Automotive Wireless Charging Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434081 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Automotive Wireless Charging Market Size

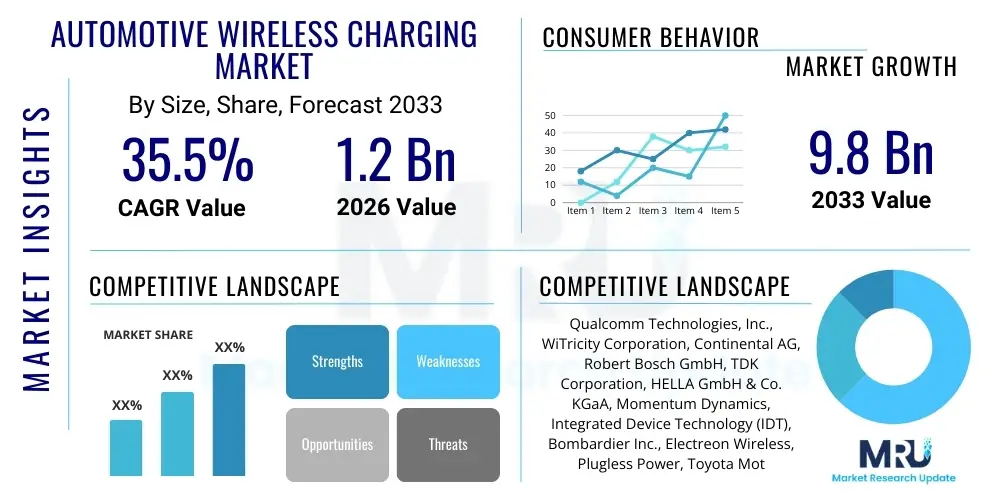

The Automotive Wireless Charging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 35.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 9.8 Billion by the end of the forecast period in 2033.

This aggressive growth trajectory is primarily fueled by the accelerating global transition towards electric vehicles (EVs) and the increasing consumer demand for enhanced convenience and sophisticated vehicle technology. Wireless charging eliminates the necessity for physical plugs and cables, significantly improving the user experience for EV owners. Furthermore, governmental incentives and stringent emission regulations across major economies, particularly in North America, Europe, and Asia Pacific, are pushing automotive manufacturers to integrate advanced technologies, positioning wireless charging as a crucial future standard in both passenger and commercial vehicle segments.

The maturation of key underlying technologies, such as magnetic resonant charging (MRC) and magnetic inductive charging (MIC), coupled with improvements in power transfer efficiency and reduced infrastructure costs, are critical factors supporting the market expansion. Standardization efforts by organizations like the Society of Automotive Engineers (SAE) are also lending stability and confidence to original equipment manufacturers (OEMs) and suppliers, encouraging large-scale adoption and integration into new EV platforms. The substantial investment in developing dynamic wireless charging systems for roadways further underscores the immense long-term potential of this market segment.

Automotive Wireless Charging Market introduction

The Automotive Wireless Charging Market encompasses technologies that enable the transfer of electrical energy to an electric vehicle (EV) without physical contact, primarily utilizing electromagnetic induction or magnetic resonance principles. These systems typically consist of a base charging pad installed on the ground or garage floor and a receiving coil integrated into the vehicle chassis. The primary goal is to provide a seamless, safe, and automated charging experience, aligning with the broader smart mobility ecosystem. Major applications span across passenger electric vehicles, commercial fleets, electric buses, and autonomous shuttle services, enhancing operational efficiency and reducing infrastructure complexity associated with conventional conductive charging methods.

The core product description involves sophisticated power electronics, advanced sensor technology for alignment and safety verification, and specialized coil designs optimizing energy transfer efficiency over a non-contact air gap. Key benefits include superior user convenience, reduced risk of cable damage or misuse, improved aesthetic integration into urban environments, and potential integration with automated parking systems. These inherent advantages position wireless charging as a foundational technology for future autonomous and interconnected transportation systems, where human intervention in charging processes must be minimized or eliminated entirely.

Driving factors propelling this market include the unprecedented global surge in electric vehicle sales, ambitious decarbonization targets set by nations, and continuous technological advancements aimed at increasing power transfer efficiency (currently approaching 90-95%) and reducing the size and weight of charging components. Furthermore, the push towards developing dynamic wireless charging infrastructure embedded in road networks promises to solve range anxiety concerns, acting as a massive long-term catalyst for market acceleration and mass consumer acceptance of EVs globally.

Automotive Wireless Charging Market Executive Summary

The Automotive Wireless Charging Market is characterized by intense technological innovation, strategic collaborations between automotive OEMs and technology providers, and robust regulatory push towards standardization. Business trends indicate a strong shift from static (parking-based) charging systems towards the development and pilot testing of dynamic (in-motion) charging solutions, which represents the next frontier of market evolution. Furthermore, component suppliers are focusing heavily on developing miniaturized, highly efficient power electronics and sophisticated communication protocols (e.g., based on SAE J2954 standard) to ensure interoperability and safety across different vehicle models and charging infrastructure types. Investment flows are concentrated on R&D for resonant charging technology, which offers greater tolerance for misalignment and a larger air gap compared to traditional inductive methods.

Regionally, Asia Pacific maintains the dominant market share, primarily driven by China's extensive EV adoption and governmental subsidies supporting domestic manufacturing and infrastructure rollout. However, Europe and North America are projected to exhibit the fastest growth rates, spurred by strict zero-emission vehicle mandates and major automotive groups committing significant capital to electrify their entire fleets. North America is particularly focused on developing high-power wireless charging solutions (>11 kW) suitable for larger SUVs and trucks, while Europe leads in standardization efforts and integrating wireless charging into public parking facilities and smart city initiatives.

Segment trends reveal that the Inductive Charging segment currently holds the larger market share due to its established maturity and lower cost, but the Resonant Charging segment is poised for rapid expansion owing to its superior performance characteristics, particularly its higher efficiency and tolerance for larger charging distances and misalignment. Passenger vehicles constitute the primary application segment, yet commercial vehicles, including heavy-duty trucks and public transit buses, are increasingly adopting wireless solutions to maximize uptime and minimize manual handling, indicating a significant future growth avenue for high-power applications.

AI Impact Analysis on Automotive Wireless Charging Market

Users frequently inquire about how Artificial Intelligence (AI) can enhance the reliability, efficiency, and intelligence of automotive wireless charging systems. Key concerns revolve around optimizing coil alignment, predicting battery health degradation due to frequent charging cycles, and managing power distribution across dense charging hubs. Users are specifically seeking AI solutions for real-time fault detection, predictive maintenance of charging pads, and dynamic power management based on grid load and vehicle battery requirements. The analysis indicates a strong expectation that AI will move wireless charging from a mere convenience feature to a highly efficient, integrated energy management system critical for smart grids and autonomous driving.

- AI optimizes vehicle parking and charging pad alignment using advanced computer vision and sensor fusion, maximizing energy transfer efficiency (AEO optimization).

- Machine Learning (ML) algorithms analyze battery state-of-charge (SoC) and state-of-health (SoH) to tailor charging profiles, minimizing thermal stress and extending battery lifespan.

- AI-driven predictive maintenance monitors the operational status of charging infrastructure components, identifying anomalies and scheduling preventative repairs before system failure.

- Generative AI models simulate complex electromagnetic field interactions and coil designs, accelerating the research and development cycle for next-generation resonant charging systems.

- Smart grid integration enabled by AI allows charging stations to dynamically adjust power draw based on real-time electricity prices and overall grid stability, supporting vehicle-to-grid (V2G) capabilities.

- AI facilitates autonomous charging protocols in robotic and self-driving vehicles, ensuring vehicles automatically seek out, align with, and initiate payment for charging without human input.

DRO & Impact Forces Of Automotive Wireless Charging Market

The Automotive Wireless Charging Market is strongly influenced by a robust set of driving forces centered on convenience and environmental mandates, while simultaneously navigating technological and infrastructural restraints. The primary drivers include the exponential increase in global EV adoption, strong governmental support for zero-emission vehicles, and the inherent simplicity and user-friendliness of contactless charging, which significantly enhances the overall EV ownership experience. These drivers exert a profound positive impact, encouraging OEMs to prioritize wireless charging as a differentiation factor in high-end vehicle models and future autonomous fleets. The opportunity landscape is vast, primarily focusing on dynamic charging—integrating charging coils directly into public roads, thereby solving issues of range anxiety and allowing for smaller, lighter EV batteries.

Conversely, the market faces significant restraints, including the currently higher installation and component cost compared to traditional plug-in chargers, which hinders mass deployment in budget EV segments. Furthermore, efficiency losses, although continuously improving, remain a constraint relative to direct conductive charging. Critical impact forces stabilizing the market include the global standardization efforts, particularly the SAE J2954 protocol, which is crucial for establishing interoperability and building consumer trust. The strategic importance of high power transfer (>22 kW) for rapid charging also dictates R&D investment, shaping the competitive landscape toward technology providers capable of delivering reliable high-throughput systems.

Segmentation Analysis

The Automotive Wireless Charging Market is segmented across multiple dimensions to accurately reflect technological diversity and application scope. Key segmentation includes the type of charging technology utilized (Inductive vs. Resonant), the specific components involved in the transfer system, the power output capabilities required for different charging speeds, and the ultimate application across various vehicle types. This granular analysis is essential for identifying high-growth niches, assessing competitive advantages, and directing strategic investments toward the most promising technology pathways. Understanding how these segments interact, particularly in the context of emerging autonomous vehicle requirements, provides a comprehensive view of the market structure.

- By Charging Type:

- Magnetic Inductive Charging (MIC)

- Magnetic Resonant Charging (MRC)

- By Component:

- Base Charging Pad (Ground Assembly)

- Power Transfer Coil

- Vehicle Interface/Receiving Coil (Vehicle Assembly)

- Power Electronics Unit (PEU)

- Control & Communication Modules

- By Power Output:

- 3 kW – 11 kW (Residential and Low Power Commercial)

- 11 kW – 22 kW (Commercial and Fleet Applications)

- Greater than 22 kW (Heavy Duty and Dynamic Charging Trials)

- By Application:

- Passenger Electric Vehicles (PEVs)

- Commercial Vehicles (Buses, Taxis, Delivery Vans)

Value Chain Analysis For Automotive Wireless Charging Market

The value chain for the Automotive Wireless Charging Market begins with upstream activities involving raw material procurement and the design of critical components, focusing heavily on specialized copper wiring for coils, advanced semiconductor materials for power electronics (e.g., SiC or GaN), and magnetic core materials. Key upstream players include specialized material providers and component manufacturers focusing on high-efficiency power management integrated circuits (PMICs) and communication hardware. This stage is dominated by technology specialization, where proprietary coil designs and patented frequency management systems provide significant competitive differentiation, influencing the overall cost and efficiency of the final product.

Midstream activities involve system integration, encompassing the assembly of the Base Charging Pad (BPP) and the Vehicle Assembly (VA), requiring deep collaboration between technology license holders, Tier 1 automotive suppliers (e.g., Continental, Bosch), and system integrators. Downstream involves the distribution channels, which are bifurcated into Direct and Indirect sales. Direct channels largely pertain to OEM integration, where charging systems are installed directly on the production line of new vehicles and bundled with high-end EV models. Indirect channels involve aftermarket installations, public charging infrastructure development by utility companies and smart city projects, and specialized installations for commercial vehicle fleets such as electric taxis and buses.

The distribution landscape requires robust partnerships with installation service providers who must handle complex civil engineering work for installing ground assemblies and ensuring compliance with local grid regulations. The high complexity of the product means that technical support, standardized testing protocols, and certification services form a crucial part of the downstream value proposition. Successful participants in this value chain must manage intellectual property aggressively while ensuring global interoperability standards are met to penetrate diverse regional markets effectively.

Automotive Wireless Charging Market Potential Customers

The primary potential customers and end-users of automotive wireless charging technology are segmented into several distinct groups, each driven by unique needs and investment priorities. The largest segment comprises private owners of high-end and luxury Electric Vehicles (EVs) who prioritize convenience, aesthetics, and technological novelty. These buyers seek seamless, automated parking and charging solutions for residential use, viewing wireless charging as a premium feature that justifies a higher initial cost. This customer base is highly influenced by OEM marketing and integration efforts, demanding systems that are discreet and easy to use without manual intervention.

The second critical customer group involves commercial fleet operators, including taxi services, last-mile delivery companies, and public transit authorities managing electric bus fleets. For these customers, the primary motivator is operational efficiency and maximizing vehicle uptime. Wireless charging allows drivers to spend less time connecting and disconnecting cables and facilitates automated charging during short stops or overnight parking, significantly improving daily route productivity. High-power wireless charging is particularly attractive here, enabling opportunity charging during short layovers.

Finally, urban planners, municipal authorities, and utility companies represent significant buyers for large-scale infrastructure projects. These entities invest in public static charging stations integrated into smart parking garages and, increasingly, in dynamic charging infrastructure embedded within public roadways. Their buying criteria focus heavily on standardization (SAE J2954 compliance), durability, resilience to environmental factors, and compatibility with grid management systems, aiming to support widespread EV adoption and foster sustainable urban mobility solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 9.8 Billion |

| Growth Rate | 35.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Qualcomm Technologies, Inc., WiTricity Corporation, Continental AG, Robert Bosch GmbH, TDK Corporation, HELLA GmbH & Co. KGaA, Momentum Dynamics, Integrated Device Technology (IDT), Bombardier Inc., Electreon Wireless, Plugless Power, Toyota Motor Corporation, WAVE (Wireless Advanced Vehicle Electrification), ZTE Corporation, Visteon Corporation, Luminwave, Siemens AG, Infineon Technologies AG, NXP Semiconductors N.V., Mojo Mobility. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Wireless Charging Market Key Technology Landscape

The technological landscape of automotive wireless charging is primarily defined by two competing and converging methodologies: Magnetic Inductive Charging (MIC) and Magnetic Resonant Charging (MRC). MIC, the more mature technology, involves transferring energy over a short distance when the transmitting and receiving coils are tightly coupled and highly aligned. While reliable and relatively cost-effective, MIC systems are sensitive to misalignment and typically require precise parking guidance. Advancements in MIC focus on improving power transfer density and integrating sophisticated sensor technology to ensure optimal coupling, thereby minimizing energy losses during the charging process.

MRC, conversely, utilizes coupled magnetic resonance, allowing for efficient energy transfer over larger air gaps and exhibiting high tolerance to misalignment, making it highly suitable for real-world driving and parking scenarios. MRC operates at higher frequencies and is the foundation for most high-power and dynamic (in-motion) charging projects currently being trialed globally. The technological focus for MRC innovators is centered on refining high-frequency power electronics, utilizing advanced Gallium Nitride (GaN) and Silicon Carbide (SiC) semiconductors to increase system efficiency, and developing proprietary resonator designs that maximize the magnetic field reach and uniformity without compromising safety standards regarding electromagnetic radiation (EMR).

Crucially, the entire technology landscape is underpinned by robust communication and safety protocols, most notably defined by the SAE J2954 standard. This standard governs interoperability, frequency requirements, EMR limits, and foreign object detection (FOD) capabilities, ensuring that the system can safely identify and react to objects placed between the charging pad and the vehicle. Future technology development is rapidly moving towards seamless integration with Vehicle-to-Grid (V2G) systems and incorporating AI-driven alignment and power management, promising fully autonomous and integrated energy transfer capabilities within the smart mobility infrastructure.

Regional Highlights

The global Automotive Wireless Charging Market exhibits distinct regional dynamics driven by varying regulatory environments, EV penetration rates, and infrastructure investment strategies.

- Asia Pacific (APAC) is the dominant market region, primarily due to the massive scale of EV production and adoption in China. Government support in China, South Korea, and Japan has fostered significant technological advancements and infrastructure build-out. APAC leads in both static and pilot dynamic charging deployments, positioning the region as a major hub for component manufacturing and system integration.

- North America is characterized by robust growth projections, fueled by aggressive decarbonization goals, substantial federal investments in EV infrastructure (e.g., through the Bipartisan Infrastructure Law), and a strong consumer preference for large, high-power vehicles. The region focuses heavily on achieving high power transfer (>22 kW) and developing standardization across states, with significant activity from key technology developers like WiTricity and Qualcomm.

- Europe shows the fastest adoption rate, driven by stringent European Union emission targets and strong OEM commitments (e.g., Volkswagen, BMW) to fully electric lineups. European growth is concentrated on smart city integration, leveraging wireless charging for public transport fleets (buses, shuttles) and integrating charging pads into urban parking environments, ensuring systems adhere to stringent aesthetic and safety regulations.

- Latin America (LATAM) and Middle East & Africa (MEA) are emerging markets, currently focused on pilot projects and infrastructure development, particularly for public transport systems in densely populated urban centers. Growth in these regions is heavily reliant on foreign investment and technological transfers, targeting long-term utility infrastructure modernization.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Wireless Charging Market.- Qualcomm Technologies, Inc.

- WiTricity Corporation

- Continental AG

- Robert Bosch GmbH

- TDK Corporation

- HELLA GmbH & Co. KGaA

- Momentum Dynamics

- Integrated Device Technology (IDT)

- Bombardier Inc.

- Electreon Wireless

- Plugless Power

- Toyota Motor Corporation

- WAVE (Wireless Advanced Vehicle Electrification)

- ZTE Corporation

- Visteon Corporation

- Luminwave

- Siemens AG

- Infineon Technologies AG

- NXP Semiconductors N.V.

- Mojo Mobility

Frequently Asked Questions

Analyze common user questions about the Automotive Wireless Charging market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical challenge hindering mass adoption of automotive wireless charging?

The primary challenge remains achieving high power transfer efficiency comparable to conductive charging while ensuring standardized interoperability (meeting SAE J2954) across diverse vehicle platforms and maintaining cost parity with conventional charging infrastructure. Efficiency loss over the air gap and the high cost of specialized resonant components are significant hurdles.

How does Magnetic Resonant Charging (MRC) differ from Magnetic Inductive Charging (MIC)?

MIC requires close physical alignment and tight coupling between coils, often over a very small air gap. MRC, based on coupled resonance, allows energy transfer over larger distances and tolerates greater misalignment, making it highly preferable for dynamic charging and simpler residential installation, albeit at a typically higher component cost.

Is dynamic wireless charging currently available commercially for passenger vehicles?

No, dynamic wireless charging (charging while driving) is predominantly in advanced pilot testing phases globally, particularly for public transport buses and dedicated fleet vehicles in localized urban corridors. Commercial deployment for general passenger vehicles requires substantial infrastructure build-out and standardization.

What role does the SAE J2954 standard play in the market?

The SAE J2954 standard is critical as it defines electromagnetic compatibility, minimum efficiency levels, foreign object detection (FOD) requirements, and interoperability specifications. It is the global benchmark ensuring that wireless charging systems from different manufacturers can safely and effectively charge any compliant EV.

Which region currently leads the market in terms of infrastructure deployment?

The Asia Pacific region, particularly driven by large-scale EV adoption and manufacturing capabilities in China, currently leads the market both in infrastructure deployment volumes and manufacturing capacity for wireless charging components and systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager