiconductors, lithium).

- High development and integration costs associated with complex electronic control systems.

- Vulnerability of complex electrical architectures to sophisticated cyber threats.

- Challenges associated with thermal management in high-density power electronics.

- Opportunities:

- Growth in Vehicle-to-Everything (V2X) communication technologies.

- Development of zonal and domain-based centralized electronic architecture.

- Expansion of specialized diagnostic services and replacement markets for complex ECUs.

- Implementation of AI and machine learning for predictive maintenance and energy optimization.

- Impact Forces:

- High investment requirements in R&D for next-generation silicon carbide (SiC) and gallium nitride (GaN) power modules.

- Competitive pressure driving component modularity and miniaturization.

- Regulatory scrutiny over component reliability and functional safety standards (ISO 26262).

- Geopolitical risks affecting global semiconductor and critical mineral supply chains.

Segmentation Analysis

The Automotive Electrical Products Market is segmented based on the component type, vehicle type, and sales channel, providing a comprehensive view of market dynamics and value distribution. The component segmentation, which includes starters, alternators, lighting, batteries, wiring harnesses, sensors, and Electronic Control Units (ECUs), is crucial for understanding the technology penetration and functional specialization within the market. ECUs and sensors represent the high-growth, high-value segment, driven by ADAS and autonomy, while wiring harnesses, though lower in value per unit, represent the largest segment by volume and are becoming increasingly complex due to high-speed data requirements. Analysis by vehicle type distinguishes between passenger vehicles, commercial vehicles (light, medium, and heavy-duty), and electric vehicles (BEV, HEV, PHEV), with EVs being the fastest-growing category demanding unique, high-voltage electrical architecture.

The sales channel segmentation differentiates between Original Equipment Manufacturers (OEMs) and the Aftermarket. The OEM channel dominates in terms of initial product value and advanced technology integration, securing components for new vehicle production. This channel is characterized by long-term contracts, high precision, and compliance with stringent quality and safety standards. Conversely, the aftermarket is vital for replacement, repair, and upgrade components, focusing on longevity, accessibility, and cost-effectiveness. The aftermarket, which is strongly influenced by the average age of vehicles on the road, is increasingly shifting towards servicing and replacing complex electronic modules rather than just traditional mechanical parts.

Understanding these segments allows market participants to tailor their strategies, focusing on R&D for high-tech components like domain controllers for the OEM segment or concentrating on robust, easily installable replacement units for the aftermarket. The convergence of these segments is evident in the EV space, where rapid technological obsolescence and proprietary systems necessitate specialized dealership service centers, blurring the line between traditional aftermarket maintenance and OEM-mandated service protocols. Future segmentation growth is expected to pivot even further towards software integration services bundled with hardware components, particularly within the high-end vehicle and autonomous technology segments, reflecting the software-defined nature of future mobility solutions.

- By Component Type:

- Starters and Alternators

- Lighting Systems (Headlights, Taillights, Interior Lighting, LEDs, Matrix Lighting)

- Batteries (12V Lead-Acid, High-Voltage Li-ion for EVs)

- Wiring Harnesses and Connectors (High-Speed Data Cables, Power Distribution)

- Switches and Relays

- Sensors (Temperature, Pressure, Position, Speed, Radar, LiDAR, Camera)

- Electronic Control Units (ECUs) and Domain Controllers

- By Vehicle Type:

- Passenger Vehicles (Sedans, SUVs, Hatchbacks)

- Commercial Vehicles (Light Commercial Vehicles, Heavy Commercial Vehicles)

- Electric Vehicles (Battery Electric Vehicles (BEV), Hybrid Electric Vehicles (HEV), Plug-in Hybrid Electric Vehicles (PHEV))

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Retail, Service Stations, Independent Repair Shops)

- By Voltage:

- 12V/24V System

- 48V System

- High Voltage (>100V, primarily 400V and 800V)

Value Chain Analysis For Automotive Electrical Products Market

The value chain for the Automotive Electrical Products Market is complex and characterized by multiple layers of specialization, starting with the extraction and processing of raw materials. The upstream segment involves the sourcing of critical materials such as specialized plastics for insulation, high-purity copper for wiring and windings, rare earth elements for permanent magnets in motors, and sophisticated semiconductor materials like silicon carbide (SiC) and gallium nitride (GaN) crucial for power electronics in EVs. Suppliers at this stage, often commodity giants or specialized chemical companies, face strong pricing pressures and supply volatility. Component manufacturers then transform these materials into individual electrical parts, such as connectors, switches, relays, basic sensors, and raw semiconductor wafers. Reliability and consistent material quality are paramount at the upstream level, as defects here can propagate throughout the entire vehicle system, leading to expensive recalls and performance degradation.

The midstream and core manufacturing stages are dominated by specialized Tier 2 and Tier 1 suppliers. Tier 2 suppliers typically produce sub-components, such as specialized microcontrollers, complex wiring harnesses, or individual power modules. Tier 1 companies, such as Bosch, Continental, and Denso, integrate these sub-components into complete systems, including full ADAS sensor packages, sophisticated electronic control units (ECUs), integrated starter generators, or battery management systems (BMS). This phase requires immense capital investment in highly automated and precise manufacturing processes, coupled with rigorous testing to meet automotive grade reliability standards (AEC-Q100, ISO 26262). Tier 1 suppliers act as critical integrators, working closely with OEMs on design and validation, effectively holding the most significant intellectual property and value-added functions within the chain, particularly concerning software and firmware development embedded in the electronics.

The downstream segment encompasses the distribution and final consumption channels. Direct distribution involves Tier 1 suppliers delivering components directly to OEM assembly lines for new vehicle installation. This requires highly efficient, just-in-time logistics and robust quality tracking. Indirect distribution channels primarily serve the aftermarket, utilizing extensive networks of authorized distributors, wholesalers, and independent retailers. These channels provide replacement parts, diagnostic tools, and accessories. The shift toward software-defined vehicles is impacting the downstream, with software updates often being delivered directly from the OEM or Tier 1 provider to the vehicle via over-the-air (OTA) technology, circumventing physical distribution entirely for some functions. The value chain is seeing increasing vertical integration, especially by EV manufacturers who are bringing battery production, power electronics, and proprietary software development in-house to secure supply and differentiate their electrical architecture from competitors.

Automotive Electrical Products Market Potential Customers

The primary customers for the Automotive Electrical Products Market fall into three distinct categories: Original Equipment Manufacturers (OEMs), the Aftermarket Service Industry, and specialized fleet operators and government agencies. OEMs, including global giants like Volkswagen Group, Toyota, General Motors, and emerging EV leaders such as Tesla and BYD, are the largest customers. They demand high-volume, customized electrical systems that meet stringent performance, weight, cost, and functional safety specifications for integration into their new vehicle models. Their purchasing decisions are driven by long-term technology roadmaps, contractual pricing stability, and the supplier's capability to co-develop cutting-edge technology, particularly in ADAS, electrification, and centralized computing domains. For OEMs, the supplier's capacity for high-quality, large-scale production and global logistical support is paramount.

The second major customer segment is the aftermarket service industry, which includes independent repair shops, franchised dealerships, parts wholesalers, and retail chains like AutoZone or O'Reilly. These customers purchase electrical components (starters, alternators, batteries, sensors, common ECUs) for repair, maintenance, and vehicle upgrades of existing vehicles. Their purchasing criteria are primarily focused on part compatibility, immediate availability, competitive pricing, and certified quality that meets or exceeds OEM specifications. As vehicles become more complex, the aftermarket is evolving to require specialized diagnostic equipment and training, making technical support and reliable supply chains for complex modules increasingly important to these service providers.

Finally, specialized fleet operators, logistics companies (e.g., UPS, FedEx), rental car companies, and various governmental and municipal bodies (e.g., police departments, transit authorities) constitute another significant customer base. These entities purchase electrical products either directly from OEMs in bulk (specialized vehicles) or utilize aftermarket channels for continuous maintenance of large vehicle populations. Their purchasing is heavily influenced by total cost of ownership (TCO), component durability, and the ability of electrical systems to support telematics, fleet management, and operational efficiency tools. The rising adoption of electric commercial fleets is making these customers particularly important for suppliers of robust, high-cycle electrical components and charging infrastructure management systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 250 Billion |

| Market Forecast in 2033 | USD 410 Billion |

| Growth Rate | CAGR 7.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Continental AG, Denso Corporation, ZF Friedrichshafen AG, Aptiv PLC, Magna International Inc., Lear Corporation, BorgWarner Inc., Panasonic Corporation, Hella GmbH & Co. KGaA, Hitachi Astemo, Valeo, Yazaki Corporation, Sumitomo Electric Industries, Motherson Sumi Systems Limited, Schaeffler Group, Visteon Corporation, Mitsubishi Electric Corporation, Infineon Technologies AG, NXP Semiconductors N.V. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Electrical Products Market Key Technology Landscape

The technological landscape of the Automotive Electrical Products Market is currently dominated by three revolutionary pillars: vehicle electrification, high-speed data communication, and the shift towards centralized computing architectures. In electrification, the key innovations center around power electronics, specifically the transition from traditional silicon (Si) insulated-gate bipolar transistors (IGBTs) to wide-bandgap semiconductors like Silicon Carbide (SiC) and Gallium Nitride (GaN). These advanced materials significantly improve the efficiency, power density, and switching speed of inverters and converters, crucial for extending the range and accelerating the charging time of electric vehicles. Furthermore, advancements in battery management systems (BMS) are vital, utilizing sophisticated algorithms and high-precision sensors to monitor cell health, temperature, and voltage, maximizing battery life and ensuring safety under various operational conditions. This shift necessitates specialized high-voltage wiring and robust connection systems capable of handling 400V and 800V loads reliably.

The need for autonomous and connected driving mandates continuous innovation in data management and sensor technology. The proliferation of ADAS features requires an enormous volume of data transfer, driving the adoption of high-bandwidth communication protocols such as Automotive Ethernet (100BASE-T1, 1000BASE-T1) to replace traditional CAN and LIN networks. This evolution affects the design of wiring harnesses and connectors, which must now minimize signal latency and crosstalk while managing stricter electromagnetic compatibility (EMC) requirements. Sensor technology is advancing rapidly, integrating sophisticated solid-state LiDAR, high-resolution radar, and advanced vision systems. These sensors are becoming smarter, often incorporating edge computing capabilities (AI processing directly at the sensor level) to pre-process data before transmission, reducing the burden on the central computing unit and enhancing real-time responsiveness of safety systems.

Perhaps the most transformative technological trend is the adoption of zonal electrical/electronic (E/E) architectures. Traditional vehicle architectures are highly distributed, with hundreds of interconnected ECUs performing specific functions. The zonal architecture consolidates control and processing into fewer, highly powerful domain or zonal controllers, reducing the complexity and weight of wiring harnesses while improving flexibility for software updates and feature scalability. This centralized approach requires highly modular and standardized hardware, enabling the vehicle to be defined primarily by its software. Supporting technologies include functional safety implementation (ISO 26262 compliance in hardware and software design), advanced thermal management for high-density computing modules, and robust cybersecurity layers embedded directly into the semiconductor hardware and communication gateways to protect the vehicle’s electrical nervous system from external threats, making the electrical component fundamentally a fusion of hardware and secure software.

Regional Highlights

- Asia Pacific (APAC):

- Europe:

- North America (NA):

The APAC region holds the largest market share and is projected to exhibit the fastest growth over the forecast period. This dominance is driven primarily by the massive automotive manufacturing bases in China, Japan, South Korea, and India. China, in particular, leads the world in electric vehicle production and sales, supported by aggressive government subsidies and mandates favoring New Energy Vehicles (NEVs). This rapid electrification has created explosive demand for high-voltage batteries, sophisticated power electronics, and specialized thermal management systems. Furthermore, increasing urbanization and rising middle-class disposable incomes across countries like India and Southeast Asia are driving higher vehicle sales volumes and increasing the penetration of ADAS features, leading to higher consumption of complex sensors and ECUs. The region also serves as a crucial global hub for electronic component manufacturing, benefiting from cost-competitive production and advanced supply chain networks, although it faces periodic challenges related to trade tensions and raw material sourcing.

Regional manufacturers are heavily investing in localized R&D centers focused on indigenous development of specialized electrical systems tailored for the unique requirements of high-volume, cost-sensitive vehicle platforms. Japan and South Korea maintain technological leadership in advanced battery technology, semiconductor manufacturing, and integrated sensor solutions necessary for Level 3 autonomy and above. The competitive intensity in APAC encourages swift technological adoption and vertical integration, particularly in the EV sector, where companies are consolidating control over the entire electrical value chain, from battery cells to proprietary ECUs and software. This strategic focus cements APAC's position as the key growth engine for the global Automotive Electrical Products Market, dictating global trends in component pricing and production scaling.

Europe represents a highly advanced market characterized by stringent emission regulations and a strong emphasis on functional safety and premium features. The region is witnessing a rapid transition toward electric and hybrid vehicles, catalyzed by the European Union's ambitious CO2 reduction targets, which necessitate the widespread adoption of 48V mild-hybrid systems and high-voltage BEVs. This regulatory push drives demand for high-efficiency power electronics, sophisticated battery management systems (BMS), and advanced electrical components capable of meeting Euro 7 emission standards. Germany, as the hub of high-end vehicle manufacturing, remains central to innovation in complex sensor fusion systems and domain controllers required for advanced ADAS and eventual autonomous driving implementation.

The European market exhibits a strong preference for high-quality, high-reliability electrical components, fostering a competitive landscape where Tier 1 suppliers focus heavily on robust, secure, and standardized solutions, often adhering to the highest levels of functional safety (ASIL D). The implementation of the General Safety Regulation (GSR) mandating advanced safety features further accelerates the integration of components like sophisticated cameras, radar units, and associated ECUs. Supply chain resilience and local manufacturing capacity have become strategic priorities following recent global disruptions, leading to increased investment in domestic semiconductor and high-voltage component production capacity, ensuring that the region remains a powerhouse for high-value electrical system technology.

The North American market, comprising the U.S., Canada, and Mexico, is defined by large-scale vehicle production, high consumer demand for large vehicles (SUVs and Trucks), and aggressive moves toward electrification and autonomy, particularly in the U.S. The region is seeing significant government investment and incentives, such as those provided by the Inflation Reduction Act (IRA), aimed at localizing EV supply chains, including battery and electrical component manufacturing. This policy shift is rapidly accelerating the transition from traditional combustion engine electrical systems to 400V and 800V architectures, driving substantial demand for domestic suppliers of inverters, converters, and specialized wiring harnesses designed for high power transmission.

Furthermore, North America is a global leader in the development and deployment of autonomous driving technology. Major technology firms and automakers are heavily testing Level 4 and 5 autonomous systems, which demand extraordinarily complex and redundant electrical architecture, including specialized AI computing platforms, multiple sensor modalities, and high-speed in-vehicle networking (Automotive Ethernet). The aftermarket segment in NA is mature and substantial, characterized by high demand for maintenance components due to the longer average age of vehicles. Consequently, the regional market provides opportunities for both cutting-edge OEM technologies and high-volume, reliable aftermarket replacement parts, underpinned by robust regulatory requirements concerning vehicle safety and cybersecurity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Electrical Products Market.- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- ZF Friedrichshafen AG

- Aptiv PLC

- Magna International Inc.

- Lear Corporation

- BorgWarner Inc.

- Panasonic Corporation

- Hella GmbH & Co. KGaA

- Hitachi Astemo

- Valeo

- Yazaki Corporation

- Sumitomo Electric Industries

- Motherson Sumi Systems Limited

- Schaeffler Group

- Visteon Corporation

- Mitsubishi Electric Corporation

- Infineon Technologies AG

- NXP Semiconductors N.V.

Frequently Asked Questions

Analyze common user questions about the Automotive Electrical Products market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary technological shift is driving growth in the Automotive Electrical Products Market?

The primary technological driver is the massive global shift toward vehicle electrification (BEVs and HEVs), necessitating the replacement of traditional 12V systems with complex high-voltage (400V/800V) architectures, power electronics (inverters, converters), and sophisticated battery management systems (BMS).

How is the move toward autonomous vehicles impacting demand for electrical components?

Autonomous vehicle development is creating soaring demand for high-performance sensors (LiDAR, radar, high-resolution cameras), specialized electronic control units (ECUs), domain controllers for sensor fusion, and high-speed data transmission wiring harnesses (Automotive Ethernet).

Which geographical region dominates the production and consumption of automotive electrical products?

The Asia Pacific (APAC) region, driven primarily by manufacturing scale and rapid electric vehicle adoption in China and South Korea, currently holds the largest market share and is projected to maintain the fastest growth rate.

What is the significance of the shift from distributed to zonal E/E architecture?

The zonal E/E architecture consolidates hundreds of individual ECUs into fewer, high-powered domain controllers. This reduces wiring complexity and vehicle weight, improves system redundancy, and facilitates seamless over-the-air (OTA) software updates, enabling the software-defined vehicle (SDV) concept.

What are the main supply chain challenges faced by manufacturers of automotive electrical components?

Key challenges include persistent global shortages of semiconductor chips required for ECUs, volatility in the pricing and supply of critical raw materials like copper and lithium, and the need to establish secure supply chains for advanced materials like Silicon Carbide (SiC) for high-voltage power electronics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager