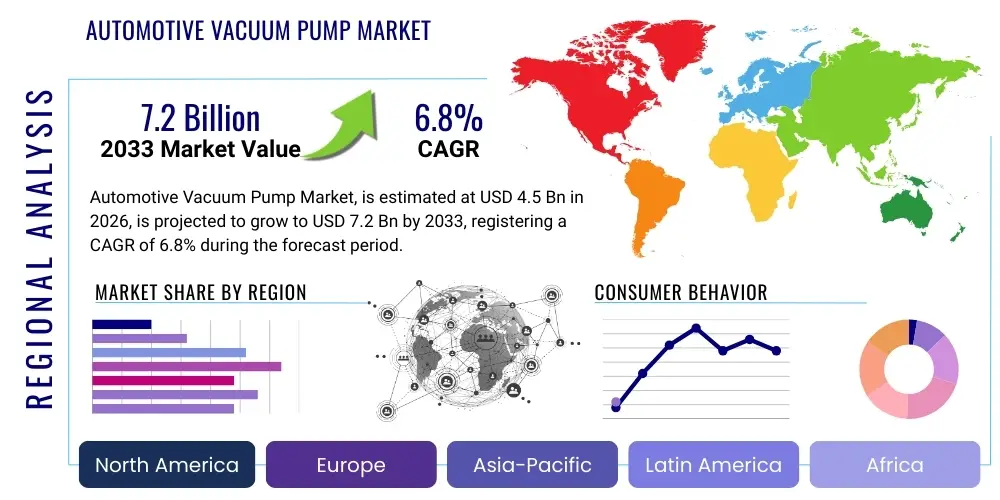

Automotive Vacuum Pump Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436895 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Automotive Vacuum Pump Market Size

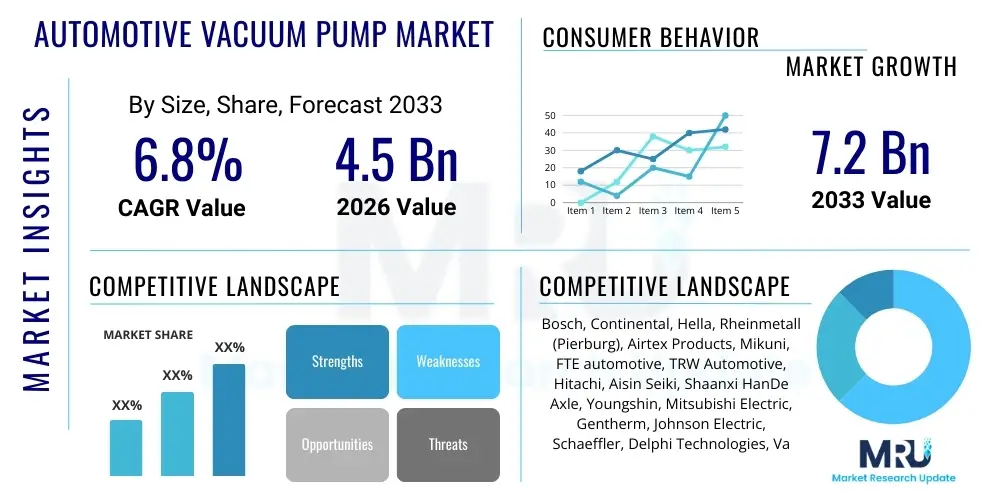

The Automotive Vacuum Pump Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033. This substantial growth is primarily driven by the increasing integration of advanced braking systems, stringent governmental regulations concerning fuel efficiency and emissions reduction, and the accelerated global transition toward hybrid and fully electric vehicle architectures, which necessitate independent vacuum generation systems.

Automotive Vacuum Pump Market introduction

The Automotive Vacuum Pump Market encompasses components vital for generating the necessary negative pressure (vacuum) required for various vehicle functions, most critically the brake booster system. These pumps are essential for ensuring braking safety and efficiency, particularly in modern internal combustion engine (ICE) vehicles where engine load management, turbocharging, and downsizing limit the traditional manifold vacuum supply. As vehicle architecture evolves, the vacuum pump transitions from a secondary component to a core element facilitating crucial safety and performance features.

Product descriptions typically delineate between mechanical (driven by the engine or camshaft) and electric (driven independently by an electric motor) vacuum pumps. Electric pumps are gaining significant traction due to their ability to operate on demand, offering superior efficiency and flexibility, which is particularly crucial for stop-start systems, mild hybrids (MHEVs), and battery electric vehicles (BEVs). Major applications span across passenger vehicles and commercial vehicles, supporting brake assistance, emission control systems, and various auxiliary functions requiring vacuum pressure integrity.

The primary driving factors for market expansion include escalating global vehicle production, especially in emerging economies, alongside the global push for enhanced vehicle safety standards, mandating features such as vacuum-assisted braking. Furthermore, the relentless pursuit of fuel economy improvements and the adoption of smaller, highly efficient turbocharged engines that generate insufficient natural vacuum are solidifying the indispensable role of dedicated vacuum pump systems. The inherent benefits derived from these pumps involve improved braking responsiveness, reduced emissions through optimized engine operation, and enhanced energy efficiency compared to traditional engine-dependent systems.

Automotive Vacuum Pump Market Executive Summary

The Automotive Vacuum Pump Market exhibits robust business trends characterized by a shift from mechanical to electric pump solutions, driven by powertrain hybridization and stringent CO2 targets. Key industry players are focusing heavily on miniaturization, noise reduction, and developing highly reliable electric pumps that seamlessly integrate with complex electronic braking systems (EBS) and regenerative braking mechanisms. The emphasis on high-pressure performance and durability, particularly for heavy-duty commercial vehicle applications, represents a significant technological focus area, alongside the standardization of communication protocols for pump control units.

Regionally, the Asia Pacific (APAC) market is poised for the fastest expansion, fueled by massive volume growth in India and China, coupled with the rapid adoption of emission standards (like China VI and Bharat Stage VI) that necessitate optimized braking and emission systems. Europe continues to lead in technological maturity and high-value electric pump adoption, primarily due to the European Union's aggressive electrification timeline and stringent safety regulations. North America maintains steady demand, influenced by the strong commercial vehicle segment and the ongoing shift towards advanced driver-assistance systems (ADAS) that rely on fail-safe braking components.

Segment-wise, the Electric Vacuum Pump segment is expected to dominate market growth throughout the forecast period, outperforming the traditional Mechanical Vacuum Pump segment. This trend is inextricably linked to the rising penetration of hybrid and electric vehicles, where an independent, dedicated vacuum source is mandatory. Within the application segment, Passenger Vehicles maintain the largest market share due to higher production volumes, although Commercial Vehicles present lucrative opportunities driven by the need for powerful, durable systems capable of handling heavy payloads and continuous operation under demanding conditions. The OEM sales channel continues to be the largest revenue contributor, reflecting the necessity of integrating these pumps into the vehicle's core design architecture.

AI Impact Analysis on Automotive Vacuum Pump Market

Common user questions regarding AI's influence on the Automotive Vacuum Pump Market center on how predictive maintenance, enhanced system diagnostics, and autonomous vehicle requirements will alter pump design and demand. Users frequently inquire if AI-driven control systems will optimize pump activation frequency, thereby extending component life and improving energy efficiency. Key concerns revolve around the potential obsolescence of current pump architectures as full brake-by-wire (BBW) systems, potentially managed by deep learning algorithms, become standard in Level 4 and Level 5 autonomous vehicles. The integration of intelligent sensors and real-time data analysis, facilitated by AI, is expected to revolutionize fault detection and performance mapping for vacuum generation systems.

AI's primary impact involves moving vacuum pumps from purely mechanical or electro-mechanical components toward intelligent, networked modules. AI algorithms, when applied to vehicle telematics and sensor data, can predict potential vacuum loss issues before they occur, scheduling proactive maintenance and improving overall vehicle reliability. Furthermore, in hybrid systems, AI can optimize the activation timing of the electric vacuum pump based on real-time driving conditions, brake pedal effort, and predicted engine start/stop cycles, leading to substantial energy savings and reduced strain on the battery system. This transition supports the overarching goal of efficient energy management in complex, electrified powertrains.

While AI does not directly manufacture the pump, it significantly affects its required intelligence, integration complexity, and operational parameters. The shift towards autonomous driving places an unprecedented premium on redundant, highly reliable braking systems. AI-powered system monitoring and control loops ensure that vacuum availability is continuously monitored and optimized, guaranteeing instantaneous brake response regardless of the powertrain state. This increased reliance on embedded intelligence necessitates closer collaboration between hardware suppliers and software developers, ultimately leading to higher value components capable of self-diagnosis and secure communication within the vehicle's network architecture.

- AI enables predictive maintenance, minimizing unexpected vacuum pump failures.

- Optimized pump activation cycles through machine learning enhance energy efficiency in hybrid vehicles.

- AI supports the development of highly reliable, redundant braking systems crucial for autonomous vehicles.

- Integration of intelligent sensors allows for real-time performance monitoring and anomaly detection.

- AI-driven diagnostics streamline fault isolation, reducing warranty claims and repair times.

- Demand for networked, intelligent electric vacuum pumps increases due to required computational capabilities.

DRO & Impact Forces Of Automotive Vacuum Pump Market

The Automotive Vacuum Pump Market is significantly influenced by key Drivers, Restraints, and Opportunities (DRO), all subject to powerful internal and external Impact Forces. The primary driver is the global proliferation of downsized and turbocharged engines, which inherently generate insufficient vacuum for brake assistance, making auxiliary vacuum pumps mandatory. Concurrently, the accelerating shift towards hybrid and electric vehicles decisively drives demand for efficient, dedicated electric vacuum pumps (EVPs), as BEVs and HEVs lack the traditional engine source of vacuum. These factors create a strong foundation for sustained market expansion, particularly in high-growth automotive manufacturing regions.

However, the market faces significant restraints, chiefly concerning the long-term technological threat posed by the development and standardization of complete brake-by-wire (BBW) systems. As these fully electronic braking systems become more prevalent, the traditional need for a vacuum booster is eliminated, potentially capping the growth of the traditional vacuum pump market in the distant future. Additionally, the complexity and higher cost associated with advanced, high-efficiency electric pumps, especially compared to their mechanical counterparts, can be a short-term restraint in cost-sensitive emerging markets. Suppliers must navigate optimizing cost while maintaining stringent quality and performance standards required by modern vehicle platforms.

Major opportunities lie in the commercial vehicle segment, particularly heavy-duty trucks and buses, which require highly robust vacuum systems for air brakes and auxiliary functions. Moreover, the aftermarket segment offers sustained revenue streams as the installed base of vehicles requiring vacuum assistance grows and components require replacement over the lifespan of the vehicle. Impact Forces such as global governmental emission mandates (e.g., Euro 7, CAFE standards) exert powerful pressure on OEMs to adopt efficient powertrain components, directly favoring electric vacuum pumps. Economic stability and global semiconductor supply chain resilience also serve as critical impact forces affecting production volume and material costs for these technologically complex components.

Segmentation Analysis

The Automotive Vacuum Pump Market is comprehensively segmented based on Type, Application, and Sales Channel, reflecting the diverse requirements across the global automotive industry. This segmentation provides a granular view of market dynamics, revealing key areas of growth, technological preference, and revenue contribution. The fundamental dichotomy between mechanical and electric pump types dictates performance characteristics and suitability for different powertrain architectures, while application segmentation separates the volume-driven passenger vehicle market from the specialized, high-durability commercial vehicle sector. Analyzing these segments is crucial for understanding current market penetration and future strategic direction, especially concerning electrification trends.

The transition toward electric vehicles is profoundly reshaping the segmentation landscape, propelling the Electric Vacuum Pump segment into a position of dominance. These electric units offer precise control, reduced energy consumption, and essential functional independence from the engine, aligning perfectly with efficiency goals and safety requirements. Geographically, segmentation highlights the differential adoption rates based on regional regulatory frameworks and consumer preferences, with mature markets prioritizing electric solutions and developing markets balancing cost-efficiency with regulatory compliance. The Aftermarket channel, driven by replacement cycles, remains stable, contrasting with the high-volume, competitive dynamics of the OEM channel.

Understanding the interplay between these segments allows stakeholders to tailor product development and market entry strategies. For instance, focusing on the Passenger Vehicle Electric segment in Europe and North America capitalizes on regulatory mandates, whereas focusing on the Mechanical segment, albeit declining, still serves specific large-engine commercial vehicle markets in regions with less stringent emission controls. Detailed segmentation analysis confirms that future innovation and investment will heavily center around robust, smart, and efficient electric vacuum pump solutions integrated within sophisticated brake management systems.

- Type: Mechanical Vacuum Pump, Electric Vacuum Pump

- Application: Passenger Vehicle, Commercial Vehicle

- Sales Channel: OEM (Original Equipment Manufacturer), Aftermarket

- Vehicle Type (Sub-Segment): ICE Vehicle, Hybrid Electric Vehicle (HEV), Battery Electric Vehicle (BEV)

Value Chain Analysis For Automotive Vacuum Pump Market

The value chain for the Automotive Vacuum Pump Market begins with Upstream Analysis, focusing on raw material procurement and core component manufacturing. Key inputs include high-grade metals (aluminum, specialized steel alloys) for housings and moving parts, complex plastic polymers, and critical electronic components such as semiconductors, motors, and control units (ECUs). Suppliers of these specialized materials and microcontrollers face constant pressure regarding pricing, quality consistency, and supply chain resilience. The competitiveness in this stage is driven by efficient material processing and vertical integration capabilities among Tier 2 suppliers, ensuring the fundamental physical and electronic reliability of the final product.

Midstream activities involve the core manufacturing and assembly of the vacuum pump systems by Tier 1 automotive suppliers. This stage requires significant investment in precision machining, cleanroom assembly environments, advanced testing protocols, and robust quality control procedures to meet stringent automotive standards (e.g., IATF 16949). Research and Development (R&D) are critical here, focusing on improving pump efficiency, reducing noise, miniaturization, and enhancing communication protocols for electric pumps. Strong intellectual property and patented designs, particularly concerning efficient motor and valve technology, provide substantial competitive advantages to leading manufacturers.

The Downstream Analysis involves Distribution Channels, where the finished products move to the final end-users. The primary channel is Direct distribution to Original Equipment Manufacturers (OEMs). Tier 1 suppliers negotiate long-term contracts and integrate their products directly into vehicle assembly lines globally. The Indirect distribution channel encompasses the Aftermarket, involving distributors, wholesalers, and independent repair shops. Aftermarket distribution relies on a wide logistical network and maintaining sufficient inventory for replacement parts. While OEM sales provide high volume stability, the aftermarket ensures sustained revenue due to continuous demand for replacement parts over the vehicle’s long lifecycle. Success in the downstream sector depends heavily on logistical efficiency, established service networks, and maintaining strong brand recognition among repair professionals and consumers alike.

Automotive Vacuum Pump Market Potential Customers

The primary potential customers and end-users of automotive vacuum pump systems are classified into two main categories: vehicle manufacturers and maintenance/repair entities. The largest volume segment comprises Original Equipment Manufacturers (OEMs), including global giants such as Volkswagen Group, Toyota Motor Corporation, General Motors, Ford Motor Company, and major commercial vehicle manufacturers like Daimler Truck and Volvo Group. These customers require massive volumes of technologically advanced, customized vacuum pumps that meet precise integration specifications, durability standards, and strict supply chain reliability mandates necessary for high-volume vehicle production. Supplier contracts with OEMs are typically long-term and involve deep R&D collaboration to integrate new systems seamlessly into future vehicle platforms.

The second crucial segment of potential customers encompasses the Aftermarket distribution channel, which includes independent automotive repair facilities, authorized service centers, and parts retailers globally. These customers purchase vacuum pumps for replacement purposes, driven by the aging vehicle fleet and the eventual failure or wear-out of installed components. Aftermarket buyers prioritize product availability, competitive pricing, and compatibility with a wide range of vehicle models. Maintaining strong relationships with major automotive parts distributors (e.g., Autozone, O’Reilly, local distributors) is essential to capture this stable, high-margin replacement business, which often uses standardized product lines rather than custom OEM specifications.

Furthermore, specialized industrial customers, such as manufacturers of high-performance tuning kits or niche vehicle builders (e.g., low-volume luxury or specialized utility vehicles), represent smaller but high-value potential end-users. These buyers often require specialized or heavy-duty vacuum pump solutions tailored for extreme operating conditions or performance modifications. Ultimately, the market is defined by the OEM segment dictating initial technology adoption and volume, while the Aftermarket segment provides the long-tail stability and revenue derived from servicing the operational lifespan of the global vehicle fleet.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch, Continental, Hella, Rheinmetall (Pierburg), Airtex Products, Mikuni, FTE automotive, TRW Automotive, Hitachi, Aisin Seiki, Shaanxi HanDe Axle, Youngshin, Mitsubishi Electric, Gentherm, Johnson Electric, Schaeffler, Delphi Technologies, Valeo, ACDelco, Denso. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Vacuum Pump Market Key Technology Landscape

The Automotive Vacuum Pump Market is undergoing a rapid technological transformation, primarily centered on the shift from traditional mechanical systems to advanced electric pump solutions. Key technology utilized includes the development of high-efficiency, permanent magnet synchronous motors (PMSMs) for electric pumps, which offer superior performance, quieter operation, and significantly lower energy draw compared to brushed DC motors. Furthermore, modern pumps integrate sophisticated electronic control units (ECUs) capable of communicating via CAN bus networks, allowing for precise, on-demand activation based on real-time brake demands and system pressure monitoring. This smart integration is fundamental to achieving high fuel economy and optimal system reliability in modern vehicle architectures.

A central technological focus is the optimization of pump design for noise, vibration, and harshness (NVH) reduction, which is particularly crucial in electric vehicles where the pump noise is not masked by the engine. This involves advanced acoustic damping materials, redesigned vanes or diaphragms, and specialized housing structures. In parallel, advancements in vane pump technology, including optimized vane materials and tighter tolerance manufacturing, continue to enhance the efficiency and lifespan of mechanical pumps used in certain high-output ICE and heavy commercial vehicle applications. Material science plays a vital role in ensuring longevity, especially in components exposed to high heat and wear.

Looking ahead, the technological landscape is increasingly influenced by the requirements of autonomous and brake-by-wire (BBW) ready systems. This necessitates the development of highly redundant, modular vacuum systems featuring fail-safe mechanisms and self-diagnostic capabilities. The integration of advanced pressure sensors and algorithms ensures instantaneous vacuum recovery and sustained performance under severe conditions. Manufacturers are also exploring innovative pumping principles, although the established rotary vane and diaphragm designs remain dominant, constantly optimized through finite element analysis (FEA) and computational fluid dynamics (CFD) modeling to push performance limits while adhering to strict packaging constraints within the engine bay or chassis.

Regional Highlights

The global automotive vacuum pump market exhibits pronounced regional differences driven by varying regulatory environments, vehicle production volumes, and the pace of electrification. The Asia Pacific (APAC) region stands out as the highest growth market, propelled by robust automotive manufacturing bases in China, India, Japan, and South Korea. China, in particular, dominates regional demand due to massive domestic vehicle production, stringent new emission standards (China VI), and accelerating adoption of New Energy Vehicles (NEVs), which mandate independent vacuum systems for regenerative braking efficiency and brake assistance.

Europe represents the technological frontrunner and a key market for advanced electric vacuum pumps. Driven by the European Union’s aggressive targets for CO2 reduction and the swift transition toward hybrid and electric vehicles, European OEMs are rapid adopters of intelligent, high-efficiency EVPs. The established presence of major Tier 1 suppliers in Germany and surrounding countries ensures continuous innovation and high market penetration of premium solutions. Safety mandates, coupled with the popularity of compact, downsized engines, cement Europe's position as a high-value market demanding optimal performance and integration.

North America maintains a substantial market share, characterized by high demand in both the passenger vehicle and heavy commercial truck sectors. While the US market lags slightly behind Europe in pure EV penetration, the growing adoption of gasoline direct injection (GDI) and turbocharging across light-duty vehicles creates consistent demand for auxiliary vacuum assistance. Furthermore, the stringent safety requirements for commercial vehicles and the necessity for robust brake systems in high-load applications contribute significantly to the demand for durable vacuum pumps, ensuring stable market expansion throughout the forecast period.

- North America: Strong commercial vehicle segment demand; stable adoption rate of EVPs in light vehicles influenced by safety standards and engine downsizing trends. Focus on redundancy and high durability.

- Europe: Leading market for electric vacuum pump technology due to stringent EU emission regulations and rapid HEV/EV adoption. High penetration of sophisticated, networked pump systems.

- Asia Pacific (APAC): Fastest-growing region driven by high volume production in China and India, increasing vehicle parc, and implementation of regional emissions standards necessitating vacuum assistance.

- Latin America: Moderate growth, primarily driven by OEM requirements for mid-range vehicle production and reliance on mechanical pump systems, transitioning gradually toward electric solutions as infrastructure allows.

- Middle East and Africa (MEA): Growth linked to increasing vehicle assembly activity and replacement market stability, although technological adoption pace is slower compared to global leaders.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Vacuum Pump Market.- Robert Bosch GmbH

- Continental AG

- Hella GmbH & Co. KGaA

- Rheinmetall AG (Pierburg)

- Aisin Corporation

- Hitachi Astemo, Ltd.

- Valeo SE

- Mikuni Corporation

- FTE automotive GmbH (a part of Valeo)

- TRW Automotive (a part of ZF Friedrichshafen AG)

- Airtex Products, LLC

- Mitsubishi Electric Corporation

- Gentherm Incorporated

- Johnson Electric Holdings Limited

- Schaeffler AG

- Delphi Technologies (a part of BorgWarner Inc.)

- Denso Corporation

- ACDelco (a part of General Motors)

- Tenneco Inc. (as a supplier of components)

- Youngshin Automotive

Frequently Asked Questions

Analyze common user questions about the Automotive Vacuum Pump market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift from mechanical to electric vacuum pumps?

The shift is primarily driven by powertrain evolution, specifically engine downsizing (turbocharging, GDI) which reduces natural manifold vacuum, and the rapid proliferation of Hybrid and Electric Vehicles (HEVs/BEVs). Electric pumps offer on-demand operation, crucial for stop-start systems and electric powertrains, improving fuel economy, enhancing braking safety, and ensuring vacuum independence from engine operation. Regulatory mandates for fuel efficiency also strongly favor the energy savings provided by EVPs.

How do autonomous vehicles affect the future demand for vacuum pump technology?

Autonomous vehicles significantly increase the demand for redundancy and high reliability in braking systems. While full brake-by-wire (BBW) systems may eventually eliminate the vacuum booster entirely, current Level 2 and Level 3 autonomous vehicles still rely heavily on fail-safe vacuum-assisted braking. This reliance necessitates intelligent, highly durable electric vacuum pumps with enhanced monitoring and rapid fault detection capabilities, driving up the value and complexity of the required technology in the short-to-medium term.

Which geographical region holds the largest market share for automotive vacuum pumps?

The Asia Pacific (APAC) region currently holds the largest market share in terms of volume, primarily due to the vast scale of automotive manufacturing in countries like China and India, coupled with rising adoption of advanced emission standards. However, Europe leads the market in terms of value and technological maturity, boasting the highest penetration rate of sophisticated and high-cost electric vacuum pump systems due to strict electrification targets and advanced safety regulations.

What are the key technical challenges facing automotive vacuum pump manufacturers?

Key technical challenges include achieving extreme levels of noise, vibration, and harshness (NVH) reduction, especially for silent electric vehicle operation. Manufacturers must also continuously improve energy efficiency and integration complexity, ensuring that electric pumps can operate reliably under various vehicle voltages and communicate securely via CAN protocols, all while maintaining strict packaging constraints and providing high durability for a long component lifespan under varying operating temperatures.

Will brake-by-wire technology completely replace the need for automotive vacuum pumps?

In the long term, widespread adoption of pure brake-by-wire (BBW) systems in new vehicle architectures is expected to negate the requirement for traditional vacuum boosters and, consequently, vacuum pumps. However, this transition is gradual. Vacuum pumps will remain essential for the massive existing fleet of ICE and hybrid vehicles, and in many new vehicle platforms as a reliable, cost-effective backup or auxiliary system, meaning displacement will be slow and segment-specific over the next decade.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager