Automotive Financing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432359 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Automotive Financing Market Size

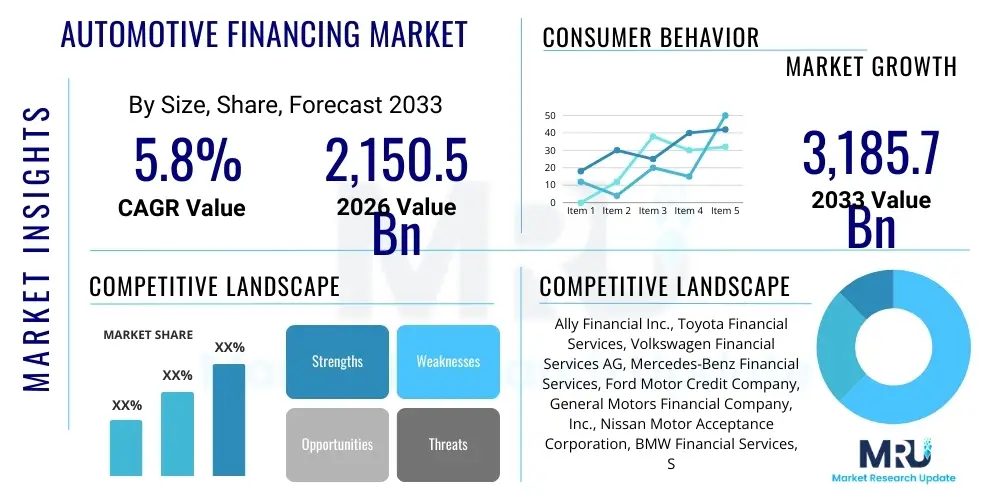

The Automotive Financing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $2,150.5 Billion in 2026 and is projected to reach $3,185.7 Billion by the end of the forecast period in 2033.

Automotive Financing Market introduction

The Automotive Financing Market encompasses all financial services offered to consumers and businesses for the acquisition of motor vehicles, including traditional loans, leases, and innovative subscription models. These financing solutions are critical instruments that bridge the gap between aspirational vehicle ownership and immediate purchasing capacity. The core product offering involves providing capital for both new and used vehicles, facilitating transactions through captive financing arms, commercial banks, credit unions, and various independent financial institutions. The market dynamics are heavily influenced by interest rate fluctuations, consumer credit health, and the overall macroeconomic environment, making it a pivotal segment of the broader financial services industry and a key enabler for the automotive manufacturing sector.

Major applications of automotive financing span both retail and commercial sectors. Retail consumers utilize financing for personal vehicle ownership, often seeking flexible payment structures and competitive interest rates for cars, trucks, and SUVs. On the commercial side, fleet financing is crucial for businesses across logistics, rental services, and ride-sharing platforms to manage large-scale vehicle acquisition and lifecycle costs efficiently. The sustained demand for personal mobility, coupled with the necessity for businesses to update their fleets to meet stricter environmental and efficiency standards, constantly drives innovation in financing products. Furthermore, the rise of electric vehicles (EVs) introduces new financing complexities related to residual value estimation and battery longevity, prompting specialized financial instruments tailored for sustainable transportation.

Key benefits derived from a robust automotive financing ecosystem include enhanced market liquidity, affordability for a wide demographic, and stimulating overall economic activity through vehicle sales. Driving factors underpinning market growth include increasing disposable incomes in emerging economies, a global shift towards electric and autonomous vehicles requiring significant capital outlay, and the proliferation of digital platforms that streamline the application and approval process. Regulatory changes concerning consumer protection and lending standards also shape the operational landscape, promoting transparency and responsible lending practices. The continuous introduction of personalized financing options, leveraging advanced data analytics, ensures that the market remains responsive to evolving consumer preferences and financial needs.

Automotive Financing Market Executive Summary

The global Automotive Financing Market is characterized by accelerating digitalization and a fundamental shift in business models, moving from purely ownership-based solutions to subscription and leasing structures, particularly in mature markets like North America and Europe. Key business trends include the convergence of traditional banking services with specialized FinTech solutions, leading to faster loan origination and enhanced customer experience through mobile applications. Operational efficiency is a dominant theme, with major players investing heavily in automation, machine learning, and AI-driven risk assessment to minimize default rates and optimize portfolio performance. Furthermore, the market is navigating increasing environmental, social, and governance (ESG) pressures, prompting lenders to prioritize financing for low-emission and electric vehicles, thereby aligning financial products with sustainable mobility goals.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by the rapidly expanding middle-class population, urbanization, and robust vehicle penetration rates in countries like China and India. While APAC growth is driven by sheer volume and new market entrants, North America and Europe emphasize technological sophistication, focusing on captive finance operations and sophisticated lease management systems. The competitive landscape varies significantly; in developed regions, competition centers around interest rate optimization and customer service quality, whereas in emerging regions, the focus remains on widening access to credit and formalizing lending processes. Geopolitical stability and local economic policies related to interest rate caps and collateral requirements fundamentally influence regional market profitability.

Segmentation trends highlight the increasing prominence of digital lending platforms and non-traditional funding sources. By financing type, traditional loans (Hire Purchase and installment loans) continue to hold the largest market share, but leasing and personal contract purchase (PCP) segments are experiencing rapid growth, driven by consumer preference for lower monthly payments and flexibility in vehicle upgrades. Segment performance is also differentiated by vehicle type; the Light Commercial Vehicle (LCV) segment shows stable growth linked to e-commerce expansion, while the Electric Vehicle (EV) financing segment, though smaller, exhibits the highest growth trajectory, spurred by government incentives and infrastructure development. Segmentation by service provider reveals that captive financing organizations maintain a competitive edge due to their close ties to manufacturing incentives and residual value guarantees.

AI Impact Analysis on Automotive Financing Market

User queries regarding AI's influence in automotive financing frequently revolve around three core themes: the automation of loan underwriting, the accuracy of predictive risk modeling, and the enhancement of personalized customer experiences. Users are keenly interested in how AI can reduce the time taken from application to approval (speed and efficiency), questioning the reliability and potential bias inherent in algorithmic decision-making, especially concerning credit scoring for non-traditional applicants. Furthermore, there is significant curiosity regarding AI’s ability to forecast residual values for rapidly evolving vehicle technologies, such as EVs, where historical data is limited. The prevailing expectation is that AI will dramatically increase operational efficiency and provide hyper-personalized financial products, while the primary concern remains centered on data security, regulatory compliance, and maintaining fairness in lending practices.

AI technologies, including machine learning algorithms and natural language processing (NLP), are fundamentally reshaping the operational landscape of automotive financing providers. In credit assessment, AI models now analyze vast datasets, including transactional histories, social indicators, and behavioral patterns, to provide a more holistic and accurate picture of a borrower's creditworthiness than traditional FICO scores alone. This advanced risk profiling minimizes exposure to defaults and allows lenders to offer tailored interest rates, ultimately expanding access to financing for customers who might be overlooked by conventional scoring methodologies. The speed of decision-making has been radically compressed, with some providers offering instant, automated loan approvals, significantly improving the customer journey and competitive positioning.

Beyond risk and underwriting, AI significantly influences marketing, customer service, and fraud detection. AI-powered chatbots and virtual assistants handle a large volume of routine customer inquiries, providing 24/7 support and reducing the need for extensive human intervention in early-stage interactions. On the fraud front, machine learning models continuously monitor application data and transaction flows, identifying subtle patterns indicative of synthetic identities or application fraud with precision unattainable by manual review. This dual impact—improving customer acquisition through personalization and safeguarding assets through advanced monitoring—positions AI as an indispensable tool for profitability and compliance in the highly competitive automotive financing sector.

- AI-driven credit scoring enables instant, automated underwriting decisions.

- Machine learning enhances residual value prediction for EVs and rapidly depreciating assets.

- Natural Language Processing (NLP) improves compliance and contract analysis efficiency.

- Predictive analytics optimize portfolio management and identify early signs of potential default risk.

- Chatbots and virtual assistants automate customer service and application triage.

- Advanced fraud detection models minimize losses from synthetic identity fraud and application manipulation.

- Hyper-personalization of financing offers based on dynamic behavioral and financial data.

DRO & Impact Forces Of Automotive Financing Market

The Automotive Financing Market is driven primarily by robust global vehicle sales, the increasing affordability facilitated by flexible financing options like leasing and PCP, and favorable macroeconomic conditions, especially low-to-moderate interest rate environments that incentivize borrowing. Digital transformation acts as a major catalyst, streamlining processes and enhancing accessibility. However, the market faces significant restraints, notably macroeconomic volatility, including inflation and potential recessionary pressures which tighten credit availability and increase default risks. Furthermore, stringent regulatory scrutiny concerning fair lending practices and data privacy imposes high compliance costs on lenders. Opportunities abound in emerging markets where vehicle penetration is low, in the proliferation of specialized EV financing models, and through strategic partnerships with FinTech firms to integrate blockchain and enhanced data analytics for greater transparency and security.

Impact forces in the market manifest through a combination of cyclical and structural shifts. Cyclical forces include central bank interest rate decisions, which immediately affect the cost of capital for lenders and, consequently, the final rates offered to consumers, directly influencing demand elasticity. Structural forces involve the ongoing transition in mobility—from ownership to usage-based models, demanding innovative financing structures like subscription services. The high capital expenditure required for transitioning to sustainable vehicle manufacturing forces captive financing arms to become more innovative in their capital generation and risk management strategies. The rapid evolution of technology also exerts significant force, compelling lenders to continuously update their platforms to remain competitive against agile, digital-native entrants.

The balancing act between maintaining high lending volume (Driver) and managing escalating credit risk (Restraint) is the central tension point for market players. Successful organizations are those that leverage AI and Big Data (Opportunity) to mitigate the risks associated with expanded lending, turning regulatory requirements (Restraint) into competitive advantages by building highly transparent and trustworthy digital platforms. The collective impact of these forces results in a market characterized by intense competition on price and service quality, demanding continuous innovation in risk management and customer engagement to ensure sustained growth and profitability. The strategic response to these dynamic forces dictates market leadership and long-term viability in the automotive financing landscape.

Segmentation Analysis

The Automotive Financing Market is meticulously segmented based on Financing Type, Vehicle Type, Service Provider, and Region, reflecting the diverse needs of both consumers and commercial entities across the globe. Understanding these segments is crucial for strategizing, as different segments exhibit varying growth rates and risk profiles. For instance, the leasing segment is growing rapidly in mature markets due to corporate fleet demands and consumer preference for short-term usage, whereas traditional installment loans dominate emerging economies where outright ownership remains the primary goal. The shift toward sustainable mobility significantly influences the vehicle type segmentation, with hybrid and electric vehicle financing emerging as critical high-growth niches requiring specialized underwriting expertise.

- By Financing Type:

- Hire Purchase/Installment Loans

- Leasing (Open-end, Closed-end)

- Personal Contract Purchase (PCP)

- Subscription Services

- Other (Refinancing, Balloon Payments)

- By Vehicle Type:

- Passenger Vehicles (Sedans, SUVs, Hatchbacks)

- Commercial Vehicles (Light Commercial Vehicles, Heavy Commercial Vehicles)

- Electric Vehicles (BEVs, PHEVs)

- By Service Provider:

- Captive Finance Companies

- Commercial Banks

- Credit Unions

- Non-Banking Financial Companies (NBFCs)/FinTech Lenders

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Automotive Financing Market

The value chain in automotive financing begins with upstream activities focused on capital procurement and technological infrastructure development. Upstream players, primarily banks and institutional investors, provide the foundational liquidity and securitization instruments necessary for financing operations. This phase involves complex risk modeling, capital adequacy management, and securing low-cost funding, which is paramount to competitive pricing downstream. Captive finance arms often benefit from direct access to manufacturing capital, streamlining this initial phase. The effectiveness of the upstream process dictates the volume and cost efficiency of financing products offered to end-users.

Midstream activities encompass the core lending operations, including application processing, credit underwriting, documentation, and compliance management. Distribution channels play a vital role here, connecting the financing product with the consumer. Direct channels involve consumers applying through the lender’s website or mobile app, offering enhanced speed and transparency. Indirect channels, which remain the dominant method, leverage dealer networks as intermediaries. Dealers facilitate the financing sale at the point of purchase, acting as a crucial interface, often receiving commissions for originating loans. Optimizing this midstream relationship between lenders and dealers is essential for market penetration and customer satisfaction.

Downstream activities involve loan servicing, portfolio management, risk monitoring, collections, and eventual asset recovery or disposition (e.g., managing off-lease vehicles or repossessions). Effective servicing ensures long-term profitability and customer retention. The increasing complexity of residual value risk, especially with rapid technological obsolescence in vehicles, places significant emphasis on sophisticated asset management. Technology adoption, particularly AI for predictive maintenance of financial health and blockchain for secure contract management, optimizes the entire value chain, reducing fraud, minimizing operational costs, and improving the overall efficiency of loan lifecycle management.

Automotive Financing Market Potential Customers

The primary end-users and buyers of automotive financing products fall into two major categories: retail consumers and commercial enterprises. Retail consumers are highly segmented based on credit profile, income level, and preferred mode of mobility (ownership vs. usage). Potential customers range from first-time vehicle buyers requiring long-term installment loans to high-net-worth individuals utilizing sophisticated leasing arrangements for luxury or high-performance vehicles. The key characteristic across all retail segments is the need for flexible, competitive, and accessible financing solutions tailored to individual financial circumstances and life stages. Lenders must cater to digital-native younger buyers demanding fully online processes, as well as older demographics who may prefer traditional in-person consultation.

Commercial enterprises represent a substantial and rapidly growing segment of potential customers, spanning sectors such as logistics, construction, car rental, and ride-sharing services. These organizations require fleet financing solutions, often involving master agreements, revolving lines of credit, and complex tax-advantaged leasing structures. Commercial buyers prioritize total cost of ownership (TCO) efficiency, scalable financing capacity, and integrated fleet management services bundled with the financial product. The rapid growth of e-commerce has significantly boosted the demand for Light Commercial Vehicle (LCV) financing among small and medium enterprises (SMEs), representing a high-opportunity customer base for targeted financing products.

A third, emerging category includes specialized customers involved in the EV ecosystem. These potential customers include individuals and businesses acquiring electric vehicles, often motivated by environmental mandates and government subsidies. Their financing needs are specialized, requiring products that accurately assess the novel risks associated with battery degradation and rapidly changing EV technology. Lenders must develop dedicated products for this niche, often partnering with manufacturers to offer subsidized rates, positioning themselves strategically to capture future market share as the global fleet transitions towards electrification.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2,150.5 Billion |

| Market Forecast in 2033 | $3,185.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ally Financial Inc., Toyota Financial Services, Volkswagen Financial Services AG, Mercedes-Benz Financial Services, Ford Motor Credit Company, General Motors Financial Company, Inc., Nissan Motor Acceptance Corporation, BMW Financial Services, Santander Consumer USA Holdings Inc., Bank of America, JP Morgan Chase & Co., Wells Fargo & Company, Capital One, HSBC Bank, ICBC Leasing, Standard Chartered PLC, BNP Paribas Personal Finance, Credit Agricole Consumer Finance, Industrial and Commercial Bank of China (ICBC), SBI Cards and Payment Services Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Financing Market Key Technology Landscape

The technological landscape in automotive financing is rapidly shifting towards a FinTech-centric model, where digital platforms and data analytics form the core competitive advantage. Key technological adoption centers around establishing seamless, paperless end-to-end lending processes. Cloud computing provides the necessary scalability and resilience for handling massive volumes of transactional data and supporting instant credit decisions across multiple geographical regions. Mobile applications have become indispensable, allowing customers to research vehicles, apply for loans, submit documentation, and manage their accounts entirely through smartphones, dramatically improving convenience and lowering the transaction costs associated with physical branches and paper-intensive processes.

Beyond digital interfaces, advanced analytics and Artificial Intelligence (AI) represent the most transformative technologies. AI-powered algorithms are used for dynamic risk modeling, moving beyond static credit scores to incorporate real-time behavioral data, which allows for more granular and fairer lending decisions. Furthermore, Machine Learning (ML) is critical in predictive maintenance of financial assets, forecasting potential defaults with greater accuracy, and optimizing collection strategies. This allows lenders to proactively engage with borrowers facing financial stress, minimizing non-performing assets (NPAs). The integration of sophisticated Business Intelligence (BI) tools helps institutions analyze market trends, competitor strategies, and internal performance metrics to drive data-informed decision-making.

Emerging technologies like Blockchain and Distributed Ledger Technology (DLT) are also gaining traction, particularly for enhancing transparency and security in the financing value chain. Blockchain holds significant potential for revolutionizing vehicle titles and ownership transfer processes, reducing fraud risks, and streamlining the securitization of automotive loan portfolios by providing immutable records of assets and contracts. Additionally, the proliferation of connected vehicle data creates opportunities for Usage-Based Financing (UBF), where telematics data is integrated into financing agreements to customize rates based on actual vehicle usage and driving behavior, a complex but highly personalized product enabled by the Internet of Things (IoT) infrastructure.

Regional Highlights

Regional dynamics play a crucial role in shaping the global automotive financing market, driven by varying levels of economic maturity, regulatory frameworks, and consumer purchasing habits. The overall trend points towards increasing market sophistication in mature economies and massive volume growth in emerging regions, necessitating localized strategies for lending institutions.

- North America (NA): The North American market is highly mature, characterized by a strong presence of captive finance companies and a high adoption rate of leasing and Personal Contract Purchase (PCP) models. Consumer credit markets are sophisticated, leveraging extensive data and advanced scoring models. The region is seeing rapid investment in digital platforms to facilitate seamless online car buying and financing, driven heavily by competitive pressure from FinTech entrants. The transition towards financing Electric Vehicles (EVs) and associated infrastructure represents a major growth area, often supported by federal and state tax credits that must be integrated into the financing structure.

- Europe: The European market, particularly Western Europe (Germany, UK, France), is dominated by robust consumer protection regulations and a strong preference for manufacturer-backed financing (captive finance). The market is highly competitive, often centering on optimizing residual value calculations for leasing contracts due to the high volume of closed-end leases. Regulatory fragmentation across the EU, especially concerning data privacy (GDPR) and cross-border lending, presents unique compliance challenges. Eastern Europe, however, offers higher growth potential driven by increasing vehicle ownership rates and improving credit infrastructure.

- Asia Pacific (APAC): APAC is the fastest-growing region globally, fueled by massive untapped demand in emerging economies like India, Indonesia, and China. Market growth is primarily volumetric, focused on new vehicle sales and traditional installment loans. Financial inclusion remains a critical challenge, requiring lenders to adopt innovative underwriting models for consumers with limited formal credit history. China, being the world's largest automotive market, leads the region in the adoption of digital financing platforms and is rapidly building out its EV financing ecosystem, often leveraging large state-owned banks and captive arms.

- Latin America (LATAM): The LATAM market faces unique challenges related to currency volatility, high interest rates, and fluctuating economic stability in major economies like Brazil and Mexico. The financing penetration rate is generally lower than in developed regions, but demand is high. Lenders often mitigate risk by requiring higher down payments and shorter loan tenors. Technological adoption is accelerating, with mobile-first lending strategies being crucial to overcoming infrastructural deficiencies and reaching underbanked populations.

- Middle East and Africa (MEA): The MEA market presents a dichotomy. The Middle Eastern Gulf nations (e.g., UAE, Saudi Arabia) feature high-value transactions, often centered on luxury vehicle financing, regulated by Sharia-compliant financial products. The African market, particularly South Africa, offers strong potential but is constrained by volatile credit conditions and underdeveloped financial infrastructure. The primary driver in this region is the need for vehicle mobility solutions in expanding urban centers, leading to growth in used vehicle financing and innovative micro-lending models.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Financing Market.- Ally Financial Inc.

- Toyota Financial Services

- Volkswagen Financial Services AG

- Mercedes-Benz Financial Services

- Ford Motor Credit Company

- General Motors Financial Company, Inc.

- Nissan Motor Acceptance Corporation

- BMW Financial Services

- Santander Consumer USA Holdings Inc.

- Bank of America

- JP Morgan Chase & Co.

- Wells Fargo & Company

- Capital One

- HSBC Bank

- ICBC Leasing

- Standard Chartered PLC

- BNP Paribas Personal Finance

- Credit Agricole Consumer Finance

- Industrial and Commercial Bank of China (ICBC)

- SBI Cards and Payment Services Ltd.

Frequently Asked Questions

Analyze common user questions about the Automotive Financing market and generate a concise list of summarized FAQs reflecting key topics and concerns.How is the rise of Electric Vehicles (EVs) impacting automotive financing products?

The rise of EVs is necessitating specialized financing products due to unique residual value risks, primarily concerning battery health and rapidly changing technology. Lenders are developing tailored leasing and subscription models that better account for fluctuating EV depreciation, often supported by manufacturer subsidies and green financing incentives to accelerate adoption.

What is the most significant technological driver shaping the automotive financing industry?

The most significant driver is the integration of Artificial Intelligence (AI) and machine learning into the underwriting and risk assessment process. AI enables instantaneous credit decisions, allows for more accurate and comprehensive risk profiling by analyzing non-traditional data, and optimizes portfolio management efficiency, fundamentally streamlining the entire lending lifecycle.

Are leasing models or traditional loans expected to dominate market growth in the near future?

While traditional installment loans (Hire Purchase) still hold the largest volume, leasing (including PCP) is projected to exhibit the highest growth rate, particularly in developed markets. This shift is driven by consumer preference for lower monthly payments, greater flexibility, and the desire to frequently upgrade vehicles without the burden of long-term ownership commitment.

How do current macroeconomic factors, such as inflation and interest rates, affect the market?

High inflation and rising central bank interest rates significantly increase the cost of funds for lenders, leading to higher interest rates for consumers. This volatility restricts market growth by reducing vehicle affordability, tightening lending standards, and increasing the probability of loan defaults, compelling lenders to adopt stricter risk management protocols.

Which geographical region presents the strongest opportunity for new market entrants in automotive financing?

Asia Pacific (APAC), particularly Southeast Asian nations and India, presents the strongest opportunity. This is driven by rapid economic development, a burgeoning middle class gaining access to credit for the first time, and relatively low vehicle ownership penetration rates, resulting in high potential volume growth for standardized financing products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager