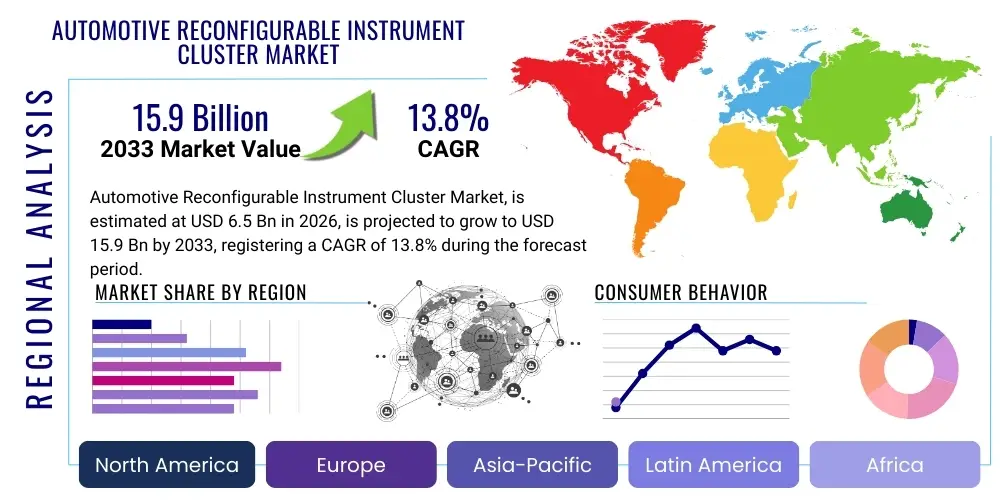

Automotive Reconfigurable Instrument Cluster Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437790 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Automotive Reconfigurable Instrument Cluster Market Size

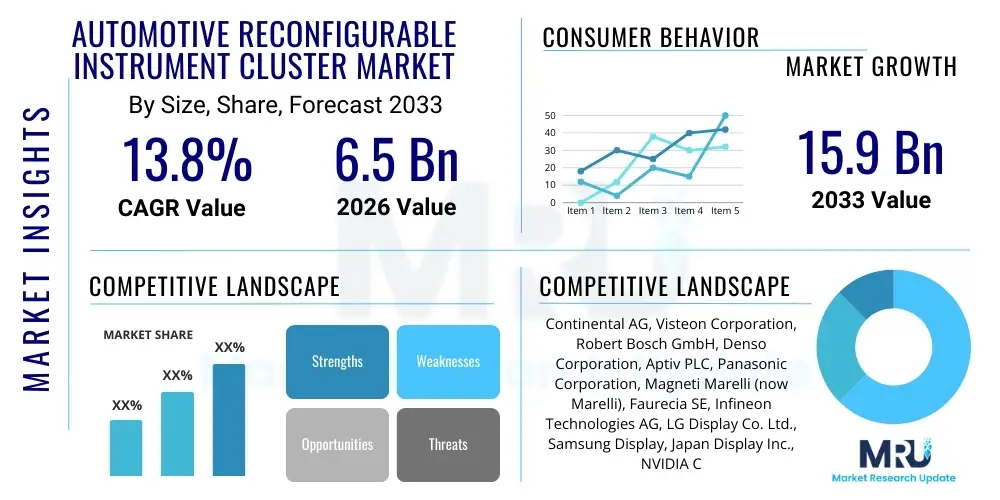

The Automotive Reconfigurable Instrument Cluster Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 13.8% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 15.9 Billion by the end of the forecast period in 2033.

Automotive Reconfigurable Instrument Cluster Market introduction

The Automotive Reconfigurable Instrument Cluster Market encompasses the development, production, and integration of fully digital display systems that replace traditional analog gauges in vehicles. These clusters offer drivers the flexibility to customize the displayed information, prioritizing navigation data, infotainment system updates, advanced driver-assistance system (ADAS) warnings, or conventional speed and RPM readings. The shift towards digitalization is primarily driven by consumer demand for enhanced connectivity, personalized driving experiences, and the integration of sophisticated vehicle safety features, requiring more complex and dynamic data visualization than traditional gauges can provide. Modern instrument clusters are central to the human-machine interface (HMI) within contemporary vehicles, serving as the primary hub for critical operational and contextual data.

Reconfigurable instrument clusters fundamentally rely on high-resolution displays, powerful graphics processors, and sophisticated embedded software to render information in real-time. Key applications span across various vehicle classes, including passenger vehicles (sedans, SUVs), commercial vehicles (trucks, buses), and specialized off-road machinery, although adoption is most rapid in premium and mid-range passenger vehicles. These systems enhance safety by reducing cognitive load through optimized data presentation and enabling dynamic warnings relevant to specific driving conditions. Furthermore, they support brand differentiation, allowing manufacturers to establish unique digital environments corresponding to their vehicle philosophy.

The principal driving factors include the rapid global adoption of connected vehicles and semi-autonomous driving capabilities, which necessitate complex data presentation regarding sensor fusion and environmental perception. Stricter global safety regulations promoting ADAS integration further mandate advanced display mechanisms. The falling costs of high-definition display technology (such as TFT-LCDs and OLEDs) and the increasing capability of automotive-grade processors are enabling widespread implementation across vehicle segments, accelerating the market's trajectory towards complete digitization of the cockpit.

Automotive Reconfigurable Instrument Cluster Market Executive Summary

The Automotive Reconfigurable Instrument Cluster market is experiencing robust growth fueled by technological convergence between the automotive and consumer electronics sectors. Business trends indicate a strong focus on software-defined vehicles (SDVs), where the instrument cluster becomes a platform for over-the-air (OTA) updates and feature monetization. Key market players are forming strategic alliances with software providers and semiconductor manufacturers to develop highly integrated cockpit domain controllers (CDCs), which manage multiple displays (instrument cluster, infotainment, head-up display) from a single electronic control unit (ECU), driving efficiency and reducing hardware complexity. Furthermore, the push towards standardized, scalable software architectures, such as those leveraging Android Automotive OS, is streamlining development cycles and improving user experience consistency across different vehicle models.

Regional trends highlight Asia Pacific (APAC), particularly China, as the fastest-growing market, driven by high volume production, strong domestic demand for advanced vehicles, and significant government investment in electric vehicle (EV) infrastructure, which inherently requires digital cockpits for battery management and range visualization. Europe and North America maintain leading positions in terms of technological maturity and early adoption of premium features, focusing on sophisticated HMI design and cybersecurity standards for integrated digital systems. The stringent regulatory environment in these regions concerning vehicle safety and ADAS functionalities further accelerates the demand for robust reconfigurable clusters capable of handling complex sensor data visualization.

Segmentation trends reveal that the TFT-LCD technology segment currently dominates the market due to its cost-effectiveness and maturity, though OLED technology is gaining traction rapidly, especially in the premium vehicle segment, offering superior contrast ratios and flexibility for complex curved displays. By vehicle type, the passenger vehicle segment holds the largest market share, directly linked to high consumer adoption rates and the frequent refresh cycle of consumer automotive models. However, the commercial vehicle segment is projected to show significant growth as fleet operators increasingly utilize digital clusters for telemetry, driver monitoring, and route optimization data presentation, enhancing operational efficiency and compliance with transport regulations.

AI Impact Analysis on Automotive Reconfigurable Instrument Cluster Market

Users frequently inquire about how Artificial Intelligence (AI) will transform the functionality and personalization of instrument clusters, moving beyond static reconfiguration to truly adaptive displays. Key concerns revolve around the role of AI in processing massive amounts of vehicular and environmental data to present only the most relevant information, thereby minimizing driver distraction and enhancing safety. Users are highly interested in how machine learning algorithms can predict driver needs based on driving patterns, context (e.g., weather, time of day), and biometric data, leading to anticipatory information display. Expectations center on AI powering advanced contextual awareness, facilitating sophisticated personalization, and enabling robust natural language processing (NLP) for seamless interaction with the cluster interface. The integration of AI is seen as crucial for the successful deployment of Level 3 and higher autonomous driving features, requiring intelligent, dynamic visual communication between the vehicle and the driver during transition periods.

- AI enables personalized content prioritization based on driver behavior profiles and real-time cognitive load assessment.

- Machine learning algorithms optimize graphics rendering and resource allocation within the cluster's operating system, improving performance efficiency.

- Contextual awareness driven by AI processes sensor fusion data to display critical ADAS warnings and navigation cues only when necessary.

- AI facilitates robust natural language understanding (NLU) for voice commands directed at cluster functions and information retrieval.

- Predictive HMI design uses AI to anticipate the driver's next action (e.g., lane change, sudden braking) and dynamically adjust the cluster layout accordingly.

- AI-driven anomaly detection monitors cluster performance and security, ensuring system reliability and identifying potential software failures proactively.

- Enables deep integration with autonomous driving stack, providing clear, adaptive visualizations of the vehicle's perception of the environment.

DRO & Impact Forces Of Automotive Reconfigurable Instrument Cluster Market

The Automotive Reconfigurable Instrument Cluster Market is fundamentally shaped by a dynamic interplay of factors. The primary drivers include the mandatory integration of complex Advanced Driver-Assistance Systems (ADAS) and the proliferation of connected car ecosystems, both of which require high-fidelity, dynamic data visualization platforms to communicate operational status and alerts effectively to the driver. Furthermore, consumer demand for luxury features and personalized in-cabin experiences continues to push original equipment manufacturers (OEMs) towards adopting highly configurable digital cockpits. The competitive landscape mandates innovation in HMI design, leveraging reconfigurable clusters to enhance brand appeal and vehicle differentiation in a crowded market. This market momentum is further supported by decreasing production costs for high-quality automotive-grade display panels and the development of powerful yet energy-efficient microcontroller units (MCUs) and System-on-Chips (SoCs) capable of managing demanding graphical interfaces.

However, significant restraints temper this growth. The most prominent challenges involve the high initial investment costs associated with developing and integrating complex digital hardware and robust, cyber-secure software stacks. Ensuring functional safety (ISO 26262 compliance) for safety-critical information displayed on the clusters remains a complex and time-consuming process. Additionally, the rapid pace of technological obsolescence in the display and semiconductor industries poses difficulties for long-term supply chain management and component life cycles required by the automotive sector. Cybersecurity concerns, given the cluster's deep integration with vehicle networks (CAN, Ethernet) and connectivity services, represent a persistent threat that requires constant expenditure on mitigation strategies.

Opportunities for market expansion are substantial, particularly driven by the accelerating transition to Electric Vehicles (EVs) globally, where the instrument cluster plays a vital role in real-time battery status monitoring, regenerative braking visualization, and charging point location. The emergence of cockpit domain controllers (CDCs) presents a major technological opportunity, allowing suppliers to offer highly integrated solutions that reduce weight, complexity, and cost across the vehicle platform. Moreover, the shift towards software-defined cockpits allows for post-sale revenue generation through Over-the-Air (OTA) updates for feature enhancements and graphic customization packages. The impact forces are strongly weighted toward technological progression and regulatory mandates regarding vehicle safety and emissions reduction, pushing manufacturers towards digitalization as an essential requirement rather than a premium option.

Segmentation Analysis

The Automotive Reconfigurable Instrument Cluster Market is comprehensively segmented based on technology, display size, vehicle type, and distribution channel, providing granular insights into demand patterns and competitive positioning. The technology segmentation differentiates between Thin-Film Transistor Liquid Crystal Display (TFT-LCD) and Organic Light-Emitting Diode (OLED) solutions. TFT-LCDs currently hold dominance due to their cost-effectiveness, proven reliability, and widespread adoption across mid-range and mass-market vehicles. However, OLED technology is rapidly penetrating the premium and luxury segments, offering advantages such as superior image quality, higher contrast ratios, true blacks, faster response times, and enabling aesthetically pleasing curved or flexible display implementations that enhance interior design.

Segmentation by display size is critical, reflecting the trend towards larger, more immersive digital cockpits. Small to medium-sized clusters (under 10 inches) remain relevant for entry-level and commercial vehicles, prioritizing functionality over extensive visualization. Conversely, large displays (10 inches and above) are standard in premium and high-end models, supporting high-resolution mapping, comprehensive ADAS overlays, and extensive personalization options. This size differentiation directly correlates with the average selling price (ASP) of the cluster unit, influencing revenue streams for component manufacturers and system integrators.

The segmentation by vehicle type clearly demonstrates that passenger vehicles, particularly SUVs and sedans, constitute the largest market share owing to sheer production volume and faster integration cycles for new technologies. Nonetheless, the commercial vehicle sector (including heavy-duty trucks and buses) is poised for high growth. Fleet operators are increasingly adopting digital clusters to improve logistics management, driver behavior monitoring, and compliance reporting, justifying the investment through quantifiable operational efficiency gains. The distribution channel segmentation primarily relies on OEM integration, which accounts for the overwhelming majority of unit deployments, with the aftermarket segment playing a smaller, though niche, role focused primarily on upgrades for older vehicles.

- Technology:

- TFT-LCD (Thin-Film Transistor Liquid Crystal Display)

- OLED (Organic Light-Emitting Diode)

- Display Size:

- Under 10 Inches

- 10 Inches to 12.3 Inches

- Above 12.3 Inches

- Vehicle Type:

- Passenger Vehicles

- Commercial Vehicles (LCVs, HCVs, Buses)

- Distribution Channel:

- OEM (Original Equipment Manufacturer)

- Aftermarket

Value Chain Analysis For Automotive Reconfigurable Instrument Cluster Market

The value chain for the Automotive Reconfigurable Instrument Cluster market is complex, spanning from raw material extraction to final integration and service. Upstream activities involve the supply of specialized components, crucially including display panels (TFT-LCD and OLED), high-performance semiconductors (GPUs, MCUs, and power management ICs), and specialized automotive-grade connectors and housing materials. Key suppliers in this phase are large display manufacturers (like LG Display and Samsung Display) and semiconductor giants (like NVIDIA, Qualcomm, and Renesas), who invest heavily in R&D to meet stringent automotive standards for temperature resistance, vibration tolerance, and longevity. The quality and cost of these foundational components significantly determine the final product's performance and commercial viability.

Midstream activities involve Tier 1 suppliers, who are the primary system integrators and manufacturers of the complete instrument cluster assembly. Companies such as Continental, Visteon, Bosch, and Denso take the raw components and manage the complex process of hardware design, embedded software development (including operating systems, graphics stacks, and functional safety architecture), testing, and final integration. This phase is characterized by high engineering intensity, focusing on HMI design optimization, cybersecurity protocols, and seamless connectivity with the vehicle's electrical architecture. Tier 1 suppliers often collaborate closely with OEMs during the vehicle platform development stage to ensure the cluster meets specific vehicle branding and regulatory requirements.

Downstream distribution channels are dominated by the Original Equipment Manufacturer (OEM) channel, where the instrument cluster is installed on the assembly line as a core component of the vehicle. Direct communication and tight partnership between Tier 1 suppliers and global OEMs (like Volkswagen, Toyota, General Motors, and Tesla) are paramount for just-in-time delivery and quality assurance. The indirect channel, or aftermarket, represents a smaller but growing opportunity for specialized providers to offer cluster upgrades or customization services, often targeting performance enthusiasts or vehicle refurbishment markets. Overall profitability within the chain is increasingly shifting towards the software and integration layers, highlighting the importance of intellectual property related to HMI algorithms and domain controller capabilities.

Automotive Reconfigurable Instrument Cluster Market Potential Customers

The primary customers for the Automotive Reconfigurable Instrument Cluster Market are global automotive Original Equipment Manufacturers (OEMs) across all segments, ranging from mass-market producers to premium luxury brands. These OEMs purchase the clusters in high volumes from Tier 1 suppliers for integration into their vehicle lines during initial production. Within the OEM category, the EV manufacturers represent a rapidly expanding customer base, as digital cockpits are fundamental to communicating crucial electric powertrain data and managing advanced battery systems. Traditional OEMs undergoing rapid electrification are also massive adopters, standardizing digital clusters across their future fleets to align with industry trends and meet evolving consumer expectations for connectivity.

A second significant customer group consists of commercial vehicle manufacturers (CV OEMs), including producers of heavy-duty trucks, long-haul buses, and specialized construction vehicles. For this segment, the clusters are crucial tools for fleet management, diagnostics, regulatory compliance (e.g., electronic logging devices), and improving driver efficiency and safety. These clusters often require more robust industrial specifications and specialized software tailored for logistical data presentation and fleet monitoring systems, rather than entertainment features. Furthermore, the aftermarket service providers and vehicle customization shops constitute a niche, yet important, segment of customers, purchasing units for upgrade projects, though their transaction volume is significantly lower than that of the major OEMs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 15.9 Billion |

| Growth Rate | 13.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Continental AG, Visteon Corporation, Robert Bosch GmbH, Denso Corporation, Aptiv PLC, Panasonic Corporation, Magneti Marelli (now Marelli), Faurecia SE, Infineon Technologies AG, LG Display Co. Ltd., Samsung Display, Japan Display Inc., NVIDIA Corporation, Qualcomm Technologies, Inc., Harman International (Samsung subsidiary), Renesas Electronics Corporation, Texas Instruments Incorporated, Stoneridge, Inc., Technisat Digital GmbH, Desay SV Automotive. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Reconfigurable Instrument Cluster Market Key Technology Landscape

The technological landscape of the Automotive Reconfigurable Instrument Cluster market is rapidly evolving, driven primarily by advancements in display technology, processing power, and software integration methodologies. Modern clusters rely heavily on high-resolution display technologies, with TFT-LCDs dominating volume production due to their maturity, cost balance, and robustness. However, Organic Light-Emitting Diode (OLED) technology is emerging as a critical differentiator in premium segments. OLEDs offer exceptional visual performance, enabling ultra-thin, lightweight, and curved screen designs that seamlessly blend with complex interior geometries, contributing significantly to sophisticated cabin aesthetics and reducing potential glare effects through superior contrast.

Processing technology is perhaps the most crucial element, shifting from dedicated, single-function microcontrollers to powerful System-on-Chips (SoCs) and Cockpit Domain Controllers (CDCs). These advanced processors, often supplied by technology giants like NVIDIA and Qualcomm, integrate powerful GPUs to manage the demanding graphical rendering requirements of multiple high-definition displays simultaneously (instrument cluster, infotainment, and HUD). This consolidation, known as domain centralization, simplifies wiring harnesses, reduces latency, improves overall system security, and enables complex functionalities like real-time 3D mapping and augmented reality overlays directly within the cluster display, enhancing the driver's contextual awareness during navigation or ADAS operation.

Furthermore, the shift towards software-defined cockpits leveraging platforms like Linux, QNX, and increasingly, Android Automotive OS, dictates the future development path. These operating systems provide a scalable, secure foundation for running complex HMI software, enabling features like seamless connectivity, over-the-air updates, and integrated application ecosystems. Key areas of focus within software technology include developing robust graphical user interface (GUI) frameworks, ensuring stringent ASIL (Automotive Safety Integrity Level) compliance for safety-critical information displayed on the cluster, and implementing advanced cybersecurity measures to protect the cluster from unauthorized access or manipulation, given its critical link to the vehicle's operational systems and external networks.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to exhibit the highest CAGR due to massive production volumes in China, South Korea, and Japan, coupled with rapid consumer adoption of high-tech features in mid-range vehicles. The aggressive push toward electric vehicle manufacturing, particularly in China and India, mandates the use of digital clusters for advanced battery management and power consumption display, making the region a critical demand center and manufacturing hub.

- Europe: Europe represents a technologically mature market characterized by stringent functional safety standards (ISO 26262) and high consumer demand for sophisticated HMI systems, particularly in premium brands (German OEMs). The early and deep integration of ADAS features and the move toward highly regulated semi-autonomous driving capabilities drive continuous investment in advanced cluster solutions capable of high-ASIL performance and robust cybersecurity features.

- North America: North America is a significant market driven by technological innovation and high average vehicle selling prices, enabling rapid adoption of large-display, premium reconfigurable clusters. The market focuses heavily on integrating cluster data with advanced connectivity services (5G, V2X) and ensuring seamless compatibility with major smartphone projection standards, catering to a connectivity-focused consumer base and leading development in advanced HMI customization.

- Latin America (LATAM): The LATAM market is growing steadily, though slower than APAC and Europe, primarily focusing on adopting cost-effective TFT-LCD solutions for mass-market vehicles. Growth is tied to local production capacity expansion and regulatory harmonization efforts regarding basic vehicle safety features, gradually leading to the replacement of purely analog clusters.

- Middle East and Africa (MEA): The MEA market remains nascent but offers targeted growth opportunities, particularly in wealthy Gulf Cooperation Council (GCC) countries where luxury vehicle sales and high-end automotive features are prioritized. Adoption is primarily driven by imported vehicle models featuring digital clusters, while local manufacturing and technology integration remain limited.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Reconfigurable Instrument Cluster Market.- Continental AG

- Visteon Corporation

- Robert Bosch GmbH

- Denso Corporation

- Aptiv PLC

- Panasonic Corporation

- Magneti Marelli (now Marelli)

- Faurecia SE

- Infineon Technologies AG

- LG Display Co. Ltd.

- Samsung Display

- Japan Display Inc.

- NVIDIA Corporation

- Qualcomm Technologies, Inc.

- Harman International (Samsung subsidiary)

- Renesas Electronics Corporation

- Texas Instruments Incorporated

- Stoneridge, Inc.

- Technisat Digital GmbH

- Desay SV Automotive

- Pioneer Corporation

- Garmin Ltd.

- BOE Technology Group Co. Ltd.

- Hyundai Mobis Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Automotive Reconfigurable Instrument Cluster market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the key difference between a digital cluster and a reconfigurable cluster?

A digital cluster uses a display instead of mechanical needles, while a reconfigurable cluster is a specific type of digital cluster that allows the driver or vehicle system to dynamically customize the layout, prioritizing different types of information (e.g., navigation maps, ADAS alerts, engine performance) based on driving context or preference. All reconfigurable clusters are digital, but not all digital clusters offer extensive reconfiguration capabilities.

Which display technology is currently dominating the market?

TFT-LCD (Thin-Film Transistor Liquid Crystal Display) technology currently dominates the Automotive Reconfigurable Instrument Cluster market by volume due to its cost-efficiency, manufacturing maturity, and proven reliability for standard automotive applications. However, OLED (Organic Light-Emitting Diode) is rapidly growing, leading the premium segment due to superior visual performance and flexible design possibilities.

How do Cockpit Domain Controllers (CDCs) impact the instrument cluster market?

CDCs integrate the computing power for the instrument cluster, infotainment system, and often the head-up display onto a single high-performance ECU. This consolidation simplifies the vehicle architecture, reduces overall system costs and weight, and enables seamless information sharing and synchronization across all in-cabin displays, significantly driving the adoption of complex, multi-display reconfigurable cockpits.

What role does cybersecurity play in the design of reconfigurable instrument clusters?

Cybersecurity is critical because the instrument cluster is deeply connected to the vehicle's internal network (CAN/Ethernet) and external connectivity systems. Designers must implement robust encryption and secure boot mechanisms to prevent unauthorized access or manipulation of critical driving data displayed to the driver, ensuring the functional safety and integrity of the vehicle operations.

Which geographical region is expected to show the highest growth rate?

The Asia Pacific (APAC) region, primarily led by China and India, is anticipated to exhibit the highest compound annual growth rate (CAGR). This acceleration is driven by the region's increasing vehicle production, rapid electrification of automotive fleets, and high consumer demand for advanced digital features, supported by significant local investment in automotive electronics manufacturing capabilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager