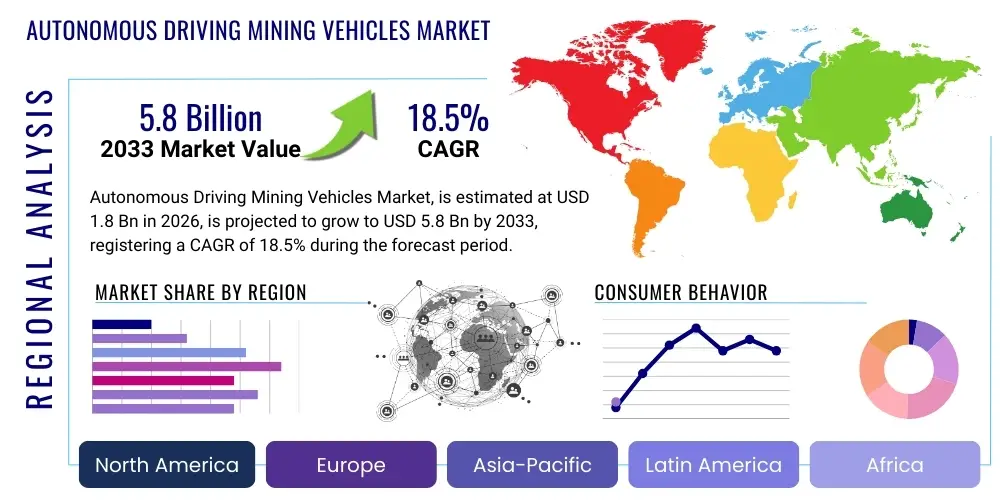

Autonomous Driving Mining Vehicles Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437540 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Autonomous Driving Mining Vehicles Market Size

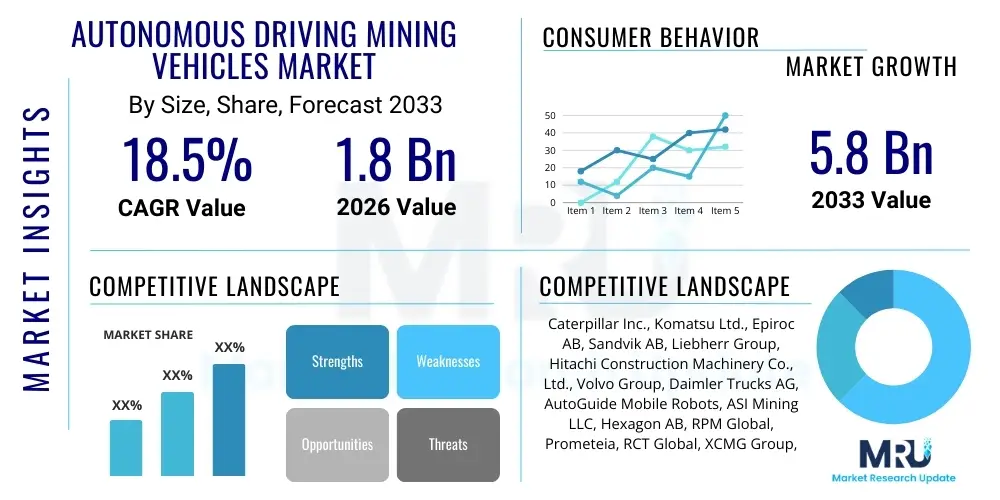

The Autonomous Driving Mining Vehicles Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 5.8 Billion by the end of the forecast period in 2033.

Autonomous Driving Mining Vehicles Market introduction

The Autonomous Driving Mining Vehicles Market encompasses the development, manufacturing, and deployment of heavy machinery designed to operate without human intervention in harsh and complex mining environments. These vehicles, including haul trucks, excavators, dozers, and drill rigs, utilize sophisticated sensor fusion technologies—such as LiDAR, radar, high-precision GPS, and computer vision—coupled with advanced AI algorithms for perception, planning, and control. The primary objective is to enhance operational safety by removing human operators from hazardous zones, drastically improve productivity through continuous operation, and reduce operational costs associated with labor and unpredictable maintenance due to human error. This market is fundamentally shifting the paradigm of mining operations, moving towards fully integrated, digitized, and remotely managed sites, thereby promising substantial economic and environmental benefits for large-scale global mining companies focused on resource extraction across metal, mineral, and coal categories.

The product description spans across various scales and functions of heavy equipment, each retrofitted or purpose-built for autonomous operation. Major applications are centered around bulk material transport (autonomous haulage systems being the dominant segment), precision drilling, loading, and dynamic stockpile management. The integration of these vehicles facilitates 24/7 continuous operations, minimizing downtime typically associated with shift changes, breaks, and fatigue management. Key benefits driving adoption include a significant reduction in fuel consumption through optimized driving patterns, lower maintenance costs due to predictable operation, and superior asset utilization rates. Furthermore, autonomous systems excel in precision, leading to better blast patterns and minimized ore dilution, ultimately improving the quality and recovery rate of extracted resources.

Driving factors for this technological migration include stringent global safety regulations requiring reduction in human exposure to risk, the sustained need for productivity gains amidst fluctuating commodity prices, and the increasing difficulty in recruiting skilled labor for remote mining sites. The evolution of 5G and robust private wireless networks at mine sites is also crucial, enabling the necessary low-latency, high-bandwidth communication required for coordinated fleet management and real-time remote monitoring. As mining companies prioritize digital transformation and environmental, social, and governance (ESG) compliance, autonomous solutions offer a verifiable pathway to achieving these complex operational goals, securing the market's strong projected CAGR through 2033.

Autonomous Driving Mining Vehicles Market Executive Summary

The Autonomous Driving Mining Vehicles Market is undergoing rapid transformation, characterized by significant investment in advanced sensing technologies and robust fleet management software platforms, signifying a major pivot in business trends towards CapEx-intensive, highly efficient mining models. Business trends are dominated by strategic collaborations between Original Equipment Manufacturers (OEMs), who supply the heavy machinery (e.g., Caterpillar, Komatsu), and specialized technology providers (e.g., Hexagon, ASI Mining) offering bespoke autonomy kits and integrated software ecosystems. This collaborative model accelerates time-to-market for complex systems and mitigates deployment risks for mine operators. Furthermore, there is a distinct trend towards 'Autonomy as a Service' (AaaS) models, allowing smaller mining operations to adopt advanced technology without the prohibitive upfront purchasing costs, fostering broader market penetration and standardizing operational best practices across the industry.

Regional trends indicate that mature mining markets, particularly North America (Canada and the US) and Australia (APAC), remain the primary adoption hubs, driven by high labor costs, vast resource reserves, and supportive regulatory environments that encourage technological experimentation in remote areas. Australia, in particular, leads in the deployment scale of autonomous haulage systems (AHS), setting global benchmarks for operational efficiency and safety performance. However, emerging markets, specifically Latin America (Chile, Peru, focusing on copper and iron ore) and parts of Africa, are demonstrating accelerating growth potential. This growth is fueled by the imperative to unlock value from deep-pit mines and address volatile political risks and supply chain challenges through localized, resilient, and human-independent operations. The focus in these regions is increasingly shifting from pilot projects to full-scale commercial deployment, often skipping semi-autonomous stages entirely to leapfrog competitors.

Segmentation trends highlight the dominance of the Haul Trucks segment, which accounts for the largest market share due to the clear and immediate return on investment provided by continuous, optimized material movement. However, the fastest-growing segment is expected to be Autonomous Drills and Auxiliary Equipment (Dozers and Loaders), as mining operations seek end-to-end automation across the entire value chain, moving beyond just haulage. In terms of technology, the shift is towards sensor redundancy and fusion, where the reliance on single modalities (like GPS) is decreasing in favor of robust, resilient systems combining advanced LiDAR, sophisticated radar mapping, and inertial measurement units (IMUs) to ensure safe operation even in adverse weather conditions or GPS-denied environments. The trend for automation level is moving decisively towards fully autonomous systems (Level 5 equivalent), driven by the successful deployment records and proven safety profiles in Tier 1 mining organizations.

AI Impact Analysis on Autonomous Driving Mining Vehicles Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Autonomous Driving Mining Vehicles Market primarily revolve around three critical themes: safety and operational reliability in dynamic environments, the optimization potential for massive fleet coordination, and the resultant changes in the mining labor landscape. Common user concerns center on whether AI systems can reliably handle unexpected edge cases, such as unmapped debris, equipment failure, or sudden environmental shifts (e.g., heavy dust or rain), without human intervention, emphasizing the need for robust machine learning models trained on highly diverse and complex real-world data sets. Users are also keenly interested in how deep learning and reinforcement learning algorithms are utilized for predictive maintenance, optimal routing (minimizing tire wear and fuel consumption), and ensuring flawless V2V (Vehicle-to-Vehicle) and V2I (Vehicle-to-Infrastructure) communication, which is vital for maximizing the efficiency of hundreds of simultaneously operating units.

The integration of advanced AI forms the bedrock of modern autonomous mining, moving beyond mere programmed automation (classical control systems) into intelligent, adaptive decision-making. AI is crucial for real-time perception tasks, using convolutional neural networks (CNNs) to process massive data streams from multiple sensors to accurately classify objects, estimate distances, and identify potential hazards faster and more reliably than humans. Furthermore, AI drives the predictive layer, using machine learning models to anticipate equipment failure based on telematics data (vibration, heat, pressure), enabling condition-based maintenance schedules that prevent costly breakdowns and significantly extend the Mean Time Between Failures (MTBF). This algorithmic superiority in perception and prediction fundamentally enhances the safety and operational uptime of autonomous fleets.

The strategic deployment of AI also heavily influences the commercial viability of autonomous mining by optimizing the entire production process. AI-powered fleet management systems utilize complex algorithms to dynamically assign tasks, manage traffic flow in pits and on haul roads, and optimize loading and dumping cycles based on real-time processing plant demand. This level of coordination, unattainable by traditional human supervisors, ensures that the mine operates as a cohesive, single integrated system, maximizing throughput and reducing bottleneck occurrences. Consequently, user expectations regarding AI focus on its ability to deliver step-change improvements in productivity, lower the energy footprint per ton of material extracted, and provide a measurable competitive advantage through superior operational metrics, thereby solidifying AI's role as the central differentiating technology in the market.

- AI enhances sensor fusion and perception capabilities, providing reliable object detection and environmental mapping in harsh mining conditions.

- Deep learning models optimize haulage routes and speed profiles, leading to significant reductions in fuel consumption and vehicle wear.

- Predictive maintenance driven by AI algorithms minimizes unexpected downtime, boosting overall fleet availability and operational uptime.

- Reinforcement learning enables vehicles to adapt and learn optimal driving behaviors in novel or complex operational scenarios, improving safety response.

- AI facilitates seamless coordination of large fleets (hundreds of vehicles) through centralized traffic management systems, reducing bottlenecks and collision risk.

- Computer vision applications, powered by AI, ensure accurate positioning and loading/unloading operations, improving resource recovery and reducing ore dilution.

- Natural Language Processing (NLP) is increasingly used in remote operations centers for better interface and command execution, streamlining control processes.

DRO & Impact Forces Of Autonomous Driving Mining Vehicles Market

The Autonomous Driving Mining Vehicles Market is powerfully influenced by a dynamic interplay of Drivers (D), Restraints (R), and Opportunities (O), which together constitute the primary Impact Forces shaping its trajectory. The fundamental drivers are overwhelmingly centered on improving human safety and achieving unparalleled productivity gains; removing personnel from physically hazardous environments, such as blast zones or collapsing areas, immediately reduces regulatory and operational risk. Concurrently, the capability for vehicles to operate 24/7 at consistent optimal performance levels, irrespective of time, weather, or fatigue, drastically increases material throughput compared to human-operated sites. These intrinsic benefits, coupled with the long-term potential for significant operational cost reductions by minimizing labor costs and optimizing fuel efficiency, create compelling financial incentives for major mining corporations to rapidly adopt autonomy.

However, significant restraints temper the pace of market adoption, primarily focusing on the substantial initial capital expenditure (CapEx) required for transitioning an entire fleet and installing the necessary sophisticated supporting infrastructure, including high-bandwidth, resilient communication networks and advanced mine-control centers. Technical challenges, such as ensuring reliable connectivity in rugged terrain, managing data privacy and cybersecurity threats inherent in networked systems, and overcoming the complexity of integrating diverse legacy equipment with modern autonomous kits, further restrict immediate deployment. The social restraint of potential job displacement and the need for significant upskilling of the existing workforce to manage new technology also presents an ongoing challenge that mining companies must strategically address to maintain societal license to operate and ensure a smooth transition.

The primary opportunities (O) for market expansion lie in the application of autonomous technology to extremely remote or exceptionally deep underground mines where human access is highly restricted or dangerous, allowing previously uneconomic reserves to be safely and efficiently accessed. Furthermore, the development of standardized, open-source software interfaces and interoperability standards presents a massive opportunity to lower technology barriers and foster competition, moving away from proprietary, OEM-locked ecosystems. The most significant long-term opportunity is the integration of autonomy with sustainability goals; optimized driving patterns and predictive maintenance lead to lower greenhouse gas emissions and reduced energy consumption, positioning autonomous mining as a key component in meeting global ESG targets. The core impact force driving accelerated growth is the proven, measurable return on investment (ROI) demonstrated by early adopters in terms of safety and total production volume, creating an undeniable pressure on competitors to implement similar systems.

Segmentation Analysis

The Autonomous Driving Mining Vehicles Market is meticulously segmented based on several operational and technological criteria, enabling stakeholders to understand the distinct growth patterns and competitive dynamics within specialized niches. Key segmentation variables include the type of vehicle being automated, the specific level of automation achieved, the underlying technologies utilized for navigation and control, and the type of application or mineral being mined. This granular analysis is crucial for OEMs and technology providers to tailor their offerings—whether focused on robust high-payload trucks necessary for iron ore extraction or smaller, more agile equipment needed for underground operations—to specific customer requirements, thereby maximizing market penetration and adoption rates across diverse mining landscapes globally.

Segmentation by Vehicle Type is perhaps the most critical determinant of market size and maturity, with Autonomous Haul Trucks dominating the revenue landscape due to the ease of implementation in large open-pit environments and the immediate safety and efficiency benefits realized from high-volume movement. However, segmentation by Automation Level is increasingly important, distinguishing between semi-autonomous systems (requiring remote supervision or limited human intervention, often found in retrofit kits) and fully autonomous, completely self-governing operations (prevalent in greenfield sites and specialized deep-underground projects). The market is consistently moving away from semi-autonomous solutions towards Level 5 equivalent operational capability, particularly as sensor costs decrease and reliability improves, necessitating a focus on end-to-end integration across all segments.

Technological segmentation highlights the competitive battleground among sensor providers and software integrators, classifying solutions based on the dominant navigation components—whether LiDAR-centric, Radar-based, or GPS-reliant systems, with modern trends favoring complex sensor fusion platforms that leverage multiple modalities for redundancy and accuracy. Finally, segmentation by Application, such as Metal Mining (e.g., copper, gold, iron ore), Mineral Mining (e.g., phosphates, industrial minerals), and Coal Mining, reflects differing operational constraints and investment cycles; for instance, coal mining faces more volatile commodity prices and stringent environmental scrutiny, impacting technology adoption decisions compared to high-value metal extraction, making customized technological approaches essential for each application segment's unique demands and profitability models.

- Vehicle Type:

- Autonomous Haul Trucks (Dominant segment due to bulk material transport)

- Autonomous Loaders and Excavators (Crucial for face digging and loading cycles)

- Autonomous Dozers and Graders (Essential for site preparation and road maintenance)

- Autonomous Drills and Blasters (Focus on precision and safety in hazardous zones)

- Automation Level:

- Semi-Autonomous Vehicles (Assisted operation, supervised control)

- Fully Autonomous Vehicles (Unsupervised operation, remote monitoring)

- Technology:

- LiDAR Systems (High-resolution 3D mapping and object detection)

- Radar Systems (All-weather long-range detection and speed measurement)

- Global Positioning Systems (High-precision GNSS/RTK required for localization)

- Computer Vision and AI (Real-time perception and classification)

- Application:

- Metal Mining (Copper, Iron Ore, Gold, Nickel)

- Mineral Mining (Potash, Phosphates, Industrial Minerals)

- Coal Mining (Surface and Underground Operations)

Value Chain Analysis For Autonomous Driving Mining Vehicles Market

The value chain for the Autonomous Driving Mining Vehicles Market is complex, involving highly specialized technological inputs upstream, sophisticated integration and manufacturing processes, and specialized service delivery downstream to the end-user mining operators. Upstream analysis reveals a dependence on advanced technology suppliers providing foundational components, including precision sensor suites (LiDAR units, high-grade IMUs, and specialized industrial cameras), high-performance computing hardware (ruggedized control units and edge processors capable of real-time AI execution), and proprietary software stacks for navigation, perception, and fleet orchestration. Key upstream players are technology giants and specialized startups whose innovations in AI and sensing dictate the ultimate performance, safety, and operational reliability of the final autonomous vehicle system, making supply chain resilience and technology partnership management critical for OEMs.

The core of the value chain involves the Original Equipment Manufacturers (OEMs) such as Caterpillar, Komatsu, and Sandvik, who integrate the technology into their heavy machinery platforms, either through factory-fit installations (greenfield sites) or sophisticated retrofit kits (brownfield sites). This integration requires deep engineering expertise to ensure seamless mechanical, electrical, and software interfaces across various machine types. Distribution channels are typically highly specialized, often relying on direct sales forces or exclusive regional dealerships that possess the necessary expertise to deploy, commission, and provide long-term maintenance and software support for these high-value, complex assets. Direct distribution ensures quality control and allows for customized deployment strategies, which are essential given the bespoke nature of mining site setups and operational demands.

Downstream analysis focuses on the end-user mining companies and the sustained services required post-deployment. The value proposition shifts from hardware sales to recurring software licensing, operational support, and performance monitoring. Indirect channels, such as specialized consulting firms and system integrators, play a vital role in assisting mining companies with site readiness assessment, change management, and connecting the autonomous fleet data back into broader enterprise resource planning (ERP) systems. The continuous feedback loop from the operational data generated by the autonomous fleet—concerning performance, component wear, and environmental conditions—is fed back to the OEMs and technology providers, driving product improvements and maintaining a high level of operational efficiency, demonstrating a deeply interlinked, cyclical value structure where maintenance and optimization services are as important as the initial vehicle sale.

Autonomous Driving Mining Vehicles Market Potential Customers

The primary customer base for Autonomous Driving Mining Vehicles consists of large, multinational mining corporations engaged in high-volume, continuous extraction operations across various geographies, particularly those focused on bulk commodities such as iron ore, copper, and coking coal. These Tier 1 and Tier 2 mining companies, including Rio Tinto, BHP, Vale, and FMG, are the leading adopters because they possess the necessary capital reserves for large-scale CapEx investments and operate mines where the economies of scale (e.g., vast open pits or long underground haul routes) maximize the ROI derived from 24/7 continuous operation and optimized fuel consumption. These companies prioritize proven safety records, system reliability, and seamless integration with existing processing and control systems, demanding robust solutions with global support capabilities and guaranteed performance metrics, making them the anchor clients for major OEMs.

A secondary, yet rapidly expanding, segment of potential customers includes mid-tier mining operators and specialized contract miners. These customers often face tighter budget constraints but are increasingly motivated by labor shortages, the high cost of skilled operators, and the desire to meet increasingly stringent ESG criteria regarding environmental impact and operational safety. For this segment, solutions that offer lower initial CapEx, such as retrofit kits for existing fleets or subscription-based "Autonomy as a Service" (AaaS) models, are highly attractive. They seek scalable solutions that can be piloted on a small scale before committing to full-scale automation, focusing particularly on maximizing the utilization of their current assets through partial automation or focused applications like autonomous drilling or pit optimization, rather than immediate full fleet replacement.

Furthermore, government-owned mining entities and state-controlled resource operations in regions like China, Russia, and the Middle East represent growing potential customers, driven by national mandates for technological modernization and resource security. While adoption speed in these regions may be influenced by political factors and domestic technological development strategies, the underlying need for efficiency, safety, and reduced reliance on volatile labor markets remains a powerful purchasing driver. Their buying decisions often involve long-term governmental contracts and require technologies that comply with specific national standards and supply chain requirements, distinguishing their procurement processes from those of purely private multinational corporations and necessitating tailored engagement strategies from market providers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 5.8 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Caterpillar Inc., Komatsu Ltd., Epiroc AB, Sandvik AB, Liebherr Group, Hitachi Construction Machinery Co., Ltd., Volvo Group, Daimler Trucks AG, AutoGuide Mobile Robots, ASI Mining LLC, Hexagon AB, RPM Global, Prometeia, RCT Global, XCMG Group, SANY Group, BAE Systems, Wenco International Mining Systems, Rockwell Automation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Autonomous Driving Mining Vehicles Market Key Technology Landscape

The technological landscape of the Autonomous Driving Mining Vehicles Market is defined by the convergence of ruggedized hardware, advanced sensor fusion architectures, and sophisticated AI-driven software stacks designed to ensure reliable operation in extreme environments. Central to this landscape is the application of multi-modal sensing, combining LiDAR for high-resolution 3D environmental mapping, Radar for robust long-range object detection unaffected by dust or fog, and high-precision Real-Time Kinematic (RTK) GPS for centimeter-level localization accuracy. The continuous advancement in solid-state LiDAR technology and the integration of specialized mining-grade radar systems capable of distinguishing complex objects are key trends. Furthermore, the reliance on high-speed, low-latency private wireless networks (LTE/5G or customized Mesh networks) at the mine site is non-negotiable, acting as the nervous system that connects the decentralized fleet to the centralized Mine Control Center (MCC), enabling real-time monitoring and control necessary for safe, coordinated operations.

Another crucial technological development is the shift towards edge computing and localized processing capabilities within the vehicles themselves. Given the immense volume of sensor data generated and the critical safety requirement for immediate decision-making, vehicles are increasingly equipped with powerful ruggedized computing units that can process perception data and execute control maneuvers without constant reliance on backhaul communication to the central server. This distributed architecture enhances resilience against network interruptions and significantly reduces decision latency, making the system safer and more responsive. Specialized software platforms, including sophisticated path planning algorithms and advanced traffic management systems specifically designed for the unique dynamics of mining routes and pit geometries, utilize machine learning to constantly optimize travel patterns, minimizing risks like vehicle bunching and maximizing fuel efficiency across the entire autonomous fleet.

Future technology trends involve the broader adoption of Vehicle-to-Everything (V2X) communication standards and highly detailed digital twins of the entire mine site. V2X allows autonomous vehicles to communicate not just with the central command but directly with each other and with infrastructure (e.g., traffic lights, barriers, load-out stations), enhancing situational awareness and collision avoidance in complex, multi-user environments. The digital twin technology, continuously updated with sensor data, provides the centralized AI platform with a precise, real-time virtual representation of the mine, enabling proactive identification of potential hazards and running simulations for optimized operations before deployment in the physical environment. This technological ecosystem, driven by AI and robust connectivity, provides the necessary platform for transitioning traditional mines into smart, fully autonomous industrial operations.

Regional Highlights

Regional dynamics play a crucial role in shaping the Autonomous Driving Mining Vehicles Market, reflecting disparities in regulatory environments, existing mining infrastructure, labor costs, and commodity focus. North America, particularly Canada and the United States, is characterized by extensive resource reserves (oil sands, copper, gold) and high operational costs, driving rapid technological adoption to maximize efficiency and mitigate labor shortages in remote locations. The region benefits from strong governmental support for industrial automation and a highly developed telecommunications infrastructure that supports the deployment of 5G and dedicated private networks, facilitating rapid commercialization. Mining companies in North America often pilot and deploy autonomous technologies in large-scale open-pit operations, focusing heavily on safety compliance and measurable productivity gains to justify significant capital expenditure.

The Asia Pacific (APAC) region, dominated by Australia, China, and India, represents the largest market share holder globally, primarily due to Australia’s world-leading position in autonomous haulage system (AHS) implementation, particularly in iron ore operations in Western Australia. Australia serves as a global benchmark for safety performance and operational excellence in autonomy, benefiting from supportive legislation and major investment by Tier 1 miners like Rio Tinto and BHP. China, while traditionally relying on domestic technology, is increasingly investing heavily in both surface and complex underground autonomous solutions, driven by aggressive modernization goals and the sheer scale of its coal and mineral extraction needs. Meanwhile, emerging markets in Southeast Asia are demonstrating interest, though adoption remains constrained by capital availability and infrastructure readiness, making AaaS models particularly appealing.

Latin America (LATAM) and the Middle East & Africa (MEA) represent high-growth potential markets. LATAM, centered on the copper and lithium triangle (Chile, Peru, Argentina), is rapidly adopting automation to manage dangerous high-altitude operations, mitigate geological instability risks, and address labor disputes impacting production continuity. The necessity to optimize deep-pit operations makes autonomous haulage critical. In MEA, particularly South Africa and key Middle Eastern countries, automation adoption is driven by the need to exploit untapped, often complex reserves efficiently and safely. While infrastructure development remains a challenge in many African countries, the long-term vision for resource exploitation, coupled with favorable commodity prices, drives strategic investments in autonomous fleets to future-proof their mining assets and secure global competitiveness, often leveraging technology from North American and European OEMs.

- North America: Leads in technological maturity and high-value resource automation; strong regulatory framework supporting safety-driven technology adoption; focus on large open-pit copper and oil sands operations.

- Asia Pacific (APAC): Dominates market size, spearheaded by Australia's extensive deployment of Autonomous Haulage Systems (AHS); China drives growth through rapid government-backed modernization and domestic technology development; setting global standards for operational scale.

- Europe: Focuses heavily on sophisticated, compact autonomous solutions for underground mining and quarrying; emphasis on strict ESG compliance and minimizing environmental footprint; strong technological base for sensor and software development.

- Latin America (LATAM): High-growth region driven by the need for safer operations in deep, high-altitude copper mines (Chile, Peru); increasing use of autonomous solutions to manage complex logistics and geopolitical risks.

- Middle East and Africa (MEA): Emerging market with significant potential; adoption motivated by deep resource extraction challenges and the necessity to leapfrog older, labor-intensive methods; constrained by capital access and infrastructure gaps in some areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Autonomous Driving Mining Vehicles Market.- Caterpillar Inc.

- Komatsu Ltd.

- Epiroc AB

- Sandvik AB

- Liebherr Group

- Hitachi Construction Machinery Co., Ltd.

- Volvo Group

- Daimler Trucks AG

- AutoGuide Mobile Robots

- ASI Mining LLC

- Hexagon AB

- RPM Global

- Prometeia

- RCT Global

- XCMG Group

- SANY Group

- BAE Systems

- Wenco International Mining Systems

- Rockwell Automation

Frequently Asked Questions

Analyze common user questions about the Autonomous Driving Mining Vehicles market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the adoption of autonomous driving technology in the mining sector?

The primary drivers are enhanced worker safety by removing humans from high-risk environments, significant improvements in operational efficiency leading to 24/7 continuous production, and substantial reductions in long-term operational costs, including lower fuel consumption and optimized maintenance schedules. Regulatory pressure to minimize accidents also plays a critical role in market growth.

How does the deployment of autonomous vehicles impact employment at mine sites?

While autonomous deployment leads to a reduction in the need for traditional vehicle operators, it simultaneously creates demand for new, highly skilled roles in remote control room operation, data analytics, software maintenance, and robotics engineering. The impact is a shift in the labor force towards high-tech, supervisory, and maintenance roles, requiring significant workforce retraining and upskilling.

What major technological challenges still exist for fully autonomous mining operations?

Key technological challenges include ensuring flawless, low-latency communication (connectivity) across vast and rugged mine sites, achieving robust sensor reliability under extreme conditions (dust, fog, extreme temperatures), and integrating autonomous systems seamlessly with diverse legacy equipment and existing IT infrastructure (interoperability hurdles).

Which vehicle type currently holds the largest market share in the autonomous mining sector?

Autonomous Haul Trucks hold the largest market share. This segment leads due to the high return on investment realized from automating the bulk material movement process in large open-pit mines, where standardized routes and continuous operations yield the fastest and most measurable efficiency gains compared to more complex, dynamic tasks like loading and excavation.

How is AI specifically utilized to improve the efficiency of autonomous mining fleets?

AI is crucial for optimization through several applications: predictive maintenance planning based on sensor data analysis, real-time optimal path planning to minimize travel distance and wear, and complex fleet orchestration algorithms that dynamically manage traffic flow and task assignment, ensuring the entire operation runs without bottlenecks and at peak performance metrics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager