Automotive Suspension Coil Springs Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434469 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Automotive Suspension Coil Springs Market Size

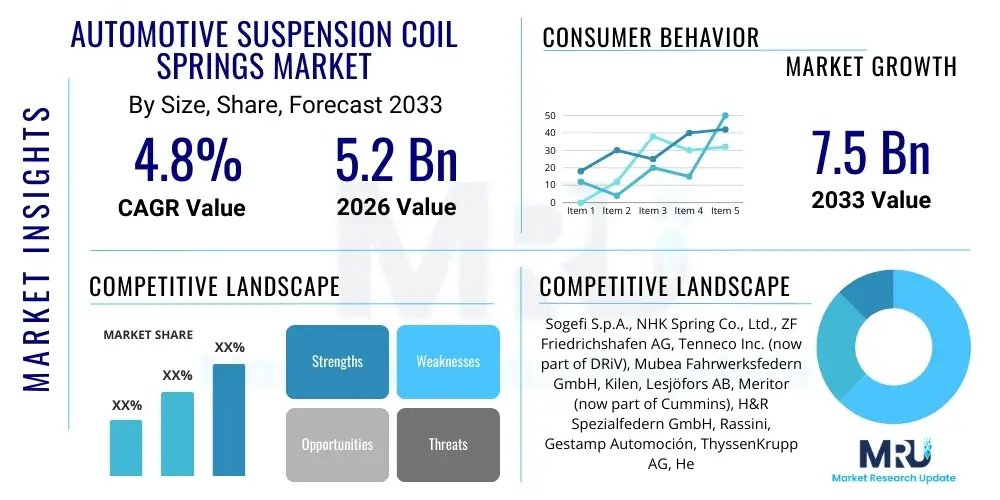

The Automotive Suspension Coil Springs Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $5.2 Billion in 2026 and is projected to reach $7.5 Billion by the end of the forecast period in 2033.

Automotive Suspension Coil Springs Market introduction

The Automotive Suspension Coil Springs Market encompasses the manufacturing, distribution, and sales of helical springs used within vehicle suspension systems. These critical components are responsible for absorbing and storing energy from road shocks and impacts, supporting the vehicle weight, and maintaining optimal ride height and handling characteristics. Coil springs work in conjunction with shock absorbers (dampers) to ensure passenger comfort, stability, and control, making them fundamental to vehicle dynamics and safety. The primary materials utilized are high-strength alloy steels, optimized for durability, fatigue resistance, and weight reduction, although advanced composite materials are emerging, particularly for high-performance or electric vehicle (EV) applications where weight savings are paramount.

Product descriptions typically categorize coil springs based on their spring rate—linear rate springs offer a consistent stiffness regardless of compression, whereas variable rate (progressive) springs adjust stiffness based on the load, offering superior comfort under light loads and better control under heavy loads. Major applications span the entire automotive spectrum, including Passenger Vehicles (PVs), Light Commercial Vehicles (LCVs), and Heavy Commercial Vehicles (HCVs). The rising global vehicle production, coupled with increasing consumer demand for enhanced ride quality and safety features, robustly drives market expansion. Furthermore, the stringent regulatory environment regarding vehicle stability and safety necessitates high-quality, precision-engineered coil springs, maintaining a steady demand in both the Original Equipment Manufacturer (OEM) and aftermarket segments.

The benefits associated with high-quality suspension coil springs include improved vehicular stability, reduced body roll during cornering, effective shock absorption leading to greater driver and passenger comfort, and extended tire and vehicle lifespan by minimizing excessive vibration and stress on chassis components. Driving factors include the rapid electrification of the automotive fleet, which demands springs capable of handling heavier battery packs while optimizing vehicle center of gravity; increasing focus on lightweight components to improve fuel efficiency and range; and infrastructural development, particularly in emerging economies, spurring vehicle sales. Technological advancements in material science, such as the use of high-tensile chrome silicon alloys and the adoption of advanced surface treatments, further enhance product longevity and performance, contributing significantly to market momentum.

Automotive Suspension Coil Springs Market Executive Summary

The Automotive Suspension Coil Springs Market is experiencing moderate yet stable growth, underpinned by consistent global vehicle production volumes and substantial investment in aftermarket service networks. Business trends indicate a strong push toward advanced manufacturing techniques, including cold coiling and hot coiling processes utilizing sophisticated numerical control (NC) machinery, to achieve tighter tolerance specifications and improved dimensional consistency. A significant emerging business trend is the increasing collaboration between material suppliers and OEMs to develop application-specific alloys that balance strength, weight, and cost effectiveness, crucial for competing in the highly sensitive OEM supply chain. Furthermore, the sustainability mandate is influencing production methods, leading manufacturers to adopt processes that minimize material waste and energy consumption, addressing regulatory and corporate social responsibility (CSR) demands.

Regional trends reveal Asia Pacific (APAC) as the primary engine of growth, driven by booming automotive manufacturing hubs in China, India, Japan, and South Korea, coupled with rapidly expanding vehicle parc demanding replacement springs in the aftermarket. North America and Europe, while mature, demonstrate strong demand for premium and specialized suspension systems, particularly those incorporating active or semi-active damping technologies which often integrate high-specification coil springs. The regulatory landscape in Europe, emphasizing vehicle safety and emissions reduction, encourages the adoption of lighter, high-performance suspension components. Conversely, emerging markets in Latin America and the Middle East and Africa (MEA) are seeing elevated demand primarily within the cost-sensitive aftermarket sector, focusing on durability and robustness suitable for diverse road conditions.

Segment trends highlight the critical role of the OEM segment, which accounts for the majority revenue share, dictated by new vehicle manufacturing schedules. Within the material segmentation, high-strength steel alloys maintain dominance due to their reliability and cost-efficiency, though composite springs are gaining traction in niche, high-performance, and electric vehicle segments due to unparalleled weight reduction benefits. Vehicle type segmentation confirms Passenger Vehicles (PVs) as the largest market component, demanding tailored solutions for comfort and handling. The most significant technological trend involves the proliferation of progressive rate springs over linear rate springs, particularly in standard vehicle models, as manufacturers seek to provide a better balance between dynamic handling and passive ride comfort, aligning with evolving consumer preferences for superior driving experiences.

AI Impact Analysis on Automotive Suspension Coil Springs Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) are transforming the traditional manufacturing processes of mechanical components like coil springs, particularly focusing on quality control, predictive maintenance, and material optimization. Key user concerns revolve around whether AI can significantly reduce material variability, leading to longer product lifespan and fewer warranty claims. Expectations include the use of AI-driven simulations to rapidly prototype complex spring geometries for active suspension systems and the integration of smart manufacturing processes (Industry 4.0) that utilize sensor data and ML algorithms to monitor coiling machines, predict potential equipment failures, and automatically adjust process parameters in real-time to maintain flawless consistency. Furthermore, users are keen to understand AI's role in supply chain resilience and demand forecasting for both OEM and aftermarket segments, ensuring optimal inventory levels for specialized materials.

- AI-powered simulation tools optimize spring geometry and material composition, reducing physical testing cycles.

- Machine learning algorithms enhance predictive quality control in the manufacturing process by analyzing high-volume sensor data from coiling machines.

- Computer vision systems, driven by AI, perform ultra-precise defect detection on finished springs, surpassing manual inspection reliability.

- AI optimizes supply chain logistics and inventory management for specialized steel alloys, minimizing lead times and procurement costs.

- Predictive maintenance schedules for manufacturing equipment are enhanced using ML, reducing unplanned downtime and improving overall equipment effectiveness (OEE).

- Integration of AI in smart suspension systems may lead to dynamic spring rate adjustment requirements, driving innovation in component design.

DRO & Impact Forces Of Automotive Suspension Coil Springs Market

The Automotive Suspension Coil Springs Market is shaped by powerful Drivers, Restraints, and Opportunities (DRO), which collectively constitute the primary Impact Forces determining market trajectory. A critical driver is the continuous growth in global vehicle production, especially in developing economies, coupled with stricter vehicle safety standards mandated by governmental and regional bodies worldwide, necessitating reliable, high-performance suspension components. The replacement market, or aftermarket, represents a stable and crucial driver, fueled by the aging global vehicle fleet and the necessity of replacing worn-out springs to maintain vehicle integrity and safety. Furthermore, technological advancements in material science, such as the development of lighter, stronger, and more corrosion-resistant alloys, allow manufacturers to offer improved performance without significant weight penalty, directly supporting automotive design trends focusing on efficiency and dynamic capabilities. The shift towards electrification acts as a major catalyst, as heavier battery packs require recalibrated and often more robust coil springs to manage the increased sprung weight and maintain desired ride dynamics.

Conversely, the market faces significant restraints, including the high volatility and fluctuating prices of raw materials, particularly specialty steel alloys (like chromium, silicon, and vanadium), which directly impact manufacturing costs and profitability, necessitating complex hedging strategies. Another restraint is the potential for substitution threat from alternative suspension technologies, such as full air suspension systems or hydraulic systems, which, while currently more expensive, offer superior load leveling and adaptability, especially in high-end luxury and heavy-duty commercial vehicle segments. The lengthy and highly regulated validation processes required by OEMs pose an additional barrier to entry for smaller or innovative companies, slow down the adoption of new materials, and necessitate substantial upfront investment in R&D and testing infrastructure. Economic downturns leading to reduced consumer spending on new vehicles and elective aftermarket repairs can also temporarily suppress demand across both primary segments.

Opportunities abound, centering primarily on the increasing market penetration of Electric Vehicles (EVs). Designing specialized, lightweight coil springs for EVs, which must manage unique load distributions and contribute minimally to the overall vehicle weight to maximize range, represents a significant growth pathway. The development of intelligent, semi-active suspension systems that require highly specialized coil characteristics to complement electronic damping control presents another high-value opportunity. Furthermore, expanding the geographical reach into underserved aftermarket segments in rapidly industrializing regions provides substantial commercial avenues for standardized and robust replacement components. The impact forces are predominantly positive, driven by technological evolution and regulatory push for safety, but tempered by material cost pressures and the disruptive potential of alternative suspension technologies. Successfully navigating these forces requires manufacturers to prioritize material innovation, operational efficiency through automation, and strategic alignment with major EV platform developers.

Segmentation Analysis

The Automotive Suspension Coil Springs Market is comprehensively segmented based on Type, Material, Vehicle Type, and Sales Channel, reflecting the diverse applications and end-user requirements within the global automotive industry. This segmentation provides a granular view of market dynamics, allowing stakeholders to identify high-growth areas and tailor their product strategies accordingly. The market structure is highly dependent on the vehicle manufacturing cycle and the lifecycle of vehicles on the road, creating distinct demand patterns in the OEM and aftermarket channels. Understanding the differential requirements across vehicle types, from standard passenger cars to specialized heavy commercial vehicles, is paramount for forecasting production demands and material specifications. For instance, the demand for sophisticated, variable-rate springs is higher in the Passenger Vehicle (PV) segment, whereas rugged, durable linear springs often dominate the Heavy Commercial Vehicle (HCV) sector due to payload considerations.

Segmentation by material is crucial as it dictates performance characteristics, cost, and weight. While conventional steel alloys remain the backbone of the industry, the increasing necessity for lightweighting has spurred research and limited commercial adoption of composite materials, which offer superior strength-to-weight ratios. The shift towards composites, though currently marginalized by high cost, is expected to accelerate, especially in premium vehicle platforms and specialized EV applications where every kilogram saved significantly impacts vehicle performance and range. Furthermore, within the steel segment, differentiation based on specific alloy composition (e.g., chrome-silicon, chrome-vanadium) reflects varying levels of required fatigue life and operating stress, directly impacting market positioning and pricing strategy.

The segmentation by Sales Channel, split between OEM and Aftermarket, highlights the dual nature of the industry. The OEM channel is volume-driven and highly competitive, characterized by long-term contracts and stringent quality requirements, making profitability contingent on massive operational scale. Conversely, the Aftermarket channel, which caters to replacement demand, is characterized by higher margins, diverse product needs across multiple vehicle models and vintages, and distribution complexity. Successful market penetration necessitates a clear strategy for managing these distinct channels, often involving separate branding and distribution networks to optimize reach and service efficiency for both vehicle manufacturers and independent repair shops globally. The convergence of these segmentation variables defines the overall competitive landscape.

- By Type:

- Linear Rate Springs

- Variable Rate (Progressive) Springs

- Tapered Wire Springs

- By Material:

- Steel (High-Strength Alloy Steel, Carbon Steel)

- Composite Materials (Fiber-Reinforced Polymers)

- By Vehicle Type:

- Passenger Vehicles (PV)

- Commercial Vehicles (CV)

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

Value Chain Analysis For Automotive Suspension Coil Springs Market

The Value Chain for the Automotive Suspension Coil Springs Market begins with upstream activities centered on the procurement and processing of specialized raw materials, primarily high-grade spring steel. Upstream analysis involves highly specialized material suppliers, such as steel mills (e.g., ThyssenKrupp, ArcelorMittal), that produce specific high-tensile wire rods or bars (chrome-silicon or chrome-vanadium alloys) designed for high fatigue applications. The quality and cost of these raw materials are the primary determinants of the final product's performance and margin structure. Manufacturers often establish long-term supply agreements to mitigate price volatility and ensure material traceability, which is critical for meeting stringent automotive safety standards. Technological sophistication in this stage focuses on metallurgical processes, heat treatment, and surface finishing of the wire rod to maximize durability and corrosion resistance prior to the actual coiling process.

The core manufacturing process, or midstream segment, involves high-precision forming, primarily hot coiling (for thick wire/HCV springs) and cold coiling (for thin wire/PV springs), followed by stress relieving, setting, grinding, shot peening (to induce compressive residual stress and enhance fatigue life), and protective coating application (epoxy or powder coating). This stage requires significant capital investment in highly automated NC machinery and quality control systems. Midstream activities are dominated by tier-one suppliers (e.g., NHK Spring, ZF, Sogefi) who manage complex supply logistics and adhere strictly to OEM quality mandates. Operational efficiency and minimizing scrap rates are vital for competitive advantage in this capital-intensive phase. Innovations here focus on integrating Industry 4.0 principles, leveraging data analytics for process optimization and achieving 'zero-defect' manufacturing targets.

Downstream analysis focuses on the distribution channels, which are bifurcated into Direct and Indirect channels. The Direct channel involves supplying finished coil springs directly to Original Equipment Manufacturers (OEMs) for integration into new vehicle assembly lines; this relationship is highly contractual and involves Just-in-Time (JIT) delivery. The Indirect channel addresses the global Aftermarket, requiring a robust network comprising regional distributors, wholesalers, independent garages, and online retailers. Effective aftermarket distribution demands extensive inventory management (due to the vast number of vehicle models and years), strong brand recognition, and efficient logistics to ensure rapid availability of replacement parts. Both channels are critical for market success, though the strategic approaches—focused on cost and volume for OEM, and margin and availability for Aftermarket—differ significantly.

Automotive Suspension Coil Springs Market Potential Customers

The primary customers for automotive suspension coil springs fall into two major categories: vehicle manufacturers (OEMs) and the vast ecosystem of the aftermarket, which includes replacement service providers and consumers. Original Equipment Manufacturers are the largest volume buyers, utilizing these components in the assembly of new vehicles across all categories—from compact sedans and SUVs to heavy-duty trucks and buses. These customers require components that meet precise engineering specifications, adhere to rigorous quality control protocols (such as ISO/TS 16949), and are delivered according to demanding JIT schedules. The purchasing decisions of OEMs are heavily influenced by performance data, strategic pricing, and the supplier's capacity for global scaling and technological collaboration, especially concerning lightweighting and compatibility with electric vehicle architectures.

The aftermarket customers represent a broader, more fragmented purchasing base driven by necessity, convenience, and cost. This segment includes independent repair shops, franchised dealerships, specialized performance modification tuners, and individual vehicle owners purchasing replacement parts. Aftermarket demand is non-cyclical and highly dependent on the average age and utilization rate of the global vehicle parc. Potential buyers in this channel prioritize availability, brand trust, warranty coverage, and component durability, particularly in regions with poorly maintained road networks. Distributors and wholesalers who aggregate inventory for these repair entities act as critical intermediaries, making their operational requirements, such as comprehensive cataloging and competitive pricing, vital for market access.

A rapidly growing segment of potential customers includes electric vehicle manufacturers and specialized EV platform developers. These clients require coil springs that are fundamentally different from those used in traditional Internal Combustion Engine (ICE) vehicles, often needing components designed to handle high static loads (due to batteries) while maintaining a low unsprung weight. As the transition to electric mobility accelerates, the ability of spring manufacturers to innovate in material science (e.g., composites) and adjust production capacity for these specialized demands will define their penetration into the future automotive landscape. These customers represent a premium segment where initial cost is often secondary to performance, longevity, and weight savings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.2 Billion |

| Market Forecast in 2033 | $7.5 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sogefi S.p.A., NHK Spring Co., Ltd., ZF Friedrichshafen AG, Tenneco Inc. (now part of DRiV), Mubea Fahrwerksfedern GmbH, Kilen, Lesjöfors AB, Meritor (now part of Cummins), H&R Spezialfedern GmbH, Rassini, Gestamp Automoción, ThyssenKrupp AG, Hendrickson International, Wuxi Jingshang Spring Co., Ltd., Eibach Springs, Betts Spring Manufacturing, Hyperco, Coaptech SAS, MAAD Group, General Motors (in-house production). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Suspension Coil Springs Market Key Technology Landscape

The technology landscape for automotive suspension coil springs is characterized by continuous refinement in material science and advanced manufacturing processes, aimed primarily at enhancing fatigue life, reducing weight, and optimizing spring characteristics for modern vehicle demands. A core technology is the evolution of high-tensile spring steel alloys, particularly chrome-silicon and chrome-vanadium steel, which offer superior strength-to-weight ratios and enhanced resilience against permanent deformation under extreme operational stress. Modern material treatments, such as advanced shot peening techniques, utilize controlled media bombardment to introduce highly beneficial residual compressive stresses on the spring surface, dramatically increasing its resistance to micro-cracking and fatigue failure. Furthermore, the application of highly durable, corrosion-resistant coatings, such as zinc phosphating followed by electrophoresis or epoxy powder coating, is critical for extending service life, especially in regions exposed to road salt and harsh environmental conditions.

In manufacturing, the transition toward sophisticated numerical control (NC) cold coiling machines represents a key technological advancement, allowing for exceptionally precise coiling geometry and highly repeatable spring characteristics, which is essential for meeting tight OEM specifications for vehicle assembly. These machines integrate real-time quality monitoring systems and process controls, often linked to enterprise resource planning (ERP) systems, facilitating the implementation of Industry 4.0 standards. Hot coiling technology, typically reserved for large-diameter wire springs used in commercial vehicles, has also seen improvements through better control over temperature profiles during the winding and quenching stages, ensuring optimal microstructure and hardness throughout the spring’s cross-section, minimizing internal stress variations.

Perhaps the most transformative technological area involves the development and limited commercial deployment of composite coil springs, predominantly made from Fiber-Reinforced Polymers (FRP), often glass fiber or carbon fiber reinforced resins. This technology offers up to 70% weight savings compared to traditional steel springs, yielding significant benefits for fuel efficiency (in ICE vehicles) and range extension (in EVs). While cost and long-term durability concerns under extreme sustained heat remain factors limiting mass adoption, continuous advancements in resin chemistry and fiber winding techniques are making composites a viable future option, particularly for premium and performance applications. The technological trajectory suggests a move towards springs designed to interface seamlessly with sophisticated electronic damper control systems, requiring ultra-precise specifications to enable dynamic adjustment of vehicle handling.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global automotive suspension coil springs market in terms of volume, driven by high-volume vehicle manufacturing in China, India, and ASEAN nations. China, as the world's largest automotive market, accounts for substantial OEM demand, while the rapidly expanding middle class in India and Southeast Asia fuels both new vehicle sales and robust aftermarket growth. The regional trend is characterized by the rapid adoption of localized, cost-effective manufacturing processes, though quality requirements are increasing rapidly due to the influx of global OEMs and stricter domestic regulations.

- North America: North America represents a mature, high-value market defined by a strong preference for large Passenger Vehicles (SUVs, trucks) and significant demand from the Heavy Commercial Vehicle (HCV) sector. The region is characterized by substantial investment in R&D, particularly focused on specialized, high-performance coil springs for off-road and high-load applications. The aftermarket in North America is highly lucrative, driven by a culture of vehicle maintenance, customization, and long vehicle lifespan, requiring a massive variety of replacement components.

- Europe: Europe is characterized by stringent emission and safety regulations, driving demand for high-performance and lightweight components. European manufacturers are leading the charge in adopting sophisticated technologies like variable-rate springs and exploring composite materials to achieve weight reduction necessary for meeting challenging EU CO2 targets. Germany, in particular, remains a key hub for innovation and high-quality, precision coil spring manufacturing, catering to premium and luxury automotive segments.

- Latin America: This region presents a challenging yet growing market, heavily focused on the aftermarket segment due to economic volatility and longer replacement cycles for vehicles. Demand focuses on robust, durable, and cost-effective coil springs capable of handling varied road infrastructure quality. Brazil and Mexico are the primary markets, serving both regional vehicle assembly operations and the extensive replacement parts network across the continent.

- Middle East and Africa (MEA): The MEA market is heavily influenced by the import of vehicles and relies significantly on the aftermarket for maintenance and repair. Demand is concentrated in countries with high infrastructure development (e.g., UAE, Saudi Arabia) and vehicle fleet expansion (e.g., South Africa). The operating environment—often involving extreme temperatures and harsh conditions—necessitates coil springs with superior corrosion resistance and high resilience, creating specific regional product requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Suspension Coil Springs Market.- Sogefi S.p.A.

- NHK Spring Co., Ltd.

- ZF Friedrichshafen AG

- Tenneco Inc. (now part of DRiV)

- Mubea Fahrwerksfedern GmbH

- Kilen

- Lesjöfors AB

- Meritor (now part of Cummins)

- H&R Spezialfedern GmbH

- Rassini

- Gestamp Automoción

- ThyssenKrupp AG

- Hendrickson International

- Wuxi Jingshang Spring Co., Ltd.

- Eibach Springs

- Betts Spring Manufacturing

- Hyperco

- Coaptech SAS

- MAAD Group

- General Motors (in-house production)

Frequently Asked Questions

Analyze common user questions about the Automotive Suspension Coil Springs market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for Automotive Suspension Coil Springs?

The key driver is the steady growth in global automotive production, both for internal combustion engine (ICE) and electric vehicles (EVs), coupled with the non-cyclical demand from the aftermarket segment for replacement components necessary to maintain vehicle safety and ride quality.

How does the shift to Electric Vehicles (EVs) impact coil spring design?

EVs require specialized coil springs designed to handle the significantly higher curb weight imposed by heavy battery packs. This necessitates using advanced, lightweight materials like composite fibers or higher-strength steel alloys to manage load while optimizing vehicle range and maintaining proper handling characteristics.

Which material type is currently dominating the suspension coil springs market?

High-strength alloy steel, particularly chrome-silicon and chrome-vanadium steel, currently dominates the market due to its proven reliability, cost-effectiveness, and superior fatigue resistance required for long-term vehicular applications across standard vehicle models.

What is the difference between linear rate and variable rate coil springs?

Linear rate springs provide a consistent level of stiffness regardless of how much they are compressed. Variable rate (progressive) springs, conversely, increase their stiffness as they are compressed, offering better ride comfort under light loads and improved control and resistance to bottoming out under heavy loads or dynamic movements.

Which geographic region exhibits the highest growth potential for coil spring manufacturers?

Asia Pacific (APAC) shows the highest growth potential, driven by the expanding automotive manufacturing base in countries like China and India, rapid urbanization, increasing per capita vehicle ownership, and substantial growth in both the OEM and replacement parts sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager