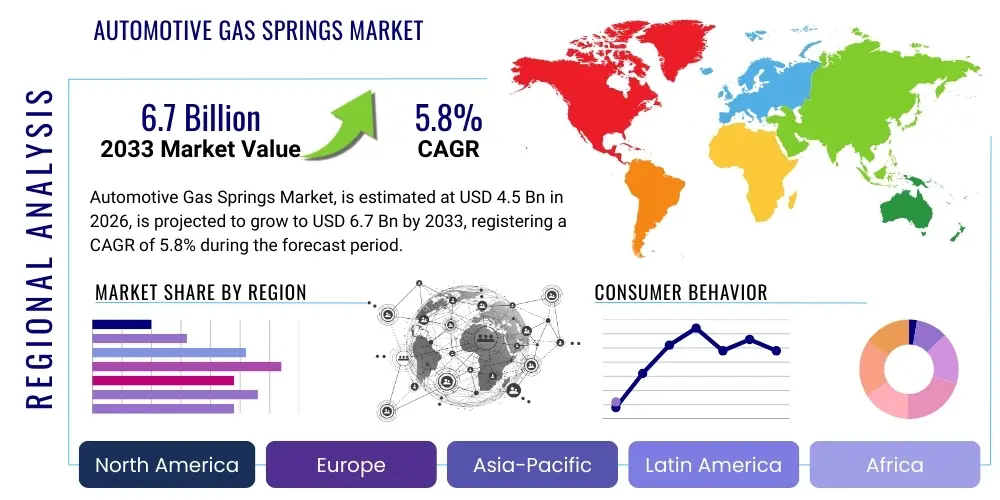

Automotive Gas Springs Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437308 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Automotive Gas Springs Market Size

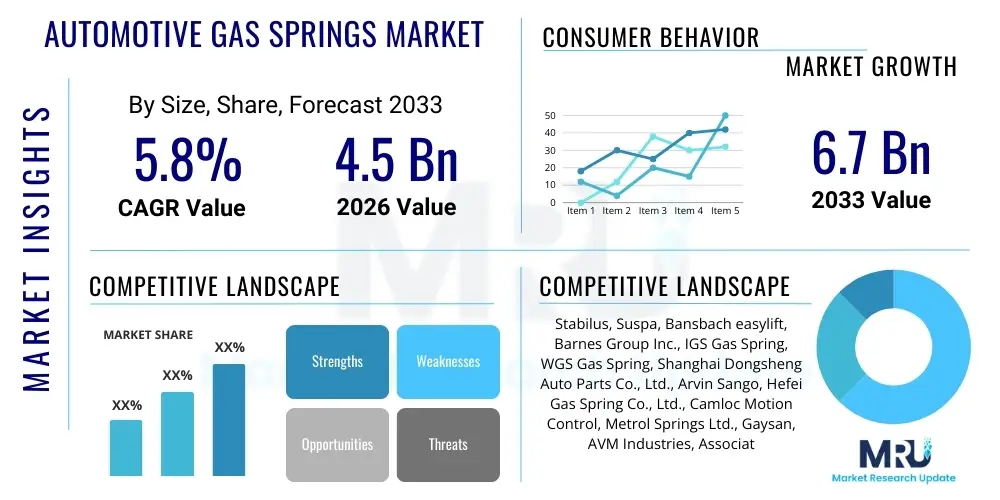

The Automotive Gas Springs Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033.

Automotive Gas Springs Market introduction

Automotive gas springs, often referred to as gas struts or dampers, are sophisticated mechanical devices designed to provide controlled motion, support, and dampening functions within vehicles. These components typically consist of a precision-manufactured cylinder containing pressurized nitrogen gas and oil, and a piston rod assembly that moves through the cylinder, creating a specific force profile. Their primary function is to assist in lifting and holding open heavy vehicle components, such as liftgates, hoods, trunks, and sometimes specialized seating or steering assemblies, enhancing user convenience and safety. The controlled release of energy provided by the compressed gas makes them essential for ergonomic design in modern automotive manufacturing.

The product description highlights their critical role in passive safety and operational efficiency. Gas springs replace traditional mechanical springs where smooth, controlled movement and positional locking are required. The internal damping mechanism, achieved through the displacement of oil, mitigates jarring stops or rapid movements, thereby protecting both the component and the user. Major applications span across passenger vehicles, commercial trucks, and specialized off-highway equipment, reflecting their versatility. In passenger cars, they are integral to power liftgate systems and ensuring effortless access to engine bays and cargo areas, directly improving the user experience.

Key driving factors supporting market growth include stringent safety regulations mandating controlled movement in vehicle access points, the global trend toward larger SUVs and crossovers requiring stronger support mechanisms for heavier liftgates, and the increasing adoption of premium vehicle features. Furthermore, advancements in material science, leading to lighter yet stronger components, are enabling gas springs to be integrated into more complex vehicle architectures. The continuous demand for enhanced vehicle ergonomics and the transition toward automated opening systems further solidify the gas spring market's robust trajectory.

Automotive Gas Springs Market Executive Summary

The Automotive Gas Springs Market Executive Summary highlights significant business trends driven by electrification and increased automation in vehicles. The transition to electric vehicles (EVs) is generating new demand for gas springs in battery housing access and charging port covers, requiring specialized corrosion-resistant and often heavier-duty components. Key business trends include the shift towards sophisticated damping technologies, such as dynamic damping control (DDC) gas springs, which adapt their resistance based on speed and load, catering to the luxury and high-performance segments. Furthermore, manufacturers are focusing on miniaturization and weight reduction to align with the overall industry objective of improving fuel efficiency and extending EV range. Strategic partnerships between gas spring manufacturers and major Tier 1 automotive suppliers are becoming crucial for integrated module design and optimized supply chain management.

Regional trends indicate that the Asia Pacific (APAC) region, led by China and India, is poised for the highest growth due to burgeoning automotive production, rising disposable incomes, and the rapid adoption of utility vehicles (SUVs). North America and Europe, while mature markets, continue to demonstrate robust demand driven by the replacement market, stricter environmental standards pushing lightweight component adoption, and the increasing popularity of large, high-utility vehicles that necessitate heavy-duty gas springs for tailgates and bonnets. Political stability and favorable foreign direct investment policies in key manufacturing hubs within APAC are accelerating capacity expansion, positioning the region as the epicenter of future growth.

Segmentation trends show that the application segment is dominated by liftgates and trunks, which represent the highest volume demand due to standardized use across most modern vehicle platforms. The compression gas spring type remains the foundational segment, though lockable gas springs are gaining traction, particularly in adjustable seating systems and specialized commercial vehicle applications where positional stability is paramount. The Original Equipment Manufacturer (OEM) segment accounts for the majority revenue share, intrinsically linked to global vehicle production cycles, while the Aftermarket (AM) segment provides critical stability, driven by replacement cycles and the need for high-quality components to maintain vehicle functionality and safety over time.

AI Impact Analysis on Automotive Gas Springs Market

User inquiries regarding AI's influence on the Automotive Gas Springs Market primarily revolve around themes of predictive maintenance, design optimization, and manufacturing efficiency. Common questions include: "How can AI optimize the physical design parameters (force, stroke, damping characteristics) of gas springs?", "Will AI-driven monitoring systems detect premature gas spring failure?", and "Can AI improve the quality control processes in high-volume gas spring manufacturing?" These questions reveal user expectation that AI will transition the gas spring from a passive mechanical component to an integrated, smart system. Users are keenly interested in how machine learning can interpret real-time data (load cycles, temperature fluctuations, usage patterns) to predict lifespan and suggest replacements proactively, thereby reducing vehicle downtime and warranty costs.

The immediate impact of Artificial Intelligence and Machine Learning (ML) is being felt most profoundly in the design and manufacturing phases (Industry 4.0). AI algorithms can rapidly simulate thousands of operating scenarios, optimizing parameters such as gas pressure, piston rod diameter, and seal geometry to achieve maximum lifespan and precise force curves under varied environmental conditions, far exceeding traditional simulation capabilities. This AI-driven design iteration significantly reduces the time-to-market for specialized gas spring applications, especially those required for complex power liftgate geometries or high-load commercial vehicle hoods. Furthermore, AI enhances material selection by predicting long-term performance and potential degradation under specific vehicle use cases, ensuring the longevity and reliability of the final product.

In terms of operational integration, AI plays a crucial role in enhancing the vehicle’s overall system performance. For instance, in advanced power liftgate modules, ML models process input from sensors (proximity, torque) to fine-tune the motor assistance and the gas spring force, ensuring smooth and quiet operation regardless of external factors like wind or inclination. This integration moves the gas spring beyond simple counterbalancing to become a dynamically interacting component. While AI does not directly change the core physics of the gas spring (pressurized nitrogen and oil), it fundamentally optimizes its application, prediction of failure, and integration into complex mechatronic systems, transforming the entire product lifecycle management (PLM) process within the automotive sector.

- AI-driven optimization of dynamic force curves and damping characteristics.

- Machine learning algorithms for predictive maintenance scheduling based on usage and environmental data.

- Enhanced quality control using computer vision and AI for detecting microscopic defects in seals and rods during manufacturing.

- Simulation and modeling using neural networks to accelerate prototype development for new vehicle models.

- Integration of ML into automated power liftgate control units for smoother, speed-controlled operation.

- Optimized inventory management and supply chain forecasting based on projected wear rates.

- Reduction of warranty claims through higher precision in manufacturing tolerances guided by AI monitoring.

DRO & Impact Forces Of Automotive Gas Springs Market

The Automotive Gas Springs Market is influenced by a dynamic interplay of Drivers (D), Restraints (R), and Opportunities (O), alongside critical Impact Forces. The primary drivers stem from the continuous evolution of vehicle design, specifically the proliferation of utility vehicles (SUVs and CUVs) that require robust, high-force gas springs for heavier liftgates and bonnets. Furthermore, escalating consumer demands for premium features, convenience, and safety—manifested through power liftgates and adjustable seating—mandate the use of reliable gas spring assemblies. Regulatory bodies worldwide are also pushing for higher passive safety standards, which indirectly fuels demand for high-quality, dependable components that ensure controlled opening and closing motions, minimizing the risk of injury. The global push for electric vehicles (EVs) also acts as a driver, as specialized, often larger, gas springs are needed to manage heavy battery access panels and charging port mechanisms.

Conversely, the market faces significant restraints. The volatility and increasing costs of raw materials, particularly steel, aluminum, and specialized sealing elastomers, exert continuous pressure on manufacturing margins. Additionally, the automotive industry's cyclical nature and fluctuating global vehicle production volumes directly impact OEM demand for gas springs, leading to periods of inventory management complexity. Another key restraint is the competitive threat from alternative lift assist technologies, such as advanced electric motors and counterbalance systems, which, particularly in high-end automated systems, might occasionally bypass the need for traditional gas spring damping. Ensuring consistent quality and preventing early failure (often linked to seal deterioration) across diverse operational environments remains a technical challenge that manufacturers must constantly address.

The market opportunities are significant, especially concerning technological advancement and geographical expansion. The development of specialized lockable gas springs (hydro-stops or double-damped units) for sophisticated applications like medical mobility vans or luxury vehicle adjustable suspensions presents high-margin avenues. Geographically, emerging economies in Southeast Asia and Africa represent untapped potential, characterized by increasing industrialization and rising vehicle ownership, offering opportunities for standardized, high-volume production. Furthermore, the aftermarket segment presents ongoing stability and growth potential, driven by the need for quality replacement parts as the global vehicle parc ages. Strategic investments in material technology, suching as surface treatments to minimize friction and corrosion, are critical opportunity areas for product differentiation and market leadership.

Segmentation Analysis

The Automotive Gas Springs Market is intricately segmented based on several key operational and functional characteristics, providing a detailed map of demand patterns across the global automotive landscape. The core segmentation types include product type (compression, tension, lockable), application (bonnets, liftgates/trunks, seats, others), sales channel (OEM and aftermarket), and material type (steel, stainless steel, composite). This diversified structure allows manufacturers to cater specifically to varying demands ranging from high-volume standardized components required by mass-market passenger cars to highly specialized, corrosion-resistant units mandated by commercial marine or off-highway vehicles. Understanding these segments is vital for strategic market positioning and identifying high-growth niches, particularly those linked to vehicle electrification and advanced safety systems.

The segmentation by application is arguably the most influential driver of volume. Liftgates and trunks constitute the largest application area, driven by nearly universal inclusion in modern SUVs, hatchbacks, and sedans. The segment for bonnets (hoods) is also substantial, especially in heavy-duty vehicles and those with complex engine bay access requirements. However, the 'other' category, encompassing adjustable seating, steering columns, and cabin storage solutions, is exhibiting the highest growth rate due to increased focus on driver and passenger ergonomics and comfort in luxury and long-haul vehicles. By product type, compression gas springs dominate due to their common use in basic lift-assist functions, but lockable and tension springs are increasing their market share in precision control environments.

From a sales channel perspective, the Original Equipment Manufacturer (OEM) channel is paramount, representing the initial installation phase and strongly correlating with global vehicle production numbers. This segment demands stringent quality checks, high volume capability, and adherence to specific vehicle model specifications, often requiring collaborative design and long-term contracts. Conversely, the Aftermarket (AM) provides stable, counter-cyclical revenue, crucial for balancing revenue streams. Aftermarket quality is increasingly scrutinized, as consumers seek reliable replacement parts that match or exceed OEM specifications, thus creating opportunities for premium, high-durability replacement units. Material segmentation is also evolving, with increasing interest in composite materials, although specialized steel remains the standard for high-pressure requirements.

- By Product Type

- Compression Gas Springs

- Tension Gas Springs (Pull Type)

- Lockable Gas Springs

- Damping/Damper Gas Springs

- By Application

- Hoods/Bonnets

- Liftgates and Trunks

- Seats and Headrests (Adjustment mechanisms)

- Fuel Flaps and Charging Ports (EVs)

- Other Specialized Applications (Steering Column Tilt, Storage Compartments)

- By Vehicle Type

- Passenger Vehicles (Hatchbacks, Sedans, SUVs, CUVs)

- Commercial Vehicles (Light, Medium, Heavy-Duty Trucks)

- Off-Highway Vehicles (Construction, Agricultural)

- By Sales Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket (AM)

- By Material

- Steel

- Stainless Steel (for corrosive environments)

- Composite Materials

Value Chain Analysis For Automotive Gas Springs Market

The value chain for the Automotive Gas Springs Market begins with the upstream segment, which is dominated by the sourcing and processing of core raw materials. This includes high-grade seamless steel tubes for the cylinder body, chrome-plated steel rods for the piston, specialized hydraulic oils, and high-performance sealing elastomers (such as synthetic rubber or specialized polymers) crucial for containing the high-pressure nitrogen gas. Suppliers in this phase face intense scrutiny regarding material quality, consistency, and adherence to stringent automotive specifications (e.g., corrosion resistance and temperature tolerance). Volatility in global steel prices and the need for consistent supply chains are major challenges at this foundational stage, necessitating strong long-term contracts and potentially vertical integration by major spring manufacturers to ensure cost stability and material traceability.

The midstream phase involves manufacturing and assembly. This is characterized by high-precision machining, welding, surface treatment (e.g., nitriding or chroming for rod durability), and the critical process of gas charging and oil filling under controlled environments. Key activities include stamping, tube cutting, deep drawing, and automated assembly line operations. Manufacturers like Stabilus and Suspa focus heavily on automation, proprietary sealing technologies, and rigorous quality testing (force degradation, cycle life) to maintain competitive advantage. The ability to customize force output and stroke length rapidly for diverse OEM requirements is a key value addition in this phase, often involving complex logistical coordination for Just-In-Time (JIT) delivery to vehicle assembly plants.

The downstream flow involves distribution and sales through both direct and indirect channels. The primary channel is direct sales to OEMs, often handled through dedicated sales and engineering teams that engage early in the vehicle design process (Tier 2/Tier 1 relationships). Indirect channels primarily serve the Aftermarket (AM), utilizing a network of authorized distributors, wholesalers, and retail auto parts stores. Successful downstream operations require efficient inventory management to service localized replacement demand, rigorous branding to establish trust in the AM, and robust technical support. The entire value chain is focused on minimizing leakage (gas and oil) and maximizing lifecycle performance, which drives continuous investment in better sealing mechanisms and quality assurance protocols.

Automotive Gas Springs Market Potential Customers

The primary customers and end-users of automotive gas springs fall broadly into two categories: Original Equipment Manufacturers (OEMs) and the Aftermarket segment, consisting of repair shops, independent garages, and vehicle owners. OEMs, including global automotive giants such as Toyota, Volkswagen Group, Ford, and General Motors, represent the largest volume buyers. These manufacturers require gas springs for integration into the assembly line of passenger vehicles (sedans, SUVs, minivans) and commercial vehicles (delivery vans, heavy-duty trucks). Their purchasing decisions are driven by stringent technical specifications, bulk pricing, reliability, and the supplier's ability to provide customized design solutions that integrate seamlessly with power opening systems and vehicle body structures.

Within the OEM category, specialized vehicle manufacturers, such as those producing high-performance sports cars (requiring finely tuned bonnet dampers) and off-highway equipment (construction machinery and agricultural vehicles requiring high-force, heavy-duty springs for cabin access and component support), form a high-value niche. These specialized customers demand extreme durability, corrosion resistance, and high-cycle life due to the harsh operating conditions of their equipment. Furthermore, the burgeoning electric vehicle (EV) manufacturers are emerging as critical potential customers, needing robust gas springs for heavier battery compartment access panels and charging port covers, often necessitating new material considerations due to potential electromagnetic interference or thermal management needs.

The Aftermarket customers—the vehicle owners and independent service providers—constitute the stable replacement market. As gas springs have a finite operational life (usually determined by the slow leakage of nitrogen gas over time), replacements are routinely required after several years of use. These customers prioritize ease of installation, availability, and cost-effectiveness, though reliability remains a critical factor. Service providers often seek relationships with reliable distributors who can offer a wide catalogue of products matching various vehicle makes and models, ensuring they can service diverse customer demands efficiently and effectively, thereby supporting vehicle safety and functionality post-warranty.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Stabilus, Suspa, Bansbach easylift, Barnes Group Inc., IGS Gas Spring, WGS Gas Spring, Shanghai Dongsheng Auto Parts Co., Ltd., Arvin Sango, Hefei Gas Spring Co., Ltd., Camloc Motion Control, Metrol Springs Ltd., Gaysan, AVM Industries, Associated Spring, MasterGasSprings, Piston Ltd., SPD Gas Spring, FlexiForce, Lift-O-Mat, DADCO. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Gas Springs Market Key Technology Landscape

The technological landscape of the Automotive Gas Springs Market is focused primarily on enhancing durability, optimizing damping characteristics, and integrating with mechatronic systems. A critical area of development involves advanced sealing technology, utilizing proprietary elastomer compounds and complex multi-lip seals to minimize nitrogen gas leakage, which is the primary cause of product failure and force degradation over time. Manufacturers are investing heavily in surface treatments for the piston rod, such as highly optimized chrome plating, ceramic coatings, or specialized nitriding processes, to reduce friction (improving smoothness of operation) and drastically enhance resistance to corrosion and wear, particularly in regions prone to severe weather or road salt exposure.

Another significant technological advancement is the rise of dynamic damping and adaptive control mechanisms. Traditional gas springs offer passive damping, but modern luxury and high-utility vehicles increasingly require gas springs with controllable damping properties. This involves incorporating internal valves or bypass mechanisms that can alter the flow of oil depending on the speed of compression or extension, resulting in smoother, more controlled movement. Lockable gas springs, often incorporating internal hydraulic locking systems, represent a crucial technology for applications requiring precise, stable positioning, such as adjustable steering columns, medical lift supports, and advanced seating systems, moving beyond simple lift assist to complex positional control.

Furthermore, the integration of gas springs into electric and automated systems (such as power liftgates) is driving innovation toward lighter-weight materials and hybrid designs. While steel remains dominant, research is ongoing into high-strength, lightweight aluminum alloys and composite materials for the cylinder body, aiming to reduce overall vehicle weight and improve fuel efficiency/EV range without sacrificing structural integrity. The future landscape will likely involve sensor integration (Smart Gas Springs) that can communicate operational status, cycle count, and remaining lifespan to the vehicle’s central diagnostic system, enabling true predictive maintenance and enhancing the overall reliability of the mechanical-electronic vehicle sub-systems.

Regional Highlights

Regional analysis indicates significant growth potential and varied maturity levels across the globe, defining specific strategic priorities for manufacturers. North America remains a highly valuable market, characterized by strong demand for large SUVs, pickup trucks, and heavy-duty commercial vehicles. The prevalence of large vehicle platforms requires high-force gas springs for heavy hoods, tailgates, and integrated access systems, driving continuous demand. Furthermore, the region has a mature and robust aftermarket, ensuring steady revenue streams from replacement cycles. Strict safety regulations and the trend toward premium vehicle features also boost the market for sophisticated, electronically integrated gas spring systems.

Europe represents a mature but technologically demanding market, driven by stringent vehicle emission standards and a strong focus on premium vehicle manufacturing. European manufacturers prioritize weight reduction, necessitating advanced materials and high-precision, space-saving designs. The region is a leader in adopting specialized gas springs for complex seating adjustments and modular vehicle interiors. Furthermore, the significant presence of manufacturers of specialty vehicles and machinery (agricultural, construction) maintains a strong demand for durable, corrosion-resistant, and high-cycle life gas springs for demanding off-highway applications.

Asia Pacific (APAC), particularly China, India, and Southeast Asia, stands out as the highest-growth region. This growth is fueled by massive urbanization, rapidly expanding middle-class populations, and the resulting surge in automotive production, especially in the compact SUV and sedan segments. While the region is characterized by high-volume, cost-competitive manufacturing, increasing safety standards and consumer expectations for power accessories are driving a shift toward higher quality, technologically advanced gas springs. APAC is also rapidly becoming a global manufacturing hub, necessitating localized R&D and supply chain strategies for international gas spring providers to efficiently serve the burgeoning OEM base.

- North America (USA, Canada, Mexico): Dominated by large vehicles (SUVs, Trucks), high demand for high-force capacity, robust aftermarket sector, and increasing OEM focus on advanced lift-assist integration.

- Europe (Germany, UK, France, Italy): Focus on weight reduction, premium segment, high technical specifications for adjustable seating and interior features, strong presence of commercial and specialty vehicle manufacturers.

- Asia Pacific (China, Japan, India, South Korea): Fastest-growing region driven by high-volume vehicle production, rising disposable incomes, rapid urbanization, and increasing adoption of standard gas spring applications in mass-market vehicles.

- Latin America (Brazil, Argentina): Growing industrialization and vehicle production volumes; sensitive to economic fluctuations but presents long-term potential for basic and medium-duty gas springs in local assembly plants.

- Middle East and Africa (MEA): Emerging market with demand concentrated in commercial and utility vehicles; focused on durable components capable of withstanding extreme temperatures and corrosive environmental conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Gas Springs Market.- Stabilus

- Suspa

- Bansbach easylift

- Barnes Group Inc. (Associated Spring Raymond)

- Hefei Gas Spring Co., Ltd.

- IGS Gas Spring

- WGS Gas Spring

- Shanghai Dongsheng Auto Parts Co., Ltd.

- Arvin Sango, Inc.

- Camloc Motion Control

- Metrol Springs Ltd.

- Gaysan

- AVM Industries

- MasterGasSprings

- Piston Ltd.

- SPD Gas Spring

- FlexiForce

- Lift-O-Mat

- DADCO

- Century Spring Corp.

Frequently Asked Questions

Analyze common user questions about the Automotive Gas Springs market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an automotive gas spring?

The primary function is to provide controlled force and motion dampening, typically assisting in the lifting and holding open of heavy vehicle components like liftgates, hoods, and trunks, enhancing safety and user convenience through pressurized nitrogen gas and oil.

How does the shift to Electric Vehicles (EVs) impact gas spring demand?

EV adoption increases demand for specialized gas springs to support heavier components like battery access covers and larger charging port flaps. These springs must often meet stringent requirements for corrosion resistance and durability due to increased exposure and structural load.

What are the key technical differences between compression and lockable gas springs?

Compression gas springs provide simple lift assistance and dampening; they cannot hold position mid-stroke. Lockable gas springs, conversely, utilize an internal valve system to hydraulically lock the piston rod at any point in the stroke, making them ideal for adjustable seating and precise positional control applications.

Which geographical region is expected to experience the highest market growth?

The Asia Pacific (APAC) region, driven primarily by China and India, is projected to show the highest growth rate due to rapid increases in automotive production volumes, urbanization, and rising consumer demand for vehicles equipped with comfort and safety features utilizing gas springs.

What major factors influence the lifespan and replacement cycle of gas springs?

Lifespan is primarily determined by the slow, inevitable leakage of internal nitrogen gas, accelerated by excessive cycling, extreme operating temperatures, and seal degradation caused by friction or corrosive environmental exposure (e.g., road salt or high humidity). Replacement is typically required when force output drops significantly.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager