Automotive Rubber Hose Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436318 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Automotive Rubber Hose Market Size

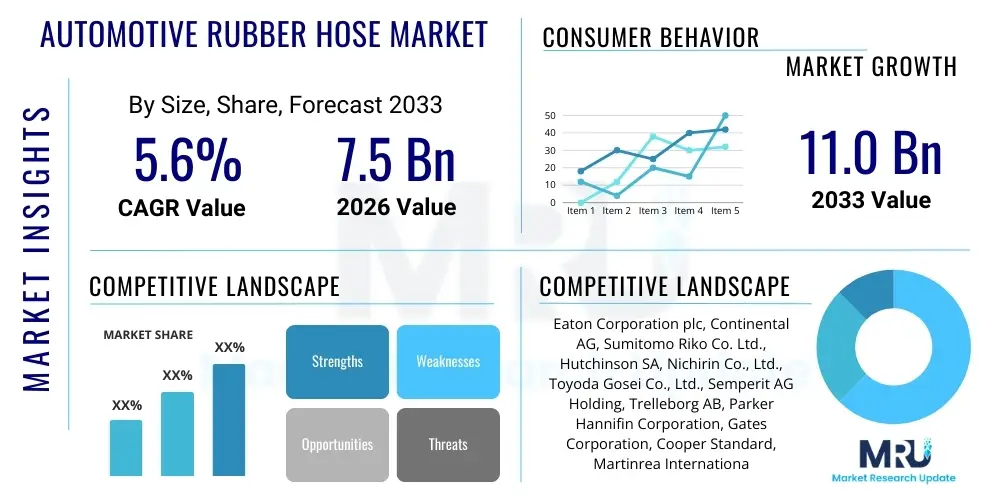

The Automotive Rubber Hose Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.6% between 2026 and 2033. The market is estimated at USD 7.5 Billion in 2026 and is projected to reach USD 11.0 Billion by the end of the forecast period in 2033.

Automotive Rubber Hose Market introduction

The Automotive Rubber Hose Market encompasses the production and supply of flexible conduits designed for transporting various fluids and gases within vehicles, including coolants, oils, air, fuel, and hydraulic liquids. These hoses are critical components ensuring the efficient operation and longevity of automotive systems such as engine cooling, air conditioning (HVAC), braking, steering, and fuel delivery. The market's growth is fundamentally tied to global vehicle production rates, the increasing complexity of vehicle architectures requiring specialized fluid management, and stringent regulatory standards concerning emission control and operational safety. Rubber hoses, utilizing materials like EPDM, Silicone, NBR, and FKM, are preferred for their flexibility, durability, resistance to temperature extremes, and compatibility with diverse automotive fluids.

Product descriptions within this segment highlight high-performance hoses capable of withstanding extreme pressure and high temperatures, which are increasingly vital in modern turbocharged and hybrid engines. Key applications include radiator hoses, heater hoses, brake hoses, power steering hoses, and vacuum hoses. The ongoing shift toward electric vehicles (EVs) is subtly influencing product requirements, necessitating hoses optimized for battery thermal management and low-temperature performance, although traditional combustion engine vehicles still constitute the dominant application base, driving immediate volume requirements. Benefits derived from utilizing high-quality automotive rubber hoses include enhanced vehicle safety, reduced maintenance costs, improved engine performance through optimal fluid circulation, and compliance with stringent environmental standards related to leakage prevention.

Driving factors propelling market expansion involve robust growth in the Asia Pacific automotive manufacturing sector, particularly in China and India, alongside the global replacement market (aftermarket) due to natural wear and tear. Furthermore, technological advancements focusing on lightweighting and material science, aiming to improve fuel efficiency and durability, are consistently driving demand for specialized rubber compounds. The integration of advanced driver-assistance systems (ADAS) and sophisticated thermal management systems in luxury and high-performance vehicles also contributes significantly, requiring tailored hose assemblies that can perform reliably under demanding operational conditions.

Automotive Rubber Hose Market Executive Summary

The Automotive Rubber Hose Market is navigating a transitional phase characterized by significant technological shifts and geographical realignment. Business trends indicate a strong emphasis on strategic partnerships between raw material suppliers (elastomer manufacturers) and Tier 1 automotive suppliers to enhance product innovation, particularly regarding high-pressure, electrically resistant, and lightweight hose assemblies crucial for modern engine downsizing and electric vehicle platforms. Consolidation among smaller players is anticipated as regulatory compliance standards, especially concerning material purity and lifespan guarantees (e.g., EU REACH regulations), increase the barrier to entry. The aftermarket segment remains a resilient revenue stream, bolstered by the aging global vehicle fleet and increasing DIY maintenance culture in mature economies, requiring standardized yet durable replacement parts.

Regional trends highlight the Asia Pacific (APAC) region as the undisputed leader in both production and consumption, driven by massive vehicle output volumes and burgeoning domestic demand in emerging economies. While North America and Europe maintain a strong demand profile for highly engineered, specialty hoses for premium and high-performance vehicles, APAC’s sheer volume ensures its market dominance. However, supply chain vulnerabilities exposed during recent global disruptions are prompting Original Equipment Manufacturers (OEMs) in established markets to seek diversified sourcing strategies, potentially fostering niche manufacturing hubs outside traditional centers, thereby decentralizing market growth slightly.

Segment trends underscore the cooling and heating system hoses (EPDM-based) as the largest volume contributors, driven by universal application across vehicle types. Nevertheless, the fastest growth is observed in high-performance hoses, specifically those used in turbochargers (requiring Silicone and FKM resistance) and fuel lines capable of handling ethanol and biofuel blends. The increasing adoption of EVs is catalyzing the thermal management segment, shifting focus from traditional engine cooling hoses to precision battery cooling circuits, demanding greater insulation, lower weight, and increased temperature stability, thus favoring specialized rubber and plastic composites.

AI Impact Analysis on Automotive Rubber Hose Market

Common user questions regarding AI's impact on the Automotive Rubber Hose Market typically revolve around how predictive maintenance algorithms will affect hose replacement schedules, whether AI-driven manufacturing systems can optimize rubber compounding for cost and performance, and if autonomous vehicle safety requirements will mandate new levels of hose reliability verifiable through digital twins and AI-based testing. Users are concerned about the longevity of the aftermarket if AI accurately predicts component failure, and conversely, they anticipate benefits in quality control and supply chain efficiency. Key themes center on maintenance predictability, material science optimization, and manufacturing process automation, seeking clarity on whether AI adoption leads to disruptive innovation or merely incremental process improvement within this traditional manufacturing sector.

The core influence of Artificial Intelligence (AI) and Machine Learning (ML) in the automotive hose industry is centered on operational efficiency and product lifecycle management. In manufacturing, AI algorithms analyze real-time sensor data from compounding mixers and extrusion lines to dynamically adjust parameters like temperature and pressure, minimizing material waste, ensuring batch consistency, and reducing defect rates. This leads to significantly higher manufacturing precision, which is crucial for safety-critical components like brake hoses. Furthermore, AI facilitates predictive maintenance on the manufacturing equipment itself, ensuring minimal downtime and optimizing overall equipment effectiveness (OEE), thereby lowering production costs and improving supply chain predictability for OEMs.

In the application phase, AI's integration into vehicle telemetry systems allows for sophisticated monitoring of operating conditions, such as fluid temperatures, vibration levels, and pressure fluctuations within the hose assemblies. This data, analyzed by ML models, provides accurate estimations of the component's remaining useful life (RUL). This predictive capability profoundly impacts the aftermarket, enabling proactive, condition-based replacement rather than time-based scheduling. While this might slightly depress unnecessary replacement volumes, it simultaneously increases the demand for "smart" or sensor-equipped hoses and reinforces the requirement for extreme product reliability and standardization across the market.

- AI optimizes rubber compounding formulas for enhanced durability and lightweighting.

- Machine Learning improves quality control processes, reducing manufacturing defects in critical assemblies.

- Predictive maintenance algorithms influence aftermarket demand by enabling condition-based replacement.

- AI-driven simulation tools accelerate the design and testing of high-pressure and thermal management hoses for EVs.

- Automated visual inspection systems using AI enhance throughput and accuracy in final product verification.

- Supply chain risk management is improved through AI analysis of material procurement and logistical bottlenecks.

DRO & Impact Forces Of Automotive Rubber Hose Market

The dynamics of the Automotive Rubber Hose Market are shaped by powerful Drivers (D) such as increasing global vehicle production, stringent emission norms necessitating optimized fluid transport systems, and robust growth in the aftermarket sector driven by an aging vehicle fleet. Restraints (R) include the volatility of raw material prices (synthetic rubber and petroleum-based additives), the competitive threat posed by thermoplastic elastomers (TPEs) and plastics in certain low-pressure applications, and the capital-intensive nature of achieving complex material certifications. Opportunities (O) arise from the rapid electrification of the automotive industry, which creates new demand for specialized battery cooling and thermal management hoses, and the potential for lightweighting through advanced material integration, appealing to efficiency-conscious OEMs. These factors collectively exert significant Impact Forces (I) on pricing power, innovation cycles, and geographical market dominance, dictating which segments experience accelerated growth.

Drivers are primarily sustained by mandatory regulatory requirements across major regions. For instance, Euro 7 and CAFE standards mandate continuous improvements in engine efficiency and emission reduction, often requiring complex, multi-layered hose structures resistant to aggressive engine environments and higher operating temperatures. The rising demand for passenger safety and comfort globally translates into increased adoption of power steering and braking systems, each dependent on high-integrity hydraulic hoses. Furthermore, economic growth in Asia Pacific and Latin America continues to fuel the expansion of vehicle parc, thereby securing long-term demand for both OEM integration and subsequent aftermarket services, making this segment recession-resistant to a degree.

However, the market faces considerable pressure from raw material cost fluctuations, particularly for synthetic rubbers (like NBR and EPDM) which are derived from petrochemicals, linking operational profitability directly to global oil prices. The substitution risk, where manufacturers consider cost-effective, lighter TPE alternatives, poses a long-term restraint, especially in less demanding applications. Manufacturers must also invest heavily in research and development to manage the transition to EV requirements, which fundamentally alter the fluid dynamics within a vehicle, necessitating new bonding techniques and specialized material combinations to handle different coolants and thermal loads effectively. Successfully navigating these restraints while capitalizing on the electrification opportunity will define competitive advantage in the coming decade.

Segmentation Analysis

The Automotive Rubber Hose Market is meticulously segmented based on key functional, material, and vehicle characteristics, allowing for targeted analysis of supply and demand dynamics across the automotive ecosystem. Primary segmentation criteria include the application area within the vehicle (e.g., HVAC, Fuel Line, Brake), the material used (e.g., EPDM, Silicone, NBR), the vehicle type (e.g., Passenger Car, Commercial Vehicle), and the sales channel (OEM vs. Aftermarket). This structured approach reveals that while EPDM remains the volume leader due to its prevalence in cooling systems, specialized materials like Silicone are capturing higher growth rates, driven by extreme temperature requirements in turbocharged and electric vehicles. The OEM channel dominates in terms of initial sales value due to higher specification requirements, but the aftermarket provides a stable, long-term stream of predictable revenue.

Understanding these segment interactions is critical for strategic planning. For example, the increasing penetration of Passenger Cars, particularly SUVs and premium models, inherently drives demand for more complex, multi-functional hose assemblies supporting sophisticated thermal management systems and complex braking architectures. Commercial Vehicles, conversely, prioritize robustness and resistance to heavy-duty operational stress, leading to a higher demand for NBR and specialized materials capable of handling high abrasion and oil exposure. Furthermore, the regulatory environment disproportionately affects the Fuel Line segment, necessitating continuous material innovation to comply with mandates related to biofuel compatibility and reduced permeability.

- By Application:

- Air Intake and Emission Control Hose

- Brake Hose

- Fuel Supply Hose (Gasoline, Diesel, Biofuels)

- Coolant Hose (Radiator, Heater)

- Vacuum Hose

- Power Steering Hose

- Air Conditioning (HVAC) Hose

- Turbocharger/Intercooler Hose

- Battery Thermal Management Hose (EV specific)

- By Material Type:

- EPDM (Ethylene Propylene Diene Monomer)

- Silicone Rubber

- NBR (Nitrile Butadiene Rubber)

- FKM (Fluoroelastomer)

- SBR (Styrene Butadiene Rubber)

- By Vehicle Type:

- Passenger Cars (PC)

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

Value Chain Analysis For Automotive Rubber Hose Market

The value chain for the Automotive Rubber Hose Market is characterized by several critical stages, starting from upstream raw material sourcing, moving through compound mixing and manufacturing, and culminating in downstream distribution and final end-user utilization. Upstream activities involve the procurement of base polymers (synthetic rubbers), reinforcing materials (like textile braids or steel wire), and chemical additives (curing agents, plasticizers, anti-oxidants). The profitability and competitive positioning of manufacturers are heavily dependent on securing stable, high-quality, and cost-effective raw material supply, making vertical integration or long-term supplier agreements a common strategy to mitigate raw material price volatility, which is a key risk factor for the industry.

The midstream phase, comprising manufacturing and assembly, involves complex processes such as compounding (mixing raw rubber with additives), extrusion, braiding or wrapping, vulcanization (curing), and final assembly into specific, vehicle-ready hose systems. Leading Tier 1 suppliers differentiate themselves here through proprietary compounding technologies that enhance hose performance parameters, such as chemical resistance, temperature tolerance, and flexibility, often investing heavily in automation and precision tooling. Distribution channels are highly structured; direct sales dominate the OEM segment, requiring Just-In-Time (JIT) delivery and compliance with stringent quality audits. Indirect channels, involving wholesalers, distributors, and retailers, manage the expansive aftermarket segment, where logistical efficiency and inventory management are paramount for success.

Downstream analysis highlights the distinct purchasing behaviors of Original Equipment Manufacturers (OEMs) and end-consumers (aftermarket buyers). OEMs prioritize technical specifications, long-term warranty provisions, and supply chain reliability, often engaging suppliers early in the vehicle design cycle. Aftermarket buyers, on the other hand, focus more on availability, price point, and ease of installation. Direct distribution ensures tighter control over product quality for OEMs, whereas the aftermarket relies on a complex network of authorized and independent distributors to reach garages and repair shops globally. Successful market participants must maintain distinct strategies for both channels, optimizing pricing and product lines accordingly.

Automotive Rubber Hose Market Potential Customers

The primary consumers and end-users of the Automotive Rubber Hose Market are broadly categorized into three major groups: Original Equipment Manufacturers (OEMs), Tier 1 and Tier 2 Automotive System Suppliers, and the Independent Aftermarket (IAM) stakeholders. OEMs represent the highest volume demand and define the most demanding specifications, incorporating hoses directly into newly manufactured vehicles, ranging from internal combustion engine (ICE) cars to battery electric vehicles (BEVs). Their purchasing decisions are driven by stringent performance criteria, long-term supply contracts, and global manufacturing footprint compatibility, necessitating a specialized and highly certified supply base for critical applications like braking and fuel lines.

Tier 1 and Tier 2 suppliers, such as those specializing in cooling systems (radiators), brake assemblies, or air conditioning units, act as indirect customers, integrating hoses as components into larger sub-assemblies which are then supplied to the OEMs. These customers require highly reliable, precisely dimensioned hoses delivered in complex kits or modules. The growth in vehicle platform standardization and modular manufacturing reinforces the importance of this customer group, as they seek hose suppliers capable of large-scale production with consistent quality across multiple global assembly plants. Their demand is highly synchronous with new model introductions and production ramp-ups across global automotive platforms.

The Independent Aftermarket (IAM) constitutes millions of repair shops, service centers, and individual vehicle owners worldwide, driving demand for replacement parts. This segment is characterized by high diversity in product specifications (covering vehicles spanning decades of production) and extreme price sensitivity, often valuing durability and cost-effectiveness over cutting-edge material science, unless dealing with high-performance or specialized modern vehicle repairs. The steady, continuous nature of replacement demand provides market stability, ensuring continued investment in robust, standardized hose designs suitable for widespread application and easy installation across varied vehicle models.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 7.5 Billion |

| Market Forecast in 2033 | USD 11.0 Billion |

| Growth Rate | 5.6% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eaton Corporation plc, Continental AG, Sumitomo Riko Co. Ltd., Hutchinson SA, Nichirin Co., Ltd., Toyoda Gosei Co., Ltd., Semperit AG Holding, Trelleborg AB, Parker Hannifin Corporation, Gates Corporation, Cooper Standard, Martinrea International Inc., Pliant Power Systems, Manuli Hydraulics, Kurashiki Kako Co. Ltd., Flexfab LLC, Transfer Oil S.p.A., Codan Rubber A/S, Fluorseals SpA, Meiji Rubber & Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Rubber Hose Market Key Technology Landscape

The technology landscape within the Automotive Rubber Hose Market is fundamentally driven by the need to meet increasingly demanding performance envelopes, particularly those related to higher operating temperatures, aggressive chemical environments (biofuels, specialized coolants), and stringent requirements for weight reduction and reduced permeability. A key technological focus is on multi-layer hose constructions utilizing specialized barrier materials (often FKM or high-performance plastics) embedded within the rubber structure to minimize fluid evaporation and diffusion, ensuring compliance with global emission standards. Furthermore, suppliers are investing heavily in advanced compounding techniques, such as Nanocomposite technology, to enhance the mechanical strength and thermal stability of standard elastomers like EPDM and NBR without adding excessive weight or bulk, thereby extending the operational lifespan of the components.

Another pivotal technological advancement involves the development of hybrid hose systems that strategically combine flexible rubber sections with rigid plastic or metal couplings. This integration allows for improved packaging efficiency within increasingly crowded engine bays, reduces the potential for leaks at connection points, and enhances the overall durability of the fluid circuit. For electric vehicles (EVs), the technology shift is focused entirely on thermal management. This necessitates specialized electrically non-conductive hoses that are resistant to aggressive battery coolants, capable of operating efficiently at lower ambient temperatures, and designed to manage the high pressures associated with sophisticated battery cooling loops. Innovations in quick-connect fittings and modular assemblies further streamline the installation process on high-volume assembly lines.

Manufacturing process technology is also evolving, driven by the need for consistency and efficiency. Automated braiding and winding machinery ensures uniform reinforcement application, critical for high-pressure applications like brake or power steering hoses. Furthermore, advanced vulcanization methods, including salt bath and microwave curing, are utilized to ensure uniform material properties and reduced curing times. Digitalization and the integration of Industry 4.0 principles, including sensor-based monitoring of curing ovens and material feed systems, are becoming standard practices among leading manufacturers. This continuous technological refinement aims to deliver components that offer optimal performance-to-weight ratios while simultaneously reducing the total cost of ownership for OEMs and end-users.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market, driven primarily by the massive automotive production bases in China, India, Japan, and South Korea. China stands as the largest single market globally, characterized by rapid urbanization, substantial growth in both domestic and export vehicle manufacturing, and accelerating adoption of electric mobility platforms. The region benefits from lower manufacturing costs and a large skilled workforce, making it the global hub for high-volume hose production. Demand is high across all application segments, particularly for PC and LCV components, fueling the growth of both domestic and international market players operating within the region.

- North America: This region is characterized by a mature aftermarket and a strong demand for high-specification hoses, particularly in the Heavy Commercial Vehicle (HCV) and high-performance vehicle segments. Strict federal regulations regarding emissions (EPA) and safety necessitate the use of premium, durable hoses, especially fluorinated elastomers (FKM) in fuel systems to minimize permeation. The market sees significant investment in R&D focusing on hoses for complex engine turbocharging systems and advanced thermal management solutions required by the burgeoning local EV production capacity, although aftermarket demand for traditional vehicles remains highly significant.

- Europe: The European market is defined by stringent environmental regulations (Euro 7 standards and ambitious EV targets) that push demand towards high-performance, lightweight, and recyclable hose solutions. Germany, France, and Italy are key consumption centers, dominated by demand from luxury and premium vehicle manufacturers who prioritize material innovation and complexity. The focus here is heavily skewed towards specialized rubber compounds for optimized fluid dynamics in smaller, turbocharged engines and the rapidly expanding need for battery thermal management hoses compliant with the highest safety standards.

- Latin America, Middle East, and Africa (LAMEA): LAMEA represents a high-potential but volatile market. Latin America, particularly Brazil and Mexico, serves as a crucial manufacturing hub, feeding both local and export markets. Demand is driven by local vehicle assembly and a significant need for robust aftermarket components suitable for challenging road conditions and often aggressive fuel blends. The Middle East focuses primarily on premium automotive segments and significant demand for heavy-duty commercial vehicle hoses vital for the logistics and energy sectors. African markets are overwhelmingly dominated by replacement parts (aftermarket) due to older vehicle fleets, prioritizing durable, cost-effective solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Rubber Hose Market.- Eaton Corporation plc

- Continental AG

- Sumitomo Riko Co. Ltd.

- Hutchinson SA

- Nichirin Co., Ltd.

- Toyoda Gosei Co., Ltd.

- Semperit AG Holding

- Trelleborg AB

- Parker Hannifin Corporation

- Gates Corporation

- Cooper Standard

- Martinrea International Inc.

- Pliant Power Systems

- Manuli Hydraulics

- Kurashiki Kako Co. Ltd.

- Flexfab LLC

- Transfer Oil S.p.A.

- Codan Rubber A/S

- Fluorseals SpA

- Meiji Rubber & Chemical Co., Ltd.

- Mishimoto

- Hebei Huayu Automotive Systems Co. Ltd.

Frequently Asked Questions

Analyze common user questions about the Automotive Rubber Hose market and generate a concise list of summarized FAQs reflecting key topics and concerns.How is the shift to Electric Vehicles (EVs) affecting demand for rubber hoses?

The shift to EVs fundamentally changes demand, reducing requirements for traditional fuel and exhaust hoses but creating high demand for specialized Battery Thermal Management (BTM) hoses. These BTM hoses must be lightweight, electrically non-conductive, and highly resistant to specialized coolants and extreme temperature cycling inherent in battery systems.

Which material segment is experiencing the fastest growth in the market?

The Silicone Rubber and Fluoroelastomer (FKM) segments are experiencing the fastest growth. Silicone is preferred for high-temperature applications like turbocharger hoses and critical EV cooling lines, while FKM offers superior resistance to aggressive chemicals, biofuels, and low-permeability requirements mandated by strict emission regulations.

What is the primary factor restraining market growth in the short term?

The primary restraint is the significant volatility and associated high cost of raw materials, particularly synthetic rubber polymers derived from petrochemical feedstock. These fluctuations impact manufacturing margins and necessitate complex supply chain hedging strategies for major producers globally.

Is the aftermarket or OEM segment more dominant in revenue generation?

While the Original Equipment Manufacturer (OEM) segment typically generates higher initial value due to specialized contract requirements and technology integration, the Aftermarket segment provides a larger, more stable, and long-term revenue base due to the continuous demand for replacement parts driven by the aging global vehicle population.

How do lightweighting trends influence rubber hose manufacturing?

Lightweighting mandates push manufacturers to innovate through thinner hose walls, optimized geometries, and the integration of advanced materials like TPEs or hybrid assemblies combining rubber with rigid plastic components. This focus aims to reduce overall vehicle mass, contributing to better fuel economy and extended EV range.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager