Automotive Holographic Display Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433865 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Automotive Holographic Display Market Size

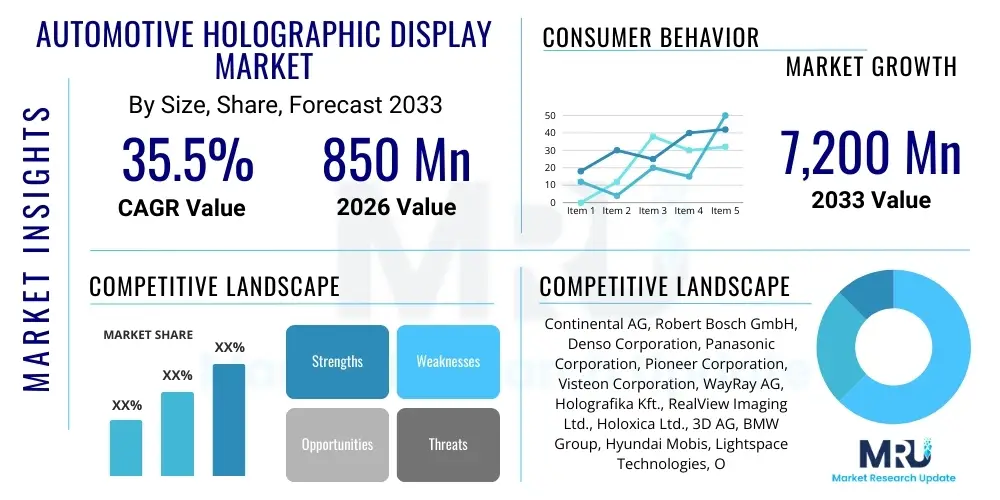

The Automotive Holographic Display Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 35.5% between 2026 and 2033. The market is estimated at USD 850 million in 2026 and is projected to reach USD 7,200 million by the end of the forecast period in 2033.

Automotive Holographic Display Market introduction

The Automotive Holographic Display Market encompasses the design, manufacture, and integration of advanced 3D visualization systems used within vehicle cockpits and windshields. These systems utilize sophisticated optical technology, primarily driven by laser and micro-mirror arrays, to project high-fidelity, customizable, three-dimensional images directly into the driver’s field of vision, enhancing safety and infotainment accessibility. Unlike traditional Head-Up Displays (HUDs) which project two-dimensional images, holographic systems create a true volumetric experience, allowing information like navigation prompts, speed, and Advanced Driver Assistance Systems (ADAS) warnings to appear spatially integrated with the external environment.

Major applications of holographic displays include augmented reality navigation, driver vital sign monitoring, contextual ADAS warnings, and comprehensive infotainment interfaces. The primary benefit these systems offer is the significant reduction in cognitive load for the driver, as relevant information is displayed without requiring the driver to refocus their eyes or look away from the road. The technology also allows for better personalization of the driving experience and opens avenues for new levels of interaction within the connected car ecosystem. Furthermore, as vehicles progress toward higher levels of autonomy (Level 3 and above), holographic interfaces are crucial for safely communicating system status and transition alerts to the human driver.

Driving factors for this market include the global push for enhanced road safety standards, the escalating consumer demand for sophisticated in-car technology, and the massive investment by Tier 1 suppliers and OEMs in advanced cockpit electronics. The integration of augmented reality (AR) capabilities is transforming conventional dashboards into immersive environments, making the holographic display a central feature of next-generation luxury and high-tech vehicles. Regulatory mandates pertaining to pedestrian safety and driver distraction are also indirectly fueling the adoption of displays that present critical data seamlessly and non-intrusively.

Automotive Holographic Display Market Executive Summary

The Automotive Holographic Display Market is experiencing robust expansion, driven primarily by the transition towards software-defined vehicles and the integration of advanced sensor fusion capabilities. Business trends highlight strategic partnerships between display manufacturers and automotive OEMs focused on standardization and mass production scaling, particularly in premium vehicle segments where high-resolution AR-HUDs are becoming standard features. Technological advancements, notably in smaller projector units and optimized waveguide optics, are lowering integration barriers and cost profiles, paving the way for eventual penetration into mid-segment vehicles. Competitive intensity is high, with intellectual property surrounding laser scanning and volumetric projection forming a critical differentiator among major players.

Regionally, North America and Europe currently dominate the market share due to stringent safety regulations, the early adoption of ADAS technologies, and the presence of major automotive innovators demanding high-end cockpit solutions. However, the Asia Pacific (APAC) region, led by China, Japan, and South Korea, is anticipated to register the highest growth rate during the forecast period. This rapid expansion in APAC is fueled by massive growth in electric vehicle (EV) production, increasing disposable incomes boosting demand for luxury features, and supportive government initiatives promoting smart transportation infrastructure. Latin America and the Middle East and Africa (MEA) are emerging markets, showing gradual adoption linked to local luxury vehicle imports and gradual investment in connected car infrastructure.

Segment trends indicate that the Head-Up Display (HUD) technology segment maintains the largest market share, specifically the AR-HUD sub-segment, due to its direct impact on driver safety and immediate commercial viability. Based on components, software and algorithms are expected to show the fastest growth as the complexity and customization requirements of holographic content increase. Passenger vehicles remain the dominant application category, though commercial vehicles are beginning to adopt simpler holographic systems for fleet management and logistical efficiency. The premium vehicle segment acts as the primary revenue generator, functioning as the proving ground for these nascent technologies before they trickle down into mass-market models through cost reduction and standardization.

AI Impact Analysis on Automotive Holographic Display Market

User inquiries regarding AI's influence on the Automotive Holographic Display Market often center on how AI algorithms personalize and optimize the projected information, ensuring it is contextually relevant and minimally distracting. Key themes include the role of AI in real-time content prioritization, predictive driver behavior analysis, and the development of truly interactive, voice-controlled 3D interfaces. Users are concerned about data privacy and the accuracy of AI-driven augmented reality overlays, particularly in complex driving scenarios. Expectations are high for AI to enable holographic displays to function as adaptive co-pilots, determining exactly what information to display, where in the driver's field of view, and when, thereby shifting the display from a static output device to a dynamic, intelligent communication platform.

- AI enhances content prioritization, displaying critical ADAS alerts holographically only when immediate action is required, reducing visual clutter.

- Machine learning algorithms analyze driver gaze and cognitive load, adjusting display brightness, size, and location to maintain optimal safety and reduce fatigue.

- Computer vision and sensor fusion, powered by AI, ensure accurate registration of holographic objects with real-world landmarks (e.g., overlaying navigation arrows precisely onto the actual road surface).

- AI facilitates natural language processing (NLP) integration, allowing drivers to interact with holographic menus and controls using voice commands and gestures.

- Predictive modeling utilizes historical and real-time data to anticipate potential hazards, projecting proactive holographic warnings before risks materialize.

- AI-driven optimization algorithms are crucial for rendering complex, high-resolution 3D holographic scenes in real-time with minimal latency, addressing performance bottlenecks.

- Personalization engines use AI to recall individual driver preferences, ensuring the holographic interface adapts seamlessly across different users of the same vehicle.

DRO & Impact Forces Of Automotive Holographic Display Market

The Automotive Holographic Display Market is heavily influenced by a confluence of technological advancements and consumer expectations, creating both significant momentum and inherent barriers. Key drivers include stringent global safety regulations mandating sophisticated collision avoidance systems, which are optimally communicated via AR-HUDs, and the escalating consumer desire for a premium, technologically advanced in-car experience. Restraints primarily involve the high initial cost associated with complex holographic projector hardware and specialized optical components, coupled with challenges related to integrating the large physical volume required for the projector units into compact vehicle dashboards. Furthermore, addressing potential motion sickness or visual fatigue caused by projected 3D imagery remains a technical hurdle requiring focused research.

Opportunities for market expansion are substantial, particularly in the realm of electric vehicles, where futuristic interiors and advanced cockpits are expected by consumers. The shift towards Level 3 and Level 4 autonomous driving necessitates the clear, unambiguous communication facilitated by holographic displays regarding system handover status, opening new application fields. Strategic growth is also possible through miniaturization efforts and the development of cost-effective, high-brightness holographic film technologies that can be applied to standard windshields, enabling wider market penetration beyond the luxury segment.

The primary impact force shaping this market is the rapid pace of digital transformation within the automotive industry, characterized by the convergence of software, sensors, and display technologies. Supplier power is currently moderate, leaning towards high for specialized optics manufacturers, while buyer power (OEMs) is substantial due to long product lifecycles and high investment requirements. The threat of substitutes, largely conventional TFT/OLED displays and traditional non-AR HUDs, is diminishing as holographic systems offer unique safety and immersion benefits that cannot be replicated by 2D interfaces. Overall, the positive impact forces driven by safety mandates and technology maturation significantly outweigh the current constraints.

Segmentation Analysis

The Automotive Holographic Display Market segmentation provides a granular view of market dynamics based on technology, component type, application, and vehicle class. Understanding these segments is critical for identifying specific investment opportunities and tailoring product development strategies. The technology segmentation highlights the dominance of Head-Up Displays, specifically the advanced Augmented Reality (AR) version, which is the immediate focus of mass commercialization due to its driver-centric safety applications. Component-wise, the market is characterized by intense development in specialized laser projection modules and the associated proprietary software necessary for 3D rendering and real-time data fusion.

Segmentation by application clearly delineates the market into Passenger Vehicles, which absorb the vast majority of current volume due to high consumer spending on in-car technology, and Commercial Vehicles, which represent an emerging niche focused on logistical navigation and operational data visualization. Furthermore, the segmentation by vehicle type underscores the strategic importance of the Premium and Luxury segments, which serve as the early adopters and key revenue drivers, subsidizing the R&D costs that will eventually allow the technology to become viable for the Mid-Segment and Economy classes through economies of scale and component standardization.

The growing complexity of holographic systems, driven by the need for seamless integration with vehicle architecture, necessitates a clear understanding of component interdependence. Software segmentation is poised for the fastest growth, as the core innovation shifts from hardware mechanics to sophisticated algorithms that manage sensor input, content projection registration, anti-distortion correction, and personalized user experiences. This software-centric shift implies that companies proficient in AI and sensor fusion will gain a competitive advantage in developing truly impactful holographic solutions.

- By Component

- Display Units/Screens

- Projectors/Optical Engines (Laser Scanning, Digital Micro-mirror Device - DMD)

- Software & Algorithms (Image Rendering, Calibration, Sensor Fusion)

- Sensors & Cameras (Used for Real-Time AR Registration)

- By Technology

- Head-Up Display (HUD)

- Conventional HUD

- Augmented Reality HUD (AR-HUD)

- Head-Mounted Display (HMD) - Niche applications

- Head-Up Display (HUD)

- By Application

- Passenger Vehicles (Sedans, SUVs, Hatchbacks)

- Commercial Vehicles (Trucks, Buses)

- By Vehicle Type

- Premium and Luxury Vehicles

- Mid-Segment Vehicles

- Economy Vehicles

Value Chain Analysis For Automotive Holographic Display Market

The value chain for the Automotive Holographic Display Market is highly complex, beginning with highly specialized upstream suppliers of core components. Upstream analysis focuses on raw materials like specialized glass, advanced polymers, laser diodes, micro-display panels (DMDs or LCOS), and high-performance electronic components. These suppliers operate in a highly concentrated market due to the stringent technical specifications required for automotive-grade components, particularly concerning temperature resilience and vibration tolerance. Companies involved in fundamental optical research and advanced materials science hold significant leverage in this initial phase.

The midstream involves Tier 2 and Tier 1 suppliers who specialize in integrating these components into functional modules. Tier 2 suppliers focus on creating the holographic projector engine, including proprietary optics and ASIC design. Tier 1 suppliers (such as Continental, Bosch, and Denso) then take these modules and integrate them with sensor fusion software and vehicle communication protocols to deliver a final, calibrated holographic display unit to the vehicle manufacturer (OEM). This integration stage requires immense expertise in automotive functional safety (ISO 26262 compliance) and cyber security, making it a high-value phase of the chain.

Downstream analysis centers on the distribution channels, which are predominantly indirect. The primary channel is the Business-to-Business (B2B) relationship between Tier 1 suppliers and major Automotive OEMs (e.g., BMW, Audi, General Motors). Once integrated into vehicles, sales occur via OEM dealerships and authorized distributors. A secondary, though smaller, distribution channel involves the aftermarket segment, where specialized repair and customization shops offer retrofitted holographic systems; however, the complexity of integration limits this indirect channel. Direct engagement between component manufacturers and OEMs is rare but sometimes occurs for strategic co-development projects regarding next-generation cockpit architectures.

Automotive Holographic Display Market Potential Customers

The primary potential customers and end-users of automotive holographic displays are categorized into several distinct groups, reflecting varied adoption rates and application requirements. Leading global Automotive Original Equipment Manufacturers (OEMs), particularly those specializing in the luxury and electric vehicle segments (e.g., Mercedes-Benz, Tesla, NIO, and major European premium brands), represent the most immediate and high-volume buyers. These customers prioritize technological differentiation, premium aesthetics, and the integration of highly advanced safety features to justify higher vehicle pricing. Their purchasing decisions are driven by the need to secure a leadership position in cockpit technology.

A secondary, rapidly growing customer segment includes Tier 1 and Tier 2 suppliers who act as intermediaries and system integrators. While not the ultimate end-user, these companies (like Visteon and Panasonic) purchase components and licenses for projection technologies to assemble the final, certified holographic modules that are then sold to the OEMs. Their focus is on scalability, cost optimization, and adherence to rigorous automotive quality standards (AEC-Q100). They are crucial in standardizing the technology for broader market adoption.

The third group encompasses commercial vehicle manufacturers (trucks and heavy equipment). Although currently a smaller market, these customers are increasingly seeking holographic solutions to improve driver efficiency, especially in long-haul logistics. Their focus is less on aesthetic appeal and more on ruggedness, reliability, and the efficient display of essential operational data, such as route optimization, load status, and real-time telematics. Finally, specialized governmental and defense organizations represent a niche customer base interested in highly customized holographic HMDs or HUDs for specialized utility vehicles and tactical driving simulators.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 7,200 Million |

| Growth Rate | 35.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Continental AG, Robert Bosch GmbH, Denso Corporation, Panasonic Corporation, Pioneer Corporation, Visteon Corporation, WayRay AG, Holografika Kft., RealView Imaging Ltd., Holoxica Ltd., 3D AG, BMW Group, Hyundai Mobis, Lightspace Technologies, OQmented GmbH, Envisics, Inc., Texas Instruments Inc., MicroVision, Inc., Sony Corporation, LG Display Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Holographic Display Market Key Technology Landscape

The technological landscape of the Automotive Holographic Display Market is characterized by intense innovation across projection methods and optical processing techniques aimed at achieving high image quality, large field of view, and reduced hardware size. The primary competing technologies include laser beam scanning (LBS) and systems based on digital micro-mirror devices (DMD) or liquid crystal on silicon (LCOS). LBS is highly favored for its ability to generate bright, focused images directly onto the windshield with low power consumption, making it ideal for the demanding light conditions faced by automotive displays. DMD and LCOS-based solutions offer flexibility in pixel density and color depth but often require more complex and bulky projection optics.

A critical advancement driving the market is the development of waveguide optics and holographic optical elements (HOEs). HOEs are sophisticated films or coatings embedded within the windshield or combiner glass that effectively diffract light, steering the projected image from a small engine into the driver’s field of view. This technology is vital for reducing the physical footprint of the projector unit, allowing easier integration into vehicle dashboards where space is severely constrained. Waveguides are essential for increasing the field of view (FoV) and virtual image distance (VID), allowing augmented reality elements to be projected further out, seamlessly blending with the real environment.

Furthermore, the integration of advanced sensor fusion technology is paramount. True Augmented Reality (AR) holographic displays rely heavily on real-time data from vehicle sensors (LIDAR, radar, cameras, GPS) to accurately map the digital holographic content onto the physical world. The display system must employ high-speed processing units and proprietary algorithms to manage depth perception, correct for geometric distortions caused by the windshield curve, and ensure the virtual image remains perfectly stable and registered, regardless of vehicle movement or road conditions. This technological convergence requires deep expertise in optics, embedded software, and high-performance computing.

Regional Highlights

- North America: This region holds a significant market share, primarily driven by the strong presence of major technology-driven automotive manufacturers and early adoption of safety-focused ADAS technologies. The U.S. and Canada are key markets, characterized by consumer willingness to pay a premium for advanced cockpit features and a regulatory environment that encourages technological integration to improve road safety metrics. Investment in semiconductor manufacturing and software development fuels high-end AR-HUD integration.

- Europe: Europe is a dominant force in the market, largely due to the concentration of luxury and high-performance vehicle manufacturers (Germany, UK) who pioneered the use of HUDs and are now aggressively integrating holographic AR technology into their new models. Strict safety standards (e.g., Euro NCAP) and a focus on minimizing driver distraction provide a continuous boost to the adoption of advanced display solutions.

- Asia Pacific (APAC): APAC is forecast to exhibit the highest CAGR, primarily fueled by massive electric vehicle production in China, favorable government policies promoting smart mobility, and high production volumes in Japan and South Korea. The rapid expansion of the middle class and increased demand for technologically sophisticated vehicles in markets like India and Southeast Asia are making APAC the future epicenter of demand growth.

- Latin America (LATAM): Market adoption in LATAM is currently nascent and primarily concentrated in the import and assembly of luxury vehicles. Growth is tied to economic stability and modernization of vehicle assembly plants, focusing initially on conventional HUDs before scaling up to complex holographic systems.

- Middle East and Africa (MEA): The MEA region shows steady, moderate growth, mainly confined to high-end vehicle sales in affluent Gulf Cooperation Council (GCC) countries. Investment in smart city infrastructure and connected car pilots could accelerate future adoption, particularly in logistics and commercial fleets leveraging holographic telematics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Holographic Display Market.- Continental AG

- Robert Bosch GmbH

- Denso Corporation

- Panasonic Corporation

- Pioneer Corporation

- Visteon Corporation

- WayRay AG

- Holografika Kft.

- RealView Imaging Ltd.

- Holoxica Ltd.

- 3D AG

- BMW Group

- Hyundai Mobis

- Lightspace Technologies

- OQmented GmbH

- Envisics, Inc.

- Texas Instruments Inc.

- MicroVision, Inc.

- Sony Corporation

- LG Display Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Automotive Holographic Display market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental difference between a traditional HUD and a holographic display in vehicles?

A traditional Head-Up Display (HUD) projects a flat, 2D image onto the windshield or a combiner glass. A holographic display, particularly an Augmented Reality Head-Up Display (AR-HUD), uses specialized optics (often laser-based or HOE) to create a true volumetric, 3D image that appears to be integrated into the real environment at variable distances, significantly enhancing depth perception and reducing cognitive load.

How does holographic technology improve vehicle safety and minimize driver distraction?

Holographic technology improves safety by projecting critical information, such as navigation prompts or ADAS alerts, directly into the driver’s primary field of view (FoV) at a long virtual image distance. This allows the driver to perceive the information without needing to refocus their eyes, keeping their attention focused on the road ahead and reacting quicker to contextual hazards highlighted by the augmented reality overlays.

Which technological component drives the cost and complexity of automotive holographic systems?

The proprietary optical engine, typically involving high-precision laser beam scanning (LBS) systems and advanced Holographic Optical Elements (HOEs), drives the highest cost. Additionally, the software required for real-time sensor fusion, distortion correction, and accurate mapping of the 3D content onto the dynamic external environment adds significant development complexity and expense.

What are the primary challenges hindering the mass adoption of holographic displays in economy vehicles?

The primary challenges include the high unit manufacturing cost of holographic projection hardware and the large physical size (packaging volume) required for the projector modules, which is difficult to integrate into the compact dashboard designs of smaller vehicles. Standardization and miniaturization efforts are key to lowering these barriers for mass-market penetration.

Which geographic region is expected to show the fastest growth rate for automotive holographic displays?

The Asia Pacific (APAC) region is projected to register the fastest Compound Annual Growth Rate (CAGR). This acceleration is fueled by the massive adoption and production of electric vehicles (EVs), significant investment in advanced cockpit technologies by major Asian manufacturers, and strong consumer demand for high-tech in-car features, particularly in China and South Korea.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager