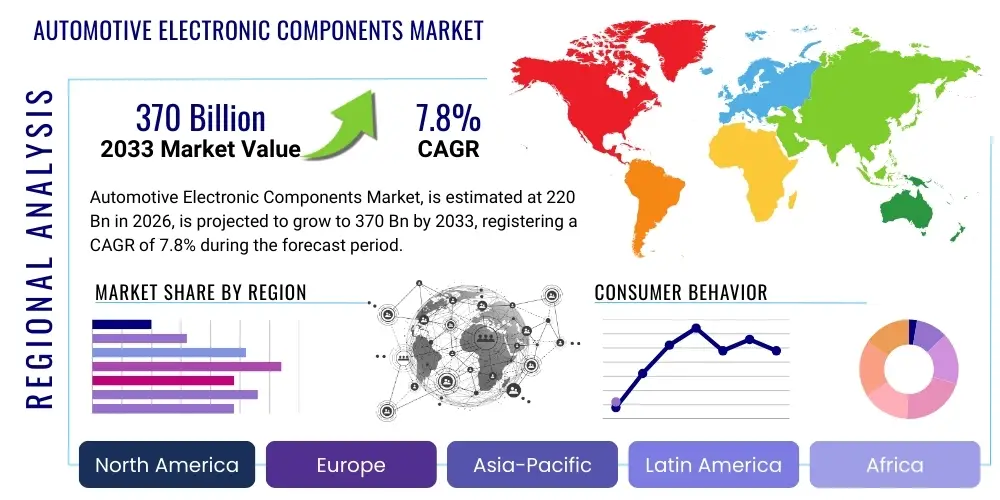

Automotive Electronic Components Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439315 | Date : Jan, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Automotive Electronic Components Market Size

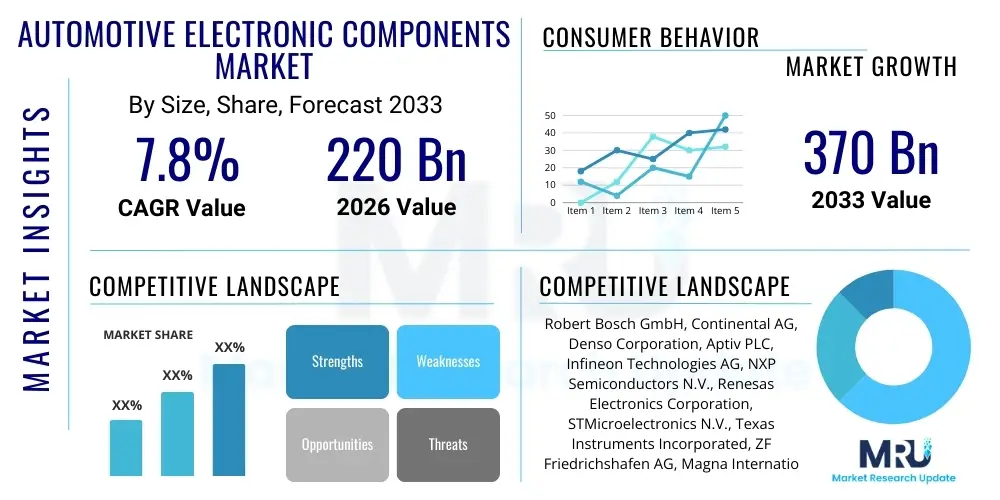

The Automotive Electronic Components Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 220 Billion in 2026 and is projected to reach USD 370 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily driven by the escalating demand for advanced vehicle features, including sophisticated safety systems, enhanced connectivity, and the accelerating transition towards electric and autonomous vehicles, all of which heavily rely on complex electronic architectures.

Automotive Electronic Components Market introduction

The Automotive Electronic Components Market encompasses a vast array of electronic parts and systems integral to the functionality, safety, and performance of modern vehicles. These components range from microcontrollers, sensors, and integrated circuits to power electronics, communication modules, and advanced driver-assistance systems (ADAS) units. Products within this market are foundational to diverse automotive applications, including engine control units (ECUs), infotainment systems, body electronics, chassis control, safety systems like ABS and airbags, and especially the burgeoning electric vehicle (EV) powertrains and battery management systems.

Major applications of these components span across critical vehicle domains such as powertrain management, enhancing fuel efficiency and reducing emissions; safety and security systems, providing active and passive protection; and advanced infotainment and connectivity features, improving the user experience. The benefits derived from these components are manifold, offering enhanced vehicle safety through features like lane-keeping assist and automatic emergency braking, improved fuel economy via optimized engine and transmission control, superior comfort and convenience through advanced climate control and seating systems, and seamless connectivity for navigation and communication.

Several potent factors are currently driving the expansion of this market. Foremost among these are the stringent global regulations mandating advanced safety features in new vehicles, compelling automakers to integrate more sophisticated electronic systems. The rapid global shift towards electric and hybrid vehicles inherently increases the electronic content per vehicle, particularly in battery management, motor control, and charging infrastructure. Furthermore, growing consumer demand for connected car features, autonomous driving capabilities, and personalized in-car experiences is pushing the boundaries of automotive electronics innovation and adoption, fueling sustained market growth.

Automotive Electronic Components Market Executive Summary

The Automotive Electronic Components Market is experiencing unprecedented dynamism, characterized by significant technological advancements and shifting industry paradigms. Business trends highlight a strong emphasis on supply chain resilience and diversification, driven by recent global semiconductor shortages that underscored the criticality of robust component sourcing. Automotive original equipment manufacturers (OEMs) are increasingly collaborating directly with semiconductor manufacturers and Tier 2 suppliers to secure critical electronic components, influencing strategic partnerships and long-term procurement agreements across the value chain. Moreover, the industry is witnessing substantial investment in software-defined vehicle architectures, where electronic hardware becomes modular and upgradable, enabling continuous innovation and personalized functionalities post-purchase, transforming traditional automotive development cycles.

Regional trends indicate Asia-Pacific as the dominant force in both production and consumption, primarily due to the region's robust automotive manufacturing base, particularly in China, Japan, and South Korea, coupled with rapidly expanding electric vehicle markets and supportive government policies. North America and Europe, while mature, are at the forefront of research and development for cutting-edge technologies, including advanced ADAS, autonomous driving systems, and premium infotainment solutions, with a strong focus on high-performance and energy-efficient electronic components. Emerging markets in Latin America and the Middle East & Africa are demonstrating steady growth, driven by increasing vehicle production, urbanization, and rising disposable incomes, leading to higher adoption rates of modern vehicle electronics.

Segment-wise, the market is primarily propelled by the escalating demand for components in Advanced Driver-Assistance Systems (ADAS) and electric powertrain applications. ADAS components, including radar, lidar, cameras, and ultrasonic sensors, are witnessing exponential growth as regulatory mandates and consumer expectations for safety features intensify. The electrification trend is similarly driving robust demand for power electronics, battery management systems (BMS), inverters, converters, and specialized microcontrollers essential for efficient energy management and motor control in electric vehicles. Infotainment and connectivity segments also continue their upward trajectory, with demand for high-resolution displays, advanced processors, and secure communication modules increasing as vehicles evolve into connected mobile ecosystems.

AI Impact Analysis on Automotive Electronic Components Market

The integration of Artificial Intelligence (AI) is profoundly reshaping the Automotive Electronic Components Market, addressing critical user questions regarding enhanced safety, autonomous capabilities, predictive maintenance, and personalized in-car experiences. Consumers and industry stakeholders are keen to understand how AI will improve the reliability and intelligence of vehicle systems, particularly in processing vast amounts of sensor data for real-time decision-making in autonomous driving, optimizing power consumption in EVs, and preventing failures through advanced diagnostics. There is also a significant interest in AI's role in creating intuitive human-machine interfaces and tailoring vehicle functions to individual driver preferences, elevating the overall driving and passenger experience. The core themes revolve around performance optimization, safety assurance, system resilience, and the development of next-generation intelligent components capable of self-learning and adaptive behavior, moving beyond purely deterministic control systems.

- AI drives the development of more sophisticated sensors (e.g., smart cameras, advanced radar) capable of real-time object detection, classification, and tracking, enhancing perception for ADAS and autonomous driving.

- Enables advanced decision-making algorithms for autonomous vehicles, processing complex environmental data to navigate safely, plan paths, and react to unpredictable scenarios.

- Facilitates predictive maintenance by analyzing sensor data from various electronic components, identifying potential failures before they occur, and reducing vehicle downtime.

- Optimizes power management in electric vehicles, using AI algorithms to enhance battery performance, range prediction, and charging efficiency through intelligent control units.

- Powers personalized in-car experiences, from adaptive infotainment systems to voice assistants and gesture control, tailored to individual driver and passenger preferences.

- Enhances cybersecurity measures for electronic systems by detecting anomalous network behavior and potential threats in real-time, safeguarding critical vehicle functions and data.

- Accelerates the design and verification process of new electronic components and architectures through AI-driven simulation and optimization tools, reducing development cycles.

- Improves manufacturing efficiency and quality control within the electronic component production lines through AI-powered robotics, vision systems, and anomaly detection.

- Enables software-defined vehicle paradigms by facilitating over-the-air (OTA) updates for AI models, allowing for continuous feature enhancement and performance improvements of electronic systems.

DRO & Impact Forces Of Automotive Electronic Components Market

The Automotive Electronic Components Market is influenced by a powerful interplay of drivers, restraints, opportunities, and broader impact forces that collectively shape its trajectory. Key drivers include the relentless pursuit of vehicle electrification, driven by environmental concerns and government incentives, which significantly increases the electronic content per vehicle for battery management, motor control, and charging infrastructure. The escalating adoption of Advanced Driver-Assistance Systems (ADAS) and the gradual progression towards autonomous driving capabilities are also profound drivers, necessitating an ever-increasing array of sophisticated sensors, processors, and communication modules. Furthermore, the growing demand for connected car features, enhanced infotainment systems, and stringent global safety regulations compel automakers to integrate more advanced and reliable electronic components, stimulating innovation and market growth.

However, the market also faces considerable restraints. Persistent global supply chain disruptions, particularly the shortage of semiconductors, have severely impacted production capacities and increased lead times, causing significant financial strain and delaying vehicle deliveries. The inherently high research and development (R&D) costs associated with developing cutting-edge automotive electronics, coupled with the complexity of integrating diverse systems and ensuring their interoperability, present substantial challenges. Moreover, growing concerns regarding cybersecurity vulnerabilities in highly connected vehicles, along with the need for robust software validation and stringent regulatory compliance across different regions, add layers of complexity and cost for manufacturers.

Opportunities within this dynamic landscape are vast. The emergence of software-defined vehicles (SDVs) presents a significant avenue for value creation, allowing for continuous feature upgrades and new service offerings through adaptable electronic architectures and over-the-air updates. Advances in sensor fusion technology, leveraging AI and machine learning to combine data from multiple sensor types for superior perception, are paving the way for more robust autonomous systems. Furthermore, the development of next-generation power electronics using novel materials like Silicon Carbide (SiC) and Gallium Nitride (GaN) promises higher efficiency and smaller form factors for EVs, while the expansion into new mobility services and smart city infrastructure opens up additional applications for sophisticated automotive electronics. These opportunities require strategic investments in R&D, fostering collaborative ecosystems, and adapting to evolving technological paradigms.

Beyond these immediate factors, broader impact forces exert considerable influence. Technological advancements, particularly in semiconductor manufacturing, AI, and communication technologies (e.g., 5G, V2X), continuously push the boundaries of what's possible in automotive electronics. Regulatory pressures, stemming from environmental mandates (emissions, recycling) and safety standards (crash avoidance, pedestrian protection), directly shape product requirements and innovation cycles. Consumer demand for safer, more connected, and environmentally friendly vehicles acts as a powerful catalyst for technological adoption. Economic conditions, including inflation, disposable income levels, and global trade policies, affect vehicle sales and, consequently, the demand for electronic components. Geopolitical factors, such as trade disputes and regional conflicts, can disrupt supply chains and investment flows, highlighting the need for resilient and localized manufacturing strategies.

Segmentation Analysis

The Automotive Electronic Components Market is broadly segmented based on various critical attributes to provide a granular understanding of its diverse landscape and growth dynamics. These segmentations allow for a detailed analysis of market performance across different component types, specific vehicle applications, the types of vehicles they equip, and the channels through which these components are distributed and sold. Such comprehensive segmentation is essential for stakeholders to identify key growth areas, understand competitive dynamics, and formulate targeted market strategies, reflecting the intricate interdependencies within the automotive ecosystem and the continuous evolution of vehicle technology.

- By Component Type:

- Sensors (e.g., Radar, Lidar, Camera, Ultrasonic, Pressure, Temperature, Position)

- Microcontrollers and Microprocessors (MCUs & MPUs)

- Integrated Circuits (ICs) (e.g., Analog ICs, Mixed-Signal ICs, Logic ICs, Memory ICs)

- Power Electronics (e.g., Inverters, Converters, MOSFETs, IGBTs, Diodes)

- Communication Modules (e.g., 5G, 4G/LTE, Wi-Fi, Bluetooth, GNSS, V2X)

- Actuators

- Memory Devices (e.g., Flash, DRAM)

- Passive Components (e.g., Resistors, Capacitors, Inductors)

- Display Units

- Other Electronic Components

- By Application:

- Advanced Driver-Assistance Systems (ADAS)

- Powertrain & Chassis

- Infotainment & Telematics

- Body Electronics

- Safety & Security Systems

- Electric Vehicle (EV) Systems (e.g., Battery Management, Motor Control, Charging)

- Human-Machine Interface (HMI)

- By Vehicle Type:

- Passenger Cars (e.g., Sedan, SUV, Hatchback)

- Commercial Vehicles (e.g., Light Commercial Vehicles, Heavy Commercial Vehicles, Buses, Trucks)

- Electric Vehicles (EVs) (e.g., Battery Electric Vehicles - BEV, Plug-in Hybrid Electric Vehicles - PHEV, Hybrid Electric Vehicles - HEV)

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

Value Chain Analysis For Automotive Electronic Components Market

The value chain of the Automotive Electronic Components Market is a complex, multi-tiered structure, commencing with the extraction and processing of raw materials and culminating in the end-user adoption of vehicles equipped with these sophisticated systems. Upstream analysis reveals a foundation built on raw material suppliers providing essential elements like silicon, rare earth metals, various plastics, and specific chemicals, which are then processed into wafers, substrates, and foundational materials for electronic manufacturing. These materials flow into specialized component manufacturers who design and produce the core electronic parts such as semiconductors (ICs, microcontrollers), sensors, power modules, and passive components. This segment requires high capital investment in fabrication plants and extensive R&D to meet stringent automotive grade specifications for reliability and performance. Consolidation and strategic alliances are common in this upstream segment to manage complexity and ensure supply security.

Further along the chain, these specialized electronic components are supplied to Tier 2 and Tier 1 suppliers. Tier 2 suppliers often focus on specific modules or sub-systems, such as advanced sensor arrays or integrated power management units. Tier 1 suppliers then integrate these components, often from multiple manufacturers, into larger, more complex systems or modules like complete ADAS units, infotainment systems, or powertrain control units, which are then delivered directly to automotive OEMs. This integration phase is critical, involving significant software development, rigorous testing, and compliance with automotive industry standards (e.g., ISO 26262 for functional safety). Tier 1 suppliers act as critical intermediaries, translating OEM requirements into functional electronic systems and managing complex supply networks.

The distribution channels for automotive electronic components are primarily segmented into direct and indirect channels. Direct sales predominantly occur between Tier 1 suppliers and automotive OEMs, where components are designed and supplied specifically for new vehicle production lines. This channel involves long-term contracts, joint development agreements, and close collaboration. Indirect channels, on the other hand, cater to the aftermarket segment, involving distributors, wholesalers, and retailers who supply electronic components for vehicle repair, maintenance, and upgrades. This includes replacement parts for existing vehicles or enhancements like aftermarket infotainment systems. The increasing complexity of electronic systems has led to a growing emphasis on authorized service networks and specialized diagnostic tools, impacting the aftermarket distribution landscape and requiring sophisticated technical support for end-users and repair shops alike.

Automotive Electronic Components Market Potential Customers

The primary potential customers and end-users of the Automotive Electronic Components Market are predominantly the Original Equipment Manufacturers (OEMs) of various vehicle types, including passenger cars, commercial vehicles, and dedicated electric vehicle manufacturers. These OEMs represent the largest customer segment, as they integrate electronic components directly into their new vehicle designs and production lines, ranging from basic safety systems to advanced autonomous driving platforms. Their purchasing decisions are driven by factors such as component reliability, performance specifications, cost-effectiveness, compliance with regulatory standards, and the supplier's ability to innovate and provide solutions tailored to evolving vehicle architectures, particularly with the rise of software-defined vehicles and electrification.

Beyond the OEMs, Tier 1 automotive suppliers constitute another significant customer base. These companies procure individual electronic components (like microcontrollers, sensors, and power semiconductors) from specialized manufacturers to integrate them into larger, more complex modules or sub-systems, such as complete ADAS modules, advanced infotainment units, or integrated powertrain control systems. These Tier 1 suppliers then deliver these complete systems to OEMs, acting as a crucial intermediary layer in the value chain. Their needs focus on component interoperability, scalability, functional safety compliance, and robust technical support from their component suppliers to ensure seamless integration into their proprietary systems.

Furthermore, the aftermarket segment represents a growing set of potential customers. This includes independent repair shops, authorized service centers, fleet operators, and even individual consumers seeking to maintain, repair, or upgrade their existing vehicles with new electronic functionalities. For instance, replacement ECUs, sensor modules for ADAS repair, or advanced infotainment upgrades fall under this category. The demand in the aftermarket is driven by the increasing electronic content in older vehicles, the need for diagnostics, and the desire for enhanced features. This segment requires components that are compatible with a wide range of vehicle models and often demands readily available, cost-effective solutions for repairs and upgrades.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 220 Billion |

| Market Forecast in 2033 | USD 370 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Continental AG, Denso Corporation, Aptiv PLC, Infineon Technologies AG, NXP Semiconductors N.V., Renesas Electronics Corporation, STMicroelectronics N.V., Texas Instruments Incorporated, ZF Friedrichshafen AG, Magna International Inc., Valeo SE, BorgWarner Inc., Vitesco Technologies GmbH, ON Semiconductor Corporation, ROHM Semiconductor, Micron Technology Inc., Marvell Technology Inc., NVIDIA Corporation, Qualcomm Technologies Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Electronic Components Market Key Technology Landscape

The Automotive Electronic Components Market is characterized by a rapidly evolving technological landscape, driven by the intense push towards vehicle electrification, automation, connectivity, and enhanced safety. At the forefront are advancements in semiconductor technology, particularly the increasing adoption of wide-bandgap materials like Silicon Carbide (SiC) and Gallium Nitride (GaN). These materials are revolutionizing power electronics, enabling higher efficiency, power density, and thermal performance in critical applications such as inverters, converters, and on-board chargers for electric vehicles, significantly extending range and reducing charging times. This shift from traditional silicon-based power components is a fundamental technological upgrade.

Sensor technologies are undergoing rapid innovation to support sophisticated Advanced Driver-Assistance Systems (ADAS) and autonomous driving. This includes the development of high-resolution radar systems capable of detecting smaller objects at longer distances, compact and robust lidar sensors for precise 3D mapping, advanced camera systems with enhanced night vision and dynamic range, and ultrasonic sensors for close-range detection. The fusion of data from multiple sensor types, often powered by AI algorithms, is a critical technological trend, providing a more comprehensive and reliable perception of the vehicle's surroundings than any single sensor type could achieve independently, thereby improving overall system safety and performance.

Furthermore, the evolution of communication technologies is pivotal for connected vehicles and vehicle-to-everything (V2X) capabilities. The deployment of 5G cellular technology is enabling ultra-low latency and high-bandwidth communication, crucial for real-time data exchange between vehicles, infrastructure, and cloud services, supporting advanced traffic management and safety applications. Alongside this, the integration of secure embedded software platforms, robust cybersecurity solutions, and high-performance computing platforms (e.g., domain controllers, central computing units) capable of processing massive amounts of data from various vehicle systems is transforming traditional distributed electronic architectures into centralized, software-defined paradigms. These technologies are foundational to enabling over-the-air updates, advanced diagnostics, and the continuous enhancement of vehicle functionalities throughout their lifecycle, making vehicles more intelligent and adaptive.

Regional Highlights

- Asia Pacific: Dominates the global market, driven by robust automotive production in China, Japan, South Korea, and India. Rapid adoption of electric vehicles, government initiatives promoting advanced automotive technologies, and a large consumer base contribute to significant demand for electronic components in ADAS, infotainment, and EV systems.

- North America: A leader in innovation for autonomous driving and connected car technologies, with strong R&D investments in high-performance computing, sensor fusion, and cybersecurity. High consumer disposable income and demand for premium features drive the integration of advanced electronics.

- Europe: Characterized by stringent emission regulations and safety standards, fostering the adoption of sophisticated powertrain electronics for fuel efficiency and comprehensive ADAS. Germany, France, and the UK are key markets, with a focus on premium and luxury vehicle segments.

- Latin America: An emerging market with steady growth, influenced by increasing vehicle production and rising demand for basic and mid-range electronic features in new cars. Brazil and Mexico are significant regional players with expanding manufacturing capabilities.

- Middle East & Africa (MEA): Growing automotive sales, particularly in the GCC countries, alongside investments in smart city infrastructure, are driving demand for connected car technologies and advanced infotainment systems. The region is also gradually adopting EVs, contributing to component demand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Electronic Components Market.- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- Aptiv PLC

- Infineon Technologies AG

- NXP Semiconductors N.V.

- Renesas Electronics Corporation

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- ZF Friedrichshafen AG

- Magna International Inc.

- Valeo SE

- BorgWarner Inc.

- Vitesco Technologies GmbH

- ON Semiconductor Corporation

- ROHM Semiconductor

- Micron Technology Inc.

- Marvell Technology Inc.

- NVIDIA Corporation

- Qualcomm Technologies Inc.

Frequently Asked Questions

What are the primary factors driving growth in the Automotive Electronic Components Market?

The market's growth is primarily driven by the global push for vehicle electrification, increasing adoption of Advanced Driver-Assistance Systems (ADAS) and autonomous driving technologies, growing consumer demand for connected car features, and stringent global safety regulations. These factors necessitate higher electronic content per vehicle, spurring innovation and demand across various component categories.

How is Artificial Intelligence (AI) impacting automotive electronic components?

AI significantly impacts the market by enhancing sensor capabilities for precise object detection, enabling advanced decision-making for autonomous driving, optimizing power management in EVs, facilitating predictive maintenance, and creating personalized in-car experiences. It also aids in design optimization and quality control in manufacturing.

What are the main challenges faced by manufacturers in this market?

Key challenges include persistent global semiconductor shortages and supply chain disruptions, the high costs associated with research and development of advanced electronics, complex integration requirements, growing cybersecurity risks in connected vehicles, and the need to navigate diverse and evolving regulatory landscapes across different regions.

Which regions are leading the Automotive Electronic Components Market?

The Asia Pacific region currently dominates the market due to its robust automotive manufacturing base and rapid EV adoption. North America and Europe are significant players, particularly in innovation for advanced ADAS and autonomous driving systems, driven by high R&D investments and demand for premium features.

What are the key technological advancements shaping the future of automotive electronics?

Future growth will be shaped by advancements in wide-bandgap semiconductors (SiC and GaN) for power electronics, sophisticated sensor fusion technologies, ultra-low latency communication modules (like 5G and V2X), secure embedded software platforms, and high-performance central computing units that enable software-defined vehicle architectures and over-the-air updates.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager