Automotive Seat Sliders Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434869 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Automotive Seat Sliders Market Size

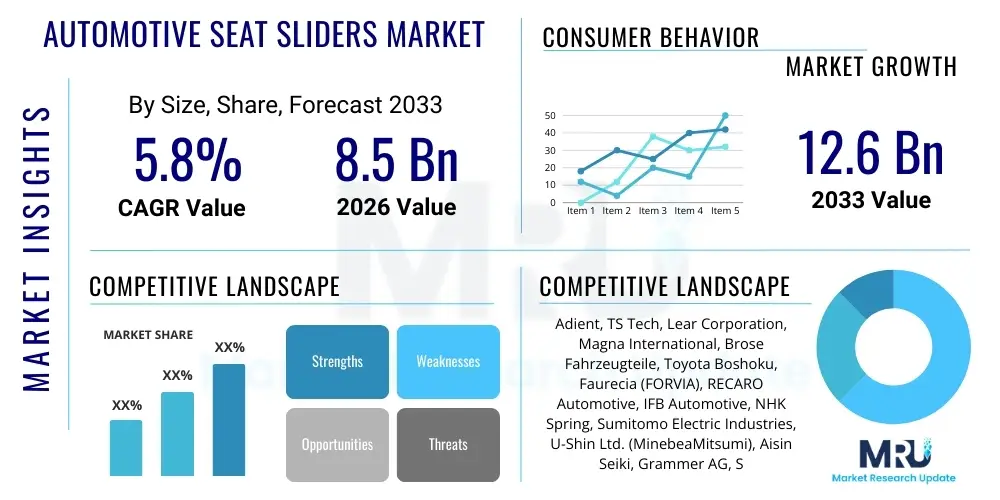

The Automotive Seat Sliders Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 12.6 Billion by the end of the forecast period in 2033.

Automotive Seat Sliders Market introduction

Automotive seat sliders are essential components within vehicle seating systems, designed to facilitate the longitudinal adjustment of the seat, thereby enhancing driver comfort, passenger accessibility, and crash safety performance. These mechanisms ensure that occupants of varying body types can position themselves optimally relative to the steering wheel and pedals, critical for both ergonomic function and operational safety. Seat sliders are typically constructed from high-strength steel or aluminum alloys and utilize either manual or powered mechanisms to achieve smooth, secure, and precise movement along rigid rails integrated into the vehicle floor pan or seat frame. Their operational integrity is paramount, as they must withstand significant forces during routine use and, crucially, maintain structural stability during collision events.

The core applications of seat sliders span the entire automotive manufacturing spectrum, including passenger cars (sedans, SUVs, hatchbacks), light commercial vehicles, and heavy-duty trucks. They are fundamental in achieving modern vehicle cabin flexibility, particularly in multi-row seating configurations where rapid adjustment or folding is necessary. Beyond standard longitudinal movement, advanced sliders incorporate features like memory functions, anti-rattle technology, and integration with complex wiring harnesses for heated or ventilated seats. The primary benefits driving market demand include improved occupant ergonomics, enhanced interior space utilization, compliance with global safety standards (such as FMVSS and ECE regulations), and differentiation in premium vehicle segments through the provision of sophisticated, powered adjustment options.

Major driving factors influencing the market trajectory involve the consistently increasing global production of vehicles, particularly in emerging economies where vehicle ownership is rising. Furthermore, stringent global safety standards mandating advanced seat attachment strength and energy absorption mechanisms compel manufacturers to utilize robust and technologically advanced slider systems. The rising consumer demand for premium, customized, and comfortable automotive interiors, coupled with the rapid expansion of the Electric Vehicle (EV) segment—which often features complex, flexible, and often lighter seating architectures—further accelerates the adoption of high-performance seat sliders, including those utilizing lightweight materials and complex electronic controls.

Automotive Seat Sliders Market Executive Summary

The Automotive Seat Sliders Market is characterized by steady technological evolution, transitioning from predominantly manual mechanisms to sophisticated, electronically controlled powered systems, especially within luxury and autonomous vehicle platforms. Current business trends indicate a strong focus among Tier 1 suppliers on optimizing material usage, primarily through the integration of high-strength, low-weight aluminum alloys and advanced steel grades to meet fuel efficiency and range targets, particularly relevant in the rapidly growing EV sector. Market consolidation is evident, with major players investing heavily in robotics and advanced manufacturing techniques to reduce production costs while adhering to increasingly strict geometric tolerances and durability requirements. Supply chain resilience, following recent global disruptions, is a key strategic imperative, encouraging regionalized manufacturing footprints across North America, Europe, and Asia Pacific to mitigate geopolitical and logistical risks.

Regionally, the Asia Pacific (APAC) stands as the dominant market, driven by high-volume vehicle production in China, Japan, and India, alongside the burgeoning demand for personal mobility solutions. This region showcases significant growth in both high-volume standardized seat sliders and custom, feature-rich systems for locally produced premium models. North America and Europe, while having lower unit growth rates compared to APAC, exhibit higher market value due to the strong preference for sophisticated, high-margin powered sliders integrated with advanced safety and comfort electronics. Regulatory alignment regarding crashworthiness and occupant protection continues to shape product development across all regions, demanding iterative design improvements and extensive validation testing.

Segment trends underscore the increasing penetration of powered seat sliders, predominantly in SUVs and high-end sedans, reflecting consumer preference for ease of use and memory functions. However, manual sliders maintain robust demand in entry-level and compact vehicle segments due to their cost-effectiveness and reliability. By material, the shift towards lightweight solutions, particularly high-strength steel (HSS) and aluminum, is a defining trend across all vehicle types, directly influencing structural design and manufacturing complexity. The Original Equipment Manufacturer (OEM) segment remains the primary revenue source, although the aftermarket segment is expanding, catering to replacement, refurbishment, and performance customization requirements, particularly in established markets with older vehicle fleets.

AI Impact Analysis on Automotive Seat Sliders Market

Common user questions regarding AI's impact on the Automotive Seat Sliders Market primarily revolve around how autonomous driving (AD) and intelligent cabin systems will alter seating requirements, whether AI can optimize slider manufacturing efficiency, and if AI-driven personalization systems will necessitate completely new slider designs. Users are concerned about the necessity of robust, multi-directional seating movement facilitated by AI for features like ‘lounge mode’ or occupant monitoring. The consensus expectation is that AI will move seat sliders beyond simple longitudinal adjustment, making them critical components of adaptive, safety-aware, and highly personalized interior environments. Specifically, AI integration will drive demand for high-precision, low-latency electronic control units (ECUs) attached to powered slider systems, allowing for instantaneous, micro-adjustments based on real-time occupant posture analysis and external driving conditions.

- AI-Driven Personalization: AI algorithms analyze driver metrics (height, weight, posture, fatigue) to automatically adjust seat position, including longitudinal slide, ensuring optimal ergonomic and safety alignment, demanding highly responsive powered sliders.

- Manufacturing Optimization: AI and Machine Learning (ML) are deployed in manufacturing facilities to optimize stamping, welding, and assembly processes, predicting equipment failures and reducing material waste, thereby lowering the unit cost of high-precision sliders.

- Autonomous Vehicle Seating Flexibility: The shift towards Level 4 and Level 5 autonomy requires seats to swivel, recline fully, and dynamically reposition; AI controls coordinate the complex movements involving multiple axes (including the slider axis) seamlessly and safely.

- Predictive Maintenance: AI monitors the operational performance and stress levels of powered slider mechanisms, predicting when components might fail and scheduling preemptive maintenance, enhancing the reliability and lifespan of the product.

- Enhanced Safety Protocols: AI systems, linked to crash detection sensors, can use powered sliders to rapidly move occupants into the safest possible position milliseconds before an impact, requiring ultra-fast, high-torque electronic slider actuators.

DRO & Impact Forces Of Automotive Seat Sliders Market

The Automotive Seat Sliders Market is significantly influenced by powerful internal and external dynamics, broadly categorized into Drivers, Restraints, and Opportunities (DRO), which collectively constitute the core Impact Forces shaping market trajectory. Key drivers include the robust, sustained demand from global vehicle manufacturing, particularly the increasing average feature content per vehicle, which often incorporates advanced powered seating. Furthermore, regulatory mandates concerning crash safety and occupant restraint systems necessitate highly rigid, robust slider assemblies capable of withstanding extreme dynamic loads, forcing consistent material and structural engineering innovation. The fundamental consumer push for enhanced cabin comfort and ergonomic design, especially in long-distance travel, directly fuels the demand for high-quality, smooth, and easy-to-adjust seating mechanisms, whether manual or powered. This interplay between mandatory safety standards and discretionary consumer preferences creates a powerful, sustained driving force for market growth and qualitative improvement.

Conversely, the market faces several restraining forces that impede rapid growth or adoption of high-end solutions. Primary among these is the escalating cost pressure throughout the automotive supply chain. While OEMs demand lightweight, high-performance sliders, they simultaneously enforce stringent cost reduction targets, making the integration of complex powered systems and expensive aluminum alloys challenging for mid-range and entry-level vehicles. Another significant restraint involves the technical complexity and regulatory hurdles associated with implementing new materials and designs. Any change must undergo rigorous and expensive validation processes to meet global safety standards, which slows down the adoption cycle for truly innovative products. Weight reduction targets, while an opportunity, also act as a constraint, as achieving high strength with minimal mass requires sophisticated and expensive manufacturing techniques and materials, often pushing up the final component price.

Significant opportunities are emerging that promise to redefine the seat slider landscape. The widespread transition to Electric Vehicles (EVs) is a crucial market opening. EVs often feature ‘skateboard’ platforms, allowing for novel interior architectures that demand flexible, flat-track seating systems, frequently integrated into the floor structure rather than a traditional frame, which presents new design challenges and opportunities for suppliers. Secondly, the rapid progression toward autonomous driving (AD) necessitates entirely new seating paradigms—such as face-to-face configurations, swivel seats, and lounge modes—all requiring advanced, multi-axis, highly robust powered slider systems coordinated by central vehicle ECUs. Suppliers who can offer modular, lightweight, and electronically adaptive slider solutions tailored for the autonomous and electric vehicle markets are uniquely positioned for substantial future growth. These emerging applications represent the most significant long-term growth vectors for the market.

Segmentation Analysis

The Automotive Seat Sliders Market segmentation provides a granular view of diverse product offerings and application landscapes, facilitating targeted strategic planning. The market is primarily dissected based on the mechanism type (manual vs. powered), material composition (steel vs. aluminum/composites), vehicle application (passenger cars vs. commercial vehicles), and sales channel (OEM vs. aftermarket). This structured breakdown reflects the varied technical requirements and cost sensitivities across different vehicle classes and regional markets. For instance, the transition from heavy steel to lightweight aluminum sliders is a critical differentiator in premium and EV segments, driven by performance and efficiency goals, whereas manual steel sliders remain the volume standard in cost-sensitive high-volume segments like small passenger cars and entry-level commercial fleets. Understanding these segmentation nuances is vital for manufacturers to align production capacity and R&D efforts with prevailing market demands and emerging technological trajectories.

- By Technology Type:

- Manual Seat Sliders

- Powered Seat Sliders (Electronic)

- By Mechanism/Track Type:

- Rail/Roller Mechanism Sliders

- Gear-Driven Sliders

- Monorail Systems

- By Material:

- High-Strength Steel Sliders

- Aluminum Alloy Sliders

- Composite Material Sliders (Hybrid Systems)

- By Vehicle Type:

- Passenger Cars (Sedans, SUVs, Hatchbacks)

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Electric Vehicles (EVs)

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

Value Chain Analysis For Automotive Seat Sliders Market

The value chain for automotive seat sliders begins with the Upstream Analysis, which focuses heavily on the procurement and processing of raw materials, predominantly high-grade steel (often advanced high-strength steel or AHSS) and specialized aluminum alloys. Key upstream players include primary metal producers and specialized stamping/extrusion companies responsible for creating the precision tracks and housing structures. The quality and purity of these materials are critical, as they directly impact the slider’s strength, durability, and weight, crucial factors for regulatory compliance. Sophisticated surface treatments and corrosion resistance coatings are also applied at this stage. Effective cost management upstream is paramount, as raw material costs constitute a significant portion of the final product price, compelling suppliers to engage in long-term supply agreements and implement efficient inventory management practices.

Moving downstream, the process involves intricate component manufacturing, including precision stamping, rolling, welding, and assembly of the tracks, runners, locking mechanisms, and, in the case of powered sliders, the integration of electric motors, gears, and ECUs. Tier 1 suppliers, who often specialize in complete seating systems, typically manage the final assembly and validation of the slider unit, ensuring it meets specific OEM dimensional and performance requirements. The final product is then distributed via two primary channels: the Direct Channel, where Tier 1 suppliers deliver the complete seat assembly (inclusive of the slider) directly to the OEM's assembly line for Just-in-Time (JIT) integration, which accounts for the vast majority of sales; and the Indirect Channel, which caters to the aftermarket. The aftermarket channel involves distribution through authorized parts dealers, independent repair shops, and online platforms, supplying replacement parts or customized performance units, though this segment is much smaller in volume compared to OEM sales.

The increasing complexity of powered sliders has introduced new specialized players into the value chain, specifically electronic component manufacturers providing sophisticated motors, sensor arrays, and microcontrollers. These components must be seamlessly integrated and tested for electromagnetic compatibility and functional safety (FuSa). Supply chain efficiency, driven by lean manufacturing principles, is critical to maintain competitive pricing. Direct distribution to OEMs requires highly reliable logistics and strict quality control protocols, often involving mandated testing regimes, further embedding the complexity of the relationship between the Tier 1 seat supplier and the vehicle manufacturer. The effectiveness of this value chain relies fundamentally on precision engineering collaboration between material suppliers, component manufacturers, and final assembly integrators.

Automotive Seat Sliders Market Potential Customers

The primary customers for the Automotive Seat Sliders Market are bifurcated into two main categories: Original Equipment Manufacturers (OEMs) and the Aftermarket segment. OEMs represent the core revenue stream, encompassing global automotive giants such as Toyota, Volkswagen Group, General Motors, Ford, Tesla, and emerging Chinese EV manufacturers like BYD and NIO. These customers require high-volume, highly standardized, yet custom-engineered seat slider units that meet their specific platform dimensions, performance metrics, and safety specifications. OEM contracts are long-term, demanding immense reliability, rigorous quality control, and the ability of the supplier to scale production rapidly. Their buying decisions are driven by factors including component cost, weight reduction capabilities, noise suppression, and integration feasibility with complex cabin electronics.

Within the OEM segment, the decision-making process is typically centralized within the seating procurement division, often influenced by the vehicle’s design team and safety engineering department. Premium and luxury vehicle manufacturers, which prioritize comfort and customization, are significant buyers of advanced powered seat sliders with multi-axis adjustment and memory functions. Conversely, high-volume economy car manufacturers focus primarily on cost-effective, durable manual sliders. Furthermore, specialized commercial vehicle builders, including truck and bus manufacturers, also constitute important OEM customers, prioritizing robustness and ease of operation suitable for demanding, high-mileage usage environments. The relationship is highly collaborative, with Tier 1 suppliers often engaging in co-development of new seating architectures.

The second category of customers is the Aftermarket, which includes independent garages, certified automotive repair centers, and specialist modification shops focused on performance tuning or accessibility needs. These customers purchase seat sliders for replacement due to wear-and-tear in aging vehicles, crash repair, or for interior customization, such as installing performance racing seats or adaptive seating solutions. This segment is characterized by a higher demand for universality and quick availability, contrasting with the bespoke requirements of the OEM channel. E-commerce platforms and parts distributors play a key role in serving this fragmented customer base, providing an indirect but necessary outlet for component manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 12.6 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Adient, TS Tech, Lear Corporation, Magna International, Brose Fahrzeugteile, Toyota Boshoku, Faurecia (FORVIA), RECARO Automotive, IFB Automotive, NHK Spring, Sumitomo Electric Industries, U-Shin Ltd. (MinebeaMitsumi), Aisin Seiki, Grammer AG, Sona Comstar, KSS Global (Key Safety Systems), Intier Automotive, Piston Group, Tata AutoComp Systems, Iron Force Industrial |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Seat Sliders Market Key Technology Landscape

The technology landscape of the Automotive Seat Sliders Market is rapidly evolving, driven primarily by demands for enhanced safety, reduced weight, and integration with vehicle electronics. A major technological focus is the development of next-generation powered sliding mechanisms. These systems utilize compact, high-torque brushless DC motors coupled with sophisticated gear trains (often planetary or helical gears) to achieve precise, quiet, and rapid adjustment. Critical innovation centers around the integration of Position Sensing Devices (PSDs) and absolute encoders, which provide real-time feedback on the seat's exact longitudinal location to the Body Control Module (BCM) or Seat ECU. This precision is vital for memory functions, automated ingress/egress positioning, and, increasingly, integration with pre-tensioner and airbag deployment strategies based on occupant position relative to crash zones.

Another dominant technological trend is lightweighting, crucial for improving fuel economy in ICE vehicles and extending range in EVs. This involves a sustained shift from traditional mild steel to Advanced High-Strength Steel (AHSS) and specialized aluminum alloys (like 6000 and 7000 series). Manufacturing techniques are adapting, with hot stamping and hydroforming being increasingly used to create tracks and runners that maintain structural integrity while significantly reducing material thickness and weight. Hybrid solutions, combining aluminum rails with steel moving parts, are becoming common, optimizing the balance between strength, stiffness, and mass. Furthermore, the minimization of system tolerance stack-up through high-precision manufacturing processes—such as laser welding and robotic assembly—is essential to reduce ‘play’ or rattle, enhancing the perceived quality and long-term durability of the slider mechanism.

The most forward-looking technology involves ‘Smart Sliders’ designed explicitly for autonomous and electric platforms. These solutions are often monorail systems integrated directly into the vehicle floor structure, maximizing design freedom. They incorporate advanced sensors that communicate wirelessly or via CAN bus with the vehicle network, supporting complex, orchestrated movements like simultaneous swivel, recline, and slide. Key enabling technologies here include fail-safe locking mechanisms that comply with stringent rollover and crash scenarios, and thermal management solutions for the integrated electronics. Furthermore, noise, vibration, and harshness (NVH) suppression technologies—including specialized dampening rollers and polymer coatings—are becoming standard features to meet the high acoustic demands of quieter electric vehicles, where mechanical noise is otherwise more noticeable to occupants.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market globally, dominated by high-volume manufacturing hubs in China, Japan, South Korea, and India. China's massive vehicle production, particularly its leading role in global EV production, drives substantial demand for both cost-effective manual sliders in entry-level segments and sophisticated, new-generation powered sliders required for next-gen EV platforms. Regulatory harmonization across ASEAN countries is slowly increasing safety standards, pushing suppliers toward more robust designs.

- North America: This region is characterized by a strong preference for large vehicles (SUVs and Trucks), which typically feature premium, multi-functional seating systems. Consequently, demand is concentrated heavily on advanced powered sliders with high load-bearing capacity and robust electronic integration, supporting memory settings and complex folding mechanisms. Safety regulations (NHTSA, FMVSS) are stringent, requiring extensive validation and testing of slider mechanisms for crash performance.

- Europe: The European market is highly mature and innovation-focused, driven by stringent CO2 emission targets which mandate aggressive lightweighting strategies. This fuels the adoption of aluminum and high-strength steel sliders. Germany, being a hub for luxury vehicle production, shows high penetration of sophisticated, electronically managed seating systems. The move towards urban mobility and smaller vehicles also requires compact and efficient slider designs.

- Latin America (LATAM): This region operates primarily as a cost-sensitive market, focusing largely on manual and standardized steel slider solutions for high-volume, economy vehicle production (Brazil and Mexico). Growth rates are stable, but adoption of advanced powered systems remains slower due to prevalent cost constraints and lower technological adoption rates compared to other major regions.

- Middle East and Africa (MEA): The MEA market is heavily dependent on imports and local assembly operations often targeting basic vehicle segments. Demand is generally low-to-medium volume, focusing on standard, reliable, and durable manual slider systems suitable for diverse environmental conditions. Premium vehicle sales in the Gulf Cooperation Council (GCC) countries do drive small, specialized segments for high-end powered systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Seat Sliders Market.- Adient

- TS Tech

- Lear Corporation

- Magna International

- Brose Fahrzeugteile

- Toyota Boshoku

- Faurecia (FORVIA)

- RECARO Automotive

- IFB Automotive

- NHK Spring

- Sumitomo Electric Industries

- U-Shin Ltd. (MinebeaMitsumi)

- Aisin Seiki

- Grammer AG

- Sona Comstar

- KSS Global (Key Safety Systems)

- Intier Automotive

- Piston Group

- Tata AutoComp Systems

- Iron Force Industrial

Frequently Asked Questions

Analyze common user questions about the Automotive Seat Sliders market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the shift towards powered seat sliders?

The primary driver is the increasing demand for enhanced occupant convenience, customization features like memory settings, and crucial integration with advanced safety systems (like pre-tensioners) that require precise, electronic seat position data for optimized deployment, particularly in premium vehicle segments and luxury SUVs.

How does the growth of Electric Vehicles (EVs) impact seat slider design?

EVs mandate extreme lightweighting to maximize battery range, compelling suppliers to use aluminum and AHSS for sliders. Furthermore, EV skateboard platforms allow for flexible, often monorail seating architectures designed for autonomous driving modes, necessitating multi-axis and flat-track powered slider systems.

Which material type is currently dominating the market for seat sliders?

High-Strength Steel (HSS) continues to dominate the market by volume due to its optimal balance of high strength, durability, and cost-effectiveness, especially in high-volume, budget-sensitive vehicle segments. However, aluminum usage is rapidly growing in premium and EV applications due to lightweighting requirements.

What role do safety regulations play in the design of automotive seat sliders?

Safety regulations, such as FMVSS in the US and ECE R17 in Europe, are critical. They mandate specific minimum strength requirements for seat attachment and energy absorption under various crash scenarios (frontal, rear, rollover), forcing continuous engineering improvements in the structural rigidity, locking mechanisms, and crash performance validation of the slider unit.

What is the current CAGR projected for the Automotive Seat Sliders Market?

The Automotive Seat Sliders Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 5.8% between the forecast years 2026 and 2033, driven by increasing global vehicle production and the rising adoption of sophisticated powered seating systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager