Automotive Exhaust Purification Catalyst Carrier Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431899 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Automotive Exhaust Purification Catalyst Carrier Market Size

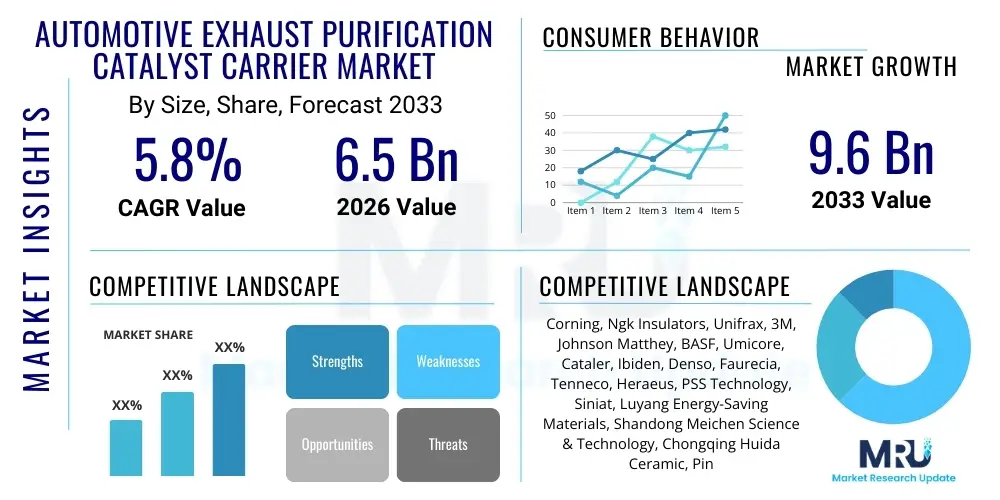

The Automotive Exhaust Purification Catalyst Carrier Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 6.5 billion in 2026 and is projected to reach USD 9.6 billion by the end of the forecast period in 2033.

Automotive Exhaust Purification Catalyst Carrier Market introduction

The Automotive Exhaust Purification Catalyst Carrier Market encompasses the specialized ceramic or metallic substrates utilized within catalytic converters to support and maximize the surface area of precious metal catalysts (such as platinum, palladium, and rhodium). These carriers are engineered primarily to facilitate the conversion of harmful exhaust gases—including carbon monoxide (CO), unburned hydrocarbons (HC), and nitrogen oxides (NOx)—into less harmful substances like carbon dioxide, water vapor, and nitrogen. The design and material selection of the catalyst carrier, particularly its geometric structure (monoliths, foams, or beads) and thermal resistance, are critical determinants of the catalytic converter’s efficiency and durability under extreme operating conditions.

Major applications for these carriers span the entire automotive sector, specifically within passenger vehicles, light commercial vehicles (LCVs), and heavy-duty vehicles (HDVs) that rely on internal combustion engines (ICE) or hybrid powertrains. The growing stringency of global emission standards, notably Euro 6/7 in Europe, LEV III in the US, and China VI, directly mandates the deployment of highly efficient catalytic converters, thereby driving demand for advanced carrier materials like high-cell-density cordierite and silicon carbide (SiC) substrates. Benefits derived from optimized catalyst carriers include superior thermal stability, reduced back pressure on the engine, improved light-off temperature performance, and enhanced mechanical strength necessary for vibration resistance.

The market is predominantly driven by legislative pressure from environmental agencies worldwide seeking to curb urban air pollution. Furthermore, the persistent demand for higher performance and fuel efficiency in modern vehicles necessitates innovation in carrier geometry and material composition to reduce weight while maintaining high catalytic activity. While the long-term shift toward electric vehicles poses a potential restraint, the interim necessity for highly efficient hybrid powertrains and stringent regulations governing existing ICE vehicles ensure robust near-term market momentum for advanced catalyst carrier technology.

Automotive Exhaust Purification Catalyst Carrier Market Executive Summary

The Automotive Exhaust Purification Catalyst Carrier Market is poised for consistent growth, fundamentally propelled by aggressive global regulatory frameworks focused on reducing vehicular tailpipe emissions. Business trends indicate a strong industry focus on optimizing substrate materials, shifting from standard cordierite to advanced materials like silicon carbide (SiC) for diesel particulate filters (DPFs) and gasoline particulate filters (GPFs), particularly in markets adopting Euro 6d and Euro 7 standards. Key manufacturers are engaging in strategic partnerships with OEMs and leveraging advanced manufacturing techniques, such as additive manufacturing, to create complex, customized carrier geometries that improve mass transfer and thermal shock resistance. This innovation cycle is essential for meeting the demands of high-performance engines and complex exhaust aftertreatment systems, including Selective Catalytic Reduction (SCR) and Lean NOx Traps (LNT).

Regionally, the Asia Pacific (APAC) market, spearheaded by China and India, is expected to exhibit the highest growth rate due to rapidly implementing stringent emission norms (e.g., China VI and Bharat Stage VI). These developing economies represent massive volumes in vehicle production, creating unparalleled demand for catalyst carriers. Europe remains a critical innovation hub, driving demand for GPFs due to the increasing penetration of gasoline direct injection (GDI) engines. North America also maintains stable growth, primarily driven by the replacement market and the stringent requirements for heavy-duty commercial vehicles, which utilize larger and more durable ceramic carriers.

Segment trends highlight the dominance of ceramic carriers, specifically cordierite monoliths, owing to their cost-effectiveness and proven performance in gasoline engines. However, the Silicon Carbide (SiC) segment is forecast to be the fastest-growing material segment, attributed to its superior thermal stability and higher filtration efficiency required for particulate matter reduction in both diesel and gasoline applications. Passenger vehicles constitute the largest application segment, but the commercial vehicle segment is displaying accelerated growth due to the high capital investment required for efficient aftertreatment systems in trucks and buses, which require robust and high-capacity carriers to handle greater exhaust volumes and severe operating cycles.

AI Impact Analysis on Automotive Exhaust Purification Catalyst Carrier Market

Common user questions regarding AI's impact on the catalyst carrier market primarily revolve around predictive maintenance, optimized material composition, and enhancing manufacturing efficiency. Users are keenly interested in how Artificial Intelligence can model complex fluid dynamics and heat distribution within catalytic converters to design carrier structures that maximize catalytic efficiency and longevity. Key themes emerging include the potential for AI-driven simulation platforms to drastically reduce R&D cycles for new carrier geometries, concerns about the required data infrastructure for real-time exhaust system monitoring, and expectations regarding the role of machine learning in optimizing the washcoat application process and predicting carrier degradation under specific operational profiles. This collective user interest suggests a demand for AI not just as a tool for automation, but as a core component for performance optimization and predictive quality control, ensuring compliance with future hyper-stringent emission standards.

AI algorithms are increasingly integrated into the material science and engineering phases of catalyst carrier development. Specifically, machine learning models can analyze vast datasets concerning temperature variations, gas flow rates, and catalytic activity across various carrier geometries and porosities. This capability allows manufacturers to simulate millions of design permutations in silico, identifying optimal structures that minimize back pressure while maximizing surface area for catalyst deposition. This drastically accelerates the time-to-market for carriers compliant with next-generation regulations (such as Euro 7, which demands enhanced performance across a wider range of operating conditions).

Furthermore, AI-driven process control systems are revolutionizing the manufacturing floor. In the highly complex process of carrier extrusion and firing, machine vision and deep learning models monitor parameters such as slurry viscosity, drying consistency, and firing temperature in real time. This proactive quality control minimizes material waste, ensures the structural integrity of the resulting monolith, and achieves highly consistent cell densities and wall thicknesses, which are paramount for performance reliability. The application of AI also extends to supply chain management, optimizing the procurement and inventory of critical raw materials like cordierite powder and silicon carbide, thereby improving operational resilience and cost management for carrier producers.

- AI-Enhanced Geometric Optimization: Machine learning (ML) models simulate exhaust gas flow dynamics and thermal distribution to design carriers with optimized cell density and wall thickness, improving catalyst contact efficiency by up to 15%.

- Predictive Maintenance of Converters: AI algorithms analyze vehicle operating data (temperature, mileage, engine load) to predict the degradation rate of the catalyst carrier, enabling timely replacement and maintaining emission compliance throughout the vehicle's lifespan.

- Automated Quality Control in Manufacturing: AI-powered vision systems detect microscopic defects or inconsistencies in extruded monoliths during production, ensuring zero-defect output for stringent OEM requirements.

- Optimized Washcoat Application: Deep learning fine-tunes parameters during the washcoat process to ensure uniform deposition of the catalyst layer, maximizing the effectiveness of expensive Precious Group Metals (PGMs).

- Advanced Material Discovery: AI accelerates the research and development of novel high-temperature resistant and chemically inert carrier materials, moving beyond traditional ceramics toward composite structures.

- Supply Chain Resilience: Predictive analytics anticipates shortages or price volatility in critical raw materials (e.g., rare earth elements used in stabilizing washcoats), allowing manufacturers to adjust procurement strategies proactively.

DRO & Impact Forces Of Automotive Exhaust Purification Catalyst Carrier Market

The dynamics of the Automotive Exhaust Purification Catalyst Carrier market are shaped by a powerful interplay between stringent legislative mandates, technological advancements, and the underlying transition of the global automotive fleet. The primary drivers revolve around the continuous tightening of emission regulations globally, such as the implementation of Euro 6d and forthcoming Euro 7 standards, which necessitate carriers with higher thermal shock resistance and increased cell density for improved efficiency. Restraints primarily include the high capital investment required for SiC carrier manufacturing, the inherent complexity and cost associated with PGMs that rely on these carriers, and, crucially, the long-term structural threat posed by the accelerating global shift toward Battery Electric Vehicles (BEVs), which bypass the need for exhaust purification systems entirely.

Opportunities for growth lie significantly in the burgeoning demand for specialized filters, such as Gasoline Particulate Filters (GPFs), driven by the widespread adoption of Gasoline Direct Injection (GDI) engines, which produce particulate matter comparable to diesel engines. Furthermore, the commercial vehicle sector, particularly heavy-duty trucks and buses, presents a lucrative niche requiring large-volume, highly durable carriers for SCR and DPF systems. Innovation in thin-wall technology for cordierite monoliths and the development of alternative, lower-cost washcoat formulations also present critical avenues for market expansion, allowing manufacturers to balance performance requirements with cost pressures imposed by OEMs.

Impact forces analysis reveals that environmental and technological factors are the most potent influences. The regulatory pressure (Driver) consistently impacts technology adoption, compelling manufacturers to invest heavily in advanced materials (like SiC and metallic substrates) to meet compliance benchmarks, thereby increasing market costs (Restraint). The high entry barrier established by requiring deep technical expertise in ceramics and metallurgy acts as a protective force for incumbent players. The shift towards hybridization in vehicles, rather than pure electrification, offers a transitional opportunity, as hybrid vehicles still require sophisticated exhaust aftertreatment to qualify for regulatory incentives, sustaining demand for high-efficiency catalyst carriers for the medium term (up to 2035).

- Drivers:

- Global Implementation of Stringent Emission Regulations (e.g., Euro 7, China VI, US Tier 3), mandating higher conversion efficiency and lower pollutant output.

- Increasing Production and Adoption of Gasoline Direct Injection (GDI) Engines, driving demand for Gasoline Particulate Filters (GPFs) utilizing high-performance carriers.

- Growing Vehicle Fleet Size, particularly in emerging Asian economies, increasing the overall volume requirement for catalytic converters.

- Technological Advancements in Thin-Wall Substrate Design, allowing for reduced thermal inertia and faster catalyst light-off times.

- Restraints:

- Accelerated Global Shift Towards Battery Electric Vehicles (BEVs), which inherently eliminate the need for exhaust purification components in the long term.

- High Cost and Volatility of Raw Materials, including cordierite precursors and the energy-intensive processing required for ceramic and SiC carriers.

- Manufacturing Complexity and High Capital Expenditure required for producing advanced, high-cell-density carrier structures.

- High Replacement Costs and Durability Concerns associated with certain carrier materials under extreme thermal cycling conditions.

- Opportunities:

- Development of Cost-Effective Silicon Carbide (SiC) Manufacturing Techniques to broaden application beyond premium diesel vehicles.

- Expansion into the Retrofit Market for Older Commercial and Industrial Vehicles in regions adopting new compliance standards.

- Focus on Hybrid Vehicle Powertrains, which require specialized cold-start catalyst systems demanding ultra-low thermal mass carriers.

- Innovation in Metallic Substrates for niche high-performance applications where mechanical strength and thermal conductivity are paramount.

- Impact Forces:

- Regulatory Environment: High influence, driving fundamental market requirements and technology adoption timelines.

- Technological Innovation: Medium to High influence, focused on improving thermal properties and reducing manufacturing complexity.

- Economic Volatility: Medium influence, affecting OEM profitability and the willingness to integrate expensive, advanced carriers.

- Sustainability Trends: High influence, indirectly driving the long-term transition away from ICEs, but directly promoting the efficiency of existing aftertreatment.

Segmentation Analysis

The Automotive Exhaust Purification Catalyst Carrier Market is segmented based on critical technical characteristics, including the material used for the substrate, the specific application in vehicle type, and the coating technology employed. The primary differentiation lies in Material Type, where manufacturers choose between ceramics (Cordierite, SiC) and metallic foils based on the required thermal performance and mechanical strength for the target engine type. Cordierite remains the volume leader due to its cost advantage and low thermal expansion, while SiC is gaining traction in regulated particulate filter markets.

Segmentation by Application is crucial, distinguishing between the high-volume Passenger Vehicle market and the more technically demanding Commercial Vehicle segment. Commercial vehicles (trucks, buses) often utilize larger, heavier-duty carriers designed to withstand long operating hours and extreme exhaust temperatures associated with diesel engines, frequently incorporating advanced DPF and SCR systems. Passenger vehicles, especially GDI models, are driving the adoption of smaller, highly efficient GPFs and three-way catalysts (TWC) utilizing thin-wall technology.

The market also segments implicitly by Coating Technology, primarily focusing on the washcoat formulation and the deposition of Precious Group Metals (PGMs). Advanced catalyst carriers require sophisticated washcoats that adhere effectively to the substrate while providing maximal surface area and thermal stability for the PGM catalysts, ensuring the entire exhaust system meets the increasingly strict regulatory thresholds for NOx and particulate matter conversion efficiency under diverse driving conditions, including critical cold-start performance.

- By Material Type:

- Cordierite Carriers

- Silicon Carbide (SiC) Carriers

- Metallic Carriers (Stainless Steel Foils)

- Aluminum Titanate (AT) Carriers

- By Application:

- Passenger Vehicles (PV)

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

- By Engine Type:

- Gasoline Engines (requiring TWCs and GPFs)

- Diesel Engines (requiring DPFs and SCRs)

- By Cell Density:

- Standard Cell Density (e.g., 400 Cells/in²)

- High Cell Density (e.g., 600 Cells/in² and above)

- By Region:

- North America (NA)

- Europe (EU)

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Automotive Exhaust Purification Catalyst Carrier Market

The value chain for the Automotive Exhaust Purification Catalyst Carrier market begins with the extraction and processing of fundamental raw materials, primarily high-purity minerals such as kaolin, talc, and alumina for cordierite, and silica sand and carbon for silicon carbide (SiC). The upstream segment is characterized by specialized chemical and material processing companies that produce highly consistent ceramic powders or metallic foils. Quality control at this stage is paramount, as the purity and particle size distribution of the precursors directly determine the final thermal and mechanical properties of the carrier substrate, necessitating strong long-term relationships between raw material suppliers and catalyst carrier manufacturers.

The intermediate stage involves highly technical carrier manufacturing (extrusion, firing/sintering, canning) carried out by core players like Corning and NGK Insulators. These companies transform raw materials into complex monolithic structures. Following carrier production, the component moves to the catalyst coating firms, often the same entity or specialized chemical companies (like BASF or Umicore), which apply the washcoat and impregnate the substrate with expensive Precious Group Metals (PGMs). This step adds immense value, transforming the inert carrier into a functional catalytic converter component.

The downstream segment involves integration and distribution. The finished catalytic converter assembly (carrier + washcoat + canning) is either supplied directly to Original Equipment Manufacturers (OEMs) for integration into new vehicle exhaust systems (Direct Channel) or distributed through an aftermarket network consisting of wholesalers, specialized exhaust system distributors, and repair shops (Indirect Channel). The OEM channel dominates the volume market, driven by long-term procurement contracts and stringent quality checks, whereas the aftermarket channel provides necessary replacement components, influenced heavily by vehicle age, driving cycles, and regional inspection standards.

Automotive Exhaust Purification Catalyst Carrier Market Potential Customers

Potential customers for Automotive Exhaust Purification Catalyst Carriers are highly concentrated within the global automotive supply chain, primarily comprising the manufacturers responsible for integrating complete exhaust aftertreatment systems. The primary buyers are Tier 1 automotive suppliers who specialize in designing and assembling catalytic converters, such as Faurecia, Tenneco (now part of Aptiv), and others. These entities procure the bare carriers and then perform the highly critical and specialized washcoating and PGM loading processes before delivering the finalized system to the vehicle manufacturer.

Secondly, the vehicle Original Equipment Manufacturers (OEMs) themselves represent a major customer group, especially large, vertically integrated automotive conglomerates that may choose to purchase carriers directly and manage certain parts of the aftertreatment assembly in-house to maintain control over proprietary designs and cost structures. Key OEMs across various regions, including Volkswagen Group, General Motors, Toyota, and Tata Motors, significantly influence the market specifications, demanding customization in size, cell density, and material based on their engine architecture and compliance requirements for specific geographic markets. The aftermarket segment, though smaller in volume, includes wholesalers and distributors serving independent garages and specialized repair networks that require replacement carriers for vehicles no longer under warranty.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 9.6 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Corning, Ngk Insulators, Unifrax, 3M, Johnson Matthey, BASF, Umicore, Cataler, Ibiden, Denso, Faurecia, Tenneco, Heraeus, PSS Technology, Siniat, Luyang Energy-Saving Materials, Shandong Meichen Science & Technology, Chongqing Huida Ceramic, Pingxiang Plansee, DCL International |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Exhaust Purification Catalyst Carrier Market Key Technology Landscape

The technology landscape of the automotive exhaust purification catalyst carrier market is dominated by advancements aimed at reducing thermal mass and increasing geometric surface area while enhancing thermal stability. The central technological challenge is achieving faster 'light-off'—the point at which the catalyst reaches the required operating temperature—to ensure pollutants are efficiently converted immediately after engine startup, a primary focus of upcoming Euro 7 regulations. Thin-wall technology is crucial here, involving the extrusion of ceramic monoliths with wall thicknesses significantly below 4 mils (0.1 mm), which drastically reduces the amount of material needing to be heated, leading to quicker light-off times without compromising mechanical integrity. Innovations in cordierite manufacturing processes focus heavily on achieving these ultra-thin walls while maintaining the structural soundness required for high-speed automated canning processes.

A second major technological development is the widespread adoption of Silicon Carbide (SiC) as the carrier material for Particulate Filters (DPFs and GPFs). SiC technology offers superior filtration efficiency and, crucially, much higher melting points and thermal conductivity compared to traditional cordierite, making it ideal for the highly exothermic regeneration processes required to burn off trapped soot, particularly in diesel applications. The technology involves intricate pore design and optimized wall-flow geometries to balance filtration efficiency (trapping particulate matter) and minimal pressure drop (maintaining engine performance). Continuous research focuses on reducing the cost of SiC production, which currently acts as a limiting factor, through more energy-efficient sintering techniques.

Furthermore, the integration of advanced coating methodologies, specifically related to the washcoat, represents a key technological frontier. Modern catalyst carriers require washcoats that utilize nano-structured materials to improve adherence, porosity, and thermal aging resistance. Technology development includes optimizing the rheology of the washcoat slurry and using precision application techniques (like spray coating or vacuum impregnation) to ensure a uniform layer thickness and distribution of stabilizers and oxygen storage components (OSCs). The goal is to maximize the utilization of expensive PGMs loaded onto the carrier surface, effectively minimizing the PGM content required per vehicle while meeting ever stricter emission targets.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, primarily driven by massive automotive production volumes in China, India, and Japan. The rigorous enforcement of emission standards, such as China VI (equivalent to Euro 6) and India's Bharat Stage VI (BS VI), has created a surge in demand for sophisticated catalyst carriers, particularly SiC DPFs and high-cell-density cordierite TWC carriers. Government incentives and mandatory testing regimes are bolstering the aftermarket as well.

- Europe: Europe remains a highly innovative market, characterized by intense regulatory pressure from the European Union (EU) seeking to introduce Euro 7, demanding further performance improvements, especially under cold-start conditions and low-load city driving. This focus drives the demand for ultra-thin-wall carriers and the mandatory installation of Gasoline Particulate Filters (GPFs) across almost all new GDI vehicles. The region exhibits high adoption rates for advanced SCR carriers in the large diesel commercial vehicle sector.

- North America (NA): The NA market, encompassing the US, Canada, and Mexico, is stable but mature. Demand is fueled by high vehicle usage rates and the ongoing transition toward stricter US EPA Tier 3 standards, particularly for light trucks and SUVs. The replacement market is significant here due to the long operational life of vehicles. The heavy-duty truck segment is a dominant consumer of large, durable ceramic and metallic carriers for compliance with state-level emissions regulations (e.g., California’s low-NOx requirements).

- Latin America (LATAM): LATAM is an emerging region characterized by slower adoption of advanced emission standards compared to Europe or APAC, although countries like Brazil and Mexico are gradually tightening regulations, creating initial demand for Euro 5/6 compliant carriers. Market growth is sensitive to economic stability and local production levels.

- Middle East and Africa (MEA): This region typically follows European or Asian technological standards, relying heavily on imported carriers. Demand is highly fragmented, with developed nations in the GCC pushing for cleaner vehicle fleets, while other sub-regions focus more on the aftermarket and retrofit solutions. Adoption of advanced SiC technology is currently low but expected to rise with imported, regulated vehicles.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Exhaust Purification Catalyst Carrier Market.- Corning Incorporated

- Ngk Insulators, Ltd.

- Unifrax LLC

- 3M Company

- Johnson Matthey PLC

- BASF SE

- Umicore N.V.

- Cataler Corporation

- Ibiden Co., Ltd.

- Denso Corporation

- Faurecia (now part of Aptiv PLC)

- Tenneco Inc. (now part of Apollo)

- Heraeus Holding GmbH

- PSS Technology Co., Ltd.

- Siniat International (Etex Group)

- Luyang Energy-Saving Materials Co., Ltd.

- Shandong Meichen Science & Technology Co., Ltd.

- Chongqing Huida Ceramic Co., Ltd.

- Pingxiang Plansee High Performance Materials Co., Ltd.

- DCL International Inc.

Frequently Asked Questions

Analyze common user questions about the Automotive Exhaust Purification Catalyst Carrier market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary materials are used for catalyst carriers and why are they chosen?

The primary materials are Cordierite and Silicon Carbide (SiC). Cordierite is favored for its low thermal expansion and cost-effectiveness, ideal for conventional gasoline engines. SiC is chosen for its superior thermal stability and melting point, making it necessary for high-temperature diesel and gasoline particulate filters (DPFs/GPFs).

How do global emission regulations directly impact the demand for catalyst carriers?

Stringent regulations (like Euro 7 and China VI) mandate higher pollutant conversion rates and faster catalyst activation ('light-off'). This drives demand for technologically advanced carriers featuring ultra-thin walls and high cell densities to maximize catalytic surface area and reduce thermal inertia.

What is the role of the catalyst carrier in particulate filters (DPFs and GPFs)?

In particulate filters, the carrier substrate is typically a wall-flow monolith (often SiC) designed to force exhaust gases through porous channel walls. The carrier acts as a physical filter to trap soot and particulate matter, which are later burned off during a high-temperature regeneration cycle, ensuring continued emission compliance.

How is the electric vehicle (EV) transition restraining the growth of this market?

Electric vehicles, being zero-emission at the tailpipe, eliminate the need for catalytic converters and thus catalyst carriers. While hybrid vehicles still require carriers, the long-term, global shift toward battery electric mobility poses a fundamental structural restraint on market expansion beyond the 2035 horizon.

Which geographical region is showing the fastest growth in the catalyst carrier market?

The Asia Pacific (APAC) region, led by China and India, is experiencing the fastest market growth. This rapid expansion is due to high-volume vehicle manufacturing combined with the recent, aggressive adoption of Euro 6/BS VI equivalent emission standards, necessitating widespread deployment of advanced aftertreatment systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager