Automotive Engine and Transmission Sensors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433559 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Automotive Engine and Transmission Sensors Market Size

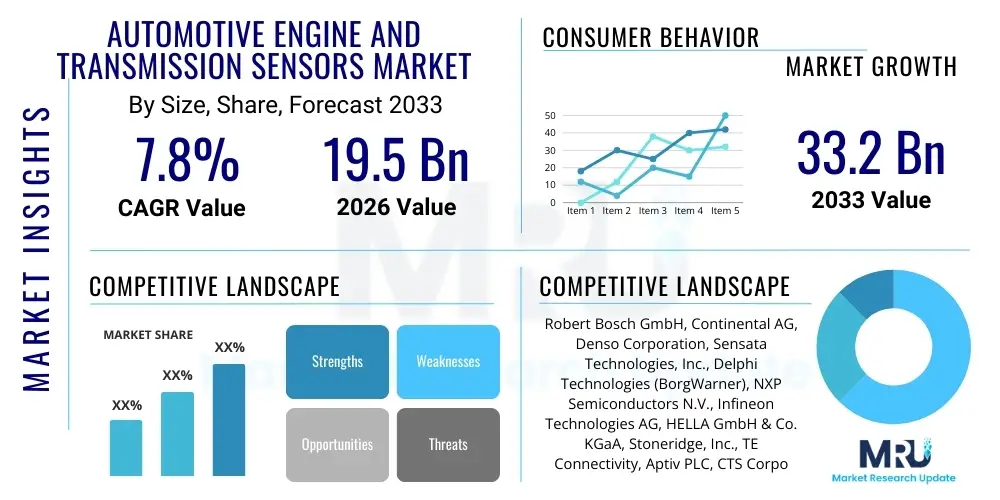

The Automotive Engine and Transmission Sensors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 19.5 Billion in 2026 and is projected to reach USD 33.2 Billion by the end of the forecast period in 2033.

Automotive Engine and Transmission Sensors Market introduction

The Automotive Engine and Transmission Sensors Market encompasses a range of sophisticated electronic components crucial for monitoring, regulating, and optimizing the performance and efficiency of internal combustion engines (ICE) and associated transmission systems. These sensors provide real-time data inputs to the Engine Control Unit (ECU) and Transmission Control Unit (TCU), enabling precise fuel injection timing, ignition control, gear shifting, and overall emissions management. Key product types include oxygen sensors, manifold absolute pressure (MAP) sensors, throttle position sensors, temperature sensors, and speed sensors (crankshaft and camshaft), all of which are fundamental for modern powertrain diagnostics and functionality.

The primary applications of these sensors lie in ensuring compliance with increasingly stringent global emission standards, such as Euro 7 and CAFE regulations, by meticulously managing the air-fuel ratio and combustion process. Furthermore, they play an indispensable role in enhancing vehicle performance, fuel economy, and operational safety. Benefits derived from advanced sensor integration include predictive maintenance capabilities, improved engine longevity, and optimized torque delivery, particularly in complex automatic and dual-clutch transmission systems. The continuous drive toward higher efficiency and reduced environmental impact mandates the deployment of more numerous, accurate, and resilient sensing devices across all vehicle classes, driving significant market expansion globally.

Driving factors propelling this market include the sustained high production volume of ICE and hybrid electric vehicles (HEVs), which still rely heavily on engine sensors for core operation. Technological advancements, particularly in Micro-Electro-Mechanical Systems (MEMS) technology, allow for smaller, more reliable, and cost-effective sensors. The growth of high-performance vehicles and the increasing complexity of modern transmissions (e.g., 8-speed and 10-speed automatics) further necessitate advanced sensing solutions for smooth and efficient operation, ensuring that the sensor market remains robust despite the long-term shift toward battery electric vehicles (BEVs).

Automotive Engine and Transmission Sensors Market Executive Summary

The Automotive Engine and Transmission Sensors Market is characterized by intense technological evolution driven by regulatory mandates and consumer demand for superior vehicle performance and fuel efficiency. Key business trends include strategic partnerships between sensor manufacturers and Tier 1 suppliers to develop integrated sensor modules and robust, temperature-resistant components tailored for high-efficiency turbocharged engines. There is a noticeable trend towards incorporating smart sensors equipped with internal processing capabilities (System-on-Chip sensors) that can filter and analyze data before transmitting it to the main ECU, thereby reducing wiring complexity and improving system latency. Furthermore, the aftermarket segment is expanding rapidly, fueled by the aging global vehicle parc and the increasing complexity of sensor replacement procedures, requiring specialized diagnostic tools and high-quality replacement parts.

Regionally, Asia Pacific (APAC) stands as the dominant market, primarily due to the substantial volume of vehicle production and sales in China, India, and Japan, coupled with the accelerating adoption of Euro VI/VII equivalent emission standards across the continent. Europe is a crucial region, characterized by high demand for sophisticated sensors driven by the earliest and most stringent environmental regulations and a strong presence of premium automotive manufacturers focused on performance monitoring. North America maintains steady growth, largely spurred by the demand for light-duty trucks and SUVs, which utilize complex transmission systems and high-output engines requiring extensive sensor arrays for effective management.

Segment trends indicate that Position Sensors, particularly those for crankshaft and camshaft position sensing, maintain significant revenue share due to their criticality in determining ignition timing and fuel injection sequence. However, Oxygen (O2) and NOx sensors are experiencing the fastest growth rate, directly correlated with the global push to curb harmful pollutants. By application, the Engine Control Unit (ECU) segment dominates the market, as engine operation requires the highest density and variety of sensors compared to transmission systems. The OEM channel holds the majority market share, though the aftermarket is gaining traction, emphasizing the need for robust supply chain management for replacement components.

AI Impact Analysis on Automotive Engine and Transmission Sensors Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Automotive Engine and Transmission Sensors Market predominantly focus on how AI enhances sensor data processing, enables predictive maintenance, and influences the design requirements of future sensor technology. Common questions revolve around the integration of machine learning algorithms for anomaly detection, the ability of AI to compensate for sensor degradation over time (sensor drift), and the necessity of higher data throughput sensors to feed sophisticated AI models. Users are keen to understand if AI will lead to the consolidation of multiple sensor functions into fewer, smarter devices, and how AI-driven optimization loops can further improve engine efficiency beyond traditional closed-loop control systems. The prevailing expectation is that AI will shift the value proposition from merely measuring physical parameters to intelligently interpreting vehicle health and optimizing performance in real-time, demanding higher accuracy, better calibration stability, and enhanced digital communication standards (e.g., CAN FD or Ethernet) from the sensor components themselves.

The integration of AI algorithms, particularly deep learning models, allows vehicle control systems to move beyond static calibration maps. AI enables sophisticated anomaly detection in engine combustion cycles or transmission shifting patterns by analyzing high-dimensional data streams from existing sensor networks, such as pressure, temperature, and acceleration sensors. This shift means that the data quality and resilience of the underlying sensors become paramount. For market participants, this translates into a need for sensors with integrated self-diagnostics and high-fidelity output that minimizes signal noise, which is essential for accurate machine learning inference. AI capabilities further extend to optimizing fuel efficiency by dynamically adjusting engine parameters based on external factors like driving style, road conditions, and environmental variables, utilizing sensor data as the primary input source.

Furthermore, AI significantly enhances predictive maintenance strategies. Instead of relying on fixed usage intervals, AI models can detect subtle changes in sensor readings that indicate impending component failure (e.g., catalytic converter efficiency loss detected by fluctuating O2 sensor readings or early bearing wear detected by vibration/knock sensors). This capability reduces unexpected downtime and lowers overall cost of ownership for fleet operators and consumers. While AI does not replace the physical sensor, it drastically increases the demand for sensors capable of delivering continuous, accurate, and timestamped data, thereby pushing manufacturers toward developing sensors optimized for digital connectivity and robustness in harsh automotive environments.

- AI algorithms enhance sensor data processing, enabling predictive maintenance models for powertrain components.

- Increased demand for smart sensors with integrated signal conditioning and self-calibration features to support AI input reliability.

- AI optimization loops dynamically adjust engine and transmission control parameters in real-time based on high-fidelity sensor data.

- Enables sophisticated anomaly detection, improving diagnostics and reducing false positives associated with standard fixed thresholds.

- Drives the need for higher data bandwidth communication protocols (e.g., Automotive Ethernet) for transmitting dense sensor information.

- Supports sensor fusion, where AI integrates data from multiple sensor types (thermal, pressure, acoustic) to derive a holistic view of powertrain health.

DRO & Impact Forces Of Automotive Engine and Transmission Sensors Market

The Automotive Engine and Transmission Sensors Market is shaped by a powerful interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the Impact Forces that dictate market direction and growth trajectory. Key drivers include the global enforcement of stringent governmental emission standards (such as Euro 7 and China VI), which necessitate highly accurate monitoring and control systems within the powertrain, directly translating into increased sensor deployment per vehicle. Additionally, the proliferation of complex powertrain technologies, including turbocharged gasoline direct injection (GDI) engines and advanced hybrid electric vehicle (HEV) architectures, demands specialized sensors capable of withstanding extreme operating temperatures and pressures. These drivers create an immediate and persistent demand for high-performance sensing solutions across the industry.

Conversely, significant restraints hinder market potential, most prominently the accelerated global shift towards Battery Electric Vehicles (BEVs). As BEVs replace traditional ICE vehicles, the demand for traditional engine-specific sensors (like O2, MAP, and knock sensors) will naturally diminish over the long term, posing a structural challenge to the market. Furthermore, challenges related to sensor integration complexity, particularly managing electromagnetic interference (EMI) and ensuring the longevity of components exposed to harsh environments, require substantial R&D investment, impacting manufacturing costs and time-to-market. The recent volatility in the global semiconductor supply chain also affects sensor production, leading to fluctuating lead times and potential cost inflation for electronic components.

Opportunities for growth are concentrated in the development of next-generation sensor technology optimized for hybrid vehicles and novel low-emission fuels (e.g., hydrogen or biofuels). Specifically, there is a burgeoning demand for highly accurate transmission sensors essential for optimizing the efficiency of complex multi-speed and continuously variable transmissions (CVTs) used in performance and heavy-duty vehicles. The expansion of the automotive aftermarket in developing economies, coupled with advancements in sensor diagnostics and condition monitoring systems leveraging AI, provides avenues for sustained revenue generation. The crucial impact forces include regulatory pressure, technological convergence (AI/IoT integration), and the long-term trend of vehicle electrification, forcing manufacturers to innovate and diversify their product portfolios rapidly.

Segmentation Analysis

The Automotive Engine and Transmission Sensors Market is segmented based on Sensor Type, Application, Vehicle Type, and Sales Channel, reflecting the diverse technical requirements across various powertrain architectures. Sensor Type segmentation is critical as it defines the core function, ranging from thermal management (temperature sensors) to combustion efficiency (O2 and NOx sensors) and timing control (position and speed sensors). The complexity and necessity of these components mean that each segment possesses distinct growth drivers and technological requirements. Understanding these segments is crucial for manufacturers in optimizing their product mix and R&D focus to align with emerging powertrain demands, particularly the stricter monitoring requirements mandated by environmental legislation.

Application segmentation differentiates between components supporting the Engine Control Unit (ECU) and those dedicated to the Transmission Control Unit (TCU). While ECU sensors traditionally dominate in volume and variety, TCU sensor demand is rising rapidly due to the trend towards increasingly complex, electronically controlled transmission systems designed for optimized fuel economy and smoother driving experience. The segmentation by Vehicle Type (Passenger vs. Commercial) reveals differences in sensor ruggedness and temperature tolerance, as commercial vehicles typically require more robust sensors built to withstand extended high-stress operation. These established segments provide the framework for analyzing market dynamics and forecasting future component demand based on shifts in vehicle production and technological adoption rates globally.

- Sensor Type: Pressure Sensors (MAP, Fuel Rail), Temperature Sensors (Coolant, Exhaust Gas), Speed Sensors (Wheel Speed, Crankshaft, Camshaft), Position Sensors (Throttle, Gearbox), Oxygen (O2) Sensors, Knock Sensors, NOx Sensors.

- Application: Engine Management System (EMS)/ECU, Transmission Control System (TCS)/TCU.

- Vehicle Type: Passenger Vehicles (PV), Commercial Vehicles (CV) (Light, Medium, Heavy-Duty).

- Sales Channel: Original Equipment Manufacturer (OEM), Aftermarket.

- Technology: Micro-Electro-Mechanical Systems (MEMS), Conventional Ceramic/Thick-Film Technology.

Value Chain Analysis For Automotive Engine and Transmission Sensors Market

The value chain for the Automotive Engine and Transmission Sensors Market begins with the upstream raw material suppliers, providing specialized materials such as high-grade ceramics, semiconductor wafers (silicon, gallium nitride), and high-temperature resistant metals essential for sensor fabrication. This upstream segment is characterized by specialized processing and high intellectual property ownership, particularly for MEMS and thin-film deposition technologies. Key activities here include material purification, component molding, and the production of sensing elements (e.g., piezoresistive elements or zirconia cells). Ensuring a stable and high-quality supply of these specialized materials is foundational, as sensor reliability is highly dependent on material integrity under extreme conditions.

The middle stage involves Tier 2 and Tier 1 manufacturers. Tier 2 suppliers often specialize in designing and manufacturing the sensor element itself (the chip or sensitive component), while Tier 1 suppliers (such as Bosch, Continental, Denso) integrate these elements into finalized sensor modules, including housing, calibration, electronic circuitry (ASICs), and connectors that interface directly with the vehicle's wire harness and ECU/TCU. These integrated modules must undergo rigorous testing for durability, vibration resistance, and accuracy across wide temperature ranges before being supplied directly to automotive OEMs. Technological expertise in miniaturization, packaging, and digital signal processing defines the competitive advantage at this stage.

Downstream activities involve distribution channels and end-users. Distribution primarily occurs through the Direct Channel to OEMs for new vehicle assembly, representing the largest volume segment. The Indirect Channel involves distribution through independent repair shops, wholesale distributors, and specialized service centers catering to the aftermarket. The aftermarket requires a high level of inventory management and cataloging due to the vast diversity of sensor models needed for older vehicles. End-user satisfaction, driven by product reliability and availability, is crucial, especially in the aftermarket where ease of installation and guaranteed compatibility influence purchasing decisions.

Automotive Engine and Transmission Sensors Market Potential Customers

Potential customers for Automotive Engine and Transmission Sensors span the entire lifecycle of a vehicle, from initial manufacturing to long-term maintenance and repair. The largest and most crucial customer segment consists of global Original Equipment Manufacturers (OEMs), including major automakers like Volkswagen Group, Toyota, General Motors, Ford, and Hyundai-Kia. These customers require massive volumes of sensors tailored precisely to their proprietary engine and transmission designs, often demanding extremely tight tolerances, high durability standards, and long-term supply agreements. OEMs drive the market for new technologies and advanced sensor features, integrating them into new vehicle platforms to meet regulatory mandates and consumer expectations for performance and fuel economy.

The second significant customer segment comprises the Tier 1 automotive suppliers (e.g., Magna, ZF, Aisin), which often purchase sensors either directly from Tier 2 sensor specialists or manufacture sensors in-house as part of integrated sub-systems, such as complete engine control modules or fully assembled transmission units. These companies act as intermediaries, focusing on system integration and validation before supplying the final product to the OEMs. Their demand centers around standardized components that offer ease of integration and high functional safety (ASIL) ratings, aligning with complex vehicle architectures.

Lastly, the Automotive Aftermarket constitutes a growing and geographically dispersed customer base. This segment includes independent garages, specialized repair shops, national and regional parts distributors, and individual vehicle owners. These customers drive demand for replacement sensors necessitated by wear-and-tear, malfunction, or collision damage. For this segment, product availability, competitive pricing, and certified quality (matching or exceeding OEM specifications) are the primary purchasing criteria. The aftermarket segment is increasingly reliant on advanced diagnostics, often requiring replacement sensors to communicate effectively with complex diagnostic tools.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 19.5 Billion |

| Market Forecast in 2033 | USD 33.2 Billion |

| Growth Rate | CAGR 7.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Continental AG, Denso Corporation, Sensata Technologies, Inc., Delphi Technologies (BorgWarner), NXP Semiconductors N.V., Infineon Technologies AG, HELLA GmbH & Co. KGaA, Stoneridge, Inc., TE Connectivity, Aptiv PLC, CTS Corporation, Emerson Electric Co., Standard Motor Products, Inc., Wells Vehicle Electronics, ZF Friedrichshafen AG, Magneti Marelli (Marelli), Wuxi Huajing Sensing Technology, Autoliv, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Engine and Transmission Sensors Market Key Technology Landscape

The technological landscape of the Automotive Engine and Transmission Sensors Market is defined by the migration from conventional electromagnetic and ceramic technologies toward advanced solid-state and Micro-Electro-Mechanical Systems (MEMS). MEMS technology, particularly prevalent in pressure and acceleration sensors (used in knock detection), enables significant miniaturization, improved sensitivity, and enhanced reliability compared to bulkier, traditional counterparts. These sensors are fabricated using semiconductor manufacturing techniques, allowing for integration with signal processing circuitry directly on the chip (System-on-Chip, or SoC solutions). This integration is crucial for maintaining signal integrity in electrically noisy vehicle environments and reducing the overall weight and complexity of the wiring harness.

Another pivotal technological trend is the adoption of smarter, digital output sensors utilizing protocols like Local Interconnect Network (LIN) or Controller Area Network Flexible Data Rate (CAN FD). Traditional sensors typically provide an analog signal, requiring external Analog-to-Digital Conversion (ADC) and processing by the ECU. Digital sensors, however, transmit calibrated and compensated data packets, offloading processing burden from the main control unit and facilitating more precise diagnostic capabilities. This shift enhances functional safety (ISO 26262 compliance) and is fundamental for supporting AI-driven powertrain control systems that require high-speed, validated data streams.

Furthermore, sensor technology specific to emissions control, notably for NOx and Particulate Matter (PM) monitoring, continues to evolve rapidly. NOx sensors, critical for Selective Catalytic Reduction (SCR) systems in diesel and high-efficiency gasoline engines, now incorporate sophisticated heating elements and robust materials to ensure accuracy across wide temperature and concentration ranges. Material science advancements, especially in zirconia and specialized polymers, are extending the operational lifespan and temperature resistance of critical components like oxygen sensors and exhaust gas temperature sensors, ensuring they meet the durability requirements of modern high-performance, compact engine architectures.

Regional Highlights

Regional dynamics play a significant role in shaping the demand and technological adoption within the Automotive Engine and Transmission Sensors Market, reflecting variances in vehicle production capacity, regulatory stringency, and consumer preferences regarding electrification.

- Asia Pacific (APAC): Dominates the global market, driven primarily by high-volume vehicle manufacturing in China, India, Japan, and South Korea. China's implementation of stringent emission standards (China VI) has significantly escalated the demand for advanced O2, NOx, and particulate matter sensors. The region is also a key manufacturing hub for global sensor players, benefiting from lower labor costs and extensive supply chain infrastructure. The rapid adoption of HEVs further boosts the demand for specialized transmission and temperature sensors used in battery and power electronics cooling systems.

- Europe: Characterized by a high demand for high-accuracy and performance-oriented sensors, necessitated by the region's focus on fuel efficiency, low emissions (Euro 7 preparation), and the dominance of premium vehicle segments. While the transition to BEVs is fastest here, hybrid vehicle production remains substantial, ensuring continued strong demand for sophisticated pressure and position sensors critical for GDI engines and complex dual-clutch transmissions. Germany, in particular, remains a core market due to its concentration of leading automotive OEMs and Tier 1 suppliers.

- North America: Exhibits robust demand, driven by the large market for light trucks and SUVs, which often utilize sophisticated, high-capacity automatic transmissions requiring extensive sensor arrays for optimal shifting and torque management. Regulatory pressures, specifically CAFE standards, push manufacturers towards turbocharged engines and complex hybrid systems, thereby increasing the sensor content per vehicle. The U.S. remains a key adopter of sensor technology for improved engine diagnostics and functional safety.

- Latin America (LATAM) & Middle East and Africa (MEA): These regions represent emerging markets characterized by strong growth in the aftermarket segment as the vehicle parc ages. While manufacturing scale is smaller, the adoption of older-generation emission standards necessitates basic engine sensor replacement and maintenance. Future growth will be linked to local production capacity expansion and the staggered introduction of stricter emission regulations, driving demand for technologically current sensing solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Engine and Transmission Sensors Market.- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- Sensata Technologies, Inc.

- Delphi Technologies (BorgWarner)

- NXP Semiconductors N.V.

- Infineon Technologies AG

- HELLA GmbH & Co. KGaA

- Stoneridge, Inc.

- TE Connectivity

- Aptiv PLC

- CTS Corporation

- Emerson Electric Co.

- Standard Motor Products, Inc.

- Wells Vehicle Electronics

- ZF Friedrichshafen AG

- Magneti Marelli (Marelli)

- Wuxi Huajing Sensing Technology

- Autoliv, Inc.

- Honeywell International Inc.

Frequently Asked Questions

Analyze common user questions about the Automotive Engine and Transmission Sensors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the Automotive Engine and Transmission Sensors Market despite the rise of EVs?

Market growth is primarily driven by the mandatory enforcement of stringent global emission standards (e.g., Euro 7), requiring high sensor redundancy and accuracy in remaining Internal Combustion Engine (ICE) and hybrid vehicles. Additionally, increasing complexity in modern transmissions and the high replacement demand in the expanding automotive aftermarket ensure sustained growth.

How is AI influencing the design requirements for new automotive sensors?

AI necessitates the development of smarter, highly reliable sensors capable of digital output (CAN FD/Ethernet) and self-diagnostics. These sensors must provide high-fidelity, low-latency data streams to support predictive maintenance models and dynamic, real-time control optimization by the ECU/TCU.

Which sensor type exhibits the fastest growth rate in the market?

NOx (Nitrogen Oxide) and Particulate Matter (PM) sensors are experiencing the fastest growth rate. This acceleration is directly attributable to rigorous global diesel and gasoline engine emission regulations requiring precise monitoring and control of exhaust aftertreatment systems.

What are the primary long-term restraints facing the engine sensor market?

The primary long-term restraint is the structural shift towards Battery Electric Vehicles (BEVs), which eliminates the need for many traditional engine-specific sensors (O2, MAP, knock sensors). Manufacturers are mitigating this by pivoting R&D towards hybrid vehicle systems and powertrain sensors for BEV cooling and power electronics.

Which region currently holds the largest market share for these sensors?

The Asia Pacific (APAC) region holds the largest market share, predominantly driven by the massive scale of vehicle production and sales in countries such as China and India, coupled with the introduction of advanced emission regulations in major regional economies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager