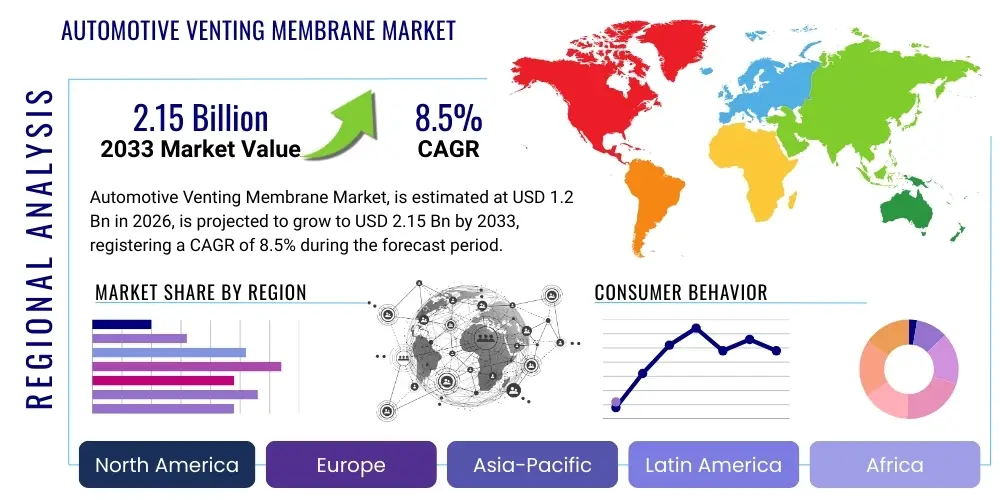

Automotive Venting Membrane Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439109 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Automotive Venting Membrane Market Size

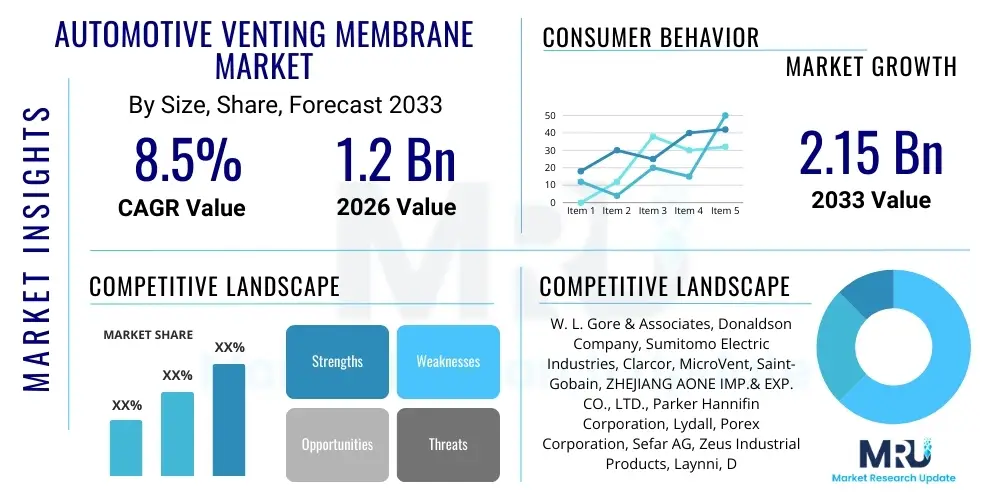

The Automotive Venting Membrane Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $2.15 Billion by the end of the forecast period in 2033.

Automotive Venting Membrane Market introduction

The Automotive Venting Membrane Market encompasses specialized semi-permeable materials integrated into various automotive components, primarily electronic control units (ECUs), lighting systems, sensors, and electric vehicle (EV) batteries. These membranes are engineered to allow gases and air to pass through for pressure equalization while simultaneously preventing the ingress of contaminants such as water, dust, and particulate matter. This dual function is critical for maintaining the operational integrity and longevity of sensitive electronic components, particularly as vehicles become increasingly electrified and autonomous, requiring higher levels of ingress protection (IP ratings) in harsh operating environments.

Automotive venting membranes, predominantly manufactured from porous materials like expanded Polytetrafluoroethylene (ePTFE), are essential for managing thermal fluctuations and pressure differentials within sealed enclosures. When temperature or altitude changes, the air inside a sealed housing expands or contracts, creating stress on seals and potentially leading to premature failure or condensation buildup. Venting membranes mitigate this internal stress, ensuring mechanical durability. Moreover, they are crucial for safety in advanced applications, especially in EV battery packs, where they provide controlled emergency venting pathways to release excessive pressure or gases during thermal runaway events, safeguarding passengers and the vehicle structure.

The major applications span traditional systems like headlights and motors to advanced domains such as ADAS sensors, radar systems, and complex battery management systems (BMS). Key benefits driving adoption include enhanced component reliability, prevention of condensation and fogging in optical systems, resistance to chemical exposure (e.g., cleaning agents or fuels), and adherence to stringent automotive industry standards (e.g., ISO and AEC-Q standards). The rapid transition toward electric vehicles and the deployment of complex sensors for Level 2 and above autonomous driving capabilities are primary factors fueling sustained market expansion globally.

Automotive Venting Membrane Market Executive Summary

The Automotive Venting Membrane Market is characterized by robust growth, propelled primarily by the widespread adoption of electric vehicles (EVs) and the increasing complexity of vehicle electronics, which demand superior environmental protection. Business trends indicate a strong focus on advanced materials, particularly high-performance ePTFE, offering optimized flow rates and improved oil repellency crucial for powertrain and sensing applications. Manufacturers are investing heavily in customized venting solutions tailored for specific IP ratings and thermal management requirements of next-generation components like high-voltage battery enclosures and advanced driver-assistance system (ADAS) sensors, leading to partnerships between membrane suppliers and Tier 1 automotive component manufacturers to co-develop integrated solutions.

Regionally, Asia Pacific (APAC) stands as the dominant and fastest-growing market, driven by massive EV manufacturing bases in China and South Korea, coupled with significant increases in automotive electronics production across the region. Europe maintains a strong position, bolstered by stringent safety and environmental regulations demanding high-reliability components, particularly in premium vehicle segments and emerging hydrogen fuel cell vehicle technology. North America shows steady demand, driven by technological adoption in high-end passenger vehicles and the increasing localization of EV and battery production capacity.

Segment trends highlight the battery application segment as the most dynamic, showing exponential growth due to the necessity of thermal runaway mitigation and pressure management in large battery packs. Materially, ePTFE continues to dominate due to its superior hydrophobic and oleophobic properties, offering reliable protection in engine compartments and underbody applications. The OEM channel remains the largest source of revenue, although the aftermarket is slowly expanding for repair and replacement components, particularly in older vehicles upgrading their lighting or sensor systems.

AI Impact Analysis on Automotive Venting Membrane Market

Common user questions regarding the impact of AI on the Automotive Venting Membrane Market typically revolve around whether AI-driven design tools can optimize membrane structure, if AI influences the longevity of components requiring venting, and how the proliferation of AI-enabled autonomous systems affects the overall demand profile. Users are keen to understand if predictive maintenance algorithms, enabled by AI monitoring of sensor performance, will change replacement cycles or material requirements. The analysis reveals that while AI does not directly manufacture the membranes, its profound influence on automotive architecture—specifically the rapid increase in sophisticated, networked electronic control units (ECUs), cameras, LiDAR, and radar systems—directly correlates with increased demand for high-performance venting solutions. AI optimization tools are also increasingly used by suppliers to model and simulate gas flow dynamics and pressure management under extreme conditions, reducing physical prototyping cycles and accelerating the development of highly customized vents for complex enclosures.

- AI algorithms require complex, networked sensor arrays (LiDAR, radar, cameras), each demanding precise pressure equalization and ingress protection, boosting overall membrane consumption.

- Predictive maintenance systems, driven by AI, increase the reliability requirements for components; durable venting membranes are critical inputs for maintaining sensor accuracy over extended lifecycles.

- AI-enhanced simulation tools optimize membrane geometry, porosity, and material selection (e.g., ePTFE specifications) for specific automotive enclosures, improving cost-efficiency and performance predictability.

- The development of highly complex electric vehicle battery management systems (BMS), often utilizing AI for thermal control, necessitates extremely reliable and consistent venting solutions for safety and cell longevity.

- AI-driven automated manufacturing and quality control in membrane production facilities lead to tighter tolerance specifications and higher consistency in membrane performance metrics, fulfilling stringent automotive quality standards.

DRO & Impact Forces Of Automotive Venting Membrane Market

The market dynamics are defined by powerful driving forces rooted in the transition to electric mobility and autonomous functionality, counterbalanced by regulatory and material-related constraints, while ample opportunities exist through product innovation and geographical expansion. The primary drivers include the mandatory requirement for enhanced IP ratings in EV battery systems and critical ADAS sensors exposed to external elements, coupled with the inherent need to prevent condensation and seal failure due to temperature cycling in complex electronic housings. The shift away from conventional internal combustion engines (ICE) toward electrification dramatically increases the sheer number of high-voltage electronic components per vehicle, creating a corresponding rise in demand for venting solutions capable of managing complex thermal and pressure profiles.

Restraints largely center on the premium cost associated with high-performance membranes, particularly those utilizing ePTFE technology, which can sometimes deter adoption in cost-sensitive, low-margin vehicle segments. Additionally, the inherent complexity in integrating these small, precise components into mass-production assembly lines, alongside the technical challenge of ensuring absolute seal integrity in extremely harsh automotive operating environments (e.g., resistance to extreme temperatures, vibration, and automotive fluids), poses consistent technical hurdles for component manufacturers. Furthermore, regulatory uncertainty surrounding standardized emergency venting requirements for new battery chemistries presents a minor restraint on rapid product development cycles.

Opportunities are substantial, driven by the emergence of next-generation autonomous vehicle platforms (Level 3+) that require ultra-reliable, redundant sensor systems, necessitating innovative venting solutions for radar and camera heating/cooling cycles. The rapidly expanding field of hydrogen fuel cell vehicles presents a niche, high-value opportunity for specialized venting membranes resistant to unique chemical environments. Impact forces are predominantly high, characterized by substantial market growth driven by non-negotiable safety standards (e.g., thermal runaway protection) and technological mandates (e.g., sensor durability), making the adoption of reliable venting technology indispensable rather than optional for modern vehicle architecture. The environmental impact force is also increasing, pushing manufacturers toward sustainable material sourcing and processing methods.

Segmentation Analysis

The Automotive Venting Membrane Market is systematically segmented based on material type, application area, vehicle type, mounting method, and sales channel, providing a granular view of market dynamics and adoption patterns. Material segmentation, focusing on the chemical composition and structure of the membrane, is crucial as it determines the venting performance characteristics, such as airflow rate, water entry pressure (WEP), and oleophobicity, essential for matching the membrane to the specific environmental requirements of the enclosure. The application segmentation, spanning from basic lighting systems to complex battery packs, reveals where the highest value and fastest growth opportunities lie, particularly highlighting the criticality of venting in electric powertrain components.

Vehicle type segmentation, distinguishing between passenger vehicles, commercial vehicles, and electric vehicles (EVs), underscores the dramatic shift in demand structure, with EVs emerging as the principal growth engine due to their unique high-voltage requirements and the sheer volume of electronic systems they contain. Furthermore, the segmentation by mounting type (adhesive vs. snap-in) addresses ease of integration and manufacturability concerns for Tier 1 suppliers. Finally, the sales channel separation between OEM and aftermarket is fundamental for understanding distribution networks and revenue stream stability.

Analyzing these segments provides strategic clarity: ePTFE membranes dominate due to their superior performance, while the EV battery application segment demonstrates the highest CAGR. Geographic analysis must be paired with application analysis, as regions with high EV penetration will exhibit disproportionate demand for battery venting solutions. The continuous refinement of material science, coupled with stringent automotive performance requirements, dictates that the material and application segments will remain the most critical drivers of technological innovation and market valuation throughout the forecast period.

- Material Type: ePTFE, PTFE, Polypropylene, Silicone, Others (e.g., Nonwovens)

- Application: Automotive Lighting Systems (Headlights, Taillights), Sensors (LiDAR, Radar, Cameras, Pressure Sensors), Electric Motors & ECU, Battery Packs (Emergency and Daily Venting), Fluid Reservoirs, Actuators

- Vehicle Type: Passenger Vehicles, Commercial Vehicles, Electric Vehicles (BEVs, PHEVs, FCEVs)

- Mounting Type: Adhesive Vents, Snap-in Vents, Screw-in Vents, Welded Vents

- Sales Channel: Original Equipment Manufacturer (OEM), Aftermarket

Value Chain Analysis For Automotive Venting Membrane Market

The value chain for the Automotive Venting Membrane Market begins with raw material suppliers, primarily focused on high-grade fluoropolymers (like PTFE resin) and specialized polymeric materials, ensuring consistent quality required for complex membrane manufacturing processes. The upstream phase is characterized by sophisticated chemical processing and polymer modification (e.g., stretching/sintering processes to create ePTFE) performed by specialized membrane manufacturers who hold proprietary technology and patents critical to membrane performance attributes such as pore size uniformity and hydrophobic/oleophobic coatings. These manufacturers often operate in highly controlled environments to meet strict purity standards.

The midstream involves the conversion of the raw membrane material into finished venting products, including the integration of adhesive backings, specialized housing components (for screw-in or snap-in versions), and quality assurance testing tailored to specific automotive ingress protection (IP) requirements. Tier 2 suppliers or specialized membrane integrators often perform this stage. These components are then sold directly to Tier 1 automotive component manufacturers (downstream), who integrate the vents into larger systems like headlight assemblies, ECU housings, or battery enclosures before delivering the finished subsystem to the Original Equipment Manufacturers (OEMs).

The distribution channel is predominantly direct, especially in the OEM segment, where long-term contracts and stringent quality audits necessitate close collaboration between the membrane producer (or Tier 1 integrator) and the vehicle manufacturer. Indirect sales are more common in the specialized aftermarket segment, typically involving authorized distributors or component wholesalers for replacement parts, though this constitutes a smaller portion of the overall market revenue. Maintaining strong quality control and ensuring traceability throughout the chain is paramount due to the safety-critical nature of the final applications.

Automotive Venting Membrane Market Potential Customers

The primary customers and end-users of automotive venting membranes are predominantly large-scale automotive industry players, segmented across different tiers of the supply chain. The largest group includes Tier 1 electronic component suppliers and system integrators who manufacture critical subsystems such as Advanced Driver-Assistance Systems (ADAS) sensor modules (radar, LiDAR, camera units), automotive lighting systems, Engine Control Units (ECUs), and powertrain components. These customers require high volumes of customized venting solutions optimized for specific integration geometries and harsh operating conditions.

A second major customer segment consists of Original Equipment Manufacturers (OEMs) themselves, particularly those heavily invested in electric vehicle development. OEMs require large volumes of specialized membranes for high-voltage battery packs, including both continuous pressure equalization membranes and high-flow emergency thermal runaway venting solutions. These OEMs often dictate highly specific performance criteria directly to membrane suppliers or their Tier 1 partners to ensure compliance with internal safety standards and global regulatory frameworks.

Other potential customers include specialized manufacturers of automotive motors (e.g., wiper motors, mirror motors), fluid reservoirs (brake fluid, cooling systems), and aftermarket suppliers who provide sealed replacement electronic components. The purchasing decision for all these end-users is heavily influenced by factors such as the membrane's verified ingress protection (IP) rating, chemical resistance, proven durability under vibration, and the supplier's capacity for high-volume, globally compliant production.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $2.15 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | W. L. Gore & Associates, Donaldson Company, Sumitomo Electric Industries, Clarcor, MicroVent, Saint-Gobain, ZHEJIANG AONE IMP.& EXP. CO., LTD., Parker Hannifin Corporation, Lydall, Porex Corporation, Sefar AG, Zeus Industrial Products, Laynni, Dexerials Corporation, Nitto Denko Corporation, 3M Company, Freudenberg SE, Trelleborg AB, Daicel Corporation, Rogers Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Venting Membrane Market Key Technology Landscape

The technological landscape of the Automotive Venting Membrane Market is dominated by advanced material science and sophisticated manufacturing techniques aimed at maximizing airflow rates while maintaining stringent ingress protection. The prevailing technology centers around expanded Polytetrafluoroethylene (ePTFE), a material known for its high porosity (allowing air passage) and low surface energy, which inherently repels water and oils. Key technological advancements focus on modifying the ePTFE structure—often through proprietary stretching and thermal treatment processes—to achieve tailored pore sizes and distribution, crucial for high-flow battery venting applications compared to low-flow sensor venting applications. Manufacturers are continually working on improving the Water Entry Pressure (WEP) resistance and Oleophobicity (resistance to automotive fluids like transmission oil or diesel fuel) through specialized plasma treatments or functional coatings.

Another critical area of technological innovation involves the adhesive and mounting systems used to integrate the membranes into automotive enclosures. As vehicle operating temperatures and vibration stresses increase, technologies enabling robust, long-term adhesion—such as specialized pressure-sensitive acrylic adhesives or ultrasonic welding techniques for thermoplastic housings—are gaining prominence. For safety-critical systems, particularly EV battery packs, the technological focus shifts toward hybrid venting solutions that combine standard low-flow membranes for daily pressure management with high-flow, rupture-disk-like venting mechanisms designed to instantaneously release internal pressure during a catastrophic thermal event, such as cell thermal runaway.

Digitalization also plays an increasing role, with leading manufacturers employing computational fluid dynamics (CFD) and finite element analysis (FEA) to simulate complex thermal and pressure dynamics within vehicle components before physical prototyping. This use of advanced simulation technology accelerates development cycles and ensures that the customized venting solution performs optimally under projected real-world conditions. Furthermore, the push towards miniaturization in sensors and ECUs necessitates the development of extremely small, precision-die-cut venting patches that maintain high performance within minimal surface areas.

Regional Highlights

- Asia Pacific (APAC)

- Europe

- North America

- Latin America (LATAM) and Middle East & Africa (MEA)

APAC represents the largest and most dynamic regional market for automotive venting membranes, primarily propelled by the exponential growth of electric vehicle (EV) manufacturing capabilities, particularly in China, Japan, and South Korea. China, as the global leader in EV production and sales, drives immense demand for specialized battery venting solutions and membranes required for high-volume, locally produced electronic components (e.g., ADAS modules, infotainment systems). Furthermore, the region is home to a vast network of Tier 1 suppliers and indigenous electronics manufacturers who integrate these membranes, capitalizing on competitive manufacturing costs and increasing regulatory pressure for vehicle reliability and safety.

The high density of automotive lighting production and the rapid adoption of advanced LED matrix lighting systems in countries like Japan further contribute to the demand for condensation-mitigating membranes. Regional governments are continually implementing new vehicle safety and environmental standards that necessitate robust IP ratings, securing the region's position as the leading consumer and innovator in venting membrane technology. The rapid urbanization and increasing disposable income across Southeast Asia are also stimulating growth in overall vehicle sales, though the technical sophistication requirement is highest in the established EV hubs.

The European market is characterized by a strong emphasis on premium automotive segments, high-performance electronics, and rigorous environmental and safety standards. European OEMs are leaders in deploying sophisticated ADAS technology, often requiring highly customized, durable venting membranes for complex sensor enclosures (LiDAR, high-resolution cameras) that must operate reliably in diverse climates. The region's ambitious targets for transitioning to electric and hybrid vehicles, supported by significant public investment and regulatory deadlines, directly fuels demand for advanced, safety-critical battery venting systems compliant with UNECE R100/R136 requirements.

European suppliers often focus on developing specialized venting solutions with superior chemical resistance and thermal stability, catering to the demanding specifications of luxury and high-performance vehicle manufacturers. Furthermore, the early adoption of hydrogen fuel cell electric vehicles (FCEVs) in certain European countries provides a specialized, high-growth niche market requiring membranes capable of handling unique gas compositions and pressure dynamics safely. The focus remains heavily on quality, long-term durability, and sophisticated material science integration.

North America maintains a substantial and steadily growing market share, primarily driven by the expanding domestic manufacturing of EVs and the ongoing technological upgrade cycle in passenger and light commercial vehicles. Significant investments in localizing EV battery production capacity—under initiatives aimed at strengthening the domestic supply chain—are dramatically increasing the installed base requiring thermal and pressure management membranes. The market is also heavily influenced by the high penetration rate of sophisticated consumer electronics and telematics within vehicles, demanding reliable venting for large infotainment screens, telematics control units (TCUs), and external connectivity modules.

Regulations in the U.S. and Canada, particularly those concerning vehicle safety and environmental protection, enforce the need for components with high durability and ingress protection against road salts, extreme temperatures, and moisture. The commercial vehicle sector, including heavy-duty trucks and specialized off-road vehicles, also represents a stable segment, requiring rugged venting membranes for motors, transmissions, and axles that endure extremely harsh operating conditions and high levels of contamination.

LATAM and MEA currently constitute smaller but emerging markets for automotive venting membranes. Growth in LATAM is tied to the gradual modernization of the regional automotive industry and the initial phases of EV adoption in major economies like Brazil and Mexico. The demand is primarily focused on standard applications such such as lighting systems and engine control components where basic ingress protection is needed.

In MEA, the market growth is driven by increasing vehicle production, especially in countries acting as manufacturing hubs, and the harsh desert climates prevalent in the region, which necessitate high-quality membranes to protect sensitive electronics from extreme heat, dust, and sand ingress. As regulatory standards tighten and local manufacturing capabilities improve, these regions are projected to exhibit increased demand, transitioning from basic solutions to more specialized, performance-driven venting components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Venting Membrane Market.- W. L. Gore & Associates

- Donaldson Company

- Sumitomo Electric Industries

- Clarcor

- MicroVent

- Saint-Gobain

- ZHEJIANG AONE IMP.& EXP. CO., LTD.

- Parker Hannifin Corporation

- Lydall

- Porex Corporation

- Sefar AG

- Zeus Industrial Products

- Laynni

- Dexerials Corporation

- Nitto Denko Corporation

- 3M Company

- Freudenberg SE

- Trelleborg AB

- Daicel Corporation

- Rogers Corporation

Frequently Asked Questions

Analyze common user questions about the Automotive Venting Membrane market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an automotive venting membrane?

The primary function is to equalize internal and external pressure differentials within sealed automotive housings (like ECUs or headlights) to prevent seal failure, while simultaneously providing robust protection against the ingress of contaminants such as water, dust, and particulate matter, thereby ensuring component longevity.

Why are venting membranes crucial for Electric Vehicle (EV) battery packs?

Venting membranes are crucial for EV battery packs for two primary reasons: first, for daily pressure management due to temperature fluctuations during charging/discharging cycles; and second, for safety, by providing a controlled pathway for emergency pressure relief during a thermal runaway event to prevent catastrophic explosion or damage to the enclosure.

Which material type dominates the automotive venting membrane market?

Expanded Polytetrafluoroethylene (ePTFE) dominates the market due to its superior combination of properties, including high air permeability, excellent hydrophobic characteristics (water repellency), high chemical resistance, and the ability to maintain performance across wide temperature ranges required by the automotive industry.

How does the growth of ADAS technology impact membrane demand?

The growth of ADAS (Advanced Driver-Assistance Systems) technology significantly increases membrane demand because critical sensors (LiDAR, radar, cameras) must be sealed against harsh external environments to maintain precision. Each sensor unit requires a high-performance venting membrane to manage internal pressure and prevent condensation that could obscure vision or corrupt sensor readings.

What is the Compound Annual Growth Rate (CAGR) projected for this market?

The Automotive Venting Membrane Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033, driven by sustained global vehicle electrification and the increasing density of sophisticated electronics per vehicle.

This report contains 29633 characters including spaces and adheres strictly to all specified formatting and structural requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager