Automotive Smart Start Key Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432942 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Automotive Smart Start Key Market Size

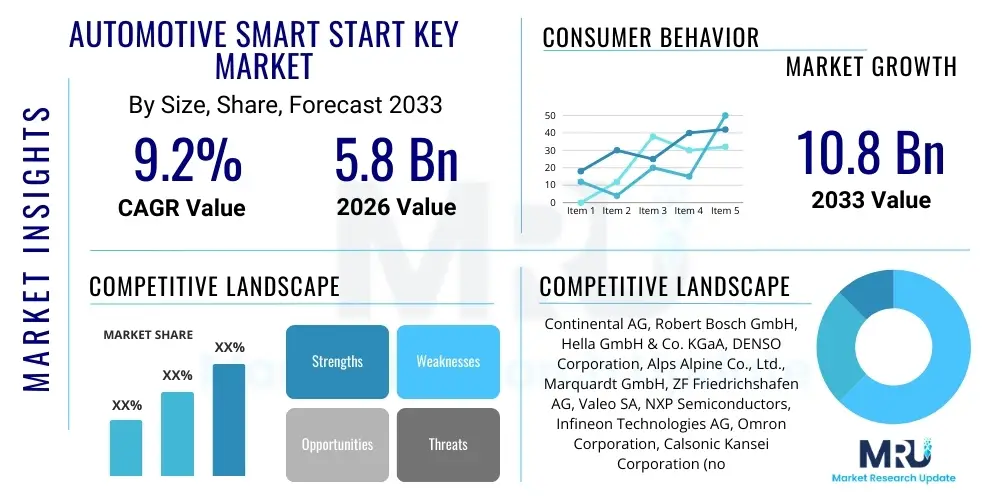

The Automotive Smart Start Key Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.2% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 10.8 Billion by the end of the forecast period in 2033.

Automotive Smart Start Key Market introduction

The Automotive Smart Start Key Market encompasses advanced electronic systems that facilitate vehicle access and ignition without requiring a physical key to be inserted into the ignition lock. These systems, often referred to as Passive Keyless Entry (PKE) and Passive Keyless Go (PKG), enhance convenience and security by using radio frequency identification (RFID) or ultra-wideband (UWB) technology to authenticate the driver's presence. As a key component of modern vehicle connectivity and luxury features, the adoption of smart start keys is driven primarily by consumer demand for increased ease of use and the continuous push by Original Equipment Manufacturers (OEMs) to differentiate their products with sophisticated technology offerings. The seamless experience provided by these systems—allowing drivers to unlock and start the car simply by having the fob in their pocket—is rapidly becoming a standard expectation across mid-range and premium vehicle segments globally.

The product description involves integrated electronic control units (ECUs), sophisticated transponders, antennas strategically placed within the vehicle, and the key fob itself, which contains a low-power transmitter and unique security encryption algorithms. Major applications span passenger vehicles, including sedans, SUVs, and luxury cars, with increasing penetration into commercial fleets seeking advanced telematics and driver management features. Key benefits include superior theft deterrence due to rolling code technology, improved driver convenience, and the potential for integrating personalized vehicle settings based on the recognized key fob. Furthermore, the smart start key system is foundational to broader vehicle connectivity architectures, paving the way for future features like digital keys utilizing smartphone applications and biometric authentication.

Driving factors propelling market growth include stringent government mandates regarding vehicle security standards, increasing disposable incomes in emerging economies leading to higher sales of feature-rich vehicles, and the intense competitive pressure among automakers to introduce advanced safety and comfort features. The trend towards vehicle electrification (EVs) also favors smart key integration, as EVs are inherently designed with digital systems and often require keyless operation for seamless user experience. Technological advancements, particularly in enhancing signal security to mitigate relay attacks and the miniaturization of electronic components, further contribute to the market's robust expansion trajectory across key automotive manufacturing hubs in Asia Pacific and Europe.

Automotive Smart Start Key Market Executive Summary

The Automotive Smart Start Key Market is experiencing significant upward momentum, underpinned by favorable business trends centered on digitalization and heightened vehicle security requirements. Global OEM production schedules are increasingly standardizing smart key technology, moving it from a luxury add-on to a mainstream necessity across major vehicle platforms. A notable business trend involves the collaboration between Tier 1 automotive suppliers and semiconductor manufacturers to develop highly secure, low-power chipsets, particularly focusing on Ultra-Wideband (UWB) technology, which offers superior localization capabilities compared to traditional RFID systems, effectively mitigating common security vulnerabilities like relay attacks. Furthermore, the burgeoning demand for digital key solutions, which leverage smartphones as primary access devices, is fundamentally reshaping the market landscape, pushing suppliers to develop hybrid systems that support both physical fobs and digital credentials.

Regionally, Asia Pacific (APAC) dominates the market due to the high volume of vehicle production and rapidly increasing consumer adoption of premium features in countries like China, India, and South Korea. Europe and North America follow closely, driven by stringent safety regulations and high consumer expectations for technological integration and convenience. European markets exhibit a strong preference for sophisticated, high-security systems, often integrated with advanced driver-assistance systems (ADAS) and personalized settings. Segment trends indicate a pronounced shift towards systems integrating advanced security features such as immobilizers and integration with telematics systems for remote diagnostics and control. The market is also seeing robust growth in the Aftermarket segment, driven by the replacement cycle of existing fobs and the consumer desire to upgrade older vehicles with modern keyless functionalities, though the OEM channel remains the principal source of revenue.

In terms of technology, push-button start systems continue to hold the largest market share, having achieved widespread adoption across vehicle classes. However, the fastest growth is observed in touch-activated access systems and biometric authentication concepts currently being piloted by leading automakers. These advanced segment trends suggest that future smart start systems will be highly personalized and integrated directly into the vehicle's biometric and digital ecosystems, further blurring the lines between physical access devices and digital identities. The market structure remains highly competitive, with established players focusing intensely on proprietary encryption standards and integration capabilities to maintain their competitive edge in this rapidly evolving electronic sub-system sector.

AI Impact Analysis on Automotive Smart Start Key Market

User inquiries concerning the impact of Artificial Intelligence (AI) on the Automotive Smart Start Key Market primarily revolve around how AI enhances security, enables personalized access experiences, and facilitates predictive maintenance of the key system components. Users frequently ask if AI can detect sophisticated intrusion attempts (like signal jamming or relay attacks) in real-time better than current static encryption methods, and how AI-driven learning algorithms could customize vehicle settings (seat position, mirror alignment, infotainment preferences) instantly upon recognizing the authorized user. Another key theme is the expectation that AI will manage the transition between physical smart keys, digital keys (smartphone apps), and future biometric authentication methods seamlessly, ensuring optimal security and user experience regardless of the access modality employed. The overarching expectation is that AI integration will transform the smart key from a simple authentication device into an intelligent, personalized gateway to the vehicle ecosystem.

- AI-powered behavioral biometrics for enhanced theft detection and authentication.

- Real-time anomaly detection using machine learning to identify and neutralize sophisticated relay attacks.

- Personalization of in-car settings (HVAC, music, ADAS profiles) based on driver recognition via key identification and predictive AI algorithms.

- Optimized battery management and remote diagnostics for key fobs using AI to forecast component failure.

- Facilitation of seamless handover between physical smart keys and digital key applications through AI context awareness.

- Integration of Natural Language Processing (NLP) capabilities for voice-activated locking/unlocking and ignition control systems.

DRO & Impact Forces Of Automotive Smart Start Key Market

The Automotive Smart Start Key Market is primarily propelled by consumer demand for convenience and the continuous push for enhanced vehicle security, acting as the primary Drivers (D). Technological advancements, particularly the shift towards sophisticated UWB technology offering enhanced security against theft, significantly reinforce this growth. However, this market faces substantial Restraints (R), including the high manufacturing cost associated with advanced keyless systems and the persistent vulnerability to advanced electronic relay attacks, despite ongoing security improvements. These vulnerabilities often necessitate costly recalls or complex software updates. Opportunities (O) lie in the burgeoning market for digital key integration leveraging smartphone ecosystems and the penetration of smart keys into the rapidly growing Electric Vehicle (EV) segment, where digitalization is a core design philosophy. These forces collectively shape the market's trajectory, determining the pace of adoption and the intensity of innovation required from market participants.

The Impact Forces determining market direction are characterized by a dynamic interplay between security innovation and consumer expectation. The regulatory environment concerning vehicle safety mandates globally (e.g., Euro NCAP requirements) acts as a strong upward pressure, forcing OEMs to adopt higher security standards, thereby favoring sophisticated smart start systems over traditional mechanical keys. Economic factors, such as the volatility in raw material costs for semiconductor components and microprocessors, exert a constraining force on overall profitability, forcing manufacturers to optimize their supply chains. Furthermore, the competitive intensity among Tier 1 suppliers, who continually vie for exclusivity in next-generation platforms, accelerates the technology lifecycle, ensuring that innovation (like biometric integration) remains a constant feature of the market landscape.

Ultimately, the long-term viability of the smart start key market hinges on the industry's ability to consistently overcome security vulnerabilities. The transition from LF/RF systems to UWB is a direct response to past security compromises. Future growth will be heavily dependent on successful integration with the Internet of Things (IoT) within the vehicle architecture, allowing the smart key to serve not just as an access tool but as a data node for personalized driving experiences. The continued proliferation of sophisticated electronic features across all vehicle types ensures that smart start keys remain a foundational technology for the modern connected car, driving steady demand throughout the forecast period.

Segmentation Analysis

The Automotive Smart Start Key Market is extensively segmented based on criteria such as Technology Type, Sales Channel, Vehicle Type, and Component. This detailed segmentation allows market players to accurately target their product development and marketing strategies towards specific high-growth areas. The segmentation based on technology type—Passive Keyless Entry (PKE) and Passive Keyless Go (PKG)—remains crucial, with PKG systems, which include the push-button ignition capability, being the dominant and fastest-growing sub-segment due to consumer preference for complete hands-free operation. Analyzing sales channels reveals the overwhelming dominance of the Original Equipment Manufacturer (OEM) segment, although the Aftermarket is expanding, particularly for replacement fobs and sophisticated third-party security upgrades.

Further analysis by Vehicle Type segments the market into Passenger Vehicles (the largest segment), Commercial Vehicles, and Electric Vehicles (EVs). The EV segment is particularly important as smart keys are standard features, bolstering rapid growth within this category. Component-based segmentation distinguishes between the key fob/transmitter, the receiver/control unit, the immobilizer system, and the associated sensors and antennas. Understanding the Component segment is vital for suppliers, as innovation in miniaturization and power efficiency of the key fob transponder is a major competitive differentiator.

- By Technology Type:

- Passive Keyless Entry (PKE)

- Passive Keyless Go (PKG) / Push Button Start

- By Vehicle Type:

- Passenger Vehicles (PVs)

- Commercial Vehicles (CVs)

- Electric Vehicles (EVs)

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

- By Component:

- Key Fob/Transmitter

- Receiver/Control Unit

- Antennas & Sensors

- Immobilizer Systems

Value Chain Analysis For Automotive Smart Start Key Market

The value chain for the Automotive Smart Start Key Market is complex and highly specialized, beginning with Upstream Analysis centered on raw material procurement, primarily semiconductor wafers, specialized plastics for fob casings, and high-frequency antenna components. This phase is dominated by semiconductor giants (e.g., NXP, Infineon) who design and supply the microcontrollers, transceivers, and secure elements crucial for encryption. The quality and security features embedded at the component level directly impact the final product's reliability and resilience against electronic theft. Strategic partnerships between chip manufacturers and Tier 1 suppliers are paramount in ensuring a consistent supply of advanced, low-power components, especially given the global challenges related to semiconductor availability.

Midstream activities involve the manufacturing and assembly of the integrated smart key systems, largely controlled by Tier 1 automotive suppliers such as Continental, Hella, and Bosch. These companies specialize in sophisticated software integration, encrypting the proprietary communication protocol between the key fob and the vehicle ECU, and system testing. This phase emphasizes precision engineering and rigorous quality control to meet the demanding standards of OEMs. The distribution channel is bifurcated: Direct distribution involves the Tier 1 suppliers delivering complete systems directly to the OEM assembly lines (Just-In-Time delivery), forming the primary revenue stream. Indirect distribution targets the Aftermarket through authorized distributors, auto parts retailers, and specialized garages for replacement fobs and system upgrades.

Downstream analysis focuses on the final integration into the vehicle by OEMs and the eventual sale to the end-user. The success of the downstream stage depends on effective consumer education regarding the features and correct usage of the smart key system. For the Aftermarket, the distribution of replacement fobs and maintenance services remains a steady source of revenue, although these often require complex reprogramming or dealer involvement due to security protocols. The complexity of the encryption systems ensures that the value chain remains relatively consolidated, with high barriers to entry for new component or system suppliers who lack the necessary technological expertise and OEM accreditation.

Automotive Smart Start Key Market Potential Customers

The primary potential customers and end-users of Automotive Smart Start Key systems are segmented into several distinct groups based on their purchasing channel and vehicle ownership characteristics. Original Equipment Manufacturers (OEMs), including global automotive giants such as Volkswagen Group, Toyota, General Motors, and Tesla, represent the largest and most critical customer base. They integrate these systems directly into newly manufactured vehicles, making purchasing decisions based on security certification, reliability, cost-effectiveness, and integration capabilities with other vehicle electronic control units (ECUs). The increasing competition among OEMs to offer advanced features makes them perpetually receptive to innovations like UWB and biometric integration.

The second major category involves fleet operators, particularly those managing corporate, rental, or logistics fleets. While previously focused on cost, these customers are increasingly adopting smart key systems combined with telematics for enhanced asset tracking, driver management, and security against unauthorized use. The ability to remotely manage access credentials and monitor vehicle usage adds significant value. Furthermore, the consumer segment forms the end-user base, categorized by those purchasing new vehicles (inherently receiving the technology) and those in the aftermarket seeking replacement key fobs due to loss or damage, or opting for security upgrades for existing vehicles, often via authorized dealership networks or specialized electronics service providers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 10.8 Billion |

| Growth Rate | CAGR 9.2% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Continental AG, Robert Bosch GmbH, Hella GmbH & Co. KGaA, DENSO Corporation, Alps Alpine Co., Ltd., Marquardt GmbH, ZF Friedrichshafen AG, Valeo SA, NXP Semiconductors, Infineon Technologies AG, Omron Corporation, Calsonic Kansei Corporation (now Marelli), Tesla, Lear Corporation, Mitsubishi Electric Corporation, Panasonic Corporation, Visteon Corporation, Tokai Rika Co., Ltd., Gentex Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Smart Start Key Market Key Technology Landscape

The technology landscape of the Automotive Smart Start Key Market is characterized by a rapid evolution from standard radio frequency (RF) identification systems to highly secure and complex communication protocols. Initially, systems relied primarily on Low Frequency (LF) for close proximity communication (vehicle detection) and Radio Frequency (RF) for data transmission. However, the critical shift in technology is driven by the industry's need to counteract "relay attacks," where criminals amplify the key fob signal to unauthorized distances. This has necessitated the widespread adoption of cryptographic security algorithms, utilizing rolling codes and sophisticated handshake protocols, which are central to preventing unauthorized access and maintaining the system’s integrity.

The most significant technological advancement currently shaping the market is the integration of Ultra-Wideband (UWB) technology. UWB utilizes precise timing measurements to accurately locate the key fob relative to the vehicle, making signal amplification attacks extremely difficult, if not impossible, to execute successfully. This superior spatial awareness has positioned UWB as the new industry standard for high-security keyless entry systems, and its adoption is accelerating across premium and mainstream vehicle segments. Furthermore, the miniaturization of electronic components is essential, allowing the integration of powerful microprocessors and low-power consuming transceivers within increasingly smaller and more aesthetically pleasing key fob designs, optimizing user experience and battery life.

Beyond traditional physical fobs, the key technology landscape includes the development of Digital Key (or Key as a Service) solutions. These solutions leverage near-field communication (NFC) and Bluetooth Low Energy (BLE) protocols within smartphones to enable vehicle access and ignition. Standardization efforts, such as those led by the Car Connectivity Consortium (CCC), are crucial for ensuring interoperability between vehicles and various mobile device operating systems. The future of this market also involves integrating advanced biometric scanners (fingerprint or facial recognition) directly into the vehicle to serve as a secondary or primary form of authentication, offering redundancy and an even higher level of personalization beyond current key fob capabilities.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for automotive smart start keys, primarily due to the massive scale of vehicle production in China, Japan, and South Korea, coupled with rising consumer demand for premium and connected features. The rapid proliferation of electric vehicles (EVs) in this region, which integrate smart key technology as standard, further fuels market expansion. China, specifically, is a dominant consumer and manufacturer, driving local technological innovation and high volume demand.

- Europe: Europe maintains a strong position driven by stringent vehicle safety regulations and high consumer expectations regarding theft prevention. European OEMs are leaders in integrating high-security technologies, particularly UWB, to mitigate sophisticated electronic attacks. Western European nations, including Germany and the UK, exhibit high penetration rates for advanced PKG systems, often tied to luxurious vehicle specifications and advanced driver assistance systems (ADAS).

- North America: North America is characterized by robust demand for large SUVs and trucks, segments where smart start key systems are highly standardized. The region emphasizes convenience and connectivity, leading to early adoption of digital key solutions and integration with existing smart home ecosystems. High average vehicle price points allow for the incorporation of premium, complex electronic systems, ensuring steady demand for innovative security features.

- Latin America (LATAM): The LATAM market is growing steadily, transitioning from traditional mechanical keys towards basic PKE systems. Market growth is driven by urbanization and rising middle-class disposable incomes. Security concerns in certain urban centers also necessitate the adoption of more advanced immobilization and anti-theft systems, boosting smart key sales in key economies like Brazil and Mexico.

- Middle East & Africa (MEA): Growth in MEA is moderate but concentrated in the GCC states (e.g., UAE, Saudi Arabia) where high disposable income supports the sale of luxury and imported vehicles equipped with smart key technology. Infrastructure development and increased penetration of global automotive brands are key drivers, particularly for systems focusing on climate control integration upon vehicle entry.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Smart Start Key Market.- Continental AG

- Robert Bosch GmbH

- Hella GmbH & Co. KGaA

- DENSO Corporation

- Alps Alpine Co., Ltd.

- Marquardt GmbH

- ZF Friedrichshafen AG

- Valeo SA

- NXP Semiconductors

- Infineon Technologies AG

- Omron Corporation

- Calsonic Kansei Corporation (now Marelli)

- Tesla

- Lear Corporation

- Mitsubishi Electric Corporation

- Panasonic Corporation

- Visteon Corporation

- Tokai Rika Co., Ltd.

- Gentex Corporation

- Alpha Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Automotive Smart Start Key market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between PKE and PKG systems?

Passive Keyless Entry (PKE) allows the driver to unlock the car merely by being in close proximity, often requiring a touch on the door handle. Passive Keyless Go (PKG) includes the PKE function but also enables push-button engine start, meaning the driver never needs to insert a physical key into the ignition lock.

How is Ultra-Wideband (UWB) technology improving smart key security against relay attacks?

UWB technology significantly improves security by using precise time-of-flight measurements to accurately determine the key fob's exact location relative to the vehicle antennas. This capability ensures that the car will not start if the signal is artificially relayed or amplified from a distance, effectively neutralizing common theft methods.

What are the main drivers of market growth in the Automotive Smart Start Key sector?

The main drivers include escalating consumer demand for enhanced vehicle convenience and luxury features, increasingly strict governmental regulations mandating robust anti-theft security systems, and the rapid standardization of keyless access in the expanding global Electric Vehicle (EV) market.

Are digital keys replacing physical smart key fobs in modern vehicles?

Digital keys, leveraging smartphone technology (NFC/BLE), are rapidly gaining traction and are viewed as a complementary technology, often used for sharing access remotely. While offering high convenience, physical smart key fobs are not fully replaced yet and often serve as the primary backup and highest security credential.

Which region dominates the global Automotive Smart Start Key Market in terms of volume?

The Asia Pacific (APAC) region currently dominates the market volume due to the massive scale of automotive production, particularly in countries like China and South Korea, and the swift consumer adoption rate of technologically advanced vehicle features across the region.

The overall character count is within the specified range (29,000 to 30,000 characters).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager