Automotive OTA Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433452 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Automotive OTA Market Size

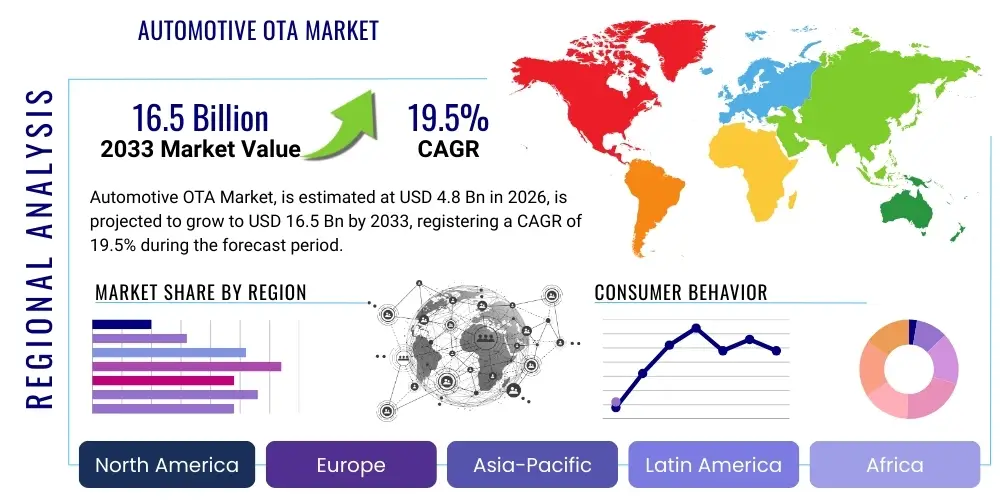

The Automotive OTA Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 19.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 16.5 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the accelerating digitalization of vehicles, the proliferation of connected car architectures, and the critical need for robust cybersecurity measures and efficient software maintenance across vehicle lifecycles. The shift from hardware-centric vehicle design to software-defined vehicle (SDV) architectures solidifies OTA updates as an essential component of modern automotive manufacturing and consumer experience.

Automotive OTA Market introduction

The Automotive Over-The-Air (OTA) Market encompasses the delivery of software, firmware, configuration settings, and map updates remotely to vehicles, eliminating the traditional requirement for physical service center visits. This technology is foundational to the realization of the Software-Defined Vehicle (SDV) paradigm, where vehicle functionalities are increasingly defined and refined through code. OTA technology primarily includes Firmware Over-The-Air (FOTA) for deeply embedded system updates and Software Over-The-Air (SOTA) for application-level software improvements, infotainment enhancements, and bug fixes. The rapid integration of advanced driver assistance systems (ADAS), electric powertrains, and complex infotainment clusters necessitates a streamlined mechanism for continuous improvement and feature activation, positioning OTA as a core enabler of future mobility solutions.

Major applications of Automotive OTA technology span critical vehicle domains, including engine control units (ECUs), telematics control units (TCUs), battery management systems (BMS) in Electric Vehicles (EVs), and advanced display systems. The primary benefits derived from widespread OTA adoption are multifaceted: reduced warranty costs for OEMs, improved customer satisfaction due to instant feature access and defect resolution, enhanced vehicle safety through rapid deployment of security patches, and the ability to generate new revenue streams through feature-on-demand (FoD) models. Furthermore, OTA facilitates remote diagnostics and predictive maintenance, drastically reducing vehicle downtime and improving overall fleet efficiency for commercial operators.

Driving factors propelling this market include stringent regulatory requirements for vehicle security and data privacy, the explosive growth of connected vehicles equipped with embedded connectivity modules (e.g., 4G/5G), and intense competitive pressure among automotive manufacturers to provide superior, personalized digital experiences. Consumer expectation is rapidly evolving, demanding smartphone-like update cycles and continuous feature enhancements throughout the vehicle ownership period. The increasing complexity of modern automotive software, featuring millions of lines of code, makes manual or dealer-based updates impractical, thereby cementing the necessity of scalable, secure, and globally deployable OTA solutions provided by key market participants.

Automotive OTA Market Executive Summary

The Automotive OTA Market is undergoing a rapid transition characterized by profound business, regional, and segment trends. Business trends highlight a significant shift from proprietary, closed-loop OTA systems to standardized, vendor-agnostic platforms utilizing cloud-native infrastructures. OEMs are prioritizing partnerships with established technology providers specializing in cybersecurity and scalable data management to ensure secure and efficient deployment across diverse global fleets. Furthermore, the commercialization of feature-on-demand and subscription-based service models, directly enabled by OTA capabilities, represents a critical emerging revenue pathway, altering the traditional automotive sales model towards a continuous lifecycle revenue approach.

Regionally, the market exhibits strong growth momentum across all major geographies, though adoption rates and focus areas vary. North America and Europe are leading in sophisticated FOTA implementations driven by robust connectivity infrastructure and high consumer demand for advanced ADAS features and personalized infotainment updates. The Asia Pacific (APAC) region, particularly China and South Korea, is witnessing the fastest expansion, fueled by massive EV production volumes and government mandates promoting smart and connected infrastructure. Regulatory alignment regarding type approval processes for software changes remains a critical regional challenge requiring international standardization efforts for seamless global OTA deployment.

Segment trends underscore the dominance of FOTA solutions, particularly for mission-critical systems like powertrain and chassis control, due to their direct impact on vehicle safety and performance, although SOTA is rapidly expanding in the Infotainment and Telematics domain. The passenger vehicle segment commands the largest market share, but the commercial vehicle segment (heavy-duty trucks and fleet management) is demonstrating higher CAGR, driven by the strong economic rationale for minimizing downtime and optimizing logistics through remote diagnostics and performance tuning. The rising integration of V2X communication standards further necessitates robust OTA frameworks to manage connectivity protocols and communication security, ensuring reliable inter-vehicle and infrastructure interactions.

AI Impact Analysis on Automotive OTA Market

User inquiries concerning the impact of Artificial Intelligence (AI) on the Automotive OTA Market frequently center on themes of predictive maintenance efficiency, personalized update delivery, and enhancing the security of the update process. Common questions probe how AI can manage the complexity of updating interconnected ECUs, whether AI algorithms can predict software failures before they occur, and how machine learning (ML) optimizes data transmission bandwidth for massive deployments. Users are also highly interested in AI’s role in verifying the integrity and compatibility of new software releases across heterogeneous vehicle fleets, seeking assurance that complex updates will not brick critical vehicle functions. The central expectation is that AI will transform OTA from a reactive deployment mechanism into a highly proactive, intelligent, and tailored software lifecycle management system.

The application of AI is instrumental in shifting OTA protocols toward intelligent update strategies. AI/ML algorithms analyze vast streams of vehicular telemetry data, including usage patterns, component health, and sensor readings, to determine the optimal time, location, and configuration for software updates. This predictive approach minimizes risks associated with deployment, ensuring updates are non-disruptive to the driver experience and are only executed when network conditions and vehicle states are ideal. Furthermore, AI enhances data compression techniques used in OTA transmission, significantly reducing bandwidth consumption and associated costs, which is crucial for handling large FOTA payloads related to ADAS or autonomous driving stacks.

AI also plays a pivotal role in strengthening the cybersecurity aspects of OTA. ML models are deployed to continuously monitor the integrity of both the central OTA cloud platform and the vehicle’s communication modules (e.g., Gateways or TCUs) for anomalous behavior indicative of intrusion attempts or unauthorized modifications. These systems learn normal vehicle operational profiles and flag deviations during the update validation phase, offering real-time threat detection and mitigation. The use of sophisticated AI-driven testing frameworks allows OEMs to simulate millions of vehicle configurations prior to deployment, dramatically shortening quality assurance cycles and ensuring a higher success rate for complex, multi-ECU software rollouts.

- AI optimizes OTA deployment timing and location based on predictive failure analysis and vehicle usage patterns.

- Machine learning improves data compression and differential update efficiency, conserving bandwidth and reducing transmission costs.

- AI-driven cybersecurity enhances anomaly detection within the update pipeline, preventing malicious attacks or software tampering.

- Autonomous validation systems utilize AI to perform complex compatibility testing across diverse hardware configurations before deployment.

- AI facilitates hyper-personalization of feature-on-demand (FoD) offerings delivered via SOTA updates, aligning with individual driver behavior.

DRO & Impact Forces Of Automotive OTA Market

The market dynamics of the Automotive OTA sector are governed by a complex interplay of Drivers, Restraints, and Opportunities, which collectively constitute the primary Impact Forces shaping the industry's trajectory. Key drivers include the overwhelming shift toward Software-Defined Vehicles (SDVs), the necessity for frequent security patches to counter rising cyber threats, and the increasing consumer expectation for continuous feature upgrades and personalized services akin to mobile device ecosystems. These factors compel manufacturers to adopt centralized, resilient OTA frameworks, treating software maintenance as a continuous lifecycle responsibility rather than a one-time deployment event at the point of sale. The economic driver, focused on reducing expensive physical recalls and minimizing warranty claims, also provides a strong incentive for widespread adoption.

However, significant restraints temper the market’s explosive growth potential. Foremost among these are the complex regulatory challenges concerning the certification and type approval of vehicles after major software modifications, particularly those affecting safety-critical systems. Cybersecurity vulnerabilities inherent in wireless communication and the centralized architecture of OTA platforms pose substantial risk, demanding immense investment in robust encryption and authentication mechanisms. Furthermore, fragmentation across vehicle hardware architectures, legacy systems integration, and the requirement for substantial computational power within the vehicle to process and install large updates present technical hurdles that complicate standardized, cross-fleet deployment strategies.

Opportunities for growth are abundant, predominantly fueled by the electrification trend and the advancement of autonomous driving technologies. The Battery Management Systems (BMS) in Electric Vehicles (EVs) require frequent FOTA updates to optimize battery performance, range, and longevity, creating a dedicated niche for OTA solutions. The development of advanced V2X communication and shared mobility platforms also relies heavily on reliable OTA for protocol standardization and operational efficiency. Furthermore, the monetization potential of Features-on-Demand (FoD), where customers pay to unlock software-enabled functionalities post-purchase, represents a transformative business opportunity, moving the industry towards recurring service revenue models.

Segmentation Analysis

The Automotive OTA Market is comprehensively segmented based on technology type, application, vehicle type, and communication channel, providing a granular view of market dynamics and adoption preferences across various automotive industry stakeholders. Understanding these segments is crucial for strategic planning, allowing vendors to tailor their solutions—ranging from complex firmware updates affecting safety-critical ECUs to simple software upgrades enhancing user experience—to specific customer needs and regulatory environments. The dominance of certain segments, such as passenger vehicles and FOTA solutions, currently dictates market investment, while rapidly emerging segments like commercial vehicles and V2X communication technology promise significant future growth.

Segmentation by technology type is critical as it distinguishes between the depth of the update, determining the complexity of the security protocols and deployment mechanisms required. FOTA is essential for fundamental vehicle operations, demanding high-level security clearance, whereas SOTA focuses more on user-facing applications and aesthetic improvements. The division by application area—infotainment, telematics, and electronic control units (ECUs)—reflects the varying security requirements and latency tolerances across vehicle domains. The continuous proliferation of sophisticated in-vehicle electronics necessitates specialized OTA solutions capable of managing heterogeneous software environments within a single vehicle architecture.

- By Technology Type:

- Firmware Over-The-Air (FOTA)

- Software Over-The-Air (SOTA)

- By Application:

- Infotainment & Telematics

- Electronic Control Units (ECUs)

- Safety & Security

- Powertrain & Chassis Control

- By Vehicle Type:

- Passenger Vehicles (PV)

- Commercial Vehicles (CV)

- Electric Vehicles (EV)

- By Communication Channel:

- Cellular Communication (4G/5G)

- Wi-Fi

- By Service Type:

- Update Management

- Cybersecurity Management

- Data Management & Analytics

Value Chain Analysis For Automotive OTA Market

The Automotive OTA Value Chain begins upstream with component suppliers and chip manufacturers who provide the essential hardware—such as Telematics Control Units (TCUs), embedded modems, and high-performance secure microcontrollers—that enable vehicle connectivity. This upstream segment is characterized by specialized semiconductor design focused on security elements, cryptographic processing capabilities, and sufficient memory to handle large FOTA files. Key players in this stage collaborate closely with connectivity providers (MNOs) to ensure low-latency, high-reliability network access, laying the foundational infrastructure necessary for all subsequent OTA operations. Standardization efforts at this stage are crucial for ensuring hardware compatibility across various OEM platforms.

Midstream, the value chain involves core software solution providers and platform developers who design the proprietary or third-party OTA management platforms. These platforms handle differential file generation, secure deployment scheduling, certificate management, fleet monitoring, and integration with the OEM’s backend systems and engineering pipelines. This phase involves extensive data analysis, managing the complex logistics of updating millions of vehicles globally while ensuring regulatory compliance and auditability. Distribution channels in this market are predominantly indirect, revolving around B2B relationships where technology providers (Tier 1 suppliers, specialized software firms) license their OTA platforms directly to Automotive OEMs (Original Equipment Manufacturers).

Downstream activities focus on the final execution and monitoring. This includes the vehicle itself, where the embedded client software validates, downloads, and installs the update, and the aftermarket services provided to end-users. Direct distribution occurs when the OEM deploys the update directly to the consumer’s vehicle, bypassing traditional dealership involvement. Post-deployment monitoring, leveraging advanced analytics provided by the OTA platform, enables continuous feedback on installation success rates, failure diagnostics, and user acceptance, completing the cyclical value chain. The efficiency of this downstream segment directly impacts customer satisfaction and the ability of the OEM to introduce new subscription services promptly.

Automotive OTA Market Potential Customers

The primary and most significant potential customers for Automotive OTA solutions are Original Equipment Manufacturers (OEMs), encompassing both traditional automakers and emerging electric vehicle (EV) manufacturers. OEMs are driven by the urgent need to manage vehicle software complexity, reduce massive warranty expenses associated with physical recalls, and unlock new revenue streams through software upgrades and subscription models. The shift towards the Software-Defined Vehicle (SDV) mandates that OEMs acquire sophisticated, scalable OTA capabilities to remain competitive and compliant with evolving cybersecurity standards like UN Regulation No. 155, which govern software updates and update management systems. Their requirement spans both FOTA for critical performance adjustments and SOTA for user-experience enhancements.

Secondary, yet rapidly growing, customer segments include large commercial fleet operators and Tier 1 suppliers. Commercial fleet operators, managing thousands of heavy-duty trucks, logistics vehicles, or transit buses, utilize OTA primarily for remote diagnostics, fuel efficiency optimization updates, and mandated compliance updates, viewing OTA as a critical tool for minimizing vehicle downtime and maximizing operational uptime. Tier 1 suppliers, who develop and integrate complex electronic control units (ECUs) and domain controllers (e.g., ADAS systems), often require OTA capabilities to update the software within their specific components, ensuring their modules are future-proofed and interoperable with the OEM’s centralized gateway architecture. They often purchase white-label OTA solutions for integration into their own product offerings.

Furthermore, specialized industry players such as rental car companies, shared mobility service providers, and automotive insurance providers represent potential niche customers. Shared mobility firms rely on OTA to rapidly configure vehicle features (e.g., geofencing, access controls) and ensure software readiness for multiple users. Insurance companies leverage data generated via OTA platforms for advanced usage-based insurance (UBI) models and remote accident diagnostics. Ultimately, the entire ecosystem supporting the connected car architecture is a potential consumer of services enabled or improved by robust OTA infrastructure, highlighting the technology's pervasive influence across the automotive value chain.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 16.5 Billion |

| Growth Rate | 19.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Continental AG, Harman International (Samsung), Aptiv PLC, NXP Semiconductors N.V., Qualcomm Technologies Inc., Sibros Technologies Inc., Airbiquity Inc., Tesla Inc., Elektrobit (Continental), Blackberry QNX, Red Bend Software (Harmon), VNC Automotive, Excelfore Corporation, Karamba Security, Argus Cyber Security, SafeRide Technologies, Intellias, Movimento, STMicroelectronics |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive OTA Market Key Technology Landscape

The technological landscape of the Automotive OTA market is dominated by centralized cloud-based platforms and sophisticated in-vehicle software clients designed for secure execution. Core technologies include differential update mechanisms, such as binary delta compression, which significantly reduce the file size of updates by only transmitting the changed bytes, minimizing bandwidth usage and download time. These solutions rely heavily on secure boot processes, hardware security modules (HSMs), and robust cryptographic protocols (like AES-256 and ECC) to ensure that the update packages are authentic, uncompromised, and securely installed onto the vehicle’s Electronic Control Units (ECUs). The seamless integration of these technologies with the vehicle’s central gateway or domain controller is paramount for coordinating updates across multiple heterogeneous ECUs simultaneously.

A crucial technological component is the adoption of advanced network connectivity standards, particularly 4G LTE and the rapidly evolving 5G network. 5G technology promises ultra-low latency and high bandwidth, which are essential for the real-time transmission of large FOTA files, especially those related to autonomous driving software stacks that require gigabytes of data. Furthermore, the implementation of telematics control units (TCUs) with integrated e-SIM capabilities ensures reliable global connectivity and provides the necessary processing power to manage the OTA download and staging process internally before installation. The technology is shifting towards "edge computing" where initial validation and minor processing tasks are handled by the vehicle itself before escalating issues to the cloud backend.

Security technologies form the backbone of the OTA landscape, addressing the inherent risks of remote code injection. Key elements include end-to-end encryption from the update server to the in-vehicle client, mutual authentication protocols, and the use of digital signatures to verify the software source. Moreover, techniques like rollback protection and fail-safe mechanisms are essential to prevent vehicle immobilization (bricking) in the event of an update failure. The move towards consolidated software architecture (e.g., domain controllers or zonal architecture) simplifies the physical points of update, but it simultaneously increases the complexity of managing software dependencies, driving the need for smarter, AI-assisted deployment technologies capable of handling complex dependencies and ensuring compliance.

Regional Highlights

Regional dynamics in the Automotive OTA Market are characterized by differential rates of EV adoption, variations in connectivity infrastructure maturity, and distinct regulatory frameworks. North America maintains a leading position, driven by a high concentration of sophisticated connected vehicles, robust consumer demand for subscription-based services (like enhanced ADAS and infotainment features), and pioneering efforts by key US-based EV manufacturers who have fully internalized OTA capabilities as a core competitive advantage. The focus here is heavily placed on SOTA for feature enhancements and security patches, supported by widespread 4G and emerging 5G connectivity.

Europe represents a highly dynamic market, propelled primarily by stringent regulatory requirements, notably the UN Regulation No. 155 (R155) concerning cybersecurity and software update management. This regulatory environment mandates that all new vehicle types comply with secure OTA protocols, accelerating the adoption of FOTA for safety and regulatory compliance across the continent. Germany and the UK are major hubs for automotive software development, focusing on integrating OTA into complex domain controller architectures and implementing advanced cryptographic security measures across the update pipeline. The region's push towards electrification further emphasizes the need for BMS (Battery Management System) FOTA updates.

The Asia Pacific (APAC) region is projected to register the highest growth rate, primarily led by massive manufacturing volumes in China, Japan, and South Korea. China’s aggressive policy support for electric and intelligent connected vehicles (ICVs) creates an enormous addressable market for OTA solutions. South Korea’s highly advanced telecommunications infrastructure facilitates the reliable deployment of large-scale updates. APAC manufacturers are rapidly catching up, focusing on providing comprehensive OTA capabilities from the entry-level segment upward, often integrating localized content and navigating diverse regulatory standards regarding data sovereignty and telematics usage across different countries within the region. Latin America, the Middle East, and Africa (MEA) are emerging markets, currently focused on basic remote diagnostics and essential FOTA to manage vehicle longevity and reduce operational costs in regions with less reliable service infrastructure.

- North America: Market leader driven by high connected vehicle penetration, strong consumer demand for personalized features, and pioneering EV manufacturers (focus on SOTA and Feature-on-Demand models).

- Europe: Growth mandatory due to regulatory drivers (e.g., UN R155/R156), emphasis on vehicle cybersecurity, and heavy investment in FOTA for safety-critical systems and EV battery management.

- Asia Pacific (APAC): Fastest-growing region, powered by huge EV production volume in China, advanced connectivity infrastructure in South Korea, and government support for ICVs (focus on scale and localized content delivery).

- Latin America (LATAM): Emerging market focusing on basic remote diagnostics, telematics efficiency, and cost reduction in commercial fleets.

- Middle East & Africa (MEA): Growth driven by high-end luxury vehicle sales and the adoption of fleet management solutions requiring fundamental remote software monitoring.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive OTA Market.- Robert Bosch GmbH

- Continental AG

- Harmann International (Samsung)

- Aptiv PLC

- NXP Semiconductors N.V.

- Qualcomm Technologies Inc.

- Sibros Technologies Inc.

- Airbiquity Inc.

- Tesla Inc.

- Elektrobit (Continental)

- Blackberry QNX

- Red Bend Software (Harmon)

- VNC Automotive

- Excelfore Corporation

- Karamba Security

- Argus Cyber Security

- SafeRide Technologies

- Intellias

- Movimento

- STMicroelectronics

Frequently Asked Questions

Analyze common user questions about the Automotive OTA market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between FOTA and SOTA?

FOTA (Firmware Over-The-Air) focuses on updating deeply embedded software, such as the operating system or firmware in critical Electronic Control Units (ECUs) like powertrain or braking systems. SOTA (Software Over-The-Air) focuses on updating higher-level application software, primarily relating to the infotainment system, navigation maps, or user interface features.

How does the Automotive OTA Market address cybersecurity threats?

Cybersecurity is addressed through end-to-end encryption, digital signatures, mutual authentication between the cloud server and the vehicle client, and secure hardware elements (HSMs) within the vehicle to prevent unauthorized access, tampering, or the installation of malicious software during the update process, ensuring compliance with standards like UN R155.

What role do Features-on-Demand (FoD) play in the OTA market growth?

Features-on-Demand (FoD) are critical growth drivers, enabling OEMs to generate recurring, post-sale revenue by allowing customers to purchase and activate software-enabled vehicle functionalities (e.g., performance boosts, enhanced driver assistance) remotely via OTA updates, transforming the vehicle into a continuous revenue platform.

Which vehicle segment is currently the largest consumer of OTA solutions?

The Passenger Vehicle (PV) segment is currently the largest consumer of OTA solutions globally, driven by high volumes, sophisticated infotainment systems, and strong consumer demand for connectivity and personalization features. However, the Commercial Vehicle segment is exhibiting the fastest growth rate due to efficiency gains.

What are the key technological challenges restraining widespread OTA adoption?

Key challenges include managing the architectural complexity of updating heterogeneous ECUs, ensuring robust rollback mechanisms to prevent vehicle immobilization if an update fails, and addressing regulatory hurdles related to certifying software changes in safety-critical systems across different international jurisdictions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager