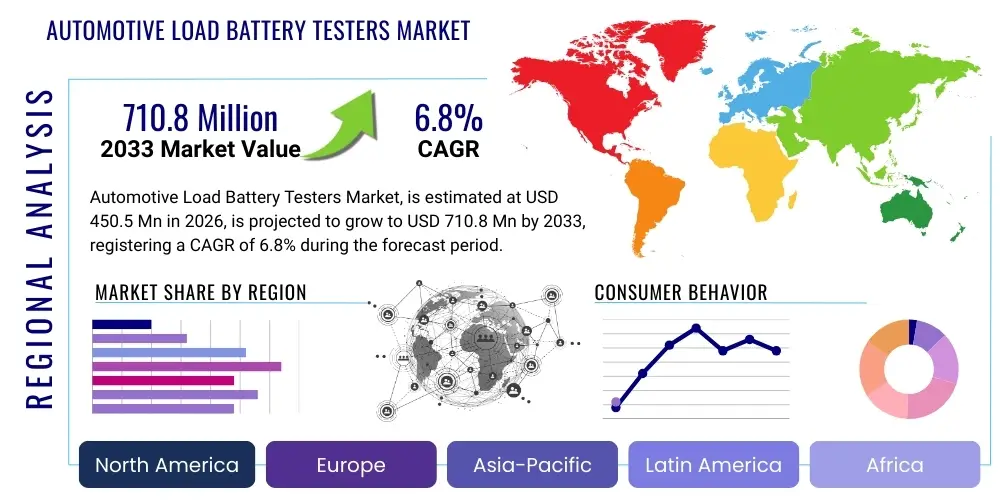

Automotive Load Battery Testers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437233 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Automotive Load Battery Testers Market Size

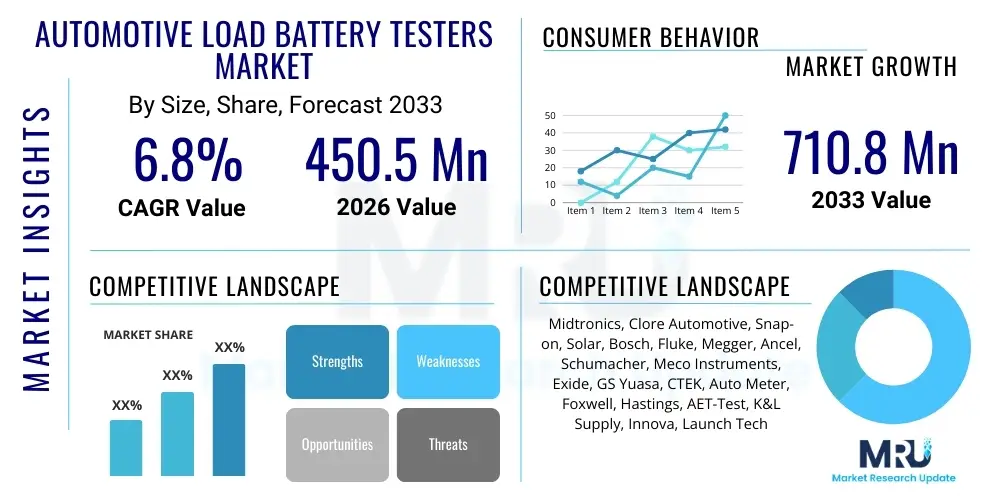

The Automotive Load Battery Testers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 710.8 Million by the end of the forecast period in 2033. This consistent expansion is driven primarily by the escalating sophistication of vehicle electrical systems, the pervasive integration of start-stop technology, and the stringent regulatory environment requiring proactive maintenance and emissions reduction. The reliability of the automotive battery is paramount for the operation of critical components, leading to increased adoption of accurate, reliable load testers in both OEM service centers and independent aftermarket garages globally. Market growth is further catalyzed by the rising average age of vehicles in key regions like North America and Europe, necessitating more frequent and detailed battery health checks to prevent unexpected failures and ensure optimal vehicle performance, thereby solidifying the demand for advanced battery testing equipment capable of simulating real-world operational loads accurately.

The transition toward electric and hybrid vehicles, while introducing specialized battery management systems, also underscores the foundational requirement for accurate testing tools that can handle higher voltages and more complex chemistries. Traditional load battery testers are evolving rapidly, incorporating features such as integrated diagnostic software, connectivity options, and enhanced algorithms to provide a more holistic view of the battery's state of health (SOH) and state of charge (SOC). This technological evolution ensures that the market remains robust, catering to both legacy internal combustion engine (ICE) vehicles and the burgeoning electrified fleet. Furthermore, the emphasis on minimizing vehicle downtime in commercial fleets, including logistics and transportation sectors, significantly boosts the demand for highly efficient, portable, and reliable load battery testers that offer quick, precise diagnostic results, allowing fleet managers to implement predictive maintenance strategies effectively. The continuous innovation by key market players, focusing on user interface improvements and enhanced accuracy under varied temperature conditions, contributes significantly to the anticipated robust CAGR throughout the forecast horizon.

Automotive Load Battery Testers Market introduction

The Automotive Load Battery Testers Market encompasses devices designed to assess the operational capacity and overall health of automotive starting, lighting, and ignition (SLI) batteries by simulating a real-world electrical load. These crucial diagnostic tools, ranging from traditional carbon pile resistive testers to modern digital conductance testers, are fundamental in determining a battery's cold cranking amperage (CCA) capability, voltage retention, and overall reserve capacity under stress. The primary product description involves equipment that applies a controlled, high-amperage load to the battery for a short duration, observing the resulting voltage drop to gauge performance degradation and impending failure. Major applications span across vehicle manufacturing, authorized dealer service departments, independent automotive repair shops, and retail battery sales outlets, where reliable battery assessment is a prerequisite for both warranty validation and effective vehicle maintenance schedules. The market's foundational driving factors include increasing consumer awareness regarding vehicle maintenance, the global proliferation of sophisticated electrical accessories in modern cars, and the necessity for preemptive detection of battery failure to enhance road safety and vehicle reliability, thereby positioning load battery testers as indispensable tools in the automotive service ecosystem.

The immediate benefits derived from the utilization of accurate load battery testers include enhanced diagnostic efficiency, reduced risk of roadside assistance events due to unexpected battery failure, and improved inventory management for service centers by accurately identifying faulty batteries requiring replacement versus those only needing a recharge. These devices help technicians provide definitive proof of battery degradation to the customer, fostering trust and streamlining the repair process. Furthermore, the market is characterized by a steady technological shift away from purely analog carbon pile testers—which are often cumbersome and require specific cooldown periods—towards digital, microprocessor-controlled testers that utilize conductance technology. While conductance testers are faster and safer, the core function of load simulation remains critical, particularly for validating the performance of heavy-duty batteries or during end-of-life testing. The driving factors are further amplified by the rigorous standards imposed by organizations such as the Battery Council International (BCI) and various national automotive safety bodies, which necessitate the deployment of calibrated and certified testing equipment, ensuring standardization and reliability across the automotive maintenance industry worldwide.

Automotive Load Battery Testers Market Executive Summary

The Automotive Load Battery Testers Market executive summary reveals strong positive business trends underpinned by continuous technological convergence, specifically the integration of diagnostic software and cloud-based data analytics with testing hardware. Key business trends show a rising preference among large fleet operators and professional garages for multifunctional diagnostic tools that combine battery testing capabilities with starter and alternator analysis, thus maximizing operational utility and justifying higher investment costs. Regional trends highlight the Asia Pacific (APAC) region as the fastest-growing market, driven by rapid urbanization, substantial growth in vehicle parc, and increasing investment in automotive infrastructure, particularly in emerging economies like China and India, where the aftermarket service sector is expanding aggressively. Conversely, North America and Europe maintain leading market shares due to high vehicle density, stringent environmental regulations necessitating optimal vehicle performance, and a mature infrastructure supporting advanced diagnostic tools. Segments trends indicate that the digital/microprocessor-based tester segment is dominating due to superior accuracy, speed, and data logging capabilities, positioning analog load testers increasingly as low-cost alternatives primarily for rudimentary testing or developing markets, while the aftermarket service sector remains the largest end-use segment globally due to the necessity of periodic battery replacement and maintenance over the vehicle lifespan.

The market trajectory is firmly positioned towards portable, user-friendly devices that offer rapid, non-invasive testing solutions, addressing the demand for efficiency in high-volume service environments. This strategic pivot is evident in the increased research and development expenditure by major manufacturers focusing on miniaturization and robust design capable of withstanding harsh garage conditions. Financial modeling suggests that merger and acquisition activities will continue as larger diagnostic equipment providers seek to acquire specialized battery testing expertise or expand their geographic footprint, particularly into untapped African and Latin American markets. The shift in segments trends also shows increasing demand for testers specifically calibrated for Enhanced Flooded Batteries (EFB) and Absorbed Glass Mat (AGM) batteries, which are integral to modern start-stop vehicles, necessitating testers capable of accurately evaluating these complex battery types. Overall, the market remains robust, characterized by stable demand fueled by essential maintenance requirements, amplified by the transition to more technologically advanced and power-intensive vehicles requiring precise diagnostic confirmation of electrical component health.

AI Impact Analysis on Automotive Load Battery Testers Market

User queries regarding the impact of Artificial Intelligence (AI) on the Automotive Load Battery Testers Market primarily focus on predictive failure analysis, the integration of AI-driven diagnostics into existing workshop management systems, and the potential for AI to standardize maintenance protocols across global operations. Users are keenly interested in how machine learning algorithms can utilize historical charging/discharging data, environmental conditions, and vehicle usage patterns (telematics) to move beyond simple 'pass/fail' testing towards sophisticated prediction of the battery's remaining useful life (RUL). Concerns often revolve around data privacy, the complexity of integrating new AI platforms with legacy testing hardware, and the reliability of AI-generated diagnostic recommendations versus traditional technician expertise. Users expect AI to enhance testing speed and accuracy, reduce false positives, and ultimately lower operational costs by optimizing battery replacement cycles, ensuring technicians can prioritize interventions based on genuine predictive risk rather than reactive failure. This summarized analysis indicates a clear market expectation for AI to transform battery testing from a static measurement task into a dynamic, predictive diagnostic service.

- AI algorithms enable advanced predictive modeling of battery degradation, accurately forecasting the remaining useful life (RUL) based on comprehensive historical data sets.

- Machine learning enhances diagnostic accuracy by identifying subtle patterns indicative of internal battery faults that standard conductance or load tests might overlook.

- Integration of AI tools facilitates automated reporting and seamless integration with dealer management systems (DMS) and telematics platforms, optimizing workshop workflow.

- AI drives the development of smart, connected testers capable of self-calibration and remote software updates, ensuring compliance with evolving battery technologies (e.g., Li-ion, solid-state).

- Enhanced decision support systems guide technicians through complex troubleshooting processes, standardizing high-quality diagnostic procedures across diverse operational locations.

DRO & Impact Forces Of Automotive Load Battery Testers Market

The dynamics of the Automotive Load Battery Testers Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively exerting significant Impact Forces on market progression and technological evolution. Key drivers include the exponential increase in the number of vehicles equipped with start-stop systems and numerous electronic control units (ECUs), which place immense and critical demands on the 12V battery, necessitating precise and regular health assessments. The opportunity landscape is significantly broadened by the global penetration of hybrid and electric vehicles, creating a distinct, high-value segment for specialized testers capable of handling high-voltage battery modules and ancillary 12V systems crucial for power management. However, these positive forces are counterbalanced by restraints such as the initial high procurement cost associated with advanced digital and AI-integrated testing units, making adoption challenging for small independent garages, alongside the ongoing challenge of achieving universal testing standardization across the variety of battery chemistries and automotive manufacturing standards worldwide, requiring manufacturers to continuously adapt their hardware and software offerings.

Impact forces are currently strongest from the regulatory environment and technological innovation sectors. Regulatory mandates, particularly in developed regions focusing on roadworthiness and emission standards (which often tie to efficient vehicle operation requiring optimal battery performance), drive mandatory testing frequencies and quality requirements for diagnostic equipment. Technological forces, specifically the miniaturization of sensors, integration of wireless communication (IoT), and the application of sophisticated algorithms (AI/ML), are rapidly rendering older, analog equipment obsolete, pushing the market towards high-throughput, integrated diagnostic solutions. The overall impact results in a market prioritizing accuracy, portability, and connectivity, favoring companies that invest heavily in R&D to meet these evolving demands. This environment ensures sustained demand from professional segments who value efficiency and comprehensive diagnostic data necessary for modern vehicle maintenance. The shift towards predictive maintenance methodologies further reinforces the necessity of these advanced tools, cementing their role as essential investments rather than optional accessories for automotive service providers.

Segmentation Analysis

The Automotive Load Battery Testers Market is comprehensively segmented based on technology type, end-use application, battery compatibility, and geographical distribution, providing a nuanced view of market dynamics and consumer preferences across various operational environments. The segmentation by technology, differentiating between analog (carbon pile) and digital (conductance/impedance) testers, highlights the accelerating transition towards sophisticated electronic diagnostics due to their non-invasive nature and speed, catering to the efficiency requirements of high-volume service centers. Furthermore, the segmentation by end-use application clearly delineates the massive influence of the aftermarket service segment, which includes independent repair shops and quick-lube facilities, representing the largest consumer base due to the repetitive nature of battery failure and replacement cycles over a vehicle’s lifecycle. Analyzing these segments is critical for manufacturers to tailor product specifications, pricing strategies, and distribution channels to effectively capture market share in both the high-accuracy professional segment and the more cost-sensitive basic maintenance segment.

- Technology Type:

- Analog Load Testers (Carbon Pile)

- Digital Battery Testers (Conductance, Impedance, Resistance)

- End-Use Application:

- Automotive OEMs (Original Equipment Manufacturers)

- Service Garages and Independent Workshops (Aftermarket)

- Battery Manufacturers and Distributors

- Commercial Fleet Operators

- Application/Vehicle Type:

- Passenger Vehicles (PV)

- Commercial Vehicles (CV)

- Battery Type Compatibility:

- Standard Flooded Lead-Acid Batteries (SFLA)

- Absorbed Glass Mat (AGM) Batteries

- Enhanced Flooded Batteries (EFB)

- Lithium-Ion (Li-ion) Batteries (Specialized Testers)

Value Chain Analysis For Automotive Load Battery Testers Market

The value chain for the Automotive Load Battery Testers Market begins with upstream analysis, focusing on the procurement of raw materials and specialized electronic components, predominantly microprocessors, sensors, resistors, casing materials, and specialized software development kits necessary for digital testers. Key upstream activities involve meticulous quality control of electronic components and securing reliable supply chains for critical microcontrollers, which dictate the accuracy and functionality of the final product. Midstream activities involve the core manufacturing and assembly processes, including PCB fabrication, housing injection molding, and calibration, often characterized by high levels of automation and stringent testing procedures to ensure compliance with automotive diagnostic standards like SAE J537. The downstream segment involves the complex distribution channel, where products move from manufacturers to regional distributors, wholesalers, automotive parts retailers, and finally to the end-users—professional technicians and automotive enthusiasts—requiring robust logistics networks and effective sales support to manage complex product variants and service requirements effectively.

The distribution channel operates through both direct and indirect routes. Direct sales are often utilized for large volume contracts with Automotive OEMs or major commercial fleet operators, where customized solutions and dedicated training are necessary, allowing manufacturers greater control over branding and pricing. Indirect channels, which dominate the aftermarket segment, leverage global distributors, large tool retailers (like Snap-on franchises), and increasingly, e-commerce platforms, offering manufacturers broad geographic reach but requiring effective channel management to maintain price consistency and product integrity. The efficiency of this distribution network is crucial, as the market demands timely availability of the latest diagnostic tools. Value chain optimization is increasingly focused on integrating IoT capabilities and cloud-based services, which add value post-sale through software updates, data analysis, and remote diagnostics support, shifting the value proposition from a singular hardware sale to a long-term service relationship based on data-driven maintenance insights, thus strengthening the bond between manufacturers and professional end-users.

Automotive Load Battery Testers Market Potential Customers

The potential customers and end-users of Automotive Load Battery Testers are broadly categorized into four primary groups, all sharing the common requirement for accurate, reliable assessment of 12V and increasingly high-voltage vehicle electrical systems. The largest cohort comprises the vast network of aftermarket service garages and independent repair workshops, including national chains and small proprietor shops, who utilize these testers daily as a fundamental tool for routine maintenance, battery replacement services, and complex electrical troubleshooting, driven by high service volumes and the necessity of preventing costly vehicle re-entry due to electrical faults. Automotive OEMs and their authorized dealer service centers represent a high-value customer segment, requiring advanced, certified testing equipment for warranty claims validation, pre-delivery inspection (PDI), and adherence to strict manufacturer maintenance protocols, often necessitating proprietary or highly integrated diagnostic platforms. These professional segments prioritize accuracy and seamless integration with existing workshop management systems over cost.

Furthermore, commercial fleet operators, managing large fleets of trucks, buses, and specialized utility vehicles, constitute a rapidly growing customer base, demanding robust, portable testers for proactive, scheduled maintenance to minimize vehicle downtime, where battery failure can lead to significant economic loss. They often opt for heavy-duty testers capable of handling high cranking amperage and surviving harsh operational environments. The fourth key group includes battery manufacturers themselves and large-scale battery distributors/retailers who require precise load testing capabilities for quality assurance during production, batch testing, and counter sales, ensuring the batteries they supply meet specified CCA ratings before they reach the consumer. The core value sought by all these buyer segments is the ability to obtain definitive, quantifiable data on battery health, translating directly into enhanced operational efficiency, reduced warranty expenditure, and improved customer satisfaction metrics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 710.8 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Midtronics, Clore Automotive, Snap-on, Solar, Bosch, Fluke, Megger, Ancel, Schumacher, Meco Instruments, Exide, GS Yuasa, CTEK, Auto Meter, Foxwell, Hastings, AET-Test, K&L Supply, Innova, Launch Tech |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Load Battery Testers Market Key Technology Landscape

The technology landscape of the Automotive Load Battery Testers Market is characterized by a significant transition from traditional resistive testing methods to sophisticated electronic and algorithmic diagnostics, primarily driven by the need for greater speed, non-invasiveness, and accuracy when dealing with modern battery chemistries. The two foundational technologies are carbon pile load testing and digital conductance testing. Carbon pile testers simulate a load by drawing a high current through an adjustable resistive element, providing a highly accurate assessment of the battery’s capacity under actual load conditions, though they are cumbersome, heat-generating, and require manual operation. Conversely, digital conductance testers measure the battery's ability to conduct alternating current through internal resistance, offering instant results without discharging the battery, making them the preferred technology for high-volume service centers due to their efficiency and safety profile, though they can sometimes struggle to accurately assess severely discharged or compromised batteries.

Beyond the core testing methodologies, the technological landscape is rapidly evolving with the integration of smart features and connectivity. Advanced testers now incorporate proprietary algorithms that analyze voltage ripple, ambient temperature, charging profiles, and system noise to provide a more holistic diagnosis, moving beyond simple CCA readings to estimate the battery's overall state of health (SOH). Connectivity technologies, including Bluetooth and Wi-Fi, enable testers to link seamlessly with mobile devices and cloud platforms, facilitating data logging, remote diagnostics, and automated reporting, which is a key requirement for modern fleet management and warranty tracking. Furthermore, the specialized segment focused on electric vehicle (EV) battery packs utilizes complex diagnostic protocols and insulation resistance testing, often integrated with the vehicle’s high-voltage Battery Management System (BMS), representing the cutting-edge of automotive battery testing technology, requiring precision instruments capable of safely handling thousands of volts.

Regional Highlights

- Highlight key countries or regions and their market relevance:

- North America: This region maintains a leading position characterized by a high average age of vehicles, mature aftermarket infrastructure, and stringent consumer expectations for vehicle reliability, driving demand for high-end digital conductance testers and sophisticated diagnostic equipment. The early adoption of advanced fleet management solutions and the presence of major diagnostic tool manufacturers like Snap-on and Midtronics further solidify the region's market dominance, emphasizing predictive maintenance models.

- Europe: The European market demonstrates robust growth, significantly influenced by the rapid adoption of vehicles with start-stop technology, which mandates the use of EFB and AGM batteries and necessitates specialized testing equipment. Regulatory pressures focusing on reducing environmental impact and mandatory vehicle inspection schemes bolster demand. Germany, the UK, and France are key contributors, favoring integration of testers with garage management software for optimized workflow.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market globally, fueled by expanding vehicle production (OEM segment) and massive growth in the vehicle parc, particularly in emerging economies like China, India, and Southeast Asian nations. The region is seeing a high demand for cost-effective, yet reliable, testing solutions in the vast and fragmented independent aftermarket sector, leading to increased competition and localized manufacturing of equipment.

- Latin America (LATAM): Growth in LATAM is steady, driven by increasing foreign investment in automotive manufacturing and the modernization of vehicle fleets. The market sees a mix of demand for both basic analog testers (due to price sensitivity) and advanced digital units in professional service centers catering to newer vehicle models. Brazil and Mexico are the primary investment hubs, influencing regional market trends significantly.

- Middle East and Africa (MEA): This region is characterized by steady uptake, primarily concentrated in the Gulf Cooperation Council (GCC) countries due to high per-capita vehicle ownership and demand for high-performance vehicles, necessitating frequent electrical system checks due to extreme climatic conditions. Market penetration in Africa is currently limited but shows potential driven by infrastructure development and the increasing import of used vehicles.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Load Battery Testers Market.- Midtronics, Inc.

- Clore Automotive, LLC

- Snap-on Incorporated

- Robert Bosch GmbH

- Fluke Corporation

- Megger Group Limited

- Ancel Official Store

- Schumacher Electric Corporation

- Solar, A Division of Clore Automotive

- Meco Instruments Pvt. Ltd.

- Exide Technologies

- GS Yuasa Corporation

- CTEK AB

- Auto Meter Products, Inc.

- Foxwell Technology Co., Ltd.

- Hastings Manufacturing Co.

- AET-Test Technology Co., Ltd.

- K&L Supply Co.

- Innova Electronics Corporation

- Launch Tech Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Automotive Load Battery Testers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a load tester and a conductance tester?

A load tester (often carbon pile) measures a battery's performance by subjecting it to a high amperage discharge, simulating starting conditions, to observe the voltage drop. A conductance tester measures the battery's ability to conduct an alternating current (AC) without significant discharge, providing a faster, non-invasive assessment of internal resistance and estimating Cold Cranking Amps (CCA), which is crucial for modern diagnostic efficiency.

How is the growth of Electric Vehicles (EVs) affecting the load battery testers market?

The proliferation of EVs necessitates specialized high-voltage diagnostic tools for the primary traction battery packs. However, EVs still rely on a traditional 12V auxiliary battery (often AGM or Li-ion) to power accessories and systems like the Battery Management System (BMS). This dual-battery setup sustains demand for advanced 12V testers capable of accurately assessing high-tech auxiliary batteries, ensuring system reliability and safety.

Which segment, OEM or Aftermarket, drives the highest demand for these testers?

The Aftermarket segment, encompassing independent service garages, auto parts retailers, and fleet maintenance facilities, drives the highest volume demand. Batteries are consumable components requiring regular replacement throughout the vehicle’s lifespan, making periodic testing essential for both preventive maintenance and warranty processing within the vast, continuous aftermarket service ecosystem globally.

What technological trends are critical for new battery testers?

The critical technological trends include integration with IoT for cloud-based data storage and remote diagnostics, implementation of AI and machine learning for predictive battery failure analysis (Remaining Useful Life estimation), and enhanced compatibility with complex battery types such as AGM, EFB, and specialized Li-ion chemistries used in modern start-stop vehicles, prioritizing speed, accuracy, and connectivity.

What are the main challenges faced by manufacturers in this market?

Manufacturers primarily face challenges related to maintaining accuracy across the diverse range of global battery chemistries and standards, managing the high research and development costs associated with integrating complex digital diagnostics and AI capabilities, and overcoming price sensitivity in the large, fragmented independent aftermarket segment, particularly in developing regions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager