Automotive Radiator Cap Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431654 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Automotive Radiator Cap Market Size

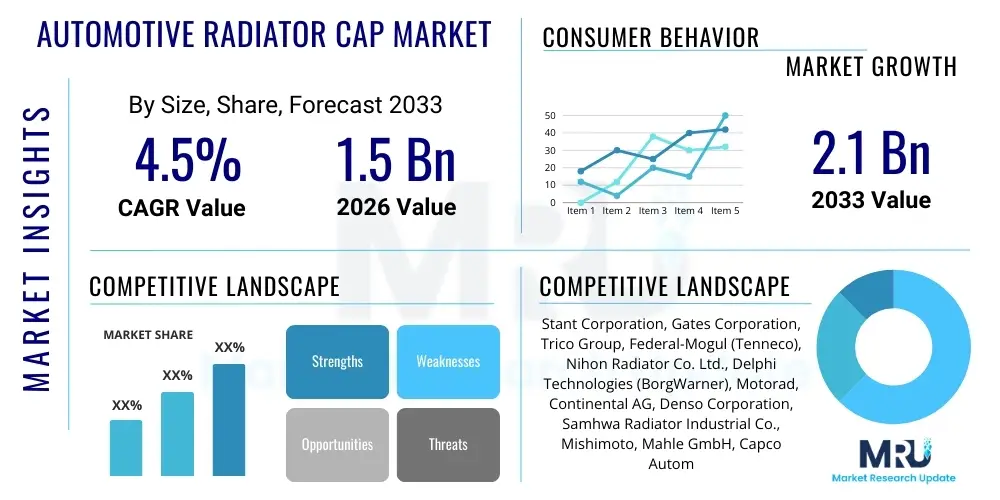

The Automotive Radiator Cap Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.1 Billion by the end of the forecast period in 2033. This consistent growth is primarily fueled by the increasing global vehicle production, especially in emerging economies, and the robust demand for replacement parts within the automotive aftermarket sector. The continuous operation of existing vehicle fleets necessitates routine maintenance and replacement of vital cooling system components, including the radiator cap, which is critical for maintaining optimal engine operating temperatures and preventing overheating failures.

The valuation reflects sustained investment in material science improvements designed to enhance the durability and thermal resistance of radiator caps, addressing the escalating performance demands of modern, high-efficiency engines. These engines often operate at higher temperatures and pressures, requiring caps built with precision sealing mechanisms and robust material compounds, such as advanced polymers and treated metals. Furthermore, regulatory mandates concerning vehicle emissions and fuel efficiency indirectly drive the need for perfectly functioning cooling systems, thereby supporting the steady expansion of the market size across both Original Equipment Manufacturer (OEM) and aftermarket channels.

Automotive Radiator Cap Market introduction

The Automotive Radiator Cap Market encompasses the manufacturing, distribution, and sale of pressure-relief valves designed to seal the radiator filler neck of internal combustion engine vehicles. These caps are indispensable components of the cooling system, serving multiple critical functions: they seal the system to prevent coolant loss, raise the boiling point of the coolant by maintaining system pressure (typically ranging from 10 to 18 psi), and feature a dual-valve mechanism (pressure valve and vacuum valve) to relieve excessive pressure and allow for vacuum suction as the engine cools down. The primary applications span across passenger vehicles (sedans, SUVs), commercial vehicles (trucks, buses), and off-highway machinery, ensuring optimal engine thermal regulation and longevity.

The core benefits derived from a properly functioning radiator cap include enhanced engine efficiency, prevention of costly engine damage due to overheating, and optimized coolant preservation. Driving factors sustaining this market include the global expansion of the vehicle parc, stringent regulatory standards mandating component reliability, and the inherent necessity of regular replacement due to wear and tear caused by exposure to extreme heat, pressure cycling, and chemical degradation from coolants. Technological advancements, particularly in materials used for seals and springs, are continuously introduced to extend the lifespan and improve the pressure accuracy of these components, ensuring they meet the sophisticated demands of modern thermal management systems.

Automotive Radiator Cap Market Executive Summary

The Automotive Radiator Cap Market demonstrates resilient growth, propelled predominantly by the aftermarket sector, which accounts for the majority of volume sales globally due to the predictable lifecycle replacement needs of cooling system components. Key business trends include the consolidation among specialized component manufacturers focused on developing premium, high-pressure caps for performance and heavy-duty applications, alongside a rising trend towards incorporating diagnostics-ready features in advanced cooling systems, though the cap itself remains largely mechanical. Regional trends highlight the Asia Pacific (APAC) as the epicenter of demand, driven by massive vehicle production volumes in China and India, coupled with the rapid expansion of the aging vehicle population requiring immediate maintenance. North America and Europe, characterized by sophisticated vehicle maintenance cultures, show strong demand for high-quality replacement caps compliant with stringent regional quality standards.

Segmentation trends reveal that metal caps, predominantly brass and stainless steel assemblies, continue to dominate the market owing to their superior durability and pressure retention capabilities, particularly in commercial vehicle applications. However, plastic-based caps are gaining traction in certain light vehicle OEM segments due to weight reduction efforts and integration into complex plastic coolant reservoirs. By application, passenger vehicles hold the largest market share, though commercial vehicles contribute significantly to revenue due to the higher pressure and robustness requirements of their cooling systems, translating into higher average selling prices for their radiator caps. The regulatory environment surrounding thermal efficiency and emissions continues to exert indirect pressure on manufacturers to ensure the highest reliability standards for all cooling system components, solidifying the market's trajectory.

AI Impact Analysis on Automotive Radiator Cap Market

User queries regarding the impact of AI on the Automotive Radiator Cap Market frequently revolve around predictive maintenance integration, quality control in manufacturing, and supply chain optimization. Users are keen to understand if AI can predict radiator cap failure before a physical breakdown occurs, thereby shifting replacement from reactive to proactive maintenance schedules. Concerns also center on how AI-driven automated inspection systems in production lines can reduce defects and improve component reliability, especially given the precision required for pressure calibration. Furthermore, there is significant interest in how machine learning algorithms can enhance supply chain resilience, optimizing inventory levels of replacement caps across vast distributor networks based on predictive demand models related to vehicle usage patterns, climate data, and fleet age profiles. These expectations suggest that while the cap itself remains a low-tech mechanical component, its lifecycle management and quality assurance are increasingly benefiting from AI-enhanced operational strategies.

- Predictive Maintenance Integration: AI algorithms analyze vehicle telematics data (engine temperature spikes, coolant pressure fluctuations) to predict imminent cap failure, enabling proactive replacement and minimizing engine damage.

- Manufacturing Quality Control: Machine vision systems powered by deep learning inspect cap sealing surfaces, spring tension, and valve placement with micro-level accuracy, significantly reducing defect rates in high-volume production.

- Supply Chain Optimization: AI-driven demand forecasting models optimize the distribution and stocking of radiator caps in the aftermarket, ensuring parts availability based on regional fleet demographics and seasonal temperature variations.

- Design Optimization Simulations: Computational fluid dynamics (CFD) and AI modeling accelerate the simulation of thermal stress and pressure cycling on new cap designs and materials, reducing development time and enhancing component robustness.

- Automated Assembly Processes: Robotics integrated with AI vision systems are utilized for precise assembly of multi-component caps, ensuring correct spring load calibration and consistent valve function, which are critical for safety and performance.

DRO & Impact Forces Of Automotive Radiator Cap Market

The Automotive Radiator Cap Market is influenced by a dynamic interplay of Drivers (D), Restraints (R), and Opportunities (O), creating distinct Impact Forces. Key drivers include the ever-expanding global vehicle population, which directly translates to increased demand for both new installations (OEM) and subsequent replacements (Aftermarket). Secondly, the shift toward higher-efficiency, smaller-displacement engines operating under elevated temperatures and pressures necessitates the use of more robust and reliable high-pressure radiator caps, driving premium product sales. Restraints primarily involve the gradual electrification of the automotive industry, as Electric Vehicles (EVs) utilize completely different, often closed-loop, thermal management systems that eliminate the traditional pressure radiator cap, posing a long-term threat to market volume. Additionally, the proliferation of counterfeit or substandard radiator caps in developing markets undermines the perceived quality and fair pricing of genuine components, impacting profitability.

Opportunities for market growth lie in the development of specialized, next-generation pressure caps integrated with thermal sensors or passive RFID tags for easy maintenance tracking and advanced diagnostics, particularly relevant for commercial fleet management. Furthermore, the stringent enforcement of vehicle safety and maintenance regulations across North America and Europe presents an opportunity for manufacturers focusing on certified, high-quality components. Impact Forces shaping the competitive landscape are dominated by the push-pull dynamic between cost efficiency demanded by high-volume OEM procurement and the need for absolute reliability dictated by safety standards and consumer expectations in the aftermarket. The critical safety nature of the cooling system means component quality must always supersede cost minimization in strategic decision-making, differentiating reputable suppliers from low-cost entrants.

The market also faces an opportunity derived from advanced materials science, specifically in developing seals and valve springs capable of enduring harsh, modern coolants (e.g., OAT, HOAT, and P-OAT formulations) for extended periods without degradation. This focus on material longevity addresses the increasing consumer demand for longer maintenance intervals and reduced vehicle downtime. Conversely, the restraint posed by increasing complexity in cooling system architecture, such as split cooling loops and integrated heat exchangers, sometimes relocates the pressure regulation function, although a pressure cap mechanism often remains integral to system servicing. Successfully navigating these forces requires manufacturers to invest heavily in material testing and intellectual property protection related to precision pressure calibration technologies.

Segmentation Analysis

The Automotive Radiator Cap Market is comprehensively segmented based on material, pressure rating, sales channel, and vehicle type, allowing for detailed analysis of demand patterns and strategic positioning. Segmentation by material is crucial, differentiating between traditional metallic caps (brass, stainless steel) known for robustness and longevity, and advanced polymer or plastic caps favored by OEMs for weight savings and integration with composite reservoirs. Pressure rating segmentation (e.g., 7 psi, 10-14 psi, 16 psi and above) directly correlates with the vehicle application and engine performance requirements. Sales channels are fundamentally divided into the high-volume OEM segment and the highly profitable, quality-driven Aftermarket segment. Understanding these segmentations is vital for manufacturers to tailor production capabilities and distribution strategies effectively across diverse global automotive environments.

- By Material Type:

- Metal Caps (Brass, Stainless Steel)

- Plastic Caps (Advanced Polymers, Composites)

- By Pressure Rating:

- Low Pressure (7-10 psi)

- Standard Pressure (11-15 psi)

- High Pressure (16 psi and above)

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Independent Aftermarket - IAM and OES)

- By Vehicle Type:

- Passenger Vehicles (PV)

- Commercial Vehicles (CV - Light, Medium, Heavy-Duty Trucks)

- Off-Highway Vehicles and Machinery

Value Chain Analysis For Automotive Radiator Cap Market

The Value Chain for the Automotive Radiator Cap Market begins with the upstream procurement of critical raw materials, primarily specialized metals (spring steel, brass alloys for housings) and high-performance elastomers (EPDM, silicone, fluorocarbon seals) required for thermal and chemical resistance. Upstream analysis focuses heavily on material sourcing efficiency and quality assurance, as the performance and lifespan of the final product are entirely dependent on the integrity of the spring mechanism and the reliability of the sealing gasket under extreme thermal cycling. Key activities at this stage include precision stamping, injection molding of plastic components, and specialized material treatments to enhance corrosion resistance. Manufacturers often maintain long-term relationships with certified metal and rubber suppliers to ensure consistency and compliance with automotive-grade standards like ISO/TS 16949.

The midstream phase involves the core manufacturing process, encompassing component assembly, precision calibration of the pressure relief valve, and rigorous quality testing. Pressure calibration is a non-negotiable step, directly impacting engine safety and cooling performance. Direct distribution channels primarily cater to the OEM segment, where high-volume, just-in-time delivery schedules are mandated for assembly line integration. These direct relationships require significant logistical efficiency and localized manufacturing presence near major automotive hubs. The indirect distribution channels, which serve the vast and fragmented aftermarket, rely on complex networks involving master distributors, regional wholesalers, parts retailers, and independent service garages.

Downstream analysis centers on market access and customer service, where the aftermarket segment thrives on product availability and brand trust. The aftermarket is highly competitive, necessitating robust branding and effective channel management to combat counterfeits and ensure genuine parts reach the end-user. Logistics efficiency for indirect distribution is crucial due to the small, standardized nature of the product, requiring optimization of warehousing and transport costs. The value captured in the downstream segment is often higher due to the premium paid for reliable replacement parts, especially in regions where vehicle downtime is costly. Furthermore, technical support and warranty provision are essential elements of maintaining brand loyalty among repair professionals and consumers alike.

Automotive Radiator Cap Market Potential Customers

The primary potential customers and buyers within the Automotive Radiator Cap Market can be categorized into two major segments: the Original Equipment Manufacturers (OEMs) and the expansive Aftermarket ecosystem. OEMs, including global giants like Toyota, Volkswagen, and General Motors, represent high-volume buyers for initial installation on new vehicles. These customers demand rigorous compliance with specific design specifications, exceptionally low defect rates, and highly competitive pricing, as the radiator cap is typically sourced as a Tier 2 or Tier 3 component within the larger cooling system assembly. Procurement decisions in the OEM segment are based on long-term supplier reliability, technological capability (especially for new vehicle platforms), and adherence to global safety and environmental regulations.

The Aftermarket segment comprises various buyers, including national and international parts distributors (e.g., Genuine Parts Company, LKQ Corporation), regional wholesalers, specialized cooling system service providers, independent repair shops, and the final vehicle owner. The aftermarket customer prioritizes availability, compatibility, and a favorable balance between quality and cost. For repair shops and service centers, ease of installation and guaranteed reliability are paramount to ensure customer satisfaction and prevent repeat repairs. The lifecycle of a vehicle dictates a continuous, predictable replacement demand from this segment, often representing a more profitable revenue stream for component suppliers compared to the thin margins typical of high-volume OEM contracts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.1 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Stant Corporation, Gates Corporation, Trico Group, Federal-Mogul (Tenneco), Nihon Radiator Co. Ltd., Delphi Technologies (BorgWarner), Motorad, Continental AG, Denso Corporation, Samhwa Radiator Industrial Co., Mishimoto, Mahle GmbH, Capco Automotive, ACDelco (General Motors), CSF Radiators, Hella GmbH & Co. KGaA, Calsonic Kansei (Magneti Marelli), Nissen Radiators, Silla Manufacturing, Inc., Nippon Gasket Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Radiator Cap Market Key Technology Landscape

While the automotive radiator cap is fundamentally a mechanical device, its reliability and performance advancements are driven by material science and precision manufacturing technologies. The key technological focus areas revolve around enhancing the sealing mechanism and ensuring accurate pressure calibration under extreme operating conditions. Modern caps utilize advanced elastomeric seals, often incorporating compounds like EPDM (Ethylene Propylene Diene Monomer) or high-grade silicone, which offer superior resistance to aggressive OAT (Organic Acid Technology) and other complex modern coolants. This material technology is crucial because seal degradation leads directly to pressure loss and potential engine overheating. Furthermore, high-precision progressive-wound spring technology is employed to guarantee that the pressure relief valve opens and closes consistently at the exact specified pressure rating, a requirement becoming more critical as manufacturers push operating temperatures higher for efficiency gains.

Another technological trend involves the shift towards integrated plastic radiator caps, particularly within OEM applications where coolant reservoirs are often manufactured from engineered polymers. This integration requires advanced injection molding techniques that ensure perfect dimensional stability and leak-proof fitting onto plastic necks, which inherently have different thermal expansion characteristics than traditional metal necks. Manufacturers are employing sensor integration technologies, although still nascent, where caps are sometimes fitted with passive RFID chips or visual indicators that simplify service diagnostics. This slight technological evolution moves the component away from being a purely mechanical part towards one that can passively contribute to the vehicle's maintenance reporting system, especially in large commercial fleets where rapid component identification is critical.

The core technology, however, remains centered on the dual-valve system—the pressure relief valve and the vacuum valve. Maintaining the vacuum relief function is crucial to prevent the radiator hoses and tank from collapsing as the engine cools and the internal pressure drops. Technological leadership in this market is demonstrated by component suppliers who can consistently manufacture caps that maintain calibration stability over tens of thousands of thermal cycles. Manufacturing excellence utilizes highly calibrated test benches to verify the opening pressure tolerance of every batch, ensuring compliance with original equipment specifications and providing the necessary assurance of quality for the demanding aftermarket repair professional. These technological advancements ensure that even a seemingly simple component meets the stringent durability demands of modern vehicular operation.

Regional Highlights

Regional dynamics significantly influence the Automotive Radiator Cap Market, reflecting differences in vehicle fleet age, manufacturing activity, and regulatory structures.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market, primarily fueled by the robust automotive manufacturing bases in China, India, Japan, and South Korea. High vehicle production volumes drive strong demand in the OEM segment. Furthermore, the large and aging vehicle population across Southeast Asia contributes immensely to the aftermarket segment, where durability and cost-effectiveness are key purchase criteria. Government initiatives promoting vehicle ownership and the gradual transition to stricter emission standards (which necessitates efficient cooling) further bolster demand.

- North America (NA): North America is characterized by a mature market with high demand for premium and heavy-duty radiator caps. The presence of a large commercial vehicle fleet (Class 8 trucks) drives substantial revenue for high-pressure, robust metallic caps. The aftermarket here is sophisticated, with consumers and technicians highly prioritizing certified quality components from established brands, supporting higher average selling prices compared to APAC. Regulatory frameworks emphasize product safety and compliance, affecting material selection and manufacturing standards.

- Europe: The European market is defined by strict quality regulations (e.g., Euro 6/7 standards impacting overall engine thermal design) and a strong emphasis on sustainability. While the overall vehicle parc growth is moderate, the demand is shifting towards high-specification, integrated cooling system components. The push towards electric vehicle adoption in this region, however, presents the most significant long-term restraint, although the vast existing fleet continues to necessitate high-quality replacement parts, particularly in the premium vehicle segment.

- Latin America (LATAM): LATAM is a price-sensitive market experiencing high growth in its vehicle parc, particularly in Brazil and Mexico. Demand is strong in both OEM (due to local assembly operations) and aftermarket segments. Manufacturers often utilize local distribution partnerships to manage complex trade regulations and logistics, focusing on standard pressure, reliable cap designs suitable for diverse climate conditions.

- Middle East and Africa (MEA): This region is notable for extreme operating conditions (high ambient temperatures), which place immense stress on cooling systems. This environment drives a critical need for high-performance, heat-resistant caps, pushing demand towards durable metallic options with superior sealing capabilities. Geopolitical stability and oil price fluctuations often influence vehicle sales and, consequently, OEM demand, but the necessity for robust replacement parts remains consistently high.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Radiator Cap Market.- Stant Corporation

- Gates Corporation

- Trico Group

- Federal-Mogul (Tenneco)

- Nihon Radiator Co. Ltd.

- Delphi Technologies (BorgWarner)

- Motorad

- Continental AG

- Denso Corporation

- Samhwa Radiator Industrial Co.

- Mishimoto

- Mahle GmbH

- Capco Automotive

- ACDelco (General Motors)

- CSF Radiators

- Hella GmbH & Co. KGaA

- Calsonic Kansei (Magneti Marelli)

- Nissen Radiators

- Silla Manufacturing, Inc.

- Nippon Gasket Co., Ltd.

- Unipoint Electric Mfg. Co., Ltd.

- Murray Corporation

- Plews & Edelmann

- Standard Motor Products (SMP)

- Borg Automotive

- Metalcaucho

- Tridon Australia

- Aisin Seiki Co., Ltd.

- GMB Corporation

Frequently Asked Questions

Analyze common user questions about the Automotive Radiator Cap market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an automotive radiator cap?

The primary function is two-fold: to seal the cooling system to prevent coolant loss and, critically, to pressurize the system (typically 10-18 psi). Pressurization raises the coolant's boiling point, allowing the engine to operate efficiently at higher temperatures without boiling over, thus preventing severe engine damage.

How often should a radiator cap be replaced?

While the exact interval varies by vehicle and quality, radiator caps are generally recommended for inspection or replacement every two to four years, or whenever major cooling system maintenance is performed. Replacement is critical if the seal is cracked, the spring is weak, or pressure holding capability is compromised, often indicated by coolant loss or recurring overheating issues.

What is the difference between an OEM cap and an aftermarket replacement cap?

An OEM cap is manufactured specifically to the vehicle producer's original specifications and installed at the factory. Aftermarket replacement caps are designed to match or exceed these specifications. High-quality aftermarket caps offer equivalent performance and are a cost-effective alternative, but buyers must ensure the cap matches the vehicle's exact pressure rating (psi) to avoid system failure.

How does the shift to electric vehicles (EVs) affect the radiator cap market?

The increasing adoption of EVs poses a long-term restraint on the traditional radiator cap market. EVs utilize closed-loop battery and cabin thermal management systems that typically do not require the conventional pressure-regulating radiator cap found on internal combustion engine vehicles (ICEVs), leading to reduced long-term demand for standard caps.

What pressure rating should I use when replacing a radiator cap?

It is imperative to replace the cap with one that has the exact pressure rating (measured in psi or kPa) specified by the vehicle manufacturer, typically found stamped on the cap or noted in the owner's manual. Using a cap with too low a rating will cause premature boiling, while too high a rating can damage cooling system components like hoses and gaskets.

Are plastic radiator caps as durable as metal caps?

Modern plastic radiator caps, made from high-grade, glass-filled polymers, are highly durable and are increasingly used by OEMs due to their light weight and integration capabilities with plastic reservoirs. However, for extreme high-pressure applications, such as heavy-duty commercial vehicles, traditional brass or stainless steel caps often retain the edge in long-term thermal fatigue resistance and sheer mechanical robustness.

What are the key indicators of a failing radiator cap?

Key indicators include visible coolant leakage around the cap or reservoir neck, frequent engine overheating, premature boiling of the coolant (hissing sound), or collapsing or swelling of the radiator hoses after the engine has cooled down. A weak vacuum valve will cause hoses to collapse, while a failed pressure valve leads to overheating.

What role do advanced materials play in modern radiator caps?

Advanced materials, particularly specialized elastomers like FKM (Fluorocarbon) and robust EPDM, are critical for the seals. These materials resist chemical degradation from modern organic acid technology (OAT) coolants and maintain flexibility under extreme temperature cycles, significantly extending the service life and pressure integrity of the cap assembly.

Why is the calibration accuracy of the pressure relief valve important?

Calibration accuracy is paramount because it directly controls the system's boiling point. If the valve opens at an incorrect pressure, the engine will either overheat (if the pressure is too low) or the system components (like the heater core or radiator) could burst or leak (if the pressure is too high), leading to catastrophic component failure.

Which geographical region exhibits the strongest current demand for radiator caps?

The Asia Pacific (APAC) region currently exhibits the strongest demand due to high volume in both new vehicle manufacturing (OEM segment, particularly China and India) and a massive, growing fleet of aging vehicles requiring regular maintenance and component replacement in the aftermarket.

What is the impact of vehicle downsizing on radiator cap design?

Vehicle downsizing and the trend toward turbocharged, high-efficiency engines lead to significantly higher operating temperatures and pressures within the cooling system. This necessitates radiator caps engineered for higher pressure ratings (16 psi and above) and materials that offer superior heat and pressure fatigue resistance, driving technological sophistication in the component.

How do counterfeits affect the integrity of the radiator cap market?

The proliferation of counterfeit radiator caps, often found in developing markets, negatively impacts market integrity by offering substandard products that fail prematurely. This leads to severe engine damage for consumers, erodes trust in the aftermarket supply chain, and forces legitimate manufacturers to invest heavily in brand protection and authentication technologies.

What distinguishes high-pressure caps used in commercial vehicles?

High-pressure caps utilized in commercial vehicles (heavy-duty trucks, buses) are typically designed for significantly higher pressure ratings (often exceeding 20 psi) and constructed almost exclusively from durable metals like treated brass or stainless steel. They feature more robust springs and seals to withstand the prolonged stress and intense heat cycles associated with long-haul, heavy-load operations.

Is there an emerging trend toward diagnostic integration in radiator caps?

Yes, while still niche, an emerging trend involves integrating passive diagnostic elements, such as thermally sensitive indicators or RFID tags, into specialized radiator caps. These features allow fleet managers and service technicians to quickly confirm maintenance history or visually assess potential overheating events without disassembling the system.

What role does the vacuum valve play within the radiator cap?

The vacuum relief valve is crucial for protecting the cooling system components. As the engine cools down, the coolant contracts, creating a vacuum inside the system. The vacuum valve opens to allow air or fluid back into the radiator, equalizing pressure and preventing the collapse or damage of radiator hoses, tanks, and the radiator core itself.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager