Automotive Parts Remanufacturing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433033 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Automotive Parts Remanufacturing Market Size

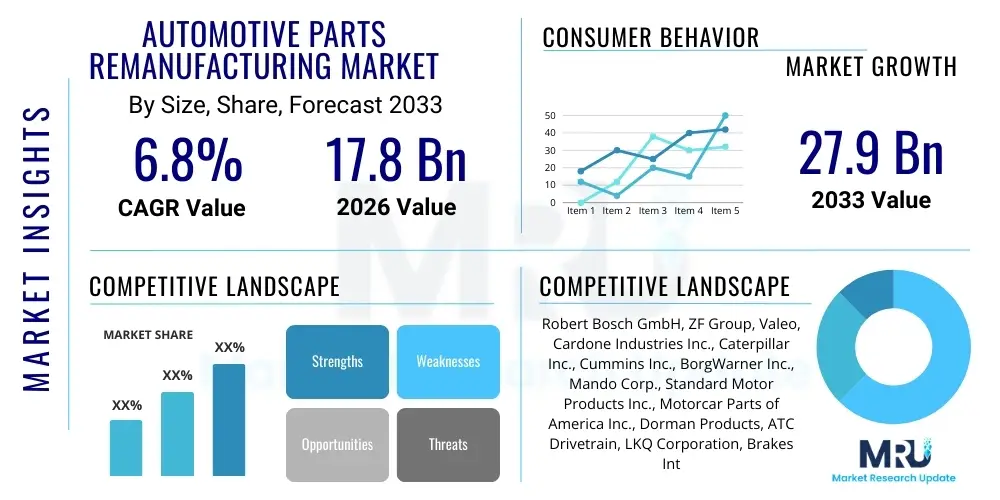

The Automotive Parts Remanufacturing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 17.8 Billion in 2026 and is projected to reach USD 27.9 Billion by the end of the forecast period in 2033.

Automotive Parts Remanufacturing Market introduction

The Automotive Parts Remanufacturing Market encompasses the industrial process of restoring end-of-life automotive components to a "like-new" or "better-than-new" condition, meeting original equipment specifications. This process involves the disassembly, cleaning, inspection, replacement of worn or obsolete parts, reassembly, and testing of components such as engines, transmissions, starters, alternators, and compressors. Unlike simple repair or rebuilding, remanufacturing requires strict adherence to standardized procedures and quality control measures, ensuring that the final product offers performance and warranty comparable to new parts, often at a significantly reduced environmental cost and lower consumer price point. The fundamental principle driving this industry is the sustainable utilization of materials and energy, positioning it as a cornerstone of the circular economy within the automotive sector.

The product description for remanufactured parts emphasizes longevity and sustainability. Major applications span both the original equipment service channel and the independent aftermarket, primarily serving vehicles that are four years old or older, where cost-effective maintenance solutions become highly desirable. Key benefits derived from adopting remanufactured components include substantial material savings, a significant reduction in the energy required for production compared to manufacturing new parts from raw materials, and minimizing landfill waste. Furthermore, remanufacturing plays a critical role in inventory management for older vehicle fleets, ensuring the availability of essential components that might be discontinued as new parts.

Driving factors for the robust growth of this market include increasingly stringent global environmental regulations promoting resource efficiency, coupled with the rising average age of vehicles on the road, particularly in developed economies. Economic pressures on consumers and fleet operators encourage the selection of high-quality, cost-effective replacement options, making remanufactured parts a compelling alternative. Government initiatives and incentives supporting green manufacturing practices further bolster market expansion. The technological advancements in sorting, cleaning, and non-destructive testing processes are also improving the quality perception and reliability of remanufactured components, thereby expanding their acceptance across various vehicle platforms and component categories.

Automotive Parts Remanufacturing Market Executive Summary

The Automotive Parts Remanufacturing Market demonstrates resilience driven by strong circular economy mandates and favorable cost structures. Key business trends indicate a critical shift towards advanced diagnostics and sophisticated re-engineering techniques, particularly for complex electronic and hybrid vehicle components. Large Original Equipment Manufacturers (OEMs) are increasingly integrating remanufacturing into their core business strategies, moving beyond simple component exchange programs to establish dedicated industrial remanufacturing facilities, thereby controlling quality and expanding market reach within their authorized service networks. Furthermore, digitalization of the supply chain, particularly for managing the supply of core components (used parts returned for remanufacturing), is streamlining operations and reducing turnaround times, enhancing the competitiveness of remanufactured goods against new aftermarket offerings.

Regionally, North America and Europe remain the dominant markets due to well-established regulatory frameworks supporting end-of-life vehicle management and a mature infrastructure for core collection and processing. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth, propelled by rapid motorization, increasing consumer awareness regarding sustainable practices, and the proliferation of organized aftermarket service centers. In emerging economies, the affordability of remanufactured parts is a primary driver, although challenges persist in standardizing core quality and intellectual property protection related to component specifications. The European Union's focus on Extended Producer Responsibility (EPR) schemes sets a global benchmark for remanufacturing mandates, influencing policy adoption worldwide.

In terms of segment trends, the transmission and engine component segments continue to hold the largest market share due to their high replacement cost and critical function, offering the most significant economic incentive for remanufacturing. However, the fastest growth is anticipated in the remanufacturing of electronic control units (ECUs), turbochargers, and components related to electric vehicle (EV) powertrains, such as battery components and power electronics. The distribution channel segment is seeing increased sophistication, with the independent aftermarket maintaining its lead but the OEM channel gaining traction by leveraging warranties and brand assurance, offering certified remanufactured parts directly to consumers, thereby blurring the lines between new and reused components in the eyes of the consumer.

AI Impact Analysis on Automotive Parts Remanufacturing Market

User inquiries regarding AI's influence in the Automotive Parts Remanufacturing Market predominantly center on how Artificial Intelligence can enhance core sorting efficiency, improve quality assurance processes, and predict component failure rates to optimize inventory management. Common questions explore the application of machine learning for non-destructive testing (NDT), specifically identifying micro-fractures or stress points invisible to the human eye, and optimizing disassembly and reassembly robotics. Concerns are often raised about the high initial investment required for integrating AI systems and the need for specialized data infrastructure to handle the vast amounts of sensor data generated during testing phases. Users are eager to understand how AI tools can bridge the labor gap by automating highly repetitive or precision-dependent tasks, ultimately aiming to reduce manufacturing variance and elevate the overall reliability of remanufactured products above current industry standards.

AI’s primary transformative effect is manifested in the enhanced precision of diagnostic and testing procedures. Machine learning algorithms, trained on vast datasets of component failures and operational lifecycles, can accurately determine which parts of a core unit must be replaced versus those that can be safely reused, moving beyond traditional manual inspection methods. This capability drastically reduces subjectivity in the inspection process, standardizing the quality output regardless of the technician's experience level. Predictive analytics, driven by AI, optimizes the procurement and inventory of necessary replacement subcomponents by forecasting failure patterns across different vehicle models and operational environments, minimizing downtime and stockouts.

Furthermore, AI-driven automation is crucial for scaling complex remanufacturing tasks. Computer vision systems facilitate rapid identification and sorting of incoming core units, distinguishing between viable cores and irreparable scrap components instantly. Robotic systems integrated with AI guidance are being deployed for highly precise operations, such as laser welding or coating application on critical surfaces, ensuring micron-level accuracy. This technological integration not only addresses skilled labor shortages but also accelerates throughput, making remanufacturing economically competitive even in high-labor-cost regions. The adoption of these intelligent systems is foundational to the industry's evolution towards a 'smart factory' model, ensuring consistent high quality for intricate, modern vehicle parts like sophisticated electronic modules.

- AI-Powered Non-Destructive Testing: Utilizing machine learning for automated fault detection in cores, improving quality control and reducing inspection time.

- Predictive Core Management: Applying AI algorithms to forecast core availability and demand, optimizing reverse logistics and minimizing supply shortages.

- Automated Precision Machining: Integrating computer vision and robotics for highly precise surface restoration and component manipulation during the remanufacturing process.

- Quality Benchmark Setting: Using deep learning to analyze performance data and set dynamic, superior quality standards for remanufactured products.

- Optimized Energy Consumption: AI systems managing factory floor operations to minimize energy usage in cleaning, heating, and testing cycles, aligning with sustainability goals.

DRO & Impact Forces Of Automotive Parts Remanufacturing Market

The Automotive Parts Remanufacturing Market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities, collectively determining its trajectory and stability. The principal driver is the compelling economic viability associated with remanufactured components, offering consumers and commercial fleets a cost reduction typically ranging from 25% to 50% compared to new parts, without compromising on functional warranty. This economic incentive is powerfully reinforced by environmental sustainability mandates, which categorize remanufacturing as a superior form of resource efficiency, significantly reducing the carbon footprint compared to primary manufacturing. Regulatory support, particularly in regions like the European Union and certain US states that encourage recycling and circular economy practices, provides a favorable operational framework, pushing manufacturers to establish formalized core return schemes and high-volume remanufacturing lines.

However, the market faces inherent restraints, most critically the fluctuating availability and quality of 'cores'—the used parts required for the remanufacturing process. A scarcity of suitable cores, often exacerbated by complex international core return logistics or competition from scrap metal recyclers, can directly impede production scale and efficiency. Another significant constraint is the persistent negative perception among some consumers and technicians regarding the reliability of remanufactured parts, despite evidence of equivalent quality. This perceptual hurdle requires continuous investment in consumer education, robust warranty programs, and formalized certification standards to build trust. Furthermore, the increasing complexity of modern automotive components, particularly integrated electronic systems, requires highly specialized testing equipment and software expertise, raising the technological barrier to entry for smaller remanufacturers.

Opportunities for long-term growth are strongly linked to the ongoing shift towards vehicle electrification and autonomous technologies. While initially perceived as a challenge, the remanufacturing of expensive EV components, such as high-voltage batteries (through specialized refurbishment), power electronics, and sophisticated sensor assemblies, presents immense value recovery potential. Technological advancements in additive manufacturing (3D printing) offer new avenues for rapidly producing small, obsolete, or highly customized subcomponents needed during the restoration process, thereby enhancing repairability and reducing reliance on scarce new parts. The expansion into emerging markets, where cost sensitivity is high and vehicle average age is rising, also represents a substantial area for market penetration, leveraging established remanufacturing expertise developed in mature economies.

Segmentation Analysis

The Automotive Parts Remanufacturing Market is systematically segmented based on the type of component being processed, the vehicle application, the channels through which the products are distributed, and the specific technological processes utilized in restoration. Analyzing these segments provides a granular understanding of market dynamics, revealing where investment is flowing, which product lines offer the highest returns, and how various distribution models intersect with consumer demand and OEM strategy. The Component segment, for example, highlights the high value placed on powertrain elements, while the Distribution Channel segment underscores the strategic battle between OEM-certified quality and the cost-effectiveness offered by the independent aftermarket. Understanding these segment behaviors is crucial for companies seeking to optimize their product portfolio and supply chain logistics in this mature but evolving industry.

- By Component:

- Engines and Engine Components (e.g., Cylinder Heads, Crankshafts)

- Transmissions and Transmission Components (e.g., Automatic and Manual Transmissions)

- Starters & Alternators (Rotating Electrics)

- Compressors (AC and Air Brake Systems)

- Steering Components (e.g., Power Steering Pumps, Rack and Pinion Gears)

- Braking Components (e.g., Calipers, Master Cylinders)

- Turbochargers and Fuel Injectors

- Electronic Control Units (ECUs) and Sensors

- Others (e.g., Clutches, Hydraulic Pumps)

- By Vehicle Type:

- Passenger Vehicles (Sedans, SUVs, Light Trucks)

- Commercial Vehicles (Heavy-duty Trucks, Buses, Off-Highway Vehicles)

- By Distribution Channel:

- Original Equipment Manufacturers (OEM) Service Network

- Independent Aftermarket (IAM)

- By Process:

- Disassembly and Cleaning

- Machining and Welding

- Coating and Plating

- Testing and Quality Assurance

Value Chain Analysis For Automotive Parts Remanufacturing Market

The value chain for automotive parts remanufacturing is highly complex, beginning upstream with the critical and often challenging phase of core sourcing and reverse logistics. This initial stage involves collecting the used, worn, or failed components (cores) from various sources—including independent garages, authorized dealerships, dismantling yards, and warranty returns—and transporting them to the remanufacturing facility. Upstream analysis focuses heavily on establishing efficient core grading and inventory management systems, as the quality and timely availability of the core directly impacts the final product cost and production schedule. Strong relationships with core suppliers and sophisticated digital tracking systems are essential to maintain a predictable flow of suitable raw material, mitigating the risk of core scarcity that characterizes this industry.

The core remanufacturing process forms the central link in the value chain, encompassing rigorous disassembly, deep cleaning (often using advanced chemical or cryogenic methods), detailed inspection, replacement of standard wear parts (like seals, gaskets, and bushings), and precision re-machining or surface restoration. This stage is highly technology-intensive, requiring specialized tooling, high-precision measuring equipment, and proprietary testing protocols to ensure the restored component meets or exceeds OEM performance specifications. Quality control and rigorous end-of-line testing are non-negotiable elements here, establishing the reliability that allows the remanufactured part to carry a competitive warranty, which is a key differentiator in the downstream market.

Downstream analysis involves the distribution channel, which is bifurcated into direct and indirect routes. Direct channels predominantly involve OEMs distributing certified remanufactured parts through their proprietary dealer networks, often bundled with new vehicle warranties. Indirect channels, which comprise the bulk of the market, utilize independent distributors, wholesalers, and large automotive parts retail chains (IAM). Effective distribution relies on efficient warehousing and inventory forecasting to ensure rapid availability, as customers often require replacement parts quickly. Marketing efforts focus on educating both mechanics and end-users about the quality, environmental benefits, and cost savings of remanufactured products, thereby overcoming historical perceptions and securing market acceptance at the point of sale.

Automotive Parts Remanufacturing Market Potential Customers

The primary end-users and buyers of remanufactured automotive parts are broadly segmented into three categories: independent repair shops and mechanics, Original Equipment Service (OES) channels including dealership service centers, and large commercial fleet operators. Independent repair shops form the largest customer base, driven primarily by the need for cost-effective repair solutions for older vehicles (typically those past the OEM warranty period). These customers prioritize product availability and price efficiency, relying on the quality assurance provided by reputable independent aftermarket brands and wholesalers. The increasing sophistication of modern vehicles, however, necessitates that these repair shops also invest in specialized diagnostic tools and training to correctly install and integrate advanced remanufactured components like ECUs and sensors.

Dealership service centers, operating within the Original Equipment Service channel, represent the second major customer segment. While they traditionally favored new parts, OEMs have increasingly mandated the use of certified remanufactured components for warranty repairs and standard service on specific vehicle lines, particularly for high-cost assemblies like engines and transmissions. For OES buyers, the motivation is twofold: maintaining high customer satisfaction through quick repairs and managing internal costs, as certified remanufactured parts offer significant cost savings compared to manufacturing entirely new replacements. The key purchasing criteria here revolve around official OEM certification, identical warranty coverage to new parts, and seamless integration with complex vehicle systems.

Commercial fleet operators, encompassing logistics companies, municipal transport systems, and construction firms, constitute a crucial B2B customer segment. For these entities, minimizing vehicle downtime and maximizing operational life cycle cost-effectiveness are paramount. Given the high mileage and demanding operational environments of commercial vehicles, they require frequent replacement of heavy-duty components such as diesel engines, transmissions, and air brake compressors. Remanufactured components provide the necessary robustness and quality standards required for sustained commercial use, coupled with the budgetary advantage that allows fleets to maintain expansive inventories of spare parts efficiently. This segment is particularly sensitive to durability, fuel efficiency implications, and the total cost of ownership (TCO) offered by the remanufactured product.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 17.8 Billion |

| Market Forecast in 2033 | USD 27.9 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, ZF Group, Valeo, Cardone Industries Inc., Caterpillar Inc., Cummins Inc., BorgWarner Inc., Mando Corp., Standard Motor Products Inc., Motorcar Parts of America Inc., Dorman Products, ATC Drivetrain, LKQ Corporation, Brakes International, Jasper Engines & Transmissions, Delphi Technologies, FTE Automotive, Remy Power Products, Holley Performance Products, Meritor Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Parts Remanufacturing Market Key Technology Landscape

The technological landscape in automotive parts remanufacturing is rapidly evolving, driven by the need to handle increasingly complex and precise modern components, particularly those involving advanced electronics and tight tolerances. A fundamental technological requirement is advanced cleaning and inspection methods. Technologies like cryogenic cleaning (using solid carbon dioxide pellets) effectively remove grime and contaminants without damaging sensitive surfaces, while sophisticated Non-Destructive Testing (NDT) techniques, including eddy current testing, ultrasonic testing, and X-ray fluorescence, are mandatory for identifying hidden flaws and material composition variations in core components before restoration begins. These technologies are crucial for standardizing core quality and ensuring reliability in the final product.

Precision machining and surface engineering constitute another pillar of technological advancement. Modern remanufacturing often involves computer numerical control (CNC) machining and grinding to restore critical surfaces, such as engine blocks and transmission valve bodies, to micron-level accuracy. Furthermore, highly durable surface treatments, including thermal spray coating, plasma transfer arc (PTA) welding, and laser cladding, are employed to restore worn bearing surfaces or sealing areas with materials superior to the original specification. These coating technologies not only extend the lifespan of the remanufactured part but also allow for the restoration of components that would have previously been deemed irreparable, thereby improving resource utilization efficiency and broadening the scope of viable cores.

The rise of high-value electronic and complex mechanical components (e.g., ECUs, turbochargers, and EV battery modules) necessitates specialized testing and validation equipment. Sophisticated dynamometers and hardware-in-the-loop (HIL) simulation platforms are used to simulate real-world vehicle operation, ensuring that remanufactured complex systems perform exactly as specified. Data analytics and machine learning are increasingly integrated into these testing benches, automatically analyzing performance data and flagging potential defects or variances in real-time. This digital integration across the entire process, from core inspection to final testing, is transforming remanufacturing from a labor-intensive process into a highly automated, data-driven industrial activity, vital for maintaining quality parity with new components.

Regional Highlights

- North America: Dominates the market, characterized by a well-organized independent aftermarket and strong regulatory support for recycling and remanufacturing initiatives. The US is a major hub, driven by the high average age of vehicles (over 12 years) and substantial logistics infrastructure for core collection. The presence of major remanufacturers and OEMs with certified programs ensures high standards and consumer confidence.

- Europe: A highly mature market focused heavily on environmental compliance, primarily driven by EU directives promoting the circular economy and resource efficiency. Germany, France, and the UK are key contributors, emphasizing the remanufacturing of heavy commercial vehicle components and sophisticated powertrain elements to meet stringent emission standards.

- Asia Pacific (APAC): The fastest-growing region, stimulated by rapid vehicle population growth and increasing cost sensitivity among consumers in countries like China and India. While the market is currently less organized than in the West, formalized remanufacturing is gaining traction as quality assurance and structured core supply chains are developed, moving away from simple repair culture.

- Latin America: Characterized by high price sensitivity and an older vehicle fleet, making remanufactured parts highly desirable. Market growth is challenged by fragmented core collection logistics and a lack of standardized regulatory frameworks, but opportunities are emerging as international remanufacturers establish local assembly and testing facilities.

- Middle East and Africa (MEA): A nascent market segment, primarily driven by the need for durable, cost-effective parts for aging utility and commercial fleets, particularly in mining and infrastructure sectors. Importation of high-quality remanufactured components from Europe and North America currently dominates, with local remanufacturing facilities slowly being established in key economic hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Parts Remanufacturing Market.- Robert Bosch GmbH

- ZF Group

- Valeo

- Cardone Industries Inc.

- Caterpillar Inc.

- Cummins Inc.

- BorgWarner Inc.

- Mando Corp.

- Standard Motor Products Inc.

- Motorcar Parts of America Inc.

- Dorman Products

- ATC Drivetrain

- LKQ Corporation

- Brakes International

- Jasper Engines & Transmissions

- Delphi Technologies (BorgWarner)

- FTE Automotive

- Remy Power Products

- Holley Performance Products

- Meritor Inc. (Caldic Collectibles)

Frequently Asked Questions

Analyze common user questions about the Automotive Parts Remanufacturing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a remanufactured part and a rebuilt or repaired part?

Remanufactured parts are restored to the original equipment manufacturer (OEM) specifications, involving complete disassembly, replacement of all worn components, and rigorous testing, ensuring "like-new" performance and warranty. Repaired or rebuilt parts only fix the component that failed and typically do not involve the same standardized quality control or full component replacement, often resulting in lower longevity.

How does the remanufacturing industry support the circular economy?

Remanufacturing is a core pillar of the circular economy by extending the life cycle of complex automotive components. It drastically reduces the need for raw material extraction and significantly lowers the energy consumption and carbon emissions associated with manufacturing new parts, transforming waste into high-value functional goods.

What challenges does the shortage of core components present to market growth?

The shortage of quality core components (used parts) is the single greatest restraint, as it directly limits production capacity and increases the procurement cost for remanufacturers. Strategies like implementing sophisticated core exchange programs and offering higher core rebates are critical for mitigating supply risk.

Are remanufactured parts suitable for modern vehicles with complex electronics and ADAS systems?

Yes, modern remanufacturing processes now incorporate specialized testing equipment and software updates to restore complex electronic control units (ECUs), sensors, and advanced driver-assistance systems (ADAS) components. High-precision restoration ensures full functionality and compatibility with intricate vehicle network architectures.

Which component segment holds the largest potential for future remanufacturing revenue?

While traditional components like transmissions and engines remain dominant by volume, the highest future revenue growth potential lies in the remanufacturing of expensive Electric Vehicle (EV) related components, specifically power electronics, high-voltage battery modules (refurbishment), and electric motor assemblies, due to their inherent high replacement cost.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager