Automotive Nickel Wire Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433552 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Automotive Nickel Wire Market Size

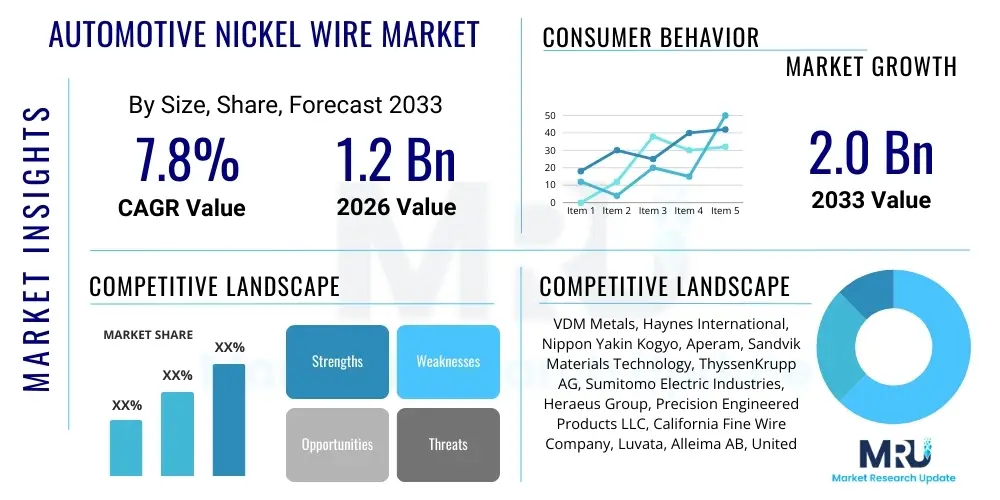

The Automotive Nickel Wire Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $2.0 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the accelerated global transition towards electric vehicles (EVs) and the increasing complexity of electronic systems integrated into modern automobiles. Nickel wire, valued for its high thermal stability, excellent corrosion resistance, and superior electrical conductivity, is becoming indispensable in high-performance automotive applications, particularly within battery management systems (BMS), sensing units, and advanced wiring harnesses that require reliability under extreme operating conditions.

The valuation reflects robust demand across several key application areas, notably high-voltage battery modules and specialized sensors crucial for safety and autonomous driving features. The stringent regulatory framework regarding vehicle emissions and the corresponding push for lightweighting and efficiency further solidify the market position of nickel and high-nickel alloys. Manufacturers are increasingly prioritizing nickel-based materials over traditional copper alloys in specific high-heat or corrosive environments, ensuring the longevity and performance of critical automotive components over the vehicle's lifespan. The projected market size demonstrates significant investment in advanced material science and manufacturing capabilities tailored specifically for the evolving automotive supply chain.

Geographic expansion, particularly in established automotive manufacturing hubs in Asia Pacific and the rapid adoption of new energy vehicles (NEVs) in Europe and North America, contributes substantially to the overall market valuation. Key stakeholders are focusing on developing ultra-fine gauge and high-purity nickel wire variants, optimizing them for micro-electronic components and advanced resistive heating elements. The consistent increase in vehicle production volumes globally, coupled with the rising nickel content per vehicle (especially in high-capacity EV batteries), provides a clear foundation for the forecasted market expansion and value appreciation through 2033.

Automotive Nickel Wire Market introduction

The Automotive Nickel Wire Market encompasses the production, distribution, and application of pure nickel wire and nickel alloy wires specifically designed for use within vehicle manufacturing. These materials are critical components utilized in sophisticated automotive systems where high reliability, precise electrical properties, and resistance to environmental stress—such as heat, vibration, and chemical exposure—are mandatory. Products range from fine wires used in temperature sensors and pressure sensors to robust wires integrated into wiring harnesses, crucial electronic modules, and high-performance battery packs, especially in the burgeoning electric vehicle sector.

Major applications of automotive nickel wire include wiring resistance temperature detectors (RTDs), specialized resistors, fuse links, high-temperature heating elements (HVAC/defogging systems), and terminals within battery connections where thermal management is paramount. The primary benefits driving its adoption include excellent solderability, low electrical resistivity, and superior mechanical strength at elevated temperatures compared to conventional materials. The wire’s magnetic properties and resistance to oxidation also make it the material of choice for precise sensor applications required for engine management, safety systems (ABS, stability control), and infotainment functionalities.

The market growth is fundamentally driven by several critical factors: the massive global shift toward electromobility, which significantly increases the demand for nickel in battery interconnections and thermal control units; the increasing penetration of advanced driver-assistance systems (ADAS) and autonomous vehicle technologies, requiring more complex and reliable sensor networks; and the continuous regulatory pressure to enhance vehicle safety and fuel efficiency, necessitating durable and lightweight component solutions. Furthermore, advancements in wire drawing and coating technologies are expanding the material’s utility into smaller, more densely packed electronic assemblies, ensuring sustained market expansion throughout the forecast period.

Automotive Nickel Wire Market Executive Summary

The Automotive Nickel Wire Market exhibits dynamic growth propelled primarily by sustained investment in Electric Vehicle (EV) infrastructure and component development. Business trends indicate a strategic pivot by major wire manufacturers towards specialized, high-purity nickel alloys optimized for thermal management and high-current applications within automotive batteries and power electronics. There is a strong emphasis on achieving higher tensile strength and improved fatigue resistance, addressing the stringent requirements of modern vehicle operation. Collaborations between material suppliers and Tier 1 automotive component manufacturers are intensifying, focusing on standardizing material specifications to streamline production and enhance supply chain resilience in the face of fluctuating raw material costs.

Regionally, the Asia Pacific (APAC) market, spearheaded by China and South Korea, maintains dominance due to high volume production of both conventional and new energy vehicles, coupled with substantial investments in localized battery manufacturing capabilities. Europe shows the fastest growth rate, fueled by aggressive governmental mandates supporting EV adoption and technological leadership in advanced automotive sensors and safety systems. North America is characterized by robust R&D spending focused on high-performance nickel-chromium and nickel-iron alloys for critical sensor and heating applications, ensuring market maturity and consistent demand across its diverse automotive manufacturing base.

Segment trends highlight the Battery/HVAC application segment as the primary growth engine, particularly the need for nickel welding wire and busbars within high-capacity battery packs. The Type segmentation shows increased preference for High Purity Nickel Wire (Ni 200/201 series) due to its superior electrical properties crucial for precision electronics and sensors. The market is also witnessing a trend toward miniaturization, driving demand for ultra-fine nickel wire (less than 0.1 mm diameter) used in micro-electronic components and complex wiring harnesses, positioning specialized material providers favorably within the competitive landscape.

AI Impact Analysis on Automotive Nickel Wire Market

User queries regarding the impact of Artificial Intelligence (AI) on the Automotive Nickel Wire Market often center on how AI-driven manufacturing efficiencies and the requirement for highly precise, reliable components in autonomous systems will influence material specifications. Common concerns revolve around whether AI will automate quality control to such an extent that material failure rates diminish drastically, potentially altering demand for ultra-premium materials, or conversely, whether the extreme operational demands of AI-driven systems (such as high-speed data processing and thermal loading) will necessitate even more specialized, high-performance nickel alloys. Users are keenly interested in AI’s role in optimizing the wire drawing process, predicting material fatigue, and integrating sensor data for real-time performance monitoring within the vehicle.

AI's primary influence is observed in two major areas: optimizing the manufacturing process and enhancing the performance requirements of the end product. In manufacturing, AI algorithms analyze vast datasets from wire drawing, annealing, and coating processes to predict material defects, minimize waste, and ensure stringent quality control, thereby improving the consistency and purity of the nickel wire produced. This precision is essential for components used in sensitive automotive electronics. Simultaneously, the deployment of AI in autonomous vehicles requires an extensive network of highly reliable sensors and high-speed data transfer cables, many of which utilize nickel alloys for optimal conductivity and thermal management. The integration of AI-powered diagnostics systems also drives demand for sophisticated, durable wires that can withstand the intense operational cycles inherent in ADAS systems.

Furthermore, AI-driven predictive maintenance and battery management systems (BMS) in EVs rely heavily on accurate thermal sensing and current flow monitoring. Nickel-based resistance wires are integral to these sensors. The complexity and data throughput of these AI systems mandate materials with exceptional long-term stability and minimal drift in electrical properties. Therefore, AI does not diminish the need for nickel wire; rather, it raises the quality standard and volume requirement for specialized, high-performance nickel alloys that can support the high data loads, thermal stress, and extreme reliability required by next-generation autonomous and electrified vehicle architectures.

- AI optimizes wire manufacturing processes (drawing, annealing) leading to higher purity and fewer defects.

- Predictive maintenance systems driven by AI increase reliance on highly accurate, nickel-based temperature and current sensors.

- AI-controlled autonomous vehicle sensors and electronic control units (ECUs) demand ultra-reliable, high-temperature resistant nickel alloy wiring.

- Machine learning algorithms are utilized for real-time fatigue analysis, dictating stricter quality requirements for automotive-grade nickel wire.

- Increased data processing and thermal loads from AI hardware necessitate specialized nickel alloys for enhanced heat dissipation and electrical stability.

DRO & Impact Forces Of Automotive Nickel Wire Market

The Automotive Nickel Wire Market is significantly shaped by a confluence of accelerating drivers (D), persistent restraints (R), emerging opportunities (O), and potent impact forces. Key drivers include the exponential growth in electric vehicle production worldwide, which necessitates vast quantities of nickel wire for battery connections and thermal management systems, and the increasing reliance on complex electronic safety systems (like ADAS) that require reliable high-performance sensors utilizing nickel elements. These driving forces create inherent market momentum, pushing material innovation and volume production capabilities across the globe. The global mandate for reduced carbon emissions and improved fuel efficiency also encourages lightweighting, often favoring high-strength, low-density nickel alloys in critical structural and electrical applications.

Restraints primarily revolve around the volatility and sustainability concerns associated with nickel raw material prices. The global nickel supply chain is subject to geopolitical risks and intense extraction and refining scrutiny, posing challenges to consistent pricing and reliable long-term supply agreements for wire manufacturers. Furthermore, the complexity and high initial cost associated with manufacturing ultra-high purity and specialized nickel alloy wires, requiring sophisticated drawing and annealing equipment, act as a barrier to entry for smaller players. While substitutes like copper alloys exist for lower-temperature or less demanding applications, the specific thermal stability and corrosion resistance of nickel often render substitution unfeasible in high-stress automotive environments.

Opportunities are abundant, particularly in developing advanced materials tailored for extreme conditions, such as high-voltage charging infrastructure and solid-state battery technology, which will redefine wire performance criteria. The expansion of hydrogen fuel cell vehicles (FCVs) also presents a niche opportunity, as nickel alloys are critical for corrosion-resistant components within the fuel cell stack. Key impact forces include stringent governmental regulations (e.g., EU RoHS/REACH compliance) dictating material composition, leading to significant R&D efforts to produce compliant and sustainable wires. Technological advancements in additive manufacturing methods for specialized nickel components, while nascent, pose a potential disruptive force, influencing how and where nickel materials are incorporated into future vehicle designs, compelling traditional wire manufacturers to rapidly adopt new fabrication methodologies to remain competitive.

Segmentation Analysis

The Automotive Nickel Wire Market is strategically segmented to provide clarity on market demand dynamics, addressing variations in material purity, application requirements, and end-user vehicle types. The segmentation by Type primarily differentiates between High Purity Nickel Wire (often used in temperature-sensitive sensors and high-precision electronic components) and Nickel Alloy Wire (including Nickel-Chromium, Nickel-Iron, and Nickel-Copper alloys, used when mechanical strength or high-temperature resistance is prioritized, such as in heating elements and specialized harnesses). This distinction is crucial as it reflects the differing costs and performance characteristics required by various automotive subsystems.

Segmentation by Application provides insight into the major demand centers within the vehicle. Key segments include Batteries/HVAC (dominated by EV battery interconnections and resistive heating elements), Sensors (critical for engine management and safety systems), Wiring Harnesses (for general electrical distribution requiring robust performance), and Electronic Components (such as resistors and terminals). The rapid growth of the Batteries/HVAC segment, driven exclusively by vehicle electrification trends, is fundamentally reshaping the volume and gauge requirements for nickel wire manufacturers globally, necessitating large-scale production capabilities focused on reliable, low-resistance materials suitable for high-current transfer.

Further segmentation by Vehicle Type—Passenger Vehicles, Commercial Vehicles, and Electric Vehicles (EVs)—allows for targeted market strategy development. EVs represent the fastest-growing segment and the highest consumer of specialized nickel wire due to the complexity and size of their battery packs and associated thermal management systems. The material specifications for passenger vehicles tend to focus on lightweighting and durability for general electronic systems, while commercial vehicles prioritize extreme durability and resistance to wear and tear over long operational cycles. Understanding these variances is vital for material suppliers to align their production capabilities and R&D efforts with specific automotive OEM needs and regulatory standards across different vehicle categories.

- By Type:

- High Purity Nickel Wire (Ni 200, Ni 201)

- Nickel Alloy Wire (Ni-Cr, Ni-Fe, Ni-Cu Alloys)

- By Application:

- Sensors and Thermocouples

- Batteries/HVAC (Heating, Ventilation, Air Conditioning)

- Wiring Harnesses and Cables

- Fuses and Electrical Components

- By Vehicle Type:

- Passenger Vehicles (PV)

- Commercial Vehicles (CV)

- Electric Vehicles (EV) and Hybrid Vehicles (HEV/PHEV)

- By Gauge/Diameter:

- Ultra-Fine Wire (Below 0.1 mm)

- Fine Wire (0.1 mm - 0.5 mm)

- Medium/Heavy Gauge Wire (Above 0.5 mm)

- By Process:

- Drawn Wire

- Coated/Insulated Wire

Value Chain Analysis For Automotive Nickel Wire Market

The value chain for the Automotive Nickel Wire Market begins with upstream activities involving the extraction, refining, and alloying of raw nickel ore. Raw material providers, often large global mining conglomerates, supply high-purity nickel cathodes or ferronickel to specialized metallurgical companies. The quality and purity of this upstream input are crucial, as slight contaminants can significantly affect the electrical and mechanical properties of the final wire product, particularly in sensitive automotive sensor applications. Processing involves melting, casting, and initial rolling into billets or rods, setting the stage for the highly specialized wire manufacturing segment. Fluctuations in nickel commodity pricing at this initial stage have a direct and significant impact on the final product cost and market pricing dynamics.

The middle segment of the value chain is dominated by specialized wire manufacturers. These firms employ advanced technologies, including cold drawing, annealing (heat treatment to achieve specific mechanical properties), and surface treatments (cleaning or coating). Precision drawing capabilities, often using diamond dies, are required to produce ultra-fine gauge wires demanded by micro-electronics and sensors. Direct distribution involves supplying finished wire products, either spooled or cut to specification, directly to Tier 1 automotive component suppliers (e.g., harness makers, sensor manufacturers, and battery pack integrators) who incorporate the wire into their final assemblies. Indirect distribution routes involve specialized metals distributors or traders who hold inventory and supply smaller-volume customers or niche aftermarket repair segments, providing crucial just-in-time inventory management services.

Downstream analysis focuses on the integration of the nickel wire into final automotive components and ultimately the vehicle assembly plant (OEM). Tier 1 suppliers utilize the wire for complex operations like automated ultrasonic welding in battery packs, or encapsulation within protective sensor housings. The final customers (the OEMs) demand stringent quality assurance, traceability, and compliance with automotive standards (such as IATF 16949). The efficiency and performance of the distribution channel—whether direct or indirect—are paramount for minimizing lead times, ensuring material specifications are met, and supporting the continuous production schedules of global vehicle manufacturing. Close collaboration between wire manufacturers and downstream integrators is essential for co-developing new materials suited for emerging technologies like 800V EV architectures or enhanced sensor resilience.

Automotive Nickel Wire Market Potential Customers

The primary potential customers and end-users of automotive nickel wire are segmented across various tiers of the automotive supply chain, reflecting the material’s integration at different stages of component assembly. The most significant customer base comprises Tier 1 suppliers who specialize in manufacturing complex subsystems. This includes companies that produce specialized wiring harnesses for high-temperature zones (like engine compartments or exhaust systems), manufacturers of thermal management systems and HVAC units that rely on nickel-based heating elements, and critical suppliers of safety sensors (e.g., oxygen, temperature, pressure sensors) where the stability of nickel resistance wire is indispensable for accurate operation. These buyers typically require high-volume, standardized products but demand rigorous quality control and technical support regarding material fatigue and thermal performance.

A second major customer category is Electric Vehicle (EV) battery pack assemblers and integrators. Given the high current and thermal requirements of lithium-ion and future solid-state batteries, nickel wire, often in the form of specialized welding wire or terminals, is critical for interconnecting cells and modules. These customers prioritize materials offering optimal conductivity, superior weldability, and exceptional resistance to internal corrosion and thermal cycling inherent in battery operation. Their purchasing decisions are heavily influenced by the wire's contribution to improving the battery's energy efficiency, reliability, and overall service life. The rapid increase in global EV production ensures this segment remains the fastest-growing consumer base for automotive nickel wire.

Finally, direct Original Equipment Manufacturers (OEMs), while sometimes sourcing components through Tier 1 suppliers, also represent potential customers, particularly those engaged in advanced R&D or specialized, low-volume vehicle production (e.g., luxury or performance vehicles). These OEMs often dictate highly specific material criteria for proprietary components, such as custom electronic control unit (ECU) internal wiring or specialized connectivity solutions required for autonomous driving hardware. Additionally, the aftermarket parts and repair industry constitutes a stable, albeit smaller, customer segment, requiring nickel wire for replacement sensors, resistive heating elements, and specialized repair kits, often sourced through indirect distribution channels focusing on durability and broad compatibility.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $2.0 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | VDM Metals, Haynes International, Nippon Yakin Kogyo, Aperam, Sandvik Materials Technology, ThyssenKrupp AG, Sumitomo Electric Industries, Heraeus Group, Precision Engineered Products LLC, California Fine Wire Company, Luvata, Alleima AB, United Wire, Reading Alloys Inc., Kanthal (A unit of Sandvik), Industrial Metals, Fort Wayne Metals, Custom Wire Technologies, Tinsley Wire (Sheffield) Ltd., Ulbrich Stainless Steels & Special Metals. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Nickel Wire Market Key Technology Landscape

The technological landscape of the Automotive Nickel Wire Market is characterized by a push towards ultra-high precision manufacturing and advanced material engineering to meet the rigorous demands of electric and autonomous vehicles. A core technology is precision wire drawing, particularly the use of multi-stage cold drawing and advanced die materials (such as single-crystal diamond dies) to achieve extremely tight tolerance and consistent mechanical properties for ultra-fine wires (down to 10 microns). Annealing technology is also critical; modern batch and continuous annealing furnaces utilize precise atmospheric control (often hydrogen or inert gas environments) to optimize the crystalline structure of the nickel, maximizing its electrical conductivity and thermal stability while minimizing internal stresses that could lead to premature failure under vibration or thermal cycling in automotive applications.

Another pivotal area is the development of specialized coatings and insulation systems tailored for high-voltage and high-temperature environments. For EV battery interconnects, manufacturers employ nickel-plating on copper wires or specialized polymeric insulation (e.g., PEEK, PTFE derivatives) that can withstand temperatures exceeding 250°C and resist aggressive chemicals and battery electrolytes. Furthermore, advancements in metal joining and welding technologies, specifically laser and ultrasonic welding techniques, are vital for battery assembly, as they require specialized nickel welding wires that ensure low-resistance, high-integrity electrical connections between battery cells. These technologies must integrate seamlessly with high-speed automated assembly lines common in modern gigafactories, demanding material consistency and predictable performance.

The integration of advanced materials science, focusing on Nickel Alloy development, is also central. Research into Nickel-based superalloys and specialized resistance alloys (e.g., Nickel-Chromium) is aimed at increasing the wire’s fatigue life and resistance to oxidation and creep under persistent high operational temperatures—requirements essential for exhaust sensors and high-temperature heating systems. Digitalization technologies, including computer-aided modeling and simulation (CAE/CFD), are increasingly used to predict the thermal and mechanical performance of new wire designs before physical prototypes are manufactured. This predictive modeling capability significantly shortens the development cycle, allowing manufacturers to quickly customize wire properties to meet evolving OEM specifications for next-generation vehicle architectures.

Regional Highlights

Regional dynamics within the Automotive Nickel Wire Market are heavily influenced by geographic concentrations of automotive production, regulatory frameworks concerning electrification, and localized raw material supply chain strengths. Asia Pacific (APAC) stands as the largest market, primarily due to China's leading role in global vehicle manufacturing (both ICE and NEVs) and the massive capacity expansion in battery production across China, South Korea, and Japan. The region benefits from lower manufacturing costs and government incentives promoting EV adoption, leading to substantial volume consumption of nickel wire for battery packs, charging infrastructure, and general electronics. The immense scale of production in APAC drives global price competitiveness and material innovation, particularly in fine wire drawing for consumer electronics integration into vehicles.

Europe demonstrates the fastest compound annual growth rate, spurred by stringent carbon emission targets set by the European Union and significant public and private investment in electromobility. Western European countries, particularly Germany and France, are focal points for advanced automotive component R&D, leading to high demand for premium, high-specification nickel alloy wires used in complex sensor systems, high-voltage harnesses, and sophisticated thermal management systems. European manufacturers prioritize compliance with strict environmental directives (like REACH) and focus heavily on material traceability and sustainable sourcing practices, adding a premium dimension to the regional market structure.

North America maintains a robust market position, characterized by high demand for high-performance specialty alloys, particularly within the commercial vehicle and large truck segments, which require exceptional durability. The region is seeing renewed investment in domestic EV and battery manufacturing, particularly driven by legislative actions aimed at securing local supply chains. This localized manufacturing push is accelerating the adoption of specialized nickel wires for domestic battery gigafactories and advanced defense-related automotive technologies. While North America's total vehicle volume is lower than APAC, the focus on heavy-duty and high-power applications ensures consistent high demand for thicker gauge and high-reliability nickel wire products.

- Asia Pacific (APAC): Market leader by volume, driven by large-scale EV and electronics manufacturing in China, South Korea, and Japan. Focus on mass production and competitive pricing.

- Europe: Highest growth region, fueled by strict emission regulations and high investment in premium EV and sensor technologies; emphasis on sustainable and traceable materials.

- North America: Strong market for specialty, high-reliability alloys used in heavy-duty vehicles and high-power EV platforms; increasing localization of the battery supply chain.

- Latin America & Middle East/Africa (MEA): Emerging markets with potential growth tied to future regional electrification plans and foreign direct investment in localized component manufacturing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Nickel Wire Market.- VDM Metals (A division of Acerinox)

- Haynes International

- Nippon Yakin Kogyo Co., Ltd.

- Aperam

- Sandvik Materials Technology (Alleima AB)

- ThyssenKrupp AG

- Sumitomo Electric Industries, Ltd.

- Heraeus Group

- Precision Engineered Products LLC

- California Fine Wire Company

- Luvata

- Kanthal (A unit of Sandvik)

- Industrial Metals International, Ltd.

- Fort Wayne Metals

- Custom Wire Technologies

- Ulbrich Stainless Steels & Special Metals

- Reading Alloys Inc.

- Johnson Matthey

- Baoji Lixing Titanium Group

- Tinsley Wire (Sheffield) Ltd.

Frequently Asked Questions

Analyze common user questions about the Automotive Nickel Wire market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers for the Automotive Nickel Wire Market growth?

The market is primarily driven by the accelerated global adoption of Electric Vehicles (EVs), which require high-purity nickel wire for battery interconnections and thermal management. Secondary drivers include the increasing complexity and proliferation of Advanced Driver-Assistance Systems (ADAS) and high-temperature sensors that mandate the reliability of nickel alloys.

How does the volatility of nickel commodity prices affect the market?

Raw nickel price volatility acts as a significant restraint, challenging wire manufacturers' ability to maintain stable pricing and profit margins. It necessitates sophisticated risk mitigation strategies, including long-term supply agreements and forward contracts, particularly for high-volume automotive suppliers.

Which application segment consumes the largest volume of automotive nickel wire?

The Batteries/HVAC segment, specifically components related to high-voltage EV battery packs, consumes the largest and fastest-growing volume of nickel wire. This material is essential for current flow integrity, thermal sensing, and mechanical stability within the demanding environment of modern traction batteries.

What role does High Purity Nickel Wire (Ni 200/201) play in modern vehicles?

High Purity Nickel Wire is crucial in highly sensitive applications such as Resistance Temperature Detectors (RTDs), precision resistors, and specialized wiring for critical electronic control units (ECUs). Its superior conductivity and minimal electrical drift ensure accurate measurements and reliable performance in safety and engine management systems.

Which geographical region is leading the innovation and consumption in this market?

The Asia Pacific (APAC) region, led by China and South Korea, currently dominates the market in terms of volume consumption due to vast automotive and battery manufacturing capacities. However, Europe shows rapid growth and leads in the innovation and adoption of premium, high-specification nickel alloy wire for advanced sensor technologies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager