Automotive V2X Antenna Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431430 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Automotive V2X Antenna Market Size

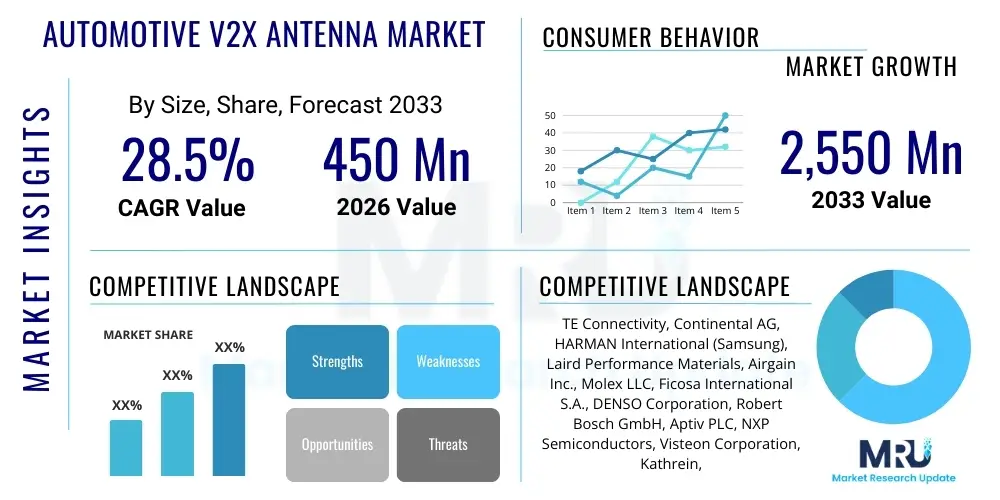

The Automotive V2X Antenna Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 2,550 Million by the end of the forecast period in 2033.

Automotive V2X Antenna Market introduction

The Automotive V2X Antenna market is fundamental to the progression of connected and autonomous vehicle technology, serving as the critical interface for communication between vehicles (V2V), infrastructure (V2I), pedestrians (V2P), and the broader network (V2N). These sophisticated antenna systems are engineered to handle high-frequency, low-latency data transmission required for safety-critical applications, enabling vehicles to exchange information about location, speed, direction, and potential hazards in real-time. The core product encompasses multi-band antennas capable of supporting both legacy Dedicated Short Range Communications (DSRC) protocols, operating typically in the 5.9 GHz band, and the increasingly dominant Cellular V2X (C-V2X) technology, which leverages 4G LTE and 5G cellular networks for enhanced coverage and throughput. The transition toward C-V2X, particularly its advanced 5G capabilities, mandates the use of highly efficient, compact, and often integrated antenna units that can reliably function across diverse operating environments and weather conditions, often necessitating smart antenna or phased array configurations for optimized beamforming and signal robustness.

Major applications of V2X antenna technology span across enhancing road safety, optimizing traffic flow, and enabling Level 3 (Conditional Automation) and higher levels of autonomous driving. Key safety applications include collision avoidance warnings, intersection movement assistance, and electronic emergency brake lights. Furthermore, V2X connectivity facilitates crucial traffic management benefits, such as adaptive cruise control coordination and optimized routing, significantly reducing congestion and fuel consumption. The antennas are typically integrated either into shark fin modules on the vehicle roof or discretely within the windshield or bumpers, requiring meticulous engineering to minimize aesthetic impact while maximizing performance and electromagnetic compatibility (EMC) with other on-board electronic systems. The increasing regulatory mandates in regions like Europe and the growing commitment from major global automotive Original Equipment Manufacturers (OEMs) to incorporate V2X capabilities as standard features are strong underlying forces driving this market’s expansion.

The primary benefits delivered by these systems revolve around dramatically reducing accident rates and improving situational awareness for both human drivers and autonomous systems. By broadcasting and receiving safety messages, V2X minimizes the dependency solely on line-of-sight sensors (like cameras and radar), allowing vehicles to "see around corners" or through heavy traffic. Driving factors propelling market growth include the global push for smart city development, which relies heavily on V2I integration; the aggressive rollout of 5G infrastructure, which provides the necessary high-bandwidth backbone for C-V2X applications; and the relentless consumer demand for advanced safety features integrated into new vehicle models. Additionally, the standardization efforts by global bodies, such as 3GPP for C-V2X, are providing the necessary framework for widespread, interoperable deployment, solidifying the market's trajectory towards mass commercialization.

Automotive V2X Antenna Market Executive Summary

The Automotive V2X Antenna market is undergoing a structural shift characterized by the rapid obsolescence of DSRC standards in favor of the more robust and scalable C-V2X technology, predominantly leveraging 5G networks for low-latency communication crucial for automated driving tasks. Current business trends indicate a strong move towards integrated multi-function antenna modules, where V2X antennas are combined with GNSS, Wi-Fi, and broadcast radio antennas to reduce complexity and installation costs for OEMs, driving profitability within the Tier 1 supplier ecosystem. Regional trends highlight the Asia Pacific (APAC) region, specifically China, as the dominant growth engine due not only to high production volumes but also to strong governmental support for C-V2X infrastructure deployment and early regulatory adoption. Meanwhile, North America and Europe continue to debate spectrum allocation and regulatory certainty, impacting the speed of mass implementation, though premium and luxury vehicle segments in these regions are increasingly adopting V2X systems ahead of official mandates.

Segment trends reveal that the Passenger Vehicle category holds the largest market share, driven by consumer safety demands and the high volume of production, though the Commercial Vehicle segment, particularly trucking fleets and public transport, is anticipated to register the highest CAGR, leveraging V2X for logistics efficiency, platooning, and route optimization. By component, the hardware segment, encompassing the antenna unit and transceiver modules, remains central, but the software and service segment, covering Over-The-Air (OTA) updates and connected services facilitated by the antenna, is demonstrating accelerated growth. From a technological standpoint, 5G C-V2X antennas are set to dominate new installations over the forecast period, replacing DSRC components entirely due to superior throughput, reliability, and the ability to integrate seamlessly with cloud services and edge computing architectures critical for fully autonomous operation and vehicle synchronization.

The competitive landscape is defined by intense collaboration between semiconductor manufacturers, specialized antenna designers, and Tier 1 automotive suppliers, focusing heavily on miniaturization, thermal management, and robust security protocols (PKI) necessary for ensuring message authenticity and integrity in safety-critical communication. The ongoing development of sophisticated antenna arrays, incorporating beamforming capabilities, is a key differentiating factor, enabling enhanced range and signal penetration in densely built urban environments where connectivity reliability is paramount. Overall, the market's trajectory is inextricably linked to the global timeline for achieving higher levels of vehicle automation and the harmonization of communication standards across major economic blocs, positioning V2X antennas as one of the most strategically important components in the future automotive electronic architecture.

AI Impact Analysis on Automotive V2X Antenna Market

User inquiries regarding the influence of Artificial Intelligence (AI) on the V2X antenna market frequently center on how machine learning algorithms can enhance the functional performance and reliability of these communication systems, moving beyond simple signal transmission. Common questions explore the application of AI in optimizing dynamic antenna configuration, predicting signal degradation in variable environments, and managing the massive data influx generated by real-time V2X interactions. Users are concerned with how AI can address interference mitigation, especially in highly congested urban environments where DSRC and C-V2X signals might clash with Wi-Fi or other wireless communications. They also seek understanding regarding AI’s role in ensuring security and detecting anomalous behavior within the V2X network, which is vital for maintaining the trustworthiness of safety-critical messages transmitted between disparate vehicles and infrastructure units.

AI's core impact is primarily focused on enhancing the cognitive abilities of the V2X communication system. Machine learning models, trained on vast datasets of traffic patterns, signal strength variations, and environmental noise, enable V2X antennas to operate as 'smart' devices. This cognitive optimization allows the antenna system to intelligently select the optimal communication channel (e.g., switching between cellular and direct short-range communications based on latency requirements and congestion levels) and dynamically adjust transmission power and beam direction. This capability, known as cognitive radio or smart antenna technology, significantly improves signal quality, reduces packet loss, and ensures the low latency required for critical applications like platooning or pre-crash sensing, addressing the crucial user expectation for enhanced performance under non-ideal real-world conditions.

Furthermore, AI is instrumental in the predictive maintenance and design verification phases of V2X antennas. AI algorithms analyze operational data from deployed antennas to predict potential hardware failures, signal decay over time, or performance degradation due to environmental stress (e.g., extreme temperatures or vibrations), allowing for proactive servicing or optimized module design iteration. In the context of autonomous driving, AI also processes the received V2X data in conjunction with sensor fusion data, utilizing deep learning to contextualize the incoming communication messages, filter out redundant or irrelevant noise, and rapidly integrate the connectivity information into the vehicle's decision-making system. This seamless, intelligent integration is paramount for achieving functional safety standards (ISO 26262) in connected vehicles that rely on V2X data for operational security, fundamentally driving the evolution of V2X hardware requirements towards higher processing capabilities integrated closer to the antenna module itself (edge computing).

- AI enables Cognitive Radio functionality, optimizing frequency selection and dynamically switching between DSRC and C-V2X based on network performance and latency needs.

- Machine Learning algorithms facilitate sophisticated Beamforming and smart antenna array management, enhancing signal directionality and range, particularly in non-line-of-sight scenarios.

- Predictive Maintenance analytics, driven by AI, monitor antenna degradation and communication reliability metrics, improving module longevity and vehicle uptime.

- AI enhances V2X security by recognizing and flagging suspicious or spoofed messages in real-time, bolstering the integrity of safety-critical communication.

- Deep Learning models are used for data fusion, integrating V2X communication packets with on-board sensor data (LiDAR, camera), improving the vehicle's overall perception and path planning accuracy.

DRO & Impact Forces Of Automotive V2X Antenna Market

The dynamics of the Automotive V2X Antenna Market are shaped by powerful Drivers promoting adoption, significant Restraints challenging implementation, and compelling Opportunities for future growth, all collectively forming the Impact Forces. A primary driver is the global regulatory impetus toward mandated V2X communication for safety, particularly the anticipated enforcement of C-V2X standards in major markets, which compels OEMs to incorporate the necessary antenna hardware into all new vehicle platforms. The rapid maturation and deployment of 5G networks globally acts as a secondary powerful driver, providing the essential low-latency, high-bandwidth backbone that enables advanced V2X use cases like cooperative perception and high-density platooning. Conversely, the market faces considerable restraints, dominated by the ongoing global debate and lack of universal consensus regarding spectrum allocation—the lingering conflict between the DSRC band (5.9 GHz) and C-V2X usage creates regulatory uncertainty that delays large-scale capital investments in infrastructure and vehicle integration. The high cost of incorporating robust, multi-band, and smart antenna systems, coupled with the complex cybersecurity requirements necessary for V2X reliability, also poses a significant barrier to entry, particularly in cost-sensitive vehicle segments.

Opportunities for growth are largely centered on leveraging C-V2X for commercial applications beyond just safety, such as fleet management optimization, logistics tracking, and providing infotainment and telematics services, thereby creating new revenue streams for service providers and justifying the initial hardware investment. The evolution towards integrated smart transportation ecosystems, where V2X communication interfaces seamlessly with smart city infrastructure (V2I), offers immense long-term potential for market expansion, transforming traffic management and public utility services. The major impact force driving the market's direction is the irreversible trend toward Level 4 and Level 5 autonomous driving. These high automation levels cannot be achieved reliably without V2X communication to provide non-line-of-sight awareness, making the antenna a non-negotiable component of the autonomous vehicle stack. This fundamental requirement ensures that despite near-term regulatory hurdles, the long-term technological trajectory of the automotive industry guarantees substantial market growth.

The impact forces currently favor the technological superiority of C-V2X, sidelining DSRC despite existing infrastructure deployments. The global supply chain constraint for semiconductors, while acting as a short-term restraint, simultaneously fosters opportunities for regionalized manufacturing and development of integrated system-on-chip solutions that bundle V2X processing and antenna drivers, streamlining production. Moreover, the increasing demand for Over-The-Air (OTA) updates and advanced vehicle diagnostics, both reliant on robust, persistent connectivity provided by V2X antennas, reinforces the necessity of these components. Stakeholders are heavily investing in standardized security platforms (e.g., SCMS for C-V2X) to mitigate the restraint imposed by cybersecurity risks, recognizing that failure to secure V2X communication could entirely halt autonomous vehicle progress. This holistic approach to safety, connectivity, and security ensures sustained momentum and validates the high growth projection for the V2X antenna market over the forecast period.

- Drivers: Global regulatory push for V2X mandatory implementation; accelerated 5G infrastructure rollout providing necessary low-latency communication backbone; increasing consumer demand for advanced safety features; and the fundamental requirement for non-line-of-sight data in autonomous vehicles (L4/L5).

- Restraints: Persistent global spectrum allocation uncertainty (DSRC vs. C-V2X); high initial cost of multi-band antenna integration and associated processing hardware; complex requirements for robust V2X cybersecurity and trust mechanisms (PKI); and fragmentation of standards across different geographical markets delaying mass deployment harmonization.

- Opportunity: Expansion into high-growth commercial vehicle segments (platooning and logistics); integration with smart city infrastructure (V2I) and edge computing platforms; diversification of revenue streams through V2X-enabled telematics, road condition monitoring, and value-added connectivity services; and technological advancements in integrated multi-antenna modules for reduced form factor.

- Impact Forces: The transformative force of autonomous driving mandates V2X communication regardless of near-term regulatory challenges; the established superiority of 5G C-V2X technology drives investment away from legacy systems; and intense focus on interoperability and security protocols accelerates market maturity.

Segmentation Analysis

The Automotive V2X Antenna Market is intricately segmented based on technology utilized, the component structure, the specific application areas, and the type of vehicle adopting the system, providing a detailed view of market dynamics and adoption patterns. The segmentation by technology—DSRC, C-V2X (4G LTE), and C-V2X (5G)—is the most critical differentiator, reflecting the ongoing global transition away from the older DSRC protocol towards the high-speed, scalable cellular-based alternatives, with 5G C-V2X systems expected to witness the fastest rate of adoption due to their inherent low latency essential for advanced safety applications. Component segmentation highlights the division between the physical Antenna Unit (the radiating element) and the integrated Telematics Control Unit (TCU) or module, which often incorporates the transceiver and necessary processing capabilities. The application categories further delineate demand based on the specific use case, ranging from vital safety applications like collision warnings to efficiency applications such as enhanced navigation and traffic optimization, offering insights into where investment is prioritized by manufacturers.

- By Technology:

- DSRC (Dedicated Short Range Communications)

- C-V2X (Cellular V2X)

- 4G LTE-V2X

- 5G NR-V2X

- Hybrid/Multi-Protocol Systems

- By Component:

- Antenna Unit (Single-band, Multi-band)

- Integrated Module (Antenna + Transceiver/TCU)

- Related Software and Services (OTA Updates, Security Stacks)

- By Application:

- Safety and Emergency Services (Collision Warning, Emergency Brake Light)

- Traffic Efficiency and Management (Platooning, Traffic Flow Optimization)

- Infotainment and Telematics (Enhanced Navigation, Data Services)

- By Vehicle Type:

- Passenger Vehicles (Sedans, SUVs, Hatchbacks)

- Commercial Vehicles (Trucks, Buses, Fleet Vehicles)

- Autonomous Shuttles and Specialized Vehicles

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Automotive V2X Antenna Market

The value chain for the Automotive V2X Antenna Market begins with upstream activities, dominated by raw material procurement and highly specialized component manufacturing. The initial stages involve acquiring high-performance dielectric materials, conductive metals (copper, silver), and advanced semiconductor chips required for the transceiver and processor components, which are essential for managing the high-frequency signals and complex processing inherent to C-V2X communication. Key upstream suppliers include specialized material science firms and semiconductor giants providing chipsets tailored for automotive-grade reliability (AEC-Q100). The midstream phase is where specialized Tier 2 antenna manufacturers and module integrators design, engineer, and rigorously test the physical antenna structure, often focusing on multi-band functionality, miniaturization, and extreme environmental resilience to meet stringent automotive standards for temperature, vibration, and ingress protection (IP) ratings. This stage involves complex R&D focused on achieving optimal radiation patterns and electromagnetic compatibility (EMC) within the restrictive confines of a vehicle’s structure.

The downstream segment of the value chain is led by Tier 1 suppliers, who integrate the V2X antenna module into larger telematics control units (TCUs) or centralized vehicle communication gateways, often combining V2X capabilities with GNSS, Wi-Fi, and eCall systems. These Tier 1 companies act as the crucial interface between component manufacturers and the final Original Equipment Manufacturers (OEMs), providing validated, ready-to-install systems that meet the specific architecture and software integration needs of the vehicle manufacturer. Distribution channels are predominantly indirect, flowing from Tier 1 suppliers directly to OEM assembly lines globally, requiring highly synchronized Just-In-Time (JIT) supply logistics to support high-volume vehicle production. Direct distribution is rare but may occur in specialized aftermarket scenarios or for small-volume vehicle fleets requiring bespoke V2X solutions, though this constitutes a minor portion of the overall market volume.

A crucial factor in the distribution channel strategy is the service and security provisioning lifecycle. V2X systems rely heavily on Public Key Infrastructure (PKI) and Security Credential Management Systems (SCMS) to authenticate messages, meaning that the software and security components must be provisioned and updated regularly throughout the vehicle’s life. This necessity introduces a service layer into the value chain where software vendors and connected service providers collaborate with OEMs to deliver Over-The-Air (OTA) updates and maintain the security certificate infrastructure. The complexity of integration—spanning RF engineering, baseband processing, security protocols, and application software—means that successful market penetration hinges on deep, collaborative partnerships between specialized component makers and high-volume automotive system integrators, ensuring that the final installed product is both technologically advanced and functionally safe for deployment on public roads.

Automotive V2X Antenna Market Potential Customers

The primary customer base for the Automotive V2X Antenna Market consists predominantly of global Original Equipment Manufacturers (OEMs) and major Tier 1 automotive system suppliers. OEMs, such as Toyota, Volkswagen, General Motors, and Hyundai, are the ultimate decision-makers, driving the design-in process for V2X technology as they integrate these components into their upcoming production vehicle platforms to comply with anticipated regulatory mandates and meet market demand for autonomous and connected features. These manufacturers require V2X antenna systems that are highly reliable, offer exceptional performance across multiple frequency bands (especially the C-V2X 5.9 GHz and potentially 5G spectrums), and can be seamlessly integrated aesthetically into the vehicle structure, often favoring multi-function shark fin modules or hidden interior installations to preserve vehicle design aesthetics.

Tier 1 suppliers, including industry giants like Bosch, Continental, and Aptiv, represent a crucial immediate customer segment. These companies purchase V2X antenna units and transceivers to integrate them into their comprehensive Telematics Control Units (TCUs) or advanced driver-assistance systems (ADAS) platforms, which are then sold directly to OEMs. Tier 1 suppliers demand robust, automotive-grade components, focusing heavily on miniaturization, cost-efficiency at high volumes, and compliance with rigorous automotive safety standards (e.g., ISO 26262 functional safety requirements). Their purchasing decisions are influenced by the ability of antenna manufacturers to provide highly integrated solutions that reduce system complexity and validation time for the final OEM customer, positioning the antenna as part of a larger, pre-validated connected solution.

Secondary, yet rapidly growing, customer segments include operators of large commercial vehicle fleets, such as logistics companies and public transit authorities, who are adopting V2X systems primarily for operational efficiency applications like platooning, logistics tracking, and predictive vehicle maintenance facilitated by V2I communication. Furthermore, smart city infrastructure developers and governmental entities responsible for transportation infrastructure represent significant indirect customers. While they may not purchase the vehicle antennas directly, their deployment of V2I road-side units (RSUs) and corresponding communication infrastructure dictates the necessary specifications and standards required for vehicle antennas to communicate effectively, influencing the procurement decisions of both OEMs and Tier 1s. The focus for these infrastructure buyers is on ensuring national or regional interoperability and scalability of the installed V2X communication ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 2,550 Million |

| Growth Rate | 28.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TE Connectivity, Continental AG, HARMAN International (Samsung), Laird Performance Materials, Airgain Inc., Molex LLC, Ficosa International S.A., DENSO Corporation, Robert Bosch GmbH, Aptiv PLC, NXP Semiconductors, Visteon Corporation, Kathrein, PREMO S.R.L., Schaffner Holding AG, Pulse Electronics, Skyworks Solutions, Amphenol Corporation, Panasonic Corporation, Huawei Technologies Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive V2X Antenna Market Key Technology Landscape

The technological landscape of the Automotive V2X Antenna Market is undergoing rapid evolution, shifting decisively from legacy DSRC (Dedicated Short Range Communications) based systems to sophisticated Cellular V2X (C-V2X) platforms. C-V2X, standardized by 3GPP, leverages both existing 4G LTE-V2X and the emerging 5G New Radio (NR) V2X technology. The 5G NR V2X architecture is the current technological pinnacle, offering ultra-reliable, low-latency communication (URLLC), which is absolutely critical for advanced use cases such as coordinated autonomous driving maneuvers, precise remote control, and sensor data sharing among vehicles (Cooperative Perception). Antennas supporting these technologies must be highly efficient and capable of handling complex radio frequency characteristics across multiple bands, including the primary 5.9 GHz safety band and various cellular frequencies, necessitating meticulous design to prevent interference and maintain signal integrity in demanding automotive environments.

A crucial technological trend shaping the market is the integration of advanced antenna techniques, specifically Smart Antenna Systems and Beamforming technology. Smart antennas utilize multiple radiating elements and advanced signal processing to dynamically adjust the antenna's radiation pattern, directing the signal precisely towards the intended receiver, thereby mitigating multipath interference and extending communication range, especially vital in densely populated urban canyons. Beamforming, a core feature of 5G V2X, focuses the radio energy into narrow, directional beams, dramatically increasing throughput and reliability while simultaneously reducing power consumption compared to omnidirectional broadcasting. This capability is essential for managing the high volume of data required for fully connected, cooperative driving scenarios and ensures that safety messages are received clearly and instantaneously by all relevant parties, irrespective of the environmental challenges.

Furthermore, the trend toward highly integrated modules—where the antenna, RF front-end (RFFE), and the baseband processing unit (TCU) are packaged together—is simplifying vehicle integration for OEMs. This technological consolidation reduces cable complexity, minimizes signal loss, and facilitates easier Over-The-Air (OTA) updates and diagnostics. Future advancements are concentrating on Massive MIMO (Multiple-Input Multiple-Output) capabilities for V2X systems, leveraging a large number of antenna elements to maximize data capacity and link reliability, preparing the ground for fully autonomous fleets communicating vast amounts of sensor and environment data in real time. The underlying technology focus is consistently on achieving higher performance (low latency, high data rates) while meeting the rigorous automotive standards for reliability, thermal stability, and long operational lifespan.

Regional Highlights

The Automotive V2X Antenna Market demonstrates distinct adoption patterns driven by regulatory frameworks and infrastructure readiness across major global regions. The Asia Pacific (APAC) region, particularly China, stands as the current global leader in C-V2X technology deployment. China has strategically prioritized 5G C-V2X, integrating it into national smart infrastructure development plans and establishing robust testbeds and deployment zones. This strong governmental backing, coupled with the massive scale of automotive production, ensures that APAC will maintain its dominance in market volume and accelerate the fastest regional growth rate, focusing on both passenger safety applications and commercial vehicle platooning initiatives to optimize complex logistical networks.

North America presents a complex, yet highly potential, market. While the region initially favored DSRC, the U.S. Federal Communications Commission (FCC) has largely redirected the crucial 5.9 GHz spectrum to Wi-Fi and C-V2X usage, mandating a transition that favors the cellular standard. This regulatory certainty, although delayed, is expected to unleash substantial investment from major US and international OEMs operating in the region. The primary focus in North America is on leveraging C-V2X for immediate safety benefits and integrating these systems with established telematics services, positioning the region for aggressive growth once the regulatory dust fully settles and mass market adoption begins, potentially utilizing 4G LTE-V2X as a transitional technology before full 5G deployment.

Europe, characterized by stringent safety regulations and a proactive approach to intelligent transport systems (ITS), is rapidly standardizing on C-V2X, primarily through the European Telecommunications Standards Institute (ETSI). European market growth is driven by legislative efforts to mandate V2X systems, focusing on vehicle interoperability and cross-border safety applications, such as the eCall system integration. The high concentration of premium and luxury vehicle manufacturers in Europe ensures early adoption of cutting-edge V2X antenna technologies, including advanced beamforming and multi-band modules, even ahead of large-scale public infrastructure readiness. The Middle East and Africa (MEA) and Latin America (LATAM) markets are nascent but showing promise, often adopting C-V2X directly as part of new 5G network buildouts, bypassing legacy DSRC technology entirely, although market penetration remains constrained by infrastructure limitations and fragmented regulatory landscapes.

- Asia Pacific (APAC): Market volume leader, driven by strong governmental mandates in China supporting 5G C-V2X deployment and rapid vehicle production growth; focus on integration into smart cities and commercial fleet platooning; expected to maintain the highest CAGR.

- North America: Experiencing a definitive shift from DSRC to C-V2X following FCC spectrum reallocation; high potential driven by significant OEM investment and early adoption in premium vehicle segments; growth trajectory tied to regulatory clarity and 5G expansion timeline.

- Europe: Driven by strict safety regulations (ETSI standards) and a focus on interoperability across member states; high adoption of advanced, high-specification antenna modules by premium automotive manufacturers; strong emphasis on cross-border ITS deployment.

- Middle East & Africa (MEA) and Latin America (LATAM): Emerging markets leapfrogging DSRC directly to C-V2X, leveraging new 5G infrastructure; growth concentrated in major metropolitan areas but limited overall by capital investment constraints for infrastructure development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive V2X Antenna Market.- TE Connectivity

- Continental AG

- HARMAN International (Samsung)

- Laird Performance Materials (Dupont)

- Airgain Inc.

- Molex LLC

- Ficosa International S.A.

- DENSO Corporation

- Robert Bosch GmbH

- Aptiv PLC

- NXP Semiconductors

- Visteon Corporation

- Kathrein (Ericsson)

- PREMO S.R.L.

- Schaffner Holding AG

- Pulse Electronics

- Skyworks Solutions, Inc.

- Amphenol Corporation

- Panasonic Corporation

- Huawei Technologies Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Automotive V2X Antenna market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between DSRC and C-V2X antenna systems?

DSRC (Dedicated Short Range Communications) utilizes a Wi-Fi-based protocol within the 5.9 GHz spectrum, whereas C-V2X (Cellular V2X) leverages established cellular network infrastructure (4G LTE or 5G NR) for communication, offering superior range, bandwidth, and low-latency capabilities critical for future autonomous driving applications.

How does the 5G rollout impact the demand for Automotive V2X Antennas?

The widespread rollout of 5G significantly accelerates demand for 5G C-V2X antennas because 5G provides the ultra-low latency (URLLC) and massive throughput necessary to support advanced V2X use cases, such as cooperative maneuvering and real-time sensor data sharing, which are impossible with previous communication standards.

Which geographical region leads the market in V2X antenna adoption and deployment?

The Asia Pacific (APAC) region, primarily led by China, currently dominates the V2X antenna market in terms of deployment and volume, driven by strong governmental support and early regulatory commitment to the 5G C-V2X standard and large-scale smart infrastructure investment.

What are the key technical challenges facing V2X antenna design and integration?

Key technical challenges include managing electromagnetic compatibility (EMC) with other on-board electronics, achieving optimal multi-band performance in a compact form factor, ensuring signal reliability in non-line-of-sight conditions, and integrating sophisticated security protocols (PKI) necessary to guarantee the authenticity of safety messages.

Are V2X antennas expected to be standard features in all new vehicles in the near future?

Yes, driven by global regulatory pressures and the fundamental requirements of Level 4 and Level 5 autonomous driving, V2X antennas are rapidly transitioning from optional features to mandatory standard equipment in new vehicle models, particularly in premium and commercial segments, to enhance road safety and traffic efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager