Autoradiography Films Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431363 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Autoradiography Films Market Size

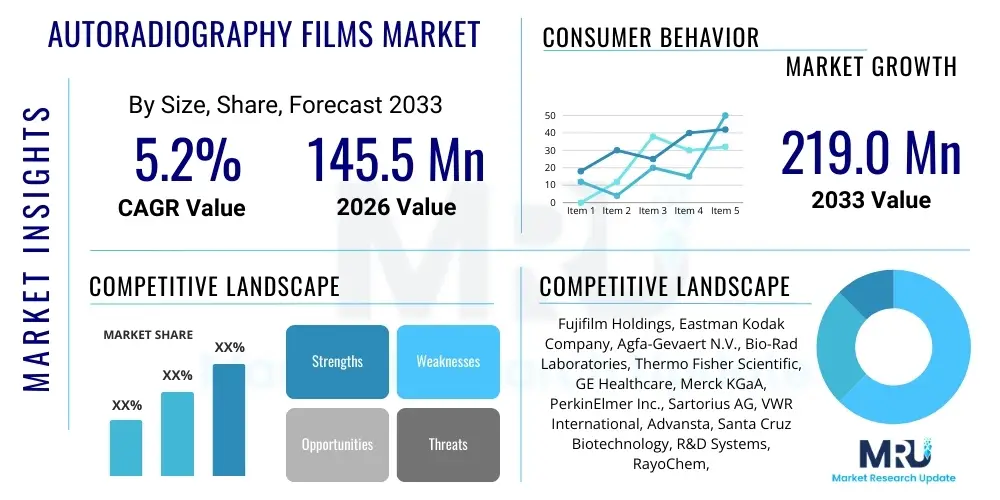

The Autoradiography Films Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.2% between 2026 and 2033. The market is estimated at $145.5 Million in 2026 and is projected to reach $219.0 Million by the end of the forecast period in 2033.

Autoradiography Films Market introduction

Autoradiography films are specialized photographic emulsions used extensively in life sciences research, particularly for detecting and visualizing radioactive isotopes incorporated into biological samples such as DNA, RNA, proteins, and tissues. This technology relies on the principle that radioactive emissions, typically beta particles or gamma rays, expose the sensitive film, creating a latent image that becomes visible upon development. These films offer high resolution and sensitivity, making them indispensable tools for applications like Northern, Southern, and Western blotting, as well as in situ hybridization and metabolic studies. The reliability and historical robustness of autoradiography films have cemented their role in molecular biology labs globally, particularly for quantitative analysis of labeled molecules.

The primary applications of autoradiography films span molecular biology, pharmaceutical research, and clinical diagnostics. In molecular biology, they are crucial for gene expression studies and protein analysis, providing clear documentation of electrophoretic separation results. For pharmaceutical companies, these films assist in drug metabolism studies by tracking radiolabeled compounds within biological systems, ensuring compliance and understanding drug kinetics. The underlying mechanisms, which involve the interaction of ionizing radiation with silver halide crystals within the emulsion layer, ensure precise localization and quantification of radiotracers, offering a tangible record of experimental outcomes.

The market growth is fundamentally driven by the escalating global investment in genomics and proteomics research, coupled with the increasing prevalence of chronic diseases necessitating detailed cellular pathway analysis. The benefits of using autoradiography films include their high dynamic range, affordability compared to advanced digital imaging systems in certain high-throughput scenarios, and their ability to handle low levels of radioactivity over long exposure periods. However, the market faces constraints due to the progressive shift towards digital phosphor imaging and charged-coupled device (CCD) cameras, which offer faster results and eliminate the need for chemical development processes. Despite these technological shifts, autoradiography films maintain a niche due to their established methodologies and ease of integration into existing laboratory workflows.

Autoradiography Films Market Executive Summary

The Autoradiography Films Market exhibits steady growth, primarily fueled by sustained investment in life science research and development, particularly in emerging economies focusing on biotechnology applications. Business trends indicate a bifurcated market: while established research institutions continue to rely on traditional film-based methods for their high resolution and cost-effectiveness in certain long-exposure experiments, there is a distinct competitive pressure from sophisticated digital imaging systems driving manufacturers to innovate in film sensitivity and consistency. Key market players are focusing on developing enhanced, high-performance films that can compete on sensitivity metrics and offer improved compatibility with standardized darkroom chemicals. Strategic alliances between film manufacturers and chemical suppliers are also becoming common to optimize the complete autoradiography workflow and maintain market relevance against digital alternatives.

Regionally, North America and Europe remain the dominant markets due to the presence of leading pharmaceutical giants, well-funded academic research centers, and sophisticated regulatory frameworks supporting biochemical experimentation. However, the Asia Pacific (APAC) region is poised for the highest growth rate, driven by significant government funding directed toward genomic research, the rapid establishment of new biotechnology startups, and expanding clinical trial activities in countries like China, India, and South Korea. These regions represent substantial opportunities for market expansion, particularly in the deployment of entry-level and general-purpose films. The Middle East and Africa (MEA) and Latin America are also showing nascent growth, stimulated by improved healthcare infrastructure and increasing adoption of molecular diagnostic techniques.

Segmentation trends highlight the dominance of the Molecular Biology application segment, which utilizes films for fundamental research techniques like blotting and sequencing. Within the product type segmentation, high sensitivity films are experiencing slightly faster adoption growth than general-purpose films, reflecting the scientific community's need for enhanced detection limits for low-abundance targets. Furthermore, the End-User segment sees Pharmaceutical and Biotechnology Companies retaining the largest share, driven by their continuous need for R&D documentation and quality control processes. The market structure suggests robust competition based on film quality, batch consistency, and reliable supply chain logistics, crucial factors given the sensitive nature of the experiments involved.

AI Impact Analysis on Autoradiography Films Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Autoradiography Films Market generally center on two main themes: the role of AI in analyzing film data and whether the automation capabilities of AI accelerate the obsolescence of film-based methods. Users frequently ask if AI-driven image processing can extract more precise quantitative data from developed films, overcoming human biases in densitometry, and if AI algorithms can predict optimal exposure times to reduce resource waste. The central concern is not the direct integration of AI into the film manufacturing process, but rather its influence on the downstream data analysis workflow. Users expect AI to enhance the utility of existing film archives by performing advanced pattern recognition, noise reduction, and automated calibration, thereby extending the practical lifespan of traditional autoradiography in highly specific research contexts where digital alternatives might be overly expensive or unsuitable.

AI's primary influence is seen in the analytical phase, specifically through advanced image processing algorithms applied to digitized film images. While AI is driving rapid development in digital imaging technologies (which are competitors to film), it simultaneously offers mechanisms to enhance the interpretation and quantification of traditional film data. Machine learning models can be trained on vast datasets of autoradiogram images to accurately identify and measure band intensities, correct for background variations, and perform sophisticated normalization, leading to more objective and reproducible results than manual or semi-manual densitometry methods. This capability validates the continued use of film in labs where initial investment in high-end digital scanners is prohibitive, allowing them to leverage modern analytical power on established, low-cost consumables.

Furthermore, AI models can be integrated into laboratory information management systems (LIMS) to optimize workflow efficiency. For instance, predictive algorithms can analyze experimental parameters (isotope type, sample concentration, intended signal strength) and historical film results to recommend optimal film types, exposure times, and developing protocols, significantly minimizing the need for repeat experiments and reducing radioactive waste. This optimization addresses one of the major drawbacks of traditional film—the iterative trial-and-error approach to exposure—thereby making the film-based method more resource-efficient and competitive against real-time digital detection systems. Thus, AI acts as an augmentative tool for interpretation, rather than a direct replacement driver for the film itself, supporting specialized film applications where high archival quality is essential.

- AI-driven densitometry and quantification of band intensities, enhancing data objectivity.

- Machine learning algorithms for automated background correction and noise reduction in scanned autoradiograms.

- Predictive modeling to optimize film exposure times and reduce waste in radiolabeling experiments.

- Integration of film analysis results into LIMS using AI for comprehensive data management and tracking.

- Development of computer vision tools to identify and classify subtle patterns in complex autoradiographic assays.

- Enhanced archival utility through AI-powered indexing and searchable metadata generation from digitized film archives.

DRO & Impact Forces Of Autoradiography Films Market

The Autoradiography Films Market is shaped by a critical balance between fundamental drivers stemming from expansive life science research and significant restraints imposed by competing, advanced digital technologies. The primary driver is the pervasive and sustained global increase in funding for genomics and proteomics, coupled with the rising incidence of chronic diseases that necessitate deep molecular-level investigation. Autoradiography films provide a highly reliable, cost-effective, and historically validated method for these foundational studies, ensuring consistent demand from academic and industrial research sectors worldwide. Simultaneously, the market is restrained by the increasing adoption of digital imaging technologies, such as phosphor imagers and CCD cameras, which offer rapid, non-chemical processing and immediate data quantification, often preferred in high-throughput environments despite their higher initial cost. This technological shift compels film manufacturers to focus on niche, specialized applications where film sensitivity or archival capacity remains superior.

Opportunities for market expansion are largely concentrated in emerging economies, particularly in the Asia Pacific region, where rapid establishment of biotechnology parks and increased governmental emphasis on domestic drug discovery are driving the need for basic research consumables. Furthermore, innovation in specialized film formulations, such as those optimized for specific low-energy beta emitters or those offering significantly faster development times without compromising sensitivity, represents a key avenue for growth. The development of films that are more environmentally friendly or require less hazardous processing chemicals also presents a strategic opportunity, aligning with global sustainability trends in laboratory practices. These innovations help bridge the gap between traditional film technology and the demands of modern, conscious research environments.

The impact forces within this market are predominantly technological and regulatory. The technological force manifests as disruptive innovation from digital alternatives, constantly pressuring film pricing and utilization volume. However, the force of established protocols and methodological inertia—where many standardized procedures and regulatory submissions still rely on film documentation—provides strong counter-impact, ensuring a steady baseline demand. Regulatory guidelines concerning the handling and documentation of radiolabeled substances in pharmaceutical R&D reinforce the use of reliable documentation methods like film. The competitive landscape is characterized by manufacturers striving to differentiate based on consistency, shelf life, and superior film coatings that reduce background noise and enhance signal fidelity. Ultimately, the market trajectory will depend on how effectively film technology can be adapted (perhaps by integrating AI analysis) to coexist alongside, rather than fully compete against, the convenience of digital detection systems.

Segmentation Analysis

The Autoradiography Films Market is strategically segmented based on factors including the type of film, the specific application area, and the end-user base, reflecting the diverse needs of the life science community. Understanding these segments is crucial for manufacturers targeting specific research needs, such as high-resolution imaging versus high-throughput quantification. The film market encompasses both general-purpose films, which serve a broad array of standard applications, and high-sensitivity films, specifically engineered for detecting trace amounts of low-energy isotopes or for reducing exposure times, catering to advanced molecular research and clinical trials involving scarce samples or short half-life tracers. This differentiation allows suppliers to match product characteristics precisely to experimental requirements, optimizing both cost and performance for the end-user.

In terms of application, the market is dominated by molecular biology, which includes routine blotting techniques like Western, Northern, and Southern blots—the foundational pillars of modern biological research. The pharmaceutical research segment is also a major contributor, utilizing films extensively for drug metabolism, pharmacokinetics studies, and binding assays involving radiolabeled drug candidates. The smaller but growing segment of clinical diagnostics leverages film for specialized tests requiring radioisotope visualization. The diversity across these applications dictates the required film specifications, impacting factors such as film thickness, emulsion composition, and anti-crossover layer properties, ensuring the films deliver optimal results across varying radiation energy levels and sample types.

The end-user segmentation reveals that Pharmaceutical and Biotechnology Companies constitute the largest revenue stream, driven by intensive and continuous R&D pipelines and stringent documentation requirements. Academic and Government Research Institutes represent the second major consumer group, often utilizing films for fundamental, grant-funded projects where budget constraints often favor film over expensive digital systems. Hospitals and Diagnostic Centers also use films, primarily for specialized clinical research or rare diagnostic procedures. The shifting landscape of research funding and technological adoption rates across these end-users significantly influences the procurement volume and type of autoradiography films demanded across global regions.

- By Type:

- General Purpose Films

- High Sensitivity Films

- By Application:

- Molecular Biology (Blotting, Sequencing)

- Pharmaceutical Research and Drug Metabolism Studies

- Clinical Diagnostics

- Proteomics and Genomics

- By End-User:

- Pharmaceutical and Biotechnology Companies

- Academic and Government Research Institutes

- Hospitals and Diagnostic Centers

Value Chain Analysis For Autoradiography Films Market

The value chain for the Autoradiography Films Market begins with the upstream sourcing of raw materials, primarily high-purity silver halides, specialized polymers for the film base (e.g., polyester), and precise chemical components for the emulsion layer and protective coatings. This upstream phase involves stringent quality control, as the sensitivity and consistency of the final film product are highly dependent on the crystalline structure and homogeneity of the silver halide grains. Manufacturers invest heavily in proprietary emulsion technologies and coating processes to optimize film performance parameters such as speed, contrast, and resolution. Key players often maintain tight control over these proprietary formulations, creating barriers to entry for new competitors who lack the necessary chemical expertise and specialized coating machinery.

The midstream stage involves the highly technical manufacturing process, including substrate preparation, emulsion coating in controlled environments (darkrooms), drying, and precise cutting and packaging. Distribution channels are critical in the subsequent stage, as autoradiography films are temperature- and light-sensitive products with defined shelf lives, necessitating cold chain logistics in some regions and reliable, fast delivery networks. Distribution often occurs through a hybrid model: large volume sales to pharmaceutical majors are often direct (involving internal procurement teams), while sales to academic institutions and smaller labs are predominantly handled by indirect distributors and specialized scientific supply companies (e.g., VWR, Fisher Scientific). These intermediaries provide localized stock management, technical support, and fulfillment capabilities necessary to serve a dispersed research community.

The downstream analysis focuses on the end-users—researchers in molecular biology labs, technicians in drug metabolism units, and clinical diagnosticians. The immediate downstream activity involves the experimental use, exposure, and subsequent chemical processing (development and fixing) in darkrooms or automated processors. Market feedback flows back through distributors and direct sales teams, influencing manufacturing adjustments related to batch consistency and new product development tailored for compatibility with modern processing equipment. Direct channels ensure deeper customer relationships for large, recurring orders, whereas indirect channels maximize market penetration, especially in emerging regions where distributors possess established local reach and logistical expertise, thereby completing the cycle of supply, utilization, and feedback necessary for market sustenance.

Autoradiography Films Market Potential Customers

The primary customers for autoradiography films are institutions and commercial entities engaged in advanced biological and medical research that requires the detection and visualization of radiolabeled targets. End-users fall mainly into three high-value categories: global pharmaceutical and large biotechnology companies, established academic and government-funded research institutions, and specialized clinical diagnostic laboratories. Pharmaceutical companies are consistent, large-volume buyers, utilizing these films extensively throughout their drug discovery pipeline, particularly for in vitro binding assays, drug absorption, distribution, metabolism, and excretion (ADME) studies, and preclinical evaluations where precise documentation of radiotracer localization is mandatory for regulatory submissions.

Academic and governmental research institutes, including major universities and national labs (e.g., NIH, CNRS), represent a vast customer base driven by grant cycles and fundamental scientific inquiry. These labs frequently employ autoradiography films for foundational molecular biology experiments (blotting, sequencing) due to their comparatively lower capital expenditure and reliance on established, reliable protocols taught in educational settings. While grant funding stability can fluctuate, the sheer volume of global biological research ensures persistent demand from this sector. Furthermore, specialized film types are often procured by groups studying radioisotopes with long half-lives or those requiring the high archival quality that traditional film inherently provides over digital printouts.

A smaller but critical customer segment comprises clinical diagnostic laboratories and hospitals involved in specialized molecular diagnostics and clinical research. While routine clinical imaging has largely shifted to digital platforms, certain specialized clinical trials, particularly those involving personalized medicine or novel radiopharmaceuticals, still necessitate film-based documentation for specific high-resolution quantification tasks. These customers prioritize consistency, regulatory compliance, and the ability to maintain long-term physical records. Therefore, manufacturers must ensure their products meet stringent quality standards and provide detailed technical support tailored to clinical laboratory environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $145.5 Million |

| Market Forecast in 2033 | $219.0 Million |

| Growth Rate | 5.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fujifilm Holdings, Eastman Kodak Company, Agfa-Gevaert N.V., Bio-Rad Laboratories, Thermo Fisher Scientific, GE Healthcare, Merck KGaA, PerkinElmer Inc., Sartorius AG, VWR International, Advansta, Santa Cruz Biotechnology, R&D Systems, RayoChem, Foton. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Autoradiography Films Market Key Technology Landscape

The technological landscape of the Autoradiography Films Market is characterized by incremental improvements aimed at enhancing sensitivity, reducing exposure times, and optimizing the film's chemical compatibility, rather than fundamental disruptive change. The core technology remains the silver halide emulsion, but innovations focus on manipulating the size and shape of the silver halide crystals, along with incorporating proprietary chemical sensitizers to boost quantum efficiency—the ability of the film to capture energy from radioactive emissions. A key area of innovation involves anti-crossover technology. By integrating specialized dye layers or protective coatings, manufacturers minimize light scattering within the emulsion and reduce signal bleed-through, leading to sharper bands and higher resolution, which is particularly vital for accurately resolving closely spaced bands in sequencing gels or complex Western blots.

Furthermore, technology development extends into the support structure of the film. The use of clear, stable polyester bases ensures mechanical stability and high optical clarity for subsequent scanning and quantification. Advances in base manufacturing minimize static electricity, a common problem in darkrooms that can lead to false exposures or artifacts on the developed film. Another crucial technological consideration is the optimization of films for specific isotopes. For instance, films tailored for low-energy beta emitters like Tritium (H-3) require specialized scintillation coatings or ultra-thin emulsion layers to ensure the weak radiation penetrates and exposes the silver grains effectively. This specialization allows films to maintain competitiveness against digital systems that may struggle with very low-energy isotopes.

Beyond the film itself, technological advancements in peripheral systems, such as automated film processors and digital densitometers, play a critical role. Modern densitometers leverage high-resolution CCD sensors and advanced scanning algorithms to accurately digitize the film image, minimizing data loss during the transition from analog to digital format. The integration of proprietary film formulas with recommended processing chemicals ensures optimal development kinetics and signal amplification. Ultimately, the technology landscape is focused on maximizing the signal-to-noise ratio, providing high linearity for accurate quantification, and ensuring batch-to-batch consistency, satisfying the rigorous demands of scientific reproducibility that define the market.

Regional Highlights

- North America: North America, comprising the United States and Canada, stands as the largest and most mature market for autoradiography films globally. This dominance is attributed to the massive scale of R&D expenditure by pharmaceutical and biotechnology giants headquartered here, coupled with substantial government and private funding directed toward academic research in genomics, personalized medicine, and oncology. The US, in particular, has a robust infrastructure of well-funded research universities and national laboratories that consistently utilize film for established protocols requiring high archival quality and reliable sensitivity. Although the adoption of digital imaging technologies is widespread, the high volume of drug development activities—especially those involving radiolabeled compounds for ADME studies—ensures continuous, large-scale demand for standardized film consumables.

- Europe: Europe represents the second-largest market, exhibiting steady growth propelled by strong government support for biomedical research, notably through programs funded by the European Union and national research councils in countries such as Germany, the UK, France, and Switzerland. This region is a major hub for both pharmaceutical manufacturing and world-class academic institutions that rely on autoradiography films for fundamental molecular and cellular research. The demand is often concentrated in established research centers with deep historical expertise in radiolabeling techniques, valuing the consistency and proven methodology provided by film technology.

The European market faces a unique dynamic where stringent environmental regulations regarding chemical disposal occasionally favor the shift towards digital imaging solutions. However, the high quality of research output and the emphasis on methodological rigor mean that film remains essential for studies requiring maximum resolution and specific isotope detection capabilities. Countries like Germany, with their strong biotech presence, and the UK, with its extensive university research sector, contribute significantly to the demand, particularly for general-purpose films used in high-volume teaching and standard blotting procedures. The slow but steady growth is maintained by continuous funding cycles dedicated to cancer research and neuroscience, areas that heavily employ radiolabeled tracers.

Market strategies in Europe often involve providing comprehensive solution packages, including films, high-quality processing chemicals, and darkroom supplies, ensuring a seamless experience for end-users. Manufacturers must navigate diverse national regulatory landscapes and varying research funding priorities across the continent. Eastern European countries are emerging as potential growth areas, showing increased investment in biotechnology infrastructure, which promises new opportunities for market penetration as their research capabilities mature and align with Western European standards.

- Asia Pacific (APAC): The Asia Pacific region is forecast to be the fastest-growing market, driven by rapidly expanding biotechnology sectors, massive government investments in R&D infrastructure, and a burgeoning pharmaceutical industry, particularly in China, India, Japan, and South Korea. These countries are increasingly focusing on becoming global leaders in drug discovery and genomic research, leading to a significant increase in the number of research labs and academic institutions requiring consumables like autoradiography films.

Growth in APAC is characterized by high demand for entry-level and general-purpose films due to the high volume of new lab establishments and teaching institutions. While Japan and South Korea demonstrate high adoption rates for advanced digital imaging, the sheer volume of foundational research in China and India, often operating under tighter budgetary constraints compared to Western counterparts, ensures robust demand for cost-effective film technology. Government initiatives aimed at promoting self-sufficiency in life science research and manufacturing also boost the domestic consumption of related laboratory products.

Market entry strategies in this region focus on establishing strong local distribution networks and providing competitive pricing structures. The diverse regulatory and logistical landscape across APAC necessitates localized strategies, including multilingual support and country-specific packaging. The long-term growth potential remains exceptionally high, fueled by the accelerating pace of academic output, the rapid expansion of clinical trial activity, and the increasing global role of regional pharmaceutical companies that rely on established, documentable research techniques like autoradiography.

- Latin America: The Latin American market, though smaller, exhibits moderate growth driven by improvements in healthcare infrastructure and increased regional collaboration in biomedical research, particularly in Brazil, Mexico, and Argentina. Economic fluctuations and inconsistent R&D funding pose restraints, but the fundamental need for molecular biology techniques in tackling regional health issues, such as tropical diseases and high rates of specific cancers, sustains the market.

In this region, films are often favored in academic settings due to budgetary limitations, as the capital investment required for high-end digital imagers is often prohibitive for smaller institutions. The focus is primarily on General Purpose Films used in university laboratories. Manufacturers often rely on third-party regional distributors to manage complex import/export logistics and provide localized sales support. Growth is heavily dependent on stable government policies promoting scientific investment.

Opportunities exist in providing educational resources and integrated supply chain solutions that simplify procurement processes for regional research consortia. As the biotechnology sector matures in key economies like Brazil, the demand for specialized, high-sensitivity films for more advanced drug development studies is anticipated to gradually increase throughout the forecast period, transitioning the market towards higher-value products.

- Middle East and Africa (MEA): The MEA market for autoradiography films is nascent but developing, largely concentrated in technologically advanced nations within the Gulf Cooperation Council (GCC) area (e.g., Saudi Arabia, UAE) and South Africa. Growth is spurred by ambitious government visions to diversify economies through investment in education, healthcare, and biotech R&D. The demand is driven by new, state-of-the-art research centers being established with significant capital backing.

The challenges in MEA include logistical complexities, varying levels of research infrastructure maturity, and dependence on imported goods. However, the commitment to building world-class medical facilities and research universities ensures a slow but steady influx of demand for all high-quality laboratory consumables. Initial demand is often met by international distributors providing bundled solutions that include equipment, film, and chemicals.

Future growth will be contingent upon sustained political stability and consistent public and private sector funding for life science initiatives. Manufacturers targeting MEA must focus on educational outreach and establishing reliable supply chains to overcome logistical hurdles. The demand for films is expected to rise as radiolabeling techniques are increasingly adopted for molecular diagnostics and specialized health research tailored to regional disease profiles.

The North American market is characterized by high demand for premium, high-sensitivity film variants, reflecting the sophisticated nature of the research being conducted. Competition is intense, driven by factors such as supply chain reliability, technical support, and rapid delivery capabilities, given the time-sensitive nature of radioisotope experiments. Regulatory compliance, particularly related to documentation standards required by the FDA for preclinical studies, further reinforces the continued use of reliable, traceable film records. Market saturation levels are high, leading manufacturers to focus on maintaining market share through superior product quality and strategic partnerships with major distribution networks that serve the vast network of decentralized research facilities across the continent.

The future growth in North America will be driven by specialized applications where film remains the gold standard, such as specific molecular profiling and long-term radiological studies. Manufacturers are prioritizing innovation in film processing optimization to reduce environmental impact and minimize development time, catering to the efficiency demands of modern American laboratories. Furthermore, the presence of major key players and distribution hubs in this region facilitates rapid product dissemination and immediate adaptation to evolving research methodologies, securing its leading position throughout the forecast period.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Autoradiography Films Market.- Fujifilm Holdings

- Eastman Kodak Company

- Agfa-Gevaert N.V.

- Bio-Rad Laboratories

- Thermo Fisher Scientific

- GE Healthcare

- Merck KGaA

- PerkinElmer Inc.

- Sartorius AG

- VWR International

- Advansta

- Santa Cruz Biotechnology

- R&D Systems

- RayoChem

- Foton

Frequently Asked Questions

Analyze common user questions about the Autoradiography Films market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the continued use of Autoradiography Films despite the rise of digital imagers?

The continued relevance of autoradiography films is primarily driven by their high resolution, superior archival quality for permanent documentation, cost-effectiveness for fundamental research and high-volume labs operating under budgetary constraints, and established integration into standardized regulatory and molecular biology protocols worldwide. They offer a reliable, analog record essential for long-term data verification, particularly in drug metabolism and preclinical studies.

Which application segment holds the largest market share for Autoradiography Films?

The Molecular Biology application segment holds the largest market share. This dominance stems from the ubiquitous use of films in foundational molecular techniques, including Southern, Northern, and Western blotting, which are indispensable for gene expression analysis, protein detection, and nucleic acid separation across academic and industrial research settings globally.

How is the adoption of Artificial Intelligence (AI) influencing the Autoradiography Films market?

AI primarily influences the downstream analysis of autoradiography films. While AI drives the competitive digital imaging market, it also enhances film utility by providing sophisticated algorithms for accurate densitometry, automated background correction, and objective quantification of digitized film images. This improves the reproducibility and data quality derived from traditional film methods.

What are the key differences between General Purpose Films and High Sensitivity Films?

General Purpose Films are optimized for routine, standard-exposure experiments, offering a balance of speed and contrast. High Sensitivity Films, conversely, are engineered with specialized emulsion formulations (often ultra-fine grains or enhanced coatings) to maximize detection efficiency for low-energy isotopes or trace targets, significantly reducing the required exposure time for demanding, low-signal experiments.

Which geographic region is projected to exhibit the fastest growth in the Autoradiography Films Market?

The Asia Pacific (APAC) region is projected to exhibit the fastest Compound Annual Growth Rate (CAGR). This acceleration is fueled by substantial government and private sector investment in building new biotechnology R&D infrastructure, the rapid expansion of pharmaceutical manufacturing, and the increasing volume of academic research activities in key economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager