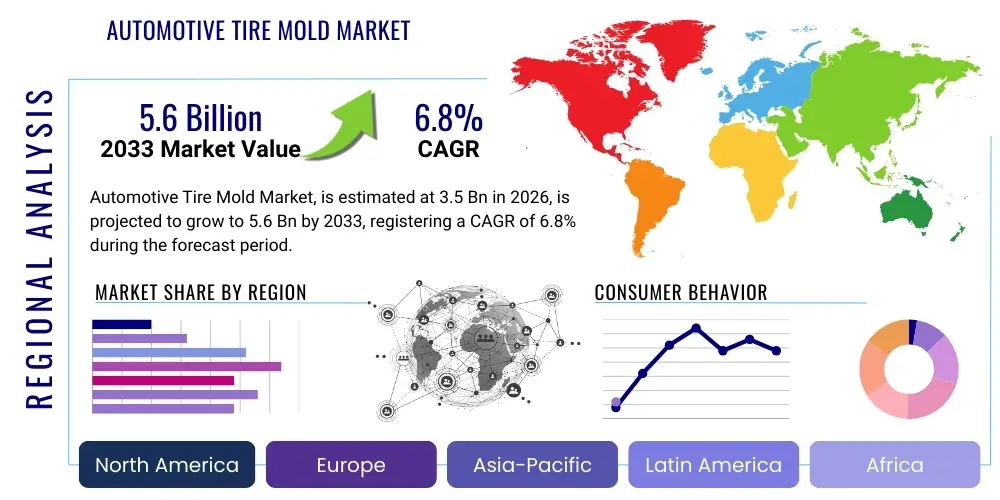

Automotive Tire Mold Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440064 | Date : Jan, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Automotive Tire Mold Market Size

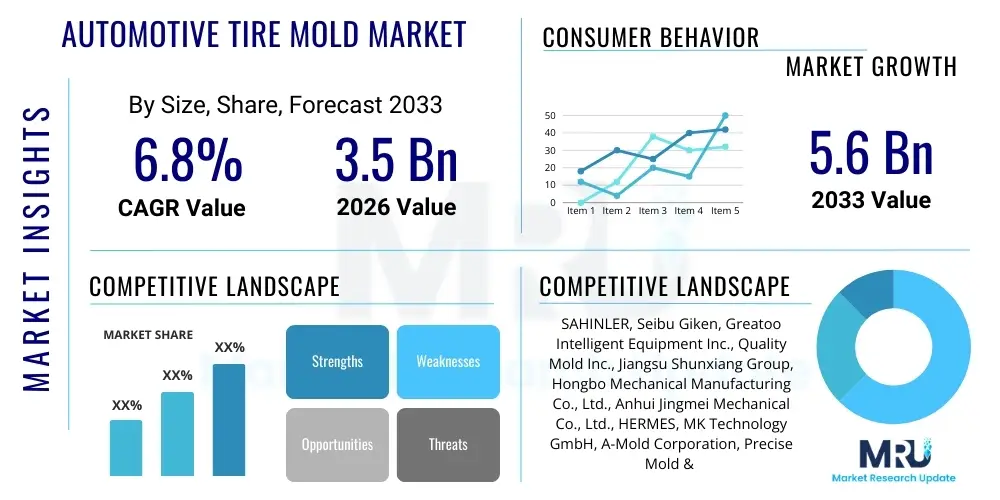

The Automotive Tire Mold Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.6 Billion by the end of the forecast period in 2033.

Automotive Tire Mold Market introduction

The automotive tire mold market is a critical, yet often overlooked, component within the expansive automotive industry, forming the backbone of tire manufacturing globally. These specialized molds are precision-engineered tools essential for shaping the raw rubber compounds into finished tires with specific tread patterns, sidewall designs, and structural integrity. The intricate design and manufacturing process of tire molds directly impact tire performance, safety, fuel efficiency, and aesthetic appeal. Their significance spans across various vehicle types, from passenger cars and light commercial vehicles to heavy-duty trucks and off-road machinery, dictating the quality and characteristics of every tire produced. The market's dynamism is inherently linked to global vehicle production trends, technological advancements in tire materials and designs, and evolving consumer demands for high-performance and eco-friendly tires.

The primary product categories within this market include segmented molds, two-piece molds, and bladder molds, each serving distinct purposes in the tire manufacturing process. Segmented molds, commonly used for radial tires, offer superior precision and flexibility in creating complex tread patterns, enabling tire manufacturers to achieve optimal grip, noise reduction, and water dispersion characteristics. Two-piece molds are typically employed for bias tires or specific applications requiring simpler designs, while bladder molds facilitate the vulcanization process by applying internal pressure and heat. Major applications span original equipment (OE) manufacturers and the aftermarket, supporting both new vehicle production and replacement tire demand. The benefits derived from advanced tire mold technology are multifaceted, encompassing enhanced tire durability, improved vehicle handling, reduced rolling resistance for better fuel economy, and the ability to produce tires tailored for specific driving conditions and performance requirements.

The market is predominantly driven by several macroeconomic and industry-specific factors. The steady growth in global automotive production, particularly in emerging economies, directly fuels the demand for new tires and, consequently, tire molds. The increasing adoption of electric vehicles (EVs) is a significant catalyst, as EVs often require specialized tires and molds designed to handle higher torque, heavier battery packs, and silent operation. Furthermore, continuous innovation in tire technology, such as the development of smart tires, self-healing tires, and lightweight, sustainable tire materials, necessitates corresponding advancements in mold design and manufacturing techniques. Regulatory pressures worldwide for improved fuel efficiency and reduced emissions also push tire manufacturers to invest in cutting-edge mold technology to produce tires with lower rolling resistance, thereby stimulating market expansion and technological innovation.

Automotive Tire Mold Market Executive Summary

The Automotive Tire Mold Market is experiencing robust growth driven by a confluence of global business trends, dynamic regional shifts, and significant segment-specific advancements. Global business trends highlight increased investment in advanced manufacturing technologies, with tire mold producers focusing on automation, digitalization, and predictive analytics to enhance efficiency and precision. The market is also characterized by a heightened emphasis on sustainability, prompting research and development into molds that facilitate the production of eco-friendly tires from recycled or bio-based materials. Strategic collaborations between mold manufacturers and tire companies are becoming more common, fostering innovation and accelerating product development cycles. Furthermore, consolidation through mergers and acquisitions is shaping the competitive landscape, as companies seek to expand their technological capabilities, market share, and geographic reach, thereby driving efficiency and optimizing supply chains.

Regional trends reveal a distinct pattern of growth and maturity across different geographies. The Asia-Pacific region, particularly China, India, and Southeast Asian countries, stands out as the primary growth engine due to booming automotive production, rapidly expanding vehicle fleets, and rising disposable incomes. This region benefits from significant investments in manufacturing infrastructure and a burgeoning middle class driving new vehicle sales. In contrast, North America and Europe represent mature markets, where growth is primarily driven by technological upgrades, replacement demand, and the increasing penetration of premium and specialty tires, including those for electric vehicles. These regions prioritize innovation in mold design for advanced tire characteristics, stricter regulatory compliance, and the adoption of industry 4.0 practices in mold manufacturing to maintain a competitive edge and address evolving environmental standards.

Segment trends underscore shifts towards more sophisticated and specialized mold types. The radial tire mold segment continues to dominate the market, reflecting the widespread adoption of radial tires in passenger cars and commercial vehicles due to their superior performance, durability, and fuel efficiency. There is a growing demand for molds capable of producing high-performance, ultra-high-performance, and all-season tires, necessitating more complex designs and robust materials. The advent of electric vehicles is creating a new niche for specialized tire molds designed for EV-specific tires, which require different load-bearing capacities, noise reduction properties, and lower rolling resistance. Furthermore, advancements in mold material science, such as the increasing use of high-strength alloys and specialized coatings, are improving mold lifespan and reducing maintenance, directly impacting manufacturing efficiency and overall market dynamics across various segments.

AI Impact Analysis on Automotive Tire Mold Market

User questions regarding the impact of AI on the Automotive Tire Mold Market frequently revolve around how artificial intelligence can revolutionize design processes, enhance manufacturing precision, optimize operational efficiency, and contribute to predictive maintenance. Key themes emerging from these inquiries include the potential for AI-driven algorithms to accelerate the development of complex tread patterns and sidewall designs, thereby shortening time-to-market for new tire models. There is also significant interest in AI's role in improving the quality and consistency of mold production through real-time monitoring and anomaly detection. Users are keen to understand how AI can reduce material waste, energy consumption, and overall operational costs in mold manufacturing, ultimately leading to more sustainable practices. Furthermore, expectations are high for AI to enable predictive maintenance of molds, minimizing downtime and extending their operational lifespan, which are critical factors for tire manufacturers seeking to maximize production output and minimize expenses.

- Design Optimization and Acceleration: AI algorithms can rapidly generate and evaluate complex tire tread patterns and mold designs, optimizing for performance characteristics like grip, noise reduction, and rolling resistance, significantly reducing design cycles.

- Enhanced Precision Manufacturing: AI-powered vision systems and machine learning models integrate with CNC machining to monitor manufacturing processes in real-time, detecting micro-defects and ensuring unparalleled precision in mold production.

- Predictive Maintenance and Lifespan Extension: AI analyzes sensor data from molds during operation to predict potential failures, scheduling maintenance proactively, reducing unexpected downtime, and extending the operational life of expensive molds.

- Quality Control and Defect Detection: AI-driven inspection systems automatically identify surface imperfections, wear, and other defects in molds, ensuring only high-quality molds proceed to tire production, thereby improving overall tire quality.

- Material Optimization and Waste Reduction: AI can simulate material flows and thermal distribution during mold manufacturing, optimizing material usage, reducing scrap rates, and contributing to more sustainable and cost-efficient production.

- Supply Chain and Inventory Management: AI models can forecast demand for different mold types, optimize raw material procurement, and streamline inventory management, ensuring timely availability of necessary components and reducing holding costs.

- Process Automation and Efficiency: AI facilitates greater automation in mold manufacturing processes, from CAD/CAM integration to robotic handling, leading to increased throughput, reduced labor costs, and consistent output quality.

- Personalized Tire Customization: AI could enable quicker development of highly specialized molds for niche or custom tire designs, responding to specific vehicle manufacturer requirements or unique consumer demands with greater agility.

DRO & Impact Forces Of Automotive Tire Mold Market

The Automotive Tire Mold Market is propelled by a robust set of drivers, constrained by specific challenges, and presented with significant opportunities, all influenced by various impact forces. Key drivers include the consistent growth in global automotive production, particularly the surge in electric vehicle manufacturing, which demands specialized tire molds. The continuous evolution of tire technology, such as the development of smart tires, self-sealing capabilities, and low rolling resistance designs, necessitates innovation in mold design and manufacturing processes. Furthermore, stringent regulatory standards for vehicle safety, fuel efficiency, and emissions globally compel tire manufacturers to invest in advanced molds capable of producing high-performance, environmentally compliant tires. The increasing disposable income in emerging economies also fuels new vehicle purchases, directly translating into higher demand for both OE and replacement tires, and thus for tire molds.

Despite the favorable growth drivers, the market faces several significant restraints. High capital investment required for establishing and upgrading mold manufacturing facilities poses a barrier to entry for new players and can strain the financial resources of existing ones. The inherent technological complexity involved in designing and producing precision tire molds necessitates specialized expertise and advanced machinery, making R&D costs substantial. Volatility in raw material prices, particularly for high-grade steel and aluminum alloys used in mold construction, directly impacts production costs and profit margins. Moreover, environmental regulations regarding manufacturing processes and waste disposal add compliance costs and operational complexities. The extended lifespan of a tire mold, while a benefit for tire manufacturers, can sometimes lead to slower replacement cycles, thus tempering demand for new molds in certain segments.

Opportunities for growth are abundant within the market, primarily stemming from the accelerating shift towards smart manufacturing and Industry 4.0 practices. The adoption of advanced technologies like additive manufacturing (3D printing) for mold components, advanced simulation software, and robotic automation presents avenues for improved efficiency, reduced lead times, and enhanced design flexibility. The rising demand for specialized tires for electric and autonomous vehicles represents a significant untapped market segment, requiring new and innovative mold solutions. Emerging economies, with their rapidly expanding automotive sectors and increasing urbanization, offer substantial growth potential for mold manufacturers. Furthermore, continuous research into lightweight and sustainable mold materials can lead to cost savings and environmental benefits, attracting investments and creating differentiation in a competitive market.

Segmentation Analysis

The Automotive Tire Mold Market is meticulously segmented based on various critical parameters, providing a comprehensive understanding of its intricate structure and diverse dynamics. These segmentations allow for a granular analysis of market trends, consumer preferences, and technological shifts across different product types, tire types, vehicle applications, and materials. Understanding these distinct segments is crucial for stakeholders to identify lucrative opportunities, tailor product offerings, and devise effective market penetration strategies. The market's complexity necessitates such detailed categorization to reflect the diverse needs of tire manufacturers and the varying demands of the automotive industry as a whole. Each segment responds to unique drivers and faces specific challenges, contributing to the overall market's growth trajectory and competitive landscape, highlighting areas of rapid expansion versus mature demand.

- By Product Type:

- Segmented Molds: High precision, complex tread patterns, ideal for radial tires.

- Two-Piece Molds: Simpler designs, cost-effective, often used for bias tires or specific applications.

- Bladder Molds: Essential for the vulcanization process, applying heat and pressure.

- Others: Including segment molds, full circle molds, etc., catering to specialized needs.

- By Tire Type:

- Radial Tire Molds: Dominant segment due to widespread use of radial tires in passenger cars and commercial vehicles.

- Bias Tire Molds: Used for specific applications, older vehicle models, or certain heavy-duty tires.

- By Vehicle Type:

- Passenger Cars: Largest segment, driven by global vehicle sales and diverse tire requirements.

- Commercial Vehicles: Includes Light Commercial Vehicles (LCV) and Heavy Commercial Vehicles (HCV), demanding robust and durable molds.

- Off-Road Vehicles: Molds for ATVs, construction vehicles, agricultural machinery requiring specific rugged tread patterns.

- Two-Wheelers: Motorcycles, scooters, requiring specialized smaller molds.

- By Material:

- Steel Molds: Traditional, durable, widely used for their strength and heat resistance.

- Aluminum Molds: Lighter, offer faster heating/cooling cycles, suitable for certain applications.

- Others: Hybrid materials, specialized alloys, or coatings for enhanced performance and lifespan.

- By Application:

- Original Equipment (OE): Molds supplied directly to tire manufacturers for new vehicle production.

- Aftermarket: Molds used for replacement tires, catering to ongoing vehicle maintenance needs.

Value Chain Analysis For Automotive Tire Mold Market

A comprehensive value chain analysis for the Automotive Tire Mold Market reveals a highly specialized and interconnected ecosystem, beginning with the meticulous sourcing of raw materials and extending through complex manufacturing processes to the final distribution channels. The upstream segment involves critical suppliers of high-grade steel alloys, aluminum, and other specialized metals, which form the foundational components of tire molds. Precision engineering firms also play a crucial role in supplying advanced CAD/CAM software and CNC machining equipment, which are indispensable for the intricate design and manufacturing of molds. These upstream activities are characterized by strict quality control, technological expertise, and robust supply chain management, as the quality of raw materials and machinery directly dictates the precision and durability of the finished molds. Relationships with these suppliers are often long-term and strategic, focusing on consistent quality and technological partnership to meet evolving industry standards.

Moving downstream, the primary customers for automotive tire molds are large-scale global tire manufacturers such as Michelin, Goodyear, Bridgestone, Continental, and Sumitomo, alongside numerous regional and specialized tire producers. These tire manufacturers integrate the molds into their tire production lines, where the molds facilitate the vulcanization process, imprinting the final tread patterns and sidewall designs onto raw rubber compounds. The choice of mold supplier by these downstream players is heavily influenced by factors such as mold precision, durability, lead times, technological capabilities for complex designs, and cost-effectiveness. The performance of the tire mold directly impacts the quality, safety, and efficiency of the tires produced, making it a critical strategic asset for tire manufacturers. Therefore, mold manufacturers often engage in close collaboration with tire companies during the design and development phases to ensure the molds meet exact specifications and performance requirements for new tire models.

The distribution channels for automotive tire molds are predominantly direct, especially for large, bespoke orders from major tire manufacturers. Mold manufacturers typically sell directly to their end-user tire companies, fostering direct communication, technical support, and customization services. This direct sales model ensures a deep understanding of customer needs and allows for the provision of highly specialized solutions. However, for smaller regional tire producers or specific aftermarket applications, an indirect distribution channel involving specialized distributors or agents may also exist. These intermediaries can provide localized sales support, technical assistance, and quicker delivery for standardized molds or replacement parts. The value chain is characterized by a strong emphasis on technical expertise, customer service, and robust after-sales support, reflecting the high-value and mission-critical nature of tire molds in the automotive industry. This integrated approach ensures efficient product delivery and consistent quality throughout the entire manufacturing ecosystem.

Automotive Tire Mold Market Potential Customers

The potential customers for the Automotive Tire Mold Market primarily comprise a diverse range of tire manufacturers, extending from global industry giants to specialized regional players, all of whom are dependent on high-quality molds for their production operations. The most prominent end-users are the Tier 1 global tire manufacturers, including companies like Michelin, Bridgestone, Goodyear, Continental, Pirelli, Sumitomo, and Yokohama. These multinational corporations operate numerous manufacturing facilities worldwide and continuously invest in advanced mold technology to produce a vast array of tires for passenger vehicles, commercial trucks, aircraft, and off-road applications. Their demand for tire molds is driven by ongoing innovation in tire design, the expansion of production capacities, and the necessity to replace worn-out molds, ensuring consistent quality and meeting stringent performance standards across their product lines. They often seek custom-engineered molds that offer superior precision, durability, and efficiency, directly impacting their competitive edge in the tire market.

Beyond the top-tier global players, the market also serves a significant number of regional and specialized tire manufacturers. These companies might focus on specific market segments, such as agricultural tires, industrial tires, solid tires, or retread tires, each requiring specialized molds tailored to their unique product specifications. While their individual order volumes might be smaller than those of global giants, collectively they represent a substantial and growing customer base, often prioritizing cost-effectiveness and reliable local support from mold suppliers. Furthermore, emerging market tire manufacturers in Asia, Latin America, and Africa are increasingly becoming important customers as they expand their production capabilities to meet rising domestic and export demands. These manufacturers are often looking for a balance of advanced technology and competitive pricing, representing a key growth demographic for tire mold suppliers.

Indirectly, automotive Original Equipment Manufacturers (OEMs) also influence the demand for tire molds. While OEMs do not directly purchase molds, their specifications for new vehicle tires drive the design and development of innovative tires by tire manufacturers. This, in turn, dictates the type and complexity of molds required. For instance, the growing market for electric vehicles has led to OEMs demanding tires with specific noise reduction, weight, and rolling resistance properties, compelling tire manufacturers to invest in new molds capable of producing these specialized EV tires. Therefore, mold manufacturers must stay abreast of OEM trends and collaborate closely with tire companies to anticipate future mold requirements. Ultimately, the entire automotive industry's health, including vehicle production rates, technological advancements, and consumer purchasing patterns, directly translates into the demand dynamics for automotive tire molds across this varied customer landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.6 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SAHINLER, Seibu Giken, Greatoo Intelligent Equipment Inc., Quality Mold Inc., Jiangsu Shunxiang Group, Hongbo Mechanical Manufacturing Co., Ltd., Anhui Jingmei Mechanical Co., Ltd., HERMES, MK Technology GmbH, A-Mold Corporation, Precise Mold & Plate, M.T.S. Srl, Sanfelippo, Dong-A Rubber Co., Ltd., Yantai Shougang Steel Pipe Manufacturing Co., Ltd., Goma Engineering PVT. LTD., JINHE PRECISION MOLD, Toyo Tanso Co., Ltd., Continental Molds Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Tire Mold Market Key Technology Landscape

The Automotive Tire Mold Market is characterized by a sophisticated and rapidly evolving technology landscape, with advancements continuously pushing the boundaries of precision, efficiency, and design complexity. Central to this landscape are Computer-Aided Design (CAD) and Computer-Aided Manufacturing (CAM) systems, which form the bedrock of modern mold development. CAD software allows engineers to create highly detailed 3D models of tire treads and sidewall patterns, enabling complex simulations and rapid prototyping of designs. CAM then translates these digital designs into precise instructions for manufacturing machinery, ensuring accuracy and consistency. These integrated systems facilitate rapid iteration and optimization, crucial for reducing development cycles and bringing innovative tire designs to market faster. The seamless integration of CAD/CAM also enables the creation of highly intricate mold features necessary for advanced tire performance characteristics, such as specialized siping and noise-reducing patterns.

Precision machining technologies, particularly multi-axis Computer Numerical Control (CNC) milling, are indispensable in the actual fabrication of tire molds. CNC machines can execute highly complex operations with micron-level accuracy, carving intricate patterns into hard metals like steel and aluminum. Laser engraving technology has also become vital for producing the fine details on mold surfaces, including micro-sipes, branding, and other aesthetic elements, which are critical for tire performance and branding. Furthermore, heat treatment processes, such as nitriding and carburizing, are extensively employed to enhance the surface hardness, wear resistance, and overall durability of the molds, extending their operational lifespan and reducing maintenance requirements. These processes are crucial given the extreme temperatures and pressures molds endure during the tire vulcanization process, necessitating materials that can withstand rigorous, repetitive industrial use.

Beyond traditional manufacturing, additive manufacturing, commonly known as 3D printing, is emerging as a transformative technology in the tire mold sector. While not yet universally used for entire molds, 3D printing is increasingly utilized for producing mold inserts, vents, or complex cooling channels that are difficult or impossible to create with conventional machining methods. This allows for customized designs, optimized thermal management within the mold, and quicker prototyping of new features. Advanced surface coatings, such as PVD (Physical Vapor Deposition) or DLC (Diamond-Like Carbon), are also gaining traction to improve mold release properties, reduce friction, prevent fouling from rubber compounds, and further enhance wear resistance, contributing to higher quality tires and longer mold life. The integration of sensors and data analytics, forming part of the broader Industry 4.0 movement, is enabling predictive maintenance and real-time process monitoring, further optimizing mold utilization and efficiency within the smart manufacturing paradigm.

Regional Highlights

- North America: A mature market characterized by a focus on high-performance and specialty tires, particularly for SUVs, light trucks, and electric vehicles. Demand is driven by replacement market needs, stringent safety regulations, and continuous R&D investment in advanced tire technologies. Key players in this region prioritize innovation in mold design and manufacturing processes to support premium tire segments and sustainable production.

- Europe: This region is defined by strong environmental regulations and a high demand for fuel-efficient and low-emission tires, propelling innovation in mold technology. Europe is a hub for high-end vehicle manufacturing, leading to consistent demand for precision molds for premium and ultra-high-performance tires. The shift towards electric vehicles and smart mobility solutions further stimulates demand for specialized molds.

- Asia Pacific (APAC): The largest and fastest-growing market globally, driven by robust automotive production in countries like China, India, Japan, and South Korea. Rapid urbanization, increasing disposable incomes, and expanding vehicle fleets contribute significantly to both OE and aftermarket tire demand. The region is witnessing substantial investments in mold manufacturing capabilities and is a key driver for market expansion due to its sheer production volume.

- Latin America: An emerging market with growing potential, influenced by economic development and increasing vehicle ownership. While currently smaller, the region is expected to experience steady growth in tire production and, consequently, tire mold demand. Focus is often on cost-effective solutions alongside increasing adoption of modern manufacturing techniques.

- Middle East and Africa (MEA): This region is an evolving market with varying levels of industrial development. Growth is primarily driven by expanding transportation infrastructure, increasing commercial vehicle fleets, and rising consumer demand for vehicles. The market here relies on a mix of local production growth and imports, with a gradual increase in demand for more advanced mold technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Tire Mold Market.- SAHINLER

- Seibu Giken

- Greatoo Intelligent Equipment Inc.

- Quality Mold Inc.

- Jiangsu Shunxiang Group

- Hongbo Mechanical Manufacturing Co., Ltd.

- Anhui Jingmei Mechanical Co., Ltd.

- HERMES

- MK Technology GmbH

- A-Mold Corporation

- Precise Mold & Plate

- M.T.S. Srl

- Sanfelippo

- Dong-A Rubber Co., Ltd.

- Yantai Shougang Steel Pipe Manufacturing Co., Ltd.

- Goma Engineering PVT. LTD.

- JINHE PRECISION MOLD

- Toyo Tanso Co., Ltd.

- Continental Molds Ltd.

Frequently Asked Questions

Analyze common user questions about the Automotive Tire Mold market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate for the Automotive Tire Mold Market?

The Automotive Tire Mold Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033, reaching an estimated USD 5.6 Billion by 2033.

Which regions are expected to drive the growth of the Automotive Tire Mold Market?

The Asia Pacific (APAC) region is expected to be the primary growth engine due to booming automotive production and expanding vehicle fleets, while North America and Europe will see growth from technological upgrades and premium tire demand.

What are the key technological advancements impacting the Automotive Tire Mold Market?

Key advancements include CAD/CAM integration, multi-axis CNC machining, laser engraving, advanced heat treatments, and the emerging use of additive manufacturing (3D printing) for complex mold components and smart manufacturing integration (Industry 4.0).

How is the rise of electric vehicles (EVs) influencing the Automotive Tire Mold Market?

The increasing adoption of EVs is a significant driver, creating demand for specialized tire molds designed for EV-specific tires, which require different load-bearing capacities, noise reduction, and lower rolling resistance properties.

What are the main challenges faced by manufacturers in the Automotive Tire Mold Market?

Manufacturers face challenges such as high capital investment requirements, technological complexity, volatility in raw material prices (e.g., steel, aluminum), stringent environmental regulations, and the need for highly specialized technical expertise.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager