Automotive Shock Absorber Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431712 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Automotive Shock Absorber Market Size

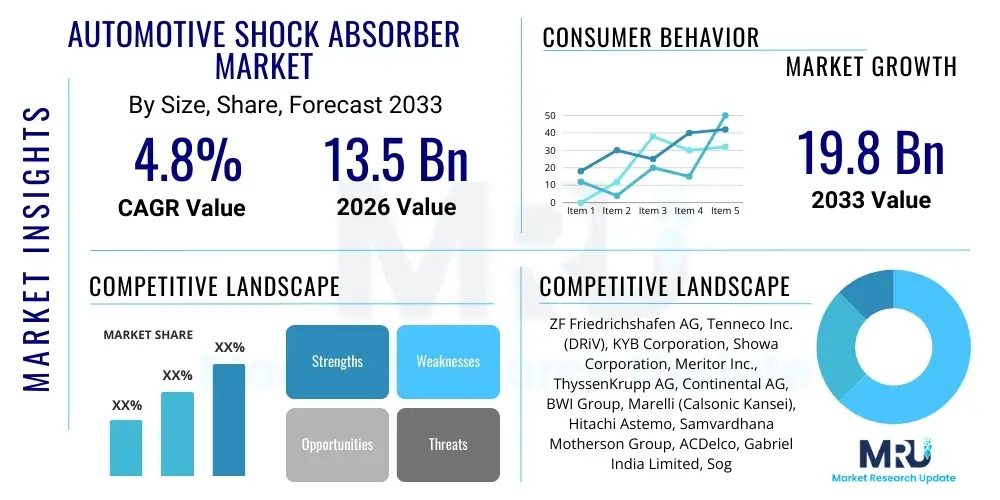

The Automotive Shock Absorber Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 13.5 Billion in 2026 and is projected to reach USD 19.8 Billion by the end of the forecast period in 2033. This substantial growth is fundamentally driven by the increasing global demand for passenger comfort, enhanced vehicle safety standards mandated by regulatory bodies worldwide, and the rapid technological evolution leading to the adoption of advanced damping solutions such as adaptive and semi-active suspension systems across mid-range and luxury vehicle segments. Furthermore, the persistent need for replacement components in the massive global vehicle parc continues to fuel the expansion of the aftermarket segment, which remains a cornerstone of market revenue.

Automotive Shock Absorber Market introduction

The Automotive Shock Absorber Market encompasses the manufacturing, distribution, and sale of components designed to dampen and absorb kinetic energy generated by vehicle suspension movements. These essential components, primarily categorized into hydraulic, pneumatic, and electrorheological types, manage the oscillations of the spring and prevent excessive bouncing, ensuring the tire maintains consistent contact with the road surface. This mechanism is critical not only for optimizing vehicle handling and stability, particularly during cornering and braking maneuvers, but also for safeguarding the longevity of other vehicle components by mitigating undue stress from road imperfections.

The product portfolio spans conventional twin-tube and mono-tube designs, progressing to sophisticated semi-active and active damping systems, which utilize sensors and electronic control units (ECUs) to instantaneously adjust damping force based on road conditions and driver input. Major applications include integration into Passenger Cars (PCV), Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV), and specialized off-road vehicles. The primary benefit derived from these technologies is superior ride quality, minimizing driver fatigue and maximizing passenger comfort, alongside significant improvements in accident avoidance through better vehicle control.

Key driving factors accelerating market expansion include stringent global safety standards, particularly in developed economies, mandating better stability control systems, which rely heavily on efficient shock absorption. Furthermore, the burgeoning demand for premium and luxury vehicles equipped with advanced suspension systems, alongside infrastructural deficits in emerging economies that necessitate robust and durable suspension components, collectively propel the market forward. The shift towards electric vehicles (EVs) also plays a role, requiring specialized shock absorbers designed to handle heavier battery packs while maintaining optimal driving dynamics.

Automotive Shock Absorber Market Executive Summary

The Automotive Shock Absorber Market is characterized by robust technological innovation and significant segmentation across vehicle type and damping technology. Business trends indicate a pronounced move towards digitalization and connectivity, integrating shock absorber performance data into the vehicle's central computing system for real-time adjustments and predictive maintenance alerts. Original Equipment Manufacturers (OEMs) are increasingly prioritizing advanced solutions like Continuous Damping Control (CDC) and Magnetorheological (MR) fluids to differentiate their offerings based on superior performance and ride comfort, thus driving higher average selling prices in the premium segment. Consolidation among major Tier 1 suppliers, focusing on acquiring specialized technological capabilities, is also a notable business trend shaping the competitive landscape.

Regional trends highlight the Asia Pacific (APAC) as the undisputed leader in volume demand, primarily fueled by massive automotive production bases in China, India, and Japan, coupled with the rapid expansion of the middle-class population increasing first-time vehicle ownership. Conversely, North America and Europe emphasize the adoption of technologically advanced, high-performance shock absorbers, often driven by strict emissions and safety regulations that favor lightweighting and precision engineering. The aftermarket remains globally significant, but with varying dynamics; while mature markets focus on high-quality branded replacements, emerging markets often prioritize cost-effectiveness, creating a duality in supply chain requirements.

Segment trends underscore the rising prominence of the Electrically Controlled Shock Absorber segment, projected to exhibit the highest growth rate due to its indispensable role in adaptive suspension systems, which are standardizing rapidly in high-end vehicle platforms. By vehicle type, Passenger Cars maintain the largest market share due to sheer volume, but Heavy Commercial Vehicles (HCVs) are increasingly adopting specialized damping technologies to enhance load stability and driver ergonomics during long hauls. The OEM segment continues to dominate revenue generation, though the high-margin aftermarket segment provides crucial revenue stability and growth opportunities, especially concerning older vehicles requiring regular component replacement.

AI Impact Analysis on Automotive Shock Absorber Market

Analysis of common user questions reveals strong interest in how AI can optimize vehicle performance and maintenance schedules related to shock absorbers. Users frequently ask about "predictive failure detection using AI," "real-time adjustment based on road hazards," and "how machine learning improves autonomous vehicle stability." The core concerns revolve around the cost of integrating AI-driven sensors and ECUs, the reliability of AI algorithms in diverse environmental conditions, and the extent to which smart shock absorbers can enhance safety beyond current electronic stability programs. Consumers and industry professionals alike anticipate that AI will transition shock absorbers from passive components to sophisticated, predictive actuators integral to autonomous driving architecture.

AI's primary influence is moving shock absorber systems toward true predictive capability. Machine learning algorithms, processing vast datasets from integrated sensors (accelerometers, position sensors, temperature gauges), can accurately forecast component wear and tear, scheduling maintenance before catastrophic failure occurs, significantly improving vehicle uptime and operational safety. This shift drastically reduces unexpected repair costs and enhances customer satisfaction. Furthermore, AI facilitates complex design optimization during the R&D phase, simulating real-world driving conditions far more accurately than traditional methods, leading to lighter, more durable, and highly efficient damping solutions tailored for specific vehicle dynamics and regional road quality profiles.

In operational vehicles, AI-powered control units enable advanced ride management. By analyzing inputs on vehicle speed, steering angle, vertical movement, and anticipated road topology (potentially via V2X communication or integrated mapping data), AI can command semi-active and active suspension systems to adjust damping coefficients in milliseconds. This anticipatory adjustment capabilities smooths ride transitions, maintains optimal vehicle pitch and roll control during dynamic maneuvers, and is indispensable for the reliable and comfortable operation of Level 4 and Level 5 autonomous vehicles, where the system must continuously manage ride comfort without human intervention.

- AI enables predictive maintenance, forecasting component failure based on sensor data analysis.

- Machine learning optimizes real-time damping adjustments for immediate response to terrain and driving style.

- AI algorithms accelerate R&D by simulating millions of road scenarios for superior component design.

- Integration of smart sensors and AI-ECUs transforms shock absorbers into data-generating, adaptive subsystems.

- Enhanced stability control provided by AI is crucial for the safe development of autonomous vehicles.

- AI drives hyper-personalization of ride comfort tailored to individual driver and passenger preferences.

DRO & Impact Forces Of Automotive Shock Absorber Market

The Automotive Shock Absorber Market is heavily influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO). Key drivers include the mandatory adoption of advanced safety features globally, such as Electronic Stability Control (ESC), which relies on sophisticated suspension tuning and damping control to function effectively. The consistent deterioration of road infrastructure in numerous developing countries necessitates robust and frequently replaced shock absorbers, sustaining both OEM and aftermarket demand. Furthermore, consumer preference for vehicles offering superior comfort, acoustic isolation, and reduced vibration is compelling manufacturers to integrate semi-active and active suspension systems, thereby stimulating high-value sales within the market.

However, significant restraints temper the market’s potential. The relatively high manufacturing and integration cost associated with advanced damping technologies, such as MR and active systems, limits their penetration primarily to the premium and luxury segments, maintaining a significant market volume for cheaper, conventional hydraulic systems. Furthermore, the burgeoning shift toward Electric Vehicles (EVs) introduces new design constraints; the heavier weight of battery packs necessitates redesigns for handling increased static load and maintaining acceptable suspension travel, posing an engineering challenge that translates into higher R&D expenditure and potentially slower adoption rates of traditional components. Additionally, the proliferation of counterfeit and low-quality aftermarket products, particularly in unregulated regions, poses a risk to both genuine manufacturers' brand integrity and overall road safety.

Opportunities for growth are abundant, particularly centered around the evolution of electrification and autonomous driving. The demand for specialized, lightweight shock absorbers, utilizing composite materials and high-strength aluminum alloys, is a major avenue for innovation aimed at offsetting battery weight and improving EV range. Moreover, the connectivity trend allows manufacturers to develop value-added services such as over-the-air updates for suspension control software, enhancing system performance post-purchase. The expansion of emerging automotive markets, driven by favorable governmental policies encouraging domestic manufacturing and infrastructure investment, presents long-term, high-volume growth opportunities for both conventional and advanced shock absorber systems. The transition toward modular suspension architectures also streamlines manufacturing processes, potentially reducing overall system costs.

Segmentation Analysis

The Automotive Shock Absorber Market is strategically segmented based on factors including product type, vehicle type, sales channel, and technology. This multidimensional segmentation helps manufacturers tailor their production and marketing strategies to diverse market needs, ranging from the cost-sensitive aftermarket for passenger cars to the highly technical requirements of commercial heavy-duty vehicles. The core segmentation by product type—twin-tube versus mono-tube—still dictates manufacturing complexity and performance characteristics, but technological segmentation (passive, semi-active, active) is increasingly defining value and growth trajectories within the industry. Understanding these segments is vital for accurately forecasting market dynamics and identifying high-growth niches, particularly those driven by regulatory changes concerning safety and emissions.

- Product Type:

- Twin-Tube

- Mono-Tube

- Technology:

- Passive Shock Absorbers (Conventional Hydraulic/Pneumatic)

- Semi-Active Shock Absorbers (e.g., CDC)

- Active Suspension Systems

- Vehicle Type:

- Passenger Cars (PCV)

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

- Two-Wheelers

- Sales Channel:

- OEM (Original Equipment Manufacturer)

- Aftermarket

- Damping Medium:

- Hydraulic

- Pneumatic

- Magnetorheological

Value Chain Analysis For Automotive Shock Absorber Market

The value chain for the Automotive Shock Absorber Market begins with the upstream procurement of essential raw materials, primarily specialized steel alloys for cylinder tubes, high-grade polymers for seals and bushings, and proprietary hydraulic fluids. Suppliers in this phase must adhere to stringent quality and consistency standards, as material integrity directly impacts the durability and performance characteristics of the final damping unit. Key upstream activities also involve the manufacturing of specialized components like pistons, rods, and valves, often requiring precision machining and advanced metallurgical processes. The cost and availability of these raw materials, coupled with commodity price fluctuations (especially steel), significantly influence the final product cost structure and manufacturer margins.

The middle segment of the value chain involves core manufacturing, assembly, and integration. Tier 1 suppliers specializing in suspension systems—such as ZF, Tenneco, and KYB—take the raw components, perform sophisticated assembly, and integrate electronic control units (ECUs) for semi-active and active systems. These manufacturers invest heavily in R&D to optimize fluid dynamics, heat dissipation, and electronic responsiveness. Direct distribution channels involve supplying these finished units directly to Automotive OEMs (e.g., Toyota, Volkswagen, Ford) for integration into new vehicle assembly lines. This relationship is often long-term and contractual, emphasizing quality assurance, just-in-time delivery, and collaborative design efforts based on vehicle platform specifications.

The downstream segment focuses predominantly on the aftermarket and service networks. Indirect distribution channels utilize independent warehouse distributors, large automotive parts retailers, authorized service centers, and specialized repair shops to reach the end-user for replacement and repair purposes. The aftermarket segment is characterized by high volume, diverse product needs (ranging from budget options to premium replacements), and crucial logistical efficiency. Success in the downstream market hinges on robust inventory management, brand recognition, and a wide distribution footprint to ensure availability across varied geographic regions and vehicle models, thereby maintaining high market penetration and revenue stability post-sale.

Automotive Shock Absorber Market Potential Customers

Potential customers in the Automotive Shock Absorber Market are diverse, ranging from high-volume global vehicle manufacturers seeking integrated suspension solutions to individual vehicle owners requiring routine maintenance parts. Automotive OEMs (Original Equipment Manufacturers) represent the largest segment in terms of value, relying on Tier 1 suppliers for high-quality, customized shock absorber systems that meet specific vehicle design parameters, performance targets, and regulatory compliance standards for new vehicle production. These customers require extensive testing and validation, often leading to long-term collaborative contracts for supply across multiple vehicle platforms, demanding innovation in lightweighting and electronic integration.

Another crucial customer segment involves Tier 1 suspension system integrators who may procure specialized components (like magnetic fluids or precision valves) from smaller, niche suppliers before delivering the complete module to the OEM. Beyond new vehicle assembly, fleet owners and managers of commercial vehicle fleets (trucking companies, public transport operators) are significant buyers. They prioritize durability, longevity, and maintenance cost efficiency, often opting for heavy-duty shock absorbers that can withstand continuous operation under heavy loads, focusing on maximizing uptime and minimizing operational interruptions caused by suspension failure.

Finally, the largest volume segment of potential customers is the global aftermarket, encompassing independent repair garages, specialized suspension service centers, national and regional automotive parts retailers (e.g., AutoZone, Halfords), and, ultimately, the millions of individual vehicle owners worldwide. These buyers drive demand for replacement components needed due to wear and tear, seeking parts that balance quality, reliability, and price point. The decision-making process in the aftermarket is highly influenced by brand reputation, warranty provisions, and immediate product availability through local distribution networks.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 13.5 Billion |

| Market Forecast in 2033 | USD 19.8 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ZF Friedrichshafen AG, Tenneco Inc. (DRiV), KYB Corporation, Showa Corporation, Meritor Inc., ThyssenKrupp AG, Continental AG, BWI Group, Marelli (Calsonic Kansei), Hitachi Astemo, Samvardhana Motherson Group, ACDelco, Gabriel India Limited, Sogefi S.p.A., Endurance Technologies Limited, WABCO Holdings Inc., Bilstein GmbH & Co. KG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Shock Absorber Market Key Technology Landscape

The technology landscape of the Automotive Shock Absorber Market is rapidly transitioning from reliance on purely mechanical, passive systems to highly sophisticated electronic control architectures. A pivotal technological advancement is the widespread adoption of Continuous Damping Control (CDC) systems, which use electronically actuated valves to continuously vary the damping force in real-time. These systems leverage integrated sensors (such as wheel accelerometers and body accelerometers) that feed data to a central ECU, allowing for millisecond adjustments to optimize both ride comfort and handling stability simultaneously. CDC technology significantly bridges the performance gap between purely conventional setups and more complex, fully active systems, making high-performance damping accessible to a broader range of vehicle classes.

Another revolutionary technology is Magnetorheological (MR) fluid damping. MR shock absorbers contain specialized fluids whose viscosity can be instantaneously altered by applying an electromagnetic field. This allows for extremely rapid and precise control over the damping characteristics without requiring complex mechanical valving. MR technology offers unparalleled responsiveness, making it highly desirable for high-performance sports cars and luxury vehicles requiring exceptional body control. Furthermore, there is a strong emphasis on lightweighting, driven by fuel efficiency regulations and the demands of EV architecture. Manufacturers are increasingly utilizing advanced lightweight materials, including composite plastics and high-strength aluminum alloys, in the construction of shock absorber bodies and components to reduce overall unsprung weight, thereby improving suspension response and overall vehicle efficiency.

The future of the technology landscape is highly focused on enhanced connectivity and full integration into vehicle dynamics control (VDC) systems. Active suspension technologies, which utilize external energy sources (e.g., hydraulic pumps or electric motors) to generate forces that counteract body movement, are becoming more refined and energy-efficient. Furthermore, sophisticated sensor integration, including non-contact linear position sensors, provides highly accurate feedback essential for AI-driven predictive maintenance and adaptive ride control. The trend toward modular design also allows manufacturers to quickly adapt a core damping unit across various vehicle platforms, reducing R&D cycles and lowering manufacturing complexity, ensuring rapid market deployment of the latest technological innovations.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand and technological adoption within the Automotive Shock Absorber Market. Asia Pacific (APAC) dominates the global market in terms of volume and installed base, driven by high-volume vehicle manufacturing hubs in China, India, and ASEAN nations. The rapid growth of vehicle production, increasing disposable income leading to higher demand for passenger vehicles, and significant infrastructure development projects propel the regional market. While cost-effective conventional shock absorbers still constitute the bulk of the market, the rising sales of premium and luxury imported vehicles are accelerating the adoption of semi-active systems in key urban centers across the region.

Europe stands out due to its stringent regulatory environment regarding vehicle safety, emissions, and pedestrian protection. This region exhibits a high penetration rate of advanced suspension systems, particularly in mid-range and premium segments, as manufacturers focus heavily on superior handling, comfort, and compliance with the latest European Union (EU) standards. European consumers are typically more demanding regarding ride quality and technological sophistication, driving innovation in areas such as lightweighting and fully integrated electronic damping control (CDC and active systems). The robust European aftermarket also benefits from the aging vehicle parc, demanding high-quality replacement parts tailored to diverse European road conditions.

North America is characterized by a strong market for Light Commercial Vehicles (LCVs), Sports Utility Vehicles (SUVs), and Heavy Commercial Vehicles (HCVs). Demand is bifurcated: the premium segment focuses on highly advanced, performance-oriented damping solutions (often utilizing MR technology for sports vehicles), while the large truck and SUV segment requires extremely durable and robust shock absorbers capable of handling rough terrain and heavy towing capacities. The aftermarket in North America is highly competitive and well-structured, with brand loyalty and extensive distribution networks being critical success factors. The gradual shift toward electrified pickup trucks and SUVs is creating a specific demand for heavy-duty, performance-optimized shock absorbers designed to manage high curb weight while maintaining dynamic stability.

- Asia Pacific (APAC): Dominates in volume; driven by high production capacity in China and India; increasing adoption of premium technology alongside strong conventional demand.

- Europe: Focus on technological sophistication, stringent safety compliance, high penetration of semi-active systems, and robust aftermarket for quality replacements.

- North America: High demand for heavy-duty and performance-oriented shock absorbers, driven by LCVs, SUVs, and high-end luxury vehicles; strong emphasis on durability and load-handling capacity.

- Latin America (LATAM): Growth propelled by vehicle fleet expansion and poor road conditions necessitating frequent replacements; market highly price-sensitive, favoring affordable conventional units.

- Middle East and Africa (MEA): Varied demand; Gulf Cooperation Council (GCC) countries favor luxury vehicles with advanced systems; Africa focuses on robust, durable components for challenging environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Shock Absorber Market.- ZF Friedrichshafen AG

- Tenneco Inc. (DRiV)

- KYB Corporation

- Showa Corporation

- Meritor Inc.

- ThyssenKrupp AG

- Continental AG

- BWI Group

- Marelli (Calsonic Kansei)

- Hitachi Astemo

- Samvardhana Motherson Group

- ACDelco

- Gabriel India Limited

- Sogefi S.p.A.

- Endurance Technologies Limited

- WABCO Holdings Inc.

- Bilstein GmbH & Co. KG

- Koni (ITW)

- SACHS (ZF Aftermarket)

- Monroe (Tenneco Aftermarket)

Frequently Asked Questions

Analyze common user questions about the Automotive Shock Absorber market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between passive, semi-active, and active shock absorbers?

Passive shock absorbers offer fixed damping characteristics and cannot adjust to changing road conditions. Semi-active systems (like CDC) use electronic valves to continuously vary damping force based on real-time sensor inputs. Active suspension systems are the most advanced, using external power sources to actively generate forces that control body movement, offering superior ride and handling.

How is the transition to Electric Vehicles (EVs) impacting shock absorber design?

EVs introduce specific challenges due to the significantly heavier weight of battery packs, requiring shock absorbers designed to handle higher static loads, manage thermal stress, and optimize suspension travel. Manufacturers are focusing on specialized, lightweight materials (e.g., aluminum and composites) and enhanced durability to maintain dynamic stability and extend EV range.

Which geographical region holds the largest market share for automotive shock absorbers?

The Asia Pacific (APAC) region currently holds the largest market share by volume. This dominance is attributed to high-volume vehicle production, particularly in China and India, coupled with rising demand across diverse vehicle segments in emerging economies.

What role does Magnetorheological (MR) technology play in modern damping systems?

MR technology utilizes a fluid whose viscosity changes instantly when exposed to an electromagnetic field. This allows for extremely rapid and precise adjustments of the damping rate, providing exceptional vehicle control and responsiveness. MR shock absorbers are predominantly used in high-performance vehicles and specialized luxury automotive applications.

What are the key drivers propelling the growth of the aftermarket shock absorber segment?

The aftermarket segment is primarily driven by the aging global vehicle parc, necessitating routine replacement due to wear and tear. Other drivers include poor road infrastructure in many regions, which accelerates component degradation, and consumer preference for quality replacement parts that restore original vehicle performance and safety standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager