Automotive Repair and Maintenance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438730 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Automotive Repair and Maintenance Market Size

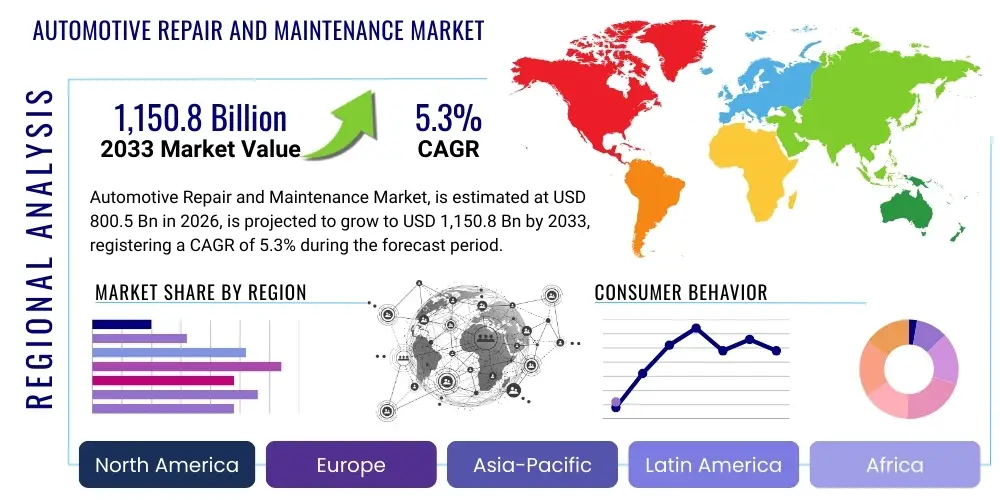

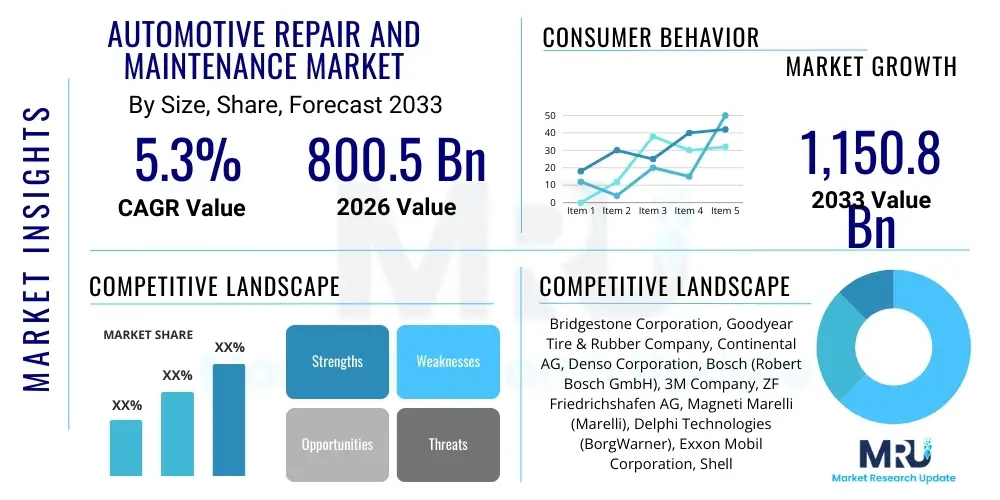

The Automotive Repair and Maintenance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.3% between 2026 and 2033. The market is estimated at USD 800.5 Billion in 2026 and is projected to reach USD 1,150.8 Billion by the end of the forecast period in 2033.

Automotive Repair and Maintenance Market introduction

The Automotive Repair and Maintenance market encompasses all services required to ensure the continued operational efficiency, safety, and longevity of vehicles post-sale. This includes scheduled routine maintenance like oil changes, fluid checks, and filter replacements, along with complex repair services related to powertrain systems, electrical components, bodywork, and advanced driver-assistance systems (ADAS). The market's growth is fundamentally driven by the increasing global vehicle parc (number of vehicles in operation), the growing average age of vehicles, and the mandatory regulatory requirements concerning vehicle safety and emissions standards across developed and developing economies.

The primary applications of these services span across passenger vehicles (PVs) and commercial vehicles (CVs), catering to both individual consumers and large fleet operators. Key services include brake repair, tire replacement and service, engine diagnostics, transmission repair, and collision repair. The increasing complexity of modern vehicles, integrating sophisticated electronics and software, necessitates specialized tools and highly trained technicians, shifting the service landscape towards specialized workshops and continuous technical education.

Major benefits derived from a robust repair and maintenance ecosystem include maximized vehicle uptime for commercial operations, enhanced fuel efficiency, and significantly improved road safety. Driving factors include technological advancements such as vehicle connectivity (telematics enabling predictive maintenance), the rise of Electric Vehicles (EVs) necessitating new specialized services (e.g., battery health monitoring), and consumer preferences leaning towards reliable and standardized service quality, often supported by digital service booking and transparent pricing models.

Automotive Repair and Maintenance Market Executive Summary

The Automotive Repair and Maintenance market is currently undergoing significant transformation, characterized by strong business trends centered around digitalization and sustainability. Digital service platforms, including mobile applications for booking and tracking repairs, are optimizing customer convenience and operational efficiency for service providers. Furthermore, the push towards electrification is reshaping service complexity; while EVs require less traditional maintenance (oil changes), they necessitate high-voltage system expertise and sophisticated battery repair infrastructure, driving specialized investments among service chains. Consolidation remains a key trend, with large independent service providers (ISPs) acquiring smaller regional shops to leverage economies of scale and expand geographical reach.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, propelled by rapid urbanization, substantial growth in the middle class, and the consequential surge in vehicle ownership, particularly in China and India. North America and Europe, characterized by high average vehicle ages and stringent regulatory frameworks, represent mature markets where technology integration (such as ADAS calibration and sophisticated diagnostics) drives higher service value. Latin America and MEA are focused on expanding formal service networks to address the growing influx of pre-owned vehicles and fleet maintenance demands.

Segment trends highlight the dominance of Independent Service Providers (ISPs) due to their competitive pricing and extensive accessibility, though OEM dealerships maintain a stronghold on in-warranty service and complex repair utilizing proprietary diagnostic tools. From a service type perspective, routine maintenance continues to generate the largest revenue share, forming the foundation of customer retention. However, specialized repair segments, particularly those related to electronics, high-voltage batteries, and collision repair involving advanced materials, are exhibiting the highest growth rates, signaling a premiumization of technical expertise within the market structure.

AI Impact Analysis on Automotive Repair and Maintenance Market

User inquiries regarding the impact of Artificial Intelligence (AI) frequently center on the disruption of traditional diagnostic processes, the enhancement of predictive maintenance capabilities, and the potential displacement or upskilling required for service technicians. Key concerns revolve around data privacy related to vehicle telematics, the accuracy and reliability of AI-driven diagnostic tools, and the necessary investment for workshops to adopt these sophisticated systems. Users are keenly interested in how AI can minimize vehicle downtime, automate scheduling, and ultimately reduce the cost of ownership through optimization. The analysis reveals a strong expectation that AI will move the industry from reactive repair to proactive, condition-based servicing, requiring integration across OEM platforms, parts suppliers, and independent garages.

AI is fundamentally reshaping the market by enabling advanced predictive maintenance. Using machine learning algorithms on vast datasets collected via connected car technology (telematics), AI can accurately predict component failures long before they occur, allowing owners to schedule maintenance proactively rather than reactively. This shift minimizes unexpected breakdowns and optimizes vehicle performance, significantly enhancing customer satisfaction and operational efficiency, especially for large fleet operators where uptime is critical. Furthermore, AI tools are streamlining the diagnostic process, analyzing complex fault codes and sensor data in real-time, drastically reducing the time technicians spend troubleshooting and increasing the first-time fix rate.

Beyond diagnostics, AI is transforming customer interaction and operational management. AI-powered chatbots and virtual assistants handle initial service inquiries, scheduling, and provide instant quotes, improving the speed and accessibility of services. Within the repair shop, AI algorithms are optimizing inventory management by predicting demand for specific parts based on historical repair data and known vehicle issues, reducing storage costs and minimizing delays associated with waiting for necessary components. This integration of AI supports higher throughput and operational transparency across the service value chain.

- Enhanced Predictive Maintenance: AI analyzes telematics data to forecast component failure, reducing unexpected downtime.

- Optimized Diagnostics: Machine learning speeds up fault finding, increasing first-time repair accuracy.

- Automated Customer Service: AI chatbots handle scheduling, initial inquiries, and pricing estimates.

- Improved Inventory Management: Algorithms predict parts demand, reducing stock holding and logistical delays.

- Advanced Technician Assistance: Augmented reality (AR) and AI systems guide technicians through complex repairs, lowering error rates.

- New Revenue Streams: Data monetization services based on vehicle usage and health data are emerging.

- Safety and Compliance Monitoring: AI monitors vehicle health to ensure adherence to safety and emissions regulations.

DRO & Impact Forces Of Automotive Repair and Maintenance Market

The Automotive Repair and Maintenance Market is driven by several powerful forces, including the persistent growth in the global vehicle population, coupled with the increasing lifespan of modern automobiles. The average age of vehicles in key regions like North America and Europe is steadily rising, directly necessitating more frequent and often more complex maintenance procedures. Counterbalancing these drivers are significant restraints, notably the scarcity of highly trained technicians capable of servicing sophisticated electronic systems and high-voltage EV components, alongside the high capital investment required for adopting advanced diagnostic tools and calibration equipment. Opportunities lie prominently in the rapid expansion of predictive maintenance services enabled by IoT and telematics, and the specialized servicing required by the growing Electric Vehicle fleet, offering new, high-margin revenue streams for early adopters.

The major driving force stems from demographic and economic shifts globally. As developing economies experience urbanization and increased disposable income, vehicle ownership surges, expanding the market’s consumer base significantly. Additionally, stringent governmental regulations mandating periodic vehicle inspections (like MOT/TÜV tests) and emission checks ensure a baseline demand for essential repair and maintenance services. The competitive intensity among service providers, driven by the fragmentation of the independent aftermarket, pushes continuous innovation in service delivery, pricing models, and digital engagement, thereby stimulating market activity and forcing efficiency improvements.

Impact forces are heavily weighted towards technological evolution and regulatory compliance. The rapid integration of Advanced Driver-Assistance Systems (ADAS) means that even minor collision repair now requires precise sensor recalibration, dramatically increasing the complexity and cost of body repair services, hence impacting pricing and required skill sets. Furthermore, the ongoing transition to battery electric vehicles (BEVs) represents both an opportunity and a major disruption; while it lowers demand for traditional combustion engine maintenance, it creates a crucial need for specialized, high-cost battery repair and management services, requiring substantial retooling and re-skilling across the global service ecosystem.

Segmentation Analysis

Segmentation of the Automotive Repair and Maintenance Market provides a granular view of revenue streams based on the type of service performed, the category of the vehicle being serviced, and the nature of the service provider. This analysis is crucial for stakeholders to tailor business strategies, target specific consumer needs, and allocate resources effectively, especially considering the divergence in service requirements between traditional Internal Combustion Engine (ICE) vehicles and Electric Vehicles (EVs). The market is primarily dissected by Vehicle Type (Passenger Vehicles vs. Commercial Vehicles, each with distinct service intervals and complexities) and Service Provider (OEM Dealerships, offering specialized warranty-compliant services, versus the highly accessible and competitive Independent Service Providers).

The Service Type segmentation reveals the core operational segments. Routine maintenance (oil, filters, brakes) remains the foundational segment due to its high volume and recurrence. However, the high-value segments are increasingly centered around specialized body repair and collision services, particularly those involving advanced materials like aluminum and carbon fiber, and sophisticated electronic system repairs. Understanding these shifts allows participants to invest in high-margin technical niches. The rise of telematics and connected services is also birthing a new category: predictive and remote diagnostic services, which are growing rapidly and are key indicators of future market trends.

Geographic segmentation is paramount, demonstrating that mature markets prioritize specialized, high-tech service due to vehicle age and complexity, while emerging markets focus on rapid expansion of basic service infrastructure to meet high demand from newly purchased, high-volume models. The overall segmentation landscape confirms a market moving towards specialization, technology integration, and convenience, requiring service providers to adopt flexible, digitally-enabled operational models.

- Service Type:

- Routine Maintenance (Oil Change, Fluid Checks, Filter Replacement)

- Tires (Replacement, Balancing, Alignment)

- Brakes (Pads, Discs, Fluid)

- Body & Collision Repair (Paint, Frame Straightening, ADAS Calibration)

- Drivetrain & Engine Repair (Transmission, Engine Diagnostics, Exhaust)

- Electrical Systems & Electronics Repair (Battery, Wiring, Infotainment)

- Service Provider:

- OEM Dealerships

- Independent Service Providers (ISPs)

- Franchise General Repair Chains (e.g., Midas, Jiffy Lube)

- Specialist Service Providers (e.g., Tire Shops, Body Shops)

- Vehicle Type:

- Passenger Vehicles (PV)

- Commercial Vehicles (CV)

- Electric Vehicles (EV) and Hybrid Vehicles

- Component Type:

- Mechanical Components

- Exterior Components

- Interior Components

- Electronics and Software

Value Chain Analysis For Automotive Repair and Maintenance Market

The value chain for automotive repair and maintenance is complex, involving several distinct stages from the sourcing of parts to final service delivery. Upstream activities are dominated by parts manufacturing (OEMs and Aftermarket suppliers like Bosch, Denso, and LKQ), focusing on the production and distribution of replacement components ranging from lubricants and filters to complex electronic modules. Key considerations in the upstream segment include quality assurance, counterfeiting mitigation, and rapid inventory replenishment to meet immediate repair needs. Strong supplier relationships and robust logistics networks are essential for maintaining efficiency and minimizing vehicle downtime across the service network.

Downstream activities center on the service delivery channels—OEM dealerships, independent garages, and franchised chains. These entities are responsible for consumer interaction, diagnostics, repair execution, and warranty administration. A crucial aspect of the downstream process is technician training and certification, especially for highly specialized tasks like EV battery handling or ADAS recalibration. The shift towards digitization means that software updates and remote diagnostics are increasingly integrated into the service delivery process, demanding strong IT infrastructure within service centers.

Distribution channels are multilayered, combining direct sales (OEM parts sold through dealerships) and indirect sales (aftermarket parts flowing through large distributors like Genuine Parts Company/NAPA, or wholesalers). Independent service providers heavily rely on these indirect channels for cost-effective and timely access to a wide range of parts. The rise of e-commerce platforms also represents a growing distribution channel, allowing consumers and small garages to procure parts directly, bypassing traditional intermediary tiers. This channel optimization significantly impacts the speed and cost efficiency of the entire repair process.

Automotive Repair and Maintenance Market Potential Customers

Potential customers for the Automotive Repair and Maintenance Market are broadly categorized into individual vehicle owners and commercial fleet operators, each possessing distinct needs and purchasing behaviors. Individual consumers, constituting the largest volume segment, prioritize convenience, transparent pricing, and trusted service quality. They typically utilize both OEM dealerships for in-warranty service and complex repairs, and local independent garages for routine, cost-sensitive maintenance. Their decision-making is highly influenced by reputation, location, and digital accessibility for booking and tracking services.

Commercial fleet operators, including logistics companies, rental agencies, and ride-sharing services, represent the highest-value segment due to the requirement for high-volume, standardized, and rapid servicing to ensure maximum asset uptime. These customers often enter into long-term service contracts, favoring providers who offer predictive maintenance capabilities, comprehensive geographic coverage, and sophisticated reporting on vehicle health and maintenance costs. The increasing electrification of commercial fleets is creating a demand for providers specializing in heavy-duty EV maintenance and charging infrastructure support.

A rapidly emerging customer segment includes operators of specialized vehicles, such as ambulances, police cars, and construction equipment, whose maintenance needs are often regulated by strict safety and operational standards. These entities require highly specialized skills, rapid response times, and compliance reporting. Service providers targeting these high-stakes users must demonstrate not only technical proficiency but also robust operational compliance and emergency service capabilities, often requiring mobile or dedicated onsite repair units.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 800.5 Billion |

| Market Forecast in 2033 | USD 1,150.8 Billion |

| Growth Rate | 5.3% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bridgestone Corporation, Goodyear Tire & Rubber Company, Continental AG, Denso Corporation, Bosch (Robert Bosch GmbH), 3M Company, ZF Friedrichshafen AG, Magneti Marelli (Marelli), Delphi Technologies (BorgWarner), Exxon Mobil Corporation, Shell plc, Valvoline Inc., Castrol (BP plc), Monro, Inc., TBC Corporation, Jiffy Lube International, Midas International, Driven Brands, Inc., Genuine Parts Company (NAPA), LKQ Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Repair and Maintenance Market Key Technology Landscape

The technological landscape of the Automotive Repair and Maintenance market is rapidly evolving, driven primarily by vehicle electrification, connectivity, and the integration of sophisticated software. Diagnostics has moved beyond simple fault code readers to complex systems requiring original equipment manufacturer (OEM)-level software access and often remote flashing capabilities. Advanced diagnostic tools utilizing cloud connectivity and machine learning are becoming standard, enabling workshops to handle the ever-increasing complexity of modern vehicle control units (ECUs) and interconnected systems. Furthermore, specialized equipment for high-voltage battery handling, repair, and thermal management in EVs is a mandatory investment for market participants aiming to future-proof their operations.

Connected vehicle technologies (telematics, IoT) form the backbone of the next generation of service delivery. These systems constantly transmit operational data, enabling service providers to offer true predictive maintenance—scheduling service based on actual component wear and driving conditions rather than fixed mileage intervals. This data integration allows for hyper-personalized service recommendations and preemptive part ordering, dramatically improving the efficiency of the service event. The utilization of digital vehicle inspection (DVI) tools, where technicians use tablets to document issues with photos and videos, enhances customer trust and transparency throughout the repair process.

Augmented Reality (AR) and Virtual Reality (VR) are emerging as critical tools for technician training and complex repair execution. AR overlays technical instructions and diagrams directly onto the physical vehicle components being serviced, speeding up repair time and minimizing errors, especially for new or infrequently encountered vehicle models. Additionally, advanced software is necessary for recalibrating Advanced Driver-Assistance Systems (ADAS) sensors post-collision or windshield replacement, which requires precise measurement and alignment tools, signifying a fusion of mechanical repair with high-precision digital calibration.

Regional Highlights

The market exhibits distinct growth patterns across major geographical regions, influenced by vehicle age, regulatory stringency, and adoption rates of new technologies like EVs.

- Asia Pacific (APAC): Dominates the market size and fastest growth rate due to rapidly expanding vehicle parc, driven by robust economic development in countries like China, India, and Southeast Asian nations. The focus here is on expanding formal aftermarket infrastructure and accommodating a high volume of new, often mid-range, vehicles. The high penetration of two-wheelers and light commercial vehicles also contributes substantially to the overall maintenance market size.

- North America: Characterized by a high average vehicle age (often exceeding 12 years), which necessitates high-frequency and complex repairs. The market is mature, with strong penetration of franchise chains and a high rate of technology adoption, particularly in telematics and digital service platforms. Significant demand exists for collision repair due to the complexity and cost associated with advanced body materials and ADAS recalibration.

- Europe: Defined by strict environmental and safety regulations (e.g., Euro 6, periodic technical inspections), ensuring steady demand for both routine and specialized repairs. The rapid transition towards electric vehicles and stringent Right to Repair legislation are key factors shaping the regional market, encouraging independent garages to invest heavily in EV diagnostic and repair training to remain competitive against OEM networks.

- Latin America: Exhibits growth potential driven by urbanization and increasing vehicle ownership, often reliant on a high percentage of used vehicles requiring frequent maintenance. The challenge remains infrastructure fragmentation and the presence of informal service sectors, though international players are working to standardize service quality and expand formal repair networks, focusing on high-volume replacement parts.

- Middle East and Africa (MEA): Growth is steady, particularly in the GCC countries due to high per-capita vehicle ownership and demand for premium brand servicing. The reliance on imported vehicles means high demand for reliable sourcing of specialized OEM and high-quality aftermarket parts. Fleet maintenance for logistics and construction sectors drives the commercial vehicle service segment significantly.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Repair and Maintenance Market.- Bridgestone Corporation

- Goodyear Tire & Rubber Company

- Continental AG

- Denso Corporation

- Bosch (Robert Bosch GmbH)

- 3M Company

- ZF Friedrichshafen AG

- Magneti Marelli (Marelli)

- Delphi Technologies (BorgWarner)

- Exxon Mobil Corporation

- Shell plc

- Valvoline Inc.

- Castrol (BP plc)

- Monro, Inc.

- TBC Corporation

- Jiffy Lube International

- Midas International

- Driven Brands, Inc.

- Genuine Parts Company (NAPA)

- LKQ Corporation

- Advance Auto Parts, Inc.

- O'Reilly Automotive, Inc.

- Tenneco Inc.

- Faurecia SE (FORVIA)

- Snap-on Incorporated

Frequently Asked Questions

Analyze common user questions about the Automotive Repair and Maintenance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected CAGR for the Automotive Repair and Maintenance Market?

The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.3% between 2026 and 2033, driven by increasing vehicle complexity and the rise of specialized EV servicing requirements.

How is the rise of Electric Vehicles (EVs) impacting automotive repair services?

EVs significantly reduce the need for traditional maintenance (oil changes, exhaust repair) but create high demand for specialized services, including high-voltage battery diagnostics, thermal management system repair, and software updates, requiring specialized training and equipment.

Which segment holds the largest share in the Automotive Repair and Maintenance Market?

The Independent Service Providers (ISPs) segment currently holds the largest market share due to their broad accessibility, cost-competitive pricing, and extensive geographical coverage, especially for routine maintenance and out-of-warranty vehicles.

What role does AI and telematics play in modern vehicle maintenance?

AI utilizes telematics data (connected vehicle data) to enable advanced predictive maintenance, accurately forecasting component failures before they occur. This shifts service from reactive repair to proactive scheduling, minimizing downtime and optimizing fleet efficiency.

What are the primary challenges facing independent repair garages?

Independent garages face challenges related to accessing OEM proprietary diagnostic data and tools, securing the specialized training necessary for advanced electronic and ADAS repairs, and meeting the high capital costs required for EV service equipment.

The preceding analysis details the core drivers and structure of the global Automotive Repair and Maintenance market, highlighting the technological shifts and competitive dynamics that will shape its trajectory through 2033. Strategic investments in digitalization, technician upskilling, and EV-specific capabilities are paramount for sustained competitive advantage.

The continued expansion of the global vehicle population, particularly in emerging economies, ensures a stable foundational demand for basic maintenance services. However, the premium segment of the market will increasingly be defined by high-technology repair—specifically, services related to ADAS calibration, complex electronic fault resolution, and sophisticated battery servicing. Market players must prioritize data integration and predictive models to meet the expectations of modern vehicle owners, who demand efficiency, transparency, and minimal disruption to their daily lives.

Regulatory frameworks, especially those surrounding environmental emissions and vehicle safety standards, continue to exert a strong influence, forcing continuous technical compliance and providing a steady stream of repair opportunities. Furthermore, legislation supporting the ‘Right to Repair’ movement, especially in Europe and North America, is crucial for fostering competition and ensuring that independent service providers have fair access to the necessary repair information and tools, thereby stabilizing the competitive balance against OEM monopolies on data and complex proprietary diagnostics.

The convergence of advanced manufacturing techniques, such as those involving lightweight materials used in body construction, further elevates the barrier to entry for high-quality collision repair, demanding significant investment in certified processes and specialized tooling. Consequently, the future success of market participants hinges not just on efficiency, but on demonstrable expertise across a highly diversified and increasingly digital service portfolio.

Geographically, while Asia Pacific drives volume growth, North America and Europe will drive value growth due to the higher complexity and cost associated with servicing older, technologically advanced fleets. Stakeholders must adopt regionally nuanced strategies, focusing on infrastructure development in emerging markets and specialized technical excellence in mature markets.

Investment in supply chain robustness is also critical, particularly concerning the reliable sourcing of certified parts for new technologies. Supply chain disruptions can severely impact service delivery timelines, directly affecting customer satisfaction and retention. Therefore, partnerships that ensure agile and transparent parts logistics are essential components of a robust market strategy in the current environment.

The final element driving future market success involves human capital development. The skills gap—the shortage of technicians qualified to service modern, complex vehicles—remains a major constraint. Companies that invest proactively in advanced technical training programs, potentially leveraging VR/AR technologies for scalable learning, will be best positioned to capture high-margin service revenue segments effectively.

In summary, the Automotive Repair and Maintenance Market is resilient, underpinned by the essential nature of its services, yet highly dynamic due to technological acceleration. Navigating this environment requires flexibility, digital integration, and a dedicated focus on specialized technical competence to capitalize on the shift towards connected and electric mobility.

Further analysis into the detailed operational strategies of key competitors reveals divergent approaches to market penetration. While large global component suppliers like Bosch focus on providing the diagnostic tools and training to empower independent garages, large service chains are concentrating on optimizing customer throughput via highly efficient express service models (e.g., Jiffy Lube, Midas). These models prioritize speed and standardization for routine tasks, ensuring high volume and brand consistency across diverse geographies.

The collision repair sector, a high-cost, high-value component of the market, is experiencing increasing consolidation. Large multi-site operators (MSOs) are dominating by securing direct repair agreements (DRPs) with insurance companies, which mandate strict quality controls and fast turnaround times. This segment requires continuous investment in state-of-the-art repair bays capable of handling sophisticated structural repairs and mandatory ADAS component re-calibration post-impact.

The digital customer journey is becoming non-negotiable. Customers now expect real-time updates on repair status, transparent pricing breakdowns provided digitally, and seamless online booking experiences. Service providers who fail to integrate these digital touchpoints risk falling behind competitors who utilize personalized communication and proactive reminders generated through CRM and telematics systems. The perceived value of the service is now heavily influenced by the ease and transparency of the transaction, not just the quality of the mechanical work.

Additionally, the transition to sustainability influences consumer choice. There is growing demand for green service alternatives, including sustainable washing practices, the use of recycled or remanufactured parts, and the application of low-VOC paints and eco-friendly lubricants. Providers who prominently feature their environmental credentials gain a competitive edge with environmentally conscious vehicle owners and corporate fleets committed to lowering their carbon footprint.

Finally, the growing trend of vehicle subscription services and long-term rentals (leasing) transfers the maintenance responsibility from the individual owner to the fleet management company. This shift creates a massive opportunity for providers to secure high-volume, long-duration maintenance contracts directly with these fleet operators, demanding sophisticated contract management and guaranteed service level agreements (SLAs) regarding vehicle uptime and repair cycle times.

To summarize the strategic environment, success in the Automotive Repair and Maintenance market hinges on three pillars: technological adaptation (mastering EV and ADAS servicing), digital excellence (optimizing the customer experience), and scale efficiency (leveraging centralized procurement and standardized operations across multiple service points). The market continues to offer robust growth potential, but increasingly rewards specialization and data-driven management.

The complexity introduced by advanced engine downsizing, turbocharging, and direct injection technologies in traditional ICE vehicles also sustains a high requirement for specialized service beyond basic routine maintenance. These sophisticated ICE systems are prone to specific issues requiring intricate diagnostics and precise repair protocols, providing a continued revenue stream even as the EV market grows. This means that hybrid expertise—proficiency in both high-tech ICE and initial EV systems—is essential for capturing the current transition market.

Moreover, regulatory scrutiny over aftermarket parts quality is intensifying globally. Consumers and service providers are increasingly demanding parts certified to meet OEM or equivalent quality standards, which benefits large, established aftermarket suppliers with robust testing and quality control processes. This preference for certified parts marginally restrains smaller, lower-cost providers and reinforces the market position of reputable distributors and manufacturers.

The penetration of global vehicle tracking and management systems into the commercial fleet sector mandates repair and maintenance providers to integrate their systems seamlessly with fleet software. This capability allows for real-time monitoring of maintenance schedules, accurate cost attribution, and streamlined workflow management for commercial clients, acting as a crucial differentiator in winning major service contracts.

The final consideration is cybersecurity, which, while not a direct repair service, is paramount for vehicle maintenance involving software updates and network connectivity. Service providers must ensure secure access to vehicle data ports and network infrastructure to prevent unauthorized access or system vulnerabilities during diagnostic and update procedures. Adherence to strict cybersecurity protocols is rapidly becoming a mandatory compliance requirement imposed by OEMs and industry regulators, further complicating the service technician's role and requiring specialized IT training.

In essence, the market future involves a service network that is less about turning wrenches and more about software management, data analysis, and high-precision calibration. This fundamental shift requires market players to redefine their core competencies and reallocate capital expenditure towards digital and specialized training assets.

The preceding sections establish a robust analytical framework covering market sizing, competitive dynamics, technological influences, and regional variance within the global Automotive Repair and Maintenance Market. This detailed perspective serves as a strategic reference for investors, service providers, and component manufacturers navigating the evolving landscape towards electrification and digitalization.

Maintaining a strong focus on customer retention through loyalty programs and extended service warranties remains a staple strategy, particularly for OEM dealerships looking to keep owners within their network beyond the initial warranty period. Independent providers, conversely, often use flexible service hours, mobile repair units, and competitive labor rates to build loyalty among value-conscious consumers and small businesses.

The rise of digital marketplaces for used vehicles also impacts maintenance cycles. Many certified pre-owned programs include comprehensive inspection and refurbishment services, often handled by specialized service centers, driving demand for high-quality, efficient mechanical and cosmetic repair work. This reliance on refurbishment ensures that even older vehicles are brought up to high operational standards before resale, guaranteeing subsequent maintenance needs.

Finally, insurance partnerships are critical, particularly in the collision and glass repair segments. Service providers who successfully secure preferred vendor status with major insurance carriers gain a substantial, steady flow of high-value repair work. This relationship necessitates investment in advanced estimating software, compliance with insurance billing practices, and maintaining high customer satisfaction metrics as measured by the insurer.

This comprehensive view underscores the multi-faceted nature of the automotive service industry, requiring agility in technology adoption, strategic segmentation, and continuous workforce development to achieve market leadership.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager