Automotive Wheel Balancing Weight Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434963 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Automotive Wheel Balancing Weight Market Size

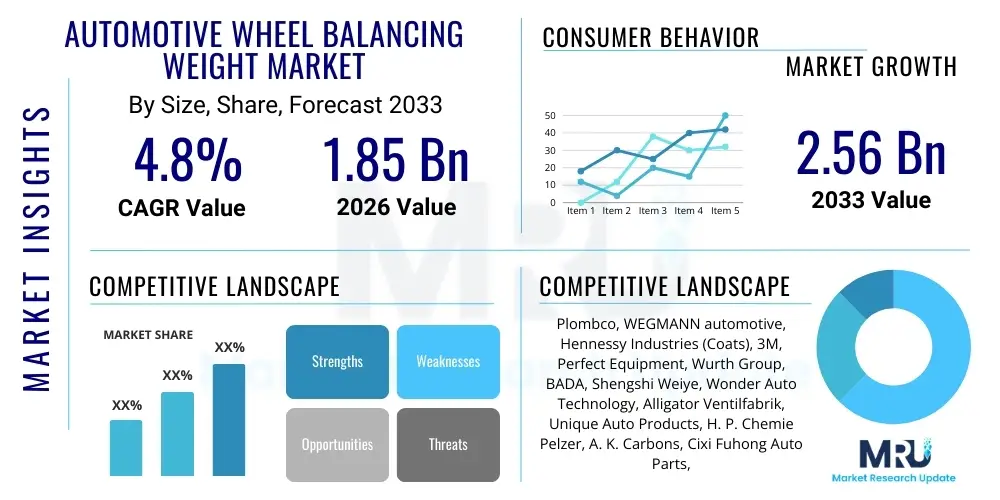

The Automotive Wheel Balancing Weight Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.56 Billion by the end of the forecast period in 2033.

Automotive Wheel Balancing Weight Market introduction

The Automotive Wheel Balancing Weight Market encompasses all products and solutions designed to ensure the uniform distribution of mass around a rotating tire and wheel assembly. These weights, typically small metallic components, are affixed to the wheel rim to counteract static and dynamic imbalances that naturally occur due to manufacturing variances in tires and wheels. Proper wheel balancing is crucial for vehicle safety, ride comfort, and tire longevity, preventing vibrations at high speeds and minimizing premature wear on suspension components and steering systems. The inherent necessity of balancing during tire installation, rotation, or repair drives the stable demand across both Original Equipment Manufacturers (OEMs) and the aftermarket service sector.

Products in this market are primarily categorized by the material used—historically lead, but increasingly dominated by steel and zinc due to environmental regulations—and the method of attachment, such as clip-on or adhesive (stick-on) weights. Major applications span passenger vehicles, light commercial vehicles, and heavy-duty trucks, with the aftermarket segment playing a critical role as consumers routinely require balancing services over the lifecycle of their tires. The fundamental benefit of these products lies in enhancing vehicle performance and safety by eliminating potentially hazardous vibrations, leading to smoother handling and improved fuel efficiency, thereby cementing their irreplaceable role in automotive maintenance.

Driving factors propelling market growth include the rising global vehicle parc, stringent regulations mandating higher vehicle safety and performance standards, and increased consumer awareness regarding the importance of regular vehicle maintenance. Furthermore, the shift towards larger diameter wheels and low-profile tires, which are more susceptible to minor imbalances, necessitates the precise application of balancing weights. Continuous advancements in wheel balancing equipment, coupled with the industry-wide transition toward environmentally friendly materials like zinc and steel alternatives to replace traditional lead weights, are shaping the market landscape and encouraging innovation in weight design and adhesive technology.

Automotive Wheel Balancing Weight Market Executive Summary

The Automotive Wheel Balancing Weight Market is characterized by a steady growth trajectory, driven primarily by the expanding global vehicle fleet and recurring demand from the aftermarket segment. Key business trends include the mandatory phasing out of lead-based weights in major economies, accelerating the adoption of sustainable alternatives, particularly coated steel and zinc weights, which now dominate the market composition. Technological advancements focus on improving adhesive weight reliability and developing streamlined balancing processes for modern aluminum alloy wheels, demanding specialized weights. The market remains competitive, with emphasis on cost-effective manufacturing and robust distribution networks to cater to high-volume service centers globally.

Regionally, Asia Pacific (APAC) stands as the dominant and fastest-growing region, fueled by massive automotive production volumes in countries like China and India, alongside the rapidly expanding vehicle aftermarket in Southeast Asia. North America and Europe maintain mature market status, characterized by high regulatory standards concerning material composition and performance, pushing innovation toward premium, non-toxic weights. Segment trends show a clear preference for adhesive (stick-on) weights, particularly in OEM applications and luxury vehicle aftermarkets, due to their aesthetic appeal and suitability for sophisticated alloy wheels, contrasting with the continued strong presence of clip-on weights in standard steel wheel assemblies.

The long-term outlook for the market is stable, underpinned by the indispensable nature of the product. While electric vehicles (EVs) introduce new dynamics, such as heavier battery packs demanding precise balancing for vibration mitigation, they do not diminish the core requirement for balancing weights. The ongoing challenge remains managing the supply chain volatility of raw materials (steel and zinc) and ensuring compliance with varied international environmental disposal regulations. Successful market players are those that effectively integrate sustainable material solutions with efficient manufacturing scales and robust logistical capabilities to serve the decentralized network of repair shops and tire service centers.

AI Impact Analysis on Automotive Wheel Balancing Weight Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) could revolutionize the tire service sector and, consequently, the wheel balancing weight market. Common questions center on the possibility of predictive maintenance systems eliminating or reducing the need for traditional balancing, or whether advanced sensor technology could automate the weight application process entirely. Analysis reveals that while AI is unlikely to eliminate the physical product, it is expected to significantly enhance the precision and efficiency of the balancing process. Key themes revolve around integrating AI with sophisticated balancing machines to optimize weight placement recommendations, predict required balancing intervals based on driving patterns and road conditions, and improve quality control in weight manufacturing, ensuring tighter tolerances and material efficiency. The core concern is maximizing service efficiency and minimizing human error in the balancing procedure through intelligent diagnostic tools.

- AI-Powered Diagnostic Systems: Implementation of ML algorithms within balancing machines to analyze vibration data, enhancing diagnostic accuracy and providing optimal weight placement solutions instantaneously.

- Predictive Maintenance Integration: Use of vehicle telematics and AI to forecast when tires will require rebalancing, shifting the market towards proactive maintenance rather than reactive service.

- Manufacturing Optimization: AI application in quality control for weight production, reducing material waste, and ensuring the conformity of zinc and steel weights to extremely narrow specification tolerances.

- Automated Weight Selection: Machine vision and AI assisting technicians by automatically identifying the correct weight type (clip-on vs. adhesive) and material based on real-time wheel scans, minimizing errors.

- Training and Simulation: AI-driven augmented reality (AR) tools utilized for technician training, standardizing the complex procedure of proper weight application across global service networks.

DRO & Impact Forces Of Automotive Wheel Balancing Weight Market

The Automotive Wheel Balancing Weight Market is influenced by a dynamic interplay of factors encompassing technological shifts, regulatory mandates, and macroeconomic stability. Key drivers include the ever-increasing volume of vehicles globally, necessitating continuous tire maintenance and balancing services, and stricter performance and safety regulations that make precise wheel balancing mandatory. Restraints primarily involve the volatile pricing of raw materials (zinc and steel), which impacts manufacturing costs, and the substantial environmental compliance hurdles associated with the complete ban on highly effective but toxic lead weights, forcing manufacturers to invest heavily in alternative materials. Opportunities emerge from the growth of premium alloy wheels requiring specialized aesthetic weights, the expansion of fleet management services demanding high-efficiency balancing solutions, and the nascent adoption of smart weights for continuous monitoring, paving the way for differentiated product offerings. These forces collectively shape the market's trajectory, ensuring steady demand while pushing the industry toward sustainability and higher technological integration.

Impact forces dictate the competitive intensity and operational landscape. Regulatory pressure is arguably the strongest external force, directly mandating material changes and influencing costs across the value chain. Technological advancements in tire pressure monitoring systems (TPMS) and integrated vehicle diagnostics, while not directly replacing balancing weights, indirectly influence the timing and nature of service, acting as a moderate impact force. Economically, the stability of the automotive aftermarket—which accounts for the vast majority of volume consumption—is crucial; recessionary periods may delay non-essential vehicle service, though tire balancing remains a critical safety requirement. Overall, the market exhibits moderate to high impact from external regulatory and environmental forces, demanding constant adaptation from manufacturers regarding material sourcing and product certification.

The transition from traditional lead weights to environmentally benign steel and zinc options represents a monumental shift driven by both regulation and corporate social responsibility, significantly influencing procurement and manufacturing investment. This shift introduces inherent complexities in weight density and size, as steel and zinc are less dense than lead, requiring larger weights to achieve the same corrective mass, which can sometimes interfere with brake calipers or aesthetics. Manufacturers must navigate these technical trade-offs while maintaining cost parity, driving innovation in weight design, such as slim-profile adhesive weights. Consequently, market success hinges on the ability to efficiently scale the production of compliant, high-performance, non-lead weights while managing the inherent raw material volatility characteristic of the industrial metals market.

Segmentation Analysis

The Automotive Wheel Balancing Weight Market is primarily segmented based on material type, product type, application method, and vehicle type, providing a granular view of demand across the industry. Material segmentation is crucial due to regulatory mandates, distinguishing between lead, steel, and zinc weights, with steel and zinc rapidly gaining dominance. Product type categorization differentiates between standard weights used for initial balancing and specialized weights designed for specific wheel types or performance applications. The application method split—clip-on versus adhesive—reflects differences in wheel material and aesthetic requirements, with adhesive weights capturing significant market share, especially for high-end alloy rims. Understanding these segments is vital for manufacturers to tailor their product offerings and distribution strategies toward specific aftermarket service needs and OEM assembly specifications.

- By Material Type:

- Lead

- Zinc

- Steel (Iron)

- Others (Composite, etc.)

- By Product Type:

- Standard Weights

- Profile Weights (Low Profile)

- Performance Weights

- By Application Method:

- Clip-on Weights

- Adhesive (Stick-on) Weights

- By Vehicle Type:

- Passenger Vehicles (PV)

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

- By Sales Channel:

- Original Equipment Manufacturers (OEM)

- Aftermarket

Value Chain Analysis For Automotive Wheel Balancing Weight Market

The value chain for the Automotive Wheel Balancing Weight Market begins with upstream activities involving the sourcing and processing of raw materials, predominantly steel, zinc, and specialized adhesive compounds. Upstream dynamics are characterized by volatility in commodity prices, necessitating strong procurement strategies and risk mitigation practices by weight manufacturers. Key activities include smelting, alloying, and coating the metal to enhance corrosion resistance, which is critical for product longevity. The efficiency of this stage directly dictates the final manufacturing cost and environmental compliance profile, making strategic supplier relationships and vertically integrated operations highly advantageous in maintaining competitive pricing and quality control standards.

The core midstream activity involves the actual manufacturing of the weights, including casting, stamping, forming, and the application of clips or adhesive strips. Manufacturers invest heavily in automated precision machinery to ensure weights meet extremely tight tolerance specifications required for effective balancing. Distribution channels form the critical downstream component, linking manufacturers to end-users. Direct sales primarily target large OEMs for initial assembly and major national tire service chains. Indirect channels, utilizing specialized distributors, wholesalers, and automotive parts retailers, are essential for penetrating the highly fragmented global aftermarket, which represents the largest volume consumption segment.

Downstream analysis highlights the importance of logistics and inventory management, as balancing weights are commodity items requiring high availability at the point of service. The service providers—tire shops, repair garages, and auto dealerships—are the immediate consumers and crucial stakeholders in the value chain. Their preference for specific weight types (e.g., brand-specific weights for dealership service) and the ease of installation drive demand. The indirect channel relies heavily on regional distributors offering broad product lines and just-in-time delivery capabilities, ensuring that the correct type, material, and weight increment are available to meet varied customer needs, solidifying the market's dependence on efficient, localized supply networks.

Automotive Wheel Balancing Weight Market Potential Customers

The primary consumers and end-users of automotive wheel balancing weights are segmented into two major categories: Original Equipment Manufacturers (OEMs) and the vast global Aftermarket segment. OEMs, including passenger car, truck, and specialized vehicle manufacturers, purchase weights in bulk for the initial assembly of vehicles. They demand high-volume production, stringent quality control, and often customized, branded weights that meet specific vehicle design and aesthetic requirements, particularly for high-performance or luxury models featuring premium alloy wheels. This segment focuses heavily on supply security and guaranteed compliance with vehicle specifications.

The Aftermarket constitutes the overwhelming majority of ongoing demand and includes a decentralized network of potential buyers. This segment is driven by routine maintenance, tire replacements, rotations, and repairs, which necessitate rebalancing. Key customers within the Aftermarket include independent tire service shops, chain auto repair garages, franchised dealerships, commercial fleet operators, and government vehicle maintenance depots. These buyers prioritize cost-effectiveness, widespread availability across various materials and sizes, and ease of use, with adhesive weights seeing increasing preference due to their versatility and compliance with modern wheel designs.

Furthermore, specialized industrial customers, such as dedicated tire retreading facilities and large-scale transportation and logistics companies that manage extensive fleets of trucks and trailers, represent significant high-volume purchasers. These professional users often require heavier, durable clip-on weights suitable for commercial vehicle steel wheels, focusing intensely on reducing downtime and maximizing tire lifespan through precise balancing. The diversity of these end-users demands that manufacturers maintain a comprehensive portfolio covering everything from standard steel clip-ons to highly customized, coated zinc adhesive strips suitable for varying operational environments and regulatory mandates.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.56 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Plombco, WEGMANN automotive, Hennessy Industries (Coats), 3M, Perfect Equipment, Wurth Group, BADA, Shengshi Weiye, Wonder Auto Technology, Alligator Ventilfabrik, Unique Auto Products, H. P. Chemie Pelzer, A. K. Carbons, Cixi Fuhong Auto Parts, TRN Precision Engineering |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Wheel Balancing Weight Market Key Technology Landscape

The core technology landscape in the Automotive Wheel Balancing Weight Market centers less on radically new product concepts and more on refinement, materials science, and manufacturing precision. The primary focus is on developing advanced adhesive technologies that ensure secure long-term attachment of stick-on weights, resisting extreme temperature fluctuations, moisture, and centrifugal forces. Manufacturers are continuously working on high-performance acrylic foam tapes and specialized primers to enhance bonding strength, especially vital for performance vehicles and harsh operating environments. Furthermore, anti-corrosion coating technology for steel and zinc weights is a key area of investment, extending the lifespan and aesthetic quality of the weight, thereby preventing premature failure or unsightly rust that could negatively affect customer perception.

Beyond the weights themselves, technological advancements in wheel balancing machines are fundamentally shaping the market. Modern balancers integrate laser technology to precisely locate the ideal placement points, minimizing human error. These machines often employ advanced software utilizing proprietary algorithms to calculate weight requirements in fewer spins, significantly increasing service bay efficiency. The development of specialized weights designed to conform perfectly to the complex contours of modern aluminum alloy rims, including low-profile and hidden-weight applications (where the weight is concealed behind the spokes), further drives niche technological development aimed at aesthetic improvement without compromising functional performance.

An emerging technological trend involves the exploration of smart or dynamic balancing systems, although currently niche. This includes potential integration with TPMS or suspension sensors to provide real-time monitoring of wheel imbalance, potentially reducing the interval between traditional service visits or allowing for automated, active counter-balancing systems, particularly in heavy-duty or specialized industrial applications. However, the current standard remains the static weight system, emphasizing that the primary technological focus for the forecast period will remain on cost-effective, precise manufacturing of non-lead alternatives and high-reliability adhesive components to meet increasing regulatory and quality demands.

Regional Highlights

The global Automotive Wheel Balancing Weight Market exhibits distinct regional dynamics driven by varying regulatory landscapes, vehicle ownership rates, and economic development levels. Asia Pacific (APAC) dominates the market share due to its massive and expanding automotive production base, led by China, India, Japan, and South Korea, which accounts for both significant OEM demand and a rapidly growing aftermarket fueled by increasing disposable incomes and vehicle ownership. The regulatory transition away from lead is progressing rapidly, pushing manufacturers in this region to swiftly convert production lines to steel and zinc.

Europe and North America represent mature markets characterized by strict environmental regulations (e.g., the ban on lead weights implemented earlier than in most other regions) and high consumer expectation for quality and performance. Demand in these regions is heavily skewed towards premium, highly aesthetic zinc and coated steel weights, especially the adhesive type, reflecting the high penetration of aluminum alloy wheels. Europe, in particular, showcases high innovation in balancing technology and weight design, often setting global standards for material compliance and testing.

Latin America, the Middle East, and Africa (MEA) are emerging markets experiencing strong growth, particularly in the aftermarket segment, driven by improving road infrastructure and increasing fleet utilization. While cost remains a significant factor, leading to a higher penetration of basic clip-on steel weights, these regions are gradually adopting international quality standards. Investment in localized manufacturing and efficient distribution networks is critical for market penetration across these diverse and often geographically challenging territories.

- Asia Pacific (APAC): Leading market due to large-scale vehicle production (OEM) and expanding aftermarket; strong growth trajectory driven by China and India; fast transition to non-lead materials.

- Europe: Highly regulated mature market; strong demand for high-quality, corrosion-resistant zinc and steel adhesive weights; focus on high aesthetic standards for premium vehicles.

- North America: Stable, high-value aftermarket; driven by high vehicle mileage and frequent service; early adoption of non-lead standards; emphasis on reliable adhesive technology and specialized weights for larger truck tires.

- Latin America: Growing aftermarket segment; focus on cost-effective, standard steel weights; market expansion linked to infrastructure improvements and increasing vehicle parc.

- Middle East and Africa (MEA): Emerging market with potential in commercial fleet segments; characterized by price sensitivity and gradual shift towards standardized, safe balancing practices.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Wheel Balancing Weight Market.- WEGMANN automotive (Hofmann Power Weights)

- Plombco Inc.

- Hennessy Industries (Coats)

- Wurth Group

- Perfect Equipment Inc.

- BADA Commercial Vehicle Parts

- Wonder Auto Technology Co., Ltd.

- Alligator Ventilfabrik GmbH

- 3M Company (Adhesive technology supply)

- Fujian Hengwei Auto Parts Co., Ltd.

- Cixi Fuhong Auto Parts Co., Ltd.

- Shengshi Weiye Auto Accessories Co., Ltd.

- Unique Auto Products

- H. P. Chemie Pelzer GmbH

- TRN Precision Engineering

- A. K. Carbons

- Trax Industrial Products

- Dongguan Siying Automobile Accessories Co., Ltd.

- M & R Products

- NorthStar Industrial (NSi)

Frequently Asked Questions

Analyze common user questions about the Automotive Wheel Balancing Weight market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers for the shift from lead to steel and zinc wheel balancing weights?

The transition is primarily driven by stringent environmental regulations, particularly in North America and Europe, banning the use of lead due to its toxicity and environmental hazards upon disposal. Steel and zinc offer compliant, sustainable alternatives, though they require higher volumes or different shapes to match lead's density.

Which application method, clip-on or adhesive, holds the largest market share?

While clip-on weights remain dominant in the Heavy Commercial Vehicle (HCV) and standard steel wheel segments, adhesive (stick-on) weights are rapidly gaining market share, particularly within the Passenger Vehicle (PV) segment and for premium aluminum alloy wheels, due to aesthetic preference and suitability for complex rim designs.

How does the growth of Electric Vehicles (EVs) impact the demand for balancing weights?

EVs maintain a strong demand for balancing weights. Due to the high torque and often heavier weight of battery packs, EVs require highly precise balancing to mitigate vibrations and ensure tire longevity, potentially driving demand for more advanced, tighter-tolerance weights and balancing processes.

What is the key technological challenge in manufacturing non-lead balancing weights?

The main challenge is achieving the required density and small size. Steel and zinc are less dense than lead, meaning manufacturers must produce larger weights to achieve the necessary corrective mass. This requires advanced casting and stamping precision to prevent interference with brake components or aesthetic issues, coupled with effective corrosion resistance coatings.

Is the market dominated by the OEM or the Aftermarket segment?

The Automotive Wheel Balancing Weight Market is overwhelmingly dominated by the Aftermarket segment. While OEMs provide initial demand, the continuous need for rebalancing, tire rotation, replacement, and repair over the lifecycle of millions of vehicles ensures that the Aftermarket generates the vast majority of volume and revenue.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager