AV System Integration Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434566 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

AV System Integration Market Size

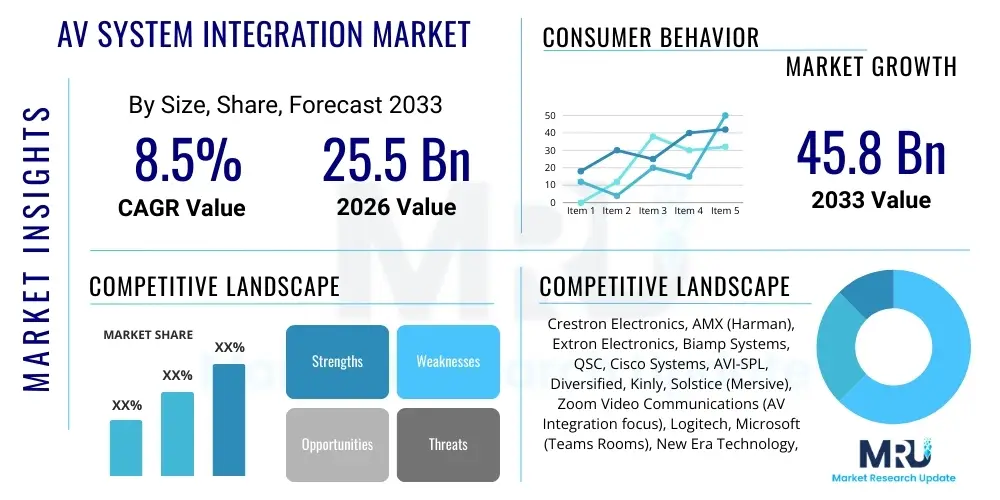

The AV System Integration Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $25.5 Billion in 2026 and is projected to reach $45.8 Billion by the end of the forecast period in 2033.

AV System Integration Market introduction

The AV System Integration Market involves the design, installation, and maintenance of complex audiovisual systems that combine diverse hardware, software, and networking components to create unified communication and collaboration environments. These integrated solutions are crucial for modern enterprises, educational institutions, government bodies, and entertainment venues, facilitating everything from video conferencing and digital signage to immersive experiences and complex command centers. The core product offering includes control systems, video walls, conferencing hardware, sound reinforcement, and specialized networking infrastructure, all integrated into a cohesive, manageable platform.

Major applications span across the corporate sector, primarily driven by the massive shift toward hybrid work models requiring seamless meeting room technology integration, and the education sector, which demands advanced learning environments for remote and in-person students. Key benefits derived from professional AV integration include enhanced operational efficiency, improved collaboration capabilities, streamlined control over complex technology stacks, and superior end-user experiences, which are vital for productivity and engagement. The primary driving factors for market expansion include the rapid proliferation of IoT devices in commercial settings, the necessity for high-resolution displays (4K and 8K), and the global acceleration of digital transformation initiatives across all industry verticals.

AV System Integration Market Executive Summary

The AV System Integration Market is witnessing robust expansion, fundamentally driven by the accelerated adoption of unified communication and collaboration (UCC) technologies globally, particularly in response to the permanent integration of hybrid working strategies. Business trends highlight a significant shift from hardware-centric solutions to software-defined AV systems and managed services, optimizing total cost of ownership (TCO) for clients and establishing recurring revenue streams for integrators. Furthermore, the convergence of IT and AV continues to reshape the competitive landscape, emphasizing the need for integrators to possess strong networking and cybersecurity expertise to manage complex, interconnected systems effectively, leading to consolidation among smaller, specialized firms.

Regionally, North America maintains market leadership, fueled by early technology adoption, substantial corporate expenditure on office modernization, and the presence of numerous large technology providers driving innovation in cloud-based AV solutions. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, primarily due to rapid urbanization, massive infrastructure development in emerging economies, and increasing investments in educational technology and smart city initiatives, creating a fertile ground for new AV system deployments. Europe remains a steady market, characterized by strong demand from the hospitality and professional services sectors for sophisticated digital experiences and regulatory compliance integration.

Segment trends underscore the dominance of the Services segment over hardware sales, reflecting client preference for end-to-end solutions covering design consulting, installation, training, and long-term managed services, including predictive maintenance and remote monitoring. Within the end-user vertical, the Corporate segment remains the largest consumer, perpetually upgrading conferencing rooms and collaboration spaces. However, specialized sectors like Healthcare (telemedicine, surgical theaters) and Government/Defense (command and control rooms) are demanding highly customized, secure, and resilient integrated solutions, driving innovation in niche areas such as secure video streaming and high-fidelity signal processing.

AI Impact Analysis on AV System Integration Market

User inquiries regarding the impact of Artificial Intelligence on AV integration frequently center on topics such as the potential for AI to automate complex setup and calibration processes, enhance meeting efficiency through intelligent room control, and personalize user experiences based on context and preference. Common concerns revolve around data privacy when using AI-driven spatial intelligence, the integration complexity of machine learning models into legacy AV infrastructure, and the ethical implications of using facial recognition or behavioral analysis in corporate environments. Users are primarily expecting AI to deliver higher reliability, reduce operational downtime through predictive maintenance, and transform passive meeting spaces into cognitive, responsive environments that require minimal manual intervention, effectively bridging the gap between hardware functionality and intuitive user interaction.

AI is fundamentally transforming the way AV systems are deployed and operated, shifting integration from a static deployment model to a dynamic, responsive platform. Cognitive AV systems leverage machine learning algorithms for tasks such as ambient noise reduction, automated camera framing (speaker tracking), and real-time transcription, significantly improving the quality and accessibility of communication. Furthermore, AI-powered analytics tools provide unprecedented insights into room utilization rates, hardware performance, and energy consumption, allowing facilities managers and IT departments to optimize resource allocation and ensure proactive maintenance schedules. This predictive capability minimizes system failure, enhancing the overall reliability and longevity of sophisticated AV installations, which is a major value proposition for end-users seeking maximal uptime.

For integrators, AI necessitates a new skill set focused on data science and software development, moving beyond traditional hardware wiring and configuration. AI is enabling the development of truly smart meeting spaces where systems automatically adjust lighting, climate, and display settings based on the recognized number of occupants, time of day, and meeting agenda pulled from calendars. This level of environmental control and contextual awareness elevates the user experience, making technology transparent and intuitive. The integration of Natural Language Processing (NLP) allows for voice command control over complex AV ecosystems, democratizing access to sophisticated technology and driving demand for next-generation, AI-ready integration platforms that support open standards and robust API connectivity.

- AI-driven automation of room calibration and acoustic tuning, significantly reducing installation time and complexity.

- Enhanced meeting productivity via intelligent camera framing, real-time noise suppression, and automated transcription services.

- Predictive maintenance analytics optimizing hardware lifecycle management and minimizing unscheduled downtime.

- Personalized user experiences through context-aware AV systems that adjust settings based on recognized user profiles or meeting type.

- Development of cognitive command and control centers utilizing AI for data synthesis and visualization across massive video walls.

- Increased adoption of facial and gesture recognition technologies for secure access control and automated system activation.

DRO & Impact Forces Of AV System Integration Market

The AV System Integration Market is powered by significant drivers, notably the pervasive trend of digital transformation across global enterprises and the mandatory requirement for sophisticated hybrid collaboration solutions following global shifts in working habits. Restraints primarily involve the high initial capital investment required for state-of-the-art AV installations, particularly for large-scale projects involving 4K or 8K video infrastructure, and the persistent challenge of interoperability across disparate hardware ecosystems and proprietary software platforms. Opportunities are vast, driven by the emergence of software-defined AV, the expansion into specialized verticals like smart healthcare facilities and esports arenas, and the potential for integrators to offer lucrative, long-term managed services contracts. These forces collectively exert substantial impact, pushing the market towards standardization, greater reliance on IP networking principles, and a focus on providing seamless, scalable, and secure cloud-managed solutions.

Drivers

The foremost driver accelerating market growth is the global paradigm shift towards unified communication and hybrid collaboration models. Corporate offices are rapidly investing in sophisticated meeting room technologies—including advanced microphones, intelligent cameras, and robust video conferencing platforms—to ensure equitable collaboration between remote and in-office participants. This need for seamless, high-quality audio and video experiences is non-negotiable for maintaining global business productivity. Additionally, the increasing expectation for high-definition visual content, such as 4K and increasingly 8K displays in venues, control rooms, and large corporate lobbies, mandates complex AV signal distribution and integration expertise, necessitating professional integration services that can handle high bandwidth requirements and low latency demands across extensive networks.

Another crucial driver is the rapid convergence of AV systems with standard IT networks. Modern AV installations are predominantly IP-based (e.g., using protocols like Dante, NDI, or AV over IP), integrating directly with enterprise security protocols, network management tools, and cloud infrastructure. This integration is driven by the desire for centralized management, remote diagnostics, and improved scalability, allowing organizations to manage hundreds of rooms efficiently from a single point. This convergence mandates that AV integrators are highly proficient in IT networking, security, and cloud architecture, transitioning their role from mere installers of hardware to strategic technology partners essential for organizational infrastructure development.

Restraints

Despite strong growth drivers, significant restraints temper market expansion, primarily centered around the substantial initial capital expenditure required for premium AV integration projects. Implementing large-scale digital signage networks, comprehensive auditorium systems, or high-fidelity command centers often involves investments running into millions, which can be prohibitive for small and medium-sized enterprises (SMEs) or institutions operating under tight budgetary constraints. This cost factor often leads organizations to opt for piecemeal or scaled-down solutions, delaying full-scale digital transformation and limiting the scope of integration projects.

Furthermore, the persistent challenge of interoperability remains a major technical restraint. The AV market is highly fragmented, with numerous vendors supplying components (displays, control systems, mixers, conferencing hardware), often utilizing proprietary communication protocols. Integrators frequently face difficulties in ensuring that all these disparate components communicate flawlessly and reliably, leading to complex and time-consuming configuration processes. This lack of universal standardization increases the risk of system instability and requires specialized, often proprietary, programming knowledge, adding layers of complexity and cost to the integration process and post-installation support.

Opportunities

A major opportunity lies in the expanding demand for managed services and long-term support contracts. As AV systems become more complex and IT-dependent, end-users increasingly prefer outsourcing system monitoring, maintenance, and technical support to specialized integrators. These recurring revenue models not only provide integrators with stable income streams but also allow them to offer superior proactive maintenance, leveraging remote diagnostics and cloud management tools to ensure maximum system uptime. This shift moves the business relationship from transactional sales to strategic, long-term partnerships focused on system performance optimization.

Additionally, significant untapped opportunities exist in niche and high-growth vertical markets. The healthcare sector presents high potential through the integration of AV systems in surgical teaching labs, advanced telemedicine platforms, and patient monitoring rooms, demanding ultra-reliable, low-latency video and secure data transmission. Similarly, the rapidly expanding esports and immersive entertainment sectors require highly specialized, broadcast-quality AV installations, including massive LED screens, sophisticated lighting control, and complex signal routing systems, creating a lucrative space for integrators with specific expertise in high-performance entertainment technology and live event production standards.

Impact Forces Summary

- Digital Transformation & Hybrid Work Mandates (High Driver)

- High Initial Capital Investment & TCO (Medium Restraint)

- Convergence of AV and IT Infrastructure (High Opportunity)

- Lack of Universal Interoperability Standards (Medium Restraint)

- Expansion of Managed Services & Recurring Revenue Models (High Opportunity)

Segmentation Analysis

The AV System Integration Market is segmented based on component (hardware, software, services), application (corporate, education, government, hospitality, retail, others), and signal type (analog, digital, IP-based). Understanding these segments is crucial as the market evolves away from simple hardware sales towards comprehensive service delivery and IP-centric solutions. The services segment, encompassing design consulting, installation, programming, and maintenance, is currently the fastest-growing category, driven by the complexity of modern systems and the organizational need for professional management. Geographically, segmentation analysis highlights differing levels of maturity, with North America leading in adoption of complex, IT-integrated solutions, while APAC is prioritizing rapid deployment in new infrastructure projects across all verticals.

The Corporate sector remains the dominant application segment, driven by continuous upgrade cycles in meeting rooms, boardrooms, and auditoriums to support sophisticated global collaboration tools. However, specialized verticals like Healthcare and Government are increasingly demanding bespoke solutions tailored for specific security and compliance requirements. For instance, government integrations often require secured, closed-network AV systems, whereas healthcare demands reliability suitable for critical patient care environments. The shift towards IP-based signal distribution (AV over IP) is a fundamental technological trend reshaping all segments, offering unprecedented scalability and flexibility compared to traditional analog or fixed digital distribution methods.

- By Component:

- Hardware (Displays, Projectors, Control Systems, Microphones, Speakers)

- Software (Management Software, Streaming Platforms, Control Applications)

- Services (Design & Consulting, Installation & Integration, Maintenance & Support, Managed Services)

- By Application:

- Corporate (Meeting Rooms, Huddle Spaces, Training Centers, Boardrooms)

- Education (Classrooms, Lecture Halls, Campus-wide AV Networks, Distance Learning)

- Government & Defense (Command Centers, Control Rooms, Secure Conference Facilities)

- Hospitality (Hotels, Conference Centers, Digital Signage)

- Retail & Digital Out-of-Home (DOOH)

- Healthcare (Operating Theatres, Telemedicine, Simulation Labs)

- Sports & Entertainment (Stadiums, Arenas, Museums)

- By Signal Type/Technology:

- Analog Systems (Declining)

- Digital Systems (HDBaseT, HDMI)

- IP-Based Systems (AV over IP, Dante, NDI)

Value Chain Analysis For AV System Integration Market

The AV System Integration value chain begins with upstream activities involving component manufacturing, dominated by specialized hardware and software providers (e.g., display manufacturers, conferencing system developers, and control system software firms). This stage is highly competitive and innovation-intensive, focusing on developing cutting-edge technologies like low-latency AV over IP encoders and sophisticated AI-driven algorithms for acoustic processing. Sourcing and procurement activities at this stage are critical, with integrators building strategic partnerships to secure favorable pricing and access to proprietary technology stacks, ensuring compatibility and supply chain resilience, especially given the global constraints on semiconductor components.

Midstream activities center on the core value proposition of the market: the actual integration, programming, and professional service delivery. This stage includes design consulting, system engineering, complex proprietary programming (e.g., Crestron or Extron programming), and physical installation. Integrators, acting as the crucial link between manufacturers and end-users, must maintain highly skilled technical teams proficient in both IT networking and complex AV signal management. Distribution channels vary, involving direct sales models for large, bespoke projects and indirect distribution via specialized AV distributors and resellers for standardized components, often managed through exclusive regional partnership agreements.

Downstream activities involve post-installation support, maintenance, and the increasingly profitable managed services layer. End-users rely on integrators for training, troubleshooting, and continuous system monitoring, often under multi-year service level agreements (SLAs). The transition to remote, cloud-based monitoring has enhanced efficiency in this downstream segment, allowing integrators to diagnose and resolve issues proactively, maximizing system uptime for clients. This strategic shift towards service-oriented engagement is maximizing customer lifetime value and positioning integrators as essential long-term technology stewards for their clients' unified communication environments.

AV System Integration Market Potential Customers

Potential customers for professional AV System Integration services encompass any organization requiring complex communication, visualization, or immersive experience technologies. The primary end-users are large multinational corporations (MNCs) that require standardization of collaboration technology across global offices to facilitate hybrid work and maintain consistent operational standards. These buyers prioritize scalability, security, and remote management capabilities in their integrated AV solutions. Educational institutions, from K-12 to higher education, represent a major segment, driven by the continuous need to upgrade lecture halls, distance learning infrastructure, and specialized laboratories to support modern pedagogical practices.

Additionally, the public sector, including government agencies, municipal organizations, and defense contractors, represents a high-value customer base, prioritizing highly secure, reliable, and often redundant command and control center integrations for mission-critical operations. The hospitality sector, encompassing luxury hotels, conference venues, and cruise lines, seeks integration solutions that enhance guest experience through sophisticated digital signage, automated room control, and immersive entertainment systems. Lastly, the healthcare sector demands precision, reliability, and compliance (e.g., HIPAA) for applications such as telemedicine carts, surgical training simulations, and high-definition video distribution within operating theaters, making them critical buyers for specialized, high-assurance AV integration.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $25.5 Billion |

| Market Forecast in 2033 | $45.8 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Crestron Electronics, AMX (Harman), Extron Electronics, Biamp Systems, QSC, Cisco Systems, AVI-SPL, Diversified, Kinly, Solstice (Mersive), Zoom Video Communications (AV Integration focus), Logitech, Microsoft (Teams Rooms), New Era Technology, TEECOM, HB Communications, CCS Presentation Systems, Alpha Technologies, Control4 (Snap One), Shure |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

AV System Integration Market Key Technology Landscape

The technological landscape of AV System Integration is rapidly evolving, driven primarily by the transition from dedicated circuit-based systems to networked, software-defined solutions. A foundational technology driving this shift is AV over IP (Audio Visual over Internet Protocol), which uses standard Ethernet networks to transmit high-bandwidth audio and video signals, replacing traditional, distance-limited cabling like HDMI and dedicated coaxial runs. Protocols such as SMPTE 2110 for broadcast-grade video, Dante for audio networking, and various proprietary and open standards are consolidating the AV infrastructure onto the enterprise IT backbone, dramatically increasing scalability and flexibility while reducing installation costs associated with specialized signal distribution hardware.

Furthermore, the integration of advanced sensors and Internet of Things (IoT) devices is crucial for creating truly intelligent meeting spaces. Room utilization sensors, people-counting cameras, and environmental monitoring devices feed data into the centralized AV control system, enabling automated adjustments to lighting, HVAC, and display configurations. Control system software provided by major players is becoming increasingly sophisticated, offering unified dashboards for managing multi-vendor hardware and leveraging API integration to communicate seamlessly with enterprise scheduling systems (like Microsoft Exchange or Google Workspace). This focus on intelligent control minimizes the learning curve for end-users and maximizes energy efficiency within integrated environments.

Another major technological thrust involves immersive visualization technologies, including micro-LED video walls and advanced projection mapping techniques, which are becoming standard in corporate lobbies, museums, and high-end retail environments. The shift to higher resolution standards (4K, 8K) and High Dynamic Range (HDR) content mandates the use of robust, high-throughput network infrastructures capable of handling massive data streams without compression artifacts or latency, pushing the boundaries of signal processing and network hardware capabilities. Security protocols are also central, as IP-based AV systems are now considered part of the IT network perimeter, necessitating encryption, access controls, and robust cybersecurity measures built into the integration design from inception.

Regional Highlights

Regional dynamics significantly influence the trajectory of the AV System Integration market, reflecting varying levels of technological maturity, regulatory environments, and expenditure patterns across different geographies. North America (NA) and Europe (EU) represent the most mature markets, characterized by high adoption rates of sophisticated, cloud-managed unified collaboration platforms, driven by demanding corporate refresh cycles and a high concentration of market-leading technology vendors and major system integrators.

The Asia Pacific (APAC) region is projected to be the fastest-growing market, primarily fueled by massive infrastructure investments, rapid digital transformation in countries like China, India, and Southeast Asia, and robust growth in the education and government sectors. While initial deployments in APAC often prioritize cost-efficiency, there is an accelerating demand for advanced, large-scale systems (such as high-resolution video walls and command centers) commensurate with the region's rapid economic expansion.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging markets, where growth is currently concentrated in urban centers and oil-rich economies investing heavily in smart city projects, educational upgrades, and high-end hospitality venues. These regions often face challenges related to infrastructure readiness and reliance on imported hardware, but the increasing availability of affordable, scalable AV over IP solutions is expected to drive substantial future market penetration.

- North America (NA): Market leader due to high corporate expenditure, robust early adoption of UC&C tools, and a strong ecosystem of integrators specialized in complex, IT-integrated AV solutions. Focus areas include hybrid meeting technology, personalized office environments, and large-scale digital signage deployments.

- Europe (EU): Characterized by stable growth, driven by demand for advanced simulation and training facilities, stringent regulatory requirements for secure communications, and a strong emphasis on sustainability in AV deployment, favoring energy-efficient components and standardized, reliable systems.

- Asia Pacific (APAC): Highest expected growth rate. Key drivers are government investment in education technology, the construction boom requiring new conference and entertainment venues, and increasing adoption of AV over IP to overcome infrastructure limitations in developing areas.

- Latin America (LATAM): Emerging market focused on enhancing educational facilities and supporting the growing corporate sector with essential video conferencing capabilities. Growth is often constrained by economic volatility but shows potential in major economies like Brazil and Mexico.

- Middle East and Africa (MEA): Growth concentrated in the Gulf Cooperation Council (GCC) nations, driven by major governmental initiatives like Saudi Vision 2030 and significant investment in mega-projects (e.g., hospitality, exhibitions), requiring world-class, large-scale immersive AV systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the AV System Integration Market.- Crestron Electronics

- AMX (Harman)

- Extron Electronics

- Biamp Systems

- QSC

- Cisco Systems

- AVI-SPL

- Diversified

- Kinly

- Solstice (Mersive)

- Zoom Video Communications (AV Integration focus)

- Logitech

- Microsoft (Teams Rooms Ecosystem Providers)

- New Era Technology

- TEECOM

- HB Communications

- CCS Presentation Systems

- Alpha Technologies

- Control4 (Snap One)

- Shure

Frequently Asked Questions

Analyze common user questions about the AV System Integration market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is AV System Integration and how does it differ from standard IT installation?

AV System Integration involves combining diverse audio, video, lighting, and control components into a unified, functional system tailored for specific communication or presentation needs. While IT installation focuses on data networks and computer infrastructure, AV integration specializes in signal transport, low-latency performance, acoustic treatment, and user interface design for optimal human interaction and experience.

What are the primary drivers for the shift towards AV over IP solutions?

The primary drivers for AV over IP adoption include enhanced scalability, flexibility, and cost-efficiency. Utilizing standard network cabling and IT infrastructure simplifies deployment across long distances, reduces hardware complexity, and allows for centralized management and monitoring of AV assets alongside traditional IT resources, preparing systems for future upgrades.

How is the rise of hybrid work models impacting the AV Integration market?

Hybrid work models are significantly boosting demand for sophisticated, intelligent meeting room technology, driving market investment in unified communication platforms, AI-enabled camera and microphone systems, and user-friendly control interfaces that ensure equitable collaboration experiences between physical and remote participants across all corporate locations.

What role does Artificial Intelligence play in modern AV systems?

AI enhances modern AV systems by enabling automation, predictive maintenance, and contextual awareness. AI is used for real-time acoustic optimization, automated camera framing, resource utilization analytics, and creating cognitive rooms that respond intelligently to user presence and specific meeting requirements without manual configuration.

Which end-user segment holds the largest market share for AV Integration?

The Corporate segment holds the largest market share, driven by continuous technology refresh cycles and substantial investment in collaboration spaces, boardrooms, and training facilities necessary to support global business operations and the demands of modern unified communication infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager