Automotive Vents Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436584 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Automotive Vents Market Size

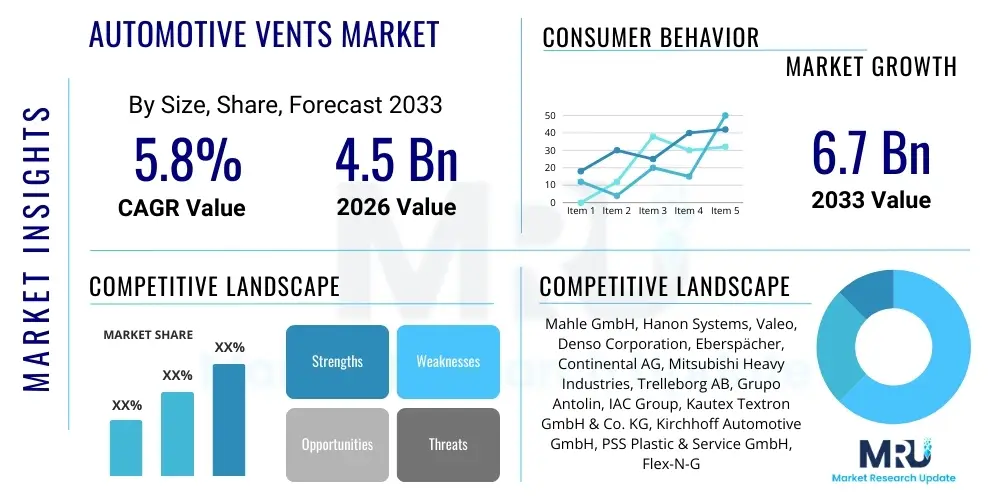

The Automotive Vents Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033.

Automotive Vents Market introduction

The Automotive Vents Market encompasses the manufacturing, distribution, and utilization of air distribution components essential for vehicle Heating, Ventilation, and Air Conditioning (HVAC) systems. These vents, integral to cabin comfort and safety, control the direction and volume of conditioned air flow within the vehicle interior, crucial for maintaining optimal temperature, humidity, and air quality. Beyond basic functionality, modern automotive vents are increasingly integrated into complex dashboard and interior panel designs, demanding sophisticated engineering focused on aesthetics, noise reduction (NVH characteristics), and ergonomic operation. The evolution of automotive design has seen a shift from traditional mechanical vents towards complex electronic and 'invisible' vent systems, particularly in premium and electric vehicles, emphasizing seamless integration with digital cockpits and minimalist interior philosophies. These components are vital for defogging windshields, distributing heat or cooling, and ensuring the health and well-being of occupants, making them critical safety and comfort features.

Major applications of automotive vents span traditional passenger cars, commercial vehicles, and the rapidly growing electric vehicle (EV) segment, where vents also play a secondary role in regulating the thermal environment around critical electronic components and battery packs, although dedicated thermal management vents often handle the latter. Key driving factors include stringent global regulations concerning vehicle cabin air quality, rising consumer demand for superior climate control and personalized comfort settings, and the ongoing trend toward vehicle interior premiumization. Material innovation, focusing on lightweight, durable, and aesthetically pleasing polymers and composites, is central to market growth, addressing OEM requirements for reduced vehicle mass and enhanced interior quality. Furthermore, the necessity for robust airflow management in autonomous vehicles, where occupants may engage in diverse activities, further drives the development of multi-zone and highly flexible ventilation systems.

The benefits derived from high-quality automotive vents extend beyond mere air redirection. They significantly contribute to reduced driver fatigue by maintaining ideal ambient temperatures, enhance safety through effective windshield defrosting and defogging, and improve the overall acoustic experience within the cabin by minimizing airflow noise. Advanced vent designs incorporate features like anti-bacterial coatings and sophisticated louver mechanisms that allow for highly granular control over airflow, supporting the integration of advanced sensors and actuator systems. The continuous innovation in design, materials, and electronic controls ensures that the automotive vent remains a dynamic and technically important component within the broader vehicle architecture, necessitating specialized manufacturing processes and rigorous quality control standards to meet the demanding operational life cycles of modern vehicles.

Automotive Vents Market Executive Summary

The Automotive Vents Market is undergoing a significant transformation driven by electrification and the integration of smart cabin technologies, resulting in robust growth projections across the forecast period. Business trends indicate a strong move toward high-value, aesthetically integrated components, where traditional suppliers are increasingly partnering with technology firms to develop electronically controlled and adaptive vent solutions. The focus on reducing Noise, Vibration, and Harshness (NVH) is paramount, necessitating advanced material science and precision engineering in louver and housing mechanisms. Furthermore, the rising adoption of hidden vents, flush-mounted designs, and active grille shutters (AGS) in luxury and performance vehicles highlights the shift away from purely functional visible components toward seamlessly integrated interior elements. Manufacturing processes are increasingly leveraging automated assembly and injection molding techniques to meet the volume demands while maintaining the precision required for complex actuator assemblies, particularly those serving multi-zone climate control systems.

Regional trends are dominated by the Asia Pacific (APAC) region, driven primarily by high volume production in China, India, and Japan, alongside rapidly expanding electric vehicle production, which mandates specialized venting for thermal management. Europe maintains a focus on premium and luxury segments, dictating demand for advanced design customization, superior material quality, and compliance with stringent interior air quality standards. North America shows steady growth, fueled by strong consumer demand for large vehicles (SUVs, trucks) often equipped with extensive multi-zone HVAC systems that require complex vent arrays. The increasing investment in manufacturing facilities in Mexico and Southeast Asia to support global supply chain diversification is also influencing regional dynamics, creating new hubs for component production and reducing reliance on singular manufacturing locations for critical components.

Segmentation trends reveal that electric vehicles (EVs) are the fastest-growing segment in terms of vehicle type, demanding vents optimized for battery thermal management environments and unique cabin layouts. By material, specialized engineering plastics, offering excellent durability, heat resistance, and flexibility for intricate molding, dominate the market, although metal finishes are utilized for aesthetic accents in premium models. The application segmentation sees HVAC system integration remaining the largest segment, but the importance of specialized defrosting and demisting vent solutions is gaining prominence due to evolving safety regulations. Lastly, the design segmentation is seeing a migration towards non-adjustable or digitally controlled louver designs, shifting control interface responsibility from mechanical knobs to central infotainment screens, thereby enhancing safety, ergonomics, and interior design flexibility.

AI Impact Analysis on Automotive Vents Market

Analysis of common user questions related to the impact of Artificial Intelligence (AI) on the Automotive Vents Market reveals key themes centered around personalization, predictive maintenance, and optimized energy usage, particularly within electric vehicles. Users are primarily concerned with how AI can move beyond simple temperature regulation to create truly personalized thermal zones for individual occupants, adapting airflow direction and intensity based on real-time biometric data or learned preferences. There is significant interest in AI algorithms managing the complex interplay between interior thermal loads and external environmental factors, ensuring maximum efficiency of the HVAC system without compromising comfort. Furthermore, users frequently inquire about the role of AI in diagnosing mechanical failures in vent actuators and dampers before they occur, minimizing downtime and maintenance costs associated with complex electronic vent systems.

The application of AI is poised to fundamentally redefine how automotive vents operate, shifting them from passive conduits to active, responsive elements of the cabin environment. AI-driven predictive control systems utilize sensor fusion data—including internal cabin temperature distribution, solar load intensity, relative humidity, and the number and position of occupants—to dynamically adjust vent settings. This capability allows for instant optimization of airflow distribution, ensuring that conditioned air is directed precisely where needed, resulting in enhanced occupant comfort and a measurable reduction in the energy consumption required to run the HVAC compressor, a particularly critical factor in maximizing EV driving range. AI algorithms can also manage the sequencing and speed of vent actuators to minimize operational noise, thereby improving cabin acoustics and perceived quality.

Looking forward, AI integration will enable new features such as self-learning HVAC profiles, where the system passively observes user adjustments over time and automatically implements preferred settings under similar environmental conditions. This level of autonomy requires highly specialized vent actuation hardware capable of micro-adjustments and quick responses, driving demand for advanced stepper motors and sensor integration directly within the vent assembly. Moreover, in the context of shared mobility and autonomous vehicles, AI will be essential for quickly restoring personalized thermal comfort settings for successive occupants, potentially using facial recognition or personalized digital keys to load individual vent and climate preferences, thus enhancing the overall customer experience and operational efficiency of vehicle fleets.

- AI-driven predictive thermal management optimizes airflow distribution based on real-time environmental and occupancy data.

- Integration of machine learning models for personalized micro-climate zones, adjusting vent direction and flow intensity per occupant.

- AI algorithms manage actuator sequencing to minimize Noise, Vibration, and Harshness (NVH) associated with vent operation.

- Predictive maintenance analytics monitor actuator health and damper movement patterns to forecast potential mechanical failures.

- Optimization of HVAC energy consumption, particularly crucial for enhancing the operational range of Battery Electric Vehicles (BEVs).

- Enabling 'invisible' or hidden vent systems to respond intelligently without manual user input, maintaining minimalist interior design.

DRO & Impact Forces Of Automotive Vents Market

The dynamics of the Automotive Vents Market are primarily shaped by a confluence of accelerating drivers related to electrification and rising consumer expectations, alongside persistent restraints such as complexity and cost, balanced by significant opportunities presented by advanced materials and autonomous driving. The primary driver is the pervasive requirement for enhanced thermal management efficiency in both traditional and electric vehicles. For EVs, the necessity to manage battery temperature and maximize cabin efficiency to preserve range mandates sophisticated, leak-proof, and electronically controlled venting systems. Simultaneously, increasing regulatory oversight, particularly related to passenger safety and interior air quality (IAQ) standards in regions like Europe and Asia, pushes manufacturers towards integrating higher quality filtration and ensuring precise directional airflow for driver alertness and safety. These factors collectively create a strong, sustained demand for advanced vent technologies.

However, the market faces constraints related to escalating component complexity and manufacturing costs. The transition from simple mechanical vents to electronically actuated, sensor-laden smart vent modules significantly increases the number of moving parts, embedded electronics, and associated software, leading to higher unit costs and increased integration challenges during vehicle assembly. Furthermore, the aesthetic demands for seamlessly integrated or 'hidden' vents require complex mold tooling and stringent dimensional accuracy, which can limit rapid design iteration and increase development lead times. The automotive industry’s rigorous testing standards, especially concerning durability and extreme temperature resilience for components situated close to the dashboard surface, represent an ongoing restraint, demanding significant upfront investment in validation and quality assurance.

Opportunities for growth are predominantly found in the adoption of lightweight materials, such as specialized high-performance polymers, which aid in overall vehicle weight reduction, and the emergence of innovative manufacturing techniques like additive manufacturing for rapid prototyping and customized low-volume production. The development of specialized vents for dedicated thermal loops, such as those used for high-efficiency battery cooling in next-generation EVs, opens lucrative niche markets. Impact forces on the market are high, driven by technological volatility, particularly the speed at which OEMs are adopting sophisticated digital cockpits and minimalist interior designs, forcing vent suppliers to rapidly innovate their product offerings. Furthermore, the competitive intensity among Tier 1 suppliers specializing in interior climate control is driving margin pressure while simultaneously demanding higher technology content and aesthetic quality, necessitating strategic investments in R&D and intellectual property development.

Segmentation Analysis

The Automotive Vents Market is strategically segmented based on crucial criteria including design, material type, application, and vehicle type, allowing for detailed analysis of market dynamics and targeted development efforts. Segmentation by design reveals the ongoing market transition from traditional mechanical vents, which offer simple manual adjustments, towards electronically actuated and increasingly integrated flush-mounted or 'invisible' vent systems. This transition is directly linked to the premiumization of vehicle interiors and the integration of centralized digital control platforms. By material, the market relies heavily on injection-molded polymers due to their cost-effectiveness, lightweight properties, and versatility in achieving complex shapes, although high-end vehicles continue to utilize metallic finishes or specialized coatings for enhanced aesthetic and tactile feedback. Understanding these segments is vital for suppliers seeking to align their material science and design capabilities with evolving OEM requirements.

Application segmentation clarifies the primary functions these components serve, with HVAC air distribution being the largest category, addressing general cabin comfort. However, specialized segments such as defroster/demister vents and dedicated electronics/battery cooling vents are experiencing rapid growth, reflecting increased focus on safety and the specific thermal challenges posed by electrification. The segmentation by vehicle type underscores the distinct operational demands across different platforms. Passenger vehicles, especially luxury sedans and SUVs, drive demand for advanced multi-zone systems, while commercial vehicles prioritize robustness and high air throughput. Crucially, the Electric Vehicle (EV) segment acts as a significant catalyst for technological innovation, requiring vent solutions optimized for minimizing power draw and maximizing thermal isolation between different vehicle zones.

These segmentations highlight the complexity of the modern automotive vent component, which is no longer a standardized part but a highly customized, technology-intensive module. The continuous pressure on suppliers to deliver customized solutions that meet specific OEM brand aesthetics (e.g., matching louver spacing and finish across an entire model line) further reinforces the strategic importance of differentiating products across these various segments. The future growth trajectory is heavily skewed towards segments prioritizing electronic control, aesthetic integration, and specialized thermal management capabilities demanded by the rapidly expanding global EV fleet, forcing manufacturers to invest heavily in actuator technology and integration expertise.

- By Design:

- Mechanical/Manual Vents

- Electronically Actuated Vents

- Invisible/Integrated Vents

- Fixed Vents

- By Material:

- Polymer/Plastic (ABS, PP, PC)

- Metal/Alloy (Aluminum, Stainless Steel)

- Composite Materials

- By Application:

- HVAC Air Distribution (Cabin Comfort)

- Defroster/Demister Vents

- Dedicated Electronics/Battery Cooling Vents

- By Vehicle Type:

- Passenger Vehicles (PC)

- Commercial Vehicles (CV)

- Electric Vehicles (EV)

- Heavy Duty Vehicles

- By Distribution Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

Value Chain Analysis For Automotive Vents Market

The value chain for the Automotive Vents Market begins with the upstream procurement of essential raw materials, primarily focusing on specialized engineering polymers such as ABS (Acrylonitrile Butadiene Styrene), Polycarbonate (PC), and Polypropylene (PP), which provide the necessary balance of lightweight properties, high-temperature resistance, and moldability required for vent housings and louvers. Suppliers of sophisticated electronic components, including micro-motors, sensors, and control boards used for electronically actuated vents, also form a critical upstream segment. The procurement stage is highly sensitive to fluctuations in global petrochemical markets and requires stringent quality checks to ensure material purity and adherence to automotive flammability and stress standards. Strategic relationships with specialized plastic compounders and component manufacturers are essential for Tier 1 suppliers to maintain cost control and innovation velocity.

The midstream phase, dominated by Tier 1 and Tier 2 suppliers, involves complex manufacturing processes, including high-precision injection molding, surface finishing, and the assembly of intricate mechanical and electronic subsystems. Tier 1 manufacturers, such as those specializing in interior or climate control systems, are responsible for design, engineering validation, and the final integration of the vent assembly, often collaborating closely with OEMs on aesthetic specifications and cabin architecture. Direct distribution channels are paramount in this market, as the vast majority of automotive vents are sold directly to Original Equipment Manufacturers (OEMs) for integration during the primary vehicle assembly process. These long-term, high-volume contracts require robust supply chain management, just-in-time delivery capabilities, and global logistical networks to support manufacturing plants worldwide.

The downstream segment primarily involves vehicle manufacturers (OEMs) who integrate the vents into the dashboard, instrument panel, and other interior trim components. Indirect distribution, though smaller, encompasses the aftermarket, where replacement vents are sold through authorized dealers, independent garages, and specialized parts retailers. The aftermarket channel places greater emphasis on standardization and ease of installation compared to the bespoke requirements of the OEM segment. Ultimately, the success of the value chain is determined by the seamless coordination between raw material providers, precision molders, and sophisticated component integrators, ensuring that the final vent assembly meets the exacting performance, acoustic, and aesthetic criteria set by the automotive manufacturers and required by end-users.

Automotive Vents Market Potential Customers

Potential customers for the Automotive Vents Market are primarily the Original Equipment Manufacturers (OEMs), specifically the major global automotive groups that produce passenger cars, light commercial vehicles, and heavy-duty trucks. Within these organizations, the key buyers are typically the interior systems procurement departments and the HVAC engineering teams, who evaluate vent modules based on criteria such as thermal efficiency, aesthetic integration potential, cost-per-unit, durability, and compliance with specific vehicle platform standards. For electric vehicles, specific procurement teams focused on battery and electronics thermal management subsystems also constitute vital customers, driving demand for high-reliability, specialized vents that operate within demanding temperature ranges. Establishing long-term supply partnerships with these OEMs is the backbone of the market, necessitating global operational scale and technical specialization.

Secondary but highly important potential customers include major Tier 1 interior suppliers who integrate various components into comprehensive module assemblies before delivering them to the OEM. These Tier 1 integrators often purchase subcomponents, such as louver mechanisms or specialized actuation motors, from Tier 2 suppliers, consolidating the supply chain. Companies like Faurecia, Continental, or Magna, which manage entire cockpit systems, are crucial intermediaries and purchasers of vent components. Their procurement requirements focus heavily on modularity, ease of assembly, and proven integration compatibility with other cockpit electronics and interior materials, driving suppliers toward standardized, yet customizable, interfaces.

Furthermore, the aftermarket segment represents a consistent, though lower-volume, customer base, comprising independent aftermarket parts distributors, certified repair shops, and insurance replacement services. These customers are primarily interested in replacement parts that match OEM specifications in terms of fit and function, focusing on durability and competitive pricing. Lastly, specialized vehicle manufacturers, including those producing recreational vehicles (RVs), buses, coaches, and bespoke luxury vehicles, require unique vent solutions tailored to their larger cabin dimensions and specific air distribution challenges. These specialized buyers often demand highly customized materials and complex, multi-zone vent configurations designed for continuous operation and passenger comfort in diverse travel conditions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mahle GmbH, Hanon Systems, Valeo, Denso Corporation, Eberspächer, Continental AG, Mitsubishi Heavy Industries, Trelleborg AB, Grupo Antolin, IAC Group, Kautex Textron GmbH & Co. KG, Kirchhoff Automotive GmbH, PSS Plastic & Service GmbH, Flex-N-Gate Corporation, Motherson Sumi Systems Limited, Visteon Corporation, Gentex Corporation, Yanfeng Automotive Interior Systems Co., Ltd., Toyoda Gosei Co., Ltd., Sanden Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Vents Market Key Technology Landscape

The technological landscape of the Automotive Vents Market is rapidly evolving, driven by the demand for enhanced cabin aesthetics, superior acoustic performance, and improved integration with digital vehicle control systems. A primary area of focus is on advanced electronic actuation systems. Traditional cable or lever mechanisms are being replaced by micro-stepper motors and linear actuators, providing high-precision, low-noise control over louver direction and air volume. This shift is essential for enabling multi-zone climate control where each vent must be capable of individual, rapid adjustment based on centralized AI commands. Furthermore, these electronic systems require robust sensors (e.g., position encoders) to provide feedback to the central HVAC ECU, ensuring that the actual airflow matches the required settings, thereby optimizing efficiency and responsiveness. The need for absolute silent operation necessitates the use of specialized damping materials and advanced gear designs within the actuation mechanism.

Material science and manufacturing innovations form another core pillar of the technology landscape. Lightweight engineering plastics (such as glass fiber reinforced polyamides and specialized PC/ABS blends) are crucial for reducing component mass while maintaining high thermal stability and structural integrity over the vehicle’s lifespan. Furthermore, Noise, Vibration, and Harshness (NVH) reduction technologies are critical. This includes optimizing the geometric design of the air channels and louvers using Computational Fluid Dynamics (CFD) simulations to minimize turbulence and whistling sounds at high flow rates. Specialized acoustic materials are integrated into the vent housing to absorb residual operational noise from the HVAC blower fan and the actuators themselves, ensuring a premium quiet cabin experience, which is particularly valued in electric vehicles where ambient noise is low.

The rise of 'invisible' or hidden vent systems represents a significant design and technological challenge. These systems often utilize advanced diffusers built directly into the dashboard panel structure, eliminating visible louvers while maintaining effective air distribution. The technology underpinning this relies on highly sophisticated fluid dynamics modeling and precision manufacturing to create narrow, yet effective, dispersal slots. Furthermore, integration technologies, particularly those linking the vent system via automotive communication protocols (like CAN or Ethernet) to the central infotainment display and climate control algorithms, are becoming standard. This allows occupants to control complex airflow patterns through a simple touchscreen interface, completing the transformation of the vent from a mechanical component into an intelligent, networked module within the vehicle's digital ecosystem.

Regional Highlights

The Asia Pacific (APAC) region dominates the Automotive Vents Market both in terms of production volume and rapidly increasing consumption, primarily driven by China's colossal automotive manufacturing base and high domestic demand for new vehicles, including a global leading share of electric vehicle production. The market dynamics in APAC are characterized by intense price competition in the mass-market segments, balanced by soaring demand for sophisticated, premium-featured interiors in the burgeoning urban consumer class. Countries like India and Southeast Asian nations are focusing on rugged, durable vent solutions suitable for harsh operating environments, while Japan and South Korea lead in integrating advanced electronic controls and aesthetically refined designs, often serving as critical export hubs for high-tech components globally. The stringent domestic standards on cabin air quality in countries like China are also forcing technological adoption related to filtration-compatible vent systems.

Europe represents a highly mature market characterized by stringent quality standards, a strong preference for premium interior components, and a focus on sustainability. European OEMs demand superior NVH performance, precision engineering, and high-quality tactile materials for their vent systems, aligning with the region's focus on luxury and high-performance vehicles. The transition to electric mobility is extremely pronounced in Europe, driving significant investments in thermal management components, including specialized vents for both cabin and thermal battery subsystems, compliant with stringent EU safety and energy efficiency directives. The regulatory landscape around material composition (e.g., REACH compliance) also heavily influences the technological choices made by vent suppliers operating within this region, prioritizing eco-friendly and low-emission polymer usage.

North America exhibits consistent demand, driven primarily by the high average vehicle size (SUVs, light trucks), which necessitates multi-zone HVAC systems and extensive vent arrays to manage larger cabin volumes effectively. Consumer preference in this region leans toward robustness and powerful air throughput, essential for dealing with climatic extremes. While technology adoption follows Europe and Asia, the market is characterized by long product lifecycles and a focus on durable, reliable components. Latin America and the Middle East & Africa (MEA) represent emerging growth opportunities, driven by increasing vehicle parc and localized manufacturing efforts. In MEA, particularly, extreme temperature conditions drive demand for high-performance, robust HVAC and vent systems capable of maintaining cooling efficiency under severe heat loads, often prioritizing reliability over highly complex electronic actuation.

- Asia Pacific (APAC): Dominates manufacturing volume; rapidly accelerating EV market driving innovation in thermal management; characterized by strong domestic demand in China and India.

- Europe: Focus on premiumization, superior NVH performance, and rapid adoption of 'invisible' vent systems in luxury vehicles; strict environmental and safety regulations drive specialized material choice.

- North America: High demand driven by large vehicle segments (SUVs, trucks) requiring extensive multi-zone climate control systems; focus on durability and high-capacity airflow.

- Latin America & MEA: Emerging markets with focus on robust, high-reliability vent systems necessary for extreme climatic variations and growing regional assembly operations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Vents Market.- Mahle GmbH

- Hanon Systems

- Valeo

- Denso Corporation

- Eberspächer

- Continental AG

- Mitsubishi Heavy Industries

- Trelleborg AB

- Grupo Antolin

- IAC Group

- Kautex Textron GmbH & Co. KG

- Kirchhoff Automotive GmbH

- PSS Plastic & Service GmbH

- Flex-N-Gate Corporation

- Motherson Sumi Systems Limited

- Visteon Corporation

- Gentex Corporation

- Yanfeng Automotive Interior Systems Co., Ltd.

- Sanden Corporation

Frequently Asked Questions

Analyze common user questions about the Automotive Vents market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving force behind the growth of the Automotive Vents Market?

The primary driving force is the rapid global shift toward Electric Vehicles (EVs), necessitating sophisticated, high-efficiency thermal management systems and vents optimized to minimize power consumption and ensure precise temperature control for batteries and occupants.

How are 'invisible' or hidden automotive vents achieved technologically?

Invisible vents utilize advanced Computational Fluid Dynamics (CFD) modeling and precision manufacturing to integrate narrow air dispersal slots directly into the dashboard or interior trim panels, relying on complex electronic actuators for dynamic flow adjustment without visible louvers.

What role does AI play in modern automotive ventilation systems?

AI is used for predictive thermal management, leveraging sensor data to create personalized climate zones, optimize airflow direction and intensity dynamically, and minimize the operational noise (NVH) of electronic vent actuators for superior cabin comfort and energy efficiency.

Which material segment dominates the manufacturing of automotive vents?

Engineering polymers and specialized plastics, such as ABS and PC/ABS blends, dominate the market due to their optimal balance of lightweight properties, high heat resistance, cost-effectiveness, and moldability required for intricate, precision vent and louver designs.

What is the importance of NVH reduction in the context of automotive vents?

Noise, Vibration, and Harshness (NVH) reduction is critical, especially in quiet electric vehicles. Suppliers must employ specialized geometric designs, acoustic materials, and silent electronic actuators to minimize air turbulence sounds and operational noise, enhancing perceived cabin quality.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager