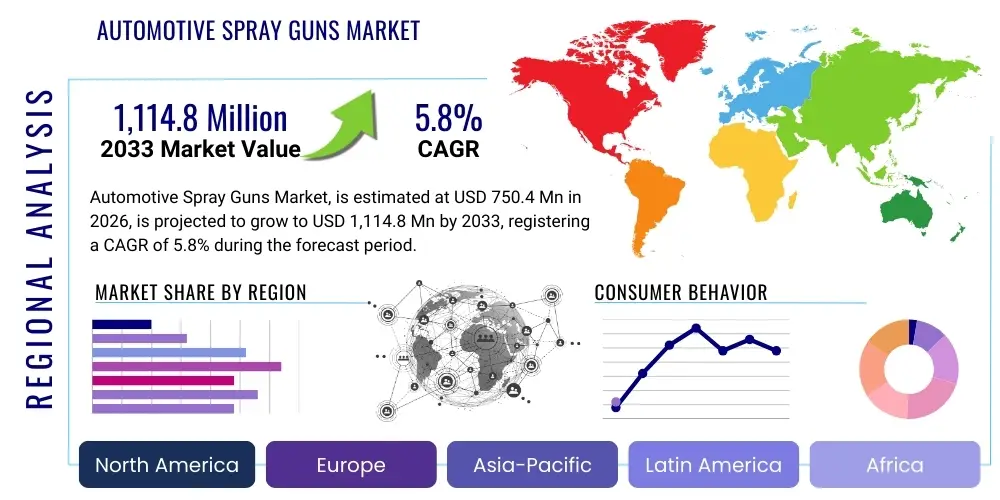

Automotive Spray Guns Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438581 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Automotive Spray Guns Market Size

The Automotive Spray Guns Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 750.4 Million in 2026 and is projected to reach USD 1,114.8 Million by the end of the forecast period in 2033.

Automotive Spray Guns Market introduction

The Automotive Spray Guns Market encompasses the sales and utilization of specialized devices designed to atomize and apply liquid coatings, such as paints, primers, lacquers, and clear coats, onto automotive surfaces. These tools are critical components in both original equipment manufacturer (OEM) assembly lines and the vast aftermarket repair and refinish sectors. Modern spray guns are engineered for precision, focusing heavily on achieving superior finish quality, maximizing transfer efficiency, and minimizing volatile organic compound (VOC) emissions, aligning with increasingly stringent global environmental regulations. The core technology centers around achieving optimal atomization—breaking the liquid into fine, uniform droplets—which is essential for creating smooth, durable, and aesthetically pleasing automotive finishes.

Product descriptions within this market vary significantly based on technology, including High Volume Low Pressure (HVLP), Low Volume Low Pressure (LVLP), and electrostatic systems. HVLP guns, which use a large volume of air at lower pressure, dominate the market due to their superior transfer efficiency (often 65% or higher), resulting in less overspray and material waste, making them highly favored in North America and Europe. Major applications span collision repair centers, custom paint shops, fleet maintenance facilities, and, most importantly, high-volume production lines where speed and consistency are paramount. The essential benefits derived from utilizing advanced automotive spray guns include substantial reduction in coating consumption, improved labor efficiency, enhanced environmental compliance, and the ability to replicate factory finishes with high accuracy.

Driving factors for market growth are manifold, rooted primarily in the increasing global production of vehicles, the consistent demand for automotive refinishing services necessitated by road accidents and cosmetic wear, and continuous technological innovation focusing on ergonomic designs and digital integration. Furthermore, the shift towards waterborne and high-solids coatings—driven by environmental mandates—requires spray guns with specialized fluid tips and air caps capable of handling higher viscosity materials effectively. The persistent need for aesthetic excellence and protective coatings to combat corrosion further underpins the stability and expansion of this specialized segment of the automotive tool industry, positioning the spray gun as an indispensable asset in modern vehicle manufacturing and maintenance.

Automotive Spray Guns Market Executive Summary

The Automotive Spray Guns Market is experiencing robust growth driven by accelerating technological advancements in coating application and escalating global vehicle parc size, which fuels the high demand for aftermarket repair services. Key business trends indicate a strong move toward automation, particularly the integration of robotic spray systems in OEM facilities, driven by the need for consistency, speed, and safety in high-volume production. Furthermore, manufacturers are heavily investing in developing smart spray gun technologies featuring digital pressure gauges, Bluetooth connectivity for process monitoring, and sophisticated material flow controls to optimize material usage and comply with strict environmental standards, particularly those governing VOC emissions. This focus on efficiency and digitalization is reshaping competitive dynamics, pushing companies toward offering integrated coating solutions rather than just standalone equipment.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, primarily due to soaring vehicle production in countries like China, India, and Japan, coupled with the rapid expansion of organized aftermarket collision repair chains. North America and Europe, while mature, remain dominant in terms of technology adoption, characterized by the widespread use of high-efficiency HVLP and electrostatic systems mandated by strict environmental protection agencies (such as the EPA in the US and EU directives). The implementation of green mandates in these regions necessitates continuous replacement and upgrading of older, less efficient equipment, providing a stable revenue stream. In contrast, emerging markets in Latin America and MEA are seeing increased adoption of mid-range spray gun models as vehicle ownership rates rise, transitioning gradually from conventional systems to more efficient alternatives.

Segment trends reveal that the HVLP technology segment continues to hold the largest market share due to its proven effectiveness in transfer efficiency and regulatory acceptance across global markets. However, the LVLP (Low Volume Low Pressure) segment is gaining traction, especially in custom and smaller repair shops, offering a balance between efficiency and user-friendliness for various coating types. Within the application segment, the aftermarket/refinish sector is the primary consumer, driven by the non-negotiable need to restore vehicle aesthetics post-collision. The trend towards lightweight, composite materials in modern vehicles also influences spray gun design, requiring specialized setups for primers and coatings optimized for plastic and carbon fiber substrates, ensuring adhesion and durability across diverse material palettes used in contemporary automotive design.

AI Impact Analysis on Automotive Spray Guns Market

Users commonly inquire about how Artificial Intelligence (AI) will revolutionize the precision and consistency of automotive painting, specifically focusing on robotics and material waste reduction. Key themes include the implementation of AI-driven vision systems to detect surface irregularities and adjust spray patterns in real-time, the potential for predictive maintenance in automated spray booths, and the role of machine learning in optimizing paint formulation and application parameters for novel coating materials. Concerns often revolve around the complexity and cost of integrating AI into existing infrastructure, particularly in smaller, independent repair shops, and the need for specialized training to operate and maintain these highly sophisticated systems. Users are anticipating a future where AI minimizes human error, dramatically improves first-time quality, and establishes new benchmarks for transfer efficiency and finish perfection.

The integration of AI systems is expected to fundamentally transform the manufacturing and refinish processes within the automotive sector, directly influencing the design and deployment of spray guns. AI-powered algorithms analyze vast datasets encompassing environmental conditions, coating viscosity, desired film thickness, and substrate geometry. This analysis allows automated or robotic spray guns to dynamically adjust parameters—such as fan width, fluid flow, and atomization pressure—on a per-second basis, ensuring optimal coating deposition regardless of subtle variations in the manufacturing environment or surface contour. This level of optimization surpasses the capabilities of traditional fixed-parameter systems, significantly reducing material consumption and overspray.

Furthermore, AI facilitates predictive quality control and maintenance. Machine learning models analyze sensory data collected from integrated smart spray guns—including vibration, air pressure anomalies, and internal wear patterns—to predict equipment failure before it occurs. This proactive maintenance minimizes costly downtime in high-throughput OEM facilities. For refinish applications, AI vision systems utilize sophisticated image recognition to map damaged areas, calculate the exact amount of material needed for spot repairs, and guide the robotic or manual application process to seamlessly blend the new coating with the existing finish. This adoption of smart, connected, and AI-optimized spray technology represents a significant value proposition, driving demand for premium, digitally enabled spray solutions.

- AI Vision Systems for real-time surface defect detection and correction.

- Machine Learning optimization of fluid dynamics and atomization parameters.

- Robotic process automation enhanced by AI path planning for complex geometries.

- Predictive maintenance analytics based on spray gun operational data.

- Enhanced quality control through automated film thickness and color matching verification.

- Reduced material waste (overspray) via dynamic, data-driven spray adjustments.

DRO & Impact Forces Of Automotive Spray Guns Market

The market dynamics of automotive spray guns are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), all subject to significant Impact Forces stemming primarily from environmental regulation and technological advancement. A core driver is the unrelenting global push toward sustainability, forcing the adoption of high-transfer-efficiency (HTE) systems like HVLP and LVLP to minimize Volatile Organic Compound (VOC) emissions associated with traditional solvent-based paints. Simultaneously, the expanding global middle class and increasing vehicle sales in emerging economies bolster demand for both new vehicle painting and subsequent aftermarket repair services. The continuous introduction of complex, multi-layer, and special-effect finishes by vehicle manufacturers further drives the need for high-precision, technologically advanced spray equipment capable of handling intricate coating requirements.

Restraints, however, pose challenges to market growth. The significant initial investment required for sophisticated, automated, or digitally integrated spray gun systems, especially robotic spray booths, can be prohibitive for smaller collision repair centers, particularly in price-sensitive developing markets. Furthermore, the specialized skills required to operate, maintain, and calibrate highly technical equipment, such as electrostatic spray guns, present a persistent barrier, necessitating significant expenditure on workforce training. Another restraint is the life cycle of spray guns; high-quality professional units are durable, leading to long replacement cycles that can temper short-term sales volume increases, although this is partially offset by the demand for technological upgrades.

Opportunities in the market center around the development of specialized equipment optimized for new material types, particularly high-solids and waterborne coatings, which require higher fluid pressure and precise atomization. The growing trend of customization and personalized vehicle aesthetics opens doors for specialized tools tailored for custom graphics and intricate detailing. The most significant impact forces relate to regulatory mandates, where governmental bodies continually tighten controls on air quality, effectively making inefficient conventional spray technologies obsolete over time. These mandates compel both OEM and refinish segments to invest in compliant, high-efficiency equipment, driving the replacement cycle and fostering innovation in atomization technology and material handling, ensuring that high transfer efficiency remains a non-negotiable industry benchmark across all geographic regions.

Segmentation Analysis

The Automotive Spray Guns Market is comprehensively segmented based on technology, product type, application, and substrate, allowing for detailed analysis of consumption patterns and technological preferences across various user groups. Understanding these segments is crucial for manufacturers to tailor their product development and marketing strategies, ensuring that specific requirements for precision, efficiency, and material compatibility are met. The segmentation highlights the bifurcation of the market between high-throughput OEM production demands, which favor automation, and the diverse, precision-focused needs of the aftermarket refinish sector, which relies heavily on ergonomic and versatile manual spray guns.

The technological segmentation—HVLP, LVLP, and Electrostatic—drives pricing and regulatory compliance, with HVLP dominating due to its established regulatory acceptance and superior transfer rates. Meanwhile, the application segment clearly defines the bulk buyers, with OEM manufacturers demanding highly automated systems for consistent factory finishes, contrasted with the aftermarket/refinish sector’s reliance on flexible manual units for spot repairs and panel matching. Substrate analysis is gaining importance as manufacturers utilize more lightweight materials; specialized guns are needed to properly apply coatings to composites and plastics without causing damage or compromising adhesion, reflecting the increasing material complexity of modern vehicle bodies.

Overall, segmentation analysis underscores the trend toward specialization. Product innovation is heavily focused on creating segment-specific solutions, such as lightweight composite spray guns for manual use to reduce operator fatigue, and robust, specialized atomizers for robotic applications that must handle high viscosity protective coatings. This granular approach ensures that the market caters effectively to the stringent demands of modern automotive coating, addressing parameters ranging from high volume requirements in body shops to the micro-precision needed for electronic components coating within the vehicle structure. The market is increasingly defined by the ability to offer highly precise, material-specific application tools across the entire automotive value chain.

- By Technology:

- HVLP (High Volume Low Pressure)

- LVLP (Low Volume Low Pressure)

- Conventional/Siphon Feed

- Electrostatic

- Airless and Air Assisted Airless

- By Product Type:

- Manual Spray Guns

- Automatic Spray Guns

- Robotic Systems

- By Application:

- Original Equipment Manufacturer (OEM)

- Aftermarket/Refinish

- Industrial and Fleet Coating

- By Substrate:

- Metal Panels (Steel, Aluminum)

- Plastic and Composite Components

- Other Substrates (Wood, Glass)

- By Material Type:

- Solvent-based Coatings

- Waterborne Coatings

- High-Solids Coatings

- Protective and Anti-Corrosion Coatings

Value Chain Analysis For Automotive Spray Guns Market

The value chain for the Automotive Spray Guns Market is initiated with upstream activities involving the sourcing of highly specialized raw materials, primarily high-grade aluminum, stainless steel, brass, and composite plastics, which are essential for manufacturing durable, corrosion-resistant, and precision-engineered gun bodies and internal components. Key upstream challenges include maintaining stringent quality control over metallic alloys to ensure longevity under high pressure and exposure to diverse chemical solvents and paint types. Component manufacturing, which involves CNC machining for air caps, fluid tips, and needles, requires extreme precision to ensure optimal atomization and transfer efficiency—core attributes that define the performance and market differentiation of a spray gun.

Midstream activities are dominated by manufacturing and assembly, where brands invest heavily in research and development (R&D) to enhance ergonomics, fluid delivery mechanisms, and nozzle design. This phase also includes rigorous testing to comply with international standards for transfer efficiency (e.g., EPA 6H standards). Downstream distribution channels are multifaceted. Direct sales are common for high-value robotic or automatic systems sold to large OEM clients, where installation, training, and long-term service contracts are integral parts of the offering. This direct approach ensures specialized technical support and customization specific to the high-volume production environment.

Conversely, manual spray guns and consumables reach the vast aftermarket through indirect channels, including authorized distributors, specialized automotive paint jobber networks, and large industrial supply retailers. These intermediaries provide crucial inventory management, local availability, and technical sales support to thousands of independent body shops and small industrial users. The efficiency of this distribution network is critical, particularly in the aftermarket segment, where immediate availability of spare parts and replacement units significantly impacts repair turnaround times. Successful market players strategically manage both direct relationships with large automakers and robust indirect networks to maintain comprehensive market penetration across all user segments.

Automotive Spray Guns Market Potential Customers

The potential customers for automotive spray guns span the entire lifecycle of a vehicle, from initial manufacturing to routine maintenance and collision repair. The largest segment of end-users comprises Original Equipment Manufacturers (OEMs), who rely on sophisticated, high-speed, and often robotic spray systems to apply primers, base coats, and clear coats on vehicle bodies moving along the assembly line. For OEMs, the priority is unparalleled consistency, minimal downtime, and the highest possible transfer efficiency to manage multi-million-dollar paint material expenditures. Decisions at this level are often driven by long-term integration capacity, service agreements, and compliance with stringent factory finish quality metrics.

The second major consumer group is the vast aftermarket, encompassing independent collision repair shops, franchised body shops, and large multi-shop operators (MSOs). These end-users demand versatile, highly ergonomic, and easy-to-clean manual spray guns capable of handling small spot repairs as well as complete vehicle repainting, all while perfectly matching the factory color and texture. For this group, factors like ease of use, cost-effectiveness, and the spray gun's performance with modern waterborne paint systems are paramount. The refinish segment is characterized by a high volume of transactions involving manual HVLP and LVLP guns and related accessories.

Finally, niche but growing customer segments include custom vehicle modification shops, fleet maintenance organizations (trucking companies, public transport), and industrial coating facilities that handle specialized protective coatings for automotive components. Custom shops require high-end precision tools for artistic and specialized finishes, whereas fleet operators prioritize durability and anticorrosion performance. These diverse demands necessitate a broad portfolio from spray gun manufacturers, ranging from basic, durable units for industrial application to highly refined, precise instruments for premium custom work, ensuring the market addresses both volume and niche quality requirements effectively.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 750.4 Million |

| Market Forecast in 2033 | USD 1,114.8 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SATA GmbH & Co. KG, Anest Iwata Corporation, Graco Inc., DeVilbiss (ITW), 3M Company, Wagner SprayTech, Carlisle Fluid Technologies, Ransburg (ITW), Nordson Corporation, Sagola, Walcom, Fuji Spray, Krautzberger GmbH, Prowin Tools, Meiji Kikai Co. Ltd., Amsler Equipment, J. Wagner GmbH, Wuxi PxR Industrial Spraying Equipment Co., Ltd., Dymax, PPG Industries (Equipment division). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Spray Guns Market Key Technology Landscape

The technological landscape of the Automotive Spray Guns Market is primarily characterized by the ongoing transition from conventional, high-pressure siphon feed guns to advanced High Volume Low Pressure (HVLP) and Low Volume Low Pressure (LVLP) systems. This shift is not merely incremental; it is regulatory-driven, as these technologies significantly increase transfer efficiency—the ratio of coating material reaching the surface versus the material sprayed—thereby minimizing waste and critically reducing VOC emissions. HVLP guns operate by delivering a large volume of air at very low pressure (typically less than 10 PSI at the air cap), maximizing material use and achieving compliance with stringent air quality regulations prevalent in North America and Europe, making them the standard choice for most high-quality refinish applications.

Electrostatic application technology represents another critical segment, predominantly utilized in high-volume OEM manufacturing. These systems apply an electrostatic charge to the atomized paint particles and ground the vehicle body, creating an attractive force that pulls the paint toward the surface. This magnetic effect allows paint to wrap around complex geometries, achieving exceptionally high transfer efficiencies (often exceeding 80%). While the initial cost and operational complexity are higher, the substantial savings in material consumption and superior edge coverage make electrostatic guns indispensable for automated production lines where every fraction of a percentage in material savings translates into millions of dollars annually. Innovation in this area focuses on developing lighter, more durable turbines and more sophisticated control units to manage the electrical charge safely and precisely.

The emerging technological frontier involves the integration of smart features and connectivity (IoT). Modern premium spray guns are now equipped with integrated digital manometers for highly accurate pressure control and increasingly, Bluetooth connectivity that links the gun to a central shop management system. This digital integration allows for real-time monitoring of application parameters, ensuring quality control, tracking material usage per job, and facilitating data-driven maintenance scheduling. Furthermore, the handling of highly viscous waterborne and new high-solids coatings has led to improvements in fluid tip and needle design, requiring manufacturers to employ specialized corrosion-resistant materials and engineering precise fluid channels to maintain fine atomization consistency regardless of material viscosity, addressing a major technical challenge posed by environmental coating mandates.

Regional Highlights

Regional dynamics within the Automotive Spray Guns Market demonstrate a clear distinction between mature, highly regulated markets and rapidly expanding, developing markets. North America and Europe are defined by the dominance of advanced, high-efficiency technologies, primarily due to strict environmental standards regarding VOC emissions. In these regions, the demand is largely driven by replacement cycles and the adoption of technologically superior equipment, such as digital-enabled HVLP and advanced robotic painting systems in OEM plants. The maturity of the aftermarket sector, characterized by a high number of professional collision repair shops, ensures sustained demand for premium, ergonomic manual spray guns from leading brands like SATA and DeVilbiss.

The Asia Pacific (APAC) region is the powerhouse of market growth, fueled by exponential increases in vehicle production, particularly in China and India, alongside the expansion of sophisticated manufacturing capabilities in South Korea and Japan. While OEM sectors in APAC quickly adopt the most advanced robotic and electrostatic solutions to meet export quality standards, the aftermarket in this region is highly fragmented. There is significant opportunity for market penetration by manufacturers offering affordable, yet high-efficiency LVLP systems, transitioning away from rudimentary conventional guns. The growing middle class and increasing traffic density boost collision rates, providing a strong foundation for long-term aftermarket revenue.

Latin America and the Middle East & Africa (MEA) represent emerging markets where the transition toward high-efficiency coating methods is accelerating, albeit at a slower pace due to higher price sensitivity and less stringent immediate regulatory pressure compared to the West. The rising establishment of global automotive manufacturing facilities (e.g., in Mexico and South Africa) necessitates investment in factory-grade equipment, driving demand for automated systems. However, the aftermarket remains highly reliant on cost-effective solutions. Overall regional expansion is closely tied to infrastructure development and the enforcement level of national environmental policies, dictating the speed at which HVLP and LVLP become universal standards.

- North America: High adoption of HVLP/LVLP; mature aftermarket; strong regulatory environment driving upgrades; significant presence of OEM robotic painting systems.

- Europe: Leadership in environmental compliance; mandatory use of HTE equipment; strong focus on ergonomic design and integration with waterborne coatings; high premium product consumption.

- Asia Pacific (APAC): Highest growth rate driven by massive vehicle production; increasing adoption of advanced robotics in OEM; high potential for LVLP expansion in the fragmented aftermarket.

- Latin America (LATAM): Growing vehicle production and collision repair demands; high sensitivity to pricing; gradual transition from conventional to efficient technologies.

- Middle East and Africa (MEA): Emerging market with focus on industrial and protective coatings; localized OEM facilities driving limited high-end demand; strong aftermarket potential as vehicle ownership increases.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Spray Guns Market.- SATA GmbH & Co. KG

- Anest Iwata Corporation

- Graco Inc.

- DeVilbiss (ITW)

- 3M Company

- Wagner SprayTech

- Carlisle Fluid Technologies

- Ransburg (ITW)

- Nordson Corporation

- Sagola

- Walcom

- Fuji Spray

- Krautzberger GmbH

- Prowin Tools

- Meiji Kikai Co. Ltd.

- Amsler Equipment

- J. Wagner GmbH

- Wuxi PxR Industrial Spraying Equipment Co., Ltd.

- Dymax

- PPG Industries (Equipment division)

Frequently Asked Questions

Analyze common user questions about the Automotive Spray Guns market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technology driving efficiency in modern automotive spray guns?

The primary technology driving efficiency is High Volume Low Pressure (HVLP). HVLP spray guns use a large volume of air at low pressure to atomize paint, significantly increasing the transfer efficiency (material applied to surface versus material wasted) to typically over 65%. This minimizes overspray, reduces material costs, and ensures compliance with strict environmental regulations like those governing VOC emissions in North America and Europe.

How do waterborne coatings impact the requirements for automotive spray guns?

Waterborne coatings, which are increasingly replacing traditional solvent-based paints due to environmental mandates, require spray guns made of stainless steel or specialized materials to prevent corrosion, as water is highly corrosive to standard components. Furthermore, waterborne coatings often have higher viscosity, necessitating improved fluid tips, air caps, and consistent pressure regulation (often achieved through digital manometers) to ensure fine, consistent atomization and a flawless finish.

What is the expected CAGR for the Automotive Spray Guns Market between 2026 and 2033?

The Automotive Spray Guns Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period from 2026 to 2033. This growth is primarily fueled by increasing global vehicle production, escalating demand for sophisticated collision repair services in the aftermarket, and mandatory technological upgrades driven by global environmental policies focusing on material efficiency.

What is the role of robotics and automation in the OEM segment of the market?

Robotics and automation are critical in the OEM segment, enabling high-speed, 24/7 consistency and precision in painting. Robotic spray systems utilize advanced electrostatic and air-assisted technologies coupled with complex path planning algorithms to ensure uniform film thickness and flawless aesthetics across every vehicle body, maximizing material utilization and minimizing human intervention and error in the high-volume manufacturing environment.

Which geographical region holds the highest growth potential for automotive spray gun adoption?

The Asia Pacific (APAC) region is projected to hold the highest growth potential, largely driven by the tremendous expansion of the automotive manufacturing sector in countries like China and India, coupled with the rapid modernization and formalization of the automotive aftermarket and collision repair industry across the region. This growth encompasses both high-end robotic systems for new production and high-efficiency manual guns for repair shops.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager