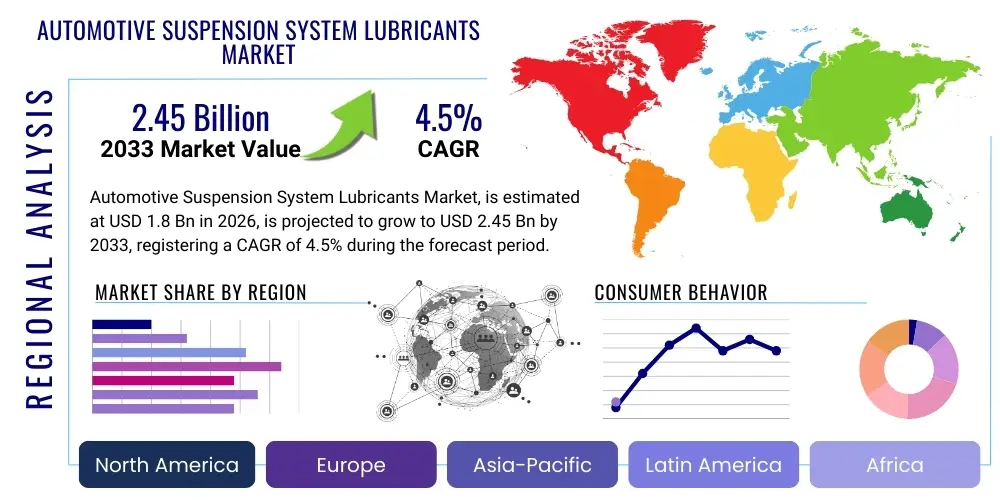

Automotive Suspension System Lubricants Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433642 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Automotive Suspension System Lubricants Market Size

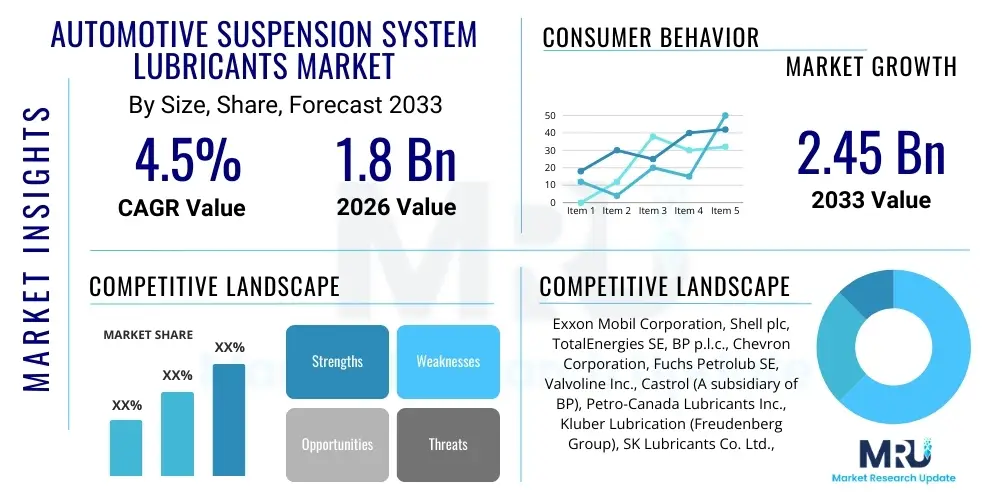

The Automotive Suspension System Lubricants Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.9% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.58 Billion by the end of the forecast period in 2033.

Automotive Suspension System Lubricants Market introduction

The Automotive Suspension System Lubricants Market encompasses specialized fluids and greases essential for maintaining the performance, durability, and smooth operation of vehicular suspension components, including shock absorbers, struts, air springs, and various linkages. These lubricants are formulated to withstand extreme temperature variations, high pressures, shear stress, and exposure to contaminants like dirt and moisture. Their primary function is to reduce friction between moving parts, dissipate heat, prevent wear and corrosion, and ensure optimal dampening characteristics, thereby significantly impacting vehicle handling, stability, and passenger comfort.

Product descriptions within this market vary widely, ranging from standard mineral oil-based hydraulic fluids used in conventional shock absorbers to advanced synthetic and semi-synthetic oils designed for high-performance and electronically controlled suspension systems (such as adaptive damping systems). Key chemical properties include viscosity stability, anti-wear additives (EP/AW), and excellent thermal and oxidative stability. The stringent requirements imposed by modern vehicle manufacturing, particularly in the premium and electric vehicle (EV) segments, necessitate continuous innovation in lubricant chemistry to meet increasingly demanding operating conditions and longer service intervals.

Major applications span the entire automotive sector, categorized into Passenger Vehicles (PV), Light Commercial Vehicles (LCV), and Heavy Commercial Vehicles (HCV). Benefits derived from high-quality suspension lubricants include extended component lifespan, reduced maintenance costs, consistent damping performance, and improved safety through enhanced road holding. Driving factors propelling market growth include the steady increase in global vehicle production and parc, the growing adoption of sophisticated suspension technologies (e.g., air suspension and magneto-rheological fluids), and increasing consumer awareness regarding preventative maintenance and the use of premium lubricants in the aftermarket segment.

Automotive Suspension System Lubricants Market Executive Summary

The Automotive Suspension System Lubricants Market is characterized by robust growth, driven primarily by evolving automotive technology and strict regulatory pressures concerning vehicle efficiency and safety. Key business trends include the shift towards high-performance synthetic lubricants, particularly in response to the demands of Electric Vehicles (EVs), which require specialized fluids due to different weight distribution, power delivery characteristics, and thermal management needs compared to Internal Combustion Engine (ICE) vehicles. Furthermore, Original Equipment Manufacturers (OEMs) are increasingly specifying advanced fluids for factory fill, raising the standard for aftermarket replacements and reinforcing the focus on quality and brand reputation among lubricant suppliers. Mergers and acquisitions focusing on specialized additive technologies are also common as major players seek to consolidate expertise and control the supply chain.

Regionally, Asia Pacific (APAC) stands out as the dominant growth engine, attributed to high volume vehicle production in countries like China, India, and Japan, coupled with rapid infrastructure development leading to a larger active vehicle fleet. North America and Europe, while mature, exhibit high growth in the premium synthetic segment, driven by the proliferation of luxury vehicles and stringent environmental regulations promoting longer-lasting, biodegradable, or low-toxicity lubrication solutions. The Middle East and Africa (MEA) and Latin America are poised for moderate growth, primarily tied to fleet expansion and necessary infrastructure improvements that stress suspension systems, thereby increasing demand for durable lubricants.

Segment trends highlight the increasing dominance of Synthetic Oil-based lubricants over traditional Mineral Oil-based products, owing to their superior performance stability under extreme conditions. Within the application segment, the Passenger Vehicle (PV) sector remains the largest consumer, though the Commercial Vehicle (CV) segment offers stable revenue streams due to the rigorous operating cycles and high maintenance requirements of trucks and buses. The Aftermarket distribution channel is critical, capturing the significant replacement demand driven by regular service intervals, while the OEM channel benefits from rising global vehicle manufacturing volumes.

AI Impact Analysis on Automotive Suspension System Lubricants Market

User queries regarding AI's influence in the Automotive Suspension System Lubricants Market frequently center on predictive maintenance capabilities, optimal lubrication scheduling, and AI-driven materials discovery for next-generation fluids. Key themes revolve around how sensor integration in modern suspension systems (like smart shocks) generates data that AI algorithms can process to recommend precise lubricant replenishment or replacement intervals, moving beyond traditional mileage-based schedules. Users are also concerned about the supply chain efficiency and quality control enhancements facilitated by AI, such as optimizing blending processes and ensuring additive consistency. Expectations are high that AI will lead to the development of "self-healing" or highly adaptive lubricants that dynamically adjust properties based on real-time driving conditions monitored by vehicle diagnostics.

AI's primary impact lies in refining the performance and application strategy of these critical fluids. By analyzing big data derived from telematics, vehicle dynamics, and operating environments (temperature, road conditions), AI can precisely determine the specific stresses placed on suspension components. This shift allows lubricant manufacturers and fleet managers to deploy customized lubrication solutions, thereby maximizing component lifespan and reducing unnecessary maintenance costs. For instance, AI algorithms can correlate specific driving styles or geographical usage patterns with lubricant degradation rates, offering hyper-personalized product recommendations.

Furthermore, AI accelerates research and development (R&D) in formulating suspension lubricants. Machine learning models are being used to simulate molecular interactions and predict the performance characteristics of new base oils and additive packages much faster than traditional laboratory testing. This capability is vital for meeting the rapid innovation cycles of the electric vehicle market, where minimizing friction losses and ensuring high thermal stability in complex damper systems are paramount. AI-enhanced quality control systems also ensure batch consistency, which is crucial for safety-critical components like suspension systems.

- AI-driven predictive maintenance scheduling based on real-time stress monitoring.

- Optimization of lubricant additive packages using machine learning simulations (AI R&D).

- Enhanced quality control and blending optimization through robotic process automation (RPA) and AI vision systems.

- Development of adaptive or smart lubricants that respond dynamically to vehicular data inputs.

- Improved supply chain forecasting and inventory management for specialty suspension fluids.

DRO & Impact Forces Of Automotive Suspension System Lubricants Market

The market dynamics are governed by a complex interplay of growth drivers stemming from technological advances and market restraints related to regulatory hurdles and competition, balanced by emerging opportunities in niche segments. The primary drivers include the consistent growth in global vehicle manufacturing, particularly in emerging economies, and the increasing complexity of suspension systems (such as electronically controlled and pneumatic suspensions) which demand higher quality, specialized lubrication products. Conversely, the market faces significant restraints, notably the extended drain intervals mandated by OEMs using higher-performing synthetic fluids, which temporarily suppress replacement demand. Furthermore, the high initial cost associated with premium synthetic and bio-based lubricants can deter price-sensitive consumers in the mass market, particularly in the aftermarket segment.

Opportunities are predominantly concentrated in the Electric Vehicle (EV) segment. EVs, due to their instant torque delivery, substantial battery weight, and regenerative braking systems, place unique and often greater stresses on suspension components, necessitating lubricants optimized for vibration control and thermal dissipation. The rising focus on sustainability also presents an opportunity for bio-based and environmentally acceptable lubricants (EALs), especially in regions with strict environmental directives. Moreover, digital engagement, including sophisticated online service portals and direct-to-consumer models for specialty fluids, offers new avenues for market penetration and customer retention.

Impact forces illustrate the high bargaining power of large OEMs, who dictate lubricant specifications and volumes, thereby putting pressure on pricing and R&D investment for suppliers. Supplier power remains moderate, characterized by a few global chemical giants controlling key additive technologies. Threat of substitutes is low because suspension systems fundamentally require specialized fluids for operation, making generic substitutes unsuitable. The intensity of competitive rivalry is high, particularly in the highly fragmented aftermarket, where major international companies compete fiercely with regional players through pricing strategies, expansive distribution networks, and brand loyalty programs. Regulatory compliance regarding toxicity and disposal also acts as an external impact force, pushing innovation towards safer formulations.

Segmentation Analysis

The Automotive Suspension System Lubricants market is systematically segmented based on Type, Base Oil, Application, and Distribution Channel, reflecting the diverse requirements across the global automotive ecosystem. This segmentation provides a granular view of demand patterns, enabling manufacturers to tailor product development and marketing strategies effectively. Understanding these segments is crucial as demand shifts from conventional products to specialized high-performance fluids driven by technological evolution in vehicle design, particularly the move towards electrified platforms and advanced driver assistance systems (ADAS) that require highly stable and responsive suspension mechanisms.

Segmentation by Type reveals the dominance of hydraulic fluids and specialized shock absorber oils, which constitute the core consumption volume. Greases, while lower in volume, are essential for linkages, bushings, and joints, requiring robust extreme pressure (EP) capabilities. The Base Oil segmentation (Mineral vs. Synthetic) is perhaps the most dynamic, with synthetic and semi-synthetic fluids gaining significant market share due to their superior viscosity index, thermal stability, and extended service life, which aligns with modern OEM requirements for reduced maintenance and improved efficiency.

Application segmentation confirms the dominance of the Passenger Vehicle (PV) segment due to sheer volume, although the Commercial Vehicle (CV) segment provides higher revenue per vehicle due to large fluid volumes and the critical nature of component protection in heavy-duty fleets. Finally, the Distribution Channel split (OEM/OES vs. Aftermarket) dictates pricing and brand strategy, with the aftermarket being crucial for replacement cycles and carrying higher price margins for premium branded products. These structured segments help stakeholders identify high-growth areas and allocate resources for strategic expansion.

- By Type:

- Hydraulic Fluids

- Greases

- Shock Absorber Oils

- Specialty Damping Fluids (e.g., Magneto-Rheological Fluids)

- By Base Oil:

- Mineral Oil-based

- Synthetic Oil-based

- Semi-Synthetic Oil-based

- By Application:

- Passenger Vehicles (PV)

- Commercial Vehicles (CV)

- Heavy Duty Vehicles (HDV)

- Light Duty Vehicles (LDV)

- By Distribution Channel:

- Original Equipment Manufacturers (OEM)/Original Equipment Suppliers (OES)

- Aftermarket

- Retail Stores/Service Stations

- Independent Workshops

- Online Sales Platforms

Value Chain Analysis For Automotive Suspension System Lubricants Market

The value chain for automotive suspension system lubricants begins with the upstream segment involving the extraction and refinement of base oils (crude oil processing or synthetic chemical manufacturing) and the production of specialized chemical additives. Major international chemical companies and specialized additive producers hold significant influence in this initial stage, as proprietary additive packages determine the final performance characteristics, such as anti-foaming, anti-wear, and thermal stability. The cost of raw materials, particularly the price volatility of crude oil and complex synthetic chemicals, directly impacts the profitability of the midstream blending and formulation activities.

The midstream segment involves the blending, compounding, and packaging of the final lubricant products. Lubricant manufacturers, who may also be integrated upstream (controlling base oil production), take these raw materials and formulate them according to specific OEM or regulatory standards (e.g., ISO, SAE viscosity grades, or manufacturer-specific codes). Quality control and adherence to precise specifications are paramount in this stage, especially for safety-critical components like suspension systems. Investment in advanced blending technology and robust analytical testing facilities is crucial for maintaining market competitiveness and meeting highly differentiated product demands.

The downstream distribution channel is bifurcated into direct and indirect routes. The direct route primarily serves the OEM/OES segment, where bulk volumes of specified fluids are supplied directly to vehicle assembly lines or component manufacturers (e.g., shock absorber producers). The indirect route caters to the vast aftermarket through a complex network of regional distributors, wholesale dealers, independent garages, and retail service chains. Online distribution is rapidly growing, offering efficiency but also creating challenges related to counterfeiting. Effective supply chain management and strong partnerships with regional distributors are essential for maximizing market reach and ensuring timely availability of products for replacement cycles.

Automotive Suspension System Lubricants Market Potential Customers

The core potential customers and end-users of automotive suspension system lubricants can be broadly segmented into four distinct categories, each with unique purchasing criteria and consumption patterns. The largest and most influential buyer group is the Original Equipment Manufacturers (OEMs) of vehicles, including car, bus, and truck manufacturers. These buyers demand large volumes of lubricants that meet stringent performance specifications and consistency standards for factory fill, prioritizing technical partnership and supply reliability. Their purchasing decisions heavily influence the required formulation chemistry for the entire vehicle lifespan.

The second critical group comprises component manufacturers, specifically producers of shock absorbers, struts, and complex air suspension systems (OES). These manufacturers require specialized fluids tailored to their specific component designs to ensure optimal performance and warranty compliance. Their procurement criteria center on fluid longevity, temperature stability, and dampening precision. Success in supplying OES often translates into guaranteed aftermarket penetration, as vehicle owners tend to use OEM-approved replacements.

The aftermarket segment is highly diversified, encompassing independent service workshops, franchised dealership service centers, and large fleet operators (e.g., trucking companies, logistics firms, public transport providers). For fleet operators, the primary buying criteria are cost-effectiveness, extended service intervals, and reliability, as lubricant quality directly impacts vehicle uptime. Independent workshops and retail consumers prioritize brand trust, accessibility, and price point, often relying on the recommendations of mechanics or parts distributors for replacement fluids.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.58 Billion |

| Growth Rate | 4.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | FUCHS, ExxonMobil, Shell, TotalEnergies, Chevron, BP, Castrol, Klüber Lubrication, SK Lubricants, Petro-Canada Lubricants, Eneos Corporation, Idemitsu Kosan, Valvoline, Lukoil, Sinopec, Quaker Houghton, Rymax Lubricants, Lubrizol Corporation, Afton Chemical, Wacker Chemie AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Suspension System Lubricants Market Key Technology Landscape

The technological landscape of the Automotive Suspension System Lubricants Market is dominated by advancements aimed at improving fluid durability, thermal performance, and friction reduction to meet the evolving demands of modern vehicle architectures. A critical area of focus is the development of Group IV (PAO) and Group V (Ester) synthetic base oils, which offer superior viscosity indices and oxidative stability compared to traditional Group I/II mineral oils. These synthetic fluids are essential for high-performance and luxury vehicles equipped with sophisticated active and semi-active suspension systems that generate considerable heat and require extremely consistent damping force across a wide operational temperature range. Formulation technology relies heavily on advanced polymer chemistry and sophisticated additive packages that prevent seal degradation, minimize shear thinning, and provide enhanced protection against cavitation and corrosion within precision-engineered shock absorbers.

Another significant technological shift involves specialty fluids designed for novel suspension systems, such as Magneto-Rheological (MR) fluids. MR fluids contain microscopic magnetic particles suspended in a carrier liquid, allowing their viscosity and damping characteristics to be instantaneously controlled by an applied magnetic field. While currently niche, this technology is utilized in premium sports cars and specialized heavy equipment, driving research into stabilizing particle suspensions and mitigating sedimentation issues. Furthermore, the push for environmental sustainability is accelerating the adoption of readily biodegradable lubricants (RBLs) and bio-based synthetic esters derived from renewable sources, particularly in applications where leakage could pose an environmental risk.

Digitalization and material science convergence also define the current landscape. Nanotechnology is emerging, with researchers exploring the incorporation of nanoparticles (such as molybdenum disulfide or carbon nanotubes) into lubricant formulations to create "superlubricity" and further reduce friction and wear at critical suspension interfaces. Furthermore, process technology is advancing through increased automation in blending and quality testing, utilizing sensors and AI to ensure product integrity. This technological evolution ensures that lubricants not only protect components but actively contribute to the overall performance characteristics of the vehicle, particularly regarding fuel economy and dynamic driving stability.

Regional Highlights

- Asia Pacific (APAC): APAC is the fastest-growing and largest market, driven by high volume vehicle production (China, India, Japan, South Korea) and a rapidly expanding vehicle parc. Infrastructure limitations in developing economies often necessitate robust suspension systems and frequent lubricant changes, boosting aftermarket demand.

- North America: Characterized by high penetration of synthetic fluids, driven by demand from heavy-duty commercial fleets and the preference for premium passenger vehicles. Focus remains on extended drain intervals and compliance with US environmental standards.

- Europe: A mature market defined by strict regulatory frameworks (REACH) emphasizing environmental safety and efficiency. Strong demand for specialized lubricants for advanced European OEM platforms, including adaptive damping systems and bio-lubricants.

- Latin America: Growth is steady, linked to recovering automotive manufacturing sectors in Brazil and Mexico. Demand is price-sensitive, balancing between cost-effective mineral oils and performance-driven semi-synthetics for commercial fleets.

- Middle East and Africa (MEA): Growing due to infrastructure projects and increasing commercial fleet sizes. High ambient temperatures necessitate lubricants with exceptional thermal stability and oxidative resistance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Suspension System Lubricants Market.- FUCHS

- ExxonMobil

- Shell

- TotalEnergies

- Chevron

- BP

- Castrol (A BP subsidiary)

- Klüber Lubrication

- SK Lubricants

- Petro-Canada Lubricants

- Eneos Corporation

- Idemitsu Kosan

- Valvoline

- Lukoil

- Sinopec

- Quaker Houghton

- Rymax Lubricants

- Lubrizol Corporation

- Afton Chemical

- Wacker Chemie AG

Frequently Asked Questions

Analyze common user questions about the Automotive Suspension System Lubricants market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between shock absorber oil and hydraulic fluid?

While both are typically hydraulic-based, dedicated shock absorber oils are highly specialized, formulated with specific additives to resist foaming (cavitation) under rapid cycling, maintain viscosity consistency across extreme temperatures, and provide precise dampening control, unlike standard bulk hydraulic fluids.

How is the Electric Vehicle (EV) trend impacting the demand for suspension lubricants?

EVs require specialized synthetic suspension lubricants due to their heavier weight, which puts more stress on damping components, and their unique thermal profiles. Lubricants must offer superior thermal management and reduced friction to maximize battery range and optimize component lifespan.

Are synthetic suspension fluids worth the higher cost compared to mineral oil-based products?

Yes, synthetic fluids generally offer significant long-term value. They provide superior thermal and oxidative stability, leading to extended component life, consistent performance stability (dampening), and often permit extended service intervals, reducing overall maintenance costs and improving vehicle safety.

Which base oil type currently dominates the Automotive Suspension Lubricants Market?

While Mineral Oil-based fluids still hold substantial volume in the mass market aftermarket, Synthetic Oil-based lubricants are rapidly gaining dominance in terms of value and technical specification, particularly for OEM factory fill and high-performance replacement applications across developed regions.

What role does Magneto-Rheological (MR) technology play in this market?

MR technology utilizes highly specialized fluids whose viscosity can be controlled electronically in real-time via magnetic fields. This technology enables semi-active suspension systems to instantaneously adjust damping force, representing a small but highly valuable segment focused on premium vehicle performance and precision control.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager