Automotive Tire Tread Sensors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434475 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Automotive Tire Tread Sensors Market Size

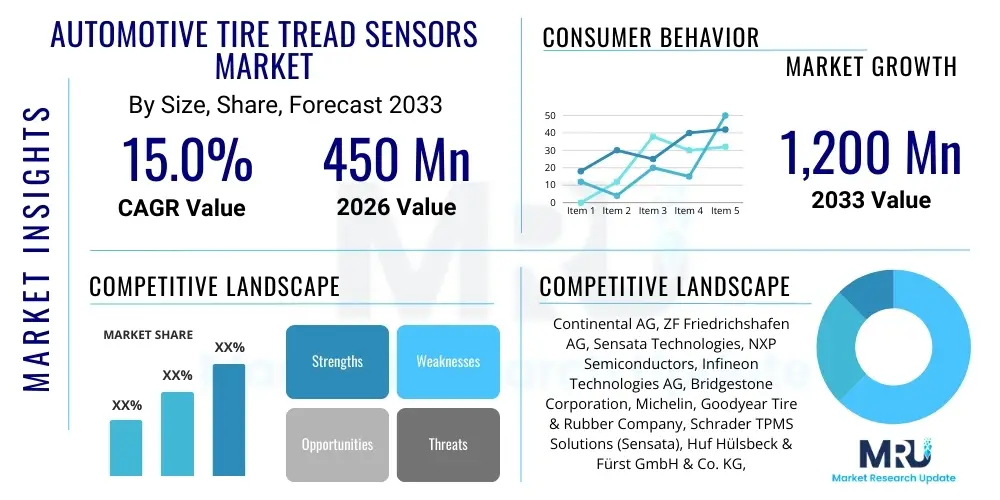

The Automotive Tire Tread Sensors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.0% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 1,200 Million by the end of the forecast period in 2033.

Automotive Tire Tread Sensors Market introduction

The Automotive Tire Tread Sensors Market encompasses advanced electronic systems designed to continuously monitor the depth and wear characteristics of vehicle tire treads. These sensors, often integrated with existing Tire Pressure Monitoring Systems (TPMS) or operating as standalone units utilizing technologies like capacitive, magnetic, or laser scanning, provide real-time data to the driver and vehicle management systems. The primary function is to enhance vehicle safety, optimize tire lifespan, and improve fuel efficiency by ensuring tires are maintained within optimal wear limits. This technology is increasingly critical in modern vehicles, especially those equipped with Advanced Driver Assistance Systems (ADAS) and autonomous capabilities, which rely heavily on precise vehicular stability data.

Major applications of these sensors span across both passenger and commercial vehicle segments. For passenger vehicles, the key benefits include proactive safety warnings regarding hydroplaning risk and ensuring compliance with regional safety inspections. In the commercial sector, particularly for large truck fleets and buses, tread depth monitoring is crucial for maintenance planning, reducing downtime, and ensuring regulatory compliance concerning operational safety standards. The integration of these sensors into the broader Internet of Things (IoT) framework allows fleet managers to remotely track tire health across numerous assets, leading to predictive maintenance capabilities.

The market is primarily driven by stringent global safety regulations mandating tire health monitoring, the escalating adoption of connected and autonomous vehicles requiring sophisticated real-time component data, and growing consumer awareness regarding the correlation between tread depth and braking performance. Furthermore, rising fuel costs incentivize fleet operators to adopt solutions that minimize rolling resistance caused by improper tire wear. Technological advancements, particularly in cost-effective micro-electromechanical systems (MEMS) sensors and wireless data transmission protocols, are accelerating market expansion globally.

Automotive Tire Tread Sensors Market Executive Summary

The Automotive Tire Tread Sensors Market is experiencing robust expansion driven by safety mandates and the technological transition towards smart mobility. Key business trends include the strong shift toward OEM integration, where sensor solutions are embedded during vehicle manufacture, ensuring higher accuracy and system reliability compared to aftermarket retrofitting. Regional dynamics indicate Asia Pacific as the fastest-growing market, propelled by massive automotive production output in countries like China and India, coupled with tightening vehicular safety standards in emerging economies. North America and Europe remain foundational markets, focusing on leveraging these sensors for insurance risk reduction and seamless integration with complex ADAS platforms.

Segment-wise, capacitive and laser/optical sensors dominate the market due to their accuracy and reliability in varying environmental conditions. The commercial vehicle segment is witnessing particularly strong adoption, driven by the high cost associated with tire replacement and the absolute necessity of minimizing non-scheduled vehicle downtime. In terms of technology, the move from purely reactive measurement systems to proactive, AI-driven predictive analytics based on tread wear data represents a significant trend. This integration enables sophisticated algorithms to forecast remaining tire life, optimizing purchasing cycles and inventory management for large fleets.

Overall market direction is characterized by collaborative partnerships between sensor manufacturers, TPMS providers, and major automotive OEMs to standardize communication protocols and data output formats. Investments in miniaturization and enhanced power efficiency are critical focuses for research and development, ensuring that these sensors can operate reliably for the entire lifespan of the tire without requiring external power sources or frequent maintenance. The market outlook is overwhelmingly positive, underpinned by the inevitable increase in regulatory oversight concerning vehicle safety.

AI Impact Analysis on Automotive Tire Tread Sensors Market

Common inquiries concerning the integration of Artificial Intelligence (AI) in the Automotive Tire Tread Sensors Market center around how AI enhances the utility of raw sensor data, improves predictive maintenance accuracy, and contributes to the safety profile of autonomous vehicles. Users are keen to understand if AI can distinguish between different types of tread wear (e.g., misalignment wear versus normal wear), how it affects decision-making systems in real-time during adverse weather, and the feasibility of creating digital twins of tires using continuous AI analysis. Key concerns revolve around data privacy, the processing power required for edge computing applications, and the standardization of AI models across different vehicle brands and tire types.

- AI enables predictive failure analysis by processing historical tread data, temperature, and pressure fluctuations, forecasting tire replacement needs with higher precision than simple threshold monitoring.

- Machine learning algorithms enhance sensor accuracy by compensating for environmental noise, road surface variability, and sensor drift over time.

- AI facilitates autonomous vehicle safety protocols by providing optimized real-time grip estimates, crucial for modulating braking and steering inputs during high-speed maneuvers or sudden changes in road conditions.

- Deep learning is employed for pattern recognition to identify anomalous wear patterns (such as uneven shoulder wear or central rib wear), signaling potential mechanical issues like improper alignment or suspension problems.

- Generative AI models assist OEMs in optimizing tire design and material composition based on aggregated real-world wear data collected by fleets of AI-integrated sensors.

- Edge AI processing minimizes latency, allowing vehicles to make immediate safety adjustments without reliance on cloud communication for critical tread health assessments.

DRO & Impact Forces Of Automotive Tire Tread Sensors Market

The market dynamics are governed by a robust interplay between mandated safety requirements (Drivers), technological hurdles in sensor integration (Restraints), and the vast potential stemming from autonomous mobility and fleet electrification (Opportunities). Key impact forces include regulatory pressure from government bodies, the rapid pace of sensor technology development pushing miniaturization and accuracy, and the competitive strategies of established TPMS players seeking to consolidate their position by incorporating tread sensing capabilities. The high initial investment costs for OEMs to redesign wheel assemblies for seamless sensor integration pose a significant constraint, especially for lower-cost vehicle segments. However, the compelling long-term return on investment (ROI) derived from reduced maintenance and improved safety compliance acts as a powerful lever driving adoption forward.

Drivers include the increasing severity of safety standards, exemplified by regulations in Europe and North America focusing on preventing road accidents caused by worn tires. The growth of the commercial logistics sector and its demand for operational efficiency directly fuels the need for real-time asset monitoring, making tread sensors essential for minimizing tire-related breakdowns. Furthermore, the rise of connected vehicle ecosystems provides a perfect infrastructure for transmitting and analyzing the large volumes of data generated by these advanced sensors, optimizing their utility beyond simple warning indicators.

Restraints primarily involve the technical challenge of ensuring sensor durability under extreme road conditions, including exposure to dirt, moisture, high impact, and broad temperature swings, all while maintaining precise measurement accuracy over several years. Data security concerns related to transmitting sensitive vehicle operational data also restrict deployment in certain markets. Opportunities lie in developing low-power, batteryless sensors (e.g., energy harvesting solutions) to eliminate maintenance requirements and integrating tire data with Vehicle-to-Everything (V2X) communication, allowing proactive warnings about road surface conditions based on aggregate fleet tire performance data. The transition to electric vehicles (EVs), which put different strains on tires due to immediate torque and increased weight, creates a distinct new segment demanding customized tread sensing solutions.

Segmentation Analysis

The Automotive Tire Tread Sensors Market is comprehensively segmented based on the technology utilized, the type of vehicle application, the specific sales channel, and the regional market dynamics. This detailed breakdown provides stakeholders with granular insights into adoption patterns and investment priorities. Sensor Type segmentation is crucial, differentiating between established, high-precision laser-based systems often used in premium and commercial sectors, and the more cost-effective, easily integrated capacitive or magnetic sensor solutions prevalent in standard passenger vehicles. The Application segmentation clearly defines the differing needs of the Passenger Vehicle market, focused on consumer safety and regulatory compliance, versus the Commercial Vehicle market, which prioritizes operational uptime and total cost of ownership reduction.

- By Sensor Type: Capacitive Sensors, Magnetic Sensors, Ultrasonic Sensors, Laser/Optical Sensors, Other Advanced Technologies

- By Vehicle Type: Passenger Vehicles, Commercial Vehicles (Light Commercial Vehicles, Heavy Commercial Vehicles, Buses)

- By Sales Channel: OEM (Original Equipment Manufacturer), Aftermarket (OES, Independent Workshops)

- By Connectivity and System: Direct TPMS Integrated Systems, Standalone Systems (Internal/External), IoT/Cloud-Connected Monitoring

- By Region: North America (US, Canada, Mexico), Europe (Germany, UK, France, Italy, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Rest of APAC), Latin America (Brazil, Argentina, Rest of LATAM), Middle East & Africa (UAE, Saudi Arabia, South Africa, Rest of MEA)

Value Chain Analysis For Automotive Tire Tread Sensors Market

The value chain for the Automotive Tire Tread Sensors Market begins with upstream activities focused on the production and sourcing of microchip components, MEMS, power modules, and raw materials (polymers, metallic alloys). Semiconductor manufacturers and specialized sensor component providers form the base, often requiring high-precision fabrication facilities. Midstream activities involve the core sensor manufacturing, assembly, calibration, and integration with wireless transmitters and microprocessors. This stage is critical for maintaining quality and complying with stringent automotive safety standards (e.g., AEC-Q100 qualification). Specialized Tier 2 suppliers often handle the complex sensor unit production before delivering them to Tier 1 automotive suppliers.

The downstream segment involves the integration of the finished sensor module into the wheel assembly or tire itself. For OEM sales, Tier 1 suppliers like Continental, Bosch, or ZF incorporate these sensors into the vehicle’s TPMS or central control unit during the manufacturing phase, requiring close collaboration with vehicle designers. The aftermarket channel involves independent repair shops and specialized tire service centers purchasing standalone or external retrofit kits directly from manufacturers or through established distribution networks. Distribution channels are highly fragmented, leveraging both direct sales for major commercial fleets and complex distributor networks for the global aftermarket.

Direct channels are preferred for high-volume OEM contracts where customization and technical support are paramount. Indirect channels, utilizing wholesalers, regional distributors, and online retailers, serve the substantial retrofit and replacement market. Efficient logistics and inventory management are crucial, especially in the aftermarket, where standardization of sensor protocols is often lacking, requiring distributors to stock a wide variety of compatible units. Ensuring post-sale support, including software updates and calibration services, adds significant value across the entire chain, particularly as sensor data integrates deeper into vehicle diagnostics.

Automotive Tire Tread Sensors Market Potential Customers

The customer base for automotive tire tread sensors is bifurcated across several key sectors, driven by different motivations—safety for consumers and operational efficiency for commercial entities. Original Equipment Manufacturers (OEMs) such as BMW, Daimler, Ford, and Toyota are primary large-volume buyers, integrating these systems directly into new vehicle platforms to meet safety regulations and offer advanced features. Their motivation is driven by compliance, competitive advantage in vehicle features, and seamless integration with complex ADAS systems. This segment demands high reliability, small form factor, and long-term warranties.

The second major category includes commercial fleet operators—spanning logistics companies, bus operators, construction fleets, and rental car agencies. For these users, tires represent one of the largest operational expenses, and maximizing mileage while minimizing sudden breakdowns is paramount. These buyers seek durable, high-accuracy sensors that provide real-time data integration with existing Fleet Management Systems (FMS). Adoption in this segment is driven purely by ROI derived from predictive maintenance, reduced fuel consumption, and insurance premium optimization.

Finally, independent tire service centers, repair garages, and individual vehicle owners (via the aftermarket) constitute the third critical segment. While the aftermarket adoption rate is currently lower than OEM, it is growing rapidly as consumers become aware of the safety benefits of monitoring tread wear. These customers typically purchase easily installable external or internal retrofit systems. Regulatory bodies and vehicle testing agencies also act as influential stakeholders, setting the standards and potentially mandating the widespread adoption of these sensing technologies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 1,200 Million |

| Growth Rate | CAGR 15.0% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Continental AG, ZF Friedrichshafen AG, Sensata Technologies, NXP Semiconductors, Infineon Technologies AG, Bridgestone Corporation, Michelin, Goodyear Tire & Rubber Company, Schrader TPMS Solutions (Sensata), Huf Hülsbeck & Fürst GmbH & Co. KG, Bendix Commercial Vehicle Systems LLC, WABCO (ZF), Siemens VDO, Bosch Mobility Solutions, Stoneridge Inc., Fobo Tire, Mobileye (Intel), TTE-Europe GmbH, Murata Manufacturing Co., Ltd., Denso Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Tire Tread Sensors Market Key Technology Landscape

The technology landscape for automotive tire tread sensors is rapidly evolving, moving beyond simple depth measurements to highly sophisticated material analysis and integrated digital tire solutions. Capacitive sensors, which measure tread loss by detecting changes in electrical capacitance as rubber wears down, represent a common, cost-effective method primarily used for internal integration within the tire liner. Magnetic sensors often utilize magnetic induction to detect wear patterns but are highly susceptible to metallic interference. Ultrasonic sensors employ sound waves to map the tire surface, offering excellent accuracy but sometimes facing challenges with complex tread patterns or high-speed operation. Laser and optical sensors mounted externally or on the vehicle chassis provide the highest precision and resolution, often favored in advanced ADAS applications requiring continuous, high-fidelity data feeds.

A significant technological focus is on enhancing connectivity and power management. Most modern sensors leverage robust wireless communication protocols, primarily utilizing Radio Frequency (RF) transmission compatible with the existing TPMS receiver (433 MHz or 315 MHz). The migration towards batteryless operation is a key innovation, utilizing energy harvesting techniques—scavenging energy from the tire's rotation, vibration, or thermal differences—to power the sensor. This eliminates the need for sensor replacement and significantly enhances system reliability and sustainability over the vehicle's lifespan.

Furthermore, the development of "smart tire" concepts involves embedding passive and active sensors directly into the tire construction itself, providing integrated data on load, temperature, pressure, and tread in a holistic manner. The future technology landscape will be dominated by sensor fusion, where data from tread sensors is combined with vehicle chassis data (e.g., steering angle, acceleration) and external environmental data (e.g., road friction coefficient estimation) via advanced AI algorithms. This fusion provides critical input for autonomous driving controllers, dramatically improving safety margins and predictive maintenance accuracy.

Regional Highlights

- Asia Pacific (APAC): APAC is anticipated to demonstrate the highest growth rate during the forecast period, driven by high volume manufacturing and robust vehicle sales, particularly in China and India. Government initiatives mandating improved vehicle safety features and the rapid adoption of commercial fleet management systems in developing economies significantly contribute to market expansion. Japan and South Korea lead in technological integration, focusing on integrating tread sensors with advanced smart vehicle systems.

- North America: North America holds a substantial market share, primarily due to stringent safety regulations (FMVSS standards) and the mature connected vehicle ecosystem. The region sees strong adoption in both OEM passenger vehicles and large commercial trucking fleets. High consumer demand for advanced safety features and the established infrastructure for IoT-based fleet monitoring systems provide a solid foundation for continued growth.

- Europe: Europe represents a technologically mature market, characterized by early adoption of sophisticated sensor technologies, driven by Euro NCAP safety ratings and strict roadworthiness inspection requirements. Germany, France, and the UK are key markets, focusing on premium vehicle integration and leveraging sensor data for insurance-related risk assessment and reducing environmental impact through optimal tire usage.

- Latin America (LATAM): The LATAM market is in an emerging phase, with growth primarily concentrated in Brazil and Mexico. Expansion is fueled by increasing foreign investments in automotive manufacturing and rising concerns over road safety, leading to gradual regulatory changes supporting the implementation of tire health monitoring systems, especially in commercial transport.

- Middle East and Africa (MEA): The MEA market is projected for moderate growth, largely influenced by commercial vehicle demand in logistics hubs (UAE, Saudi Arabia) and mining operations (South Africa). High temperatures and challenging road conditions in parts of the region make accurate tire monitoring critical, driving specialized demand for highly robust sensor technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Tire Tread Sensors Market.- Continental AG

- ZF Friedrichshafen AG

- Sensata Technologies

- NXP Semiconductors

- Infineon Technologies AG

- Bridgestone Corporation

- Michelin

- Goodyear Tire & Rubber Company

- Schrader TPMS Solutions (Sensata)

- Huf Hülsbeck & Fürst GmbH & Co. KG

- Bendix Commercial Vehicle Systems LLC

- WABCO (ZF)

- Siemens VDO

- Bosch Mobility Solutions

- Stoneridge Inc.

- Fobo Tire

- Mobileye (Intel)

- TTE-Europe GmbH

- Murata Manufacturing Co., Ltd.

- Denso Corporation

Frequently Asked Questions

Analyze common user questions about the Automotive Tire Tread Sensors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an automotive tire tread sensor?

The primary function is to measure the remaining depth of the tire tread in real-time. This data is critical for alerting drivers and fleet managers to potential safety risks, such as reduced braking capability and increased hydroplaning risk, and for optimizing predictive maintenance schedules.

How do tire tread sensors integrate with existing vehicle technology?

Tire tread sensors are typically integrated by communicating wirelessly via radio frequency with the existing Tire Pressure Monitoring System (TPMS) receiver or the central Electronic Control Unit (ECU). This allows the data to be displayed on the vehicle dashboard or transmitted to cloud-based fleet management systems.

Which sensor technology is considered the most accurate for measuring tread depth?

Laser or optical sensors, often mounted on the vehicle chassis, generally provide the highest accuracy and resolution for tread depth measurement, as they scan the tire surface directly. However, internally mounted capacitive sensors offer a robust, integrated, and increasingly accurate alternative for OEM applications.

Are tire tread sensors mandatory under current automotive safety regulations?

While TPMS (Tire Pressure Monitoring Systems) are widely mandatory globally, specific regulations explicitly mandating continuous, real-time tire tread depth sensors are still evolving. However, their inclusion is strongly encouraged by safety bodies and is becoming a standard feature in new, high-end vehicle models and commercial fleets seeking compliance optimization.

What is the key benefit of adopting tread sensors for commercial fleet operations?

The key benefit for commercial fleets is maximizing operational uptime and minimizing the Total Cost of Ownership (TCO). Real-time tread monitoring enables precise predictive maintenance, preventing costly road failures, optimizing tire rotation schedules, extending tire life, and ensuring fuel efficiency by maintaining optimal rolling resistance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager