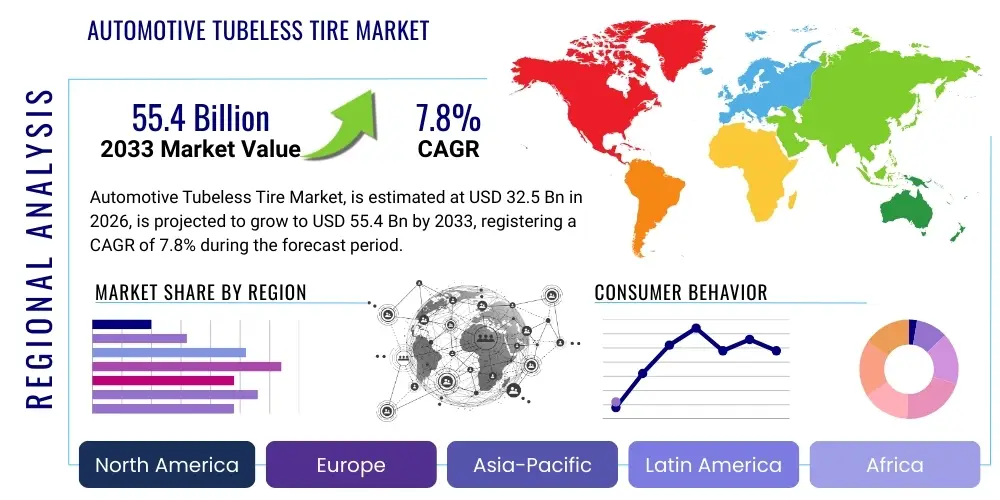

Automotive Tubeless Tire Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438984 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Automotive Tubeless Tire Market Size

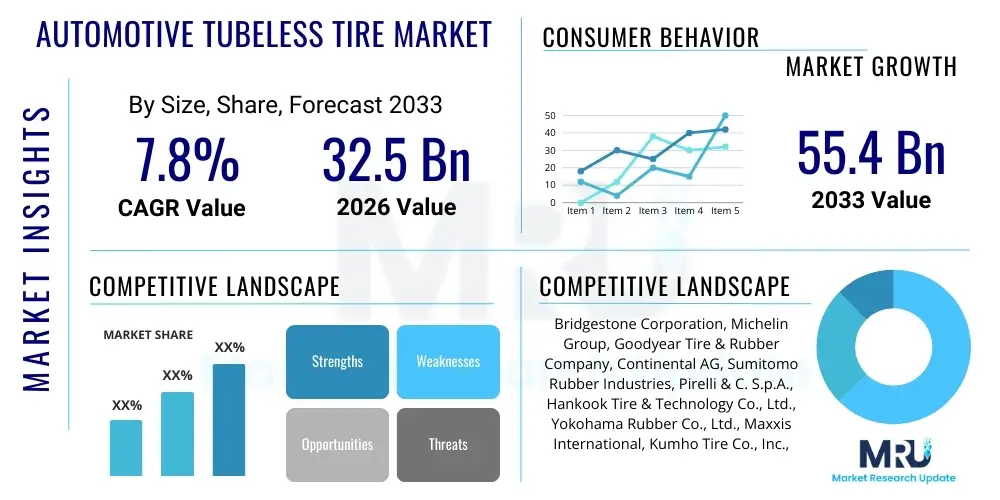

The Automotive Tubeless Tire Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 32.5 Billion in 2026 and is projected to reach USD 55.4 Billion by the end of the forecast period in 2033.

Automotive Tubeless Tire Market introduction

The Automotive Tubeless Tire Market encompasses the manufacturing, distribution, and sale of tires designed to hold air pressure without the need for an inner tube. These tires feature an integral lining of impermeable rubber (often butyl rubber or halogenated butyl rubber) bonded to the inside of the tire casing, which seals the air directly against the wheel rim. This design offers superior safety by ensuring slower air loss compared to conventional tube tires, drastically reducing the risk of sudden blowouts and providing drivers with improved control during puncture events. Tubeless tires are rapidly becoming the standard equipment across passenger vehicles, light commercial vehicles (LCVs), and increasingly, heavy commercial vehicles (HCVs), driven by stringent safety regulations and evolving consumer demands for higher efficiency and reliability.

Major applications for tubeless tires span the entire automotive spectrum, including Original Equipment Manufacturers (OEMs) and the aftermarket replacement segment. Key benefits contributing to market growth include enhanced fuel efficiency due to lighter weight and reduced rolling resistance, superior heat dissipation leading to extended tire life, and simplified maintenance. The structural integrity of modern tubeless tires, often incorporating advanced material science such as specialized rubber compounds, silica-based fillers, and reinforced cord layers (polyester or nylon), ensures optimal performance characteristics across diverse climatic and road conditions. This technological sophistication positions tubeless tires as crucial components in vehicle performance and safety ecosystems globally.

Driving factors propelling market expansion are fundamentally linked to global trends in vehicle production, infrastructure development, and regulatory mandates. The accelerating adoption of electric vehicles (EVs) mandates high-performance tires capable of handling instant torque delivery and supporting heavy battery weights, a requirement ideally met by specialized tubeless tire constructions. Furthermore, rising disposable incomes in emerging economies, coupled with significant governmental investments in highway networks, increase vehicle miles traveled (VMT), thereby stimulating consistent demand in the replacement market. The mandatory incorporation of Tire Pressure Monitoring Systems (TPMS) in key regions like North America and Europe further reinforces the preference for tubeless designs, which are inherently compatible with precise pressure monitoring technologies.

Automotive Tubeless Tire Market Executive Summary

The global Automotive Tubeless Tire Market is characterized by robust business trends centered on sustainability, smart manufacturing, and material innovation. Manufacturers are intensely focused on developing eco-friendly tires utilizing bio-based and recycled materials to meet evolving environmental standards and consumer expectations for sustainable products, pushing towards circular economy models within the tire industry. Technological advancements, particularly in smart tires embedded with sensors for real-time data collection (wear, pressure, temperature), represent a significant business opportunity, allowing for predictive maintenance and enhanced fleet management efficiency. The market structure remains highly competitive, dominated by a few multinational giants, though specialized smaller firms are carving out niches through high-performance or sustainable product lines.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by burgeoning automotive production in China, India, and Southeast Asia, alongside expanding vehicle ownership rates driven by rapid urbanization. North America and Europe maintain maturity but lead in the adoption of premium and high-performance tubeless tires, particularly driven by rigorous safety standards and the swift penetration of electric and autonomous vehicles which demand highly specialized tire specifications. Regulatory environments across these regions, emphasizing fuel economy standards and mandates for minimum tire performance requirements, continue to shape regional consumption patterns and product development priorities, particularly concerning rolling resistance optimization.

Segment trends reveal that the Passenger Vehicle segment maintains the largest market share, directly correlated with the high volume of production and turnover in the consumer automotive sector. However, the Commercial Vehicle segment is exhibiting strong growth, driven by the operational efficiencies and reduced downtime offered by tubeless radial tires in logistics and transport fleets. In terms of construction, radial tubeless tires overwhelmingly dominate due to their superior handling, durability, and fuel economy benefits compared to bias-ply alternatives. The aftermarket segment, propelled by the necessity of routine tire replacement and repair, constitutes a vital revenue stream, often offering higher margin opportunities than the competitive OEM supply chain.

AI Impact Analysis on Automotive Tubeless Tire Market

Common user questions regarding AI's impact on the Automotive Tubeless Tire Market frequently center on how artificial intelligence will enhance product durability, optimize manufacturing processes, and revolutionize tire performance monitoring. Users are keenly interested in predictive maintenance capabilities offered by AI-integrated smart tires, questioning the accuracy of wear prediction algorithms and the security of transmitted tire data. Furthermore, significant curiosity exists around how AI can accelerate material science innovation, specifically in designing novel rubber compounds that balance grip, longevity, and sustainability requirements. The consensus expectation is that AI will move the industry beyond reactive maintenance to a proactive, data-driven operational model, drastically reducing warranty claims and improving overall road safety through highly personalized tire performance optimization strategies tailored to specific driving behaviors and environments.

- AI-driven Predictive Maintenance: Utilizing machine learning algorithms on sensor data (from TPMS and embedded chips) to predict tire failure, optimal rotation schedules, and replacement timing with high accuracy, minimizing vehicle downtime for commercial fleets.

- Manufacturing Optimization: Employing AI in quality control and process management, optimizing mixing ratios, curing times, and molding precision to reduce defects and waste, thereby enhancing throughput and consistency in tubeless tire production lines.

- Material Innovation Acceleration: Using Generative AI and computational materials science to simulate and design novel tire compounds, speeding up the research and development lifecycle for sustainable, high-performance, and lightweight tubeless structures.

- Enhanced Design and Simulation: Applying AI for complex finite element analysis (FEA) simulations, optimizing tread patterns, sidewall stiffness, and overall tire geometry for improved wet grip, noise reduction, and reduced rolling resistance specific to EV platforms.

- Supply Chain and Inventory Management: Implementing AI and IoT for real-time tracking, forecasting demand fluctuations across different regional markets, and optimizing raw material procurement (natural rubber, synthetic polymers) to mitigate supply chain risks and volatile pricing.

DRO & Impact Forces Of Automotive Tubeless Tire Market

The Automotive Tubeless Tire Market is primarily driven by escalating safety concerns and the continuous innovation required to support next-generation vehicle architectures. The main restraint is the volatile pricing and supply chain unpredictability of critical raw materials, primarily natural rubber and petroleum-derived synthetic polymers. Significant opportunities emerge from the electrification of the global vehicle fleet, which demands specialized, durable, and low-rolling-resistance tires, alongside the proliferation of smart tire technologies leveraging IoT connectivity. These forces collectively propel the market forward, dictating product development cycles and influencing major investments in manufacturing capacity expansion and material research globally.

Drivers: The fundamental driver is the intrinsic safety advantage of tubeless tires, which prevents catastrophic blowouts, making them mandatory or highly preferred by OEMs globally. Additionally, government regulations focused on improving fuel economy and reducing carbon emissions are compelling manufacturers to produce tubeless tires with ultra-low rolling resistance, often achieved through advanced silica technology and optimized tread design. The global expansion of the vehicle fleet, particularly in high-growth nations in APAC, ensures a consistent and high-volume demand for both OEM fitting and aftermarket replacement. The shift towards higher average vehicle speeds and payload requirements, especially in the commercial sector, further necessitates the reliability and heat management capabilities inherent in tubeless radial constructions.

Restraints: The market faces substantial resistance from the erratic fluctuation in the prices of key raw materials, including synthetic rubbers, steel cords, and carbon black, which directly impact manufacturing costs and pricing stability. Furthermore, despite tubeless technology being widespread, the initial cost of tubeless tires can be marginally higher than conventional tube tires, which sometimes acts as a constraint in highly price-sensitive developing markets. Technical challenges related to maintaining the internal airtight liner integrity under extreme stress and the difficulty in repairing certain types of sidewall damage compared to simple tube replacement also pose minor, localized restraints.

Opportunities: Major opportunities reside in capturing the rapidly expanding electric vehicle tire segment, where the specific requirements for noise dampening, immediate torque handling, and high load capacity are paramount, demanding entirely new tubeless designs and materials. The integration of IoT and embedded sensors into smart tubeless tires offers avenues for recurring service revenue and highly valuable data insights for OEMs and fleet operators. Moreover, the push for sustainable manufacturing opens up opportunities for companies pioneering the use of sustainable rubber sources, derived from guayule or dandelions, and implementing comprehensive tire recycling programs, meeting the growing consumer demand for environmentally conscious products.

Impact Forces: The impact forces driving this market are predominantly technological and regulatory. Technological breakthroughs in polymer science and additive manufacturing are continuously enhancing tire performance parameters (grip, wear resistance, rolling efficiency). Regulatory harmonization, particularly concerning tire labeling, safety standards (e.g., wet grip performance), and mandated TPMS installation, uniformly forces product evolution across major geographies. Economic factors, such as GDP growth and consumer spending power, determine the replacement cycle frequency and the preference for premium versus economy segment tires. Competitive intensity forces constant innovation in design, material usage, and production efficiency to maintain pricing advantage and market share.

Segmentation Analysis

The Automotive Tubeless Tire Market is comprehensively segmented across several crucial dimensions, including vehicle type, application, sales channel, construction type, and material. This granular segmentation provides a clear framework for analyzing market dynamics, revealing that the Passenger Vehicle segment remains the largest volume driver, while the Commercial Vehicle segment promises accelerated revenue growth due to high utilization rates and the mandatory adoption of advanced radial tires. Construction technology is overwhelmingly dominated by radial tires, favored for their performance and longevity. The sales channel splits robustly between the OEM segment, tied directly to new vehicle production, and the highly active Aftermarket segment, which is sustained by the regular maintenance requirements of the global installed vehicle base.

Detailed analysis of the material segment highlights a continuous shift toward specialized synthetic polymers and bio-based alternatives, driven by performance enhancement needs and sustainability goals. The application segment, separating two-wheelers, passenger cars, light commercial vehicles (LCVs), and heavy commercial vehicles (HCVs), shows varied growth rates; LCVs and passenger cars are expanding fastest, mirroring global logistic demands and personal mobility trends. Understanding these segment interactions is critical for manufacturers aiming to optimize product portfolios and distribution strategies, particularly as the industry navigates the transition to electric mobility, which places unique demands on tire specifications across all vehicle classes.

- By Vehicle Type:

- Passenger Cars (PC)

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

- Two-Wheelers (Motorcycles and Scooters)

- By Application:

- On-Road Use

- Off-Road Use

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

- By Construction Type:

- Radial Tubeless Tires (Dominant Segment)

- Bias Tubeless Tires (Niche Segment)

- By Material Type:

- Synthetic Rubber (Styrene Butadiene Rubber, Polybutadiene Rubber)

- Natural Rubber

- Fillers (Carbon Black, Silica)

- Reinforcing Materials (Steel, Nylon, Polyester Cords)

Value Chain Analysis For Automotive Tubeless Tire Market

The value chain for the Automotive Tubeless Tire Market is characterized by highly integrated global operations, starting with the upstream supply of complex raw materials. Upstream activities involve sourcing natural rubber (primarily from Southeast Asia) and synthetic inputs (petrochemical derivatives like SBR and BR). The volatility of these commodities dictates primary cost structures, making long-term supply agreements crucial for major tire manufacturers. Key upstream players also include specialized chemical companies providing high-performance fillers like treated silica, essential for achieving low rolling resistance and high grip, especially for high-end and EV tires. Efficient raw material management and quality control at this stage are paramount to ensuring final product integrity.

The central phase involves high-capital manufacturing and sophisticated R&D activities, where leading tire companies leverage automated factories and proprietary mixing technologies to transform raw inputs into finished tubeless tires. This stage is dominated by stringent quality checks, compliance with regional safety standards (e.g., ECE, DOT), and continuous material engineering aimed at reducing weight and improving durability. The downstream segment focuses heavily on distribution channels. Direct distribution to OEMs is characterized by long-term contracts and just-in-time delivery schedules, requiring specialized logistics networks. Indirect distribution, servicing the aftermarket, relies on a vast network of authorized dealers, independent garages, large retail chains, and increasingly, e-commerce platforms, offering varying levels of service and repair capabilities.

The distribution channel is split between direct sales to large fleet operators and indirect sales through extensive dealer networks. Direct sales ensure higher margin control for manufacturers but require substantial infrastructure investment. Indirect sales provide wider market penetration, relying heavily on wholesaler and retailer relationships for localized inventory management and customer service support, particularly for tire fitting and balancing services. The growth of digital platforms is enabling manufacturers to bypass traditional intermediaries for consumer-direct sales, optimizing inventory visibility and offering personalized product recommendations, a critical evolution in the aftermarket landscape.

Automotive Tubeless Tire Market Potential Customers

The primary customers in the Automotive Tubeless Tire Market are segmented into high-volume Original Equipment Manufacturers (OEMs) and diverse end-users participating in the Aftermarket segment. OEMs, including global giants like Toyota, Volkswagen, General Motors, and Tesla, are essential buyers, purchasing tires in massive quantities for installation on new vehicles. Their purchasing decisions are highly influenced by performance metrics, cost-effectiveness, and the tire supplier's capability to meet stringent technical specifications related to noise, rolling resistance, and high-speed stability. The shift towards EV production has made specialized EV tire suppliers highly sought after by these manufacturers.

The aftermarket segment caters to the replacement needs of all vehicle owners globally. This diverse customer base includes individual consumers requiring standard passenger car tires, owners of specialized high-performance vehicles demanding premium, speed-rated tires, and most critically, commercial fleet operators (logistics companies, rental agencies, public transport services). Commercial customers, particularly heavy-duty fleet managers, prioritize tire longevity, fuel efficiency, and retreadability, viewing tires as a major operational cost. Their purchasing is driven by Total Cost of Ownership (TCO) analysis, making specialized, durable tubeless tires for trucks and buses a high-value product category.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 32.5 Billion |

| Market Forecast in 2033 | USD 55.4 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bridgestone Corporation, Michelin Group, Goodyear Tire & Rubber Company, Continental AG, Sumitomo Rubber Industries, Pirelli & C. S.p.A., Hankook Tire & Technology Co., Ltd., Yokohama Rubber Co., Ltd., Maxxis International, Kumho Tire Co., Inc., Cooper Tire & Rubber Company, Trelleborg AB, MRF Limited, CEAT Limited, Apollo Tyres Ltd., Toyo Tire Corporation, Cheng Shin Rubber Ind. Co., Ltd., Giti Tire, Linglong Group, Shandong Linglong Tire Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Tubeless Tire Market Key Technology Landscape

The technology landscape in the Automotive Tubeless Tire Market is rapidly advancing, focusing primarily on minimizing rolling resistance, maximizing wear life, and integrating digital capabilities. A cornerstone technology is the widespread adoption of advanced silica compounds and coupling agents. These materials are crucial for reducing the hysteresis losses that contribute to rolling resistance without compromising wet grip performance, a vital requirement particularly for electric vehicles seeking to maximize battery range. Furthermore, nanotechnology is being increasingly utilized to incorporate specialized fillers into rubber matrices, enhancing material stiffness, durability, and resistance to thermal degradation, directly extending the functional life of the tubeless tire casing.

Another major technological advancement is the rise of the "Smart Tire" ecosystem. This involves embedding sophisticated sensors (accelerometers, pressure gauges, temperature monitors) and Radio Frequency Identification (RFID) tags directly into the tubeless tire structure. These sensors transmit real-time data to the vehicle's onboard computer and fleet management systems, facilitating predictive maintenance, optimizing inflation pressures for specific loads, and ensuring regulatory compliance. The development of self-sealing and self-inflating tire technologies, although still nascent, promises to further enhance the maintenance-free appeal of tubeless tires, addressing minor punctures and continually maintaining optimal pressure levels without user intervention, significantly boosting road safety and efficiency for commercial applications.

In manufacturing, the move towards highly automated and digitized production lines, leveraging Industry 4.0 principles, is optimizing efficiency and customization. Technologies like laser cutting for tread patterns and robotic molding systems ensure absolute precision and material consistency across high-volume production runs. Research efforts are also centered on airless tire concepts, which, while not strictly tubeless, are a disruptive evolution of the non-pneumatic design, aiming to eliminate the risk of punctures entirely. Manufacturers are investing heavily in these futuristic designs, which promise to combine the safety of tubeless architecture with complete immunity to pressure loss, potentially revolutionizing the tire market within the next decade, especially for highly demanding autonomous vehicle applications.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market in terms of volume due to massive automotive production bases in China, India, and Japan, coupled with rapidly rising vehicle ownership rates. The region exhibits high demand across all segments, particularly for two-wheelers and passenger vehicles, driven by urbanization and improved road infrastructure. This region is critical for both OEM and replacement sales growth, reflecting intense investment in local manufacturing facilities by global giants.

- North America: Characterized by high penetration of specialized, high-performance tubeless tires, particularly for SUVs, trucks, and the accelerating EV segment. Market growth is stable, driven by strict regulatory requirements (like mandatory TPMS) and a strong preference for premium, durable tires that handle demanding climates and high mileage requirements. Technological adoption, especially smart tire integration, is fastest here.

- Europe: A mature market focused heavily on safety, sustainability, and low rolling resistance mandates enforced by EU regulations. European consumers show a strong preference for eco-labeled and performance-rated tires. The region is a key innovation hub for winter and all-season tubeless tires and is leading the transition towards tires made from sustainable and recycled materials, driven by Green Deal objectives.

- Latin America (LATAM): Exhibits moderate growth, primarily influenced by economic recovery and domestic vehicle production in Brazil and Mexico. Price sensitivity is high, leading to strong competition in the mid-range and economy tubeless tire segments, though demand for robust tires capable of handling varied road conditions is consistently strong.

- Middle East and Africa (MEA): Emerging market with increasing adoption, particularly in the GCC countries driven by large vehicle fleets and infrastructure projects. Demand is centered on tubeless tires designed to withstand extreme high temperatures and challenging arid environments, focusing on durability and heat resistance properties.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Tubeless Tire Market.- Bridgestone Corporation

- Michelin Group

- Goodyear Tire & Rubber Company

- Continental AG

- Sumitomo Rubber Industries

- Pirelli & C. S.p.A.

- Hankook Tire & Technology Co., Ltd.

- Yokohama Rubber Co., Ltd.

- Maxxis International

- Kumho Tire Co., Inc.

- Cooper Tire & Rubber Company

- Trelleborg AB

- MRF Limited

- CEAT Limited

- Apollo Tyres Ltd.

- Toyo Tire Corporation

- Cheng Shin Rubber Ind. Co., Ltd.

- Giti Tire

- Linglong Group

- Shandong Linglong Tire Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Automotive Tubeless Tire market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the high adoption rate of tubeless tires in new vehicles?

The primary driver is significantly enhanced vehicle safety. Tubeless tires prevent rapid deflation upon puncture, allowing for controlled stopping, minimizing the risk of catastrophic blowouts, and offering superior stability compared to conventional tube tires, aligning directly with global automotive safety standards.

How are electric vehicles (EVs) changing the design requirements for tubeless tires?

EVs demand tubeless tires with specific characteristics: higher load capacity due to heavy batteries, immediate torque resistance, superior noise reduction for a quieter cabin experience, and crucially, ultra-low rolling resistance to maximize battery range and energy efficiency. This requires specialized construction and advanced silica compounds.

What technological advancements are critical for the future growth of the tubeless tire aftermarket?

The future growth is heavily reliant on smart tire technology, involving embedded sensors (IoT) that monitor pressure, temperature, and wear life in real time. This data supports predictive maintenance models for commercial fleets and enhances driver safety and efficiency for private vehicle owners, stimulating replacement demand for advanced products.

Which geographical region exhibits the fastest growth potential for the Automotive Tubeless Tire Market?

Asia Pacific (APAC), particularly fueled by the automotive markets in China and India, holds the fastest growth potential. This growth is driven by rising disposable incomes, rapid urbanization leading to increased vehicle sales, and substantial infrastructure development supporting higher vehicle utilization across all segments.

What are the main material challenges faced by tubeless tire manufacturers regarding sustainability?

The main challenges involve diversifying away from traditional petroleum-based synthetic rubber and volatile natural rubber sourcing. Manufacturers are prioritizing R&D into bio-based materials, utilizing recycled plastics, and developing tires with improved retreadability and longevity to meet stringent environmental regulations and consumer demand for circular economy products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager