Automotive PVC and PU Leather Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440027 | Date : Jan, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Automotive PVC and PU Leather Market Size

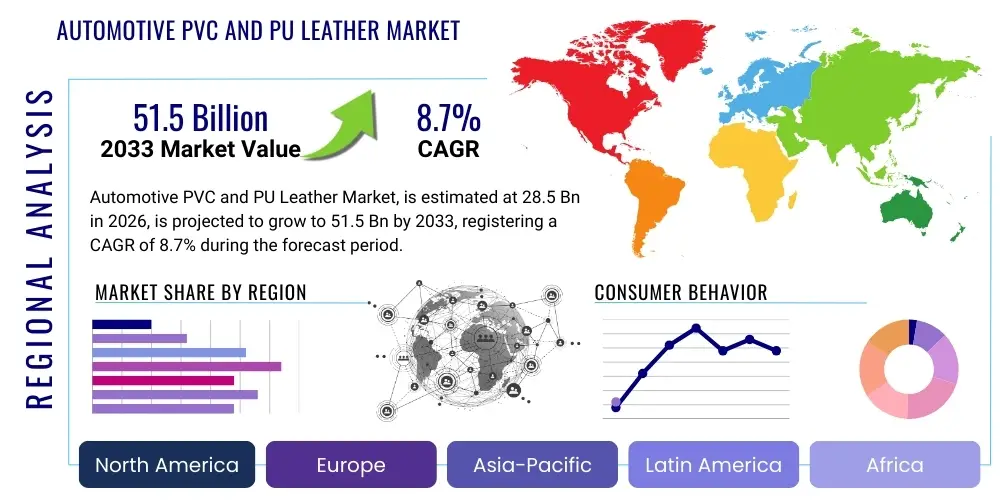

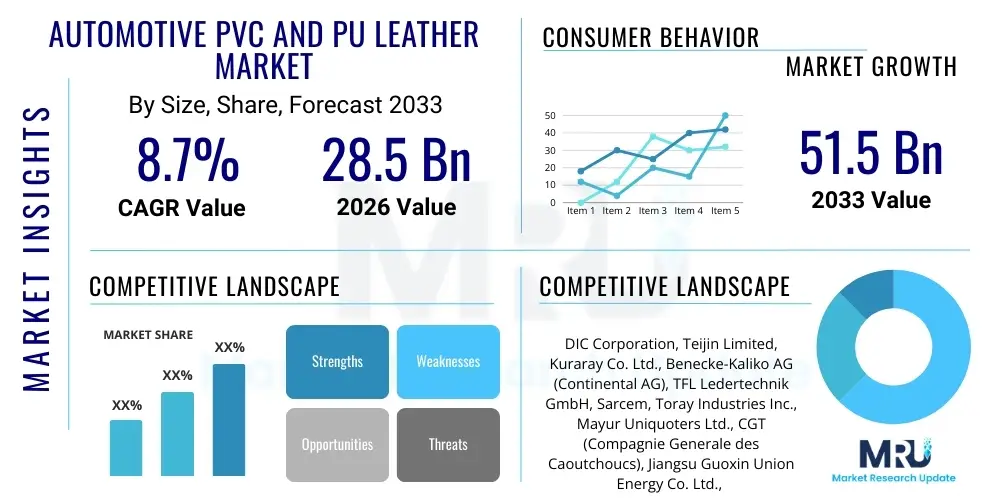

The Automotive PVC and PU Leather Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.7% between 2026 and 2033. The market is estimated at USD 28.5 Billion in 2026 and is projected to reach USD 51.5 Billion by the end of the forecast period in 2033.

Automotive PVC and PU Leather Market introduction

The automotive PVC (Polyvinyl Chloride) and PU (Polyurethane) leather market encompasses a comprehensive and expanding array of advanced synthetic leather materials, meticulously engineered for application within vehicle interiors. These innovative materials are specifically designed to replicate the luxurious aesthetic appeal, sophisticated tactile qualities, and plush feel of genuine leather, while simultaneously delivering superior performance attributes such as exceptional durability, remarkable cost-effectiveness, and unparalleled design flexibility. Their primary utilization extends across critical interior components, including comfortable seating surfaces, robust door panels, aesthetically pleasing dashboards, and ergonomic steering wheels. By serving as versatile synthetic alternatives, these materials effectively cater to a broad and diverse spectrum of automotive segments, ranging from economical entry-level models to opulent luxury vehicles, thereby empowering automotive manufacturers with an extensive suite of adaptable solutions for contemporary interior design and styling.

The inherent benefits of utilizing PVC and PU leather in automotive applications are manifold and represent compelling advantages over traditional materials. These benefits include superior abrasion resistance, ensuring long-term aesthetic integrity even under rigorous daily use, alongside exceptional ease of cleaning, which significantly simplifies vehicle maintenance. Furthermore, these materials offer remarkable UV stability, preventing fading and degradation when exposed to sunlight, and possess strong resistance to stains, mildew, and common automotive chemicals. Such properties make them highly desirable for an industry where longevity, robust performance, and low maintenance are paramount. Continuous advancements in manufacturing processes have notably improved the feel, breathability, and overall haptics of these synthetic materials, effectively narrowing the perception gap with natural leather in terms of premium quality and passenger comfort.

The market for automotive PVC and PU leather is principally propelled by several key driving factors that reflect broader industry trends and evolving consumer demands. These include the consistently increasing global automotive production, particularly within rapidly developing economies, which inherently fuels demand for interior materials. A growing preference among automakers and consumers for cost-efficient interior solutions that do not compromise on visual appeal or functional performance is also a significant driver. Furthermore, rising environmental and ethical concerns associated with animal husbandry and leather processing are increasingly directing manufacturers towards sustainable, cruelty-free synthetic alternatives. The continuous development of advanced formulations that offer enhanced performance characteristics, such as lighter weight and improved recyclability, alongside the rapid expansion of the electric vehicle (EV) market, which often prioritizes innovative and lightweight interior materials, further accelerates the adoption and growth of automotive PVC and PU leather solutions.

Automotive PVC and PU Leather Market Executive Summary

The automotive PVC and PU leather market is currently navigating a period of dynamic transformation, shaped by a complex interplay of evolving consumer preferences, rapid technological advancements, and an increasingly stringent global regulatory landscape. Current business trends conspicuously indicate a pronounced emphasis on sustainability, compelling manufacturers to substantially increase their investments in the research, development, and production of bio-based and recycled content synthetic leathers. This strategic shift is a direct response to the burgeoning consumer demand for eco-friendly products and the industry's broader commitment to reducing its environmental footprint. Concurrently, there is a discernible trend towards greater customization and personalization of vehicle interiors, where the intrinsic versatility of PVC and PU leather enables the creation of unique design patterns, bespoke color palettes, and intricate textures, affording automakers significant opportunities to differentiate their product offerings in a competitive market. Moreover, the market is witnessing strategic consolidation activities among prominent key players, alongside the formation of strategic partnerships and collaborations, all aimed at enhancing global production capabilities, streamlining supply chains, and expanding market reach into new geographical territories.

Analyzing regional trends reveals that Asia Pacific unequivocally stands as the dominant market for automotive PVC and PU leather, a position primarily attributable to the robust and expansive automotive manufacturing bases located in economic powerhouses such as China, India, Japan, and South Korea. This dominance is further bolstered by the region's rapidly rising disposable incomes, which consistently fuel consumer demand for feature-rich and aesthetically pleasing vehicles. In contrast, North America and Europe represent mature markets, distinguished by their rigorous environmental regulations that actively drive innovation towards sustainable synthetic leathers and a consistent, albeit sophisticated, demand for premium vehicle interior aesthetics and superior material performance. Meanwhile, Latin America and the Middle East & Africa regions are rapidly emerging as high-growth markets, experiencing significant expansion spurred by accelerating urbanization, industrialization initiatives, and substantial foreign investments within the automotive sector, collectively leading to augmented vehicle sales and a consequent surge in demand for high-quality interior materials.

Segment-specific trends within the market underscore that PU leather is progressively gaining considerable traction and market share over traditional PVC leather. This preference for PU is largely driven by its superior softness, enhanced breathability, and often more environmentally benign production processes, which resonate strongly with contemporary sustainability objectives. Applications in vehicle seating and general interior trims continue to represent the largest and most foundational segments, although there is a clearly noticeable and steady increase in the demand for these versatile materials in other critical areas, such as dashboard coverings and steering wheel wraps, for their enhanced durability, tactile quality, and elevated aesthetic appeal. While the passenger vehicle segment steadfastly remains the largest consumer of automotive synthetic leathers, the commercial vehicle sector is also significantly expanding its adoption of these durable and easily maintainable materials, particularly within the contexts of public transport fleets, long-haul logistics vehicles, and other demanding operational environments where resilience and hygiene are paramount.

AI Impact Analysis on Automotive PVC and PU Leather Market

Common user questions and industry discussions related to the impact of Artificial Intelligence (AI) on the automotive PVC and PU leather market frequently revolve around how this transformative technology can fundamentally optimize material properties, streamline complex manufacturing processes, and significantly enhance design capabilities. Stakeholders are particularly keen to understand if AI can facilitate the development of genuinely "smart" synthetic leathers that boast integrated functionalities, such as self-healing properties or adaptive climate control, or if it possesses the potential to drastically reduce material waste and substantially improve the overall environmental footprint of production cycles. There is also considerable curiosity surrounding AI's prospective role in accurately predicting material performance under diverse and extreme operational conditions, optimizing intricate global supply chains for raw materials, and enabling highly personalized interior designs tailored to individual consumer preferences. Ultimately, the overarching expectation among users is that AI will drive the industry towards more efficient, sustainably produced, and profoundly consumer-centric product development and manufacturing paradigms.

- AI-driven advanced algorithms can be utilized for the precise optimization of material formulations, leading to synthetic leathers with enhanced durability, superior haptic feedback (feel), and significantly improved sustainability profiles through the intelligent selection of components and process parameters.

- Implementation of AI-powered predictive maintenance systems for manufacturing equipment can drastically reduce unexpected downtime, minimize production waste, and ensure operational continuity in the complex synthetic leather production lines, leading to higher efficiency and cost savings.

- Deployment of automated quality control systems integrated with AI vision and machine learning algorithms can ensure consistent material standards, instantly detecting subtle defects, color inconsistencies, or texture flaws, thereby guaranteeing premium product quality and reducing rework.

- AI can optimize complex global supply chains for raw materials and finished products, leading to improved logistics efficiency, reduced transportation costs, optimized inventory levels, and enhanced resilience against market disruptions, ensuring a more stable and cost-effective material flow.

- Leveraging AI and machine learning for data analysis can facilitate personalized interior design recommendations based on extensive customer preference data, demographic trends, and predictive analytics, allowing automakers to offer highly customized vehicle interiors at scale.

- Research and development efforts, amplified by AI, can lead to the creation of truly smart synthetic materials with seamlessly integrated sensors for advanced functionalities such as adaptive heating, cooling, dynamic ambient lighting, or sensitive touch interfaces, transforming the in-car experience.

- AI-powered simulation and virtual prototyping tools can rapidly accelerate the research and development cycles for new material compositions and textures, allowing for virtual testing of performance characteristics and aesthetic outcomes before physical production, significantly saving time and resources.

- Real-time monitoring of various production parameters through AI-enabled systems can provide immediate insights and adjustments, leading to substantial improvements in energy efficiency, minimization of production defects, and overall optimization of the manufacturing process for synthetic leathers.

DRO & Impact Forces Of Automotive PVC and PU Leather Market

The automotive PVC and PU leather market is profoundly shaped by a confluence of intricate drivers, significant restraints, and promising opportunities, each exerting substantial influence on its trajectory, growth potential, and overall dynamics. A primary driver is the relentless and expansive growth in global automotive production, particularly evident in rapidly industrializing emerging economies, which consistently fuels the fundamental demand for interior solutions that are both cost-effective and aesthetically pleasing. The intrinsic and widely recognized benefits of synthetic leather, such as its superior durability, remarkable resistance to wear and tear, and inherent ease of maintenance, further solidify its position as a preferred material over genuine leather across numerous vehicle segments. Additionally, the increasing consumer preference for ethically produced, cruelty-free, and vegan alternatives, coupled with a heightened global environmental awareness, significantly boosts the adoption rate of synthetic leathers throughout the automotive supply chain.

However, the market is not without its considerable challenges and restraints that can temper its growth potential and introduce market volatility. One significant restraint is the inherent volatility in the prices of key raw materials, such as crude oil derivatives essential for PVC and PU synthesis, which can lead to unpredictable production costs and adversely impact profit margins for manufacturers. Furthermore, intense competition from an array of alternative interior materials, including various advanced textiles and sustainable fabrics, along with the persistent and deeply ingrained preference for genuine leather in the ultra-premium and luxury vehicle segments, poses ongoing and formidable challenges. Moreover, growing environmental concerns surrounding the long-term disposal, biodegradability, and recyclability of certain synthetic materials, particularly PVC, represent a stringent regulatory hurdle and exert continuous pressure on the industry to innovate towards more sustainable and circular material solutions.

Despite these challenges, the market is replete with abundant opportunities that promise significant avenues for expansion and technological innovation. The burgeoning electric vehicle (EV) market, for instance, presents a substantial and compelling growth avenue, as EVs often prioritize lightweight, sustainable, and technologically integrated interiors, characteristics for which advanced synthetic leathers are exceptionally well-suited. Moreover, continuous advancements in material science are leading to the groundbreaking development of next-generation bio-based and recycled synthetic leathers, directly addressing critical sustainability concerns and consequently opening entirely new market segments and consumer bases. The increasing demand for highly customizable and personalized vehicle interiors, driven by evolving consumer expectations for unique and tailored experiences, also provides a fertile ground for manufacturers to offer an unprecedented diversity of textures, colors, and integrated functionalities, leveraging the inherent versatility and adaptability of PVC and PU leather. These collective impact forces critically dictate the strategic decisions of market players and profoundly influence the overall evolutionary path of the automotive PVC and PU leather industry.

Segmentation Analysis

The automotive PVC and PU leather market is meticulously segmented to provide a comprehensive and granular understanding of its diverse components, intricate underlying market dynamics, and prevailing industry trends. This detailed segmentation is absolutely crucial for accurately identifying specific growth areas, navigating the competitive landscapes effectively, and formulating highly tailored product development and market entry strategies. The market is primarily bifurcated along several key dimensions: by product type, which distinguishes between the two primary synthetic materials; by application, detailing their use across various interior components; and by vehicle type, categorizing their adoption across different automotive segments. Each of these classifications offers distinct and valuable insights into evolving consumer preferences, varying industry adoption patterns, and the nuanced demand dynamics. Such a granular analytical approach enables a precise assessment of market penetration and future growth prospects across a broad spectrum of automotive sectors, thereby facilitating highly targeted market interventions and robust strategic planning for all stakeholders within the value chain.

- By Product Type: This segment differentiates the market based on the chemical composition and inherent properties of the synthetic leather.

- PVC Leather: Known for its robustness, cost-effectiveness, and excellent resistance to abrasion and moisture, often favored for high-traffic areas and more budget-conscious vehicle models.

- PU Leather: Valued for its softer touch, enhanced breathability, and closer resemblance to genuine leather, increasingly preferred for seating surfaces and premium interior trims due to its superior haptic qualities and often more environmentally friendly manufacturing processes.

- By Application: This segment categorizes the market based on the specific interior components where PVC and PU leather are utilized.

- Seats: The largest application segment, where synthetic leathers provide durability, comfort, and aesthetic appeal, catering to diverse vehicle classes from economy to luxury.

- Dashboards: Used for their aesthetic versatility, UV resistance, and tactile qualities, contributing to the overall interior ambiance and premium feel.

- Door Panels: Applied for their durability, ease of cleaning, and design integration with other interior elements, enhancing both functionality and visual appeal.

- Steering Wheel Covers: Chosen for grip, tactile comfort, and resistance to wear from constant handling, improving driver experience and longevity.

- Headliners: Utilized for their lightweight properties, aesthetic finish, and sound-absorbing characteristics, contributing to cabin comfort and perceived quality.

- Other Interior Trims (e.g., gear shift boots, armrests, center consoles, sun visors): Encompasses a wide range of smaller components where synthetic leathers offer durability, design consistency, and a premium touch.

- By Vehicle Type: This segment classifies the market based on the type of automotive vehicle.

- Passenger Vehicles: The largest consumer segment, including sedans, hatchbacks, SUVs, and luxury cars, where synthetic leathers are widely used across all interior applications due to diverse consumer demands and cost considerations.

- Commercial Vehicles: Includes trucks, buses, vans, and specialty vehicles, where durability, ease of maintenance, and cost-effectiveness of synthetic leathers are highly valued for rigorous daily operational use and extended vehicle lifespans.

- By Sales Channel: This segment distinguishes between the primary routes through which synthetic leather materials reach the end-use automotive applications.

- Original Equipment Manufacturer (OEM): Materials supplied directly to automotive manufacturers for integration into new vehicle production lines, requiring high volume, consistent quality, and adherence to stringent specifications.

- Aftermarket: Materials sold for vehicle repair, customization, restoration, and replacement purposes, catering to individual consumers, specialized workshops, and aftermarket component suppliers, often demanding a broader range of styles and smaller batch sizes.

Value Chain Analysis For Automotive PVC and PU Leather Market

The intricate value chain for the automotive PVC and PU leather market commences with the critical upstream suppliers of foundational raw materials, which are absolutely indispensable for the complex synthesis and formulation of these advanced polymeric materials. This initial stage predominantly involves major petrochemical companies that provide essential monomers, such as vinyl chloride for PVC production, and a specialized array of isocyanates and polyols for PU synthesis. Complementing these core chemicals, various specialty chemical manufacturers supply vital additives including plasticizers, stabilizers, and high-performance pigments, while textile manufacturers are crucial providers of diverse fabric backings, which give synthetic leather its structural integrity and drape. The intrinsic quality, consistent availability, and cost-effectiveness of these foundational components directly and profoundly influence the final product attributes, performance characteristics, and overall production costs within the industry. Therefore, establishing efficient sourcing strategies, securing long-term supply agreements, and fostering robust relationships with these upstream providers are unequivocally essential for maintaining production continuity, ensuring quality control, and sustaining a competitive edge within the highly dynamic market.

Progressing downstream along the value chain, these diverse raw materials are meticulously processed and transformed by specialized synthetic leather manufacturers. These manufacturers undertake a series of sophisticated operations, including precision compounding, advanced coating techniques (such as knife-over-roll, reverse roll, or transfer coating), and elaborate finishing treatments, all designed to convert raw polymers into high-grade automotive PVC and PU leather. These highly specialized manufacturers frequently deploy cutting-edge technologies and proprietary processes to achieve specific textures, intricate patterns, and superior performance characteristics, such as enhanced durability, exceptional UV resistance, and critical flame retardancy properties, all tailored to meet stringent automotive standards. The resulting, high-quality synthetic leather is then strategically supplied either directly to major automotive Original Equipment Manufacturers (OEMs) for seamless integration into new vehicle production lines, or to an extensive network of aftermarket suppliers who cater to the diverse needs of vehicle customization, repair, and replacement services, addressing both aesthetic upgrades and functional restoration. The efficiency and reliability of this midstream manufacturing and supply segment are pivotal for ensuring the consistent delivery of materials that meet the rigorous demands of the automotive sector.

The distribution channel represents a critical final link in the value chain, playing a pivotal role in ensuring the timely, efficient, and cost-effective delivery of these highly specialized materials to various automotive assembly plants and a multitude of retail outlets globally. Distribution channels are typically bifurcated into two primary routes: direct and indirect. Direct sales strategies often involve establishing long-term, high-volume contracts and fostering deep, direct engagement between large synthetic leather manufacturers and major automotive OEMs. This direct approach ensures a stable and predictable supply chain, facilitates collaborative product development tailored to specific vehicle models, and enables rapid response to evolving design requirements. Conversely, indirect channels encompass a broader and more diverse network of specialized distributors, regional wholesalers, and various retail outlets that collectively serve smaller automotive component manufacturers, niche customizers, and the expansive aftermarket segment. Both direct and indirect channels are absolutely vital for comprehensive market penetration; direct channels emphasize scale, integration, and strategic partnership, while indirect channels focus on broad market reach, localized availability, and specialized product offerings. Optimizing both upstream and downstream logistics, coupled with implementing robust and adaptable distribution strategies, is therefore paramount for achieving sustainable success and maintaining a strong competitive position in this intensely competitive global market.

Automotive PVC and PU Leather Market Potential Customers

The primary potential customers for the automotive PVC and PU leather market are segmented across various integral tiers of the expansive automotive industry, ranging from large-scale global vehicle manufacturers to highly specialized interior component suppliers and the dynamic aftermarket sector. Automotive Original Equipment Manufacturers (OEMs) collectively represent the largest and most significant segment of end-users. These OEMs directly integrate PVC and PU leather into the mass production of new vehicles for a multitude of interior applications, including comfortable seating, sophisticated dashboards, resilient door panels, and various other interior surfaces. Their substantial demand is predominantly driven by a confluence of factors, including the imperative for cost-efficiency in large-scale production, the flexibility offered in interior design and styling, stringent durability requirements to meet vehicle lifespan expectations, and the evolving consumer preferences for sustainable, aesthetically pleasing, and technologically advanced interiors across a diverse range of vehicle models, encompassing passenger cars, popular SUVs, luxury sedans, and robust commercial vehicles.

Tier-1 and Tier-2 automotive suppliers also constitute an exceptionally significant and specialized customer base within this market. These companies are highly specialized in manufacturing complete interior systems, such as entire cockpit modules, or producing individual high-value components, including fully assembled seats, sophisticated door modules, and ergonomic steering wheels, which are subsequently supplied directly to the OEMs for final vehicle assembly. These critical suppliers require high-quality, consistently uniform, and precisely specification-compliant PVC and PU leather materials that are capable of withstanding rigorous automotive standards and can seamlessly integrate into their often complex and high-volume production processes. The accelerating trend towards modular design, coupled with the widespread adoption of just-in-time (JIT) delivery systems across the automotive industry, further accentuates the critical need for highly reliable, responsive, and innovative material suppliers to these essential component manufacturers, ensuring smooth and efficient production flows.

Beyond the realm of new vehicle production, the automotive aftermarket sector forms another crucial and continuously expanding customer segment for PVC and PU leather. This diverse segment encompasses professional automotive upholsterers specializing in interior restoration, dedicated repair shops handling accident damage or wear-and-tear, and a growing community of DIY enthusiasts who utilize PVC and PU leather for bespoke vehicle restoration projects, personalized customization enhancements, or the replacement of worn-out or damaged interior components. The demand within this aftermarket segment is notably influenced by factors such as the average age of vehicles on the road, prevailing aesthetic preferences for interior upgrades and personalization, and the broad availability of diverse material options in terms of color, texture, and performance characteristics. As such, manufacturers and distributors of automotive PVC and PU leather must strategically tailor their product offerings, pricing structures, and distribution strategies to effectively cater to the distinct needs, volume requirements, and purchasing behaviors of these varied customer groups, ranging from the mass production demands of OEMs to the specialized, often smaller-batch requirements of aftermarket specialists.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 28.5 Billion |

| Market Forecast in 2033 | USD 51.5 Billion |

| Growth Rate | 8.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DIC Corporation, Teijin Limited, Kuraray Co. Ltd., Benecke-Kaliko AG (Continental AG), TFL Ledertechnik GmbH, Sarcem, Toray Industries Inc., Mayur Uniquoters Ltd., CGT (Compagnie Generale des Caoutchoucs), Jiangsu Guoxin Union Energy Co. Ltd., Achilles Corporation, Recticel NV, Wuhan Double Plastic Manufacturing Co. Ltd., Xiefu Group, Dongguan Dongfang Leather Co. Ltd., Yantai Wanhua Polyurethanes Co. Ltd., Fujian Long'an Synthetic Leather Co. Ltd., Nan Ya Plastics Corporation, San Fang Chemical Industry Co. Ltd., H.R. Textiles Pvt. Ltd. |

| Regions Covered | North America (U.S., Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, ASEAN, Rest of APAC), Latin America (Brazil, Argentina, Rest of Latin America), Middle East, and Africa (MEA) (GCC Countries, South Africa, Rest of MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive PVC and PU Leather Market Key Technology Landscape

The automotive PVC and PU leather market is undergoing continuous and rapid evolution, driven by significant technological advancements that are fundamentally aimed at enhancing material performance, bolstering sustainability credentials, and elevating overall aesthetic appeal. Key technological innovations in this sector predominantly revolve around sophisticated coating techniques, such as precision transfer coating and advanced direct coating methods. These techniques allow for remarkably precise control over the material's thickness, enable the creation of highly intricate textures, and significantly improve intrinsic durability, ensuring that the synthetic leather meets the demanding wear-and-tear requirements of automotive interiors. Furthermore, ongoing innovations in polymer science are consistently leading to the development of highly enhanced formulations for both PVC and PU, specifically focusing on achieving increased softness, superior breathability, and exceptional resistance to common automotive stressors, including extreme temperature fluctuations, prolonged UV radiation exposure, and corrosive chemical spills. The integration of advanced antimicrobial and antifungal agents directly into these materials is also becoming an increasingly prevalent practice, effectively addressing critical hygiene concerns and significantly extending the longevity of vehicle interiors.

Moreover, substantial technological efforts are being strategically directed towards achieving superior sustainability outcomes across the entire lifecycle of synthetic leathers. This critical focus includes the pioneering development of solvent-free PU manufacturing processes, frequently employing innovative water-based or hot-melt technologies. These advanced processes are instrumental in substantially reducing volatile organic compound (VOC) emissions during the production phase and throughout the material's operational lifecycle within a vehicle, aligning with stringent environmental regulations and corporate responsibility goals. Concurrently, cutting-edge research into bio-based polyols and innovative PVC alternatives, which are derived from renewable resources such as various plant-based oils or meticulously recycled plastics, represents a significant frontier in green material technology. These profound innovations are specifically designed to significantly lessen the environmental footprint associated with synthetic leathers, aligning seamlessly with global sustainability objectives and directly addressing the surging consumer demand for eco-friendly and responsibly sourced automotive interior products, thereby fostering a more circular economy within the industry.

In terms of both aesthetic and functional technologies, the market is benefiting from highly advanced embossing and printing techniques that enable the creation of remarkably realistic grain patterns and highly customized designs, capable of mimicking genuine leather with astonishing accuracy or generating entirely novel visual effects. Digital printing, in particular, offers unprecedented flexibility for producing intricate patterns and facilitating deep personalization, allowing for bespoke interior finishes. The ongoing development of innovative self-healing coatings, which can effectively repair minor scratches or abrasions, and the integration of advanced functional layers, such as those designed for adaptive heating, efficient cooling, or dynamic ambient lighting, represent emerging technologies that promise to fundamentally transform the future of automotive interiors. These collective technological advancements contribute to the emergence of a new generation of automotive synthetic leathers that are not only exceptionally high-performing and environmentally sustainable but also highly customizable, aesthetically versatile, and deeply functionally integrated, thereby comprehensively meeting the rapidly evolving demands of the modern, technologically driven automotive industry.

Regional Highlights

- Asia Pacific: This region stands as the undisputed dominant market for automotive PVC and PU leather, primarily driven by the consistently high volume of vehicle production and robust sales, particularly in economic powerhouses such as China, India, Japan, and South Korea. Rapid urbanization, coupled with steadily increasing disposable incomes across these nations, fuels a significant demand for automotive interiors that are both affordable and uncompromising in quality and aesthetics. The region also benefits from a strong presence of both global synthetic leather manufacturers and innovative local players, collectively driving intense competition and continuous technological advancement.

- Europe: As a mature and highly sophisticated market, Europe is characterized by exceptionally stringent environmental regulations that actively push for the development and adoption of sustainable, low-VOC (Volatile Organic Compound) synthetic leathers. There is a strong and consistent demand for premium and luxury vehicle interiors, which in turn drives relentless innovation in high-quality PU leather formulations that offer superior haptics and extended durability. Key contributing countries to this regional market include Germany, France, the UK, and Italy, each with a significant automotive manufacturing base and discerning consumer preferences.

- North America: This represents a significant and steadily growing market, primarily propelled by strong consumer preference for exceptionally durable, comfortable, and visually appealing vehicle interiors. The region has seen an increasing adoption of synthetic leathers, particularly in popular vehicle segments like SUVs and light trucks, where robustness and ease of maintenance are highly valued. The focus here is strongly on advanced material performance, sophisticated design flexibility, and a burgeoning interest in ethically sourced vegan and sustainable interior options, reflecting evolving societal values and environmental awareness.

- Latin America: An emerging market experiencing rapid expansion, Latin America is characterized by increasing automotive production, particularly concentrated in key countries such as Brazil and Mexico. Economic growth, combined with a rising middle-class population, significantly contributes to the escalating demand for new vehicles and, consequently, the interior materials required for them. While growth is strong, price sensitivity remains a considerable factor, influencing material choices and driving demand for cost-effective yet quality synthetic leather solutions.

- Middle East & Africa (MEA): This region is identified as a growing market, influenced by the expansion of automotive assembly plants and a steadily rising rate of vehicle ownership across its diverse nations. There is a distinct demand for exceptionally durable and highly heat-resistant materials, primarily due to the prevailing arid and often extreme climate conditions in many parts of the region. Increased foreign direct investments in industrial infrastructure and local manufacturing capabilities further support the market's continuous expansion and the adoption of advanced synthetic interior solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive PVC and PU Leather Market.- DIC Corporation

- Teijin Limited

- Kuraray Co. Ltd.

- Benecke-Kaliko AG (Continental AG)

- TFL Ledertechnik GmbH

- Sarcem

- Toray Industries Inc.

- Mayur Uniquoters Ltd.

- CGT (Compagnie Generale des Caoutchoucs)

- Jiangsu Guoxin Union Energy Co. Ltd.

- Achilles Corporation

- Recticel NV

- Wuhan Double Plastic Manufacturing Co. Ltd.

- Xiefu Group

- Dongguan Dongfang Leather Co. Ltd.

- Yantai Wanhua Polyurethanes Co. Ltd.

- Fujian Long'an Synthetic Leather Co. Ltd.

- Nan Ya Plastics Corporation

- San Fang Chemical Industry Co. Ltd.

- H.R. Textiles Pvt. Ltd.

- Sekisui Chemical Co., Ltd.

- Kyowa Leather Cloth Co., Ltd.

- PolyOne Corporation (Avient Corporation)

- Sumitomo Bakelite Co., Ltd.

Frequently Asked Questions

What is the primary difference between automotive PVC and PU leather, and why does it matter?

Automotive PVC leather (Polyvinyl Chloride) is generally known for its robust durability, excellent abrasion resistance, and cost-effectiveness, making it ideal for high-wear areas or budget-conscious vehicle models. PU leather (Polyurethane), conversely, offers a softer, more flexible, and breathable feel, closely mimicking genuine leather, and is often preferred for seating and premium interior touches due to its superior haptic qualities. The choice matters as it impacts vehicle aesthetics, comfort, durability, and cost-effectiveness for manufacturers and consumers alike, influencing overall interior design and market positioning.

Why are synthetic leathers experiencing increasing popularity over genuine leather in modern automotive interiors?

Synthetic leathers are experiencing a surge in popularity due to several compelling advantages: superior cost-effectiveness compared to genuine leather, enhanced durability against prolonged wear and damaging UV exposure, immense design versatility allowing for diverse colors and textures, and significantly easier cleaning and maintenance. Additionally, the growing global emphasis on ethical sourcing and environmental sustainability, with synthetic options often being cruelty-free and having a lower carbon footprint through advanced production methods, strongly contributes to their increased adoption in contemporary automotive designs.

How are current sustainability trends specifically impacting the automotive PVC and PU leather market?

Sustainability trends are profoundly reshaping the automotive PVC and PU leather market by driving significant innovation towards eco-friendlier solutions. Manufacturers are heavily investing in developing bio-based synthetic leathers derived from renewable resources, incorporating recycled content from post-consumer plastics, and implementing solvent-free manufacturing processes to reduce VOC emissions. This focus is aimed at mitigating environmental impact, improving material recyclability, and meeting the escalating consumer demand for sustainable vehicle interiors, especially in regions with stringent environmental regulations such as Europe and North America.

What are the main applications of PVC and PU leather within a vehicle, and which is typically preferred for each?

The main applications for synthetic leathers within a vehicle are diverse: seats, dashboards, door panels, steering wheel covers, headliners, and other interior trims like armrests and gear shift boots. PU leather is generally preferred for seating and dashboards due to its softer feel and aesthetic appeal, aiming for premium comfort. PVC leather, with its higher durability and cost-effectiveness, is often chosen for door panels, floor coverings, and commercial vehicle seating where robustness and ease of maintenance are paramount. Both types offer versatility, allowing for application based on specific requirements for durability, comfort, and visual design.

Which geographical region currently dominates the automotive PVC and PU leather market, and what are the underlying reasons for this dominance?

The Asia Pacific region currently dominates the automotive PVC and PU leather market. This commanding position is primarily attributed to its high-volume automotive production and sales, particularly in major manufacturing hubs like China, India, Japan, and South Korea. The region benefits from rapid urbanization, a continuously expanding middle class with increasing disposable incomes fueling vehicle purchases, and robust local manufacturing infrastructures that support competitive pricing and supply chain efficiency. Furthermore, the presence of numerous key material suppliers and a strong focus on both cost-effectiveness and versatile design capabilities contribute significantly to its market leadership.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager