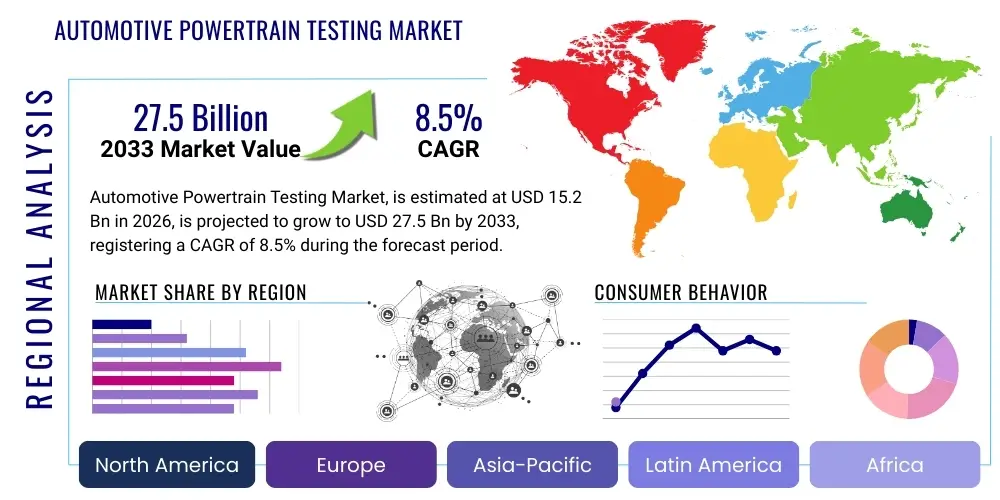

Automotive Powertrain Testing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438794 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Automotive Powertrain Testing Market Size

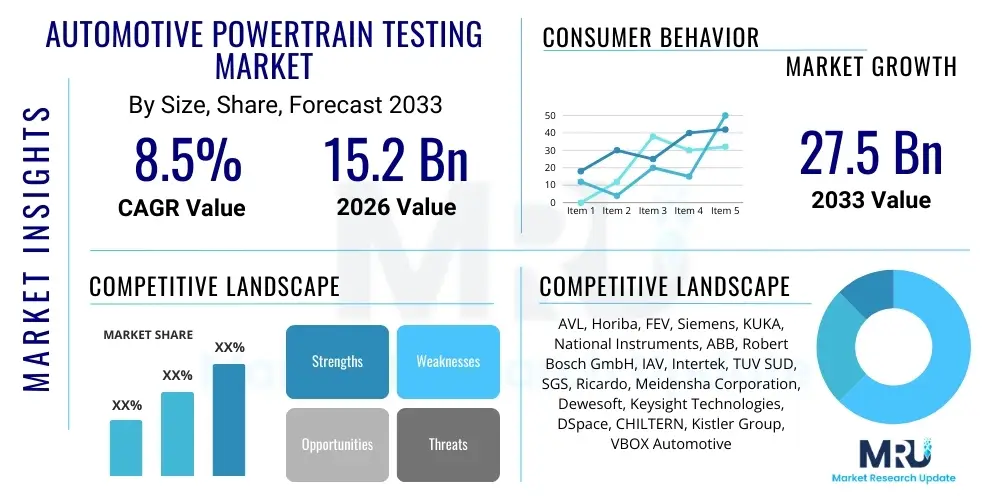

The Automotive Powertrain Testing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 15.2 Billion in 2026 and is projected to reach USD 27.5 Billion by the end of the forecast period in 2033.

Automotive Powertrain Testing Market introduction

The Automotive Powertrain Testing Market encompasses the specialized equipment, software, and services used to validate the performance, durability, and compliance of vehicle powertrains, which include engines, transmissions, drivelines, and increasingly, electric components like batteries, electric motors, and inverters. This testing is crucial for ensuring that vehicles meet stringent global regulatory standards regarding emissions (such as Euro 7 and CAFE), fuel efficiency, and safety. The primary objective is to optimize system performance, reduce noise, vibration, and harshness (NVH), and accelerate time-to-market for new vehicle models. The testing environment spans highly sophisticated test cell systems, dynamometers, and simulation tools designed to replicate real-world operating conditions under controlled laboratory settings, enabling iterative design improvement and component verification before mass production.

Product descriptions within this market cover a wide array of specialized testing apparatus, ranging from engine dynamometers capable of handling high horsepower outputs to chassis dynamometers used for overall vehicle testing. With the accelerated shift toward electric vehicles (EVs), the scope has expanded significantly to include e-motor testing, battery pack cyclers, thermal management systems testing, and specialized inverter testing rigs. Major applications include performance mapping, endurance testing, regulatory compliance validation (homologation), and quality control for both internal combustion engine (ICE) and electric vehicle (EV) components. The integration of advanced data acquisition systems and real-time simulation tools is transforming traditional testing methods into highly efficient, predictive engineering processes, reducing physical prototype requirements.

Key benefits driving the market growth include enhanced product reliability, compliance with increasingly strict global emissions and safety mandates, and significant cost savings achieved through optimized design cycles. The need for continuous innovation in powertrain efficiency, particularly in hybrid and fully electric architectures, necessitates robust testing infrastructure. Furthermore, factors such as the digitalization of the testing process, including Hardware-in-the-Loop (HIL) and Software-in-the-Loop (SIL) simulation, are major driving forces. These digital tools allow manufacturers to front-load validation activities, addressing potential failures earlier in the development phase, thus accelerating the global transition toward sustainable mobility solutions.

Automotive Powertrain Testing Market Executive Summary

The Automotive Powertrain Testing Market is experiencing dynamic growth, fundamentally driven by the global regulatory push for electrification and lower emissions, transforming testing methodologies from traditional mechanical validation to highly sophisticated electrical and thermal performance assessments. Business trends indicate a robust shift towards modular and flexible test cell designs capable of testing both conventional ICEs and complex electric powertrains, including integrated e-axles and high-voltage battery systems. Leading companies are focusing on developing simulation-based testing platforms that leverage AI and machine learning to reduce physical testing time and costs, enhancing efficiency across the R&D cycle. Furthermore, consolidation among testing service providers and technology developers is prevalent as firms seek to offer comprehensive, end-to-end solutions covering development, validation, and certification services globally.

Regionally, Asia Pacific, led by China and India, dominates the market volume due to high automotive production rates and increasing adoption of domestic EV standards, necessitating massive investments in localized testing infrastructure. Europe and North America, while having mature markets, are focusing heavily on sophisticated R&D testing for next-generation architectures, particularly hydrogen fuel cells and advanced battery chemistry, driven by strict mandates like the European Union's emissions targets. These regions are seeing accelerated adoption of advanced technologies like cloud-based testing management and virtual testing platforms to optimize global collaboration and resource utilization.

Segment trends reveal that the Electric Powertrain Testing segment is growing at the fastest rate, outpacing traditional engine and transmission testing. Within this segment, battery testing equipment, particularly cyclers and calorimeters for thermal management analysis, represents a significant investment area. By application, R&D remains the largest segment, but the importance of regulatory compliance and homologation testing is surging due to complex global standards. The market structure is also evolving, with independent testing centers (ITCs) gaining prominence by providing specialized, high-capital testing services that OEMs and Tier 1 suppliers prefer to outsource, ensuring regulatory compliance without the burden of continuous equipment upgrades.

AI Impact Analysis on Automotive Powertrain Testing Market

Common user questions regarding AI's influence in the Automotive Powertrain Testing Market frequently revolve around how AI can accelerate testing cycles, the reliability of AI-generated test cases, and the potential displacement of traditional physical testing. Users are concerned about the complexity of integrating machine learning models with existing Hardware-in-the-Loop (HIL) systems and the accuracy of predictive failure analysis. Key themes center on leveraging AI for predictive maintenance of testing equipment, optimizing dynamometer scheduling, and, most critically, generating synthetic driving cycles and complex failure scenarios that are difficult or time-consuming to replicate physically. Expectations are high regarding AI's ability to interpret vast amounts of sensor data generated during durability tests, enabling engineers to pinpoint subtle performance degradation patterns and thereby significantly enhance the efficiency and predictive capability of the entire validation process.

- AI algorithms optimize test matrix design, reducing the total number of physical runs required for certification.

- Machine learning facilitates predictive failure analysis, identifying potential component weaknesses based on real-time data streaming from test cells.

- AI enhances the efficiency of calibration processes for engine control units (ECUs) and battery management systems (BMS) by rapidly searching optimal parameter spaces.

- Natural Language Processing (NLP) aids in analyzing regulatory documents to ensure test protocols are fully compliant with the latest global standards.

- Predictive maintenance of testing rigs and dynamometers minimizes costly downtime and improves asset utilization rates.

- AI enables the creation of highly realistic virtual simulation environments, supporting advanced Software-in-the-Loop (SIL) and Hardware-in-the-Loop (HIL) testing.

- Data synthesis tools driven by AI generate complex, realistic synthetic driving data to augment scarce real-world test data, particularly for autonomous vehicle (AV) powertrains.

DRO & Impact Forces Of Automotive Powertrain Testing Market

The Automotive Powertrain Testing Market is shaped by a confluence of powerful dynamics, primarily driven by mandatory compliance with global emission regulations and the rapid, irreversible shift toward electric vehicle technology. Key drivers include the necessity for precise efficiency optimization in hybrid and EV components, requiring advanced thermal management testing and high-speed motor characterization. Restraints largely center on the prohibitively high initial capital expenditure required to establish and upgrade dynamic testing facilities, particularly the specialized infrastructure needed for high-voltage EV battery testing and sophisticated hydrogen fuel cell validation. Opportunities are vast, primarily residing in the development of virtual validation tools (HIL/SIL) and the growing demand for specialized testing services related to e-axles and integrated propulsion modules, allowing faster iteration and deployment of new technologies globally. These drivers and restraints collectively create strong impact forces, pushing market participants toward digitalization and highly specialized expertise.

A major driver is the accelerating pace of innovation in battery technology, which necessitates continuous, rigorous testing for performance, safety, and longevity under extreme conditions. OEMs must ensure their EV powertrains can withstand varying climates and charging cycles without degradation, fueling demand for sophisticated climatic chambers and battery cyclers. However, a significant restraint is the shortage of highly skilled engineering talent capable of operating and interpreting results from these complex, integrated test systems, especially concerning functional safety standards (ISO 26262). The inherent difficulty in correlating results between physical test cells and virtual simulation environments also presents a technical hurdle that slows down adoption for some manufacturers.

The primary opportunities lie in the market expansion of outsourced testing and certification services, enabling smaller OEMs and startups to access state-of-the-art facilities without substantial upfront investment. Furthermore, the integration of advanced data analytics and cloud computing into testing environments offers an opportunity to centralize global testing data, improving collaboration and significantly reducing overall development time. The impact forces are acutely felt in the competitive landscape, where technology providers must continuously innovate their testing hardware and software to remain relevant amidst rapidly changing powertrain architectures. The push for faster development cycles and lower physical prototype costs solidifies the trend toward simulation-heavy validation, fundamentally reshaping the business models of testing equipment manufacturers and service providers.

Segmentation Analysis

The Automotive Powertrain Testing market is segmented primarily based on the type of component being tested (internal combustion vs. electric), the vehicle classification (passenger vs. commercial), the purpose of the test (R&D vs. certification), and the end-user (OEMs vs. service providers). The market's structural evolution is heavily influenced by the transition from mechanical to electrical validation, making the "Electric Powertrain Testing" subsegment the key growth engine. Traditional segmentation by engine type is gradually being replaced by segmentation focused on integrated modular systems, such as e-axles and hybrid transmissions. This shift dictates the type of dynamometers and specialized instrumentation required, creating distinct market demand characteristics across these segments.

Detailed analysis of the market segments confirms that the testing of high-voltage battery systems and e-motors is the most capital-intensive area, driving demand for specialized infrastructure upgrades globally. In contrast, the market for conventional powertrain testing, while mature, remains stable due to long-term demand for compliance testing and the continued production of hybrid vehicles. Geographically, segmentation reflects varying regulatory priorities; for instance, European segmentation emphasizes hydrogen testing, while Asian markets prioritize mass production testing for volume EV platforms. Understanding these granular segment trends is crucial for stakeholders to align their product offerings with evolving OEM requirements and regulatory timelines.

- By Vehicle Type

- Passenger Vehicles (PV)

- Commercial Vehicles (CV)

- By Component/Test Type

- Engine Testing (ICE)

- Transmission Testing

- Driveline and Axle Testing

- Electric Powertrain Testing (Battery, E-motor, Inverter, E-Axle)

- By Application

- Research & Development (R&D)

- Certification & Homologation

- Quality Assurance & Durability Testing

- By End-User

- Original Equipment Manufacturers (OEMs)

- Tier 1 Suppliers

- Independent Testing Centers (ITCs) and Service Providers

Value Chain Analysis For Automotive Powertrain Testing Market

The value chain for the Automotive Powertrain Testing Market begins upstream with raw material and component suppliers, particularly manufacturers of specialized sensors, data acquisition systems, high-precision mechanical components for dynamometers, and power electronics for electrical testing rigs. The critical intermediate stage involves the core technology providers—firms that design, integrate, and deploy complete test cell solutions, including software platforms for automation (test bed automation systems) and simulation tools (HIL/SIL). This stage requires deep integration expertise to combine mechanical hardware, electronics, and sophisticated software into a cohesive testing environment. Strong differentiation is achieved here through intellectual property related to proprietary simulation models and real-time control algorithms, often requiring extensive calibration expertise.

The downstream flow involves the direct and indirect distribution channels. Direct sales channels are typically utilized for large-scale, custom test cell installations where OEMs or major Tier 1 suppliers purchase equipment directly from the technology vendors (e.g., AVL, Horiba) and receive installation and ongoing maintenance services. Indirect channels involve systems integrators, distributors, and calibration consultants who might specialize in specific regional markets or niche testing applications, acting as intermediaries to provide turnkey solutions to smaller customers or ITCs. A significant and growing part of the downstream value chain is the testing service segment, where ITCs and third-party laboratories (like TÜV SÜD or Intertek) utilize the equipment to provide validation, certification, and compliance services to the entire automotive ecosystem.

The efficiency of the entire value chain is increasingly reliant on seamless integration between the hardware and the software stack, especially for managing the enormous datasets generated during durability testing. Upstream innovation in sensor technology (e.g., highly accurate torque and speed sensors, thermal imaging systems) directly impacts the quality of the testing output. Downstream success is determined by the service providers' ability to maintain compliance expertise across rapidly changing regulatory landscapes (e.g., WLTP, RDE, and new EV safety standards). The shift towards electrification necessitates a complete restructuring of the distribution of services, favoring providers who can offer high-voltage safety consulting alongside physical testing facilities.

Automotive Powertrain Testing Market Potential Customers

The primary customers of the Automotive Powertrain Testing Market span the entire automotive manufacturing and development ecosystem, ranging from large multinational corporations to specialized engineering firms and regulatory bodies. The most significant segment of end-users consists of Original Equipment Manufacturers (OEMs), including established players and new electric vehicle manufacturers (NEVMs). These companies require massive, dedicated testing facilities to handle the rigorous R&D, validation, and quality control of their proprietary powertrain technologies, especially during the crucial stages of new platform development for EVs and highly efficient ICEs. OEMs often invest heavily in their own internal testing labs to maintain proprietary knowledge and rapidly iterate design changes, prioritizing equipment robustness and sophisticated automation software.

Another crucial customer segment includes Tier 1 and Tier 2 suppliers, who are responsible for designing and delivering critical powertrain components such as turbochargers, fuel injection systems, transmissions, battery packs, and e-motors. These suppliers require precise component-level testing equipment to ensure their parts meet the stringent performance and durability requirements set by the OEMs before integration. Their purchasing decisions are often driven by the need for specific, highly accurate test benches that can handle high volume, standardized compliance checks, and material fatigue analysis. This segment’s demand is increasing due to the trend of system integration, where suppliers deliver fully validated modular systems (like e-axles) rather than individual components.

Finally, Independent Testing Centers (ITCs) and certification agencies represent a high-growth customer base. Organizations such as TÜV, SGS, and specialized independent laboratories purchase sophisticated testing equipment to offer outsourcing services for regulatory certification (homologation), emissions testing, and specialized endurance programs. They serve a wide range of clients, from small firms needing compliance checks to large OEMs seeking external validation or requiring access to specialized, high-cost equipment (like hydrogen fuel cell testers) that is uneconomical to maintain in-house. This customer group values flexibility, high throughput, and accreditation compatibility above all else.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.2 Billion |

| Market Forecast in 2033 | USD 27.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AVL, Horiba, FEV, Siemens, KUKA, National Instruments, ABB, Robert Bosch GmbH, IAV, Intertek, TUV SUD, SGS, Ricardo, Meidensha Corporation, Dewesoft, Keysight Technologies, DSpace, CHILTERN, Kistler Group, VBOX Automotive |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Powertrain Testing Market Key Technology Landscape

The technological landscape of automotive powertrain testing is rapidly transitioning from reliance on purely mechanical testing to integrated electromechanical systems heavily supported by advanced software and simulation capabilities. Key technologies driving this evolution include highly dynamic and regenerative dynamometers, which are essential for testing electric motors and batteries, as they allow energy generated during braking or motor operation to be fed back into the grid, significantly reducing operating costs. Furthermore, sophisticated thermal management equipment, such as battery calorimeters and specialized climate chambers, is becoming standard to accurately assess performance and safety degradation across extreme temperature ranges, a critical factor for EV adoption in diverse global climates. The necessity for high-speed, high-fidelity data acquisition (DAQ) systems capable of handling thousands of data channels simultaneously is paramount for comprehensive analysis.

The most transformative technology in the current landscape is the widespread adoption of virtualization techniques, notably Hardware-in-the-Loop (HIL) and Software-in-the-Loop (SIL). HIL testing uses real controllers (like the ECU or BMS) connected to a simulated environment, allowing validation of complex software functions before physical prototypes are ready. This methodology drastically compresses the development timeline. Complementary to this is the integration of predictive modeling and digital twins—virtual representations of the powertrain system—which are used to run countless optimization loops and durability simulations. These tools, often powered by AI, enable engineers to identify potential issues and optimize calibration parameters virtually, reserving physical test cells for final validation and regulatory compliance only, thereby improving asset utilization rates dramatically.

Another area of intense technological focus is the development of modular and flexible test beds. As OEMs shift between ICE, hybrid, and fully electric architectures, the demand is high for test equipment that can be quickly reconfigured to accommodate different powertrain sizes, voltage levels (up to 1000V for commercial EVs), and component interfaces. Sensor technology is also advancing, with a focus on non-intrusive measurement techniques and robust sensors capable of operating reliably in harsh environments, such as those encountered in hydrogen fuel cell testing where precise flow and pressure monitoring is required. Cloud-based testing infrastructure and advanced cybersecurity protocols are essential for managing global testing data, ensuring data integrity, and facilitating collaboration across geographically dispersed engineering teams, positioning software as the primary competitive differentiator in the modern testing market.

Regional Highlights

- Asia Pacific (APAC): Dominates the market in terms of production volume and installed capacity, driven primarily by China’s aggressive electric vehicle mandates and rapid domestic automotive expansion in India and Southeast Asia. The region is seeing massive investment in localized battery and e-motor testing facilities to support the high-volume manufacturing goals of local and international OEMs, making it the fastest-growing market globally for advanced testing equipment and services.

- Europe: Characterized by stringent emission standards (Euro 7) and a strong focus on advanced R&D for next-generation mobility solutions, including hydrogen fuel cells and highly efficient plug-in hybrids. Europe represents the largest market for specialized, high-precision, and sophisticated validation technologies, heavily leveraging virtual testing methods (HIL/SIL) to ensure compliance with complex functional safety and cyber security regulations.

- North America: The market is defined by a significant push towards EV platform modernization, particularly in the United States, driven by governmental incentives and corporate sustainability goals. North America exhibits high demand for testing equipment related to commercial electric vehicles (trucks and buses) and autonomous vehicle powertrain validation, prioritizing robust, long-duration durability testing and advanced battery thermal management solutions.

- Latin America, Middle East, and Africa (MEA): These regions show slower but steady growth, focusing primarily on maintenance and upgrade of existing conventional powertrain testing infrastructure, coupled with foundational investments in EV testing as local governments begin to introduce basic electrification policies. Demand is largely fulfilled by outsourced services from international ITCs and refurbished equipment sales, though oil-rich nations are starting to invest in hydrogen technology R&D facilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Powertrain Testing Market.- AVL List GmbH

- Horiba Ltd.

- FEV Group GmbH

- Siemens AG

- KUKA AG (Specialized Robotics)

- National Instruments Corporation (NI)

- ABB Ltd.

- Robert Bosch GmbH

- IAV GmbH

- Intertek Group plc

- TUV SUD AG

- SGS SA

- Ricardo plc

- Meidensha Corporation

- Dewesoft d.o.o.

- Keysight Technologies

- DSpace GmbH

- Kistler Group

- Chiltern Automotive (part of Ricardo)

- VBOX Automotive

Frequently Asked Questions

Analyze common user questions about the Automotive Powertrain Testing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving growth in the Powertrain Testing Market?

The primary factor driving growth is the mandatory global transition to electrified vehicles (EVs) and hybrid architectures, coupled with increasingly stringent emission regulations (e.g., Euro 7), necessitating substantial investment in specialized high-voltage battery and e-motor testing infrastructure.

How is AI transforming traditional powertrain validation methods?

AI is transforming validation by enabling predictive failure analysis, optimizing complex test cycles, and facilitating the rapid development of digital twin models and highly realistic virtual testing environments, significantly reducing reliance on costly and time-consuming physical prototypes.

Which segment holds the highest growth potential in the forecast period?

The Electric Powertrain Testing segment, specifically specialized subsegments like high-voltage battery testing (cyclers, calorimeters) and E-Axle system validation, holds the highest and fastest growth potential due to accelerated global EV production goals.

What are the main restraints hindering market expansion?

The main restraints are the substantial initial capital expenditure required for high-voltage and regenerative testing equipment, complexity in integrating software systems (HIL/SIL) with physical test beds, and a shortage of specialized engineering talent in electric powertrain calibration and validation.

Why are Independent Testing Centers (ITCs) becoming more important?

ITCs are gaining importance because they offer flexible, specialized access to high-cost, state-of-the-art testing equipment and certification expertise, allowing OEMs and Tier 1 suppliers to outsource non-core validation activities and achieve rapid regulatory compliance without heavy internal capital investment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager