Automotive F&I Solution Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431730 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Automotive F&I Solution Market Size

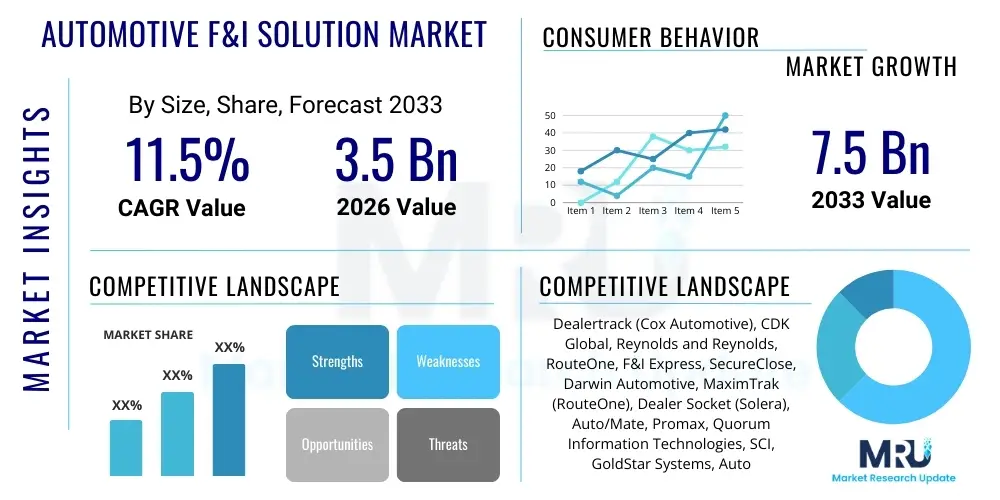

The Automotive F&I Solution Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033.

Automotive F&I Solution Market introduction

The Automotive Finance and Insurance (F&I) Solution Market encompasses software platforms, digital tools, and comprehensive services designed to streamline and optimize the processes related to financing, leasing, and the sale of auxiliary protection products (such as extended warranties, gap insurance, and maintenance plans) within automotive dealerships and retail environments. These solutions integrate critical functions like credit application submission, lender communication, deal structuring, regulatory compliance management, and e-contracting, fundamentally transforming the traditional, often paper-intensive F&I office into a modernized, efficient, and transparent operation. The core product revolves around enterprise resource planning (ERP) systems and specialized dealer management systems (DMS) modules that facilitate seamless data flow from the initial customer interaction through to the final contract signing, significantly enhancing the overall customer experience and increasing profitability for the dealer.

Major applications of Automotive F&I solutions span across new and used vehicle sales, leasing operations, and the aftermarket services sector. These systems are crucial for compliance management, ensuring that dealers adhere to complex federal, state, and local regulations pertaining to lending practices and product disclosure, thereby mitigating legal and financial risks. Furthermore, F&I solutions are increasingly being deployed in digital retail environments, enabling consumers to complete significant portions of the financing and F&I product selection process online before ever stepping foot in the dealership. This digital integration is vital for meeting contemporary consumer expectations for convenience and personalized purchasing journeys, particularly as e-commerce penetration in the automotive sector accelerates globally.

The key driving factors propelling market expansion include the increasing demand for digital retailing tools that offer speed and transparency, the necessity for dealers to maximize profit margins through efficient F&I product penetration, and the continuous pressure from regulatory bodies requiring robust audit trails and standardized processes. Benefits derived from the adoption of these solutions are manifold: accelerated deal closure times, reduced operational overhead, higher customer satisfaction scores due to shortened transaction times, enhanced compliance records, and significantly improved product presentation effectiveness through visual, interactive tools. As the industry shifts toward omnichannel retail models, F&I solutions serve as the critical infrastructure connecting online engagement with in-store execution, solidifying their role as indispensable tools for modern automotive commerce.

Automotive F&I Solution Market Executive Summary

The Automotive F&I Solution Market is experiencing robust growth, driven primarily by the global shift towards digital retailing and the acute need for seamless integration across sales channels. Current business trends indicate a significant consolidation among solution providers, focusing on creating unified platforms that offer end-to-end capabilities, from lead management and Customer Relationship Management (CRM) integration to final contract signing and remittance. Key strategic imperatives for market players include incorporating advanced analytics and predictive modeling to optimize F&I product recommendations tailored to individual buyer profiles, thereby maximizing per-vehicle retail (PVR) profitability. Furthermore, the emphasis on ensuring data security and privacy, particularly concerning sensitive financial customer data, is driving investment in cloud-based, compliant F&I infrastructure, moving away from legacy on-premise systems.

Regional trends highlight North America as the dominant market, characterized by high vehicle sales volumes, stringent regulatory environments necessitating advanced compliance tools, and a mature ecosystem of sophisticated dealerships that prioritize technology adoption. However, the Asia Pacific (APAC) region is poised for the fastest growth, fueled by the rapid modernization of dealership networks in countries like China and India, the burgeoning middle class driving vehicle ownership, and governmental initiatives promoting digital financial inclusion. European markets are focusing heavily on integrating F&I solutions with emerging mobility models, such as subscription services and peer-to-peer leasing, demanding flexible platforms that can handle diverse, non-traditional ownership structures. Cross-border integration capabilities are becoming essential as global automotive groups seek standardized F&I processes worldwide.

Segment trends underscore the burgeoning demand for e-contracting and remote signing functionalities, largely accelerated by recent global events that mandated contactless transactions. By deployment type, the cloud-based segment is expected to maintain its leadership due to superior scalability, lower total cost of ownership (TCO), and ease of integration with third-party software ecosystems. In terms of F&I product segments, Vehicle Service Contracts (VSCs) and Gap Insurance remain the highest revenue generators, necessitating F&I solutions that provide clear, compliant disclosure and presentation tools. The increasing complexity of financing electric vehicles (EVs) and their specialized maintenance needs is creating a new niche for F&I solutions providers specializing in EV-specific protection plans and financing models, distinguishing their offerings in a rapidly evolving market landscape.

AI Impact Analysis on Automotive F&I Solution Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Automotive F&I Solution Market frequently center on themes of automation, personalization, and risk mitigation. Common questions include how AI can automate loan decisioning and speed up approvals, whether AI algorithms can predict which F&I products a customer is most likely to purchase, and concerns about potential bias in AI-driven credit scoring or product recommendation engines. Users are highly interested in the capacity of AI to enhance compliance monitoring by flagging suspicious or non-compliant deal structures in real-time. Overall expectations suggest that AI is viewed as the primary tool for shifting F&I from a high-pressure sales environment to a highly efficient, data-driven consultative process, reducing friction for the consumer while simultaneously maximizing profitability and minimizing regulatory exposure for the dealership. The core demand is for intelligent systems that can process vast amounts of customer data and lending criteria instantaneously to deliver optimized, personalized F&I packages.

- Automated credit decisioning: AI expedites loan approval processes by instantly analyzing borrower profiles against diverse lender criteria, significantly reducing wait times.

- Personalized product recommendations: Machine learning algorithms analyze historical purchase data and customer demographics to predict optimal F&I product bundles (VSCs, GAP, tire protection) for maximum uptake.

- Compliance monitoring and auditing: AI actively monitors deal structures for adherence to truth-in-lending laws and regulatory mandates, flagging potential non-compliance risks instantly.

- Chatbot and virtual assistant integration: AI-powered tools manage initial customer inquiries regarding financing options and product details, providing 24/7 informational support.

- Predictive inventory analysis: AI forecasts demand for specific F&I products based on anticipated vehicle sales trends and seasonal variations.

- Fraud detection improvement: Advanced AI models detect anomalies in application data and documentation, strengthening anti-fraud measures in the financing process.

- Dynamic pricing optimization: Algorithms continually adjust F&I product pricing and warranty terms based on market conditions, risk assessment, and competitive data.

- Enhanced data mining: AI processes unstructured data (customer communication, sales notes) to provide deeper insights into customer behavior and sales process bottlenecks.

- Streamlined e-contracting verification: AI validates scanned documents and e-signatures against established compliance standards, accelerating the finalization process.

- Bias mitigation in lending: Implementation of transparent, auditable AI models to ensure fair and equitable lending practices, addressing rising regulatory scrutiny on algorithmic bias.

DRO & Impact Forces Of Automotive F&I Solution Market

The Automotive F&I Solution Market is shaped by powerful Drivers, inherent Restraints, and transformative Opportunities, collectively defining the Impact Forces influencing its trajectory. The primary driver is the pervasive digital transformation across the automotive retail ecosystem, demanding solutions that can seamlessly integrate online sales processes (digital retailing) with in-store F&I operations. The constant imperative for dealers to enhance per-vehicle profitability (PVR) serves as another major catalyst, as sophisticated F&I software maximizes product penetration and manages pricing complexity effectively. Furthermore, increasing regulatory complexity, particularly surrounding consumer protection and lending disclosures, compels dealers to invest in compliant, automated F&I platforms to minimize litigation risk and ensure transparent dealings.

Conversely, significant restraints temper the market's growth. High initial implementation costs and the substantial requirement for specialized training pose barriers, especially for smaller, independently owned dealerships with limited IT budgets. Data security concerns remain a critical restraint; the sensitive nature of financial and personal customer data necessitates robust security infrastructure, and any perceived vulnerability can delay adoption. Moreover, the legacy nature of some existing Dealer Management Systems (DMS) creates integration hurdles, as new, advanced F&I platforms often struggle to communicate effectively with outdated foundational dealer software, resulting in fragmented data ecosystems.

Opportunities for market expansion are abundant, particularly in the realm of predictive analytics and hyper-personalization. The growing electric vehicle (EV) segment offers a unique opportunity for developing specialized F&I products (e.g., battery degradation coverage, specialized charging infrastructure warranties) and corresponding software tools to manage them. The global trend toward Subscription and Mobility-as-a-Service (MaaS) models necessitates innovative F&I solutions designed for usage-based insurance and short-term leasing arrangements, moving beyond traditional ownership models. Collectively, these impact forces—driven by digitalization and efficiency needs, constrained by cost and integration complexity, and leveraged through new mobility trends—ensure a dynamic and competitive market environment.

Segmentation Analysis

The Automotive F&I Solution Market is comprehensively segmented based on several key dimensions, including Solution Type, Deployment Model, Dealership Type, and End-User. Solution Type segmentation differentiates between core software modules like Deal Structuring, Compliance Management, and Menu Selling tools, which form the functional backbone of the F&I office. The Deployment Model is crucial, distinguishing between traditional on-premise installations and the rapidly growing cloud-based (SaaS) offerings, reflecting the broader IT trend toward flexible, scalable, and remote-accessible infrastructure. Dealership Type recognizes the diverse needs of franchised and independent dealers, while End-User segmentation addresses the varying requirements of captive finance arms, third-party lenders, and insurance providers, ensuring specialized product development tailored to each participant in the automotive finance ecosystem.

- By Solution Type:

- Deal Structuring and Desking Software

- Menu Selling Software

- E-Contracting and E-Signing Solutions

- Compliance and Regulatory Management Tools

- Customer Relationship Management (CRM) Integration Modules

- F&I Product Management and Rating Engines

- Analytics and Reporting Tools

- By Deployment Model:

- Cloud-Based (SaaS)

- On-Premise

- By Dealership Type:

- Franchised Dealerships (New Vehicle Sales)

- Independent Dealerships (Used Vehicle Sales)

- Mass Market Retailers and Auto Groups

- By End-User:

- Automotive Dealers

- Captive Finance Companies

- Banks and Credit Unions (Third-Party Lenders)

- Insurance Providers and Administrators

- By F&I Product:

- Vehicle Service Contracts (VSCs)/Extended Warranties

- Guaranteed Asset Protection (GAP) Insurance

- Tire and Wheel Protection

- Maintenance Plans and Prepaid Services

- Credit Life and Disability Insurance

- Appearance Protection Products

Value Chain Analysis For Automotive F&I Solution Market

The value chain of the Automotive F&I Solution Market begins with upstream activities dominated by software developers and data providers. Software developers are responsible for the core programming, architectural design, and continuous updating of F&I platforms, incorporating the latest technologies such as AI and machine learning for predictive analytics. Data providers supply essential inputs, including credit bureau scores, vehicle history reports, regulatory changes, and lender rate sheets, which are critical for the functionality of desking and compliance tools. This upstream integration requires specialized expertise in financial regulations and automotive retail dynamics to ensure the underlying software is both powerful and compliant. Strategic partnerships between smaller specialized F&I software firms and large Dealer Management System (DMS) providers are essential at this stage to ensure market penetration and compatibility.

The midstream involves the distribution channel, which is typically bifurcated into direct and indirect methods. Direct distribution involves major software vendors selling their solutions directly to large dealer groups, captive finance arms, or Original Equipment Manufacturers (OEMs). This approach allows for highly customized implementations and strong post-sales support tailored to enterprise-level needs. The indirect channel relies heavily on third-party integrators, resellers, and consultants who specialize in automotive technology implementation. These partners often bundle F&I solutions with other dealership software (such as CRM or accounting systems) to provide a comprehensive technology stack, catering mainly to smaller or mid-sized independent dealerships that lack dedicated IT teams for deployment and integration management.

Downstream activities focus on the end-users—automotive dealerships and finance institutions—and the ongoing service requirements. Dealers utilize these solutions to structure deals, manage inventory, present F&I products, and complete e-contracting. The efficiency and success of the solution are ultimately measured by increased F&I product penetration rates, higher PVR, and compliance adherence. Post-implementation services, including training, technical support, and continuous regulatory updates, form a significant part of the downstream value. The feedback loop from dealers to the solution developers is crucial for iterative product improvement and maintaining relevance in a rapidly evolving legislative and technological landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dealertrack (Cox Automotive), CDK Global, Reynolds and Reynolds, RouteOne, F&I Express, SecureClose, Darwin Automotive, MaximTrak (RouteOne), Dealer Socket (Solera), Auto/Mate, Promax, Quorum Information Technologies, SCI, GoldStar Systems, AutoLoop, Vision Dealer Solutions, StoneEagle, Equifax, TransUnion, Experian |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive F&I Solution Market Potential Customers

The primary and most immediate potential customers for Automotive F&I solutions are franchised and independent automotive dealerships globally. Franchised dealerships, dealing primarily with new vehicles and often tied to OEM captive finance arms, require robust solutions emphasizing high-volume, standardized processing, and stringent adherence to manufacturer guidelines and localized lending laws. Independent dealerships, which focus predominantly on the used vehicle market, prioritize flexibility, rapid integration with multiple third-party lenders, and efficient inventory management integration within their F&I systems. Both segments seek systems that enhance customer experience, minimize legal exposure, and drive up the highly profitable F&I product penetration rate, making efficiency and compliance the top purchasing criteria.

A secondary, yet rapidly expanding customer base includes large multi-franchise dealer groups and centralized auto retailers. These entities demand enterprise-level F&I solutions capable of providing unified reporting, standardized training across multiple locations, and centralized regulatory oversight. They often prefer cloud-based SaaS models for scalability and easier management of diverse regional regulations. These large groups require advanced analytics modules within their F&I solutions to benchmark performance across their various stores and identify best practices for maximizing profitability, necessitating solutions that go beyond simple transaction processing.

Finally, the ecosystem participants, including captive finance companies (e.g., Ford Credit, Toyota Financial Services), third-party banks, credit unions, and F&I product administrators, represent significant potential customers. Captive finance arms require deep integration with dealer solutions to streamline their specific lending programs and product offerings. Insurance carriers and F&I administrators use these solutions for automated product rating, contract issuance, and claims processing, needing solutions that ensure seamless data exchange and regulatory alignment. The transition to digital contracting has made these finance and insurance backend players increasingly reliant on sophisticated, interoperable F&I software architecture.

Automotive F&I Solution Market Key Technology Landscape

The technological landscape of the Automotive F&I Solution Market is rapidly evolving, driven by the shift from transactional processes to customer-centric, digitally integrated experiences. Cloud computing, primarily Software-as-a-Service (SaaS), forms the foundational technology, allowing vendors to offer scalable, pay-as-you-go models that drastically reduce the IT burden on dealerships. This cloud infrastructure facilitates real-time data synchronization between the dealer, the lender, and F&I product providers, ensuring that rates and compliance documentation are always current and accessible from any device. Furthermore, advanced Application Programming Interfaces (APIs) are crucial for enabling seamless integration between core F&I platforms and peripheral systems such as CRM, DMS, and digital retail tools, fostering a truly unified omnichannel customer journey, which is essential for modern high-volume operations.

The second pillar of the technology landscape involves data analytics and Artificial Intelligence (AI). AI is employed extensively in predictive modeling, determining a customer's creditworthiness faster and suggesting the optimal F&I product combinations based on historical sales data, credit profile, and vehicle type. Machine learning (ML) algorithms are being used to optimize the "menu presentation" process, dynamically adjusting product visibility and pricing to increase customer acceptance rates and dealer PVR. Big data processing capabilities are utilized to generate comprehensive regulatory audit trails, track Key Performance Indicators (KPIs), and provide granular insights into sales efficiency and compliance risks, moving the F&I manager role toward strategic data interpretation rather than purely administrative tasks.

Finally, technologies focused on security, compliance, and user experience (UX) are paramount. Blockchain technology is beginning to be explored for secure and immutable record-keeping of ownership and finance contracts, promising enhanced transparency and reduced fraud in e-contracting. E-signature and remote identification verification tools are critical for enabling true digital retailing, ensuring legal validity and security for non-face-to-face transactions. The emphasis on mobile-first and tablet-optimized user interfaces ensures that F&I managers can conduct the entire sales process fluidly, whether at their desk or engaging with the customer directly in the showroom or remotely, providing speed and flexibility throughout the complex contracting phase.

Regional Highlights

- North America (U.S. and Canada): North America dominates the global F&I Solution Market due to a mature automotive retail sector, high average transaction prices, and stringent consumer protection regulations (e.g., compliance with CFPB guidelines). The region exhibits the highest adoption rate of advanced solutions like e-contracting and AI-driven menu selling, driven by large dealer groups that prioritize technological investment for competitive advantage and operational efficiency. The U.S. remains the epicenter of innovation, heavily influencing global trends in digital retailing and finance technology integration.

- Europe (Germany, U.K., France): The European market is characterized by diverse regulatory landscapes across member states, necessitating highly adaptable F&I solutions that can manage varying tax structures, lending laws, and consumer protection frameworks (such as GDPR). The market growth is being accelerated by the adoption of alternative mobility models, particularly leasing, car subscriptions, and Mobility-as-a-Service (MaaS). Key growth drivers include the need for seamless digital documentation and multilingual contract generation capabilities to service cross-border transactions efficiently.

- Asia Pacific (China, Japan, India): APAC is projected to be the fastest-growing region, fueled by rising vehicle sales, the rapid digitalization of developing economies, and an expanding middle-class demanding streamlined purchasing experiences. China leads in volume and technological readiness, focusing on mobile-first finance applications. India and Southeast Asian nations are modernizing their dealership infrastructure, creating immense demand for scalable, cloud-based F&I solutions that can integrate quickly with evolving local financial ecosystems and diverse regional lending institutions.

- Latin America (Brazil, Mexico): The market in Latin America is marked by fragmented distribution channels and varying degrees of economic stability and regulatory oversight. F&I solution adoption here is focused on mitigating financial risk, combating fraud, and providing transparent, standardized contracts in markets often characterized by complex bureaucratic processes. Solutions emphasizing credit risk assessment and compliance with regional banking standards are gaining traction as major global groups enter these markets.

- Middle East and Africa (MEA): Growth in the MEA region is concentrated primarily in the GCC countries, where high luxury vehicle sales and significant infrastructure investment support the adoption of high-end F&I systems. The focus is on implementing enterprise-level systems for large auto groups and standardizing processes across various international brands operating in the region, particularly emphasizing Sharia-compliant finance modules where applicable.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive F&I Solution Market.- Dealertrack (Cox Automotive)

- CDK Global

- Reynolds and Reynolds

- RouteOne

- F&I Express (RouteOne)

- SecureClose

- Darwin Automotive

- MaximTrak (RouteOne)

- Dealer Socket (Solera)

- Auto/Mate

- Promax

- Quorum Information Technologies

- SCI

- GoldStar Systems

- AutoLoop

- Vision Dealer Solutions

- StoneEagle

- Equifax

- TransUnion

- Experian

Frequently Asked Questions

Analyze common user questions about the Automotive F&I Solution market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of implementing cloud-based F&I solutions?

Cloud-based F&I solutions offer superior scalability, lower total cost of ownership (TCO) by eliminating local server maintenance, and facilitate real-time updates for compliance and lender rates, ensuring secure and accessible operation across multiple dealership locations and digital platforms.

How does e-contracting influence the speed of the automotive retail process?

E-contracting significantly accelerates deal closure by eliminating paper processing, errors, and manual handling. It enables instant validation, secure digital signature capture, and immediate submission of complete financial packages to lenders, drastically reducing the time a customer spends in the F&I office.

What role does AI play in optimizing F&I product sales?

AI utilizes machine learning algorithms to analyze customer data and predict the most relevant F&I products for individual buyers. This enables F&I managers to present personalized, non-pressure menus, which maximizes product penetration and profitability (PVR) while enhancing customer satisfaction.

Which regulatory challenges most impact the F&I Solution Market?

The most significant regulatory challenges include adherence to consumer protection laws (like TILA and CFPB rules in the U.S.), managing data privacy standards (such as GDPR internationally), and ensuring transparent, compliant disclosure of all finance and insurance product details to the consumer during the transaction.

What is the difference between Deal Structuring and Menu Selling software?

Deal Structuring software focuses on the core finance transaction, calculating loan terms, interest rates, and lender submission protocols. Menu Selling software is the presentation tool used in the F&I office to visually and compliantly display all available protection products and their costs to the customer, facilitating informed purchase decisions.

The Automotive F&I Solution Market is poised for substantial transformation, moving rapidly from fragmented, legacy systems to integrated, AI-driven platforms. This evolution is necessitated by increasing consumer demand for transparent, fast digital transactions and the continuous regulatory pressure requiring flawless compliance execution. The convergence of software solutions, big data analytics, and cloud infrastructure is creating a highly competitive environment where only vendors offering truly unified, compliant, and customer-centric platforms will secure long-term market leadership. Investment in cybersecurity and continuous adaptation to emerging mobility models, such as electric vehicles and subscription services, are critical strategies for future growth in this dynamic sector.

Future market expansion is heavily dependent on the ability of F&I solution providers to successfully integrate their platforms with the rapidly growing ecosystem of third-party digital retailing tools. This holistic integration ensures that the customer journey, from online vehicle selection to final financing approval and F&I product selection, remains unbroken and consistent. Furthermore, emerging markets, particularly in APAC and Latin America, present untapped potential as vehicle ownership increases and local dealerships seek technologically advanced methods to professionalize their sales and finance operations, often leapfrogging older on-premise solutions directly to advanced cloud SaaS models. The ongoing pressure on dealerships to maximize every potential revenue stream ensures sustained investment in F&I technologies designed to optimize profitability per vehicle.

To capitalize on these trends, key players are focusing on strategic mergers and acquisitions to consolidate market share and acquire specialized technologies, especially in areas like AI-based personalization and e-contracting security. The shift in focus from merely automating paper processes to leveraging data for proactive business intelligence represents the market's fundamental transformation. Compliance tools are evolving into predictive compliance engines that actively prevent errors before they occur, drastically reducing dealer liability. This continuous innovation, coupled with the mandatory digital integration required by modern automotive commerce, solidifies the F&I solution market as a vital component of the global automotive ecosystem, guaranteeing strong growth throughout the forecast period.

The dominance of cloud-based deployment is not merely a trend but a foundational requirement for agile market participation. Cloud platforms facilitate rapid deployment of updates necessitated by frequent regulatory shifts and new lender requirements, a flexibility that traditional on-premise systems cannot match. Moreover, the inherent scalability of the cloud supports massive auto groups that need centralized reporting and consistent data standards across hundreds of locations. Security protocols embedded in SaaS solutions, often superior to those managed by individual dealerships, address the critical concerns surrounding sensitive consumer financial data, making the cloud the preferred architecture for future F&I technological development and investment across all major geographical regions including North America, Europe, and the rapidly digitizing APAC markets.

Analysis of the F&I Product segment reveals enduring demand for protection products, with Vehicle Service Contracts (VSCs) consistently being the cornerstone of F&I revenue. However, the market is diversifying. The rising prevalence of electric vehicles mandates new VSC coverages addressing specialized components like batteries and high-voltage systems. Similarly, the growing complexity of vehicle technology, encompassing advanced driver-assistance systems (ADAS) and sophisticated infotainment setups, increases the cost of repair, driving consumer interest in comprehensive extended warranties. Furthermore, the high residual values associated with new vehicles necessitate robust Gap Insurance offerings. F&I software must therefore be versatile enough to rate, present, and compliantly contract a rapidly diversifying portfolio of protection products efficiently.

Geographically, while North America provides market stability and a large addressable base for high-value enterprise solutions, the future impetus for exponential growth originates from Asia Pacific. Countries like China are leading the charge in integrating mobile payment and financing solutions directly into the vehicle purchase process, setting global benchmarks for speed and convenience. For vendors targeting APAC, localized language support, compatibility with diverse national credit systems, and adherence to varying data localization laws are non-negotiable requirements. The competition in these emerging markets is high, demanding that F&I solution providers offer highly modular and flexible platforms capable of rapid customization to meet distinct regional operational needs.

The intensifying competitive landscape requires strategic differentiation, moving beyond feature parity to genuine value creation through actionable data insights. Vendors are increasingly bundling F&I modules with advanced training and consultative services, positioning themselves as strategic partners rather than just software providers. The ability to demonstrate a tangible increase in PVR, coupled with a measurable decrease in compliance risk and processing time, is the key performance metric that determines vendor selection. As the line between the sales department and the F&I office continues to blur in the digital retailing model, the integration capabilities of the F&I platform become the most critical technical specification for dealer adoption.

Looking ahead, the market anticipates further vertical integration, where DMS providers acquire specialized F&I technology firms to offer single-source, end-to-end dealer management ecosystems. This consolidation simplifies the technology stack for the dealer, reducing integration headaches and increasing data integrity across all departments. This trend is particularly evident in North America, driven by major players aiming to control the entire flow of automotive retail data. For smaller, innovative F&I pure-play firms, the strategy involves specializing in niche areas, such as blockchain-enabled contract verification or highly specific AI underwriting tools, positioning themselves as attractive acquisition targets or essential technology partners within the broader, consolidating market structure.

The evolution of the Automotive F&I Solution Market reflects the broader shift towards customer empowerment. Modern F&I solutions facilitate transparent, informed buying experiences, contrasting sharply with the historical perception of F&I as an opaque, high-pressure environment. By integrating tools like interactive menus and consumer-facing compliance disclosures, the software empowers the buyer to make voluntary decisions regarding protection products. This enhanced transparency is not only good for customer satisfaction but is increasingly mandated by regulatory bodies globally. Therefore, the long-term success of any F&I solution hinges on its ability to drive profitability for the dealer while simultaneously ensuring a positive, fully compliant, and transparent experience for the customer, aligning business goals with regulatory imperatives.

The sustained emphasis on enhancing profitability within the highly competitive automotive retail sector ensures that investment in sophisticated F&I solutions remains a top priority for dealerships worldwide. F&I departments traditionally represent one of the highest margin revenue centers for a dealership, and optimizing this area directly translates to improved bottom-line performance. Solution providers continuously innovate to offer tools that analyze inventory profitability, optimize lender placement based on dealer reserve, and accurately forecast the revenue impact of various F&I product mixes. This relentless pursuit of maximizing Per-Vehicle Retail (PVR) through technological enablement is a foundational driver that guarantees the continued expansion and technological sophistication of the F&I solution market for the foreseeable future, making it resilient against economic fluctuations.

Technological advancement is not limited to front-end sales tools; significant investment is also being channeled into back-office integration and accounting reconciliation. Modern F&I solutions must seamlessly interface with dealership accounting software and manufacturer systems to ensure accurate tracking of commissions, remittances to finance companies, and regulatory reporting. The automated reconciliation capabilities offered by advanced platforms reduce administrative overhead, minimize human error in financial tracking, and accelerate the cash flow cycle for the dealership. This efficiency gain, extending from the initial customer interaction through to final financial closure and reporting, provides comprehensive justification for the high initial investment in enterprise F&I systems across global auto groups.

The diversification of mobility options, including short-term rentals, ride-sharing platforms, and corporate fleet management, is creating entirely new customer segments for F&I solutions. These businesses require specialized F&I platforms that can handle usage-based insurance, short-duration leasing contracts, and maintenance packages tailored to high-mileage commercial use. Traditional F&I systems designed for standard five-year loans are insufficient. Vendors are now developing flexible, modular platforms capable of managing complex, non-linear ownership and usage structures, positioning themselves to capture the substantial revenue potential inherent in the future of mobility, which extends well beyond the traditional consumer retail segment. This strategic pivot ensures the F&I solution market's relevance in the evolving automotive landscape.

Furthermore, the competitive edge is increasingly determined by the speed of technology implementation and user adoption. Even the most powerful F&I software can fail if dealer personnel cannot use it effectively or if the deployment process disrupts ongoing sales operations. Therefore, market leaders are investing heavily in immersive training programs, dedicated implementation teams, and intuitive, user-friendly interfaces (UX/UI). The focus is on reducing the learning curve for F&I managers who are often not technology experts. Solutions designed for tablet or mobile access that mirror the simplicity of consumer applications tend to achieve higher adoption rates, directly translating to more consistent PVR performance across the dealer network. This commitment to usability is essential for converting technological potential into tangible business results.

The strategic importance of F&I data cannot be overstated. Beyond compliance and transaction processing, the data generated by these systems—such as customer preferences, product penetration rates by vehicle type, and lender performance—is invaluable for informing dealership marketing, inventory purchasing decisions, and overall business strategy. Modern F&I solutions serve as powerful data warehouses, providing advanced analytical dashboards that allow dealer principals to track minute performance variations across different F&I product categories, manager performance, and sales channels. This analytical power transforms the F&I department from a transactional entity into a critical strategic intelligence unit, further driving the indispensable nature of advanced F&I software within the automotive retail business model.

The global reach of automotive manufacturers and large dealer groups requires F&I solutions that can support multi-currency, multi-language, and multi-regulatory environments simultaneously. This demand for global standardization yet local compliance is a significant complexity driver in the market. Solution providers must maintain extensive, continually updated databases of international tax laws, consumer lending statutes, and documentation requirements, ensuring that a single platform can operate effectively across continents. This requirement elevates the barrier to entry for smaller, localized software providers and favors large, established vendors with the resources for global compliance monitoring and system maintenance, fostering further market concentration among key players.

The integration of Vehicle Service Contract (VSC) administration and claims processing directly into the F&I platform represents another vital technological area. Real-time access to accurate VSC rating and contract generation ensures compliance and accuracy at the point of sale. More advanced systems are now incorporating claims pre-approval and tracking capabilities, linking the sale process directly to the post-sale service experience. This integration improves customer satisfaction by providing transparent claims management and offers the dealership better control over the profitability and performance of the VSC products they sell. This seamless, end-to-end lifecycle management is rapidly becoming a standard expectation for comprehensive F&I solutions.

In summary, the Automotive F&I Solution Market is characterized by intense innovation centered around digitalization, AI-driven personalization, and robust compliance infrastructure. The necessity for high-margin revenue streams, coupled with the mandatory shift towards transparent, frictionless digital retailing, guarantees that these solutions will remain central to the profitability and operational success of the global automotive retail industry through 2033. The market’s continuous adaptation to new vehicle types and emerging mobility models ensures its sustained relevance and rapid technological advancement.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager