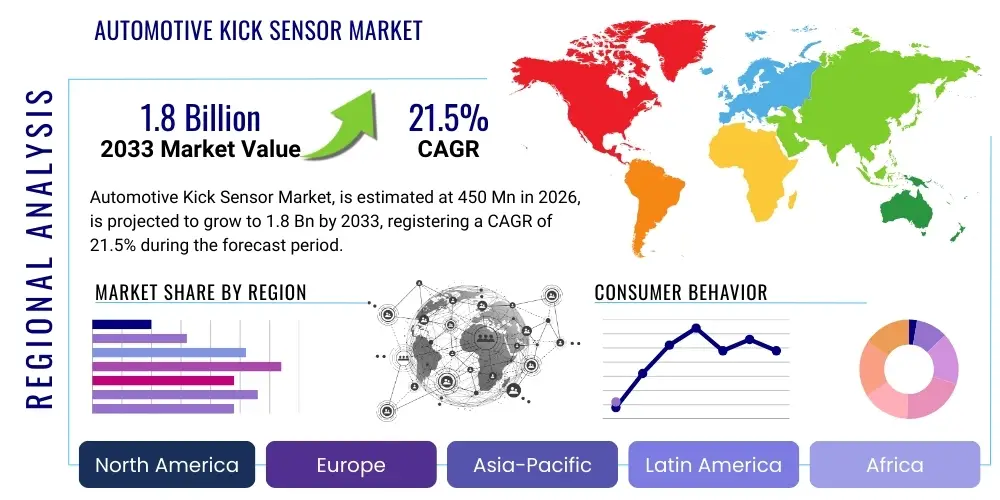

Automotive Kick Sensor Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440211 | Date : Jan, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Automotive Kick Sensor Market Size

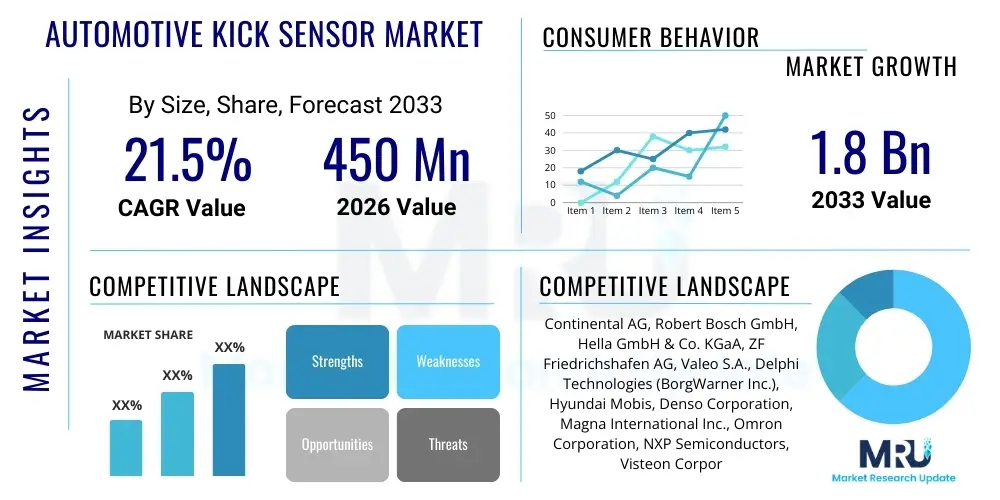

The Automotive Kick Sensor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 21.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 1.8 Billion by the end of the forecast period in 2033.

Automotive Kick Sensor Market introduction

The Automotive Kick Sensor Market encompasses the technology and solutions designed to enable hands-free operation of vehicle components, primarily tailgates and sliding doors, through a simple foot motion. This innovative technology enhances user convenience, accessibility, and the overall premium feel of a vehicle, aligning with the growing consumer demand for advanced driver-assistance systems (ADAS) and smart vehicle features. Kick sensors typically employ various sensing technologies such as capacitive, radar, or ultrasonic sensors to detect the presence and motion of a foot under the rear bumper or side of the vehicle, subsequently triggering the opening or closing mechanism.

Major applications of automotive kick sensors include powered tailgates in SUVs, crossovers, and wagons, where users often approach the vehicle with their hands full, and automatic sliding doors in minivans or commercial vans, significantly improving loading and unloading efficiency. These sensors contribute to an enhanced ownership experience by reducing physical effort and providing a seamless interaction with the vehicle. The integration of kick sensors into modern vehicle architecture reflects a broader trend towards developing more intuitive and user-centric automotive designs, moving beyond traditional mechanical interfaces to embrace smarter, gesture-controlled functionalities.

The primary benefits of these systems revolve around unparalleled convenience, particularly for individuals carrying groceries, luggage, or children, offering a safer and more hygienic alternative to manually opening doors. Driving factors for market expansion include the increasing production and sales of SUVs and MPVs, which are prime candidates for such features, the rising disposable income in emerging economies enabling greater adoption of premium vehicle features, and a general industry push towards vehicle electrification and automation, where integrated smart sensors play a crucial role in creating holistic user experiences. Furthermore, the burgeoning e-commerce delivery sector is also driving demand for efficient cargo access solutions, subtly influencing the adoption of kick sensor technology in light commercial vehicles.

Automotive Kick Sensor Market Executive Summary

The Automotive Kick Sensor Market is experiencing robust growth, driven by escalating consumer demand for convenience features and the ongoing technological advancements in automotive electronics. Business trends indicate a strong emphasis on integrating these sensors with other vehicle systems, such as advanced driver-assistance systems (ADAS) and keyless entry systems, to offer a more unified and intelligent vehicle ecosystem. Original Equipment Manufacturers (OEMs) are increasingly incorporating kick sensors as standard or optional features in mid-range to luxury vehicle segments, recognizing their value proposition in enhancing user experience and brand differentiation. Furthermore, the market is witnessing significant innovation in sensor accuracy and reliability, with manufacturers leveraging advanced algorithms and sensor fusion techniques to mitigate issues related to false triggers and environmental interference, which were initial challenges for early-generation systems. The competitive landscape is characterized by a mix of established automotive suppliers and specialized sensor technology companies vying for market share through product differentiation and strategic partnerships.

Regional trends highlight Asia Pacific as the dominant market, propelled by rapid urbanization, increasing vehicle production in countries like China and India, and a growing middle class with rising purchasing power willing to invest in convenience and luxury features. Europe and North America also represent significant markets, characterized by a high penetration of premium vehicles and strong consumer preference for advanced automotive technologies. The demand in these mature markets is further fueled by replacement cycles and the continuous introduction of new vehicle models equipped with state-of-the-art features. Emerging regions such as Latin America and the Middle East and Africa are anticipated to demonstrate considerable growth potential, as their automotive industries mature and consumer adoption of advanced vehicle technologies accelerates, albeit from a smaller base. Localization of manufacturing and supply chains within these regions is also a developing trend, aimed at reducing costs and improving market responsiveness.

In terms of segment trends, the capacitive sensor segment currently holds a significant share due to its cost-effectiveness and proven performance, particularly for tailgate applications. However, radar and ultrasonic sensor technologies are gaining traction, especially in scenarios requiring higher accuracy, robustness against environmental factors, and broader detection ranges, such as in complex vehicle geometries or adverse weather conditions. The passenger vehicle segment, notably SUVs and MPVs, remains the largest application area, but there is an increasing inclination towards adopting kick sensor technology in light commercial vehicles and specialized fleet vehicles for enhanced operational efficiency. The OEM channel dominates sales, reflecting the factory-fitted nature of these sophisticated systems, yet the aftermarket segment is also showing steady growth as vehicle owners seek to upgrade older models or customize their existing vehicles with premium convenience features. This dual-channel approach ensures market penetration across different vehicle lifecycles and consumer preferences.

AI Impact Analysis on Automotive Kick Sensor Market

User questions regarding the impact of AI on Automotive Kick Sensor Market frequently center on themes of enhanced reliability, predictive capabilities, and the integration of these sensors into broader intelligent vehicle systems. Users are keen to understand how AI can reduce false positives, improve performance in diverse environmental conditions, and enable more sophisticated, personalized interactions beyond simple open/close functions. There is a strong expectation that AI will make kick sensors not just more functional, but also smarter, more adaptable, and intrinsically linked to the vehicle's overall intelligence, leading to a truly seamless and intuitive user experience. Users also question the potential for AI to introduce new features, such as pre-emptive actions or integration with autonomous driving functionalities, thereby expanding the utility and value proposition of these sensors significantly.

- AI-driven algorithms enhance sensor accuracy and reduce false triggers by intelligently distinguishing between intentional foot gestures and incidental movements, leveraging machine learning models trained on vast datasets of user interactions.

- Predictive analytics powered by AI can anticipate user intent based on proximity, historical patterns, and contextual cues, allowing for more responsive and personalized tailgate or door operations, potentially even before a full kick gesture is completed.

- AI facilitates sensor fusion, combining data from kick sensors with other vehicle sensors (e.g., proximity sensors, cameras) to create a more comprehensive understanding of the environment and user presence, thereby improving reliability and safety.

- Machine learning allows kick sensors to adapt to individual user behaviors and preferences over time, optimizing sensitivity and response characteristics for a more tailored and intuitive interaction.

- AI enables advanced diagnostics and predictive maintenance for kick sensor systems, identifying potential malfunctions proactively and minimizing downtime, thereby enhancing system longevity and user satisfaction.

- Integration with voice assistants and other smart vehicle interfaces via AI allows for multi-modal interaction, where a kick gesture can be combined with voice commands for complex actions, increasing overall convenience.

- AI can contribute to cybersecurity by identifying unusual patterns or unauthorized access attempts related to the sensor system, thereby safeguarding vehicle integrity and preventing misuse.

DRO & Impact Forces Of Automotive Kick Sensor Market

The Automotive Kick Sensor Market is shaped by a dynamic interplay of driving forces that propel its growth, significant restraints that pose challenges, and emerging opportunities that promise future expansion. Key drivers include the ever-increasing consumer demand for convenience and luxury features in modern vehicles, especially as vehicle ownership becomes more intertwined with digital and smart technologies. The robust global growth in the sales of Sport Utility Vehicles (SUVs) and Multi-Purpose Vehicles (MPVs), which are ideal candidates for hands-free tailgate solutions, further amplifies this demand. Additionally, the continuous advancements in sensor technology, coupled with the decreasing cost of electronic components, make these systems more accessible and attractive for a broader range of vehicle segments. The push towards vehicle electrification and autonomy also necessitates more intuitive human-machine interfaces, positioning kick sensors as a crucial component of future smart mobility solutions, enhancing both safety and user experience by simplifying vehicle access.

Despite the strong growth drivers, the market faces several notable restraints. One primary concern is the relatively high cost of integrating sophisticated kick sensor systems, which can limit their adoption in economy or entry-level vehicle segments. Technical complexities related to sensor calibration, software integration, and ensuring reliable performance across diverse environmental conditions (e.g., extreme temperatures, heavy rain, snow, dirt) also present significant engineering challenges. There is also the potential for false positives or unintentional activations, which can lead to user frustration or safety concerns, particularly if not adequately addressed through advanced algorithms and rigorous testing. Consumer awareness and understanding of the technology's benefits and limitations can also be a barrier, as unfamiliarity might lead to hesitant adoption. Furthermore, the aesthetic impact of sensor placement and wiring in some vehicle designs can also be a minor constraint, although OEMs are consistently working on seamless integration.

Opportunities for market expansion are substantial and diverse. The burgeoning aftermarket segment presents a significant avenue for growth, as owners of older vehicles seek to upgrade their cars with modern convenience features. Integration of kick sensor technology with advanced driver-assistance systems (ADAS) and autonomous driving platforms could unlock new functionalities and enhance overall vehicle intelligence, moving beyond simple tailgate operations. The expansion into commercial vehicles, such as delivery vans and logistics fleets, offers a vast untapped market where hands-free access can dramatically improve operational efficiency and safety for drivers. Furthermore, customization and personalization options, allowing users to define specific gestures or sensitivity levels, could cater to individual preferences and create a more unique user experience. The development of more robust, cost-effective, and versatile sensor technologies, potentially leveraging solid-state solutions or advanced AI, will unlock new applications and foster broader market penetration across various vehicle types and price points, including micro-mobility and specialized transportation solutions.

Segmentation Analysis

The Automotive Kick Sensor Market is comprehensively segmented to provide a granular understanding of its diverse components and dynamics. This segmentation helps in identifying key growth areas, market trends, and strategic opportunities across various technological applications, vehicle types, and distribution channels. The market can be broadly analyzed based on the underlying technology utilized for detection, the specific application within the vehicle, the type of vehicle integrating the sensor, and the sales channel through which these systems reach the end-users. Each segment and sub-segment exhibits unique characteristics influenced by technological advancements, cost considerations, consumer preferences, and regional automotive industry trends, thereby shaping the competitive landscape and investment decisions within the market.

- By Technology

- Capacitive Sensor: Detects changes in the electric field when a foot enters the sensing zone, commonly used due to its cost-effectiveness.

- Radar Sensor: Utilizes microwave signals to detect motion and distance, offering robust performance in various weather conditions and precise object detection.

- Ultrasonic Sensor: Employs sound waves to measure distance and detect objects, often used for proximity sensing and less prone to certain environmental interferences.

- By Application

- Tailgate: The most prevalent application, enabling hands-free opening and closing of vehicle trunks and hatchbacks.

- Sliding Doors: Used in minivans and commercial vehicles for hands-free access to side doors, enhancing passenger and cargo accessibility.

- Other Applications: Includes emerging uses like foot-activated running boards, fuel cap openers, or other smart access features.

- By Vehicle Type

- Passenger Vehicles:

- Sedans

- SUVs

- MPVs

- Hatchbacks

- Coupés

- Commercial Vehicles:

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Buses & Coaches

- Passenger Vehicles:

- By Sales Channel

- Original Equipment Manufacturer (OEM): Sensors integrated during vehicle manufacturing.

- Aftermarket: Sensors sold and installed after vehicle purchase, for upgrades or replacements.

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Automotive Kick Sensor Market

The value chain for the Automotive Kick Sensor Market begins with extensive upstream activities focused on research, development, and the manufacturing of core sensor components. This segment involves specialized suppliers producing capacitive elements, radar modules, ultrasonic transducers, microcontrollers, wiring harnesses, and associated electronic control units (ECUs). These suppliers invest heavily in material science, semiconductor technology, and software development to ensure the precision, reliability, and cost-effectiveness of the individual sensor parts. The quality and innovation at this initial stage are critical as they directly impact the performance and integration capabilities of the final kick sensor system. Furthermore, ongoing innovation in miniaturization and power efficiency are key competitive differentiators within the upstream segment, as they enable more flexible and discreet integration into vehicle designs.

Moving downstream, the midstream segment of the value chain involves the integration and assembly of these individual components into complete kick sensor modules and systems. This stage is primarily handled by Tier 1 automotive suppliers who specialize in developing sophisticated sensor modules, including the necessary housing, mounting brackets, and software algorithms for gesture recognition. These suppliers work closely with automotive Original Equipment Manufacturers (OEMs) during the vehicle design and development phases to ensure seamless integration of the kick sensor system into specific vehicle platforms. This collaborative process includes rigorous testing for functionality, durability, and compliance with automotive safety standards. The ability of these integrators to offer comprehensive solutions, from hardware to software, and to customize systems for various vehicle models, is crucial for their competitive positioning.

The final stage of the value chain focuses on distribution and after-sales support, reaching the end-user. For the direct distribution channel, kick sensor systems are delivered directly to OEM assembly plants for factory installation in new vehicles. This channel accounts for the majority of the market, driven by long-term supply agreements and stringent quality control. The indirect distribution channel pertains to the aftermarket, where kick sensor kits are distributed through a network of automotive parts retailers, independent garages, and specialized installers. This channel caters to vehicle owners seeking upgrades or replacements for their existing vehicles, offering a broader reach to a diverse customer base. Effective logistics, a robust service network, and comprehensive customer support are essential in both direct and indirect channels to ensure customer satisfaction and sustained market growth, further solidifying the long-term value proposition of automotive kick sensors.

Automotive Kick Sensor Market Potential Customers

The primary potential customers and end-users of automotive kick sensors are diverse, reflecting the broad applicability and increasing demand for hands-free convenience features in the automotive sector. Leading this group are Automotive Original Equipment Manufacturers (OEMs), including global manufacturers of luxury, premium, and even mid-range passenger vehicles. OEMs integrate kick sensor technology directly into their vehicle assembly lines, offering these features as standard equipment or as part of optional convenience packages. Their purchasing decisions are driven by consumer demand for advanced features, competitive differentiation, vehicle design integration, and compliance with evolving safety and accessibility standards. OEMs across various segments, from high-volume SUV and MPV producers to niche luxury car manufacturers, represent the largest and most influential customer segment, as they directly embed this technology into millions of new vehicles annually.

Beyond the new vehicle market, the aftermarket segment represents a significant and growing pool of potential customers. This includes individual vehicle owners who wish to upgrade their existing cars with modern hands-free tailgate or sliding door functionality. These customers typically seek to enhance the convenience and value of their vehicles without purchasing a new model. Aftermarket demand is served by a network of independent automotive parts retailers, online distributors, and specialized vehicle accessory installers. The appeal in the aftermarket lies in offering cost-effective retrofit solutions that provide similar benefits to factory-installed systems, often with universal or semi-universal compatibility. The growth of this segment is closely tied to the availability of reliable, easy-to-install, and competitively priced aftermarket kits, accompanied by effective marketing and distribution channels.

Furthermore, commercial vehicle fleet operators and manufacturers of Light Commercial Vehicles (LCVs) also represent a burgeoning customer segment. Businesses that rely on delivery vans, utility vehicles, or specialized transport solutions can significantly benefit from hands-free access to cargo areas, which streamlines operations, improves efficiency, and enhances the safety of their drivers, particularly those making frequent stops or handling heavy loads. For these customers, the value proposition extends beyond mere convenience to tangible operational cost savings and improved worker productivity. As the e-commerce and logistics sectors continue their rapid expansion, the adoption of kick sensor technology in these commercial applications is poised for considerable growth, driven by the need for optimized workflow and rapid access to goods during delivery processes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 1.8 Billion |

| Growth Rate | 21.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Continental AG, Robert Bosch GmbH, Hella GmbH & Co. KGaA, ZF Friedrichshafen AG, Valeo S.A., Delphi Technologies (BorgWarner Inc.), Hyundai Mobis, Denso Corporation, Magna International Inc., Omron Corporation, NXP Semiconductors, Visteon Corporation, Lear Corporation, Mitsubishi Electric Corporation, Panasonic Corporation, Alps Alpine Co. Ltd., Autoliv Inc., Gentex Corporation, Sensata Technologies, TE Connectivity |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Kick Sensor Market Key Technology Landscape

The technological landscape of the Automotive Kick Sensor Market is characterized by a blend of established sensing principles and emerging innovations aimed at enhancing reliability, accuracy, and user experience. At its core, the market leverages three primary sensing technologies: capacitive, radar, and ultrasonic. Capacitive sensors operate by detecting changes in an electric field when a conductive object, such as a human foot, enters its sensing zone. These sensors are relatively simple, cost-effective, and widely adopted, particularly for tailgate applications where the detection area is relatively fixed and the environment is controlled. Their performance can, however, be susceptible to environmental factors like heavy rain or snow if not properly designed and calibrated. Continuous advancements in electrode design and signal processing algorithms are improving their robustness and reducing sensitivity to false triggers.

Radar technology, on the other hand, utilizes microwave signals to detect the presence and motion of objects. These sensors emit radar waves and measure the reflections to determine distance, speed, and direction. Radar-based kick sensors offer superior performance in harsh weather conditions, including heavy rain, snow, or fog, and are less affected by dirt or ice accumulation on the bumper. This robustness makes them an attractive option for premium vehicles and regions with challenging climates. Furthermore, radar sensors can provide more precise object detection and differentiate between a foot and other objects more effectively, leading to higher reliability. The ongoing development of compact, low-cost radar modules is expanding their applicability across a broader range of vehicle segments, and their integration with other vehicle radar systems for ADAS is a growing trend, allowing for sensor fusion and enhanced contextual awareness.

Ultrasonic sensors, which emit high-frequency sound waves and measure the time it takes for the echo to return, are also employed for proximity detection in kick sensor systems. While generally less expensive than radar, their performance can be affected by ambient noise, temperature changes, and certain surface textures. However, they are effective for short-range detection and can complement other sensor types in a multi-sensor setup to improve overall system accuracy and redundancy. Beyond the core sensing hardware, the technology landscape also includes sophisticated software algorithms for gesture recognition, filtering of environmental noise, and integration with the vehicle's Electronic Control Unit (ECU) and Controller Area Network (CAN bus). Advanced signal processing, machine learning, and AI are increasingly being deployed to interpret complex foot movements, predict user intent, and adapt sensor sensitivity to individual user preferences, thereby transforming basic detection into an intelligent and personalized interaction with the vehicle. Wireless communication technologies are also playing a role in connecting sensor modules with the vehicle's central systems, simplifying wiring and enabling modularity.

Regional Highlights

- North America: This region stands as a significant market for automotive kick sensors, driven by a high consumer preference for convenience features and luxury amenities in vehicles. The strong demand for SUVs and pickup trucks, which are ideal platforms for hands-free tailgate technology, further fuels market growth. Consumers in North America are generally early adopters of advanced automotive technologies, and robust economic conditions support the purchase of vehicles equipped with premium features. The presence of major automotive OEMs and a well-established aftermarket further contribute to the market's maturity and expansion. The focus here is on seamless integration and enhancing the overall user experience, with a strong emphasis on reliability and ease of use in varying environmental conditions across the vast geographical expanse.

- Europe: Europe represents a mature market characterized by stringent safety regulations and a strong emphasis on engineering excellence and technological innovation. The high penetration of premium and luxury vehicle brands, particularly from Germany, contributes significantly to the adoption of kick sensor technology as a standard or desirable feature. European consumers value both convenience and sophisticated engineering, leading to demand for highly reliable and aesthetically integrated solutions. The region also boasts a robust supply chain for automotive components, fostering continuous innovation in sensor design and manufacturing. While environmental regulations drive the shift towards electric vehicles, kick sensors play a crucial role in maintaining and enhancing the convenience factor in these modern vehicles.

- Asia Pacific (APAC): The Asia Pacific region is projected to be the largest and fastest-growing market for automotive kick sensors. This growth is primarily attributable to the burgeoning automotive industry in countries like China, India, Japan, and South Korea, coupled with rapidly increasing disposable incomes and a rising middle class. Consumers in APAC are increasingly aspiring for premium vehicle features and smart technologies. China, in particular, leads in vehicle production and sales, with a strong appetite for SUVs and MPVs, making it a pivotal market for kick sensors. The presence of numerous global and regional automotive manufacturers, along with a dynamic electronics manufacturing sector, creates a highly competitive and innovative environment. Government initiatives promoting smart cities and advanced vehicle technologies further accelerate market expansion across the region.

- Latin America: This region is an emerging market for automotive kick sensors, experiencing gradual but steady growth. The market is influenced by increasing vehicle production, particularly in Brazil and Mexico, and a growing consumer interest in modern vehicle features. Economic stability and expanding automotive sales contribute to the adoption of convenience technologies, albeit at a slower pace compared to developed regions. The market in Latin America is often driven by the introduction of new vehicle models that incorporate these features as standard in higher trims, and as vehicle penetration increases, the demand for such amenities is expected to follow an upward trajectory. Strategic partnerships between global suppliers and local manufacturers are key to market development here.

- Middle East & Africa (MEA): The MEA region presents considerable growth potential for the automotive kick sensor market. Countries in the Middle East, characterized by high per capita incomes and a strong preference for luxury and high-end vehicles, are early adopters of advanced automotive features. The increasing investment in infrastructure and the diversification of economies away from oil also support the growth of the automotive sector. In Africa, while the market is still nascent, urbanization and rising incomes in key economies are gradually driving demand for modern vehicles equipped with enhanced convenience and safety features. The growing presence of international automotive brands and increasing vehicle imports are key factors shaping the demand for kick sensors across this diverse region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Kick Sensor Market.- Continental AG

- Robert Bosch GmbH

- Hella GmbH & Co. KGaA

- ZF Friedrichshafen AG

- Valeo S.A.

- Delphi Technologies (BorgWarner Inc.)

- Hyundai Mobis

- Denso Corporation

- Magna International Inc.

- Omron Corporation

- NXP Semiconductors

- Visteon Corporation

- Lear Corporation

- Mitsubishi Electric Corporation

- Panasonic Corporation

- Alps Alpine Co. Ltd.

- Autoliv Inc.

- Gentex Corporation

- Sensata Technologies

- TE Connectivity

Frequently Asked Questions

What is an automotive kick sensor and how does it work?

An automotive kick sensor is a specialized electronic system that enables hands-free operation of vehicle components, such as tailgates or sliding doors, through a simple foot motion. It typically uses capacitive, radar, or ultrasonic technology to detect the presence and specific movement of a user's foot beneath a designated area of the vehicle, often the rear bumper. Upon recognition of the correct gesture, the sensor sends a signal to the vehicle's electronic control unit (ECU), which then activates the motor to open or close the component automatically, enhancing convenience for users with occupied hands.

How do kick sensors improve convenience for vehicle owners?

Kick sensors significantly enhance convenience by allowing vehicle owners to open or close their tailgates or sliding doors without needing to use their hands or search for keys. This is particularly beneficial when carrying groceries, luggage, children, or when one's hands are dirty. It streamlines the loading and unloading process, reduces physical effort, and provides a more hygienic interaction with the vehicle. The hands-free operation adds a premium feel and improves accessibility, making vehicle interaction smoother and more efficient in everyday scenarios.

Are automotive kick sensors reliable in all weather conditions?

The reliability of automotive kick sensors in various weather conditions depends heavily on the underlying technology and system design. While capacitive sensors can be susceptible to heavy rain, snow, or ice if not properly sealed and calibrated, radar-based sensors generally offer superior performance in adverse weather, resisting interference from moisture, dirt, and extreme temperatures. Manufacturers are continuously improving sensor robustness through advanced materials, sophisticated algorithms, and sensor fusion techniques to ensure consistent and reliable operation across a wide range of environmental challenges, making them increasingly dependable in diverse climates.

What types of vehicles most commonly feature kick sensors?

Automotive kick sensors are most commonly featured in Sport Utility Vehicles (SUVs), Multi-Purpose Vehicles (MPVs), crossovers, and wagons due to their large tailgates and the frequent need for hands-free access for cargo. They are also increasingly being integrated into minivans and light commercial vehicles (LCVs) to facilitate easier access to sliding doors and cargo areas, benefiting commercial operators and families alike. While initially a premium feature, kick sensors are now becoming more prevalent in mid-range passenger vehicles as consumer demand for convenience features grows and technology costs become more accessible across broader vehicle segments.

What is the future outlook for the automotive kick sensor market?

The future outlook for the automotive kick sensor market is highly positive, driven by continuous technological advancements, increasing consumer demand for smart vehicle features, and the expansion into new application areas. Future innovations will focus on integrating AI and machine learning to enhance sensor accuracy, reduce false positives, and enable more predictive and personalized user interactions. The market is also poised for growth through broader adoption in commercial vehicles, integration with advanced driver-assistance systems (ADAS), and potential expansion into autonomous vehicle applications. As costs decrease and reliability improves, kick sensors are expected to become a standard feature across an even wider range of vehicle types, solidifying their role in creating intuitive and intelligent mobility experiences.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager