Automotive Rubber Hoses Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435176 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Automotive Rubber Hoses Market Size

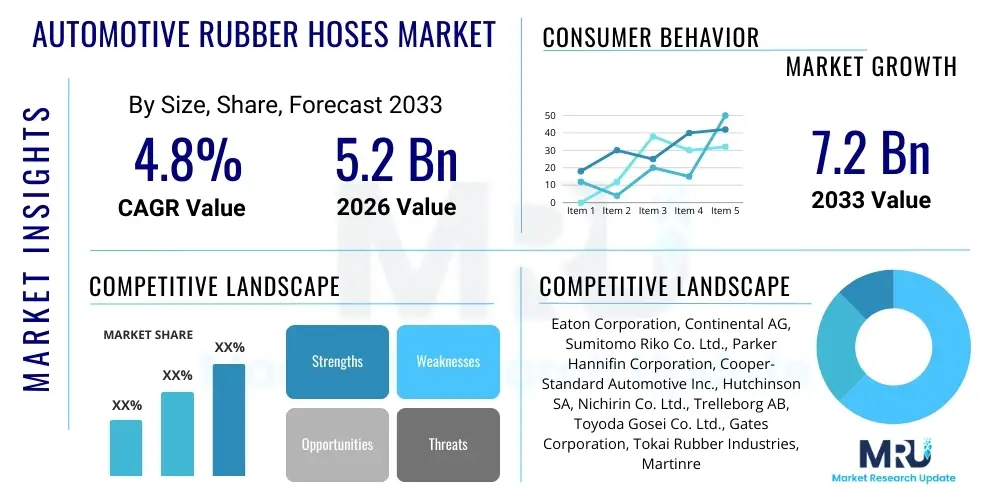

The Automotive Rubber Hoses Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $5.2 Billion in 2026 and is projected to reach $7.2 Billion by the end of the forecast period in 2033.

Automotive Rubber Hoses Market introduction

The Automotive Rubber Hoses Market encompasses the manufacturing and supply of flexible conduits designed to manage the flow of various fluids and gases within vehicles, including coolant, oil, air, brake fluid, and fuel. These hoses are critical components ensuring the operational efficiency, safety, and longevity of internal combustion engine (ICE) vehicles and, increasingly, electric vehicles (EVs). Product types range significantly based on application, material composition (such as EPDM, silicone, nitrile rubber, and fluorocarbon materials), and structural reinforcement, dictating their resistance to high temperatures, pressure, abrasion, and specific chemical corrosion within the engine bay and chassis systems. The primary function is to provide reliable fluid transfer under demanding automotive operating conditions.

Major applications for automotive rubber hoses span across several vital systems, including cooling and heating systems (radiator hoses, heater hoses), braking systems (brake fluid hoses), fuel delivery systems, turbocharger and air induction systems, and power steering mechanisms. The structural integrity and material quality are paramount, as hose failures can lead to significant vehicle breakdown or safety hazards. Benefits of high-quality rubber hoses include superior vibration damping, flexibility for installation in tight spaces, and robust resistance to thermal cycling. The ongoing shift toward hybrid and electric vehicles is subtly reshaping demand, emphasizing thermal management hoses for battery and electronics cooling systems, which require specialized rubber and elastomer compounds capable of managing higher-voltage environments and stricter temperature tolerances.

Driving factors propelling market growth include the robust expansion of the global automotive manufacturing sector, particularly in Asia Pacific economies, coupled with stringent environmental regulations mandating efficient engine operation and reduced emissions. This pushes manufacturers to adopt advanced materials that can withstand higher operating temperatures required for modern, downsized, and turbocharged engines. Furthermore, the average age of vehicles on the road is increasing in developed markets, necessitating a growing demand for replacement and aftermarket hoses. Regulatory mandates related to vehicle safety, fuel efficiency standards, and emission controls worldwide consistently drive innovation in rubber hose material science and design, ensuring continuous market evolution and sustained demand.

Automotive Rubber Hoses Market Executive Summary

The Automotive Rubber Hoses Market is demonstrating resilient growth, primarily fueled by the accelerating production volumes in emerging economies and the escalating complexity of fluid management systems in modern vehicles. Key business trends indicate a strong focus on lightweighting and durability, driven by OEM requirements to enhance overall vehicle efficiency and reduce material waste. Manufacturers are heavily investing in specialized elastomeric compounds, such as high-performance silicone and fluorocarbon elastomers, necessary for critical applications like turbocharger air ducts and battery cooling lines in electric vehicles. Strategic acquisitions and long-term supply agreements between tier-1 suppliers and major automotive OEMs are defining the competitive landscape, emphasizing global supply chain resilience and localized production capabilities, particularly in the APAC region where production output dominates.

Regionally, Asia Pacific maintains its dominant market share, attributed to the immense scale of automotive manufacturing in China, India, Japan, and South Korea, coupled with rapidly expanding aftermarket opportunities. North America and Europe, characterized by stringent emission norms and a high penetration rate of premium and luxury vehicles, demonstrate high demand for specialized, high-performance hoses, particularly those engineered for complex cooling, braking, and fuel injection systems. The transition toward electric mobility is uneven across geographies; while Europe and China lead in EV adoption, this shift necessitates a fundamental reconfiguration of hose product portfolios, prioritizing thermal management systems over traditional engine hoses, though the conventional ICE aftermarket remains a stable revenue generator globally.

Segment trends reveal that the Cooling/Heating system application segment holds the largest market share, directly correlated with the necessity of robust thermal management across all vehicle types. By material type, EPDM (Ethylene Propylene Diene Monomer) remains foundational due to its excellent resistance to heat and aging, but there is a distinct shift towards silicone rubber for high-temperature and high-performance applications, such especially in forced induction systems. The OEM channel continues to represent the largest sales volume, yet the aftermarket segment is projected to exhibit a faster CAGR, driven by fleet expansion, maintenance cycles, and the need for durable replacement parts. Furthermore, passenger vehicles constitute the dominant end-user segment, although the commercial vehicle sector is increasingly demanding heavy-duty, highly durable hoses optimized for long-haul operations and engine longevity.

AI Impact Analysis on Automotive Rubber Hoses Market

User inquiries regarding AI's influence on the Automotive Rubber Hoses Market predominantly revolve around three key themes: how AI enhances quality control and defect detection during manufacturing; whether predictive maintenance frameworks using AI will alter aftermarket demand cycles; and the role of AI in optimizing material synthesis and compound formulation for next-generation hose requirements, particularly for EVs. Users are seeking clarity on the feasibility and ROI of integrating AI-powered machine vision systems for real-time inspection, expecting higher product reliability and reduced scrap rates. Furthermore, there is considerable interest in how vehicle diagnostics, informed by AI, might predict hose degradation, potentially streamlining the supply chain for targeted replacement parts and thereby affecting traditional aftermarket inventory strategies.

The direct application of AI does not involve substituting the rubber hose product itself, but rather revolutionizing the processes surrounding its design, manufacturing, and lifespan management. AI-driven simulation platforms are now being utilized to model fluid dynamics, thermal stress, and material fatigue with unprecedented accuracy, accelerating the development cycle for specialized hoses required in high-pressure environments like modern fuel delivery or advanced battery cooling loops. This predictive modeling capability allows manufacturers to optimize material thickness, reinforcement structure, and compound viscoelastic properties digitally before physical prototyping, significantly reducing R&D costs and time-to-market for complex engineered hoses.

In the production phase, AI manifests through advanced robotics and Quality 4.0 initiatives. Machine learning algorithms, coupled with high-resolution cameras, are deployed for real-time automated optical inspection (AOI) to identify microscopic flaws, variations in material curing, or dimensional inconsistencies far beyond human capability. This rigorous, AI-enhanced QC ensures zero-defect output for mission-critical components, driving up the overall standard of quality across the industry. Although the volume demand remains tied to vehicle production, AI contributes fundamentally by enabling higher performance standards necessary to meet evolving OEM demands for extended warranties and operational safety, ultimately making rubber hoses more technologically integrated components within the smart vehicle ecosystem.

- AI-powered Machine Vision enhances real-time defect detection in manufacturing, improving quality assurance and reducing scrap rates.

- Predictive Maintenance (PMM) systems utilizing AI may optimize aftermarket demand by identifying and scheduling precise replacement intervals for hoses based on operational data.

- AI simulations accelerate R&D by modeling thermal and pressure stresses, optimizing material compound formulation and hose structural design for high-performance applications (e.g., EV thermal management).

- Supply chain optimization through AI forecasting improves inventory management for raw materials (synthetic rubber, reinforcing fibers) and finished goods distribution channels.

- Generative Design algorithms assist engineers in creating complex, space-efficient hose routings within highly congested engine bays and chassis structures.

DRO & Impact Forces Of Automotive Rubber Hoses Market

The market is significantly influenced by a dynamic interplay of drivers and restraints. Key drivers include mandatory emission reduction standards (such as Euro 7 and CAFE regulations), which necessitate complex and precise fluid handling systems in modern engines, requiring specialized hoses capable of handling higher temperatures and pressures efficiently. The growing production of vehicles globally, especially the sustained recovery in automotive output following supply chain disruptions, provides a fundamental demand baseline. Concurrently, the increasing complexity of vehicle cooling systems, driven both by engine downsizing (turbochargers generating more heat) and the expansion of battery thermal management in EVs, acts as a primary market accelerator, compelling innovation in material science.

Conversely, significant restraints challenge market expansion and profitability. The volatile pricing and supply chain instability of key raw materials, particularly synthetic rubbers (like NBR and FKM) and petroleum-derived chemicals, exert considerable pressure on manufacturing margins. Furthermore, the inherent shift away from traditional ICE vehicles towards Battery Electric Vehicles (BEVs) reduces demand for certain high-volume traditional hoses (e.g., fuel lines, exhaust gas recirculation hoses), forcing manufacturers to rapidly retool and re-specialize their production capabilities towards fewer, but often higher-specification, thermal management hoses. Competition from non-rubber alternatives, such as advanced plastic (PA/TPE) or metal tubing, especially in low-pressure or non-flexible applications, also acts as a constraint, forcing rubber hose producers to justify their product selection based on superior flexibility and damping capabilities.

Opportunities for market stakeholders center on capitalizing on the EV revolution by focusing R&D efforts specifically on high-dielectric, high-temperature, and flame-retardant hoses essential for battery packs and electronics cooling. The robust expansion of the aftermarket in developing nations, driven by rising vehicle parc numbers and delayed maintenance schedules, presents a substantial sales opportunity for replacement parts. The key impact forces shaping the market include technological advancements in material science—specifically the development of highly durable, lightweight, and recyclable elastomers—and regulatory pressure demanding components that contribute to overall vehicle lightweighting and reduced environmental footprint throughout the product lifecycle. These forces compel continuous investment in specialized extrusion and curing technologies.

- Drivers:

- Stringent global emission regulations necessitating complex engine and exhaust systems.

- Increasing global vehicle production volumes, particularly in emerging markets.

- Rising complexity and heat generation in downsized, turbocharged ICE engines.

- High demand for specialized thermal management hoses in Battery Electric Vehicles (BEVs).

- Restraints:

- Volatile costs and supply instability of synthetic rubber raw materials.

- Competition from alternative materials (e.g., polyamide tubing, metallic lines).

- Reduced demand for traditional engine-related hoses due to the accelerated adoption of BEVs.

- High capital expenditure required for specialized tooling and certification in the OEM segment.

- Opportunities:

- Development and commercialization of advanced rubber compounds for EV thermal and power electronics cooling.

- Expansion of high-margin aftermarket sales in rapidly developing economies.

- Integration of sensor technology within hoses for advanced condition monitoring and predictive maintenance.

- Focus on lightweighting and sustainable manufacturing practices to meet OEM corporate responsibility goals.

- Impact Forces:

- Technological shifts toward electrification and hybridization fundamentally altering product mix.

- Global regulatory landscape defining minimum quality and durability standards.

- Pressure from OEMs for Tier 1 suppliers to meet cost reduction targets while enhancing product performance.

- Supply chain globalization and the need for localized production facilities to mitigate geopolitical risks.

Segmentation Analysis

The Automotive Rubber Hoses Market is meticulously segmented based on application, material type, vehicle type, and distribution channel, providing a granular view of market dynamics and opportunity pockets. This multifaceted segmentation helps stakeholders align their R&D and manufacturing strategies with areas of highest growth potential, particularly the critical shift toward electrification applications. The market structure reflects the complexity of modern vehicles, where each system—from braking to air induction—requires distinct hose specifications tailored to handle specific pressures, temperatures, and fluid chemistries. Analyzing these segments is essential for understanding competitive positioning and forecasting future demand patterns based on technological shifts and regulatory changes impacting vehicle design globally.

By application, the segments reflect core functional requirements within a vehicle, with Cooling/Heating systems dominating due to their presence and necessity across almost all vehicles, followed closely by Fuel Delivery systems and Brake/Transmission systems which are critical safety components demanding the highest quality standards. Material segmentation, crucial for performance differentiation, highlights the reliance on EPDM for general high-heat resistance and the increasing adoption of Silicone and Fluoroelastomers for extreme conditions, such as high-boost turbocharger applications or high-voltage battery cooling where dielectric properties are key. Vehicle type segmentation clearly positions passenger vehicles as the highest volume market, but the commercial vehicle segment provides higher margin opportunities due to the requirement for extreme durability and longevity.

The distribution channel split between Original Equipment Manufacturer (OEM) and the Aftermarket is vital for revenue strategy. The OEM segment is governed by stringent quality audits, long development cycles, and volume contracts, driving innovation and requiring specialized tooling. Conversely, the aftermarket segment, characterized by diversified distributors and shorter procurement cycles, relies on robust brand reputation, availability, and cost-effectiveness for replacement parts. Understanding the nuanced demand curves within each segment—such as the high demand for fuel and oil hoses in the aging ICE fleet (aftermarket) versus the focused demand for thermal management hoses in new BEV production (OEM)—is paramount for sustained market participation and growth. This structure clearly maps current expenditure and forecasts where future investment will be concentrated.

- By Application:

- Cooling/Heating Systems (Radiator Hoses, Heater Hoses)

- Fuel Delivery Systems (Fuel Lines, Return Lines)

- Brake Systems (Vacuum Hoses, Brake Fluid Hoses)

- Air Induction Systems (Turbocharger Hoses, Air Filter Hoses)

- Steering Systems (Power Steering Hoses)

- Others (EGR Hoses, Vacuum Lines)

- By Material Type:

- EPDM (Ethylene Propylene Diene Monomer)

- Silicone Rubber

- Nitrile Rubber (NBR)

- Fluoroelastomers (FKM/Viton)

- Others (AEM, ECO)

- By Vehicle Type:

- Passenger Vehicles (PV)

- Commercial Vehicles (CV)

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

- By Distribution Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

Value Chain Analysis For Automotive Rubber Hoses Market

The value chain for the Automotive Rubber Hoses Market begins with the upstream segment, dominated by raw material suppliers. This stage involves the extraction and refinement of petroleum products necessary for the production of synthetic rubber polymers (such as EPDM, NBR, and FKM) and various plasticizers, reinforcing fibers (like aramid or polyester), and curing chemicals. The quality and cost of these raw materials significantly dictate the final product's performance and profitability. Key players in this upstream segment are typically large chemical and petrochemical companies. Price volatility in crude oil and the subsequent impact on polymer costs are major risk factors managed through hedging and long-term procurement contracts. Innovation at this stage focuses on developing advanced, high-performance, and sustainable elastomeric compounds that offer better heat resistance and lower weight.

The core manufacturing and midstream activities involve compounding, extrusion, braiding or spiraling (for reinforcement), curing (vulcanization), and finishing processes. This stage is highly technology-intensive, requiring specialized extrusion equipment and precision tooling to meet stringent dimensional tolerances mandated by automotive specifications. Direct sales often occur between hose manufacturers (Tier 2/3 suppliers) and Tier 1 suppliers, who then assemble larger modules (like engine cooling systems) for the Original Equipment Manufacturers (OEMs). Direct integration with OEM design teams is common, especially for specialized hose assemblies critical to new vehicle platforms, necessitating rigorous testing and validation processes to achieve compliance with global automotive standards (e.g., ISO/TS 16949). Efficiency and automation in curing processes are critical for throughput and cost control.

The downstream segment encompasses distribution channels, which are fundamentally split between the OEM and Aftermarket routes. The OEM channel utilizes direct and controlled supply lines to vehicle assembly plants, prioritizing just-in-time delivery and zero-defect quality. The aftermarket channel is significantly more complex, involving regional distributors, wholesalers, independent repair garages, and ultimately the consumer. Indirect channels dominate the aftermarket, where brand recognition, inventory management, and broad geographic coverage are essential for success. Digitalization is increasingly impacting the downstream, with e-commerce platforms facilitating direct-to-mechanic sales, demanding optimized logistics and comprehensive product cataloging. Efficient distribution networks are vital for maximizing replacement market penetration and ensuring timely availability of high-demand spare parts across diverse global regions.

Automotive Rubber Hoses Market Potential Customers

The primary customer base for the Automotive Rubber Hoses Market consists of Original Equipment Manufacturers (OEMs) of passenger cars, commercial vehicles (trucks, buses), and specialized off-highway equipment, alongside the vast network of independent operators and retailers constituting the global aftermarket. OEMs represent the highest volume demand and require components tailored to specific design parameters and rigorous performance benchmarks for integration into new vehicle production lines. For this segment, the focus is on achieving mass production scalability, superior quality certification, collaborative R&D capabilities, and competitive pricing under long-term supply contracts. Key purchasing drivers for OEMs include hose longevity, material lightweighting, and compliance with the latest environmental and safety standards.

The secondary, yet rapidly expanding, customer base is the Aftermarket, which serves replacement and maintenance needs for the existing global vehicle fleet (vehicle parc). This segment includes large parts retailers, independent wholesalers, authorized parts distributors, and maintenance garages. Aftermarket buyers prioritize product availability, competitive pricing, ease of installation, and consistent durability that matches or exceeds OE specifications. As the average age of vehicles increases in major markets, the replacement cycle for rubber hoses—which naturally degrade over time due to heat, pressure, and ozone exposure—drives sustained and reliable demand through this channel. Specialized service providers focusing on high-performance tuning or classic vehicle restoration also form a niche but high-value customer group demanding application-specific, high-specification hose products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.2 Billion |

| Market Forecast in 2033 | $7.2 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eaton Corporation, Continental AG, Sumitomo Riko Co. Ltd., Parker Hannifin Corporation, Cooper-Standard Automotive Inc., Hutchinson SA, Nichirin Co. Ltd., Trelleborg AB, Toyoda Gosei Co. Ltd., Gates Corporation, Tokai Rubber Industries, Martinrea International Inc., Metalcaucho, Flexfab LLC, Sunsong Holdings Ltd., Transfer Oil S.p.A., Hiflex Hose Private Limited, Semperit AG Holding, Luohe Guoxing Rubber, Zhejiang Tiantai Auto Hoses. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Rubber Hoses Market Key Technology Landscape

The technological evolution within the Automotive Rubber Hoses Market is principally driven by the necessity for enhanced durability, higher temperature resistance, reduction in weight, and specialized fluid compatibility, particularly within the context of vehicle electrification. A significant area of focus is on compound formulation science, where manufacturers are increasingly utilizing advanced synthetic elastomers like high-grade AEM (Ethylene Acrylic Elastomer) and FKM (Fluoroelastomers) to withstand extreme thermal cycling and aggressive chemical agents found in modern fuels, oils, and coolants. Furthermore, sophisticated extrusion techniques, including multi-layer co-extrusion, are being employed to integrate barrier layers (e.g., fluoropolymer liners) into fuel hoses, significantly reducing permeation rates to comply with stringent evaporative emission regulations (LEV III, Euro 7). This complexity in material layering necessitates tighter process control and advanced curing methods, such as salt bath curing or infra-red vulcanization, to ensure uniform mechanical properties and long-term hose integrity.

Structural technology enhancements are concentrating heavily on reinforcement and noise reduction. Fiber reinforcement, typically involving polyester, rayon, or aramid yarn, is critical for achieving high burst pressure ratings, especially in power steering and turbocharger boost hoses. Modern braiding and spiraling machinery incorporate high precision winding to ensure consistent wall thickness and optimal flexibility-to-pressure resistance ratio. A notable technological shift is the integration of specialized dampening materials and convoluted designs to minimize Noise, Vibration, and Harshness (NVH) characteristics, a growing concern in quieter electric vehicles where engine noise no longer masks component sounds. Acoustic damping rubber formulations are increasingly used in air induction systems to minimize intake noise while maintaining optimal airflow dynamics, contributing directly to driver comfort and vehicle refinement, particularly in premium segments.

The manufacturing process itself is adopting Industry 4.0 principles, integrating sensor-based monitoring and automation (as discussed in the AI section) to ensure consistency and traceability. This includes precision cutting and automated assembly of hose ends, couplings, and quick connectors, significantly reducing the potential for human error. For EV applications, specific technological innovations include the development of dielectric hoses for battery cooling systems. These hoses must not only manage temperature effectively but also possess high electrical resistance to prevent current leakage and ensure safety in high-voltage battery environments. The convergence of material science (high-performance elastomers), structural engineering (optimized reinforcement), and manufacturing digitalization (precision automation) defines the current technological trajectory, aiming to deliver lighter, safer, and more durable fluid conveyance solutions across both ICE and electrified vehicle platforms.

Regional Highlights

- Asia Pacific (APAC): APAC is the global leader in the Automotive Rubber Hoses Market, driven by its status as the world's largest automotive manufacturing hub, encompassing high-volume production countries like China, India, Japan, and South Korea. The region benefits from lower labor costs, robust industrial infrastructure, and an exponentially growing domestic demand for new vehicles, translating into high OEM sales volumes. While EV production accelerates rapidly, traditional ICE vehicles still dominate, providing stable demand for standard cooling and fuel hoses. Key regional strategies focus on localization of production to serve the massive domestic markets effectively, mitigating logistical risks and import tariffs.

- Europe: Europe represents a mature market characterized by stringent environmental regulations (e.g., Euro 7) and a high penetration of electric and hybrid vehicles. Demand here is characterized by a strong preference for high-performance and specialty hoses (e.g., FKM-lined turbo hoses, specialized thermal management systems) necessitated by complex engine designs and advanced safety systems. The European market emphasizes lightweighting, sustainability in material sourcing, and superior quality, driving higher average selling prices (ASPs) compared to APAC. Germany, France, and the UK are primary markets for both OEM supply and premium aftermarket parts.

- North America: North America exhibits significant demand, balanced between large-scale truck manufacturing and a robust passenger vehicle market. The market is defined by a large, aging vehicle parc, which significantly boosts aftermarket revenue for replacement parts. Regulatory shifts, particularly the aggressive transition goals toward electrification set by the US government, are rapidly pivoting supplier focus toward high-specification thermal and refrigerant hoses required for new EV platforms. High labor costs necessitate advanced manufacturing automation and competitive sourcing strategies.

- Latin America (LATAM): LATAM remains a price-sensitive market where demand is largely tied to local economic stability and vehicle import policies. Brazil and Mexico are the principal manufacturing centers, attracting investments from global suppliers seeking to leverage regional free-trade agreements. The market primarily caters to mid-range passenger vehicles and heavy commercial transport, valuing cost-effective, durable hoses that can withstand diverse climatic conditions and rough road infrastructure.

- Middle East and Africa (MEA): This region is heavily reliant on vehicle imports, though some localized assembly exists (e.g., South Africa, Turkey). Demand for rubber hoses is primarily aftermarket driven, focusing on replacement parts that can endure extreme heat and dusty conditions. Investment opportunities are tied to developing local distribution networks and providing robust, high-temperature resistant products suitable for desert climates and low-sulfur fuel environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Rubber Hoses Market.- Eaton Corporation

- Continental AG

- Sumitomo Riko Co. Ltd.

- Parker Hannifin Corporation

- Cooper-Standard Automotive Inc.

- Hutchinson SA

- Nichirin Co. Ltd.

- Trelleborg AB

- Toyoda Gosei Co. Ltd.

- Gates Corporation

- Tokai Rubber Industries

- Martinrea International Inc.

- Metalcaucho

- Flexfab LLC

- Sunsong Holdings Ltd.

- Transfer Oil S.p.A.

- Hiflex Hose Private Limited

- Semperit AG Holding

- Luohe Guoxing Rubber

- Zhejiang Tiantai Auto Hoses

Frequently Asked Questions

What is the projected Compound Annual Growth Rate (CAGR) for the Automotive Rubber Hoses Market?

The Automotive Rubber Hoses Market is projected to exhibit a CAGR of 4.8% between 2026 and 2033, driven primarily by increasing global vehicle production, the complexity of fluid management systems, and rising aftermarket demand for replacement parts.

How is the shift to Electric Vehicles (EVs) affecting demand for rubber hoses?

The EV transition is shifting demand away from traditional fuel and exhaust-related hoses toward specialized thermal management hoses required for cooling high-voltage battery packs, power electronics, and charging systems, necessitating advanced materials like high-dielectric silicone.

Which application segment holds the largest share in the Automotive Rubber Hoses Market?

The Cooling and Heating Systems application segment currently holds the largest market share, as robust thermal management, including radiator and heater hoses, is essential across nearly all types of internal combustion and electrified vehicles globally.

What are the primary raw materials used in automotive rubber hose production?

Key raw materials include synthetic rubber polymers such as EPDM (Ethylene Propylene Diene Monomer), Silicone rubber, NBR (Nitrile Rubber), and FKM (Fluoroelastomers), along with reinforcing materials like aramid or polyester fibers.

Which region dominates the global market for Automotive Rubber Hoses?

Asia Pacific (APAC) dominates the market, owing to the large-scale automotive manufacturing base in countries like China, India, and Japan, coupled with the rapid expansion of both OEM production and the regional vehicle parc.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager