Automotive Grommet Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434257 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Automotive Grommet Market Size

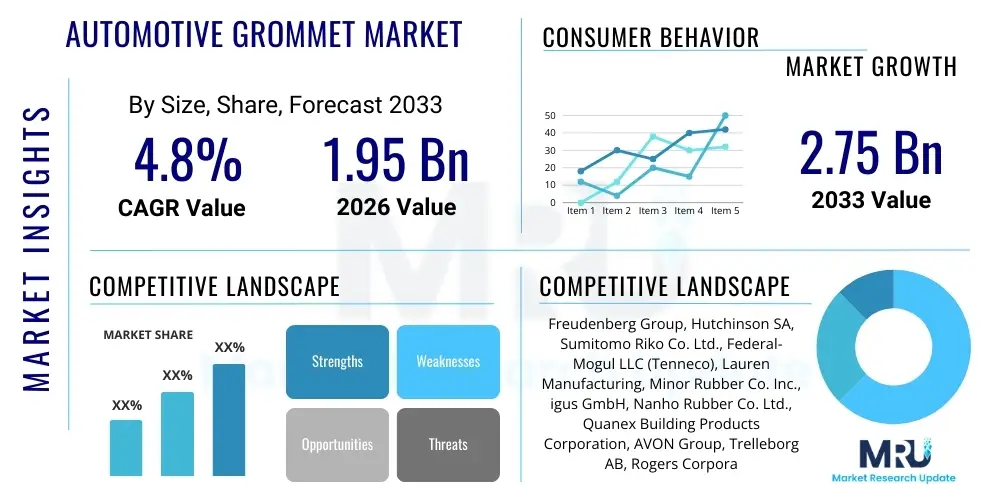

The Automotive Grommet Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.95 Billion in 2026 and is projected to reach USD 2.75 Billion by the end of the forecast period in 2033.

Automotive Grommet Market introduction

The Automotive Grommet Market encompasses components primarily used for sealing, vibration damping, and protecting wires, cables, and hoses passing through vehicle body panels or chassis structures. These small but critical components prevent abrasion, maintain environmental sealing against dust and moisture, and reduce noise transmission, thereby significantly contributing to overall vehicle quality and longevity. Modern vehicles, characterized by complex electronic architectures and stringent NVH (Noise, Vibration, and Harshness) requirements, necessitate high-performance grommets made from advanced rubber compounds and engineered thermoplastics to meet demanding operational specifications.

Major applications for automotive grommets span across the entire vehicle, including the engine bay (for powertrain wire harnesses), the body structure (for cable pass-throughs in the firewall and doors), and interior systems (for climate control and infotainment wiring). Their utility extends beyond mere protection; they are fundamental to electrical insulation integrity and fluid containment in specialized systems. As vehicle electrification accelerates, the demand for specialized, high-temperature, and flame-retardant grommets for battery packs and high-voltage cabling systems is rapidly increasing, positioning grommets as indispensable safety and reliability components.

The primary driving factors for market growth include the continuously increasing complexity of vehicle electronics, which requires more cable management and protection points. Furthermore, tightening global safety standards and consumer expectations for enhanced acoustic performance and durability push original equipment manufacturers (OEMs) to invest in high-quality sealing solutions. The global shift toward lightweighting materials also influences the market, fostering innovation in thermoplastic elastomers (TPE) and silicone-based grommets that offer comparable performance to traditional rubber while reducing overall vehicle mass.

Automotive Grommet Market Executive Summary

The Automotive Grommet Market is experiencing robust growth, propelled by the persistent increase in vehicle production, particularly within the Asia Pacific region, and the global megatrend of electric vehicle (EV) adoption. Key business trends involve supplier consolidation and intensified research into lightweight, durable, and sustainable materials like TPEs and bio-based polymers to satisfy OEM mandates for weight reduction and environmental compliance. Furthermore, the push for increased automation in grommet manufacturing, including robotics and precision molding, is aimed at improving quality consistency and reducing manufacturing costs, which is crucial given the high-volume nature of the automotive supply chain.

Regionally, Asia Pacific (APAC) remains the undisputed growth engine, driven by massive manufacturing bases in China, India, and ASEAN nations, coupled with increasing domestic demand for new passenger vehicles. North America and Europe, while mature markets, demonstrate strong demand for premium and specialized grommets necessary for advanced driver-assistance systems (ADAS) and high-voltage EV architectures, often commanding higher average selling prices. This duality—volume growth in APAC and value growth in Western markets—defines the immediate geographical landscape.

Segmentation trends highlight a pivot toward silicone and engineered plastic grommets over traditional synthetic rubber, primarily due to enhanced heat resistance, superior durability, and reduced weight. Application-wise, the engine and chassis segments, which require extreme temperature and chemical resistance, are seeing significant material evolution. The growing complexity of wire harnesses in modern cars ensures that the wire management and protection segment will continue to dominate market volume, necessitating customized solutions tailored to specific vehicle platforms and regulatory requirements.

AI Impact Analysis on Automotive Grommet Market

Common user questions regarding AI’s impact on the Automotive Grommet Market frequently revolve around optimizing design, predictive failure analysis, and enhancing manufacturing efficiency. Users are keenly interested in how Artificial Intelligence can minimize material waste, particularly in complex injection molding processes, and how machine learning algorithms can predict the optimal material composition required to meet specific NVH or thermal tolerance parameters for new vehicle designs. A prevalent concern is whether AI-driven design synthesis could lead to highly optimized, yet proprietary, grommet designs, potentially altering the competitive landscape among suppliers. Furthermore, inquiries focus on integrating AI into quality control systems (visual inspection using deep learning) to virtually eliminate defects in high-volume production runs.

- AI-Powered Design Optimization: Utilizing generative design algorithms to simulate complex stress points and thermal loads, resulting in lighter, more durable, and material-efficient grommet geometries, significantly reducing prototype cycles.

- Predictive Maintenance in Manufacturing: Implementing machine learning models to analyze sensor data from injection molding machines, predicting equipment failure, optimizing mold temperatures, and adjusting pressure parameters to ensure consistent part quality and uptime.

- Enhanced Quality Control (QC): Deployment of deep learning-based visual inspection systems capable of instantly detecting minute surface flaws, flash, or dimensional inconsistencies far exceeding human capabilities, ensuring high compliance with automotive safety standards.

- Supply Chain Forecasting: AI algorithms improving demand forecasting accuracy for raw materials (rubber compounds, polymers), minimizing inventory holding costs, and mitigating risks associated with supply chain volatility.

- Custom Material Formulation: Using machine learning to correlate material properties (e.g., Shore hardness, tensile strength, heat deflection temperature) with specific performance criteria, rapidly developing novel elastomer blends suitable for extreme EV operating environments.

DRO & Impact Forces Of Automotive Grommet Market

The dynamics of the Automotive Grommet Market are governed by a robust interaction of drivers, significant restraints, and emerging opportunities, collectively shaping the direction of industry evolution. The principal driver is the relentless growth in global vehicle production, especially in emerging economies, combined with the increasing electronic content per vehicle, which directly correlates with the number of wires and, consequently, the number of required protective grommets. However, the market faces constraints primarily related to fluctuating raw material prices (synthetic rubber and petroleum-derived polymers) and the imperative for manufacturers to consistently meet stringent, zero-defect quality standards in a price-sensitive commodity component segment. Opportunities arise predominantly from technological shifts, particularly the move towards electric vehicles, which mandates new high-performance sealing materials, and the development of intelligent, sensor-integrated grommets for next-generation ADAS applications.

Drivers: Intensified focus on reducing NVH levels in premium and EV segments, mandatory regulatory requirements for improved fire safety and wiring insulation integrity, and the sustained expansion of the global automotive manufacturing base. The transition from mechanical to electrical systems (e.g., brake-by-wire, steer-by-wire) increases wire harness complexity, thereby boosting demand for advanced routing and sealing solutions.

Restraints: Significant cost pressure from OEMs demanding highly localized and competitive pricing models, the technical challenge of designing grommets that accommodate large variations in cable diameters and routing paths, and the increasing operational complexity associated with managing a vast portfolio of highly customized parts. Furthermore, the lifespan and durability requirements in severe under-the-hood environments present material science limitations that must be continuously overcome.

Opportunities: Rapid market expansion in the development of specialized high-voltage grommets for EV battery packs and charging ports, exploration of sustainable and lightweight bio-based or recycled polymer materials, and integration of smart technologies, such as RFID or embedded sensors, into grommets for real-time monitoring of cable health or seal integrity. Advanced 3D printing techniques also offer avenues for rapid prototyping and low-volume customization.

The impact forces are substantial, driven by stringent quality mandates and material innovation needs. The most critical impact force is the material transition driven by electrification; this force compels traditional rubber manufacturers to invest heavily in silicone and high-performance TPE capabilities, fundamentally restructuring the competitive advantage of established players. The sustained pressure on cost, coupled with demands for zero defects, ensures that manufacturing process optimization (utilizing automation and AI) remains a high-impact factor influencing supplier selection and market penetration strategy.

Segmentation Analysis

The Automotive Grommet Market is comprehensively segmented based on material type, application area, and vehicle type, allowing for granular market assessment. Material segmentation provides insights into technological advancements, highlighting the shift toward lightweight and high-temperature resistant options. Application segmentation is crucial for understanding demand elasticity across different vehicle systems, with powertrain and body segments representing the largest volume consumers. Furthermore, the segmentation by vehicle type differentiates between the demanding performance characteristics required for passenger vehicles versus the rugged durability necessary for commercial vehicles.

- By Material Type:

- Rubber Grommets (Synthetic Rubber, Natural Rubber)

- Plastic Grommets (PVC, Nylon, Polyethylene)

- Silicone Grommets

- Thermoplastic Elastomers (TPE) Grommets

- By Application:

- Body (Firewall, Doors, Trunk)

- Chassis

- Engine (Powertrain)

- Interior (Dashboard, Cabin Wiring)

- By Vehicle Type:

- Passenger Vehicles (Sedans, SUVs, Hatchbacks)

- Commercial Vehicles (LCVs, HCVs)

- By Sales Channel:

- Original Equipment Manufacturers (OEMs)

- Aftermarket

Value Chain Analysis For Automotive Grommet Market

The value chain for the Automotive Grommet Market begins with the upstream suppliers responsible for sourcing and processing specialized raw materials. This includes synthetic rubber producers (EPDM, SBR, NBR), silicone compound suppliers, and petrochemical companies providing base polymers for plastics and TPEs. Material suppliers often differentiate themselves based on formulation capabilities, offering compounds specifically tailored for high heat, oil resistance, or flexibility. The quality and stability of raw material pricing are critical factors influencing the profitability and consistency of the downstream manufacturing process.

The core manufacturing stage involves specialized molding techniques, primarily injection molding for plastics and compression or transfer molding for rubber components. Manufacturers must maintain high precision and strict quality control due to the critical safety and NVH function of the grommets. This stage involves complex tooling design and continuous investment in automation to handle the high-volume, low-margin nature of the product. Direct distribution typically involves tier-1 suppliers delivering components directly to OEM assembly lines, managed through complex just-in-time (JIT) logistics to minimize inventory risk for the vehicle manufacturers.

Downstream activities involve integration and distribution. In the OEM channel, grommets are frequently bundled with larger wire harness assemblies (a common practice where harness manufacturers act as Tier 1 suppliers, integrating grommets sourced from Tier 2 specialists). The aftermarket distribution channel relies on specialized automotive parts distributors and regional wholesalers, focusing on popular vehicle models and replacement needs due to wear and tear or accidental damage. Both direct and indirect channels demand robust inventory management and precise part identification to ensure compatibility across diverse vehicle platforms.

Automotive Grommet Market Potential Customers

The primary and largest segment of potential customers for automotive grommets comprises Original Equipment Manufacturers (OEMs), including global giants such as Toyota, Volkswagen Group, General Motors, and Tesla. These customers purchase high volumes of specialized, custom-designed grommets directly from Tier 1 or Tier 2 suppliers for integration into new vehicle production lines. Their purchasing decisions are heavily influenced by factors such as component weight, compliance with stringent quality and thermal specifications, and the supplier's ability to provide global logistical support and competitive pricing over the vehicle program's lifecycle.

A secondary, yet significant, customer base consists of Tier 1 automotive system suppliers, particularly those specializing in wire harnesses, chassis systems, and interior modules (e.g., Lear Corporation, Yazaki, Aptiv). These companies procure grommets as subcomponents to complete their larger assemblies before delivery to the OEMs. For these customers, the key requirement is seamless integration, precise dimensional accuracy, and certification documentation, ensuring the grommets meet the ultimate OEM specifications without causing assembly line slowdowns.

Furthermore, the Aftermarket segment represents a consistent demand source, encompassing independent auto repair shops, specialized maintenance centers, and large retail auto parts chains. These customers require standard, universal, or direct-replacement grommets for vehicle repairs and maintenance. While the volume per transaction is lower than that of OEMs, the aftermarket provides stable revenue streams for standardized products, often leveraging indirect distribution channels like wholesalers and online platforms for broader reach.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.95 Billion |

| Market Forecast in 2033 | USD 2.75 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Freudenberg Group, Hutchinson SA, Sumitomo Riko Co. Ltd., Federal-Mogul LLC (Tenneco), Lauren Manufacturing, Minor Rubber Co. Inc., igus GmbH, Nanho Rubber Co. Ltd., Quanex Building Products Corporation, AVON Group, Trelleborg AB, Rogers Corporation, M.G. Rubber Company, Kismet Rubber Products, Standard Rubber Products Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Grommet Market Key Technology Landscape

The technology landscape for automotive grommets is characterized by advancements in material science, focusing on creating lightweight components that maintain high levels of sealing integrity and chemical resistance. A key technological trend is the proliferation of Thermoplastic Elastomers (TPEs). TPEs offer the flexibility and sealing properties of rubber combined with the processing ease of plastic, allowing for complex geometries to be produced quickly and cost-effectively via injection molding. This shift is crucial for mass production and for meeting OEM demands for materials that contribute to overall vehicle lightweighting without sacrificing performance, especially in highly demanding zones like the engine compartment and battery enclosures.

Another crucial technological development involves multi-component molding techniques, such as 2K or multi-shot injection molding. This technology enables the creation of grommets that integrate different materials—for example, a rigid plastic base for secure mounting combined with a softer rubber or silicone lip for superior sealing—in a single, automated manufacturing cycle. This complexity of design enhances functional performance, improves assembly speed for OEMs, and allows for highly customized components tailored to specific automotive ingress points, minimizing the risk of water or dust penetration. Furthermore, advanced surface treatment technologies are being explored to reduce friction during installation, thereby preventing damage to the grommet or the wire harness jacket.

In the manufacturing sphere, automation technologies, including robotic material handling and sophisticated computer-aided quality inspection systems (often incorporating AI), are standardizing production. Precision tooling and mold fabrication techniques are paramount, given the tight tolerances required for effective sealing in harsh environments. For electric vehicle applications, research is intensely focused on high-dielectric strength silicone and specialized compounds that can withstand the intense heat generated by high-voltage cabling, representing a critical area of material innovation that is redefining the technological baseline for sealing solutions.

Regional Highlights

The global Automotive Grommet Market exhibits distinct growth patterns across key geographical regions, dictated primarily by automotive production volume, regulatory stringency, and the pace of EV adoption.

- Asia Pacific (APAC): APAC is the dominant region both in terms of volume and growth rate, primarily driven by China, India, and ASEAN countries, which host massive production hubs for both domestic consumption and export. The robust growth in mid-range and compact passenger vehicles necessitates high-volume production of standardized rubber and plastic grommets. Furthermore, government mandates supporting EV manufacturing in China are creating intense demand for specialized silicone and high-performance polymer grommets for battery systems.

- North America: This region is characterized by high demand for premium and specialized components, focusing heavily on safety and advanced connectivity. The US market drives demand for high-quality, durable grommets suitable for larger SUVs and pickup trucks, which require superior NVH performance. North America is rapidly investing in EV manufacturing capacity, leading to strong immediate demand for complex, engineered sealing solutions tailored for high-voltage systems and sophisticated ADAS wiring.

- Europe: Europe emphasizes stringent environmental standards, driving innovation in lightweight materials like TPEs and recycled content polymers. The strict EU regulations concerning acoustic comfort and safety mean that European OEMs demand superior sealing performance. Germany, France, and the UK are primary consumers, with a strong focus on high-performance vehicles and accelerating EV transition, thereby ensuring sustained growth in the value-added segment of the market.

- Latin America (LATAM): Growth in LATAM is closely linked to fluctuating domestic vehicle production volumes, particularly in Brazil and Mexico. The market generally prioritizes cost-effectiveness, favoring standardized rubber and PVC grommets. However, the influence of global platforms assembled locally is gradually introducing demand for more advanced material solutions.

- Middle East and Africa (MEA): This region maintains a comparatively smaller market share, relying largely on imported components. Demand is concentrated in key vehicle assembly nations and is highly sensitive to economic and geopolitical stability. The extreme temperature variations in the Middle East necessitate grommets with excellent thermal stability and UV resistance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Grommet Market.- Freudenberg Group

- Hutchinson SA

- Sumitomo Riko Co. Ltd.

- Federal-Mogul LLC (Tenneco)

- Trelleborg AB

- Lauren Manufacturing

- Minor Rubber Co. Inc.

- igus GmbH

- Nanho Rubber Co. Ltd.

- Quanex Building Products Corporation

- AVON Group

- Rogers Corporation

- M.G. Rubber Company

- Kismet Rubber Products

- Standard Rubber Products Co.

- Nichirin Co. Ltd.

- Toyoda Gosei Co. Ltd.

- Continental AG

- Bridgestone Corporation

- SaarGummi Technologies GmbH

Frequently Asked Questions

Analyze common user questions about the Automotive Grommet market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an automotive grommet in modern vehicles?

The primary function of an automotive grommet is protection, sealing, and vibration damping. Grommets protect wire harnesses, cables, and hoses from abrasive damage when passing through sharp-edged metal panels (e.g., the firewall or chassis) while simultaneously creating a seal to prevent the ingress of water, dust, and contaminants, thereby maintaining NVH (Noise, Vibration, and Harshness) integrity.

How is the transition to Electric Vehicles (EVs) affecting the demand for grommets?

The EV transition is significantly increasing demand for high-performance grommets, particularly those made from silicone and advanced TPEs. These materials are essential for managing high-voltage cabling and battery pack enclosures, requiring superior thermal stability, dielectric strength, and flame retardancy compared to traditional rubber compounds used in internal combustion engine vehicles.

Which material segment currently dominates the Automotive Grommet Market?

Rubber (synthetic and natural) still holds the largest share by volume due to its cost-effectiveness and excellent damping properties, especially in conventional applications. However, the Plastic and Thermoplastic Elastomers (TPE) segments are experiencing the fastest growth rates due to demands for lightweighting, superior heat resistance, and easier manufacturing processing (injection molding).

What major challenges are constraining the growth of the grommet market?

Key constraints include the volatility and rising cost of raw materials (rubber and specialized polymers), intense price pressure exerted by global OEMs seeking cost reductions, and the technical complexity of designing customized components that must maintain zero-defect standards under extreme thermal and chemical stress throughout the vehicle's lifespan.

Which geographical region offers the most significant growth potential for grommet manufacturers?

The Asia Pacific (APAC) region, driven by continuous expansion in vehicle production in China, India, and Southeast Asia, offers the most significant growth potential by volume. This growth is sustained by both the rising middle class purchasing new vehicles and substantial investments in regional automotive supply chains and new energy vehicle manufacturing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager