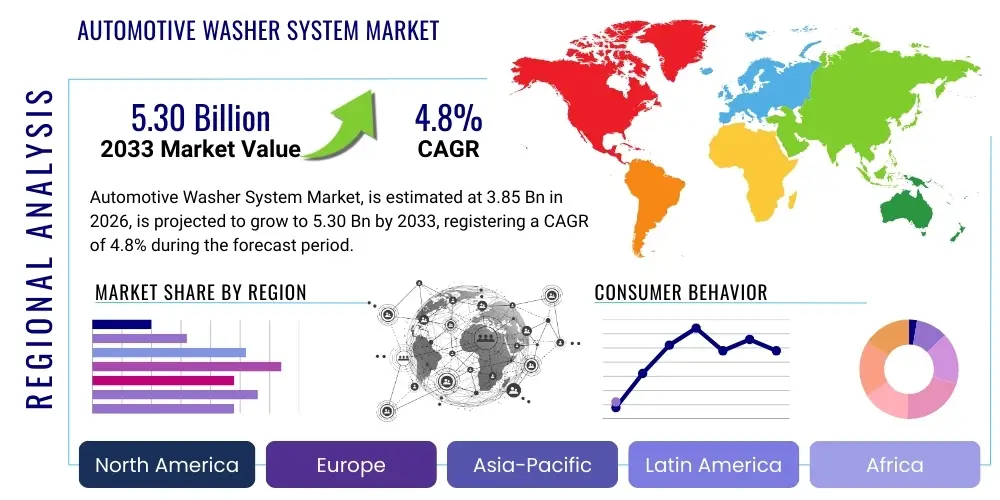

Automotive Washer System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440633 | Date : Jan, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Automotive Washer System Market Size

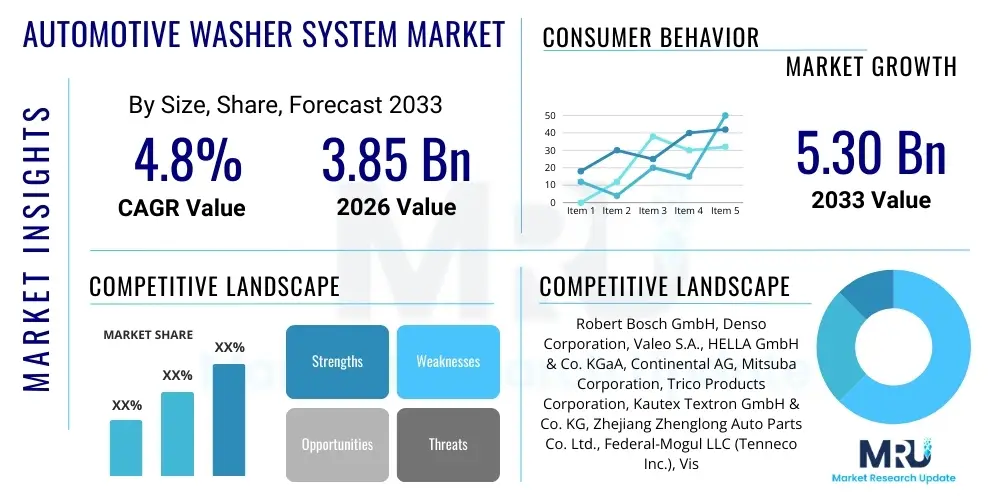

The Automotive Washer System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 3.85 Billion in 2026 and is projected to reach USD 5.30 Billion by the end of the forecast period in 2033. This growth is primarily driven by an increasing focus on vehicle safety, enhanced driver visibility requirements, and the integration of advanced driver-assistance systems (ADAS) that rely on clear sensor visibility. The expanding global automotive production, particularly in emerging economies, further contributes to this upward trajectory, as washer systems are a standard component across all vehicle segments. Moreover, evolving regulatory landscapes in various regions mandate improved visibility features, thereby stimulating demand for more efficient and sophisticated washer technologies.

Automotive Washer System Market introduction

The Automotive Washer System Market encompasses the design, manufacturing, and distribution of components and complete systems dedicated to cleaning the windshield, rear window, headlights, and increasingly, cameras and sensors in modern vehicles. These systems are crucial for maintaining optimal driver visibility and ensuring the proper functioning of advanced safety features. Key components typically include reservoirs, pumps, nozzles, tubing, and wiper blades, working in conjunction with a washer fluid formulated to effectively remove dirt, grime, insects, and other obstructions from vehicle surfaces. The primary function of these systems is to enhance driving safety by providing a clear view of the road, particularly in adverse weather conditions, thereby reducing the risk of accidents.

Major applications of automotive washer systems extend beyond traditional windshield cleaning to encompass sophisticated headlight washers, which are essential for maintaining the luminous intensity of high-performance headlights, and specialized camera/sensor washers vital for ADAS components like rearview cameras, front-facing cameras for lane keeping assist, and parking sensors. The benefits of these systems are manifold, including improved driver safety, enhanced aesthetic appeal of the vehicle, and extended lifespan of wiper blades and optical sensors. Furthermore, modern systems are evolving to offer greater efficiency, reduced fluid consumption, and intelligent activation based on environmental conditions or sensor detection, contributing to overall vehicle performance and convenience.

Driving factors for the market's robust growth include stringent global safety regulations that mandate clear visibility, a rising consumer preference for premium vehicles equipped with advanced features, and the rapid proliferation of ADAS technologies. As ADAS relies heavily on an unobstructed view from various sensors, the demand for integrated and highly effective washer systems for these components is surging. Urbanization and increasing road density worldwide also contribute to higher accumulation of dirt and debris on vehicles, necessitating reliable cleaning solutions. Innovations in material science for improved nozzle design, sensor integration for automatic activation, and the development of eco-friendly washer fluids are further propelling market expansion, making these systems more efficient and integral to the driving experience.

Automotive Washer System Market Executive Summary

The Automotive Washer System Market is experiencing dynamic growth, propelled by a confluence of technological advancements, evolving regulatory landscapes, and increasing consumer expectations for vehicle safety and convenience. Business trends indicate a strong shift towards intelligent and integrated washer systems, particularly those designed to maintain the clarity of ADAS sensors and cameras. Manufacturers are investing heavily in R&D to develop compact, high-performance pumps, advanced nozzle designs offering wider spray patterns and reduced fluid consumption, and smart activation systems. The market sees strategic collaborations between component suppliers and OEMs to integrate these sophisticated solutions seamlessly into new vehicle architectures. Furthermore, sustainability is becoming a key focus, driving innovations in biodegradable washer fluids and energy-efficient pump technologies, reflecting a broader industry commitment to environmental responsibility.

Regionally, the market exhibits varied growth trajectories, with established automotive markets in North America and Europe leading in the adoption of advanced washer systems due to stringent safety standards and high consumer disposable income. However, the Asia Pacific region, spearheaded by countries like China, India, and Japan, is emerging as a significant growth engine, driven by burgeoning automotive production, rapid urbanization, and an increasing penetration of premium and luxury vehicle segments. Latin America and the Middle East & Africa also present considerable opportunities as vehicle parc expands and safety regulations become more harmonized with global standards. Each region's unique climate and road conditions also influence the specific demands for washer system robustness and functionality.

Segmentation trends highlight a notable shift towards specialized washer systems beyond traditional windshield cleaning. Headlight washer systems are gaining traction, especially with the proliferation of LED and matrix headlights that require pristine surfaces for optimal performance. More significantly, camera and sensor washer systems are experiencing exponential growth, directly linked to the widespread adoption of ADAS features across all vehicle categories. In terms of technology, electrically actuated pumps and smart nozzles are becoming standard, replacing older, less efficient mechanical systems. The aftermarket segment also continues to play a crucial role, providing replacement components and upgrade options, driven by regular wear and tear and consumer demand for improved visibility and safety features for older vehicles.

AI Impact Analysis on Automotive Washer System Market

Common user questions regarding AI's impact on the Automotive Washer System Market often revolve around how AI can make these systems smarter, more efficient, and integrated with other vehicle functions. Users are keen to understand if AI will lead to predictive maintenance for washer systems, autonomous cleaning without driver intervention, and optimized fluid usage. There's also interest in how AI can enhance the performance of ADAS-integrated washer systems, ensuring critical sensors are always clear. Concerns may include the complexity of AI integration, potential for malfunction, and the cost implications for consumers. Overall, the prevailing expectation is that AI will transform washer systems from simple utility features into sophisticated, adaptive, and integral components of future intelligent vehicles, enhancing both safety and convenience through proactive and precise operation based on real-time environmental data.

- AI-powered sensors can detect precise levels of dirt, dust, and debris on windshields, headlights, and ADAS cameras, triggering cleaning cycles only when necessary, optimizing fluid consumption.

- Predictive algorithms can analyze usage patterns and environmental conditions to alert drivers about low fluid levels or potential system malfunctions before they occur, improving reliability.

- Integration with vehicle's weather and navigation systems allows AI to anticipate adverse conditions (e.g., upcoming rain, dusty roads) and pre-emptively prepare or activate washer systems.

- Machine learning can optimize spray patterns and pressure based on the type of obstruction and vehicle speed, ensuring more effective and efficient cleaning for various surfaces.

- AI-driven object recognition for ADAS can prioritize cleaning of specific camera lenses or sensors that are critical for immediate safety functions, ensuring their continuous operational integrity.

- Autonomous vehicles will heavily rely on AI to manage and execute all cleaning functions independently, ensuring a constant clear view for all on-board sensors without human input.

- AI can facilitate advanced diagnostics for washer system components, identifying issues with pumps, nozzles, or fluid levels, streamlining maintenance and repair processes.

DRO & Impact Forces Of Automotive Washer System Market

The Automotive Washer System Market is significantly shaped by a combination of drivers, restraints, and opportunities, all contributing to various impact forces. Drivers primarily include the escalating global demand for enhanced vehicle safety features, which necessitates superior driver visibility in all conditions. Stricter government regulations worldwide regarding vehicle safety standards, particularly those pertaining to visibility and headlight performance, also act as a powerful catalyst. Furthermore, the rapid integration of Advanced Driver-Assistance Systems (ADAS) and autonomous driving technologies mandates consistently clear sensors and cameras, thus propelling the demand for specialized and highly efficient washer systems. Consumer preference for premium features and convenience in modern vehicles also contributes to market growth, as advanced washer systems offer an improved driving experience.

Conversely, the market faces several restraints. The increasing cost associated with integrating sophisticated washer systems, especially those designed for ADAS components, can elevate the overall vehicle price, potentially impacting adoption in budget-sensitive segments. Complexity in design and manufacturing, coupled with the need for specialized materials to withstand diverse environmental conditions and chemical compositions of washer fluids, also poses challenges. Moreover, competition from alternative cleaning methods or technologies, although currently limited, could emerge as a future restraint. The environmental concerns related to the disposal of certain washer fluid chemicals and the energy consumption of pumps, though often minor, present hurdles that require innovative solutions and sustainable product development.

Opportunities within this market are abundant, particularly with the continuous evolution of smart vehicle technologies. The development of intelligent washer systems that utilize sensors for automatic activation, predictive maintenance capabilities, and adaptive cleaning cycles presents a significant growth avenue. The expansion of the electric vehicle (EV) market also offers an opportunity for developing tailored, energy-efficient washer systems that minimize power draw. Furthermore, emerging markets with growing automotive production and rising disposable incomes present untapped potential for both OEM and aftermarket sales. Innovation in eco-friendly and biodegradable washer fluid formulations, alongside advancements in material science for lighter and more durable components, also represent key areas for future market expansion and differentiation, allowing manufacturers to address both performance and sustainability demands. These dynamics collectively exert considerable impact forces, driving innovation, influencing strategic partnerships, and shaping the competitive landscape of the automotive washer system industry.

Segmentation Analysis

The Automotive Washer System Market can be comprehensively analyzed through various segmentation categories, offering granular insights into specific market dynamics and growth drivers. These segments typically include classification by component type, application, vehicle type, technology, and sales channel, each revealing distinct trends and opportunities. Understanding these segments is crucial for manufacturers, suppliers, and stakeholders to tailor product development, marketing strategies, and investment decisions effectively. The market is not monolithic; rather, it comprises several niche areas, each with its unique demand characteristics and competitive landscape, ranging from basic windshield cleaning to highly specialized ADAS sensor maintenance.

- By Component Type:

- Reservoirs

- Pumps (Electric, Manual)

- Nozzles (Fixed Jet, Fan Jet, Heated, Telescopic)

- Wiper Blades

- Hoses & Connectors

- Washer Fluid

- By Application:

- Windshield Washer Systems

- Rear Window Washer Systems

- Headlight Washer Systems

- Camera & Sensor Washer Systems (e.g., for Rearview Cameras, LiDAR, Radar)

- By Vehicle Type:

- Passenger Cars (Sedans, SUVs, Hatchbacks, Luxury Vehicles)

- Commercial Vehicles (Light Commercial Vehicles, Heavy Commercial Vehicles)

- Electric Vehicles (EVs)

- Autonomous Vehicles

- By Technology:

- Conventional/Manual Systems

- Automatic/Sensor-based Systems

- Smart/Integrated Systems (with ADAS)

- Heated Washer Systems

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Replacement, Upgrade)

Value Chain Analysis For Automotive Washer System Market

The value chain for the Automotive Washer System Market is complex and multi-layered, encompassing raw material sourcing, component manufacturing, assembly, distribution, and end-user engagement. Upstream activities begin with the procurement of essential raw materials such as various plastics for reservoirs and housings, rubber for hoses and wiper blades, metals for pumps and nozzles, and specialized chemicals for washer fluids. Key suppliers in this stage provide these materials to component manufacturers, ensuring quality, cost-effectiveness, and adherence to automotive industry standards. This foundational stage is critical as the quality and properties of these raw materials directly impact the durability, performance, and environmental footprint of the final washer system components, necessitating robust supply chain management and quality control processes from the outset.

Midstream activities involve the specialized manufacturing of individual components like pumps, nozzles, reservoirs, and wiper blades by dedicated automotive parts suppliers. These components are then either sold individually to aftermarket distributors or integrated into complete washer systems by system integrators, who might also be major Tier 1 automotive suppliers. The assembly process often includes rigorous testing and quality assurance to ensure that the systems meet OEM specifications for performance, reliability, and safety. Downstream activities focus on the distribution and sale of these systems. This includes direct sales to Original Equipment Manufacturers (OEMs) for integration into new vehicle production lines (primary distribution channel), as well as sales to the aftermarket through a network of wholesalers, retailers, and independent repair shops for replacement and repair purposes. The efficiency of these distribution channels is vital for timely delivery and market penetration across global regions.

The distribution channel within the automotive washer system market operates through both direct and indirect models. Direct channels primarily involve Tier 1 suppliers selling integrated washer systems or major components directly to vehicle manufacturers (OEMs). This relationship is characterized by long-term contracts, co-development efforts, and stringent quality requirements. Indirect channels dominate the aftermarket segment, where products are distributed through a multi-tiered network. This typically includes large automotive parts distributors, who then supply to smaller regional distributors, independent garages, and retail chains. Online platforms and e-commerce have also emerged as significant indirect channels, offering consumers and repair shops greater accessibility to a wide range of replacement parts. The effectiveness of these diverse channels hinges on efficient logistics, inventory management, and strategic partnerships to ensure broad market reach and customer satisfaction.

Automotive Washer System Market Potential Customers

The Automotive Washer System Market serves a broad spectrum of potential customers, primarily segmented into Original Equipment Manufacturers (OEMs) and the aftermarket segment, which includes individual vehicle owners, automotive repair shops, and fleet operators. OEMs represent the largest customer base, as washer systems are a standard fitment in nearly every new vehicle manufactured globally. These customers are vehicle manufacturers (e.g., Ford, Toyota, BMW, Tesla) who procure integrated washer systems or individual components directly from Tier 1 suppliers for installation during the vehicle assembly process. Their purchasing decisions are driven by factors such as cost-effectiveness, compliance with safety regulations, integration capabilities with advanced vehicle systems, and the ability to meet specific design and performance criteria for various vehicle models. This segment demands high volumes, consistent quality, and often seeks long-term development partnerships.

The aftermarket segment constitutes another significant portion of potential customers, driven by the ongoing need for replacement parts, repairs, and upgrades for existing vehicles. Individual vehicle owners are direct consumers of washer fluids and occasionally replacement wiper blades or nozzles, often purchasing these through retail auto parts stores, hypermarkets, or online platforms. Automotive repair shops, including authorized dealerships and independent garages, are crucial intermediate customers within the aftermarket. They purchase a wider array of components, such as pumps, reservoirs, hoses, and specialized tools, to service and repair customer vehicles. Their purchasing decisions are influenced by component availability, brand reputation, pricing, and the ease of installation, aiming to provide reliable and efficient service to their clientele.

Furthermore, fleet operators, including rental car companies, public transport authorities, and commercial logistics firms, represent a distinct group of potential customers. These entities require robust and reliable washer systems for their large fleets, which often operate under demanding conditions and accrue high mileage. They prioritize durability, ease of maintenance, and cost-efficiency in their procurement decisions for both new vehicle purchases and aftermarket servicing. Specialized vehicle manufacturers, such as those producing construction equipment, agricultural machinery, or heavy-duty trucks, also form a niche customer segment, demanding highly durable and powerful washer systems tailored to their unique operational environments. The diversity of these customer groups underscores the multifaceted demand landscape within the automotive washer system market, necessitating varied product offerings and distribution strategies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.85 Billion |

| Market Forecast in 2033 | USD 5.30 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Denso Corporation, Valeo S.A., HELLA GmbH & Co. KGaA, Continental AG, Mitsuba Corporation, Trico Products Corporation, Kautex Textron GmbH & Co. KG, Zhejiang Zhenglong Auto Parts Co. Ltd., Federal-Mogul LLC (Tenneco Inc.), Visiocorp Inc., SMP Deutschland GmbH, ASMO Co., Ltd. (now part of Denso), AFI (Automotive Fluid Innovations), ITW Global Fluid Management |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Washer System Market Key Technology Landscape

The Automotive Washer System Market is continuously evolving with significant technological advancements aimed at improving efficiency, performance, and integration with modern vehicle systems. One of the primary technological shifts involves the transition from traditional mechanical pumps to more sophisticated electric pumps, offering precise control over fluid delivery, variable pressure capabilities, and quieter operation. These electric pumps are often integrated with smart control units that can modulate spray patterns and fluid volume based on vehicle speed, ambient conditions, and the severity of contamination detected by sensors. This intelligent control minimizes fluid waste and maximizes cleaning effectiveness, contributing to overall vehicle efficiency and environmental responsibility. Furthermore, the development of compact and lightweight pump designs is crucial for integration into increasingly space-constrained vehicle architectures, especially in electric and hybrid vehicles where every component's weight and size are optimized for range and performance.

Another critical area of technological innovation lies in nozzle design and placement. Advanced nozzles now feature multiple jets, fan-spray patterns, or even heated elements to prevent freezing in cold climates, ensuring consistent performance. Telescopic headlight washer nozzles, for instance, retract flush with the bumper when not in use, improving aerodynamics and aesthetics. The integration of washer systems with rain sensors and light sensors allows for automatic activation, providing convenience and proactive cleaning. Beyond traditional windshields and headlights, a burgeoning technological focus is on dedicated washer systems for ADAS cameras and sensors. These systems employ micro-nozzles and highly precise spray patterns to clear obstructions from critical sensors like front-facing cameras, radar, and LiDAR units, which are indispensable for features like adaptive cruise control, lane-keeping assist, and autonomous driving functions. Maintaining the clarity of these sensors is paramount for vehicle safety and the accurate operation of advanced driving assistance systems.

Material science also plays a vital role in the technological landscape, with advancements in durable, lightweight plastics for reservoirs and corrosion-resistant materials for pumps and tubing, enhancing the lifespan and reliability of the entire system. Innovations extend to the washer fluids themselves, with the development of biodegradable, streak-free, and highly effective formulations designed to tackle specific types of grime and insect residue without damaging vehicle finishes or affecting sensor performance. The move towards connectivity and integration means that future washer systems are likely to be part of a broader vehicle health monitoring network, utilizing predictive analytics to alert drivers or maintenance personnel of potential issues, low fluid levels, or component wear. This holistic approach, leveraging IoT and AI, is transforming washer systems from simple utility features into intelligent, proactive components integral to the safety and comfort ecosystem of modern and future vehicles.

Regional Highlights

- North America: This region is characterized by a mature automotive market with stringent safety regulations and high consumer expectations for vehicle comfort and technology. The presence of major automotive OEMs and a strong aftermarket segment drives consistent demand for advanced washer systems. The increasing penetration of ADAS and autonomous vehicle development further boosts the market, particularly for specialized camera and sensor cleaning solutions. Extreme weather conditions in parts of North America also drive demand for heated washer systems and robust components.

- Europe: Europe is a highly competitive market known for its focus on premium vehicles, strict environmental standards, and advanced automotive technologies. Regulations such as Euro NCAP's emphasis on ADAS performance indirectly bolster the demand for effective sensor washer systems. Countries like Germany, France, and the UK lead in technological adoption, favoring sophisticated, integrated washer solutions. The region also shows a strong trend towards eco-friendly washer fluids and energy-efficient system components.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing automotive market globally, driven by significant vehicle production in China, India, Japan, and South Korea. Rapid urbanization, increasing disposable incomes, and the expansion of the middle class are fueling demand for both new vehicles and aftermarket parts. While basic washer systems dominate lower-segment vehicles, the rising luxury and premium segment, coupled with a growing focus on safety and ADAS adoption, is accelerating the demand for advanced and intelligent washer systems, particularly for cameras and sensors.

- Latin America: This region is an emerging market for automotive washer systems, characterized by steady growth in vehicle production and an expanding vehicle parc. Brazil and Mexico are key markets, witnessing increased foreign direct investment from global automotive players. Demand is driven by local automotive manufacturing and a growing aftermarket. While cost-effectiveness remains a significant factor, improving safety standards and consumer awareness are gradually pushing for better-performing washer solutions.

- Middle East and Africa (MEA): The MEA region is experiencing gradual growth in its automotive sector, with countries like South Africa, Saudi Arabia, and UAE showing particular promise. The demand for washer systems here is influenced by specific environmental factors, such as dusty conditions in arid regions, necessitating robust and highly effective cleaning solutions. Increasing vehicle imports and a burgeoning local assembly industry contribute to both OEM and aftermarket demand, though market maturity varies significantly across countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Washer System Market.- Robert Bosch GmbH

- Denso Corporation

- Valeo S.A.

- HELLA GmbH & Co. KGaA

- Continental AG

- Mitsuba Corporation

- Trico Products Corporation

- Kautex Textron GmbH & Co. KG

- Zhejiang Zhenglong Auto Parts Co. Ltd.

- Federal-Mogul LLC (Tenneco Inc.)

- Visiocorp Inc.

- SMP Deutschland GmbH

- ASMO Co., Ltd. (now part of Denso)

- AFI (Automotive Fluid Innovations)

- ITW Global Fluid Management

- Wabco Holdings Inc. (now part of ZF Friedrichshafen)

- Pricol Limited

- Doga S.A.

- Standard Motor Products, Inc.

- Magna International Inc.

Frequently Asked Questions

Analyze common user questions about the Automotive Washer System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is an automotive washer system and why is it important?

An automotive washer system is a vehicle component designed to clean the windshield, rear window, headlights, and increasingly, cameras and sensors using water or a specialized fluid. It is crucial for maintaining optimal driver visibility, enhancing safety by clearing obstructions, and ensuring the proper functioning of advanced driver-assistance systems (ADAS).

How do modern automotive washer systems differ from older ones?

Modern systems are more advanced, often featuring electric pumps for precise fluid delivery, intelligent nozzles (e.g., heated, multi-jet), and integration with vehicle sensors (rain, light). They now frequently include dedicated washers for ADAS cameras and sensors, offering automatic activation and optimized fluid usage, unlike simpler, manually controlled older systems.

What role do washer systems play in Advanced Driver-Assistance Systems (ADAS)?

Washer systems are critical for ADAS by ensuring that cameras, radar, and LiDAR sensors have an unobstructed view. Dirt, dust, or ice on these sensors can impair ADAS functionality (e.g., adaptive cruise control, lane keeping), making dedicated, efficient cleaning systems essential for safety and performance.

What are the key technological advancements driving the automotive washer system market?

Key advancements include intelligent sensor-based activation, development of micro-nozzles for precise targeting of ADAS sensors, efficient electric pumps, heated washer fluid systems for cold climates, and the integration of AI for predictive maintenance and optimized cleaning cycles. Material science advancements also contribute to lighter, more durable components.

What are the environmental considerations for automotive washer systems?

Environmental considerations include developing biodegradable and eco-friendly washer fluid formulations to reduce chemical runoff. Additionally, efforts are focused on improving the energy efficiency of electric pumps to minimize power consumption and on using recyclable materials for components like reservoirs and hoses to reduce waste.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager