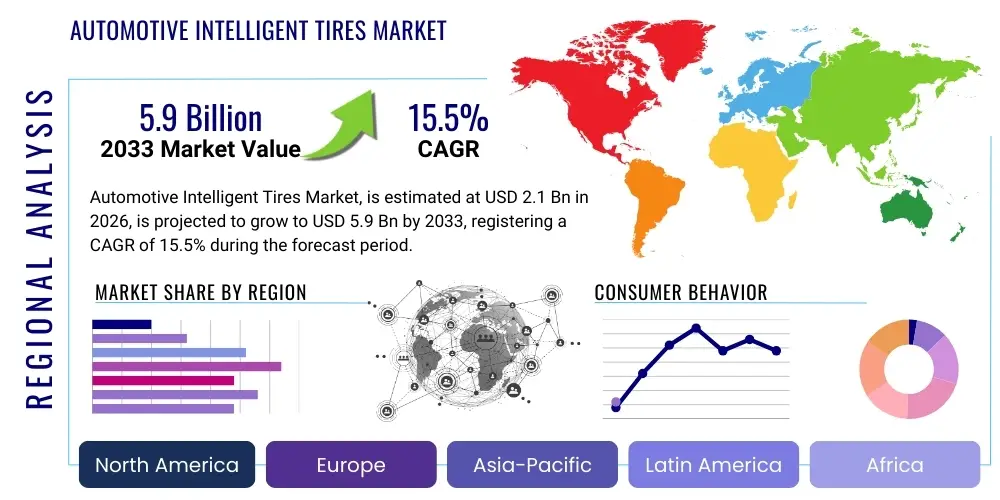

Automotive Intelligent Tires Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438160 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Automotive Intelligent Tires Market Size

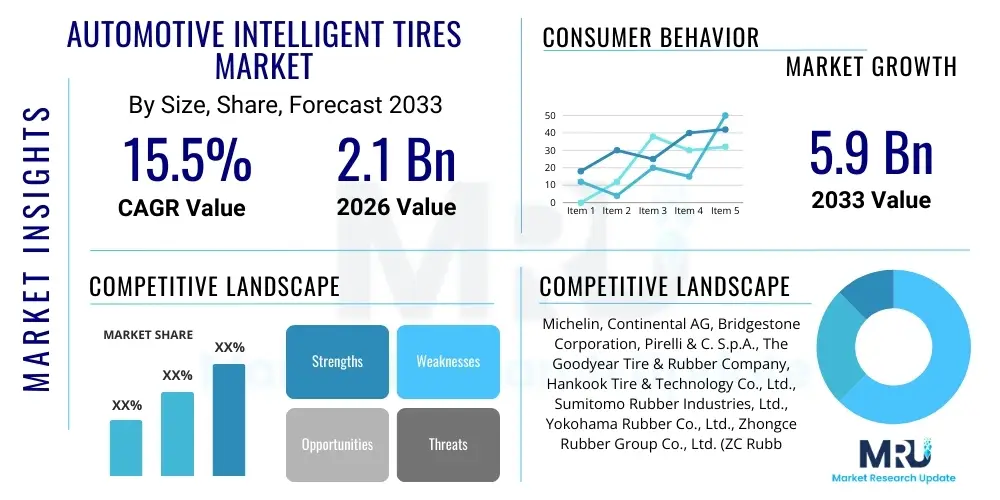

The Automotive Intelligent Tires Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.5% between 2026 and 2033. The market is estimated at $2.1 Billion in 2026 and is projected to reach $5.9 Billion by the end of the forecast period in 2033.

Automotive Intelligent Tires Market introduction

Intelligent tires represent a significant technological evolution beyond conventional pneumatic tires, integrating sophisticated sensor technology and embedded connectivity to monitor critical operational parameters in real-time. These advanced tires are designed to collect data on pressure, temperature, tread depth, load, and internal stresses, transmitting this information wirelessly to the vehicle's onboard systems or external cloud platforms. This capability enhances vehicle safety, optimizes fuel efficiency, and significantly improves maintenance planning by providing predictive diagnostics, moving the industry toward a proactive maintenance model rather than a reactive one. The fundamental product description involves a standard tire casing augmented with micro-electromechanical systems (MEMS) sensors, RFID tags, or sometimes self-sealing/run-flat capabilities, all integrated with advanced software for data processing.

Major applications of intelligent tires span across various vehicle types, including passenger vehicles, light commercial vehicles (LCVs), heavy commercial vehicles (HCVs), and specialty vehicles used in fleet management, logistics, and emerging autonomous transportation systems. In consumer vehicles, the primary benefit revolves around enhanced driver safety through continuous monitoring of tire health, preventing blowouts caused by underinflation and optimizing vehicle stability control. For commercial fleets, the application is critical for operational efficiency, minimizing downtime due to tire failures, extending tire lifespan through optimal pressure management, and reducing overall fuel consumption, which constitutes a major operating expense for logistics providers globally. The integration with fleet telematics platforms further solidifies their utility in B2B environments.

The market is primarily driven by increasingly stringent regulatory mandates concerning vehicle safety and emissions reduction globally, particularly in developed economies in North America and Europe, which are mandating TPMS (Tire Pressure Monitoring Systems) and encouraging further integration of sophisticated monitoring capabilities. Furthermore, the rapid growth and investment in autonomous vehicles (AVs) and electric vehicles (EVs) necessitate reliable, real-time data regarding the tire-road interface, propelling the demand for highly accurate intelligent tire systems. The benefits derived, such as reduced maintenance costs, improved payload management, and enhanced road safety, collectively serve as powerful catalysts for the sustained adoption of intelligent tires across both OEM and aftermarket channels.

Automotive Intelligent Tires Market Executive Summary

The Automotive Intelligent Tires Market is poised for substantial expansion driven by convergence of automotive digitalization, strict safety regulations, and the operational demands of commercial fleet operators seeking cost efficiencies. Key business trends indicate a strong move toward standardization of sensor integration directly within the tire structure, rather than relying solely on valve-stem-mounted sensors, ensuring greater durability and data fidelity. Strategic partnerships between tire manufacturers and automotive Original Equipment Manufacturers (OEMs) are crucial, focusing on developing integrated vehicle-to-cloud communication infrastructure essential for leveraging real-time tire data for predictive maintenance algorithms. Furthermore, sustainability goals are influencing design, with manufacturers exploring advanced materials and renewable energy sources for powering embedded sensors, positioning intelligent tires as a core component of sustainable mobility solutions.

Regional trends demonstrate North America and Europe maintaining leading positions due to robust regulatory frameworks, high consumer safety awareness, and significant uptake in heavy-duty commercial vehicle fleet operations that prioritize operational uptime and efficiency gains from tire monitoring. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth trajectory, fueled by rapidly expanding vehicle production, increasing adoption of advanced driver assistance systems (ADAS) in emerging markets, and massive government investment in smart city infrastructure and logistics networks, particularly in China and India. Standardization challenges and high initial costs in developing regions currently restrict immediate mass adoption, but economies of scale resulting from increased production volume are expected to mitigate these restraints over the forecast period.

Segment trends highlight the dominance of the Passenger Vehicle segment in terms of volume, primarily driven by OEM installations mandated by safety legislation. However, the Commercial Vehicle segment is witnessing higher revenue per unit and faster growth in advanced features, as fleets gain immediate Return on Investment (ROI) from reduced fuel consumption and optimized tire life. In terms of technology, sensor integration (particularly MEMS-based pressure and temperature sensors) remains the highest revenue-generating component. Software and connectivity services are expected to experience accelerated growth, reflecting the industry's shift from merely sensing data to providing actionable insights and integrated vehicle health management solutions, often facilitated via subscription models tailored for fleet customers.

AI Impact Analysis on Automotive Intelligent Tires Market

Common user questions regarding AI's impact on the intelligent tires market generally center on how AI transforms raw tire data into actionable predictive insights, enhances autonomous driving safety, and optimizes fleet efficiency. Users frequently ask about the complexity of AI algorithms needed to interpret vibration and strain data for identifying early signs of wear or failure, and the role of machine learning in developing adaptive inflation systems that adjust based on road conditions or driving style. Concerns also focus on data privacy, the cost implications of implementing AI-driven cloud analytics platforms, and the reliability of AI predictions in diverse operating environments. The underlying expectation is that AI will move the intelligent tire from a data collector to an active decision-making component within the vehicle ecosystem, ensuring proactive safety and maintenance management.

AI's primary influence is enabling the transition from simple threshold alerts (e.g., low pressure) to complex predictive failure modeling. Machine learning algorithms analyze vast datasets streaming from intelligent tires—including temperature fluctuations, acceleration profiles, and internal strain patterns—to predict the remaining useful life (RUL) of the tire with high accuracy. This capability is invaluable for fleet managers, allowing for just-in-time maintenance scheduling and minimizing unexpected vehicle breakdowns. Furthermore, AI facilitates advanced tire-road friction estimation, a critical input for Level 3 and higher autonomous driving systems, providing AVs with crucial real-time context about traction limits, especially in adverse weather conditions like heavy rain or ice.

The sophistication of AI in this domain extends to optimizing tire performance dynamically. For instance, AI can process data from tire sensors alongside external data sources (like GPS, weather forecasts, and vehicle dynamics) to recommend optimal tire pressure adjustments for current conditions, thereby maximizing grip, reducing rolling resistance, and conserving energy in electric vehicles. This adaptive performance management requires robust edge computing capabilities within the tire or the immediate vehicle platform, coupled with powerful cloud-based analytics training the models. This fusion of sensory input and cognitive processing fundamentally elevates the value proposition of intelligent tires beyond passive monitoring.

- AI enables highly accurate Predictive Maintenance and Remaining Useful Life (RUL) forecasting for tires.

- Machine Learning algorithms analyze complex vibration signatures to detect subtle internal damage and irregular wear patterns.

- AI optimizes tire inflation pressure dynamically based on real-time load, speed, and environmental conditions.

- Integration with Autonomous Driving Systems (ADS) allows AI to estimate tire-road friction coefficients for enhanced safety and maneuvering.

- AI supports sophisticated data monetization models by providing deep operational insights to fleet management platforms.

- Edge AI processing minimizes latency and bandwidth usage by filtering and processing critical data directly at the tire level.

DRO & Impact Forces Of Automotive Intelligent Tires Market

The Automotive Intelligent Tires Market is influenced by a strong interplay of enabling factors, restrictive barriers, and significant future opportunities, creating a dynamic impact force structure. The primary driving forces include global regulatory pushes for improved vehicle safety, the accelerating adoption of electric vehicles and autonomous driving technologies that rely heavily on precise tire performance data, and the demonstrable economic benefits realized by commercial fleets through reduced operational costs and increased uptime. These drivers provide powerful momentum, ensuring continuous OEM integration and sustained growth in advanced markets. However, high initial investment costs for intelligent tire technology, complexity related to data standardization and interoperability across different vehicle platforms, and user concerns regarding sensor durability and maintenance in harsh environments act as key restraints. Furthermore, the long replacement cycle of tires presents a structural limitation to rapid market penetration.

Opportunities in this market are vast, centered mainly around innovative service models and technological diversification. The shift towards Mobility-as-a-Service (MaaS) and Tire-as-a-Service (TaaS) models presents a significant avenue for recurring revenue, particularly within the logistics and heavy trucking sectors, where tire maintenance can be bundled into a subscription service based on performance and mileage. Developing cost-effective, battery-less sensor solutions (e.g., powered by piezoelectric or kinetic energy harvesting) is another major technological opportunity that could overcome current constraints related to sensor lifespan and maintenance. Moreover, expanding the scope of intelligent tires to provide data on road surface quality and environmental conditions opens up collaborations with infrastructure management authorities and smart city initiatives, creating new revenue streams beyond traditional automotive applications.

The impact forces are fundamentally skewed towards expansion, driven by regulatory compliance and technological necessity. The necessity of reliable, real-time feedback for Advanced Driver Assistance Systems (ADAS) and autonomous functionality places intelligent tires as mission-critical components, exerting a positive, high-level impact force. Conversely, the market must address the economic impact force of initial cost; if manufacturers fail to achieve economies of scale rapidly, adoption in price-sensitive emerging markets will remain slow. Overall, the market trajectory suggests that the powerful drivers related to safety and efficiency will continue to outweigh the financial and technical restraints, leading to sustained double-digit growth throughout the forecast period, underpinned by continuous technological refinement and evolving business models.

Segmentation Analysis

The Automotive Intelligent Tires Market is comprehensively segmented based on components, vehicle types, sales channels, and underlying technology, providing a detailed view of market penetration and growth opportunities across distinct product categories and end-user requirements. This segmentation highlights the differing adoption rates between original equipment manufacturers (OEMs) and aftermarket service providers, as well as the unique demands posed by heavy commercial vehicles compared to standard passenger cars. The component segmentation specifically breaks down the market by the revenue generated from hardware (sensors, connectivity modules) versus software/data services, which is crucial for assessing the long-term strategic value of recurring revenue streams.

Analyzing the segmentation reveals that the OEM sales channel currently dominates the market, primarily due to the integrated nature of intelligent tire systems with the vehicle's electrical architecture and mandated installations during vehicle assembly. However, the aftermarket segment is projected to grow significantly faster, driven by the increasing need to retrofit existing vehicle fleets (especially commercial trucks) with smart technology to capture efficiency gains and meet specific regulatory mandates for older vehicles. Technological segmentation, primarily comparing basic TPMS with advanced integrated systems, shows a clear trend towards highly integrated, software-intensive solutions capable of delivering predictive analytics rather than simple pressure alerts.

The differentiation across vehicle types illustrates the varying degrees of technological complexity and investment. Passenger vehicles typically adopt standard sensor packages focused on safety and fuel economy. In contrast, commercial vehicles require rugged, highly durable sensors capable of handling extreme loads, variable speeds, and integrated fleet management software, resulting in higher average selling prices and greater market potential based on operational utility. Understanding these segmental dynamics is essential for market participants planning product development, sales strategies, and investment prioritization.

- By Component:

- Sensors (Pressure, Temperature, Strain, Acceleration)

- Software and Algorithms

- Connectivity Modules (Bluetooth, RFID, NFC)

- Tread and Casing Materials

- By Vehicle Type:

- Passenger Vehicles (PV)

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

- By Technology:

- Tire Pressure Monitoring Systems (TPMS)

- Integrated Sensor Systems (ISS)

- Run-Flat Technology Integrated Solutions

- RFID and NFC Embedded Tags

Value Chain Analysis For Automotive Intelligent Tires Market

The value chain for the Automotive Intelligent Tires Market is complex and involves multiple specialized stages, beginning with the highly technical upstream sourcing of raw materials and sophisticated sensor components, extending through manufacturing and final integration, and concluding with a service-centric downstream market. Upstream activities are dominated by specialized suppliers providing micro-electromechanical systems (MEMS) sensors, advanced connectivity modules (Bluetooth Low Energy chips), and sophisticated rubber compounds engineered to house embedded electronics without compromising durability. Key challenges in the upstream segment involve miniaturization, ensuring the reliability of electronic components under extreme thermal and mechanical stress, and establishing robust supply chains for high-tech components that traditionally do not reside within the standard tire manufacturing ecosystem.

The midstream phase focuses on the integration of these smart components during the tire manufacturing process, followed by comprehensive quality control and calibration. Major tire manufacturers invest heavily in R&D to develop proprietary methods for embedding sensors and ensuring seamless data transmission. The distribution channel is multifaceted, relying heavily on direct sales to OEMs for new vehicle integration, alongside specialized distribution networks for the aftermarket segment, which includes independent tire retailers, specialized automotive service chains, and direct contracts with large commercial fleet operators. The shift towards providing data services necessitates strong partnerships with telematics providers and cloud service platforms, thereby introducing new entities into the traditional distribution pathway.

Downstream activities are increasingly characterized by data analytics and software services. The direct link involves selling the physical tire, but the significant value capture occurs in the indirect services, where real-time tire data is aggregated and analyzed in the cloud. This data feeds into predictive maintenance platforms, route optimization software, and insurance risk assessment models. End-users, particularly commercial fleets, often prefer these indirect, service-based offerings (Tire-as-a-Service) that shift the burden of monitoring and maintenance back to the tire supplier, fundamentally changing the traditional transactional relationship into a continuous performance partnership. This emphasizes the critical role of software developers and data scientists in the later stages of the intelligent tire value chain.

Automotive Intelligent Tires Market Potential Customers

The primary potential customers and end-users of intelligent tires span two major categories: Original Equipment Manufacturers (OEMs) and end-use operators, further segmented into B2C and B2B markets. OEMs represent the largest customer base in terms of initial unit volume, as they integrate intelligent tire systems directly into new vehicles to meet regulatory requirements, enhance safety ratings, and support advanced vehicle features like ADAS and self-driving capabilities. For OEMs, the key purchasing drivers are seamless integration, reliability, and cost-effectiveness at scale, often requiring long-term supply agreements and co-development efforts with tire manufacturers to ensure compatibility with proprietary vehicle platforms.

Within the B2B segment, commercial fleet operators—including long-haul trucking companies, municipal bus services, and specialized logistics providers—are high-value, sophisticated customers. These operators utilize intelligent tires not just for safety, but primarily as a critical tool for operational expenditure reduction. Real-time data helps them reduce fuel consumption by ensuring optimal inflation, decrease costly roadside breakdowns, and extend tire lifespan through precise rotation and maintenance schedules. The willingness of these customers to invest in premium, data-enabled solutions is strong because the ROI is measurable and immediate, often preferring bundled services or subscription models (TaaS) over outright purchases of hardware components.

The B2C segment, consisting of individual vehicle owners accessing the aftermarket, is primarily driven by safety consciousness and the desire to upgrade existing vehicles. While price sensitivity is higher in this segment, early adopters, owners of high-performance vehicles, and environmentally conscious consumers seeking improved fuel economy represent key niches. Future growth in the B2C aftermarket will be significantly influenced by the ease of installation, perceived value of the data provided through user-friendly smartphone applications, and the general penetration of smart vehicle technologies into the mass market. Insurance companies are also emerging as indirect potential customers, utilizing intelligent tire data for risk assessment and offering incentives for vehicles equipped with advanced tire monitoring.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.1 Billion |

| Market Forecast in 2033 | $5.9 Billion |

| Growth Rate | CAGR 15.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Michelin, Continental AG, Bridgestone Corporation, Pirelli & C. S.p.A., The Goodyear Tire & Rubber Company, Hankook Tire & Technology Co., Ltd., Sumitomo Rubber Industries, Ltd., Yokohama Rubber Co., Ltd., Zhongce Rubber Group Co., Ltd. (ZC Rubber), Kumho Tire Co., Inc., Nexen Tire Corporation, Trelleborg AB, Apollo Tyres Ltd., MRF Limited, CEAT Ltd., Giti Tire, Cooper Tire & Rubber Company, Chengshan Group Co., Double Coin Holdings Ltd., Sailun Group Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Intelligent Tires Market Key Technology Landscape

The technological landscape of the Automotive Intelligent Tires Market is rapidly evolving, moving from basic Tire Pressure Monitoring Systems (TPMS) to complex integrated sensor platforms capable of providing multi-parameter data streams. At the core of this transformation are advanced sensor technologies, primarily based on Micro-Electro-Mechanical Systems (MEMS). These sensors are miniaturized and robust, designed to withstand the harsh environment within the tire cavity. They measure not only pressure and temperature but also complex variables like tire acceleration (critical for analyzing rotational dynamics), strain within the casing, and acoustic properties, allowing algorithms to derive information on tread wear and road contact patch characteristics. The effectiveness of these systems hinges on their reliability and longevity, driving significant investment into self-powering solutions, such as energy harvesting from tire deformation (piezoelectric effect) or kinetic energy capture, to eliminate the need for traditional batteries.

Connectivity and data transmission represent the second major technology pillar. Early systems relied on basic radio frequency (RF) transmission, but newer intelligent tires utilize low-power connectivity standards like Bluetooth Low Energy (BLE) or Near Field Communication (NFC) and Radio Frequency Identification (RFID) tags. BLE allows continuous, energy-efficient communication with the vehicle's centralized Electronic Control Unit (ECU) or directly with a driver's mobile device. RFID and NFC technologies are typically used for static, near-field identification purposes, such as tracking inventory, verifying authenticity, and managing logistical data within manufacturing and fleet maintenance facilities. Furthermore, the integration of 5G and V2X (Vehicle-to-Everything) communication frameworks is critical for the future, enabling tire data to be aggregated into broader cloud platforms for real-time fleet-wide optimization and shared with smart city infrastructure for road condition mapping.

Software and proprietary algorithms constitute the third, high-value technology layer. This includes the firmware embedded in the sensor chips for initial data processing (edge computing) and the cloud-based analytics platforms necessary for converting raw data into actionable intelligence. Key algorithmic developments include proprietary models for estimating tread depth based on rotational changes or internal acoustic signatures, sophisticated AI models for predicting tire failure probability (RUL), and dynamic performance management systems that suggest optimal speed or load distribution adjustments to the driver or fleet manager. The ability of manufacturers to develop and secure intellectual property around these predictive algorithms, often linking tire data with other vehicle telematics data (like ABS/ESP feedback), is increasingly defining competitive advantage in the intelligent tire sector.

Regional Highlights

- North America: This region is a leading market, characterized by stringent governmental regulations, particularly the TREAD Act requirements for mandatory TPMS in the US, and a highly advanced commercial trucking sector. Adoption rates are high, driven by the strong emphasis on fleet operational efficiency and significant investment in autonomous vehicle technology. The presence of major automotive OEMs and technology firms collaborating on integrated vehicle platforms sustains high market growth. The US and Canada are key revenue generators, with focus shifting towards advanced data monetization services (TaaS) for large logistics firms.

- Europe: Europe represents a mature but technologically progressive market, heavily influenced by EU safety regulations and ambitious environmental goals, including mandates for reducing CO2 emissions, which intelligent tires aid by optimizing rolling resistance. Germany, France, and the UK are primary adopters, driven by premium passenger vehicle segments and rigorous fleet management practices. The region is a hub for R&D in sensor integration and sustainable tire materials, positioning it as a leader in deploying complex integrated sensor systems and advanced predictive analytics.

- Asia Pacific (APAC): APAC is the fastest-growing regional market, propelled by booming vehicle production, rapid urbanization, and massive infrastructure development in China, India, and Japan. While the market in developing APAC countries is highly price-sensitive, increasing awareness of road safety and the explosive growth of e-commerce and logistics services are compelling fleet operators to adopt intelligent tires. China is the largest volume contributor, where domestic manufacturers are rapidly scaling up technology implementation, often leveraging government initiatives related to smart mobility and electric vehicles.

- Latin America (LATAM): The LATAM market is currently characterized by moderate adoption, largely concentrated in commercial fleets operating in countries like Brazil and Mexico, where logistics challenges and high fuel costs drive interest in efficiency-improving technologies. Growth is constrained by economic volatility and slower regulatory harmonization compared to Europe or North America, but the potential for aftermarket growth, particularly in truck and bus tire management, remains substantial as regional safety standards gradually tighten.

- Middle East and Africa (MEA): Adoption in MEA is primarily driven by specific climatic needs (managing extreme heat, which impacts tire pressure and lifespan) and robust investments in transportation infrastructure linked to oil and gas sectors and strategic logistics hubs (UAE, Saudi Arabia). The market is segmented, with high-end luxury vehicle adoption in wealthier GCC states, while commercial viability in other regions depends heavily on customized, rugged intelligent tire solutions designed for challenging terrains and long operational cycles.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Intelligent Tires Market.- Michelin

- Continental AG

- Bridgestone Corporation

- Pirelli & C. S.p.A.

- The Goodyear Tire & Rubber Company

- Hankook Tire & Technology Co., Ltd.

- Sumitomo Rubber Industries, Ltd.

- Yokohama Rubber Co., Ltd.

- Zhongce Rubber Group Co., Ltd. (ZC Rubber)

- Kumho Tire Co., Inc.

- Nexen Tire Corporation

- Trelleborg AB

- Apollo Tyres Ltd.

- MRF Limited

- CEAT Ltd.

- Giti Tire

- Cooper Tire & Rubber Company

- Chengshan Group Co.

- Double Coin Holdings Ltd.

- Sailun Group Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Automotive Intelligent Tires market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of intelligent tires for commercial fleets?

The primary benefit for commercial fleets is significant operational cost reduction achieved through predictive maintenance, maximized fuel efficiency via optimal tire pressure, and reduced downtime, leading to increased asset utilization and higher Return on Investment (ROI).

How do intelligent tires contribute to the development of autonomous vehicles (AVs)?

Intelligent tires provide critical real-time data on tire-road friction, load distribution, and temperature, which are essential inputs for the precise maneuvering, stability control, and failure prediction systems required by Level 3 and higher autonomous driving platforms.

What are the main technology components integrated into an intelligent tire system?

The main components include Micro-Electro-Mechanical Systems (MEMS) sensors (for pressure, temperature, and strain), connectivity modules (such as Bluetooth Low Energy or RFID), embedded firmware, and specialized cloud-based software platforms utilizing AI for predictive analytics.

What is the projected growth rate (CAGR) for the Automotive Intelligent Tires Market?

The Automotive Intelligent Tires Market is projected to exhibit robust expansion, growing at a Compound Annual Growth Rate (CAGR) of 15.5% between the years 2026 and 2033, driven largely by regulatory pressures and fleet digitization.

Does the intelligent tire market face challenges related to sensor lifespan or power supply?

Yes, a key challenge is ensuring the sensor lifespan matches the tire lifespan. Manufacturers are actively addressing this by developing energy harvesting technologies (e.g., kinetic or piezoelectric) to create battery-less, maintenance-free smart sensor solutions embedded within the tire structure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager