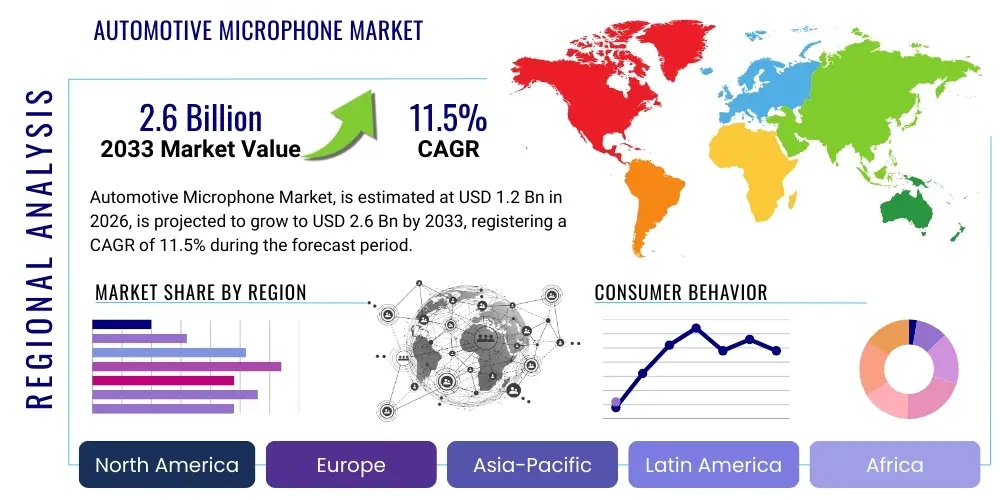

Automotive Microphone Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437904 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Automotive Microphone Market Size

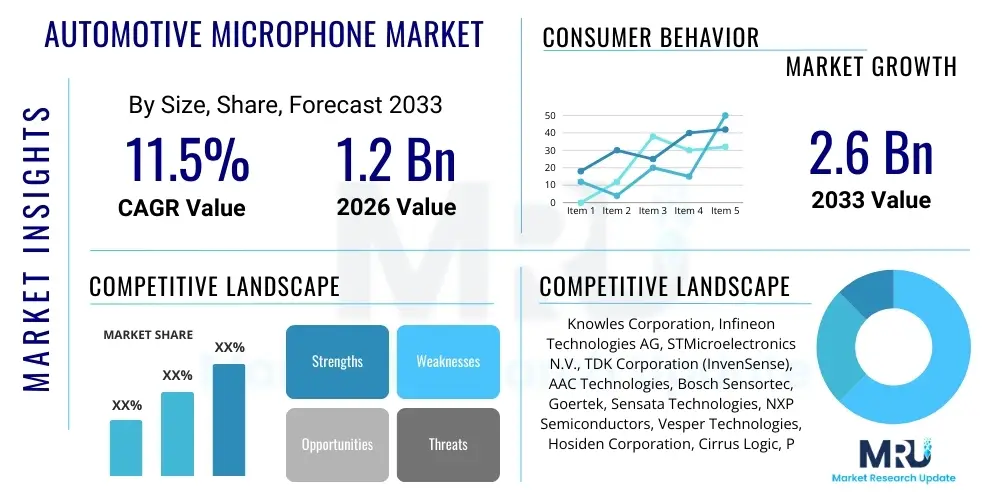

The Automotive Microphone Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.6 Billion by the end of the forecast period in 2033.

Automotive Microphone Market introduction

The Automotive Microphone Market encompasses the design, manufacturing, and distribution of specialized acoustic sensors integrated into vehicles for various functionalities, fundamentally driven by the proliferation of advanced in-car communication, infotainment, and safety systems. These microphones are critical components supporting hands-free calling (HFC), voice command recognition (VCR), in-car communication (ICC) for front and rear passengers, and sophisticated Active Noise Cancellation (ANC) systems, which enhance overall cabin quietness and occupant comfort. Modern automotive environments necessitate microphones capable of high acoustic performance, exceptional reliability under extreme temperature fluctuations, and superior noise immunity to filter out engine noise, road noise, and ventilation sounds, thereby ensuring clear audio input for processing by the vehicle's electronic control units (ECUs).

Automotive microphones are increasingly migrating from traditional electret condenser microphones (ECMs) to advanced Micro-Electro-Mechanical Systems (MEMS) technology. MEMS microphones offer superior miniaturization, improved consistency, resistance to vibration, and compatibility with surface-mount technology (SMT) processes used in high-volume automotive assembly lines. Major applications extend beyond basic communication to include integrated safety features, such as emergency call systems (eCall) mandated in various regions, and sophisticated driver assistance systems where acoustic data might play a supplementary role in environmental sensing. The primary benefit derived from these components is improved driver safety by minimizing distraction while maximizing accessibility to vehicle functions and external communication links.

The market is primarily driven by rigorous safety standards pushing hands-free operation adoption and the consumer demand for connected vehicles featuring seamless integration with smartphones and sophisticated infotainment interfaces. Furthermore, the rapid development of autonomous driving technologies requires highly accurate voice localization and command input for potential human-machine interaction (HMI) within the complex sensory landscape of Level 3 and above vehicles. These factors collectively accelerate the adoption rate of multi-microphone arrays, particularly in premium and mid-segment vehicles, laying the groundwork for spatial audio processing and personalized acoustic zones within the cabin.

Automotive Microphone Market Executive Summary

The Automotive Microphone Market is witnessing robust expansion, propelled by structural shifts in the automotive industry toward digitalization and electrification, emphasizing enhanced cabin experience and functional safety. Key business trends include aggressive investment in high-performance digital MEMS microphones, which offer lower power consumption and simplified integration compared to analog variants. The market structure is consolidating, with established semiconductor and acoustic component manufacturers focusing on strategic partnerships with Tier 1 suppliers to standardize microphone arrays and processing algorithms required for complex applications like vehicular noise suppression and crystal-clear voice assistance systems. Furthermore, the shift towards software-defined vehicles (SDVs) means that microphone performance and acoustic data processing are becoming integral parts of the vehicle’s overall software architecture, driving demand for optimized, low-latency hardware solutions.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by burgeoning automotive manufacturing bases in China and India, coupled with high adoption rates of advanced driver assistance systems (ADAS) and connected car technologies, often driven by intense competition in the electric vehicle (EV) segment. Europe and North America maintain significant market shares, characterized by stringent regulatory mandates concerning safety (eCall) and a high penetration of premium vehicles requiring advanced Active Noise Cancellation (ANC) solutions. Regional growth is further influenced by local preference for specific communication protocols and the varying levels of maturity in infrastructure supporting connected vehicle services, directly impacting the demand for robust in-cabin acoustic technology.

In terms of segmentation, the technology segment is rapidly transitioning towards MEMS microphones, largely replacing older ECM technology due to manufacturing scalability and superior performance characteristics in harsh automotive environments. By application, the Voice Recognition and Hands-Free Communication segment remains dominant, but the Active Noise Cancellation (ANC) segment is projected to exhibit the highest CAGR, especially in electric vehicles where the absence of engine noise amplifies road and wind noise, necessitating sophisticated acoustic countermeasures. The growing demand for multi-zone voice command capabilities and personalized audio experiences ensures continued innovation within the segment focused on array microphone configurations capable of precise sound source localization.

AI Impact Analysis on Automotive Microphone Market

Common user questions regarding AI's impact on the automotive microphone market center around three main themes: how AI improves voice accuracy in noisy environments, whether AI localization features require more microphones, and the future integration of voice biometrics and sentiment analysis. Users are particularly concerned with AI's ability to reliably isolate human speech from complex background noise (road, wind, music) in real-time, thereby maximizing the usability of in-car voice assistants like Alexa, Google Assistant, or native systems. The prevailing expectation is that AI, specifically using Deep Learning (DL) models for noise suppression and acoustic echo cancellation (AEC), will transform raw microphone data into highly actionable input, demanding higher fidelity microphones and integrated processing power to support these complex algorithms, thereby increasing both the volume and value of microphones utilized per vehicle.

The integration of Artificial Intelligence, particularly machine learning algorithms focused on acoustic signal processing, profoundly impacts the Automotive Microphone Market by elevating performance requirements and expanding functional scope. AI models are crucial for advanced beamforming, source separation, and noise reduction techniques, allowing microphones to operate effectively even in highly cluttered acoustic fields—a major challenge in vehicle cabins. This dependency drives demand for high-Dynamic Range (HDR) digital MEMS microphones and multi-microphone arrays (typically 4 to 8 units per vehicle) optimized for spatial audio capture, as the effectiveness of AI-driven acoustic processing is directly correlated with the quality and quantity of input data received from the sensor hardware.

Furthermore, AI facilitates the development of intelligent applications far beyond simple command input, including driver state monitoring (through detecting changes in voice tone or coughs) and enhanced safety features like detecting emergency vehicle sirens and alerting the driver, even when the in-cabin noise level is high. This necessitates microphones with extremely low self-noise and highly stable frequency responses across the human speech spectrum. The need for computational resources to run these sophisticated AI algorithms often pushes the integration of initial signal pre-processing capabilities directly into the microphone module (Smart Microphones), blurring the lines between the sensor and the edge computing unit and ensuring faster, more reliable data transmission to the main vehicle controller.

- AI drives demand for multi-microphone arrays for enhanced beamforming and sound source localization.

- Deep Learning algorithms significantly improve Noise Suppression (NS) and Acoustic Echo Cancellation (AEC) performance.

- AI enables advanced features like driver voice biometrics and acoustic event detection (e.g., siren recognition).

- Integration requires higher-fidelity Digital MEMS microphones with low latency and high dynamic range.

- The development of smart, edge-processing microphones integrates AI capabilities directly into the sensor module.

DRO & Impact Forces Of Automotive Microphone Market

The Automotive Microphone Market is significantly influenced by a balanced set of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces shaping its trajectory. Key drivers include stringent governmental regulations mandating hands-free operation and emergency communication systems (e.g., eCall, ERA-GLONASS), which require reliable in-cabin voice capture. Simultaneously, the accelerating consumer demand for seamless smartphone integration, sophisticated voice assistants, and high-quality in-cabin entertainment drives the adoption of advanced microphone arrays. However, market growth is restrained by challenges related to integrating high-performance microphone arrays into diverse vehicle models and the technical complexity associated with mitigating extremely high ambient noise levels within the automotive cabin, requiring substantial investment in R&D for effective acoustic algorithms and materials science.

Major opportunities are emerging from the rapid transition toward Electric Vehicles (EVs) and autonomous driving platforms. EVs, being quieter than internal combustion engine (ICE) vehicles, require sophisticated Active Noise Cancellation (ANC) systems, significantly increasing the count of microphones per vehicle (often dedicated solely to ANC). Autonomous vehicles, reliant on advanced Human-Machine Interfaces (HMI), will utilize microphones for multi-modal interaction and passenger monitoring, demanding highly robust acoustic sensors. The impact forces indicate a trend towards miniaturization, digitalization (MEMS transition), and functional integration, pushing component manufacturers to deliver comprehensive acoustic sensing solutions rather than isolated components.

The enduring impact forces suggest that quality and reliability will increasingly outweigh cost as a critical factor, particularly as microphones become essential safety components (e.g., in eCall) and integral parts of the complex sensor suite required for L3+ autonomy. Restraints such as long qualification cycles inherent to the automotive supply chain and intense competitive pricing pressure in high-volume segments necessitate efficient manufacturing processes (like MEMS fabrication) and strong intellectual property portfolios related to acoustic algorithms. The overarching market dynamic favors suppliers who can offer standardized, highly reliable, digitally integrated acoustic solutions that seamlessly interface with the vehicle's central processing unit, meeting both safety compliance and consumer expectations for premium audio quality.

Segmentation Analysis

The Automotive Microphone Market is meticulously segmented based on technology, connectivity, application, and vehicle type, reflecting the diverse and evolving requirements of the automotive ecosystem. The foundation of this segmentation lies in distinguishing between the core sensing technology—Electret Condenser Microphones (ECM) versus Micro-Electro-Mechanical Systems (MEMS)—which profoundly influences performance, size, cost, and reliability. This technological division is critical as it dictates the potential for digital integration and advanced signal processing capabilities required for modern applications. The subsequent segmentation by connectivity (analog vs. digital output) further defines how easily the microphone interfaces with the vehicle's electronic control units (ECUs) and digital networking systems, with digital being the clear future trend due to enhanced noise immunity over long cable runs.

Segmentation by application highlights the shift in market focus from basic communication functions to complex acoustic sensing. While Hands-Free Communication (HFC) and Voice Recognition (VR) traditionally drove volume, the fastest growth is observed in segments related to noise management, specifically Active Noise Cancellation (ANC) and Active Sound Enhancement (ASE), crucial particularly for the rising EV fleet. These specialized applications demand different array configurations and performance metrics (e.g., low-frequency response for ANC versus high-frequency clarity for VR). Finally, the vehicle type segmentation (Passenger Vehicles, Commercial Vehicles) and vehicle class (Economy, Mid-Segment, Premium) clarify spending patterns, with Premium vehicles typically adopting multi-mic arrays and specialized ANC systems first, followed by mid-segment vehicles as technology costs decrease.

Understanding these segments is vital for market strategists, as it reveals where investment in component design (e.g., ruggedized MEMS for engine compartments, low-noise variants for cabin interiors) yields the highest returns. The increasing complexity of in-car communication systems, such as personalized audio zones and passenger intercoms, also acts as a micro-segmentation driver under the broader application umbrella. The continued displacement of analog components by digital alternatives underscores the overarching trend of digitalization and software-defined acoustic environments in the modern vehicle architecture, maximizing sensor data reliability for downstream processing.

- Technology

- MEMS Microphones (Digital and Analog)

- ECM Microphones (Electret Condenser Microphones)

- Connectivity

- Analog

- Digital (PDM, I2S)

- Application

- Hands-Free Communication (HFC)

- Voice Recognition & Command (VR)

- Active Noise Cancellation (ANC) & Active Sound Enhancement (ASE)

- Telematics and Safety (eCall/bCall)

- In-Car Communication (ICC)

- Vehicle Type

- Passenger Vehicles (PV)

- Commercial Vehicles (CV)

Value Chain Analysis For Automotive Microphone Market

The value chain for the Automotive Microphone Market is defined by a multi-tiered structure, starting with upstream raw material providers and culminating in the final integration into the vehicle's electronic system. Upstream activities involve the sourcing of specialized materials, including semiconductor wafers (crucial for MEMS fabrication), acoustic dampening materials, and complex packaging components. Key players at this stage include specialized foundries and material suppliers who ensure the quality, purity, and compliance of materials necessary for components that must withstand harsh automotive conditions, such as extreme temperatures and high vibration levels. Innovation at this stage focuses on enhancing the inherent reliability and acoustic properties of the diaphragm and transducer elements.

Midstream processing involves Tier 2 and specialized microphone manufacturers (e.g., Knowles, Infineon, STMicroelectronics) who convert raw materials into finished microphone capsules or modules, often integrating necessary pre-amplification and Analog-to-Digital Conversion (ADC) circuitry. These components are then supplied to Tier 1 automotive suppliers (e.g., Continental, Bosch, Harman) who integrate the individual microphones into complex subsystems—such as full infotainment modules, telematics units, or ceiling-mounted arrays—alongside software algorithms for noise reduction, beamforming, and acoustic echo cancellation. The distribution channel predominantly flows through these established Tier 1 partnerships, as automotive manufacturers (OEMs) prefer procuring pre-validated, integrated systems rather than individual sensors directly, ensuring compliance with strict automotive quality standards (e.g., AEC-Q100).

Downstream activities involve the final integration of these Tier 1 subsystems onto the vehicle assembly line and subsequent aftermarket support. Direct distribution to OEMs is rare for standardized components like microphones; instead, the indirect distribution model through Tier 1 suppliers dominates the landscape. The aftermarket segment, though smaller, supports replacement parts and system upgrades, utilizing certified distributors and repair networks. The critical value-add in the downstream segment is the performance tuning and calibration of the microphone arrays post-installation, ensuring optimal performance of voice commands and ANC functionality tailored to the specific acoustic characteristics of each vehicle model and interior layout. The complexity of automotive qualification and the need for seamless integration reinforce the dominance of established indirect distribution channels.

Automotive Microphone Market Potential Customers

The primary customers and end-users of the Automotive Microphone Market are classified predominantly into four categories: Original Equipment Manufacturers (OEMs), Tier 1 Automotive System Integrators, the Automotive Aftermarket segment, and specialized mobility service providers. OEMs, such as Ford, General Motors, BMW, Toyota, and Tesla, are the ultimate buyers whose design specifications dictate the required technical parameters (e.g., number of microphones, digital versus analog, specific packaging) and overall volume. However, OEMs typically do not purchase microphones directly; instead, they issue contracts to Tier 1 suppliers to develop and supply the complete electronic subsystem—be it an infotainment unit, eCall module, or overhead console.

Tier 1 Automotive System Integrators, including companies like Continental, Bosch, Aptiv, and Harman International, represent the immediate, high-volume buyers for microphone manufacturers. These companies act as critical intermediaries, responsible for selecting, validating, integrating, and often packaging the microphone components with necessary processing hardware and proprietary software algorithms before delivering the finished, tested subsystem to the OEM. Their role involves rigorous testing to meet reliability standards (AEC-Q100) and ensuring interoperability with the vehicle’s central network, making them the most influential purchasing decision-makers in the value chain regarding component specifications.

The aftermarket consists of distributors and installation specialists who cater to existing vehicle owners seeking upgrades, repairs, or retrofitting (e.g., installing third-party hands-free kits or advanced telematics systems). Although this segment consumes lower volumes compared to the OEM channel, it represents an opportunity for generalized, high-flexibility microphone products. Finally, emerging potential customers include developers of next-generation mobility solutions, such as autonomous shuttle services and fleet management companies, who may require specialized acoustic monitoring and communication solutions tailored for shared, highly utilized vehicle environments, often necessitating robust, highly sensitive microphones for cabin environment analysis and safety compliance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.6 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Knowles Corporation, Infineon Technologies AG, STMicroelectronics N.V., TDK Corporation (InvenSense), AAC Technologies, Bosch Sensortec, Goertek, Sensata Technologies, NXP Semiconductors, Vesper Technologies, Hosiden Corporation, Cirrus Logic, Panasonic Corporation, Sony Semiconductor Solutions, Alps Alpine Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Microphone Market Key Technology Landscape

The technological landscape of the Automotive Microphone Market is undergoing a fundamental transformation, primarily driven by the transition from traditional Electret Condenser Microphones (ECM) to Micro-Electro-Mechanical Systems (MEMS) technology. MEMS microphones are fabricated using standard semiconductor manufacturing techniques, allowing for extreme miniaturization, high volume production consistency, and inherent resistance to mechanical shock and vibration—critical attributes for automotive applications. The integration of the acoustic sensor and the integrated circuit (IC) into a single, compact package is the cornerstone of MEMS dominance, offering improved Signal-to-Noise Ratio (SNR) and enhanced immunity to Radio Frequency (RF) interference, which is prevalent in modern vehicles packed with wireless communication systems (5G, Wi-Fi, Bluetooth). The ongoing technological push is focused on increasing the Acoustic Overload Point (AOP) of MEMS devices, allowing them to handle the extremely loud sound pressures that can occur within the vehicle cabin without distortion, while simultaneously maximizing the SNR for capturing quiet speech commands.

A second major technological trend is the pervasive shift towards digital connectivity, exemplified by microphones utilizing Pulse Density Modulation (PDM) or I2S interfaces, rapidly replacing traditional analog output microphones. Digital connectivity eliminates the need for bulky analog circuitry and provides superior signal integrity over longer transmission lines, simplifying integration into complex vehicle architectures where microphones may be located far from the main processing unit. Digital MEMS microphones facilitate advanced features such as synchronous sampling across large arrays, essential for high-precision beamforming algorithms used in voice localization and targeted noise cancellation. Furthermore, integrating specialized signal processing capabilities directly onto the microphone package (often termed 'Smart Microphones' or 'Edge-Processed Microphones') reduces latency and offloads computational burden from the central ECU, accelerating real-time response times necessary for safety-critical and highly interactive systems like voice assistants and Active Noise Cancellation (ANC).

Beyond the core sensing technology, innovation is heavily concentrated on the systems surrounding the microphone, specifically complex acoustic algorithms and array configurations. Advanced technological solutions include sophisticated beamforming techniques that use data from multiple microphones to create a virtual "listening cone," effectively isolating the speaker's voice while suppressing ambient noise and internal reflections (acoustic echo cancellation). This is crucial for multi-passenger interaction and enhancing the reliability of voice recognition systems. Furthermore, the development of specialized microphones tuned for specific automotive tasks, such as low-frequency sensing for Active Noise Cancellation (ANC), is growing. ANC technology relies on precisely measuring intrusive noise inside the cabin and generating an inverse sound wave, requiring highly accurate, low-frequency responsive microphones strategically placed near the source of unwanted noise, often integrated into seat belts or headliners. This confluence of reliable hardware and intelligent software processing defines the current high-tech trajectory of the market.

Regional Highlights

- Asia Pacific (APAC) Dominance and Growth Momentum: APAC is anticipated to be the largest and fastest-growing regional market, largely attributable to China's commanding position as the world's largest automotive manufacturer and consumer. The region is characterized by aggressive adoption of Electric Vehicles (EVs) and high consumer expectation for sophisticated in-car connectivity and infotainment features, particularly in markets like China, South Korea, and Japan. Government initiatives supporting vehicle safety and the competitive landscape of local OEMs pushing feature-rich models at competitive prices drive the rapid penetration of multi-microphone arrays for VR, HFC, and increasingly, ANC, across all vehicle segments. India is also emerging as a significant contributor, driven by growing passenger vehicle sales and mandatory telematics regulations, ensuring sustained demand for essential automotive acoustic components.

- North America (NA) Focus on Premium and Safety Features: North America holds a substantial market share, primarily driven by high consumer adoption rates of premium vehicle classes, which extensively feature advanced acoustic systems, including multi-zone climate controls integrated with voice command and high-fidelity Active Noise Cancellation. Strict regulatory environments, especially regarding driver distraction and mandates for emergency services like eCall in the broader market, ensure continuous integration of reliable communication microphones. The regional focus is heavily centered on integration with established consumer ecosystems (e.g., Apple CarPlay, Android Auto, Amazon Alexa) and the rapid development and testing of L3 and L4 autonomous vehicles, requiring robust acoustic sensor arrays for human-machine interaction validation.

- Europe's Regulatory Influence and Premium Segment Adoption: Europe is a mature market distinguished by some of the world's most stringent vehicle safety and environmental regulations, most notably the mandatory implementation of eCall systems, which guarantees a baseline demand for automotive microphones compliant with specific telematics standards. The region also boasts a high concentration of luxury and high-end vehicle manufacturers who are early adopters of complex acoustic technologies like advanced ANC systems, passenger intercoms, and personalized audio zoning. European market growth is stable, driven primarily by replacement cycles, continuous quality upgrades, and the progressive integration of sophisticated noise management features across the core model lineup, closely tied to the region’s ambitious electrification targets.

- Latin America and Middle East & Africa (MEA) Emerging Markets: These regions represent developing markets for automotive microphones, characterized by increasing vehicle parc and slowly modernizing regulatory frameworks. Growth here is primarily driven by the increasing integration of basic hands-free communication systems in mid-range vehicles and early stages of connected vehicle adoption. While volumes are currently lower than in the established regions, the potential for expansion is significant, particularly as local regulatory bodies begin to mandate certain safety features, mirroring successful implementations in Europe and North America, creating a growing baseline demand for robust, cost-effective microphone solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Microphone Market.- Knowles Corporation

- Infineon Technologies AG

- STMicroelectronics N.V.

- TDK Corporation (InvenSense)

- AAC Technologies

- Bosch Sensortec

- Goertek

- Sensata Technologies

- NXP Semiconductors

- Vesper Technologies

- Hosiden Corporation

- Cirrus Logic

- Panasonic Corporation

- Sony Semiconductor Solutions

- Alps Alpine Co., Ltd.

- Baidu Inc. (Acoustic AI)

- Harman International (Tier 1 Integration)

- Continental AG (Tier 1 Integration)

- Aptiv PLC (Tier 1 Integration)

- Rohde & Schwarz (Testing Equipment)

Frequently Asked Questions

Analyze common user questions about the Automotive Microphone market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between ECM and MEMS automotive microphones, and which technology is leading the market?

ECM (Electret Condenser Microphones) are older, generally analog, and rely on an external charge, making them more susceptible to vibration and temperature variances. MEMS (Micro-Electro-Mechanical Systems) microphones are silicon-based, offering superior miniaturization, reliability (AEC-Q100 compliance), and ease of integration into digital architectures (PDM/I2S). MEMS technology, driven by its suitability for harsh automotive environments and high-volume manufacturing consistency, is rapidly leading the market, particularly for advanced applications like ANC and voice recognition arrays.

How many microphones are typically used in a modern vehicle, and what drives the increasing count?

The microphone count in a modern vehicle ranges typically from 2 to 10 units, depending on the class and features. Economy cars may only have 2 (one for HFC/eCall). Premium and electric vehicles often use 6 to 10 microphones. The increasing count is driven primarily by Active Noise Cancellation (ANC), which requires multiple dedicated sensors to measure cabin and road noise, and the implementation of multi-zone voice recognition systems for individual passenger interaction.

What role does Active Noise Cancellation (ANC) play in the growth of the Automotive Microphone Market, especially concerning EVs?

ANC is a major growth catalyst. In Electric Vehicles (EVs), the absence of engine noise amplifies road, tire, and wind noise, making the cabin less comfortable at highway speeds. ANC systems use microphones to monitor this unwanted noise and generate opposing sound waves to cancel it out, significantly enhancing acoustic comfort. This essential feature in EVs mandates a higher density of high-performance microphones, often four or more units dedicated solely to ANC functionality.

How is AI impacting the performance and required specifications of automotive microphones?

AI, through deep learning algorithms for signal processing, demands higher fidelity and multi-channel input from microphones. AI-driven features like advanced beamforming, accurate sound source localization, and real-time noise suppression require microphones with higher Signal-to-Noise Ratios (SNR), higher Acoustic Overload Points (AOP), and digital output (PDM/I2S) to ensure clean, reliable data for complex acoustic models to process, thereby driving up the quality floor for sensor specifications.

What are the key challenges related to integrating microphone arrays into vehicle platforms?

The primary challenges include managing acoustic echo cancellation (AEC) caused by speakers, mitigating the high level of ambient noise (road noise, HVAC fan), ensuring consistent microphone performance across extreme temperature variations, and navigating the lengthy and demanding AEC-Q100 qualification cycles required by automotive OEMs. Proper placement and calibration of arrays are essential to achieve optimal beamforming and voice isolation tailored to the specific cabin geometry.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager