Automotive Middleware Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438659 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Automotive Middleware Market Size

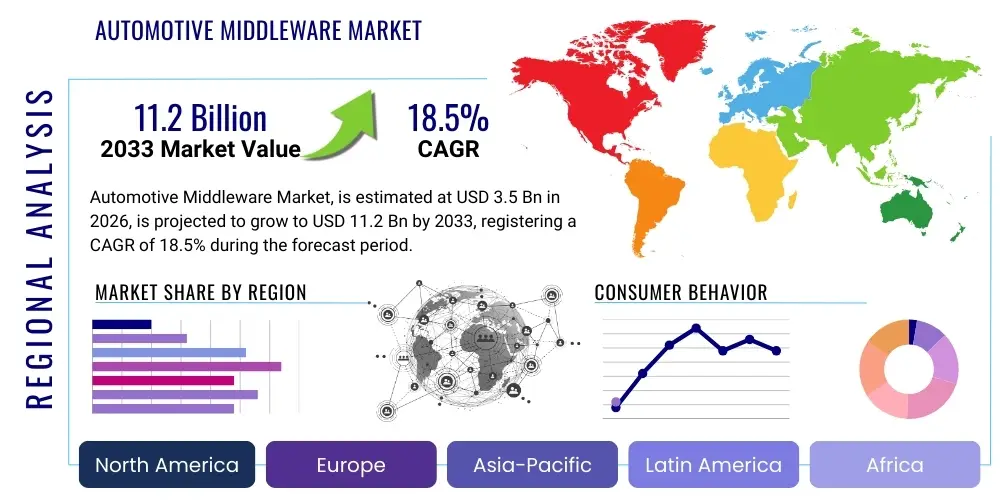

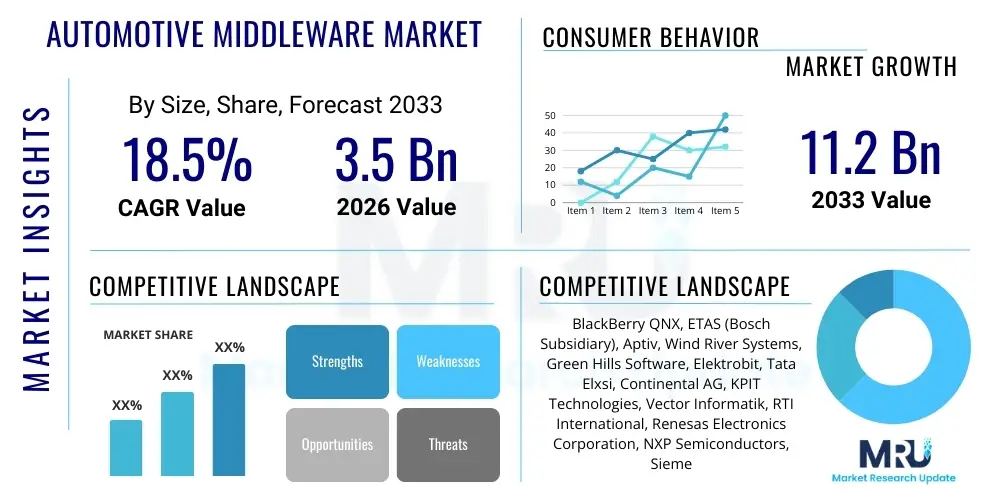

The Automotive Middleware Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 11.2 Billion by the end of the forecast period in 2033.

Automotive Middleware Market introduction

The Automotive Middleware Market encompasses software layers situated between the vehicle's operating system, hardware, and the application software. This critical layer facilitates communication, coordination, and integration of diverse Electronic Control Units (ECUs) and domain controllers within modern vehicles. As vehicles transition into sophisticated software-defined platforms, middleware solutions—such as AUTOSAR (Automotive Open System Architecture), proprietary stacks, and increasingly, standardized communication protocols like DDS (Data Distribution Service) and SOME/IP (Scalable service-Oriented Middleware over IP)—become indispensable for managing complexity, ensuring real-time performance, and upholding functional safety standards (ISO 26262). The product description centers on its role as an abstraction layer, allowing automotive Original Equipment Manufacturers (OEMs) and Tier 1 suppliers to develop application software independently of underlying hardware changes, thereby accelerating development cycles and enabling Over-The-Air (OTA) updates.

Major applications of automotive middleware span across crucial vehicular domains, including Advanced Driver Assistance Systems (ADAS), infotainment systems, body and comfort electronics, and powertrain control. In the ADAS domain, middleware manages high-throughput data streams from sensors (Lidar, Radar, Cameras) and distributes processing tasks across high-performance computing platforms, which is essential for enabling L2+ and L3 autonomous driving functionalities. Furthermore, within the cockpit domain, middleware facilitates seamless integration between smartphone mirroring, navigation, and vehicle diagnostics, providing a unified user experience. The primary benefit derived from adopting robust middleware solutions is enhanced system reliability, improved scalability, and reduced complexity associated with integrating heterogeneous systems from multiple vendors.

Driving factors propelling this market include the relentless pursuit of higher levels of vehicle autonomy (L4 and L5), the increasing demand for connected car features (V2X communication), and the necessity for centralized electronic architectures (EE Architectures). The shift from distributed ECU architectures to domain control units (DCUs) and subsequently to centralized high-performance computing (HPC) platforms necessitates advanced middleware to manage communication redundancy, handle vast amounts of data, and maintain deterministic performance required for mission-critical functions. Regulatory mandates concerning vehicle safety and cybersecurity also enforce the adoption of certified and secure middleware frameworks that can isolate software components and prevent unauthorized access, further bolstering market growth across key automotive regions.

Automotive Middleware Market Executive Summary

The Automotive Middleware Market is undergoing a fundamental transformation driven by the paradigm shift towards software-defined vehicles (SDVs). Key business trends highlight intense collaboration and strategic partnerships between traditional automotive suppliers (Tier 1s) and technology giants (Big Tech, software specialists) to develop integrated middleware platforms that support multi-core processors and heterogeneous hardware environments. There is a discernible trend toward the consolidation of software stacks, moving away from specialized, proprietary middleware toward more generalized, service-oriented architectures (SOA) based on Ethernet backbones. Financial investments are heavily skewed towards developing middleware compliant with emerging standards like Adaptive AUTOSAR, which provides the necessary flexibility for highly dynamic and resource-intensive applications such such as autonomous driving stacks and complex graphical user interfaces (GUIs).

Regional trends indicate that North America and Europe currently hold significant market share, primarily due to the stringent regulatory landscape promoting advanced safety features and the high consumer demand for sophisticated in-vehicle infotainment and connectivity solutions. These regions are early adopters of centralized E/E architectures and are home to pioneering OEMs heavily invested in developing L3/L4 autonomous capabilities, requiring advanced real-time operating systems and middleware solutions. The Asia Pacific (APAC) region, particularly China, is projected to exhibit the highest growth rate during the forecast period. This rapid expansion is fueled by aggressive governmental support for electric vehicles (EVs), the rapid digitalization of the automotive sector, and the proliferation of local tech companies developing integrated domestic software ecosystems tailored for next-generation vehicle platforms. Market expansion in APAC is strongly focused on connectivity and localized infotainment experiences, demanding flexible middleware platforms.

Segmentation trends reveal that safety-critical middleware, including solutions designed for chassis control and ADAS, accounts for a substantial revenue share, driven by mandatory safety requirements and the technical complexity involved in ensuring functional safety (ASIL D levels). However, the connectivity and infotainment segment is poised for rapid growth, reflecting the continuous consumer expectation for seamless integration between digital life and the driving experience. Furthermore, the segmentation by deployment type is shifting decisively towards embedded solutions tailored for high-performance computing platforms, replacing standalone ECUs middleware. The rise of multi-domain and zonal architectures is accelerating the adoption of domain-specific middleware layers capable of inter-domain communication and resource partitioning, emphasizing service discovery and orchestration capabilities crucial for managing complex vehicular functions efficiently and securely.

AI Impact Analysis on Automotive Middleware Market

Common user questions regarding AI's impact on the Automotive Middleware Market center on how artificial intelligence will influence the software stack's requirements for latency, throughput, and determinism. Users frequently inquire about the integration challenges of high-level AI inference engines (e.g., neural networks for perception and planning) with traditional real-time operating systems (RTOS) managed by middleware. Key concerns revolve around the safety certification process when dynamic, learning algorithms are deployed, and how middleware must adapt to manage massively parallel processing units (GPUs, NPUs) alongside conventional microcontroller units (MCUs). The general expectation is that AI will drive the need for middleware specializing in data orchestration, resource virtualization, and reliable cross-domain data transport, moving beyond simple message queues to sophisticated data-centric connectivity architectures that support heterogeneous computing and ensure high-integrity communication necessary for autonomous functions.

The integration of deep learning models and complex decision-making algorithms fundamentally changes the requirements placed on automotive middleware. AI-driven applications, particularly in autonomous driving and advanced sensor fusion, generate enormous volumes of data that must be processed in real-time with ultra-low latency. Traditional middleware often struggles with this scale and speed. Consequently, next-generation middleware must incorporate advanced capabilities for real-time data filtering, pre-processing at the edge, and efficient routing of specific data payloads to dedicated AI accelerators. This necessity has spurred the development of data-centric middleware standards, optimizing for publisher-subscriber models that ensure timely delivery of sensor information critical for safety decisions, thereby reducing the reliance on centralized processing bottlenecks.

Furthermore, AI introduces complexity related to resource management and system security. AI applications are inherently resource-hungry, requiring dynamic allocation of compute power, memory, and network bandwidth across shared high-performance platforms. The middleware must evolve to include sophisticated hypervisors and virtualization techniques that allow safe partitioning of the hardware, ensuring that safety-critical functions (managed by certified software) are isolated from non-critical AI stacks. This adaptation is crucial for maintaining functional safety and cybersecurity, as failure in an AI-driven system should not propagate to essential vehicle controls. AI is thus pushing middleware developers toward incorporating robust system monitoring, diagnostic, and fault isolation mechanisms directly into the core communication layer.

- Real-Time Data Orchestration: AI drives the demand for middleware capable of handling ultra-low latency, high-throughput communication necessary for sensor fusion and decision-making in L4/L5 autonomous systems.

- Heterogeneous Compute Management: Middleware must effectively manage and abstract diverse processing units (CPUs, GPUs, NPUs, FPGAs) to allocate resources dynamically for AI model inference and training.

- Service-Oriented Architecture (SOA) Enhancement: AI relies on dynamic services; middleware facilitates service discovery, deployment, and management across domains, supporting complex interactions between perception, localization, and planning services.

- Functional Safety for Dynamic Systems: Integrating AI necessitates new safety standards and mechanisms within middleware to monitor AI integrity, detect unexpected behavior, and provide safe fallback paths (ASIL requirements for ML components).

- Over-The-Air (OTA) Updates for Models: Middleware platforms must securely and reliably manage the deployment and validation of new or updated AI models and algorithms across the vehicle fleet.

- Data Abstraction Layers: AI algorithms need standardized, abstracted access to sensor data; middleware provides the necessary interfaces, decoupling AI application logic from proprietary hardware specifics.

- Edge Processing Optimization: Middleware is increasingly tasked with optimizing data flows to enable efficient pre-processing and localized inference at the edge, reducing bandwidth requirements and reaction time.

- Cybersecurity Hardening: AI-driven complexity increases the attack surface; middleware is crucial for enforcing strict partitioning, secure booting, and protected memory access for AI stack components.

DRO & Impact Forces Of Automotive Middleware Market

The Automotive Middleware Market is principally driven by the industry's irreversible move towards centralized E/E architectures and software-defined vehicles, fueled by the rising consumer expectation for integrated connectivity and advanced driver assistance systems (ADAS). Key drivers include stringent governmental regulations mandating enhanced safety features and the economic necessity for OEMs to accelerate software development timelines through hardware abstraction. However, the market faces significant restraints, notably the complexity and high cost associated with migrating from legacy, distributed architectures to new, service-oriented middleware frameworks, alongside the critical challenges related to cybersecurity threats and the need for standardized, cross-vendor compatibility. Opportunities are abundant, specifically in the development of hypervisor-integrated middleware for high-performance computing platforms, the expansion into the rapidly growing electric vehicle (EV) segment, and the creation of specialized data-centric middleware optimized for V2X communication and real-time AI processing.

Impact forces in this domain are high, stemming largely from technological advancement and regulatory pressure. The transition to centralized domain controllers (DCUs) and zonal architectures is a profound structural shift that mandates the adoption of advanced middleware solutions like Adaptive AUTOSAR and specialized Real-Time Operating Systems (RTOS) capable of managing mixed-criticality systems. Regulatory bodies worldwide are continuously raising the bar for functional safety (ISO 26262) and cybersecurity (ISO/SAE 21434), directly influencing the design and certification requirements for all automotive middleware components. Furthermore, the emergence of powerful silicon providers offering integrated System-on-Chips (SoCs) tailored for automotive HPC creates strong external pressure, forcing middleware vendors to optimize their stacks for specific hardware accelerators and complex multi-core environments, ensuring maximum performance utilization.

The primary restraint, the high barrier to entry imposed by functional safety certification, acts as a significant stabilizing force. Achieving safety integrity levels (ASIL B to ASIL D) for middleware running complex communication stacks requires extensive validation and rigorous testing, which is time-consuming and expensive. This restraint tends to favor established players with proven safety records. Nonetheless, the overwhelming opportunity presented by the vast untapped potential of autonomous driving stacks pushes the market forward aggressively. As the industry moves towards L4 autonomy, middleware will transition from a communication layer to an integral resource manager, tasked with orchestration, fault tolerance, and dynamic service management, defining the operational efficiency and safety of future vehicles.

Segmentation Analysis

The Automotive Middleware Market is segmented primarily based on key technological attributes, operational function, deployment location within the E/E architecture, and the level of autonomy supported. Functional segmentation distinguishes between connectivity middleware (focusing on V2X and cloud integration), safety-critical middleware (ADAS, braking), and infotainment middleware (HMIs, cockpit functions). Deployment segmentation differentiates between hardware-agnostic embedded middleware (e.g., core AUTOSAR stacks) and integrated solutions designed specifically for high-performance centralized computing platforms using hypervisors. The comprehensive segmentation helps OEMs choose the appropriate software architecture based on the vehicle platform's complexity, safety requirements, and target application domain, ensuring optimized performance and certification compliance for specific vehicular functions.

- By Component Type:

- Operating System (OS) Middleware

- Data Distribution Service (DDS)

- Message Passing Interface (MPI)

- Software Development Kits (SDKs)

- Application Programming Interfaces (APIs)

- Hypervisor Middleware

- By Technology/Standard:

- Classic AUTOSAR

- Adaptive AUTOSAR

- Proprietary Middleware Stacks

- Data Distribution Service (DDS)

- SOME/IP (Service-Oriented Middleware over IP)

- MQTT (Message Queuing Telemetry Transport)

- By Application Domain:

- Advanced Driver Assistance Systems (ADAS) & Autonomous Driving

- Sensor Fusion Middleware

- Real-time Planning and Control Middleware

- High-Performance Computing (HPC) Communication

- Infotainment & Cockpit Systems

- HMI (Human Machine Interface) Middleware

- Connectivity (V2X, Cloud) Middleware

- Smartphone Integration Middleware

- Body & Comfort Electronics

- Powertrain & Chassis Control

- Safety-Critical RTOS Middleware (ASIL D)

- By Vehicle Type:

- Passenger Vehicles

- Standard (ICE/Hybrid)

- Electric Vehicles (EVs)

- Commercial Vehicles

- Heavy Trucks

- Buses

- By Deployment Location/Architecture:

- Distributed ECU Architectures (Legacy)

- Domain Controller Units (DCUs)

- Zonal Architectures

- Centralized High-Performance Computing (HPC) Platforms

Value Chain Analysis For Automotive Middleware Market

The value chain for the Automotive Middleware Market begins upstream with semiconductor manufacturers and OS providers, who supply the foundational hardware (SoCs, MCUs) and core operating systems (Linux, QNX, proprietary RTOS). This foundational layer dictates the performance ceiling and security baseline of the entire software stack. Key upstream players include specialized silicon vendors who design automotive-grade chips suitable for high-performance computing, along with foundational software providers who offer hypervisors and low-level drivers crucial for hardware abstraction. Efficiency and security at this stage are paramount, as middleware solutions must be meticulously optimized for the underlying hardware architecture to achieve required real-time performance and thermal management.

The midstream segment constitutes the core function of the market: the development and integration of the middleware itself. This stage involves specialized software firms, established Tier 1 suppliers (shifting roles from hardware providers to software integrators), and dedicated middleware solution providers (e.g., those focused on AUTOSAR stacks or proprietary communication layers). These entities build the essential communication fabric, service-oriented layers, and abstraction interfaces that allow application developers to operate efficiently. The differentiation in this stage lies in compliance with standards (AUTOSAR, ISO 26262), the robustness of their cybersecurity measures, and their ability to integrate seamlessly across multiple vendor ecosystems. Distribution channels are complex, involving direct licensing models where middleware is sold or licensed directly to OEMs or Tier 1s, often bundled with support and integration services.

Downstream, the value chain involves application developers (internal OEM teams, third-party software firms) who utilize the middleware to build final applications for ADAS, infotainment, and vehicle control. The direct customers are primarily the OEMs and Tier 1 suppliers who are responsible for the final vehicle integration and certification. The distribution channel is heavily skewed toward indirect models where the middleware is embedded within the vehicle's electronic architecture during the design phase. Direct sales are often observed in the form of maintenance contracts, software licensing renewals, and professional services related to integration and customization. The effectiveness of the middleware directly impacts the time-to-market and the overall quality and safety of the vehicle's software-driven features, linking the value back to the end-user experience and brand reputation.

Automotive Middleware Market Potential Customers

Potential customers and primary buyers of automotive middleware solutions are predominantly automotive Original Equipment Manufacturers (OEMs) and large, globally active Tier 1 automotive suppliers. OEMs, including major players in traditional combustion engines, electric vehicle specialists, and new mobility providers, are increasingly investing in in-house software development capabilities but still rely on external middleware vendors to provide foundational, certified stacks (like Classic and Adaptive AUTOSAR) necessary for functional safety and complex domain integration. For these buyers, the key decision criterion is the middleware's certification level (ASIL compliance), its capability to support centralized E/E architectures, and the total cost of ownership over the vehicle's lifecycle, factoring in OTA updates and long-term maintenance.

Tier 1 suppliers, such as those specializing in cockpit systems, ADAS hardware, or chassis control units, represent the second major customer segment. These companies procure middleware to integrate their hardware components effectively and provide standardized interfaces to the OEM. For instance, a Tier 1 developing a new sensor suite for autonomous driving requires middleware that can efficiently handle sensor data fusion and communication with the central domain controller, ensuring deterministic latency. The purchasing decision here is heavily influenced by the middleware's compatibility with their proprietary hardware and its support for high-bandwidth protocols like Ethernet and SOME/IP.

Emerging customers include specialized technology companies entering the automotive sector, such as autonomous vehicle technology startups and mobility service providers who develop highly specific software stacks for robotaxis or fleet management. These players often seek highly modular, lightweight, and open-source-compatible middleware solutions that can be rapidly customized for their niche applications, focusing less on traditional, heavy, certified stacks and more on modern, data-centric solutions like DDS. Additionally, industrial control and testing firms that develop simulation and validation tools for automotive software also act as buyers, requiring licenses for representative middleware stacks to accurately test application software before physical deployment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 11.2 Billion |

| Growth Rate | CAGR 18.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BlackBerry QNX, ETAS (Bosch Subsidiary), Aptiv, Wind River Systems, Green Hills Software, Elektrobit, Tata Elxsi, Continental AG, KPIT Technologies, Vector Informatik, RTI International, Renesas Electronics Corporation, NXP Semiconductors, Siemens, ZF Friedrichshafen AG, Argus Cyber Security, TTTech Auto, OpenSynergy, Aricent (Capgemini Engineering), IBM. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Middleware Market Key Technology Landscape

The technology landscape of automotive middleware is highly dynamic, centered on the evolution from monolithic, proprietary software stacks to flexible, service-oriented architectures (SOAs). The adoption of Ethernet as the high-speed backbone for in-vehicle communication is foundational, necessitating middleware that supports protocols like SOME/IP for efficient service discovery and communication. Furthermore, Data Distribution Service (DDS) is rapidly gaining traction, particularly for handling massive, real-time data flows from autonomous driving sensors, offering deterministic, quality-of-service (QoS) guarantees crucial for mission-critical applications. The shift towards powerful multicore System-on-Chips (SoCs) requires sophisticated middleware capable of managing task scheduling and ensuring hardware resource partitioning, often through integrated hypervisors, which allow multiple operating systems (e.g., QNX for safety, Linux for infotainment) to run concurrently and safely on a single physical compute unit.

Adaptive AUTOSAR represents a critical technological shift, moving beyond the traditional constraints of Classic AUTOSAR (used primarily for microcontrollers and hard real-time tasks) to provide a platform suitable for high-performance computing (HPC) environments running complex applications like ADAS and AI. Adaptive AUTOSAR integrates concepts from standard IT architectures, supporting POSIX operating systems, service discovery, and secure communication, addressing the complexity introduced by C++ application development and dynamic service deployment. Concurrently, hypervisor technology is integral, acting as a crucial layer of middleware itself. Hypervisors ensure memory protection and isolation between different software domains—for example, preventing a failure in the non-safety-critical infotainment domain from affecting the ASIL-D-rated autonomous driving stack—thereby supporting mixed-criticality systems on centralized platforms.

Another emerging technological focus is Over-The-Air (OTA) update middleware. As vehicles become perpetually connected, the capability to securely, efficiently, and reliably update various software components, from low-level ECUs to high-level AI models, becomes essential. OTA middleware must incorporate robust security checks, differential update capabilities (to minimize data transfer), and fail-safe mechanisms to ensure the vehicle remains operational even if an update fails midway. Looking ahead, security-focused middleware, including embedded intrusion detection systems (IDS) and secure boot mechanisms managed at the middleware level, are becoming standard requirements to counter sophisticated cyber threats targeting the vehicle's communication channels and application layers, ensuring holistic vehicle protection across all domains.

Regional Highlights

Regional dynamics play a crucial role in shaping the Automotive Middleware Market, influenced by regulatory frameworks, consumer adoption rates of new vehicle technologies, and the concentration of automotive R&D facilities. North America and Europe lead in advanced ADAS and autonomous vehicle technology development, consequently exhibiting high demand for complex, certified middleware solutions, particularly those adhering to Adaptive AUTOSAR standards and incorporating robust cybersecurity features. These regions are characterized by a focus on high-reliability, safety-critical middleware necessary for Level 3 and Level 4 deployment, driving significant investment from established OEMs and Tier 1 suppliers in next-generation electronic architectures. Furthermore, the strong presence of major technology providers specializing in silicon and operating systems (e.g., QNX, Green Hills) further cements their technological leadership in foundational middleware layers.

The Asia Pacific (APAC) region, dominated by the markets of China, Japan, and South Korea, is projected to be the fastest-growing market. This growth is primarily driven by the aggressive push for electrification and the rapid adoption of highly connected vehicles (V2X). China, in particular, is witnessing intense competition among local EV manufacturers who prioritize innovative, localized infotainment and connectivity features, often utilizing open-source or domestically developed middleware stacks tailored for fast iteration cycles. While safety standards are important, the initial focus in parts of APAC often lies in delivering feature-rich digital cockpits and robust cloud connectivity, requiring flexible, high-throughput connectivity middleware. Japan and South Korea, however, maintain a strong focus on high-quality, safety-certified solutions, aligning more closely with European standards for mission-critical systems.

Latin America and the Middle East & Africa (MEA) currently represent smaller markets but are expected to experience moderate growth, mainly concentrated in urban centers adopting basic levels of advanced safety features (e.g., mandated ABS, basic ADAS). Middleware demand in these regions is focused on cost-effective, reliable solutions for basic vehicle functions and growing telematics requirements, rather than the high-end autonomous stacks seen in North America and Europe. However, regional regulatory changes regarding vehicle safety standards and increasing foreign investment in localized automotive manufacturing will gradually increase the adoption of standardized middleware platforms over the forecast period, emphasizing the need for robust software maintenance capabilities.

- North America: Leading market for ADAS/AV middleware; high demand for certified, safety-critical stacks (ASIL D); strong integration of hypervisors and HPC platforms; presence of major software and semiconductor innovators.

- Europe: Pioneers in functional safety (ISO 26262) and cybersecurity (ISO/SAE 21434) compliance; rapid deployment of Adaptive AUTOSAR and SOA architectures; key region for advanced R&D and standardization efforts.

- Asia Pacific (APAC): Highest expected growth rate, driven by EV adoption and demand for advanced connectivity; China focuses on domestic, innovative solutions for infotainment; Japan and South Korea maintain emphasis on reliability and safety protocols.

- Latin America: Emerging market focusing on basic safety and telematics applications; gradual movement towards standardized global architectures driven by global OEM platforms.

- Middle East & Africa (MEA): Nascent market primarily driven by regulatory push for basic safety features and investment in localized assembly; future growth linked to smart city initiatives and logistics sector digitalization.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Middleware Market.- BlackBerry QNX

- ETAS (Bosch Subsidiary)

- Aptiv

- Wind River Systems

- Green Hills Software

- Elektrobit

- Tata Elxsi

- Continental AG

- KPIT Technologies

- Vector Informatik

- RTI International (Real-Time Innovations)

- Renesas Electronics Corporation

- NXP Semiconductors

- Siemens

- ZF Friedrichshafen AG

- Argus Cyber Security (A Continental Company)

- TTTech Auto

- OpenSynergy

- Aricent (Capgemini Engineering)

- IBM

Frequently Asked Questions

Analyze common user questions about the Automotive Middleware market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary role of middleware in Software-Defined Vehicles (SDVs)?

The primary role of automotive middleware in Software-Defined Vehicles (SDVs) is to act as the essential communication and abstraction layer, decoupling application software from underlying hardware details. It enables seamless integration across heterogeneous systems (ECUs, domain controllers, HPCs), manages real-time data flows, facilitates service discovery, and ensures functional safety and cybersecurity compliance necessary for complex, interconnected vehicular features and Over-The-Air (OTA) updates.

How does Adaptive AUTOSAR differ from Classic AUTOSAR and what is its application?

Classic AUTOSAR is designed for resource-constrained microcontrollers (MCUs) handling hard real-time tasks (like powertrain control) and uses static configurations. Adaptive AUTOSAR, conversely, is built for high-performance computing (HPC) platforms running POSIX operating systems (like Linux) and supports dynamic service-oriented architectures (SOA). It is primarily used for complex, non-deterministic applications such as autonomous driving stacks, infotainment systems, and advanced sensor fusion.

What is the significance of the Data Distribution Service (DDS) protocol in autonomous driving middleware?

DDS is highly significant in autonomous driving middleware because it offers a data-centric connectivity standard that guarantees ultra-low latency, high-throughput, and quality-of-service (QoS) for real-time data exchange. It is critical for efficiently routing massive streams of sensor data (Lidar, Radar) between different processing nodes in a distributed manner, ensuring deterministic timing essential for safety-critical path planning and object perception algorithms.

What are the main cybersecurity challenges addressed by modern automotive middleware?

Modern automotive middleware addresses cybersecurity challenges by enforcing strict software isolation (via hypervisors), managing secure communication channels (e.g., using secure SOME/IP or Transport Layer Security), facilitating secure boot procedures, and integrating intrusion detection systems (IDS). The goal is to prevent unauthorized access, isolate compromised components, and protect the integrity and confidentiality of critical vehicle data and functions across the E/E architecture.

How do centralized E/E architectures impact the demand for middleware solutions?

The shift to centralized E/E architectures (domain controllers and zonal systems) dramatically increases the complexity managed by middleware. It drives demand for middleware that can handle mixed-criticality systems, support robust resource virtualization, manage high-speed Ethernet communication across domains, and orchestrate dynamic services. This transition is boosting the market for specialized hypervisor-integrated and Adaptive AUTOSAR-compliant middleware platforms.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager