Automotive Oil Seal Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437644 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Automotive Oil Seal Market Size

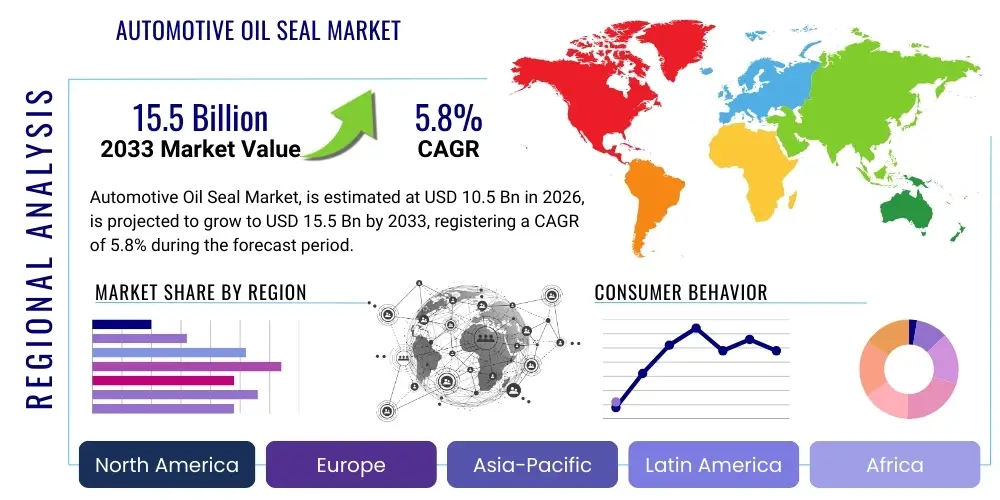

The Automotive Oil Seal Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $10.5 Billion in 2026 and is projected to reach $15.5 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the consistently high global production rates of passenger and commercial vehicles, coupled with the increasing average age of vehicles in operation, which necessitates high replacement demand in the aftermarket segment. Furthermore, the rising complexity of powertrain architectures, including the integration of hybrid and electric vehicle systems, requires specialized sealing solutions capable of handling higher rotational speeds, varying temperature ranges, and aggressive fluids, thereby stimulating market value.

The valuation reflects robust demand not only from Original Equipment Manufacturers (OEMs) relying on advanced sealing materials like PTFE and high-performance elastomers for enhanced efficiency and durability but also from the burgeoning maintenance and repair sector. Geopolitical shifts influencing manufacturing hubs and the stringent implementation of emission standards globally are compelling automotive manufacturers to adopt superior oil seals that minimize frictional losses, contributing directly to fuel economy improvements and reduced environmental impact. The transition towards e-mobility, while reducing the number of dynamic seals in traditional combustion engines, concurrently introduces demand for unique seals tailored for electric motors, gearboxes, and battery cooling systems, ensuring sustained market expansion across diverse applications.

Automotive Oil Seal Market introduction

The Automotive Oil Seal Market encompasses the manufacturing and distribution of specialized components designed to contain lubricants, prevent the entry of contaminants (such as dirt, moisture, and debris), and maintain pressure differentials within various automotive systems, primarily the engine, transmission, axles, and steering mechanisms. Oil seals are critical components fabricated typically from elastomers, thermoplastics, and sophisticated composite materials, ensuring the functional integrity and longevity of mechanical systems by preventing fluid leakage. Key product types include radial shaft seals, valve stem seals, and oil pump seals, each engineered to specific application requirements concerning operating temperature, speed, pressure resistance, and chemical compatibility with modern synthetic oils and transmission fluids.

Major applications of oil seals are pervasive across the automotive structure. In Internal Combustion Engine (ICE) vehicles, they are vital for crankshafts, camshafts, and valve trains, ensuring optimal engine performance and adherence to stringent environmental regulations by preventing oil burn and leakage. In modern automotive applications, particularly within complex automatic transmissions and driveline systems, high-precision seals manage complex fluid dynamics under severe shear stresses. Benefits derived from high-quality oil seals include enhanced vehicle reliability, reduction in maintenance frequency, improved fuel efficiency through minimized friction (NVH reduction), and overall compliance with safety standards, making them indispensable components in modern vehicle manufacturing processes.

Driving factors propelling this market include the sustained increase in global vehicle production, particularly in emerging economies where vehicle ownership is rapidly expanding. Technological advancements in material science, leading to the development of seals offering superior heat resistance and wear characteristics, also significantly contribute to market growth. Furthermore, the accelerating global shift towards complex driveline systems, including Dual-Clutch Transmissions (DCTs) and sophisticated all-wheel-drive systems, mandates the use of highly specialized and resilient seals. The aftermarket, fueled by an expanding global car parc and the necessity for scheduled component replacement, acts as a steady and robust revenue stream for oil seal manufacturers.

Automotive Oil Seal Market Executive Summary

The Automotive Oil Seal Market is characterized by intense innovation centered on material composition and design optimization, driven predominantly by the escalating requirements of modern powertrain electrification and stringent global emissions standards. Business trends highlight a strong focus on lightweighting materials, such as replacing traditional rubber with high-performance PTFE (polytetrafluoroethylene) seals, which offer superior friction reduction and durability, directly appealing to OEM demands for efficiency gains. Furthermore, strategic consolidations and partnerships between material suppliers and seal manufacturers are increasing to ensure supply chain stability and expedite the integration of new elastomer technologies capable of handling extreme conditions inherent in turbocharged and high-pressure engine systems. The shift towards modular sealing solutions that simplify installation and offer multi-functional sealing capabilities is another dominant business trend.

Regionally, Asia Pacific (APAC) stands as the undisputed market leader, propelled by the massive automotive manufacturing bases in China, India, Japan, and South Korea, which cater both to domestic consumption and international export markets. The North American and European markets, while mature in production volume, drive the demand for premium, technologically advanced seals due to stricter regulatory environments (e.g., Euro 7 and CAFE standards) and the accelerated adoption rate of electric vehicles (EVs). Latin America and the Middle East & Africa (MEA) represent significant growth opportunities, largely due to rapid industrialization, expanding vehicle parc growth, and increasing infrastructure investments that boost demand for both passenger and commercial vehicles, subsequently fueling the aftermarket segment.

Segment trends reveal that the aftermarket segment, driven by replacement cycles, holds a consistent and substantial share of the revenue, although the OEM segment dictates the technological pace. By product type, radial shaft seals remain the most widely used, but complex integrated cassette seals are gaining traction due to easier assembly and enhanced reliability. Material segmentation shows a strong migration away from standard NBR (Nitrile Butadiene Rubber) towards high-performance materials like FKM (Fluoroelastomer) and HNBR (Hydrogenated Nitrile Butadiene Rubber), particularly in severe-duty applications. The growing penetration of hybrid electric vehicles (HEVs) and battery electric vehicles (BEVs) is creating a nascent, yet rapidly evolving, segment demanding specific low-friction, high-dielectric seals for electric axle drives and battery thermal management systems.

AI Impact Analysis on Automotive Oil Seal Market

Common user inquiries concerning the impact of Artificial Intelligence (AI) on the Automotive Oil Seal Market revolve primarily around predictive maintenance capabilities, optimization of manufacturing processes, and the design phase of sealing solutions. Users are frequently seeking clarity on how AI-driven simulations can predict seal failure rates under complex operating conditions (e.g., varying loads and temperatures), thereby improving material selection and extending product lifecycle. Key themes include the integration of sensor technology (smart seals) with AI algorithms for real-time monitoring and failure diagnostics. There is also significant interest in how machine learning can streamline the highly specialized manufacturing processes, particularly injection molding and bonding, to reduce defects, optimize material usage, and accelerate the development cycle for new elastomer compounds suitable for next-generation vehicle architectures, including high-speed electric drive units and autonomous vehicle systems.

AI is expected to revolutionize the research and development pipeline for oil seals by enabling faster, more precise virtual testing of seal designs. Traditional finite element analysis (FEA) can be significantly enhanced by AI algorithms that process vast datasets on material performance, resulting in seals that are perfectly optimized for friction reduction, heat dissipation, and chemical resistance before physical prototyping even begins. This capability drastically reduces time-to-market for complex sealing solutions required by OEMs undergoing rapid platform shifts towards electrification and modular chassis designs. Furthermore, AI facilitates the personalization of manufacturing runs, allowing suppliers to quickly adjust production parameters to meet nuanced specifications for different global clients or specialized vehicle models.

The manufacturing floor benefits immensely from AI integration through advanced robotics and quality control systems. AI-powered visual inspection systems can detect microscopic defects in seal surface finishes or material compositions with far greater accuracy and speed than human inspectors, ensuring zero-defect output for mission-critical components like engine and gearbox seals. Moreover, predictive maintenance driven by AI models monitors machine health in the manufacturing equipment itself, minimizing downtime and ensuring consistent production quality and throughput, particularly for high-volume standard seals and high-precision specialized seals, thereby lowering overall operational expenditure and enhancing supply chain predictability.

- AI-driven predictive maintenance modeling for proactive seal replacement in fleet management.

- Optimization of material compound formulation using machine learning to enhance elastomer durability and friction properties.

- AI integration in quality control (QC) via advanced visual inspection of seal surface integrity and dimensional conformity.

- Enhanced virtual prototyping and simulation using deep learning to predict sealing behavior under extreme thermal and mechanical loads.

- Optimization of production line efficiency and throughput through real-time adjustment of injection molding and curing parameters.

DRO & Impact Forces Of Automotive Oil Seal Market

The dynamics of the Automotive Oil Seal Market are defined by critical Drivers, pervasive Restraints, emerging Opportunities, and interconnected Impact Forces that shape strategic decision-making and market evolution. The primary driver is the global regulatory push for enhanced fuel economy and lower emissions, compelling OEMs to mandate high-efficiency, low-friction sealing solutions that minimize parasitic losses in the powertrain. Concurrently, the increasing complexity of vehicle platforms, including multi-speed transmissions and advanced turbocharging systems, necessitates seals capable of operating under increasingly harsh conditions (higher temperatures, faster rotational speeds). However, this market faces significant restraints, chiefly the volatile cost and supply fluctuations of raw materials, particularly high-performance elastomers like FKM and specialty chemicals, which directly impact manufacturing costs and pricing stability. Another restraint is the long development cycle required for validating new sealing materials against automotive longevity standards.

Opportunities for growth are predominantly centered around the electrification trend. The transition to electric vehicles (EVs) creates new, specialized sealing requirements for electric motor bearing protection, high-voltage battery enclosures, and thermal management systems, opening entirely new revenue streams distinct from traditional ICE applications. Furthermore, the proliferation of the Internet of Things (IoT) provides an opportunity to develop "smart seals" integrated with micro-sensors that transmit real-time diagnostic data on pressure, temperature, and wear, moving the industry toward condition-based monitoring rather than fixed replacement schedules. The aftermarket segment in developing regions also presents a major opportunity due to the lack of stringent official service networks, driving demand for accessible, reliable replacement parts.

The impact forces influencing the market are multifaceted. Technological impact forces are high, driven by advancements in polymer science and manufacturing precision, enabling seals to perform reliably for longer durations. Economic impact forces are moderate to high, as the market is highly sensitive to global automotive sales cycles and fluctuating commodity prices. Environmental impact forces are escalating, with regulations demanding not only performance but also sustainable manufacturing practices and the use of materials with lower environmental footprints. The cumulative effect of these forces suggests a sustained trend towards premium, technologically dense products, compelling manufacturers to invest heavily in R&D to maintain competitive advantage and regulatory compliance across diverse global markets.

Segmentation Analysis

The Automotive Oil Seal Market is comprehensively segmented based on material, product type, application, sales channel, and vehicle type, allowing for precise market sizing and strategic targeting. The segmentation reflects the diverse technological requirements across different vehicle systems and service environments. Material segmentation is crucial, differentiating between standard elastomers (NBR, ACM) used in general applications and high-performance polymers (FKM, PTFE, HNBR) required for high-temperature and high-speed environments, particularly in complex engines and advanced automatic transmissions. The continuous push for enhanced friction reduction heavily influences material segment growth, favoring advanced composite structures.

Segmentation by product type includes critical components such as radial shaft seals (widely used in crankshafts and axles), valve stem seals (essential for engine lubrication control), and integrated cassette seals (complex units combining sealing lips, dust lips, and bearings into a single assembly for easier installation and superior protection). Application segmentation categorizes usage across the engine (most demanding environment), transmission and driveline (requiring high-pressure resistance), and steering and suspension systems. This granular segmentation highlights where technological complexity and value addition are concentrated, typically favoring transmission and engine applications due to their critical function.

Furthermore, segmentation by sales channel (OEM vs. Aftermarket) provides crucial insight into distribution strategies, pricing dynamics, and product lifecycles. While the OEM segment is volume-driven and technologically demanding, the aftermarket offers stable margins and is influenced by vehicle population and replacement cycles. Vehicle type segmentation—covering passenger cars, light commercial vehicles (LCVs), and heavy commercial vehicles (HCVs)—shows varying demands; HCVs prioritize durability and resistance to rugged conditions, whereas passenger vehicles focus more on low friction and NVH (Noise, Vibration, and Harshness) reduction, making the overall segmentation vital for manufacturers to align product portfolios with specific industry needs.

- By Product Type:

- Radial Shaft Seals (Rotary Seals)

- Valve Stem Seals

- Integrated Cassette Seals

- Bonded Piston Seals

- Other Seals (O-rings, Gaskets)

- By Material Type:

- Elastomers (NBR, ACM, HNBR, FKM/Viton, Silicone)

- Thermoplastics (PTFE, PEEK)

- Composite Materials

- By Application:

- Engine & Cooling System

- Transmission & Driveline

- Steering & Suspension

- Braking Systems

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

- By Vehicle Type:

- Passenger Cars (PC)

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

- Electric Vehicles (EV)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Automotive Oil Seal Market

The Automotive Oil Seal market value chain begins with the upstream segment, dominated by raw material suppliers and specialized chemical companies. This initial stage involves the complex synthesis and compounding of high-performance elastomers, including Fluoroelastomers (FKM), HNBR, and advanced PTFE compounds, along with the provision of necessary metal reinforcements and bonding agents. The upstream segment is critical as the performance of the final oil seal is intrinsically linked to the chemical stability, purity, and availability of these materials. Supply chain resilience and managing the volatility of petrochemical feedstock prices are major factors at this stage. Manufacturers often engage in long-term contracts or vertical integration to secure stable access to critical, high-grade polymers essential for meeting OEM specifications.

The core manufacturing stage involves specialized processes such as precision injection molding, compression molding, and vulcanization, followed by highly precise finishing and quality control checks. Seal manufacturers utilize advanced manufacturing technologies, including automated assembly lines and computerized numerical control (CNC) machining for metal casings, to achieve the extremely tight tolerances required for dynamic sealing applications. The subsequent distribution stage is bifurcated: direct distribution to Original Equipment Manufacturers (OEMs) and indirect distribution through the aftermarket channel. Direct OEM distribution requires Just-in-Time (JIT) delivery and adherence to rigorous quality standards specific to vehicle assembly lines worldwide, often necessitating localized manufacturing facilities near major automotive clusters.

The downstream segment primarily consists of end-users, encompassing global automotive OEMs for new vehicle production, and independent repair workshops, franchised service centers, and retailers in the aftermarket. Direct sales to OEMs involve complex qualification processes and long-term supply agreements. Indirect distribution to the aftermarket utilizes extensive networks of wholesalers, regional distributors, and online parts retailers, focusing on comprehensive product cataloging, competitive pricing, and efficient logistics for replacement parts. The increasing role of e-commerce platforms is significantly restructuring the indirect distribution channel, offering greater accessibility and transparency for service providers sourcing maintenance and repair components globally.

Automotive Oil Seal Market Potential Customers

Potential customers for the Automotive Oil Seal Market are segmented primarily into two major categories: Original Equipment Manufacturers (OEMs) and the expansive Aftermarket segment. OEMs represent the highest volume buyers, encompassing global automotive assembly firms such as General Motors, Toyota, Volkswagen Group, and specialized manufacturers of internal combustion engines, transmissions (e.g., ZF, Aisin), and electric drive units (EDUs). These customers require millions of units annually, focusing intensely on zero-defect quality, advanced technical specifications (low friction, high heat tolerance), and seamless integration into automated assembly processes. They are the primary drivers of technological innovation in the seal industry, demanding solutions tailored for new vehicle platforms, including hybrid and electric architectures, and requiring seals that contribute directly to achieving strict fuel economy targets and warranty longevity.

The Aftermarket segment constitutes a diverse array of end-users/buyers, crucial for sustaining the market’s profitability due to replacement cycles. This includes independent garages and maintenance workshops, major auto parts wholesalers (e.g., Bosch, Denso), franchised dealerships and service centers, and increasing numbers of online parts distributors targeting DIY mechanics. Aftermarket buyers prioritize product availability, reliability, and competitive cost, often stocking seals for a wide range of older and current vehicle models. The replacement market is highly influenced by the average age of vehicles on the road (car parc) and the quality perception of major seal brands, making brand reputation and comprehensive catalog coverage essential selling points for suppliers targeting this extensive and fragmented customer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $10.5 Billion |

| Market Forecast in 2033 | $15.5 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Freudenberg Sealing Technologies, SKF, NOK Corporation, Trelleborg AB, EagleBurgmann, Dana Incorporated, ElringKlinger AG, Federal-Mogul (Tenneco), Timken Company, Hutchinson S.A., Dichtomatik, James Walker Group, Flowserve Corporation, Gapi Group, Greene, Tweed, Kastas Sealing Technologies, Musashi Sealing, Saint-Gobain, Parker-Hannifin Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Oil Seal Market Key Technology Landscape

The technological landscape of the Automotive Oil Seal Market is constantly evolving, driven by the shift towards higher performance, greater efficiency, and adaptability to new powertrain technologies, especially electrification. A core area of innovation lies in material science. The deployment of Polytetrafluoroethylene (PTFE) lip materials, replacing conventional elastomers in high-speed rotary applications, is crucial. PTFE offers significantly lower friction, minimizing power loss and heat generation, which is paramount for both fuel economy in ICE vehicles and range optimization in EVs. Further material advancements focus on developing custom FKM and HNBR compounds that exhibit superior chemical resistance to aggressive synthetic oils and resistance to higher continuous operating temperatures (up to 200°C) without compromising elasticity or dynamic sealing capability over extended vehicle lifespans.

Manufacturing technology advancements are equally important, with a focus on achieving precision and consistency in high volumes. This includes advanced injection molding techniques that ensure perfect bonding between the elastomer lip and the metal casing, preventing premature detachment under high dynamic stress. The rise of integrated cassette seals represents a significant technological leap. These seals combine multiple functions—such as sealing, dust exclusion, and sometimes bearing integration—into a single, pre-assembled unit. This not only simplifies the assembly process for OEMs but also guarantees optimal installation conditions, drastically reducing the risk of installation error which is a common cause of field failure. Furthermore, surface treatment technologies, such as micro-grooving or laser structuring on the seal lip, are employed to actively manage fluid film thickness and hydrodynamic pumping action, optimizing the sealing effectiveness.

The emerging technological frontier is the integration of sealing solutions into electric vehicle (EV) architectures, requiring seals designed for Electric Drive Units (EDUs) that operate at speeds far exceeding traditional ICE powertrains (often >15,000 RPM). This demands seals with specialized dynamic run-out control and robust thermal management properties, frequently incorporating non-conductive materials to prevent electrical tracking in proximity to high-voltage systems. Another vital area is the development of "smart seals" embedding micro-sensors that wirelessly communicate real-time condition data to the vehicle’s control unit. This nascent technology enables condition-based monitoring, shifting maintenance practices from reactive to predictive, a trend highly valued in commercial fleet operations and future autonomous vehicle systems where unexpected downtime must be eliminated.

Regional Highlights

The Automotive Oil Seal Market exhibits distinct regional dynamics heavily influenced by manufacturing concentration, regulatory frameworks, and vehicle penetration rates. Asia Pacific (APAC) dominates the global landscape, accounting for the largest market share due to the presence of high-volume automotive manufacturing nations like China, India, and Japan. This region is not only a major consumer of standard seals for domestic vehicle production but also increasingly drives demand for advanced materials as it rapidly adopts stringent emission standards and accelerates EV manufacturing, requiring high-performance sealing for battery and motor assemblies.

Europe and North America represent technologically mature markets where demand is driven less by volume expansion and more by quality, longevity, and technological sophistication. Regulatory demands, such as European Union mandates on CO2 reduction, push OEMs towards premium, low-friction sealing solutions (e.g., PTFE and specialty FKM) that contribute to marginal efficiency gains. These regions are also early adopters of innovative sealing solutions for electric vehicle platforms and are characterized by a well-established and highly structured aftermarket, ensuring robust replacement demand for certified, high-quality seals.

- Asia Pacific (APAC): Leading market share driven by high-volume manufacturing in China and India; rapid adoption of EV technologies creates new demand for specialty seals; strong growth in the aftermarket due to expanding vehicle parc.

- Europe: Focus on premium, low-friction seals due to stringent Euro emission standards; strong innovation concentration driven by major German and French automotive groups; high acceptance rate of complex cassette seals.

- North America: Significant aftermarket consumption due to a large and aging vehicle population; robust demand for seals in heavy-duty commercial vehicles; steady transition towards hybrid and electric sealing solutions across major domestic manufacturers.

- Latin America (LATAM): Emerging market characterized by cost-sensitive demand; steady growth correlated with infrastructure development and increasing domestic vehicle assembly; high reliance on imported seal technology.

- Middle East & Africa (MEA): Growth fueled by infrastructure spending and increasing commercial vehicle imports; challenging operational environments (extreme heat, dust) require highly durable seals, particularly in the heavy commercial sector.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Oil Seal Market.- Freudenberg Sealing Technologies

- SKF

- NOK Corporation

- Trelleborg AB

- Dana Incorporated

- ElringKlinger AG

- Federal-Mogul (Tenneco)

- The Timken Company

- Hutchinson S.A.

- Gapi Group

- Greene, Tweed

- Eaton Corporation plc

- Flowserve Corporation

- Saint-Gobain

- Parker-Hannifin Corporation

- Dichtomatik

- Kastas Sealing Technologies

- Musashi Sealing

- James Walker Group

- EagleBurgmann

Frequently Asked Questions

Analyze common user questions about the Automotive Oil Seal market and generate a concise list of summarized FAQs reflecting key topics and concerns.What materials are essential for oil seals in electric vehicles (EVs)?

EVs primarily require seals made from advanced, low-friction materials such as specialized PTFE compounds and high-performance FKM/HNBR elastomers. These materials are essential because they must withstand the extremely high rotational speeds of electric motors (exceeding 15,000 RPM) and offer superior chemical compatibility with unique battery cooling fluids and low-viscosity transmission oils, while also sometimes requiring dielectric properties for insulation near high-voltage components.

How does the shift to advanced transmissions impact oil seal design?

The increasing adoption of complex transmissions, such as Dual-Clutch Transmissions (DCTs) and 8-speed or 10-speed automatic transmissions, demands oil seals capable of managing higher operating pressures, dynamic fluid fluctuations, and greater thermal loads. This drives the market towards using integrated cassette seals and precision-engineered radial shaft seals that offer enhanced dynamic run-out control and minimized fluid friction to maximize transmission efficiency and service life.

What is the primary difference between OEM and Aftermarket oil seal demand?

OEM (Original Equipment Manufacturer) demand is characterized by high volume, rigorous technical specifications, long qualification cycles, and a focus on achieving the lowest possible friction coefficient to meet fuel efficiency standards. Aftermarket demand is driven by replacement needs, characterized by high product diversity across many models, rapid fulfillment requirements, and a greater emphasis on cost-effectiveness and readily available stock coverage for older vehicles.

How do global emission regulations affect the Automotive Oil Seal Market?

Stringent global emission regulations (like Euro 7 and CAFE standards) necessitate that all engine components contribute to maximum efficiency. For oil seals, this means an increased mandate for low-friction sealing solutions, primarily using PTFE, to reduce parasitic power loss in the engine and driveline. This regulatory pressure accelerates the phase-out of conventional, higher-friction elastomers in critical applications and mandates investment in advanced composite seals.

Which region holds the largest market share for Automotive Oil Seals and why?

The Asia Pacific (APAC) region holds the largest market share, predominantly due to its status as the world’s largest hub for automotive production. Countries like China, Japan, and India manufacture massive volumes of passenger and commercial vehicles, generating high demand both for original equipment sealing solutions and for subsequent replacement components in their rapidly growing domestic vehicle populations (car parc).

The comprehensive analysis underscores the critical role of material science innovation and manufacturing precision in sustaining growth within the Automotive Oil Seal Market. The convergence of electrification requirements, severe regulatory demands for efficiency, and the necessity for robust aftermarket supply chains defines the strategic priorities for market stakeholders moving toward 2033. Investments in PTFE and specialized FKM technologies are paramount for competitive positioning.

The market trajectory is firmly focused on producing technically advanced sealing systems that not only contain fluids but actively contribute to the overall performance, longevity, and environmental compliance of both traditional and electric vehicle powertrains. This necessitates continuous collaboration between chemical suppliers, seal manufacturers, and automotive OEMs to address evolving fluid compatibility challenges and dynamic stress requirements inherent in next-generation mobility solutions.

Further expansion of the market depends heavily on navigating global supply chain volatility, particularly regarding polymer raw materials. Companies demonstrating vertical integration or strong supplier partnerships are best positioned to mitigate risk and capitalize on the sustained, complex demand from the global automotive industry, ensuring the steady supply of mission-critical seals across all major vehicle segments and geographical regions.

The integration of advanced monitoring capabilities, sometimes referred to as 'Industry 4.0' initiatives, within the seal manufacturing process is also becoming a non-negotiable factor. Utilizing real-time data from production lines, facilitated by AI and machine learning, allows manufacturers to maintain extremely tight dimensional tolerances and material consistency, which is vital for seals operating in high-pressure environments, such as those found in modern engine timing systems and advanced hydraulic transmissions. Failure to adhere to these precision standards directly translates to increased warranty claims for OEMs, making manufacturing excellence a key competitive differentiator.

Furthermore, the maintenance and repair segment, particularly in emerging markets, faces unique challenges regarding counterfeit parts. The market analysis reveals that reputable seal manufacturers are increasingly focusing on robust brand protection measures, including serialization and advanced packaging, to ensure that the quality and performance promised by their OEM products are maintained in the aftermarket channel. This protection strategy is crucial for sustaining brand loyalty and ensuring vehicle safety and reliability throughout the component's intended lifecycle, particularly in regions where quality control over replacement parts can be variable.

In terms of product lifecycle management, the dual nature of the market—ICE and EV—requires manufacturers to manage divergent product portfolios. While ICE seals demand continuous optimization for efficiency and heat resistance, EV seals require entirely new designs focused on electrical isolation and extreme rotational speed capabilities. Companies that successfully manage this dual-track development strategy and efficiently allocate R&D resources across these contrasting demands are anticipated to secure long-term leadership positions. The complexity inherent in managing two distinct technological paths ensures that specialized knowledge in polymer engineering remains a high-value asset in the automotive sealing industry.

The macroeconomic factors, particularly shifts in global automotive trade policies and environmental mandates, exert a substantial influence on regional sourcing strategies. For instance, manufacturers in Europe are intensely focused on localizing supply chains to reduce logistics costs and carbon footprint, leading to increased investment in European manufacturing sites for high-performance elastomers and finished seal assemblies. Conversely, suppliers targeting the vast APAC volume market must establish significant production capacity within that region to remain cost-competitive and meet the scale demands of major Asian auto manufacturers, thereby shaping regional investment profiles and operational footprints.

The necessity for continuous compliance with evolving chemical regulations, such as REACH in Europe, also impacts material development. Seal manufacturers must proactively replace or reformulate compounds containing restricted substances, even if those substances currently offer superior performance characteristics. This regulatory overhead forces substantial investment in R&D for compliant alternatives that maintain or exceed current performance benchmarks, adding complexity to the upstream segment of the value chain and potentially increasing lead times for new product introductions.

Finally, the growing trend of vehicle connectivity and autonomous driving systems subtly influences the demand profile. While not direct consumers of traditional oil seals, these advanced systems require reliable sealing for numerous ancillary components, including sophisticated sensor housings, cooling pumps for Lidar/Radar units, and electronic control unit (ECU) enclosures. These applications necessitate highly specialized static and dynamic seals that offer environmental protection (dust, moisture ingress) and robust durability under varying external conditions, representing a niche but high-growth area for specialized sealing solutions within the broader automotive market context.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager