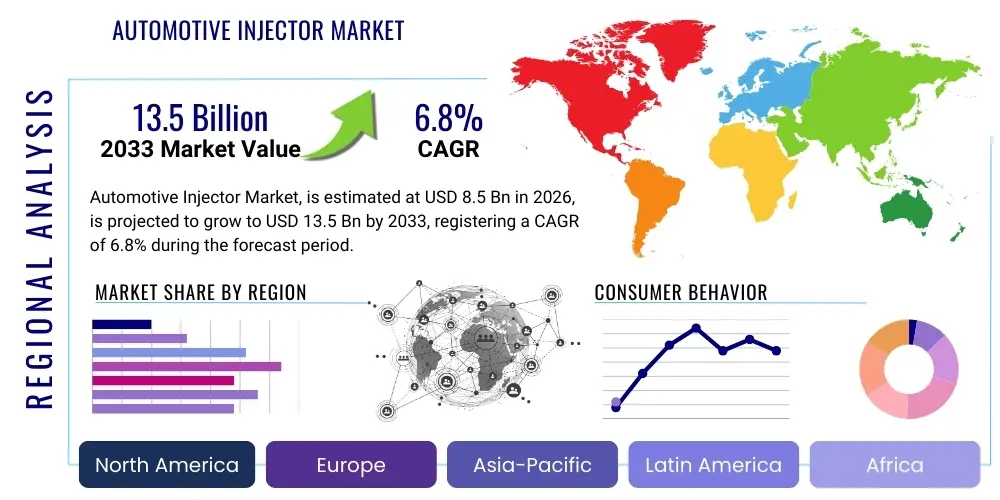

Automotive Injector Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435837 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Automotive Injector Market Size

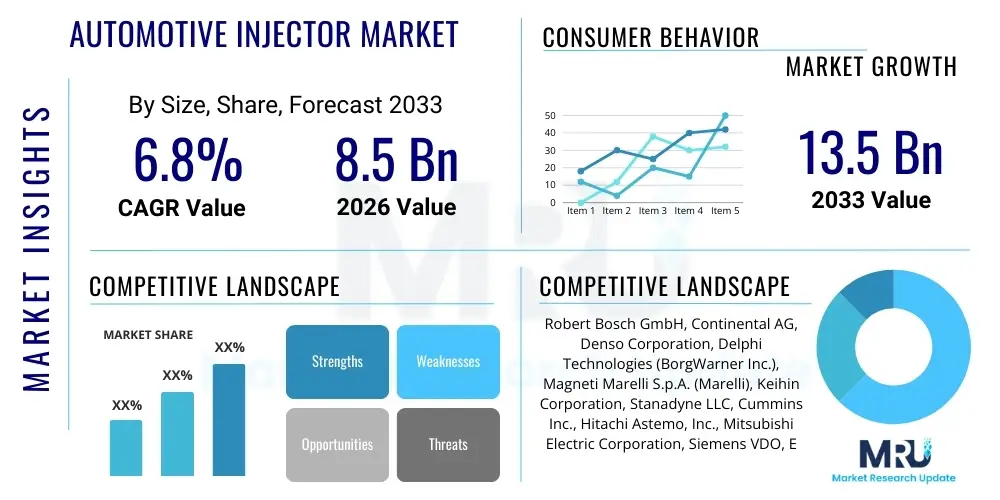

The Automotive Injector Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 13.5 Billion by the end of the forecast period in 2033.

Automotive Injector Market introduction

The Automotive Injector Market encompasses the systems responsible for precise fuel delivery into internal combustion engines (ICE), playing a pivotal role in optimizing engine performance, enhancing fuel economy, and crucially meeting stringent global emission standards. Automotive injectors are electromechanical devices engineered to atomize fuel into fine droplets, ensuring efficient mixing with air prior to combustion. The product range includes Gasoline Direct Injection (GDI) injectors, Port Fuel Injection (PFI) injectors, and Diesel Common Rail Direct Injection (CRDi) injectors, each tailored for specific engine architectures and fuel types. Major applications span passenger vehicles, commercial trucks, off-highway machinery, and high-performance racing platforms, reflecting the ubiquity of ICE technology across the transportation sector.

The core benefits derived from advanced injector technology involve reduced hydrocarbon and nitrogen oxide emissions, significant improvements in power output per liter, and overall operational efficiency. Modern high-pressure injection systems, particularly GDI and CRDi, enable engineers to achieve higher compression ratios and more precise control over the combustion event, mitigating the environmental impact of fossil fuel usage while complying with increasingly strict governmental regulations such as Euro 7 and CAFE standards. The global shift towards cleaner energy and the necessity for downsizing engines without compromising power output are fundamental drivers sustaining innovation and market penetration for sophisticated injector systems.

Key driving factors accelerating market expansion include the sustained demand for high-performance vehicles, the persistent dominance of hybrid electric vehicles (HEVs) and plug-in hybrid electric vehicles (PHEVs) which still rely on advanced ICE technology, and the robust growth of the heavy-duty commercial vehicle sector, particularly in emerging economies like India and China. Furthermore, the mandatory implementation of real driving emissions (RDE) testing globally necessitates the adoption of state-of-the-art injection components that maintain efficiency and cleanliness under varying operational conditions, ensuring the market remains fundamentally strong despite the long-term trend toward full battery electric vehicles (BEVs).

Automotive Injector Market Executive Summary

The Automotive Injector Market exhibits resilient growth driven primarily by technological advancements in fuel efficiency and mandatory emission reduction targets. Current business trends indicate a significant market shift from conventional Port Fuel Injection (PFI) towards higher-pressure systems, specifically Gasoline Direct Injection (GDI) and Diesel Common Rail Direct Injection (CRDi), due to their superior efficiency and ability to meet demanding regulatory criteria. Key manufacturers are heavily investing in piezo technology and advanced material science to improve injector responsiveness, durability, and pressure handling capabilities, positioning themselves strategically for the transition phase where hybrid powertrains will dominate before mass battery electric vehicle (BEV) adoption is realized globally. The emphasis remains on developing components compatible with synthetic and alternative fuels, including ethanol blends and hydrogen combustion engines, diversifying the product portfolio beyond traditional gasoline and diesel applications.

Regionally, the Asia Pacific (APAC) stands as the principal growth engine, fueled by the rapid expansion of automotive manufacturing bases, increasing vehicle parc, and stricter implementation of emission norms (such as China VI and Bharat Stage VI). Europe, while leading in electrification efforts, presents a strong market for highly sophisticated, low-emission GDI and CRDi systems, driven by the immediate need for compliance with Euro 6d and upcoming Euro 7 standards, particularly in the premium and commercial vehicle segments. North America focuses intensely on maximizing fuel economy (CAFE standards) in large-engine platforms, leading to high demand for advanced multi-hole injectors and precision metering units, ensuring sustained market value across these developed regions.

Segmentation trends highlight the supremacy of GDI technology in the gasoline segment, overtaking PFI due to performance benefits, while the diesel segment is universally dominated by CRDi systems, essential for heavy-duty and large commercial transportation. By sales channel, the Original Equipment Manufacturer (OEM) segment holds the commanding market share, reflecting the continuous integration of these high-tech components into new vehicle production lines. However, the aftermarket segment is experiencing substantial growth, driven by the need for replacement parts, repair services, and performance upgrades for the rapidly aging global fleet of ICE and hybrid vehicles, creating lucrative opportunities for specialized component suppliers and distributors.

AI Impact Analysis on Automotive Injector Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Automotive Injector Market generally center on several critical themes: how AI optimizes combustion efficiency, whether AI can predict injector failure for proactive maintenance, the role of machine learning in design and manufacturing processes, and how AI-driven engine control units (ECUs) fine-tune injection parameters in real-time. Users are concerned about the shift from purely mechanical engineering to integrated electromechanical systems governed by sophisticated algorithms. Key expectations include personalized performance tuning, significant reductions in calibration time during engine development, and enhanced diagnostic capabilities that extend the operational life of highly stressed, high-pressure injectors. There is also specific interest in how AI aids in maintaining optimal air-fuel ratios under dynamic driving conditions, ensuring continuous compliance with stringent emission regulations throughout a vehicle's lifespan, moving beyond static mapping towards adaptive and predictive control strategies.

AI's primary influence is moving injection control from pre-programmed look-up tables to real-time adaptive systems. Modern engine control units (ECUs), leveraging neural networks, can monitor dozens of input variables (temperature, pressure, altitude, fuel quality, engine load) and instantaneously adjust injector pulse width, timing, and multi-shot strategies (pilot, main, post-injection) with unprecedented accuracy. This predictive optimization ensures the fuel burn is consistently near-perfect, regardless of environmental factors or component wear, directly translating into lower emissions and better fuel economy. For injector manufacturers, AI speeds up the design cycle by simulating fluid dynamics and stress analysis of new injector designs, drastically cutting down physical prototyping costs and time-to-market for next-generation components engineered for extreme pressures (e.g., 350 bar GDI systems).

Furthermore, AI-powered diagnostic systems are transforming the aftermarket sector. By analyzing patterns in sensor data (e.g., O2 sensor readings, exhaust gas temperatures, engine vibration), AI algorithms can detect subtle deviations indicative of injector clogging, wear, or leakage long before they cause noticeable performance degradation or regulatory non-compliance. This predictive maintenance capability minimizes unexpected downtime for fleet operators and ensures optimal performance for consumers. On the manufacturing floor, AI is integral to quality control, utilizing computer vision systems to inspect micro-tolerances in nozzle hole geometry and solenoid assembly, maintaining the exceptionally high precision required for reliable high-pressure operation. This level of algorithmic oversight enhances component reliability, which is paramount given the critical safety and performance functions injectors perform.

- AI-driven real-time injection mapping for dynamic fuel delivery optimization.

- Predictive maintenance analytics identifying potential injector failures (clogging, wear) before performance decay occurs.

- Machine learning algorithms accelerating the design and simulation of high-pressure GDI and CRDi components.

- Enhanced quality control in manufacturing using AI vision systems to inspect micron-level tolerances of nozzle holes.

- Adaptive ECU control adjusting injection timing based on environmental factors (altitude, temperature, humidity) and fuel quality variations.

- Integration of AI in hybrid powertrain management to seamlessly transition between electric and combustion modes, requiring instantaneous injector activation.

- Optimization of multi-shot injection strategies (pilot, main, post) using deep learning for noise reduction and particulate matter control in diesel engines.

DRO & Impact Forces Of Automotive Injector Market

The Automotive Injector Market is shaped by a powerful interplay of technological drivers and regulatory constraints, alongside significant opportunities arising from emerging market dynamics. Drivers (D) are dominated by global mandates for emission reduction, forcing widespread adoption of high-pressure direct injection systems like GDI and CRDi, which are intrinsically more efficient than their predecessors. Restraints (R) primarily revolve around the accelerating global transition towards battery electric vehicles (BEVs), which fundamentally bypass the need for fuel injectors, posing a long-term existential threat to the market, and the high precision requirements and associated costs of manufacturing advanced high-pressure components. Opportunities (O) are significant within the hybrid vehicle segment, where advanced injectors are indispensable, and in the growing aftermarket for servicing and upgrading the vast existing fleet of ICE vehicles. These forces collectively dictate the pace of innovation and market evolution, particularly impacting suppliers' strategies for product lifecycle management and portfolio diversification.

Key drivers include stringent environmental legislation, notably Euro 7 in Europe, LEV III in the US, and China 7 standards, demanding significant cuts in NOx and Particulate Matter (PM) emissions. These regulations cannot be met by older Port Fuel Injection (PFI) systems, compelling OEMs to integrate high-pressure GDI (up to 500 bar) systems and ultra-high-pressure CRDi systems across nearly all new ICE and hybrid vehicle platforms. Furthermore, the relentless pursuit of corporate average fuel economy (CAFE) standards drives engine downsizing coupled with turbocharging, where precise fuel metering provided by advanced injectors is critical for maintaining performance parity while reducing displacement. The growing demand for premium, high-performance vehicles, which inherently rely on high-flow, high-precision injectors for maximum power output, also substantially contributes to market momentum.

The market faces significant restraints, principally the substantial capital investment required by manufacturers to meet the exacting tolerances (often measured in microns) necessary for advanced injector systems, leading to higher component costs and supply chain complexities. Moreover, the increasing market penetration of fully electric vehicles, particularly in passenger segments in developed markets, represents a palpable long-term deceleration factor, forcing traditional component suppliers to strategically pivot towards hybrid components or non-automotive sectors. Opportunities are robust in the rapid development of low-carbon fuels (e.g., biofuels, synthetic fuels), which require specialized injector materials and calibration, presenting new product development avenues. The HEV and PHEV markets, projected to dominate sales for the next decade, require the highest-efficiency injectors to maximize the benefits of the combustion engine complement, offering a strong transitional market for advanced component providers.

Segmentation Analysis

The Automotive Injector Market segmentation provides a granular view of component consumption across different engine types, fuel types, and vehicle categories, revealing crucial trends in technological adoption and market preference. The segmentation highlights the underlying industry shift towards cleaner and more efficient combustion technologies, directly influenced by regulatory pressures and consumer demand for superior performance and fuel economy. Analysis by Fuel Type, Technology, Vehicle Type, and Sales Channel allows stakeholders to pinpoint specific areas of high growth, such as the increasing demand for GDI systems in passenger cars and the robust requirement for high-pressure CRDi units in the heavy commercial vehicle segment. This detailed categorization is essential for effective strategic planning, R&D investment prioritization, and targeted market entry strategies globally.

The market is predominantly segmented by the fundamental technology used for fuel delivery. Gasoline injection systems are currently undergoing a mass transition from PFI to GDI, where fuel is sprayed directly into the combustion chamber, offering thermal efficiency gains of 15-20% compared to traditional manifold injection. Diesel systems are nearly monolithic in their adoption of Common Rail Direct Injection (CRDi), characterized by extremely high injection pressures (up to 2,500 bar or more), essential for minimizing particulate matter and NOx emissions in heavy-duty applications. Furthermore, the market is differentiated by vehicle type, with light commercial vehicles and passenger cars being the largest consumers of gasoline injectors, while heavy commercial vehicles and off-highway equipment dominate the demand for robust diesel injectors. The aftermarket segment is becoming increasingly specialized, focusing on high-quality remanufactured and new replacement parts critical for maintaining the efficiency of vehicles beyond their warranty period.

- By Technology:

- Gasoline Direct Injection (GDI)

- Port Fuel Injection (PFI)

- Common Rail Direct Injection (CRDi)

- Unit Injector System (UIS)

- By Fuel Type:

- Gasoline

- Diesel

- Alternative Fuels (CNG/LPG/Ethanol)

- By Vehicle Type:

- Passenger Vehicles (PV)

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

- Off-Highway Vehicles

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (AM)

Value Chain Analysis For Automotive Injector Market

The Automotive Injector market value chain is characterized by high precision manufacturing and complex integration, beginning with raw material sourcing and culminating in global distribution and aftermarket support. Upstream analysis involves the procurement of highly specialized materials such as high-strength steels, ceramics, and advanced polymers necessary for the high-pressure and high-temperature environments injectors operate within. Key upstream activities include securing stable supplies of precision solenoid valves, piezo stacks, and micro-machined nozzles, where quality control and material science research are paramount. Component manufacturing is highly centralized among a few global Tier 1 suppliers who possess the necessary capital and technical expertise to maintain the micron-level tolerances required for injector performance and reliability. The upstream stage is highly competitive and capital-intensive, emphasizing vertical integration or strong, long-term relationships with specialized material processors.

The midstream phase focuses on the complex assembly, calibration, and testing of the final injector unit. This stage is dominated by Tier 1 automotive suppliers who integrate sophisticated electronics (ECUs) with the mechanical components, ensuring the finalized injector meets specific OEM engine requirements, including flow rate accuracy, spray pattern uniformity, and compliance with noise, vibration, and harshness (NVH) targets. Rigorous testing protocols, including endurance tests simulating millions of cycles under extreme conditions, are non-negotiable before delivery. Direct distribution occurs almost exclusively to Original Equipment Manufacturers (OEMs), integrated directly into engine assembly lines across global manufacturing plants, requiring a robust and geographically dispersed supply chain capability to minimize logistical risks and support just-in-time inventory systems.

Downstream analysis primarily involves the distribution channels, which are bifurcated into direct sales to OEMs and indirect sales via the aftermarket. Direct sales leverage established contractual agreements for new vehicle production. The indirect channel, or aftermarket, relies on a network of authorized distributors, independent wholesalers, service garages, and specialized repair shops. This channel provides replacement units and maintenance kits, often driven by failure modes such as clogging or electronic malfunctions after prolonged use. Effective aftermarket strategies require strong brand recognition and robust inventory management to quickly supply the precise part required for thousands of different engine variants globally. Success in the aftermarket depends on providing high-quality, often remanufactured or new, components that meet OEM specifications to maintain vehicle efficiency and emission compliance.

Automotive Injector Market Potential Customers

Potential customers for the Automotive Injector Market are broadly categorized based on their role in the transportation ecosystem, primarily comprising entities that design, manufacture, operate, or maintain internal combustion engine systems. The most significant customer segment is the Original Equipment Manufacturers (OEMs) of automobiles, trucks, and off-highway equipment, including major global automotive groups, commercial vehicle manufacturers, and large-scale engine builders (e.g., manufacturers of marine or industrial power generation engines). These OEMs require millions of precision-engineered injectors annually for new vehicle assembly, focusing intensely on component reliability, integration capability with advanced ECUs, and strict compliance with design specifications tailored to achieve emission certification (e.g., Euro, EPA standards).

Another crucial customer base lies within the hybrid vehicle sector. While full BEVs eliminate the need for injectors, the rapid proliferation of hybrid electric vehicles (HEVs) and plug-in hybrid electric vehicles (PHEVs) creates high demand for highly efficient, extremely durable injectors capable of handling frequent start-stop cycles and rapid temperature fluctuations associated with hybrid operation. These customers demand specialized solutions that offer instantaneous response times and maintain efficiency across various operating modes, driving continued R&D investment in this niche.

The third major segment encompasses the vast global aftermarket, including independent service operators (ISOs), dedicated repair garages, fleet operators (trucking, logistics, public transport), and specialized performance tuning shops. These customers purchase replacement or upgrade injectors, driven by maintenance schedules, component failures, or the desire for enhanced engine performance. Aftermarket customers value availability, competitive pricing, and certified quality (whether new or remanufactured) to minimize vehicle downtime and maintain operational efficiency across their often large, aging vehicle fleets. Addressing the needs of this segment requires a distinct strategy focused on global distribution reach and support for legacy product lines.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 13.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Continental AG, Denso Corporation, Delphi Technologies (BorgWarner Inc.), Magneti Marelli S.p.A. (Marelli), Keihin Corporation, Stanadyne LLC, Cummins Inc., Hitachi Astemo, Inc., Mitsubishi Electric Corporation, Siemens VDO, Eaton Corporation, Wuxi Diesel Engine Works, PurePower Technologies, Inc., Carter Fuel Systems, NGK Spark Plug Co., Ltd. (Niterra), ASNU, Kolbenschmidt Pierburg GmbH, Federal-Mogul LLC (Tenneco), Tupy S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Injector Market Key Technology Landscape

The Automotive Injector Market technology landscape is defined by continuous innovation aimed at achieving higher injection pressures, faster response times, and finer fuel atomization, all critical for optimizing the combustion process under strict regulatory oversight. Key technological advancements include the transition from standard solenoid-actuated injectors to highly responsive piezo-electric injectors, particularly prevalent in premium GDI and CRDi systems. Piezo technology uses the inverse piezo effect to rapidly expand and contract a ceramic stack, allowing for significantly quicker actuation cycles and the ability to execute multiple precise injection events (multi-shot) within a single combustion stroke. This precision is essential for noise reduction, particulate matter control, and maximizing thermal efficiency, particularly in highly compressed diesel and turbocharged gasoline engines.

Another pivotal area is the material science involved in nozzle design and body construction. High-pressure systems require components capable of handling continuous operational pressures exceeding 2,000 bar (in diesel applications) and temperatures encountered during high engine loads. Manufacturers are developing materials and specialized coatings to resist erosion, cavitation, and corrosive effects of newer biofuels and high-octane gasoline formulations. Furthermore, the development of miniaturized and highly durable injector bodies allows for easier integration into complex, compact engine architectures, which is a necessity given the trend of engine downsizing. The integration of advanced filtration technologies to protect the microscopic nozzle holes from contamination is also a major focus, as high-precision injectors are highly susceptible to clogging which dramatically impacts emission compliance.

Digitalization and control unit complexity represent the third major technology pillar. Modern injectors are inextricably linked to sophisticated Engine Control Units (ECUs) that employ advanced algorithms, often incorporating adaptive learning capabilities, to manage injection strategies. Future advancements are focusing on closed-loop control systems where real-time combustion feedback (e.g., cylinder pressure sensors) is used to immediately adjust injection timing and quantity, maximizing fuel utilization under all operating conditions. This digital control is critical for maintaining performance longevity and ensuring the longevity of emission compliance required by new global standards. The development of pressure amplification technology, such as the use of intensified rails or specialized pump systems, ensures the injector receives the necessary ultra-high pressure required for optimal fuel atomization in performance and heavy-duty applications.

Regional Highlights

Regional dynamics heavily influence the adoption and growth trajectory of the Automotive Injector Market, reflecting differing regulatory environments, manufacturing capacities, and consumer demands across continents. Asia Pacific (APAC) holds the dominant market share and is projected to exhibit the highest growth rate during the forecast period. This growth is underpinned by large-scale vehicle manufacturing in China, India, and Southeast Asia, coupled with the mandatory implementation of stringent emission standards (e.g., China VI, BS VI) that necessitate the rapid adoption of high-efficiency GDI and CRDi technologies in new vehicles. The sheer volume of vehicle sales and the reliance on ICE and hybrid technology for personal and commercial transport ensure sustained demand in this region.

Europe represents a highly mature but technologically advanced market, driven by the world's most aggressive emission targets, including the shift towards Euro 7 preparations. While BEV penetration is highest here, the necessity to clean up the existing fleet and optimize HEV performance maintains strong demand for premium, ultra-high-pressure piezo injectors, particularly in the high-performance passenger car and heavy commercial vehicle sectors. European manufacturers are leaders in developing and integrating 350-bar and higher-pressure GDI systems to reduce particulate emissions, providing a significant market for specialized, high-cost components.

North America is characterized by robust demand in both the light-duty truck/SUV segment and the heavy-duty transportation sector. Regulations imposed by the EPA and CAFE standards continually push manufacturers toward efficiency improvements, resulting in widespread adoption of GDI technology in gasoline engines and advanced CRDi systems for diesel applications. The replacement market (aftermarket) is substantial in the US due to the large existing vehicle parc and the need for durable replacement parts that can withstand severe weather conditions and long duty cycles. Latin America and the Middle East & Africa (MEA) are emerging markets experiencing growing urbanization and increasing motorization rates. Although they often lag slightly in adopting the absolute latest emission standards, the general global trend towards cleaner vehicles is propagating, creating rising demand for modern, reliable injection systems, particularly within the commercial and logistics sectors.

- Asia Pacific (APAC): Dominant market share; driven by high vehicle production volume in China and India; mandatory BS VI and China VI implementation accelerating GDI/CRDi adoption.

- Europe: High-value market focused on advanced, ultra-high-pressure Piezo injectors; driven by Euro 6d and preparation for Euro 7 standards; strong HEV component demand.

- North America: Significant GDI adoption in trucks and SUVs; large aftermarket fueled by extensive vehicle parc; driven by EPA and CAFE fuel economy regulations.

- Latin America: Growing demand in key markets (Brazil, Mexico); focus on increasing quality and efficiency in commercial vehicle fleets; transition towards modern PFI and low-pressure GDI.

- Middle East and Africa (MEA): Market growth tied to infrastructure development and commercial fleet expansion; gradual regulatory harmonization driving baseline demand for modern injection systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Injector Market.- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- Delphi Technologies (BorgWarner Inc.)

- Magneti Marelli S.p.A. (Marelli)

- Keihin Corporation

- Stanadyne LLC

- Cummins Inc.

- Hitachi Astemo, Inc.

- Mitsubishi Electric Corporation

- Siemens VDO

- Eaton Corporation

- Wuxi Diesel Engine Works

- PurePower Technologies, Inc.

- Carter Fuel Systems

- NGK Spark Plug Co., Ltd. (Niterra)

- ASNU

- Kolbenschmidt Pierburg GmbH

- Federal-Mogul LLC (Tenneco)

- Tupy S.A.

Frequently Asked Questions

Analyze common user questions about the Automotive Injector market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of Gasoline Direct Injection (GDI) over Port Fuel Injection (PFI) technology?

The shift to GDI is primarily driven by global regulatory mandates requiring higher fuel efficiency and lower tailpipe emissions, particularly particulate matter. GDI allows for higher compression ratios, precise control over combustion timing, and superior thermal efficiency compared to PFI, resulting in significantly improved fuel economy and reduced emissions compliant with standards like Euro 7 and CAFE.

How does the increasing adoption of Hybrid Electric Vehicles (HEVs) impact the demand for automotive injectors?

HEV adoption positively impacts the demand for highly advanced, durable injectors. HEVs still rely on an internal combustion engine, but the engine is subject to frequent start-stop cycles and rapid operational temperature changes. This necessitates injectors that are extremely reliable, responsive, and capable of maintaining high efficiency and low emissions under variable conditions, sustaining the demand for premium GDI and CRDi components.

What is the key technological difference between solenoid and piezo-electric injectors in modern engines?

Piezo-electric injectors utilize a ceramic stack that expands rapidly when an electric charge is applied, offering significantly faster actuation times and greater precision than solenoid injectors. This speed allows for precise multi-shot injection events within milliseconds, crucial for optimizing combustion, reducing noise, and meeting ultra-low particulate matter emission targets in high-pressure systems.

How do stringent global emission standards, such as Euro 7, affect the manufacturing complexity of injectors?

Stricter emission standards mandate injectors capable of operating at extremely high pressures (up to 2,500 bar) with micron-level tolerance in nozzle hole geometry. This demands highly complex, specialized manufacturing processes, expensive materials resistant to wear and corrosion, and advanced quality control (often AI-assisted) to ensure every component meets the precision required for consistent, clean combustion.

What role does the aftermarket play in the overall Automotive Injector Market?

The aftermarket plays a crucial and growing role by supplying replacement and remanufactured injectors for the vast global fleet of existing ICE and hybrid vehicles. As high-pressure injectors age and fail due to contamination or wear, the aftermarket ensures vehicles remain operational and compliant with emission laws, offering significant opportunities for specialized distributors and service providers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager