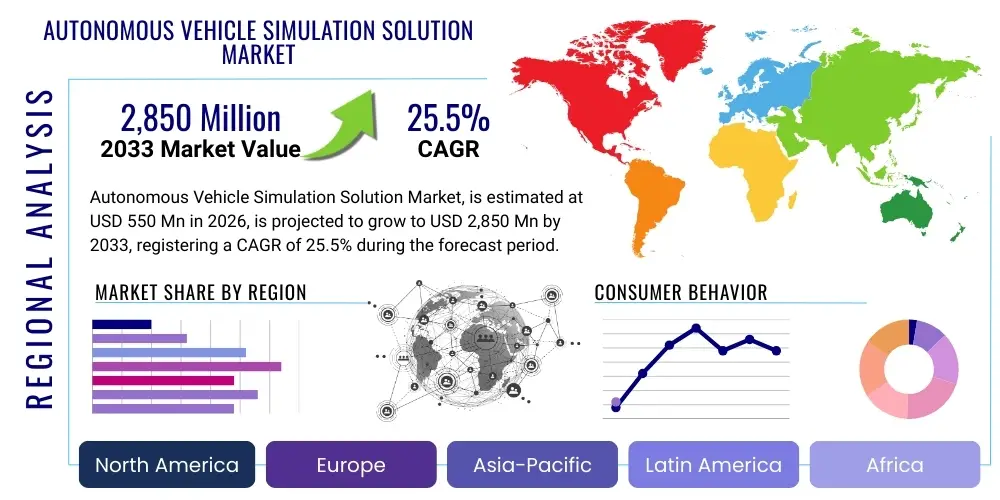

Autonomous Vehicle Simulation Solution Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431427 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Autonomous Vehicle Simulation Solution Market Size

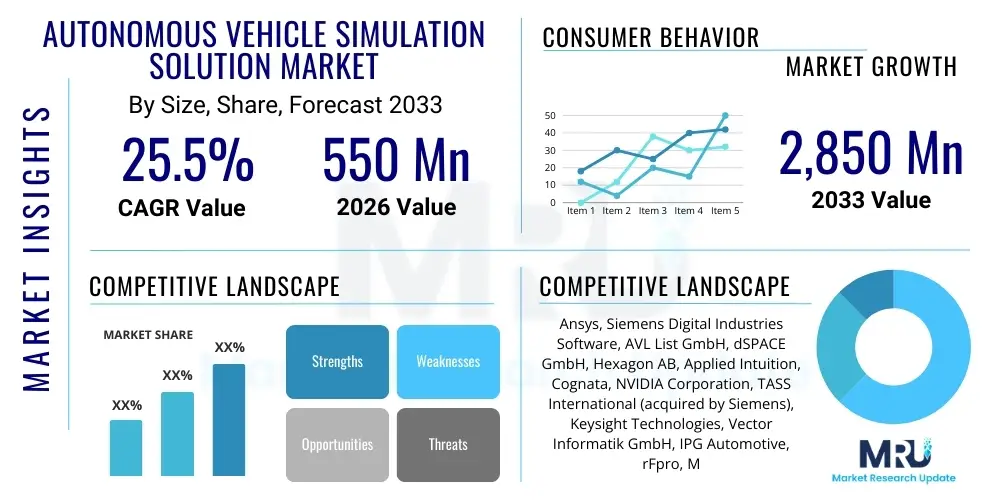

The Autonomous Vehicle Simulation Solution Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 25.5% between 2026 and 2033. The market is estimated at USD 550 Million in 2026 and is projected to reach USD 2,850 Million by the end of the forecast period in 2033. This substantial expansion is primarily driven by the escalating complexity of Advanced Driver-Assistance Systems (ADAS) and the critical need for robust validation and verification (V&V) methodologies before autonomous systems can be deployed safely on public roads. The high cost and time required for physical road testing of Level 4 and Level 5 autonomous vehicles necessitate a scalable, reproducible, and rigorous simulation environment, thereby fueling market demand.

The transition toward fully autonomous systems requires billions of miles of testing, a feat practically impossible to achieve solely through physical testing. Simulation solutions offer a cost-effective alternative by allowing developers to test complex, rare, or dangerous edge cases (known as corner cases) in a controlled virtual environment. The market valuation reflects the intense investment poured into developing highly realistic sensor models, vehicle dynamics models, and environment simulation tools, often integrating machine learning techniques to generate synthetic data for perception system training. The projected CAGR underscores the industry’s acceptance of simulation as the foundational technology for achieving functional safety standards (like ISO 26262) and the upcoming safety of the intended functionality (SOTIF) requirements.

Autonomous Vehicle Simulation Solution Market introduction

The Autonomous Vehicle Simulation Solution Market encompasses specialized software, hardware, and services designed to model, test, and validate the complex software stack of autonomous vehicles (AVs). The core product involves creating high-fidelity digital twins of vehicles, sensor arrays (LiDAR, Radar, Cameras), environmental conditions, traffic agents, and infrastructure. Major applications include Hardware-in-the-Loop (HIL), Software-in-the-Loop (SIL), and Vehicle-in-the-Loop (VIL) testing, critical for verifying algorithms related to perception, planning, and control systems. The primary benefit derived from these solutions is the significant reduction in V&V costs and time, enabling safe and rapid iteration on development cycles. Key driving factors include increasing regulatory pressure for verifiable safety, the proliferation of AI in driving functions, and the inherent risks and impracticality of extensive physical testing for achieving high levels of autonomy (L4 and L5).

Simulation platforms provide developers with the necessary tools to expose the autonomous system to a vast and diverse set of scenarios, ranging from routine highway driving to hazardous and unpredictable urban conditions that would be too dangerous or logistically prohibitive to reproduce in the real world. Modern simulation solutions are moving beyond basic geometric rendering, focusing heavily on physics-based modeling, particularly for advanced sensor simulation, where accuracy is paramount to train and validate perception models effectively. This technological evolution allows for comprehensive testing of sensor fusion algorithms, failure injection, and redundancy management systems, essential components for safety-critical applications in autonomous driving.

Furthermore, the market is characterized by a strong interplay between virtual testing and real-world data collection. Simulation acts as a crucial bridge, allowing developers to replay real-world accidents or near-miss scenarios in a virtual environment for debugging and refinement. The increasing adoption of open-source standards and standardized interfaces, though still fragmented, is gradually improving interoperability between different simulation tools and making it easier for smaller startups and academic institutions to contribute to the autonomous driving ecosystem. This collaboration accelerates the overall development timeline and pushes the boundaries of what is possible in verifiable autonomous system deployment.

Autonomous Vehicle Simulation Solution Market Executive Summary

The Autonomous Vehicle Simulation Solution Market is currently experiencing a rapid shift toward cloud-based deployment models, driven by the massive computational requirements associated with large-scale scenario generation and high-fidelity sensor simulation. Business trends indicate strong consolidation, with major established engineering and software firms acquiring specialized simulation startups to integrate niche expertise, particularly in synthetic data generation and digital twin technology. Geographically, North America and Asia Pacific are dominating growth; North America leads in early adoption and advanced R&D, while APAC, fueled by strong government mandates and high volume production in China, is rapidly scaling its simulation infrastructure. Segment trends highlight the preeminence of Software-in-the-Loop (SIL) simulation due to its flexibility and early stage integration, although Hardware-in-the-Loop (HIL) systems remain critical for final verification stages, necessitating continuous improvements in hardware acceleration and real-time processing capabilities.

A key theme across the market is the imperative for validation tools to bridge the "correlation gap"—the discrepancy between simulated results and real-world performance. This technical challenge is driving investment into advanced physics engines, material modeling, and sophisticated weather/lighting simulation to ensure the virtual environment accurately reflects reality. The competitive landscape is evolving beyond merely providing software tools; vendors are increasingly offering comprehensive managed services, including scenario database curation, metric validation frameworks, and integrated development environments (IDEs) tailored specifically for autonomous stack developers. This service orientation is essential for capturing smaller players and OEMs that lack the internal resources to manage highly complex simulation infrastructures independently.

Moreover, the integration of 5G connectivity and edge computing is poised to further revolutionize the market by enabling distributed simulation and real-time data streaming from test fleets directly back into the virtual validation loop. This capability allows for continuous feedback and over-the-air updates to the simulation environment, ensuring that the validation process remains synchronized with rapidly evolving real-world conditions. Investment is also heavily skewed toward tools that support multi-sensor fusion simulation, as L4/L5 systems rely fundamentally on redundant and diverse perception data, requiring simulation platforms to accurately model the complex interplay between different sensor modalities under various environmental constraints.

AI Impact Analysis on Autonomous Vehicle Simulation Solution Market

User inquiries regarding the intersection of AI and Autonomous Vehicle (AV) simulation often focus on several critical themes: the feasibility of using AI to generate realistic, yet challenging, scenarios; the ability of AI tools to close the reality gap by improving sensor fidelity; and the existential question of how simulation can robustly validate systems (the autonomous stack itself) that are fundamentally based on machine learning. Users seek validation that simulation is not just training data, but a genuine verification tool. Concerns also center on the computational overhead required for leveraging Generative Adversarial Networks (GANs) or other deep learning models for synthetic data generation, and how these AI-driven tools integrate seamlessly with established validation workflows like ISO 26262 compliance.

AI is profoundly transforming the simulation market, moving it from strictly deterministic scenario testing to intelligently guided exploration of the vast scenario space. Machine Learning (ML) techniques are now employed to analyze massive real-world driving datasets, identify rare and critical edge cases, and automatically generate synthetic variations of these scenarios, maximizing the efficiency of the testing process. Furthermore, AI-powered tools, such as deep learning-based sensor models, are being used to enhance the fidelity of simulated sensor outputs, bridging the gap between ray-traced graphics and the actual raw data perceived by real sensors. This synthetic data generation capability is especially crucial for training robust perception systems when real-world data collection is insufficient or too costly for specific corner cases, such as unusual lighting or debris conditions.

The implementation of Reinforcement Learning (RL) within the simulation environment allows developers to train the AV control policies directly in the virtual world before deployment. Additionally, AI contributes significantly to the optimization of simulation resources; smart prioritization algorithms determine which simulations provide the highest safety criticality score, ensuring computational efforts are focused on areas where failure probability is highest. This move towards intelligent testing ensures that the necessary millions of miles of virtual testing are performed effectively and efficiently, providing greater confidence in the overall safety case presented by the AV developers, addressing the core concern of utilizing simulation for validating complex AI-driven decision-making systems.

- AI drives Scenario Generation: Utilizes ML algorithms (e.g., GANs, deep reinforcement learning) to automatically generate high-criticality, diverse, and complex edge cases for stress-testing AV software.

- Synthetic Data Enhancement: Improves sensor model fidelity by generating realistic, large-scale, labeled datasets, accelerating the training of perception systems and reducing dependence on expensive real-world labeling efforts.

- Test Case Optimization: Uses ML for smart test planning and prioritization, ensuring computational resources are allocated to scenarios most likely to expose system weaknesses or safety critical failures.

- Digital Twin Fidelity: AI techniques are deployed to correlate simulated performance metrics with real-world test results, continuously refining physics models and minimizing the reality gap.

- Behavior Modeling: Enables more realistic simulation of human drivers, pedestrians, and cyclists (non-ego agents) through advanced behavioral modeling based on observed driving patterns and predictive AI.

DRO & Impact Forces Of Autonomous Vehicle Simulation Solution Market

The Autonomous Vehicle Simulation Solution Market is powerfully driven by the non-negotiable requirement for verifiable safety mandated by international regulatory bodies and consumer expectations, compounded by the rapidly increasing complexity of L4 and L5 autonomy stacks. However, the market faces significant restraints, primarily the enormous computational costs associated with high-fidelity, large-scale simulations, and the persistent challenge of the "correlation gap"—ensuring that results derived virtually accurately reflect real-world performance. These restraints create lucrative opportunities, specifically in developing integrated digital twin platforms, leveraging synthetic data pipelines, and integrating V2X (Vehicle-to-Everything) communication and 5G technologies to create highly dynamic and geographically accurate simulation environments. These factors exert a combined impact force that pushes development toward highly scalable, cloud-native, and AI-enhanced validation solutions, favoring vendors capable of offering end-to-end V&V frameworks.

Drivers are rooted in technological necessity and economic viability. The sheer impossibility of validating autonomous systems through physical testing alone (estimated requirements of 8.8 billion miles for full L5 validation) makes simulation indispensable. Regulatory frameworks, such as the upcoming SOTIF (Safety Of The Intended Functionality, ISO/PAS 21448), mandate systematic scenario-based testing to prove robustness against unknown and unexpected conditions, directly boosting the demand for sophisticated scenario generators. The economic driver is the substantial cost savings achievable by shifting testing phases from expensive physical prototypes and track time to scalable virtual environments, speeding up the development cycle significantly and allowing for rapid, reproducible regression testing after software updates.

Restraints fundamentally revolve around fidelity and scalability. High-fidelity sensor simulation (especially LiDAR and complex camera interactions under extreme weather) requires immense computational power, making it a significant capital expenditure constraint for smaller developers. Moreover, the lack of standardized metrics and toolchain interoperability creates friction, forcing developers into complex integration projects. The opportunity landscape is broad, encompassing the development of open, industry-wide scenario databases, the utilization of High-Performance Computing (HPC) clusters via the cloud to overcome computational limitations, and the creation of "certification-by-simulation" frameworks that regulatory bodies can trust. This focus on trust and certification is key to unlocking the next phase of market expansion, linking simulation results directly to functional safety claims, driving further innovation in real-time correlation and physics modeling.

Segmentation Analysis

The Autonomous Vehicle Simulation Solution Market is broadly segmented based on Component, Deployment Type, Application, and Vehicle Level. Analyzing these segments provides a detailed perspective on current technological adoption and future growth areas. The Component segmentation, comprising Software, Hardware, and Services, reveals that the Software segment, particularly advanced physics engines and scenario generation tools, currently holds the largest market share due to its flexibility and necessity across all stages of the V&V process. However, the Services segment is expected to exhibit the highest CAGR as OEMs increasingly rely on specialized providers for synthetic data generation, cloud infrastructure management, and compliance consulting. Deployment type preference is swiftly shifting from traditional On-Premise installations towards Cloud/Hybrid models, reflecting the need for scalable computing power for large-scale parallel scenario execution and collaborative development across geographically dispersed teams.

Application-wise, the Verification and Validation (V&V) segment dominates the market, confirming simulation's primary role as a safety assurance tool rather than solely a development aid. Within V&V, Software-in-the-Loop (SIL) simulation is currently the most heavily utilized due to its early integration in the development pipeline, followed closely by Hardware-in-the-Loop (HIL) systems, which remain critical for final, pre-deployment system checks involving actual ECUs and sensors. Future growth is anticipated in the Training and Data Generation applications, driven by the acute industry demand for high-quality, labeled synthetic data to train deep learning perception models effectively. Furthermore, the market segmentation by Vehicle Level (L1/L2 ADAS vs. L3/L4/L5 Autonomy) clearly shows that the L3/L4/L5 segment is the primary growth engine, commanding premium solutions that require the highest fidelity sensor and environment modeling due to their increased functional complexity and safety criticality.

- Component

- Software (Physics Engines, Scenario Editors, Visualization Tools)

- Hardware (HIL Rigs, High-Performance Computing Clusters, Data Acquisition Systems)

- Services (Consulting, Managed Cloud Services, Synthetic Data Generation, Custom Tool Integration)

- Deployment Type

- On-Premise

- Cloud/Hybrid

- Application

- Training and Data Generation (Synthetic Data)

- Verification and Validation (V&V)

- Research and Development

- V&V Sub-Segments

- Software-in-the-Loop (SIL)

- Hardware-in-the-Loop (HIL)

- Processor-in-the-Loop (PIL)

- Vehicle Autonomy Level

- L1 and L2 (ADAS Simulation)

- L3, L4, and L5 (Full Autonomy Simulation)

Value Chain Analysis For Autonomous Vehicle Simulation Solution Market

The value chain for Autonomous Vehicle Simulation Solutions begins upstream with foundational technology and data providers. This phase involves mapping companies that supply high-definition mapping data (HD Maps), digital terrain models, and specialized software IP, such as advanced physics engines and real-time operating systems (RTOS) necessary for HIL performance. These providers establish the basic fidelity and realism achievable by the simulation platform. Key activities in the upstream sector include extensive real-world data collection, data processing, and the development of core mathematical models that govern sensor behavior (e.g., ray tracing, noise modeling) and vehicle dynamics. Success at this stage relies heavily on IP ownership and deep expertise in computational physics and geographic information systems (GIS).

The midstream sector is dominated by the simulation software vendors and integrators—companies that develop the actual end-user simulation platforms and toolchains (e.g., scenario authoring tools, visualization dashboards, and execution environments). These entities integrate the foundational IP from upstream providers and add layers of complexity, focusing on user experience, compliance frameworks, and scalability. Direct distribution involves vendors selling and licensing their software platforms directly to major Automotive OEMs (Original Equipment Manufacturers) and Tier 1 suppliers. Indirect distribution often utilizes channel partners, system integrators, and specialized consultants who customize and deploy the complex simulation environments according to specific client needs and regional safety regulations, ensuring seamless integration into the client’s existing ADAS/AV development pipeline.

Downstream consists of the end-users: the automotive industry, R&D institutions, and government regulators. OEMs and Tier 1 suppliers are the primary consumers, utilizing these solutions for continuous integration/continuous deployment (CI/CD) of AV software, final V&V, and certification readiness. The downstream activities generate critical feedback loops, where real-world test results are compared against simulated data, feeding back into the upstream physics models for continuous improvement and refinement of the digital twin fidelity, which is paramount for maintaining industry trust in the simulation process. The increasing importance of synthetic data generation also positions certain data-as-a-service providers as integral downstream partners, supplying tailor-made datasets for specific operational domains.

Autonomous Vehicle Simulation Solution Market Potential Customers

The primary customers for Autonomous Vehicle Simulation Solutions are the major global Automotive Original Equipment Manufacturers (OEMs), who bear the ultimate responsibility for the safety and performance of their autonomous fleets. These customers require end-to-end simulation suites capable of handling everything from rapid prototype testing (SIL) to final production validation (HIL/VIL) across a massive spectrum of scenarios. OEMs are increasingly investing in proprietary simulation infrastructure, necessitating partnerships with software vendors for licensing, customization, and continuous feature updates tailored to their specific hardware architecture and software stacks, such as specific sensor configurations and proprietary control algorithms.

Tier 1 suppliers represent another critical customer segment, as they are responsible for developing and validating specific components of the AV stack, such as radar modules, camera systems, electronic control units (ECUs), and specialized middleware. These suppliers require simulation solutions that can integrate seamlessly with the OEM’s environment, allowing them to test their components in isolation and as part of a larger system. Their simulation needs focus heavily on component-level fidelity, including detailed sensor modeling and signal processing simulation, ensuring that their hardware performs reliably under all simulated conditions before delivery to the OEM assembly line, often demanding specific HIL capabilities.

Beyond the established automotive supply chain, the market serves specialized niche customers including technology startups focusing on specific autonomous driving functions (e.g., planning, localization, mapping), dedicated R&D institutions, and academic consortia working on future mobility challenges. These customers typically require more flexible, subscription-based cloud simulation services to manage costs and benefit from the latest algorithmic improvements without significant upfront hardware investment. Additionally, regulatory bodies and insurance companies are emerging potential customers, seeking simulation tools to verify compliance and assess risk profiles associated with specific AV deployment strategies and accident reconstruction scenarios, driving demand for neutral, verifiable simulation platforms.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 2,850 Million |

| Growth Rate | 25.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ansys, Siemens Digital Industries Software, AVL List GmbH, dSPACE GmbH, Hexagon AB, Applied Intuition, Cognata, NVIDIA Corporation, TASS International (acquired by Siemens), Keysight Technologies, Vector Informatik GmbH, IPG Automotive, rFpro, Mechanical Simulation Corporation (CarSim), RTI (Real-Time Innovations), Waymo (in-house tools), General Motors (Cruise Simulation), Microsoft Azure Simulation, Aimsun (PTV Group), Deepen AI. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Autonomous Vehicle Simulation Solution Market Key Technology Landscape

The core technological landscape of AV simulation is defined by the necessity for realism and scalability, centering on three main pillars: high-fidelity physics modeling, scalable computing architectures, and intelligent data generation tools. High-fidelity physics modeling is critical for accurately replicating how sensors interact with the real world; this includes detailed modeling of light scattering, weather effects, and material properties for cameras and LiDAR, and complex wave propagation models for radar. The accuracy of the vehicle dynamics model (e.g., tire models, suspension) is also crucial, especially for validating emergency maneuvers and complex control inputs in the HIL environment. These physics engines must operate in real-time or faster-than-real-time (Fidelity over speed) to be viable for comprehensive V&V campaigns, often requiring specialized GPU acceleration frameworks like CUDA or proprietary parallel processing architectures.

Scalable computing architecture forms the backbone of modern simulation. The shift toward cloud-native platforms, utilizing services like AWS, Azure, and Google Cloud, allows developers to run millions of parallel simulation instances concurrently, addressing the enormous computational demand of mileage accumulation and scenario coverage. Technologies such as Docker and Kubernetes are instrumental in managing these distributed workloads efficiently. Furthermore, the integration of specialized HIL hardware, featuring FPGA (Field-Programmable Gate Array) technology and dedicated real-time operating systems, remains vital for testing the actual Electronic Control Units (ECUs) under deterministic, hard real-time constraints, ensuring low latency and high reliability during the final testing stages of the control loop.

Finally, intelligent data generation and handling tools are rapidly becoming proprietary differentiators. This includes advanced AI-driven scenario generation, where machine learning techniques analyze vast datasets of driving patterns to generate statistically improbable yet safety-critical corner cases that traditional manual scenario creation often misses. Synthetic data generation pipelines, often powered by Generative Adversarial Networks (GANs) or diffusion models, are used to create realistic sensor imagery and point clouds that are indistinguishable from real-world data but come with perfect, precise labeling—a prerequisite for training advanced perception systems. The technological focus is increasingly shifting towards tools that not only simulate the physics but also the entire digital thread of the vehicle, from initial requirements management through to final performance verification, heavily leveraging digital twin technologies for lifecycle management.

Regional Highlights

Geographically, the Autonomous Vehicle Simulation Solution Market demonstrates varied dynamics influenced by regulatory environments, automotive production capabilities, and technology adoption rates. North America, particularly the United States, holds a significant market share and is a leader in early technology adoption and advanced R&D. This dominance is driven by high investment from major technology companies (e.g., Google's Waymo, Cruise) and a strong push for Level 4 and Level 5 autonomous capabilities. The presence of stringent regulatory demands, coupled with the availability of specialized cloud computing infrastructure, makes North America a core hub for developing and deploying cutting-edge simulation tools, focusing heavily on AI integration and complex sensor fusion validation. The competitive environment fosters continuous innovation in high-fidelity sensor modeling and large-scale parallel testing capabilities.

Europe represents another robust market, characterized by strict safety standards (driven by organizations like Euro NCAP) and a strong focus on functional safety adherence (ISO 26262 and SOTIF). European OEMs and Tier 1 suppliers, notably in Germany, necessitate extremely reliable and certifiable simulation tools that can prove compliance throughout the entire development lifecycle. The market here emphasizes highly specialized HIL systems and comprehensive V&V toolchains, with a notable interest in scenario databases reflecting diverse European driving behaviors and infrastructure characteristics. Regulations often push vendors to focus on formal verification methods and tools that can demonstrate the statistical probability of safety under simulated conditions, prioritizing depth of verification over sheer mileage accumulation.

Asia Pacific (APAC) is projected to exhibit the highest growth rate during the forecast period, primarily due to massive investment in autonomous technology by governments and automotive giants in China, Japan, and South Korea. China’s push for smart mobility and its huge volume automotive production mandate rapid scaling of simulation capabilities. The APAC market focuses on cost-effective, high-throughput simulation solutions capable of generating scenario diversity relevant to dense urban environments and diverse driving cultures specific to the region. Investment is focused on integrating simulation with national testing facilities and developing localized HD mapping technologies. This region is a major consumer of synthetic data generation services to rapidly train localized perception models tailored for challenging local road environments.

- North America: Market leader in R&D and L4/L5 deployment; high adoption of cloud-based HPC for parallel testing; strong focus on regulatory frameworks in states like California and Arizona.

- Europe: High demand driven by strict safety and certification standards (ISO 26262, SOTIF); emphasis on detailed HIL systems and formal V&V methods; major markets include Germany, France, and Scandinavia.

- Asia Pacific (APAC): Fastest growing region fueled by government mandates (especially China) and high volume manufacturing; concentration on urban, high-density scenario simulation and localized synthetic data generation.

- Latin America and MEA: Emerging markets, currently focused on L2/L3 ADAS simulation; slower adoption rates constrained by initial investment costs and regulatory fragmentation; growing opportunities in infrastructure and smart city project simulation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Autonomous Vehicle Simulation Solution Market.- Ansys

- Siemens Digital Industries Software (including TASS International)

- AVL List GmbH

- dSPACE GmbH

- Hexagon AB (including MSC Software)

- Applied Intuition

- Cognata

- NVIDIA Corporation

- Keysight Technologies

- Vector Informatik GmbH

- IPG Automotive

- rFpro

- Mechanical Simulation Corporation (CarSim)

- Real-Time Innovations (RTI)

- ETAS (Robert Bosch GmbH subsidiary)

- Deepen AI

- Aimsun (PTV Group)

- Foretellix

- TTTech Auto

- Plexim GmbH

Frequently Asked Questions

Analyze common user questions about the Autonomous Vehicle Simulation Solution market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the 'correlation gap' and how do simulation providers address it?

The correlation gap refers to the discrepancy between the performance of an autonomous system in a virtual environment versus its performance in the real world. Simulation providers mitigate this by using advanced physics-based sensor models, integrating real-world data feedback loops to calibrate virtual environments (digital twin refinement), and leveraging AI/ML tools to continuously adjust material and environmental parameters for higher fidelity.

Why is Software-in-the-Loop (SIL) simulation currently the most prevalent method?

SIL is dominant because it offers the highest flexibility and scalability, allowing developers to test billions of scenarios early in the development cycle before committing to expensive physical hardware. It is ideal for rapid iteration, debugging, and testing control logic and planning algorithms without the constraints of real-time hardware execution.

How is synthetic data generation impacting the cost and efficiency of autonomous vehicle testing?

Synthetic data generated through simulation dramatically reduces the cost and time associated with real-world data collection and manual labeling, especially for rare and dangerous edge cases. It provides perfectly labeled data necessary for training deep learning perception models, accelerating the overall training pipeline and improving model robustness.

What role does the cloud play in the future growth of AV simulation solutions?

Cloud computing enables the market to overcome the key restraint of computational costs. Cloud deployment facilitates massive parallelization of testing scenarios (virtual mileage accumulation), global collaboration, and access to High-Performance Computing (HPC) resources on demand, making large-scale verification for L4/L5 systems economically viable for a wider range of developers.

How do autonomous vehicle simulation solutions ensure compliance with critical safety standards like SOTIF?

Simulation solutions provide the necessary framework for systematic scenario-based testing required by SOTIF (Safety Of The Intended Functionality). They allow developers to define, execute, and document tests for unexpected scenarios, proving that the autonomous system operates safely and robustly even outside its nominal operating conditions, thereby generating auditable proof for regulatory compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager