Automotive Electronic Brake System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431819 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Automotive Electronic Brake System Market Size

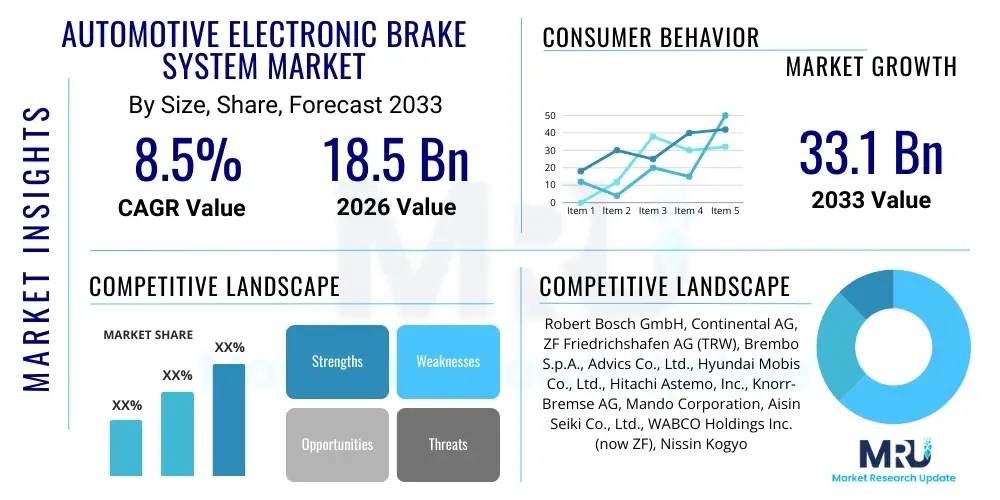

The Automotive Electronic Brake System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 33.1 Billion by the end of the forecast period in 2033.

Automotive Electronic Brake System Market introduction

The Automotive Electronic Brake System (EBS) Market encompasses highly sophisticated components and modules designed to enhance vehicle stability, control, and overall safety far beyond traditional hydraulic braking systems. Key systems include Anti-lock Braking System (ABS), Electronic Stability Control (ESC), Electronic Brakeforce Distribution (EBD), and, increasingly, advanced systems like Brake-by-Wire (BBW) and regenerative braking modules crucial for electric and hybrid vehicles. The fundamental purpose of these electronic systems is to manage tire slip, optimize braking pressure independently at each wheel, and integrate seamlessly with Advanced Driver Assistance Systems (ADAS) suchs as Automatic Emergency Braking (AEB). These systems are transitioning from passive safety features to active control modules essential for semi-autonomous driving capabilities, thereby solidifying their role as non-negotiable components in modern vehicle architecture.

The increasing global emphasis on road safety regulations, particularly mandates enforced by governmental and regional bodies like the European Union (EU) and the National Highway Traffic Safety Administration (NHTSA) in the US, is a primary catalyst driving market expansion. For instance, the compulsory inclusion of ESC in most light vehicles manufactured globally has structurally altered the demand landscape, ensuring continuous high volume production and technological refinement. Furthermore, the rapid electrification of the global vehicle fleet significantly boosts demand for electronic braking systems that can effectively manage the integration of friction braking with energy recuperation, thereby maximizing efficiency and range. These specialized requirements in Electric Vehicles (EVs) necessitate complex sensor integration and high-speed processing capabilities inherent to modern EBS platforms.

Major applications of these systems span the entire automotive spectrum, ranging from passenger vehicles (sedans, SUVs) and light commercial vehicles to heavy-duty trucks and buses. Beyond basic safety enhancement, the benefits of advanced EBS include reduced stopping distances, enhanced directional stability during emergency maneuvers, improved pedal feel variability, and crucial foundation for L2 and L3 autonomy levels. Driving factors are multifaceted, involving consumer preference for higher safety ratings, technological innovation leading to cost reduction in electronic components, and stiff competition among OEMs to differentiate their products through superior safety performance and connectivity features, pushing the boundaries of traditional brake system design towards fully electro-mechanical implementations.

Automotive Electronic Brake System Market Executive Summary

The global Automotive Electronic Brake System market is characterized by robust growth, fueled predominantly by stringent safety regulations mandating ESC and ABS installations worldwide, coupled with the accelerating adoption of electric vehicles (EVs) and advanced autonomous driving technologies. Business trends indicate a strong focus on integration—specifically, the consolidation of braking, steering, and suspension controls onto single, high-speed domain controllers, moving away from disparate electronic control units (ECUs). Key players are investing heavily in Brake-by-Wire (BBW) systems, particularly Electro-Mechanical Brakes (EMB), which promise faster response times, reduced weight, and simplified assembly lines, positioning BBW as a major disruptive force in the long term. Strategic alliances between Tier 1 suppliers and software developers are crucial for embedding complex algorithms required for advanced ADAS functionality directly into the braking system infrastructure.

Regional trends highlight Asia Pacific (APAC), led by China and India, as the fastest-growing market due to rapid urbanization, increasing per capita income resulting in higher vehicle sales, and the gradual imposition of stricter safety standards mirroring Western markets. Europe and North America, while mature, remain central to technological innovation, particularly concerning sophisticated driver assistance and autonomous features where EBS forms the safety redundancy layer. In these regions, the transition to EV platforms is immediate and significant, driving intensive demand for specialized regenerative braking modules. Conversely, Latin America and MEA are focused on implementing foundational safety systems (ABS/ESC mandates), providing a steady demand for established, cost-effective EBS solutions.

Segmentation trends reveal that the Electronic Stability Control (ESC) segment maintains the largest market share by system type due to mandatory installations, although the Traction Control System (TCS) and Anti-lock Braking System (ABS) segments remain foundational. By vehicle type, the Passenger Vehicle segment dominates consumption, driven by high production volumes and earlier adoption of advanced features. However, the commercial vehicle segment is projected to exhibit a high growth rate, largely due to governmental pressures to improve safety and efficiency in fleet operations. By component, sensors (wheel speed, yaw rate, lateral acceleration) and Electronic Control Units (ECUs) are critical components seeing increased sophistication and integration into centralized domain controllers, reflecting the architectural shift towards software-defined vehicles.

AI Impact Analysis on Automotive Electronic Brake System Market

User queries regarding the impact of Artificial Intelligence (AI) on the Automotive Electronic Brake System Market predominantly revolve around three critical themes: system responsiveness in autonomous driving, predictive maintenance capabilities, and the security of brake-by-wire protocols. Users frequently ask how AI enhances the safety margin of Automatic Emergency Braking (AEB) and if machine learning can predict brake component failure before it occurs. A major concern is the latency introduced by complex AI algorithms versus the necessity of instantaneous braking response, particularly under severe weather or unexpected road conditions. Furthermore, questions arise regarding the transition from rule-based braking logic to AI-driven predictive control systems, especially concerning ethical parameters and reliability verification for safety-critical functions.

AI's influence is profound, transforming EBS from reactive safety systems into proactive, intelligent control modules essential for Level 3 and higher autonomy. Machine learning algorithms analyze vast streams of sensor data—from radar, lidar, and cameras—to predict impending collision scenarios or loss of control with higher accuracy and speed than traditional human perception or simpler control logic. This predictive capability allows the EBS to pre-charge the system or apply minimal, imperceptible braking to stabilize the vehicle fractions of a second earlier. This integration of AI also facilitates sophisticated brake path optimization in complex maneuvers, ensuring the vehicle maintains stability while interacting with dynamic elements in the environment. AI further enables highly customized brake feel and performance characteristics that adapt dynamically to the driver's profile, driving style, and current road conditions, moving towards personalized and optimized braking experiences.

- AI-driven Predictive Braking: Enhances AEB functionality by interpreting complex environmental data to reduce reaction time and minimize false positives.

- Optimized Brakeforce Distribution: Uses machine learning to dynamically adjust braking pressure based on real-time road surface friction and vehicle load distribution.

- Predictive Maintenance: AI algorithms analyze vibration, temperature, and usage patterns to forecast component wear, signaling maintenance needs before failure occurs.

- Enhanced Redundancy Management: AI systems manage the fail-operational performance of Brake-by-Wire systems, ensuring safety protocols are maintained even if a primary component fails.

- Software-Defined Braking: Facilitates Over-the-Air (OTA) updates for brake software, improving performance and security throughout the vehicle lifecycle.

DRO & Impact Forces Of Automotive Electronic Brake System Market

The dynamics of the Automotive Electronic Brake System (EBS) market are governed by a robust interaction of stringent governmental safety mandates and rapid technological evolution, encapsulated by four major forces: Drivers, Restraints, Opportunities, and Impact Forces. Mandatory inclusion of foundational safety features (ABS, ESC) globally serves as the primary structural Driver, ensuring market penetration across all vehicle classes. Simultaneously, the accelerating shift towards electric and hybrid vehicles necessitates advanced EBS capable of regenerative braking, creating intense demand for electro-hydraulic and brake-by-wire solutions. These drivers solidify market growth by institutionalizing EBS as a fundamental component of modern vehicular safety and efficiency standards, directly correlating market size with global vehicle production volumes and regulatory compliance requirements.

However, significant Restraints temper this growth trajectory. The high initial cost associated with advanced systems like Brake-by-Wire, coupled with the complexity of integrating multiple sensors and ECUs, poses a barrier, especially in cost-sensitive emerging markets. Furthermore, the increasing reliance on software and connectivity introduces vulnerabilities related to cybersecurity, requiring continuous and expensive investment in securing the safety-critical brake functionality from external threats. Opportunities for significant market expansion exist primarily in the development and mass adoption of fully Electro-Mechanical Brakes (EMB), which eliminate hydraulic fluid and promise superior packaging flexibility and efficiency. Moreover, the integration of EBS with cloud-based data analytics offers Tier 1 suppliers and OEMs the chance to leverage usage data for performance improvement and new service creation, such as real-time brake monitoring and insurance correlation.

The overall Impact Forces are largely positive and accelerating. Regulatory pressure is the strongest impact force, continuously raising the baseline requirement for vehicle safety technology. Technological convergence, specifically the merging of ADAS requirements with braking systems, means that EBS providers are essential partners in the autonomous vehicle ecosystem. These forces compel innovation, driving manufacturers toward standardized, modular, and highly integrated brake system architectures. The market structure dictates that suppliers must maintain flawless product reliability and adhere to ASIL-D safety standards (Automotive Safety Integrity Level D) for critical systems, placing tremendous competitive pressure on quality control and validation procedures globally.

Segmentation Analysis

The Automotive Electronic Brake System Market is comprehensively segmented based on System Type, Component, Vehicle Type, and Technology, providing a detailed view of current market demands and future growth trajectories. Understanding these segment dynamics is crucial for strategic market positioning, as different regions and vehicle classes prioritize distinct levels of complexity and safety integration. The segmentation highlights the transition from fundamental safety systems like ABS towards more advanced, proactive control modules such as Brake-by-Wire systems, which are increasingly adopted in premium vehicles and high-performance electric platforms, reflecting a clear progression in vehicle safety engineering.

The market analysis confirms that mandatory safety features drive the volume segments, while technological innovation and electrification drive value segments. For instance, the component segment is witnessing rapid value growth in sophisticated sensors (like integrated inertial measurement units) and high-performance ECUs designed to handle complex algorithms associated with autonomous driving, rather than basic hydraulic units. By focusing on these segments, manufacturers can align their product development pipelines with the highest growth potential areas, ensuring relevance in a swiftly evolving automotive landscape characterized by software dominance and hardware virtualization.

- By System Type:

- Anti-lock Braking System (ABS)

- Electronic Stability Control (ESC)

- Electronic Brakeforce Distribution (EBD)

- Traction Control System (TCS)

- Brake-by-Wire (BBW) Systems

- Automatic Emergency Braking (AEB)

- By Component:

- Sensors (Wheel Speed Sensors, Yaw Rate Sensors, Pressure Sensors)

- Electronic Control Unit (ECU)

- Actuators (Hydraulic Modulators, Electric Motors)

- Software & Algorithms

- By Vehicle Type:

- Passenger Vehicles (PV)

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

- By Technology:

- Electro-Hydraulic Braking System

- Electro-Mechanical Braking System (EMB)

Value Chain Analysis For Automotive Electronic Brake System Market

The value chain for the Automotive Electronic Brake System market is highly structured and critical, beginning with the upstream sourcing of raw materials, progressing through sophisticated component manufacturing, assembly by Tier 1 suppliers, and concluding with integration by Original Equipment Manufacturers (OEMs) and subsequent aftermarket distribution. Upstream analysis focuses on specialized suppliers providing high-precision components such as semiconductor chips for ECUs, specialized sensors (e.g., magneto-resistive wheel speed sensors), and high-tolerance materials for hydraulic components and actuators. The robustness of this initial stage, particularly the supply chain for microcontrollers and dedicated chips required for ASIL-D safety standards, dictates the production capacity and resilience of the entire market. Dependence on a few large semiconductor manufacturers for safety-critical processing power represents a concentrated risk that the industry is actively managing through diversification and regional supply chain localization efforts.

Mid-stream activities are dominated by Tier 1 suppliers, such as Bosch, Continental, and ZF, who design, assemble, and rigorously test the complete EBS modules (e.g., ABS/ESC units, BBW modules). These Tier 1 companies invest significantly in research and development to integrate complex software algorithms and ensure compliance with global safety standards. Their deep domain expertise and established relationships with global OEMs position them as the core value creators. The downstream process involves the direct integration of these complete systems into vehicles by OEMs during assembly. The distribution channel is bifurcated: Direct sales involve large, long-term contracts between Tier 1 suppliers and OEMs, often involving highly customized design specifications. Indirect channels cover the aftermarket and service segment, where replacement parts (sensors, ECUs, calipers) are distributed through authorized dealer networks, independent repair shops, and specialized parts wholesalers, ensuring vehicle safety maintenance throughout its operational life.

The direct channel represents the vast majority of market value, focusing on initial fitment and technological innovation. The indirect channel, while smaller in value, is vital for long-term customer satisfaction and maintaining vehicle safety integrity, often demanding robust counterfeit protection measures due to the safety-critical nature of the components. The increasing complexity of EBS, especially Brake-by-Wire, necessitates specialized diagnostic tools and training for aftermarket service providers, creating new market opportunities for maintenance service providers and specialized software diagnostic tool developers.

Automotive Electronic Brake System Market Potential Customers

Potential customers in the Automotive Electronic Brake System Market primarily consist of Original Equipment Manufacturers (OEMs) across the globe, who serve as the direct purchasers and integrators of these complex systems. These customers are highly demanding, focusing intensely on component reliability, adherence to stringent safety integrity levels (ASIL), scalability across different vehicle platforms, and competitive pricing. The shift towards modular vehicle architectures and standardized interfaces means OEMs prefer suppliers capable of delivering unified braking platforms that can be customized via software for various models, from entry-level sedans requiring standard ABS/ESC to high-end EVs utilizing full Brake-by-Wire systems with integrated regenerative capabilities.

The customer base is diversifying due to emerging market entrants, notably electric vehicle startups (e.g., Rivian, Lucid) and technology giants developing autonomous platforms. These new players prioritize state-of-the-art, fully electronic systems that offer minimal packaging constraints and maximum integration with centralized vehicle computing platforms, often bypassing traditional hydraulic-based solutions entirely. Fleet operators, particularly those managing large commercial vehicle fleets (trucking, logistics, public transport), are increasingly influential potential customers in the aftermarket, driven by the necessity to comply with stricter safety regulations (e.g., Electronic Stability Control for trucks) and the desire to leverage predictive maintenance features enabled by advanced EBS data analytics to minimize operational downtime and improve fuel efficiency.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 33.1 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG (TRW), Brembo S.p.A., Advics Co., Ltd., Hyundai Mobis Co., Ltd., Hitachi Astemo, Inc., Knorr-Bremse AG, Mando Corporation, Aisin Seiki Co., Ltd., WABCO Holdings Inc. (now ZF), Nissin Kogyo Co., Ltd., Autoliv Inc., Haldex AB, Federal-Mogul Corporation, Veoneer Inc., Bendix Commercial Vehicle Systems LLC, HELLA GmbH & Co. KGaA, BorgWarner Inc., and Johnson Electric Holdings Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Electronic Brake System Market Key Technology Landscape

The technology landscape of the Automotive Electronic Brake System market is rapidly shifting from traditional hydraulically assisted systems to fully electronic and integrated platforms, driven by the demands of electrification and autonomous driving. The predominant technology currently employed is the Electro-Hydraulic Braking System, which leverages a hydraulic mechanism controlled electronically via the ECU, typically embodied by the standard ABS and ESC systems. However, the critical trend involves the migration toward sophisticated Brake-by-Wire (BBW) architectures. These systems decouple the brake pedal from the hydraulic system, providing greater control flexibility and allowing for complex integration with regenerative braking in EVs, thereby optimizing energy recovery. The development of advanced hydraulic modulators that can handle high-pressure differentials and rapid valve adjustments is central to optimizing this current generation of electro-hydraulic systems, preparing them for higher levels of ADAS integration.

The most disruptive technological shift is the emergence of Electro-Mechanical Braking (EMB), or 'dry brakes,' a sub-segment of BBW. EMB replaces all hydraulic components (fluid, pipes, pumps) with electric motors and gears directly actuating the calipers. This technology offers numerous advantages: faster response, reduced weight, simplified vehicle assembly, enhanced energy efficiency, and total control decoupling, crucial for full L4 autonomy where fail-operational requirements are paramount. While EMB still faces challenges related to power consumption, cost, and stringent reliability verification (ASIL-D), extensive R&D efforts are underway to commercialize it for mass-market vehicles within the forecast period. Furthermore, the integration of advanced sensors, including high-resolution wheel speed sensors and sophisticated inertial measurement units (IMUs), is essential, as these components provide the precise data input necessary for the complex predictive algorithms managed by high-speed, multi-core Electronic Control Units (ECUs) serving as domain controllers.

Connectivity is also a major technological focus. Modern EBS units are equipped with robust communication protocols (e.g., CAN FD, Automotive Ethernet) to ensure high-speed, secure data exchange with other vehicle domains, such as powertrain and steering systems. This interconnectedness supports centralized control architecture, allowing for holistic vehicle dynamics management. Furthermore, the incorporation of highly specialized safety software that complies with industry standards like ISO 26262 is non-negotiable, ensuring functional safety throughout the system's operational lifecycle. The combination of advanced electro-mechanics, high-performance computing, and robust software engineering defines the current cutting edge of electronic brake system technology.

Regional Highlights

- Asia Pacific (APAC) Market Dominance and Growth: APAC currently represents the largest and fastest-growing regional market, driven primarily by high vehicle production volumes in China, India, Japan, and South Korea. China, in particular, leads the global EV market, creating overwhelming demand for electronic brake systems optimized for battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), emphasizing regenerative braking functionality. Regulatory changes in developing APAC nations, which are increasingly mandating basic safety features like ABS and ESC for newly manufactured vehicles, provide a substantial base demand for standardized EBS components. Furthermore, the region is becoming a hub for automotive electronics manufacturing, benefiting from strong local supply chains that reduce production costs and time-to-market.

- North America (NA) - Advanced Feature Adoption: North America is characterized by high penetration rates of advanced safety features and is a primary driver for the adoption of ADAS-integrated EBS, specifically Automatic Emergency Braking (AEB) systems. Consumer preference for large SUVs and light trucks, combined with high safety ratings requirements imposed by organizations like the Insurance Institute for Highway Safety (IIHS), pushes OEMs to adopt the latest technologies, including sophisticated Brake-by-Wire solutions and redundant braking systems necessary for Level 2+ autonomy. The region is leading investment in cybersecurity measures related to safety-critical systems, addressing the inherent risks of connected and electric vehicles.

- Europe - Regulatory and Technological Leadership: Europe is recognized for its early and rigorous adoption of mandatory safety regulations (ESC mandate) and its ongoing leadership in promoting vehicle electrification. The European market focuses heavily on integrated chassis control systems, where EBS is fully synchronized with steering and suspension (e.g., E-Chassis concepts). The push for CO2 reduction targets accelerates the demand for highly efficient regenerative braking capabilities. European suppliers are at the forefront of developing sophisticated Electro-Mechanical Braking (EMB) technologies, aiming for zero-emission and hydraulic-free brake systems in future vehicle generations, maintaining its position as a key innovation center.

- Latin America (LATAM) and Middle East & Africa (MEA) - Foundation Growth: These regions represent significant potential for foundational market expansion. LATAM countries are progressively adopting stricter safety standards, leading to increasing fitment rates of basic ABS and ESC systems in passenger vehicles. Market growth here is primarily volume-driven, focusing on cost-effective, proven electronic brake solutions. In MEA, regulatory harmonization, especially within the Gulf Cooperation Council (GCC) states, is gradually boosting demand for safety technologies, although the pace of adoption remains slower compared to APAC and established Western markets. Growth in these areas is supported by the increasing inflow of global vehicle models equipped with standard EBS features.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Electronic Brake System Market.- Robert Bosch GmbH

- Continental AG

- ZF Friedrichshafen AG (TRW)

- Brembo S.p.A.

- Advics Co., Ltd.

- Hyundai Mobis Co., Ltd.

- Hitachi Astemo, Inc.

- Knorr-Bremse AG

- Mando Corporation

- Aisin Seiki Co., Ltd.

- WABCO Holdings Inc. (now ZF)

- Nissin Kogyo Co., Ltd.

- Autoliv Inc.

- Haldex AB

- Federal-Mogul Corporation

- Veoneer Inc.

- Bendix Commercial Vehicle Systems LLC

- HELLA GmbH & Co. KGaA

- BorgWarner Inc.

- Johnson Electric Holdings Ltd.

Frequently Asked Questions

Analyze common user questions about the Automotive Electronic Brake System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Automotive Electronic Brake System market?

The primary factor driving market growth is the enforcement of global mandatory safety regulations, specifically those requiring the standard installation of Electronic Stability Control (ESC) and Anti-lock Braking System (ABS) in all newly manufactured vehicles, coupled with the rapid expansion of the Electric Vehicle (EV) segment demanding advanced regenerative braking systems.

How does Brake-by-Wire (BBW) technology differ fundamentally from traditional electronic braking systems?

Brake-by-Wire fundamentally differs by replacing the mechanical or hydraulic link between the brake pedal and the wheel brakes with electronic signals. This decoupling allows for highly precise, computer-controlled braking, instantaneous integration with ADAS functions like AEB, and optimized energy recovery in electrified powertrains, unlike traditional systems which rely on hydraulic pressure as the primary actuation medium.

What role does Artificial Intelligence (AI) play in modern electronic braking systems?

AI plays a crucial role by enabling predictive braking capabilities. Machine learning algorithms analyze complex sensor data (radar, lidar, camera) to anticipate vehicle instability or collision threats faster than conventional methods, allowing the system to pre-charge or apply braking proactively, significantly enhancing the efficacy of Automatic Emergency Braking (AEB) and improving overall functional safety.

Which regional market holds the highest potential for future market expansion?

The Asia Pacific (APAC) region, led by China and India, holds the highest potential for future market expansion. This is attributed to robust growth in local vehicle production, accelerating EV adoption rates, and the ongoing implementation of increasingly stringent safety mandates across developing economies within the region, driving substantial volume demand.

What is the main restraint preventing faster adoption of sophisticated Electro-Mechanical Braking (EMB) systems?

The main restraint is the high initial cost and complexity of the technology, coupled with the necessity for exhaustive validation and certification to meet the stringent ASIL-D functional safety standard. Furthermore, issues regarding the long-term operational reliability and specialized power supply requirements of pure electro-mechanical components need full resolution before widespread mass-market adoption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager