Avian Influenza Vaccines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437143 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Avian Influenza Vaccines Market Size

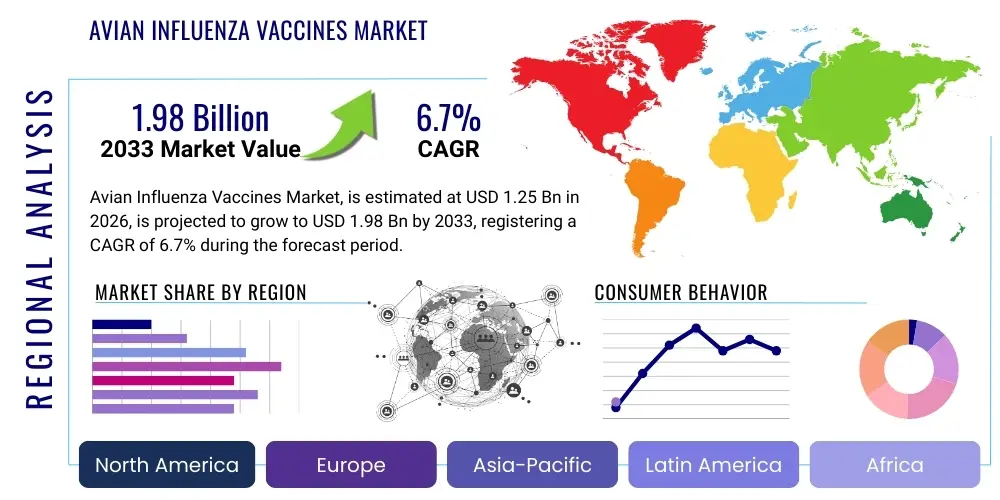

The Avian Influenza Vaccines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% between 2026 and 2033. The market is estimated at USD 1.25 billion in 2026 and is projected to reach USD 1.98 billion by the end of the forecast period in 2033.

Avian Influenza Vaccines Market introduction

The Avian Influenza Vaccines Market encompasses biological products designed to prevent or mitigate the impact of Avian Influenza (AI), commonly known as bird flu, primarily in domestic poultry populations. These vaccines are critical tools in comprehensive disease control strategies, particularly against highly pathogenic avian influenza (HPAI) strains like H5N1 and H7N9, which pose significant threats to food security, the global poultry trade, and, occasionally, human health. The core application lies in prophylactic immunization programs targeting commercial layer chickens, broilers, and breeding flocks to reduce virus shedding, limit economic losses associated with mass culling, and stabilize international trade routes frequently restricted due to outbreak declarations. The product description spans traditional inactivated vaccines, which are derived from killed virus particles, and modern recombinant vaccines that express specific protective antigens, offering enhanced safety and differentiating capabilities.

Driving factors for sustained market growth include the increasing frequency and geographical spread of HPAI outbreaks worldwide, often linked to migratory bird patterns and intensifying poultry production systems. Governments and major poultry producers are increasingly recognizing vaccination as a necessary adjunct to strict biosecurity measures, especially in endemic regions like parts of Asia and Africa. The economic benefit derived from vaccination—avoiding mass culling, maintaining production continuity, and protecting genetic stock—substantially outweighs the investment cost, particularly for long-lived layer and breeder birds. Furthermore, technological advancements, such as the development of multivalent and faster-acting recombinant vaccines, are improving efficacy and acceptance among veterinary regulators.

The market is defined by a continuous cycle of research and development driven by the rapid antigenic drift of the influenza virus. Effective vaccines must closely match the circulating field strains, necessitating constant surveillance and rapid strain updating capabilities by manufacturers. Major applications focus intensely on high-density poultry operations where the risk of transmission is highest. Benefits include not only direct protection of the flock but also safeguarding public health by reducing the zoonotic risk associated with close contact between infected birds and humans. The complex regulatory environment, which mandates specific testing and authorization before deployment, acts as both a barrier and a quality control mechanism within this highly specialized veterinary pharmaceutical sector.

Avian Influenza Vaccines Market Executive Summary

The Avian Influenza Vaccines market is undergoing a fundamental shift characterized by rapid technological innovation and evolving regulatory acceptance, particularly regarding the use of recombinant and marker vaccines. Business trends indicate a consolidation among key manufacturers striving to develop broad-spectrum vaccines capable of protecting against multiple clades of HPAI, driven by the need for simplified logistics and quicker response times during emerging pandemics. The dominant trend involves a move away from conventional inactivated vaccines towards superior recombinant platforms, which offer better cross-protection and enable differentiation between infected and vaccinated animals (DIVA strategy), a crucial requirement for maintaining trade statuses in non-vaccinating countries. Furthermore, there is a growing investment in regional manufacturing hubs, especially in Asia Pacific, to ensure localized supply chain resilience against endemic strains.

Regional trends highlight the significant division between vaccination-accepting markets and those adhering to non-vaccination policies. Asia Pacific (APAC) remains the largest and fastest-growing market due to highly dense poultry populations, endemic HPAI presence, and established government-mandated vaccination programs (e.g., in China, Vietnam, and Egypt). In contrast, regions like North America and the European Union traditionally prioritize strict biosecurity and culling, but recent, unprecedented outbreaks are forcing high-level discussions regarding the strategic implementation of vaccination, potentially opening massive new commercial opportunities for vaccine producers. Latin America is also emerging as a pivotal region, balancing high export demands with localized outbreak management, driving demand for high-quality, export-compliant vaccines.

Segment trends emphasize the growing dominance of recombinant vaccine types, specifically vector-based vaccines (e.g., fowlpox or herpesvirus vectors), which are favored for their stability, single-dose efficacy, and DIVA compatibility. While layer and breeder birds constitute the primary application segment due to their long production life, the sheer volume of broiler production globally presents a vast untapped potential if cost-effective, easily administered vaccination strategies (like in-ovo or mass oral delivery) become commercially viable. The trend is moving towards integrating vaccine use into broader precision livestock management systems, utilizing data analytics to forecast risk and optimize vaccination schedules for maximum herd immunity and economic return.

AI Impact Analysis on Avian Influenza Vaccines Market

User queries regarding AI's influence on the Avian Influenza Vaccines market frequently center on its ability to accelerate pandemic preparedness, enhance vaccine matching precision, and revolutionize outbreak surveillance. Users are particularly keen to understand how AI-driven bioinformatics can predict antigenic drift, a key challenge in vaccine efficacy, significantly faster than traditional methods. Key themes emerging from user concerns involve the need for robust, real-time data integration across veterinary, epidemiological, and genetic databases to inform rapid vaccine strain selection and manufacturing scale-up. Expectations are high that AI will transition vaccine production from a reactive, laborious process to a proactive, predictive model, thereby minimizing the lag time between identifying a novel strain and deploying a protective vaccine.

The application of Artificial Intelligence and Machine Learning (ML) algorithms is poised to transform vaccine development by analyzing vast genomic datasets from circulating AI viruses. These systems can identify evolutionary hotspots and predict the next likely dominant strain, allowing manufacturers to initiate 'pre-emptive' vaccine development. This capability dramatically reduces the clinical timeline, ensuring that vaccines are ready or near-ready when a new clade emerges. Furthermore, AI optimizes clinical trial design and manufacturing processes, predicting yield efficiencies and detecting quality anomalies during large-scale production, which is crucial for handling the immense volume requirements of the global poultry industry.

Beyond the laboratory, AI significantly enhances market intelligence and deployment strategies. ML models utilize spatial-temporal data—including climate variables, bird migration patterns, poultry density, and trade routes—to accurately forecast the probability and location of future outbreaks. This predictive policing allows veterinary authorities to target vaccination efforts precisely, maximizing the cost-effectiveness and epidemiological impact of limited vaccine supplies. Ultimately, the AI impact is expected to foster a more resilient market structure, capable of adapting swiftly to global viral challenges, reducing both the economic losses to the poultry sector and the potential risk of zoonotic transmission to human populations.

- AI accelerates the identification of novel avian influenza viral clades and predicts antigenic drift patterns.

- Machine Learning algorithms optimize vaccine formulation and antigen selection for improved cross-protection.

- Predictive analytics enhance real-time surveillance, enabling targeted and preemptive vaccine deployment strategies in high-risk areas.

- AI systems streamline R&D cycles by analyzing complex bioinformatics data, speeding time-to-market for updated vaccine strains.

- Automated data integration improves the efficacy of the DIVA (Differentiating Infected from Vaccinated Animals) testing protocols essential for regulatory compliance.

DRO & Impact Forces Of Avian Influenza Vaccines Market

The dynamics of the Avian Influenza Vaccines Market are shaped by a powerful confluence of drivers, constraints, and inherent opportunities, collectively categorized as DRO (Drivers, Restraints, Opportunities). Primary drivers include the escalating global threat posed by highly pathogenic avian influenza, evidenced by the recurrent H5N1 outbreaks across continents, compelling governments and industry stakeholders to invest heavily in preventative measures. The substantial economic losses incurred through mandatory culling, coupled with subsequent trade barriers imposed on infected regions, provide a forceful impetus for proactive vaccination programs. This financial incentive is compounded by growing consumer demand for safer food supply chains, pressuring producers to adopt the highest biosecurity and health standards, which increasingly include strategic immunization.

However, the market faces significant restraints, principally dominated by regulatory hesitancy and the complex logistics of mass vaccination. Historically, many key poultry-producing and exporting regions, notably the EU and the US, have maintained a ‘non-vaccination’ policy, fearing that vaccination might mask infection, complicate surveillance, and subsequently lead to trade bans from non-vaccinating partners who adhere to the notion of 'disease-free status without vaccination.' This regulatory hurdle is slowly being addressed through the development of DIVA-compatible marker vaccines, yet implementation remains a complex geopolitical challenge. Additionally, the sheer scale required for vaccinating billions of poultry birds, often requiring individual injection and robust cold chain management, presents an operational and cost restraint, particularly in developing economies.

Opportunities for growth are concentrated in technological breakthroughs and geographic expansion. The development of advanced, cost-effective vaccine platforms, such as oral administration or in-ovo vaccination techniques, promise to drastically reduce labor costs and increase the speed of large-scale deployment. Furthermore, the increasing acceptance of strategic vaccination in formerly non-vaccinating regions, driven by the persistent spread of novel HPAI variants, represents a significant untapped market potential. Impact forces acting upon the market include climate change, which alters migratory bird routes and creates new interfaces between wild and domestic birds, increasing transmission risk, alongside the continuous pressure from global trade agreements that dictate acceptable veterinary standards and import/export prerequisites, thereby strongly influencing the type and acceptance of vaccines utilized.

Segmentation Analysis

The Avian Influenza Vaccines market is comprehensively segmented based on vaccine type, product application, and the route of administration, reflecting the diverse needs of the global poultry industry and various regional regulatory requirements. Understanding these segments is crucial as different types of poultry (layers, breeders, broilers) require distinct vaccination protocols, efficacy periods, and cost structures. The segmentation also highlights the technological shift occurring within the industry, where modern recombinant vaccines are increasingly challenging the traditional dominance of inactivated whole-virus vaccines due to superior safety profiles, capacity for rapid updates, and critical compatibility with modern surveillance strategies like DIVA testing.

The market is predominantly segmented by Vaccine Type into inactivated whole-virus vaccines and recombinant vaccines. Inactivated vaccines are cost-effective but generally require two doses and lack DIVA compatibility, limiting their acceptance in export-focused markets. Recombinant vaccines, utilizing vectors such as Marek's Disease Virus (rMDV) or Fowlpox (rFPV), offer the advantage of single-dose administration, robust immunity, and seamless integration into existing poultry health programs. Application segmentation primarily differentiates between commercial poultry, which constitutes the bulk of demand, and smaller-scale backyard or hobby farming, which often utilizes centralized government-sponsored vaccination drives.

Further segmentation by administration route—injection (subcutaneous or intramuscular) versus mass methods (e.g., aerosol or drinking water)—dictates feasibility and cost-efficiency, especially for high-volume flocks like broilers. The strategic shift towards advanced administration methods, particularly in-ovo vaccination technology, is expected to drive significant market efficiency gains. The complex interplay between these segments is vital; for instance, regulatory bodies often specify which vaccine types (e.g., DIVA-compatible) are permissible for layer flocks in export zones, demonstrating how market forces are intrinsically tied to both efficacy and global trade policy.

- By Vaccine Type:

- Inactivated Vaccines (Whole Virus)

- Recombinant Vaccines (Vector-Based)

- Viral Vector Vaccines (e.g., rMDV, rFPV)

- Subunit Vaccines

- Next-Generation Vaccines (e.g., DNA, mRNA—Emerging)

- By Application:

- Commercial Poultry (Broilers, Layers, Breeders)

- Backyard/Smallholder Poultry

- By Administration Route:

- Injection (Intramuscular/Subcutaneous)

- Mass Administration (Drinking Water, Spray/Aerosol—Limited Use for AI)

- In-Ovo Vaccination

- By Target Strain:

- H5 Subtypes (H5N1, H5N2, H5N8)

- H7 Subtypes (H7N9)

- Multivalent Vaccines

Value Chain Analysis For Avian Influenza Vaccines Market

The value chain for the Avian Influenza Vaccines Market is intricate, characterized by high-technology input, stringent quality control, and significant regulatory oversight, distinguishing it from general veterinary pharmaceuticals. The chain begins with intensive upstream activities focused on research and development (R&D) and antigen selection. Due to the rapid evolution (antigenic drift) of the AI virus, manufacturers must continuously monitor circulating field strains globally and quickly adapt vaccine candidates. This R&D stage involves high capital expenditure in bioinformatics, virology labs, and biological containment facilities (BSL-3). Key upstream suppliers include providers of high-quality adjuvants (to enhance immune response), cell culture media, and specialized viral vector platforms essential for recombinant vaccine production.

Midstream activities center on manufacturing, scale-up, and quality assurance. Vaccine production requires specialized facilities compliant with Good Manufacturing Practices (GMP). For inactivated vaccines, this involves large-scale virus propagation in embryonated eggs or cell lines, followed by inactivation and formulation. Recombinant vaccine production leverages cell culture systems for vector growth, demanding advanced bioprocessing expertise. Quality control and batch release testing are bottleneck stages, ensuring the vaccine meets required potency, purity, and safety standards mandated by national veterinary regulatory agencies. The consistency of production scale-up is crucial, especially during outbreaks when demand spikes unexpectedly.

Downstream analysis highlights the complexity of distribution and final delivery. The stability of avian vaccines necessitates a robust cold chain logistics network (typically 2°C to 8°C) from the manufacturing plant to the farm gate. Distribution channels are highly regulated, involving direct sales to large integrated poultry companies, sales through specialized veterinary distributors, and significant procurement by governmental veterinary services (indirect channel) responsible for national control programs. The final step involves administration by veterinarians or trained poultry farm staff. The direct channel often services large commercial operations that negotiate bulk pricing, while indirect distribution through government tender predominates in regions managing endemic disease, emphasizing the government's pivotal role as a major market buyer and regulator.

Avian Influenza Vaccines Market Potential Customers

The primary customer base for Avian Influenza Vaccines consists overwhelmingly of entities involved in large-scale commercial poultry production, alongside national and international governmental and non-governmental health organizations. Integrated poultry producers, who manage the entire supply chain from breeding to processing, represent the most critical segment of buyers. These large corporate entities prioritize vaccines that offer high efficacy, are compatible with export requirements (i.e., DIVA compatibility), and can be administered efficiently at high volumes, often seeking direct procurement agreements with major vaccine manufacturers to secure consistent supply and optimized pricing structures. Their decision-making is driven purely by economic protection—minimizing flock mortality and avoiding costly production interruptions caused by mandatory culling or trade restrictions.

A second major customer segment includes government veterinary authorities and ministries of agriculture, particularly in countries where Avian Influenza is endemic or where widespread, preventative vaccination campaigns are mandated (such as in parts of Asia, Africa, and the Middle East). These governmental buyers typically initiate large-scale tender processes to procure vaccines for distribution to small and medium-sized farms, often subsidizing or providing the vaccine free of charge. Their purchasing decisions are primarily motivated by national biosecurity, public health protection (reducing zoonotic risk), and the maintenance of domestic food security. The size and consistency of governmental tenders make them crucial for market stability and long-term volume commitment.

Finally, international organizations such as the Food and Agriculture Organization (FAO), the World Health Organization (WHO), and various non-governmental organizations (NGOs) focused on animal and public health serve as essential customers, often funding and facilitating vaccination programs in developing nations. While smaller in volume compared to commercial poultry giants, their role is strategically vital in outbreak response and capacity building in regions lacking sufficient veterinary infrastructure. These buyers seek reliable, globally recognized vaccine solutions that fit within complex, multi-faceted disease control strategies across diverse geopolitical settings. The end-user, therefore, ranges from the multi-billion dollar commercial poultry executive planning his flock health budget to the veterinary official managing a national disease eradication program.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.98 Billion |

| Growth Rate | 6.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Boehringer Ingelheim, MSD Animal Health (Merck), Zoetis, Ceva Santé Animale, Elanco Animal Health, Yebio Bioengineering, Harbin Veterinary Research Institute (HVRI), Ringpu Biology, Phibro Animal Health, Vaxxinova, Medion Farma Jaya, Shandong Lukang, Qilu Animal Health, FATRO S.p.A., Biovet Private Limited, ChengDu QianKun, Vaksindo Satwa Nusantara, Beijing Compromise, Zydus Animal Health. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Avian Influenza Vaccines Market Key Technology Landscape

The technological landscape of the Avian Influenza Vaccines Market is currently dominated by two primary platforms: traditional inactivated whole-virus technology and advanced recombinant vector technology. Traditional inactivated vaccines rely on growing large quantities of the virus, chemically inactivating it, and mixing it with adjuvants. While well-established and cost-effective, their primary limitation is the lack of DIVA compatibility and the requirement for a close antigenic match to the circulating strain, demanding frequent updates and reducing preparation lead time. Innovation within this platform focuses on improving adjuvant systems to elicit a stronger, broader immune response with fewer side effects, thereby marginally extending their market relevance in cost-sensitive or government-subsidized programs.

The cutting edge of the market is defined by recombinant vaccine technology. This includes using viral vectors, such as Marek's Disease Virus (rMDV) or Fowlpox Virus (rFPV), to carry and express the hemagglutinin (HA) gene of the target AI strain. These recombinant vaccines are inherently safer as they do not involve handling the live pathogenic virus during production, and critically, they allow for DIVA strategies because the vaccinated bird generates antibodies only against the HA protein, not the internal components of the field virus. This technological capability is instrumental in overcoming trade barriers, as countries can confidently differentiate between vaccination-induced immunity and natural infection, driving significant preference and adoption, especially among large commercial breeders.

Emerging technologies, including nucleic acid vaccines (DNA and mRNA platforms), are receiving significant R&D attention due to their potential for unprecedented speed and flexibility in manufacturing. These platforms bypass the need for traditional cell or egg culture, enabling rapid customization and scale-up in response to new outbreaks—a crucial advantage given the constant mutation rate of AI. Although these technologies are currently prevalent in human vaccinology (e.g., COVID-19), their application in the high-volume, cost-sensitive veterinary space, particularly for poultry, is still in the developmental and early commercialization phase. Their success will depend on achieving low manufacturing costs and demonstrating stability suitable for the poultry supply chain.

Regional Highlights

The geographical analysis of the Avian Influenza Vaccines market reveals distinct dynamics driven by local poultry production intensity, regulatory stances on vaccination, and the historical prevalence of endemic disease. Asia Pacific (APAC) stands out as the most significant market globally. This dominance is attributed to the presence of some of the world's largest poultry populations, often raised in high-density environments conducive to viral spread, and the high endemicity of H5N1 and other HPAI strains. Countries like China, Vietnam, and Egypt have established, often mandatory, national vaccination programs utilizing locally produced and internationally supplied vaccines, making the region a critical demand center. The ongoing need for customized, region-specific vaccine strains tailored to local clades ensures continuous high demand.

North America, traditionally prioritizing strict biosecurity and culling, is experiencing a fundamental regulatory shift driven by the unprecedented spread of the H5N1 clade in recent years, impacting both commercial flocks and wild birds. While prophylactic mass vaccination is not yet standard, strategic, risk-based deployment is under serious consideration by regulatory bodies in the United States and Canada. This shift represents a massive potential growth opportunity for manufacturers of advanced, DIVA-compatible recombinant vaccines, as any adopted vaccine must not jeopardize the region's high-value export status. This region also serves as a major hub for R&D and advanced vaccine technology innovation.

Europe presents a fragmented market scenario, with most European Union members historically prohibiting routine vaccination to maintain disease-free status necessary for intra-EU and global trade. However, sustained H5N1 pressure has recently led to policy reevaluation, with countries like France initiating large-scale pilot vaccination programs for ducks. This cautious but accelerating acceptance of strategic vaccination programs, coupled with high animal welfare standards, creates demand for premium, highly efficacious, and ethically developed vaccine solutions. Latin America, focused heavily on export (especially Brazil), maintains strict vigilance; while vaccination is limited, localized outbreaks in high-risk zones drive targeted demand. Finally, the Middle East and Africa (MEA) constitute a rapidly growing market, driven by the dual challenges of rapidly expanding commercial poultry sectors and persistent endemic HPAI infections, requiring both basic inactivated vaccines (for cost-effectiveness) and modern, quality-assured products.

- Asia Pacific (APAC): Dominant market share and fastest growth; driven by endemic HPAI, dense poultry populations, and mandatory government vaccination programs (China, Vietnam).

- North America: High potential growth area due to regulatory reconsideration of strategic vaccination programs following severe H5N1 outbreaks; focus on recombinant, DIVA-compatible vaccines.

- Europe: Transitioning from strict non-vaccination policy to pilot programs in specific sectors (e.g., ducks in France); emphasis on high-quality, fully compliant marker vaccines.

- Latin America (LATAM): Market demand highly correlated with export status maintenance; strategic, targeted vaccination for risk mitigation; Brazil and Mexico are key players.

- Middle East and Africa (MEA): Rapidly increasing demand fueled by expansion of commercial poultry operations and high endemic disease burden; significant dependence on governmental tenders.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Avian Influenza Vaccines Market.- Boehringer Ingelheim

- MSD Animal Health (Merck)

- Zoetis

- Ceva Santé Animale

- Elanco Animal Health

- Yebio Bioengineering

- Harbin Veterinary Research Institute (HVRI)

- Ringpu Biology

- Phibro Animal Health

- Vaxxinova

- Medion Farma Jaya

- Shandong Lukang

- Qilu Animal Health

- FATRO S.p.A.

- Biovet Private Limited

- ChengDu QianKun

- Vaksindo Satwa Nusantara

- Beijing Compromise

- Zydus Animal Health

- Novartis Animal Health (Acquired by Elanco/Boehringer)

Frequently Asked Questions

Analyze common user questions about the Avian Influenza Vaccines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of growth in the Avian Influenza Vaccines Market?

The central driver is the persistent and increasing prevalence of Highly Pathogenic Avian Influenza (HPAI) strains globally, particularly H5N1, coupled with the substantial economic imperative to avoid mass culling, trade restrictions, and subsequent losses in the commercial poultry sector.

What is a DIVA vaccine and why is it crucial for market acceptance?

DIVA stands for Differentiating Infected from Vaccinated Animals. These are marker vaccines, usually recombinant, that allow diagnostic tests to distinguish between antibodies produced due to vaccination and those resulting from natural infection by a field strain. DIVA compatibility is crucial for high-value export markets like Europe and North America to maintain disease-free status while implementing strategic vaccination.

Which technological platform is expected to dominate the future Avian Influenza Vaccines market?

Recombinant vector-based vaccines (using viral vectors like rMDV or rFPV) currently dominate advanced markets due to superior safety and DIVA capability. However, next-generation platforms, particularly mRNA vaccines, are expected to rapidly gain share as R&D focuses on their speed, manufacturing flexibility, and potential for cost reduction in high-volume production.

How does the regulatory environment in key poultry exporting regions impact vaccine adoption?

The regulatory environment, particularly the historical non-vaccination stance in major exporters like the US and EU, acts as a primary restraint. This policy, designed to prevent trade disruption, mandates that any adopted vaccine must be highly effective, safe, and, most importantly, DIVA-compatible to ensure market access and avoid trade bans.

What role does Artificial Intelligence play in modern Avian Influenza vaccine development?

AI is pivotal in accelerating pandemic preparedness by utilizing bioinformatics and machine learning to analyze global viral genomic data, accurately predict antigenic drift (future mutations), and optimize strain selection for new vaccine candidates, significantly reducing the time required between outbreak identification and deployment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager