Aviation and Aerospace Insurance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434626 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Aviation and Aerospace Insurance Market Size

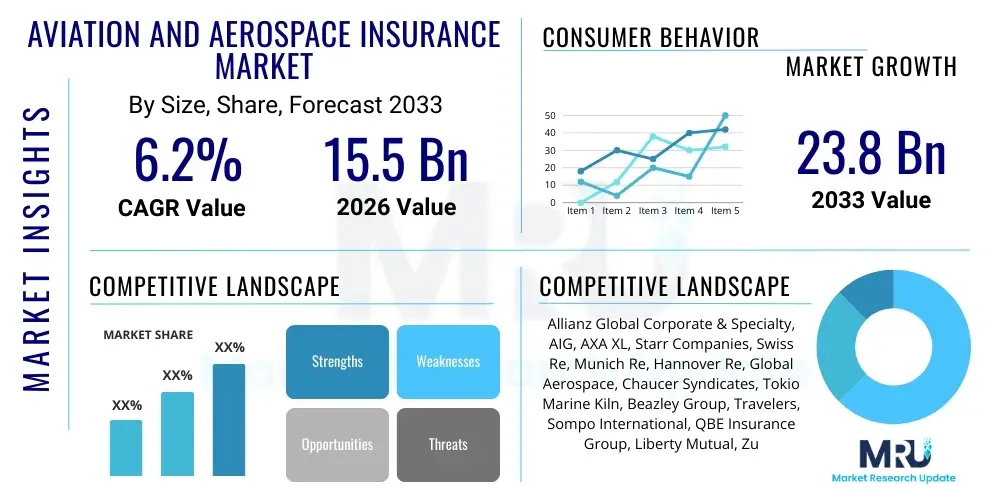

The Aviation and Aerospace Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 23.8 Billion by the end of the forecast period in 2033.

Aviation and Aerospace Insurance Market introduction

The Aviation and Aerospace Insurance Market encompasses specialized risk management products designed to protect assets and liabilities across the entire spectrum of the aviation and space industries. This highly technical segment of the insurance sector provides critical financial safeguards for commercial airlines, general aviation operators, aerospace manufacturers, maintenance, repair, and overhaul (MRO) facilities, and increasingly, commercial space ventures. Coverage typically includes Hull All Risks (physical damage to the aircraft), Hull War Risks, Passenger and Third-Party Liability, Products Liability for manufacturers, and specialized Space Launch and In-Orbit policies. The complexity of these risks, often involving high values and catastrophic potential, necessitates deep underwriting expertise and substantial capital capacity, primarily provided by global reinsurers and specialized syndicates.

The primary applications of aviation insurance are centered around ensuring operational continuity and meeting stringent international regulatory requirements, such as those mandated by the International Civil Aviation Organization (ICAO). Key benefits include comprehensive risk transfer for highly volatile assets, protection against multi-million dollar liability claims arising from accidents, and compliance documentation necessary for flight operations globally. Moreover, for aerospace manufacturers, product liability coverage is paramount, safeguarding against financial repercussions stemming from component failures or design defects in aircraft sold worldwide. This intrinsic link between regulatory adherence and operational viability solidifies the demand for sophisticated insurance solutions.

Driving factors for market expansion are fundamentally tied to the global increase in air traffic, particularly in emerging economies, leading to larger and newer aircraft fleets requiring comprehensive coverage. Furthermore, the rapid commercialization of Low Earth Orbit (LEO) activities, including satellite deployment and nascent space tourism, is creating entirely new risk profiles demanding innovative insurance products. The mandatory nature of liability coverage, coupled with rising asset values due to the acquisition of advanced, expensive aircraft like the Boeing 787 or Airbus A350, continuously pushes the total insured value (TIV) higher, contributing significantly to market growth.

Aviation and Aerospace Insurance Market Executive Summary

The Aviation and Aerospace Insurance Market is defined by intense capital concentration, driven primarily by the cyclical nature of catastrophic losses and the stringent regulatory environment governing global air travel. Current business trends indicate a hardening market environment characterized by increasing premium rates, particularly in liability and hull war coverages, following several years of adverse claims experience and heightened geopolitical risks. Technological advancements, notably the integration of flight data analytics and telematics, are beginning to shift underwriting practices from retrospective analysis to predictive risk modeling, enhancing efficiency for carriers but also increasing data requirement complexity for insured entities. This move toward data-driven decision-making represents a pivotal strategic focus for market leaders aiming to mitigate accumulation risk.

Regionally, North America and Europe currently dominate the market in terms of premium volume, largely due to the presence of major carriers, global reinsurance hubs (such as Lloyd's of London), and the headquarters of major aerospace manufacturers. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate during the forecast period. This accelerated growth is primarily attributed to massive infrastructure investments, burgeoning air passenger traffic, fleet expansion by flag carriers in China and India, and the rising establishment of MRO facilities across Southeast Asia. Latin America and MEA, while smaller, are seeing targeted growth spurred by internal aviation modernization programs and increased defense spending.

Segment trends reveal that the Aviation Liability Insurance segment, covering third-party and passenger claims, remains the largest revenue generator, reflecting the potentially astronomical costs associated with major aviation incidents. Conversely, the Space Risk Insurance segment, though smaller, is experiencing the most significant disruptive growth, propelled by the increasing cadence of private launch services (SpaceX, Blue Origin) and the deployment of large LEO satellite constellations. End-user trends show that Scheduled Airlines maintain the largest market share, but growth in the General Aviation and Business Jet sectors is contributing meaningful premium increases, driven by increased high-net-worth individual travel and fractional ownership models.

AI Impact Analysis on Aviation and Aerospace Insurance Market

User queries regarding the impact of Artificial Intelligence (AI) frequently center on how these technologies will mitigate inherent industry risks and streamline traditionally cumbersome processes like complex claims assessment and manual underwriting. Key themes include the use of machine learning (ML) for superior catastrophic event modeling, enabling insurers to better manage accumulation risk across global portfolios. Users are also intensely focused on AI's role in processing vast datasets generated by modern aircraft sensors and flight recorders, aiming for real-time risk assessment and preventative underwriting adjustments, thereby moving the industry toward truly proactive insurance solutions rather than reactive claims handling. Expectations are high that AI will significantly reduce operational expenses and provide a competitive edge in pricing accuracy.

The integration of AI technologies, particularly in predictive analytics and computer vision, is fundamentally transforming the assessment of Hull damage and MRO risk. Insurers are leveraging AI algorithms to analyze satellite imagery, drone inspections, and sensor data from maintenance logs to automatically detect potential physical damage or operational anomalies before they escalate into high-cost incidents. This predictive capability is vital in an industry where asset values are extremely high and downtime is prohibitively expensive. Moreover, AI-driven natural language processing (NLP) is being deployed to rapidly analyze voluminous policy documents, regulatory changes, and historical claim data, significantly speeding up the policy issuance and renewal cycle for specialized coverages.

However, concerns revolve around data privacy, regulatory compliance across different jurisdictions (especially regarding flight data), and the potential for algorithmic bias in risk selection, which could lead to unfair pricing or exclusion of specific aviation sectors. Despite these challenges, the consensus among market participants is that AI adoption is inevitable and essential for maintaining profitability in a high-severity, low-frequency claim environment. AI enables more granular risk segmentation, allowing underwriters to move beyond traditional factors like fleet age and route complexity to incorporate dynamic operational metrics, thereby refining pricing and capital deployment strategies.

- AI enhances catastrophic risk modeling and exposure assessment precision.

- Machine Learning (ML) automates complex claims triage and settlement processes.

- Predictive maintenance driven by AI reduces aircraft downtime and subsequent claims frequency.

- Natural Language Processing (NLP) accelerates analysis of policy documentation and regulatory text.

- Improved fraud detection in general aviation claims through pattern recognition algorithms.

- AI enables granular, dynamic pricing based on real-time flight operational data (telematics).

DRO & Impact Forces Of Aviation and Aerospace Insurance Market

The Aviation and Aerospace Insurance Market is powerfully influenced by a unique set of Drivers, Restraints, and Opportunities (DRO), which collectively shape the impact forces defining its trajectory. Key drivers include the consistent long-term growth of global air passenger travel, particularly in emerging markets, necessitating constant fleet expansion and modernization. The stringent and non-negotiable regulatory environment—requiring high levels of liability coverage globally—acts as a continuous demand floor for the insurance market. Furthermore, the rapid expansion of the commercial space industry, encompassing launch services and large-scale satellite constellations, is introducing novel, high-value risks that insurers are keen to underwrite, albeit cautiously. These drivers create an expansive environment for premium growth and specialized product development.

Conversely, the market faces significant restraints, primarily stemming from the inherently high capital requirements needed to cover catastrophic risks. Major aviation disasters or large-scale product liability claims (e.g., related to aircraft groundings) can lead to billions of dollars in losses, significantly eroding underwriting profitability and leading to extreme market hardening cycles. Geopolitical instability and increasing instances of Hull War and Terrorism risks necessitate specialized, expensive coverage, often leading to capital constraints. Furthermore, the limited pool of highly specialized underwriting expertise globally poses a bottleneck to growth, especially in emerging high-risk areas like cyber liability for air traffic control systems and space assets. The volatility associated with low-frequency, high-severity events makes consistent long-term pricing difficult.

Opportunities for innovation are abundant, particularly driven by technological transformation. The proliferation of Unmanned Aerial Systems (UAS) or drones across commercial applications (delivery, inspection, surveillance) demands specialized insurance products tailored to unique operational and liability risks. The nascent but rapidly growing sector of urban air mobility (UAM) and air taxis, utilizing electric vertical takeoff and landing (eVTOL) aircraft, presents an entirely new ecosystem requiring tailored hull, liability, and product coverage solutions. The increasing reliance on telematics and IoT data from aircraft also provides an opportunity for insurers to transition toward proactive risk management partnerships with airlines, moving beyond traditional indemnity models to offer integrated risk prevention services. The impact forces are thus heavily skewed toward technological adaptation and regulatory compliance.

Segmentation Analysis

The Aviation and Aerospace Insurance Market is comprehensively segmented across several dimensions, allowing for precise risk assessment and tailored product offerings. The core segmentation is typically structured by the Type of Coverage, the specific Application or End-User, and the geographical region. Type segmentation defines the fundamental nature of the risk being covered, ranging from damage to physical assets (Hull All Risks) to financial obligations arising from injury or damage to third parties (Liability). Application segmentation focuses on the operational domain, distinguishing between high-frequency commercial airline risks and specialized, one-off space launches.

Furthermore, end-user segmentation is critical as it dictates the risk profile and required limits of indemnity. A large multinational aerospace manufacturer requires extensive product liability coverage covering defects across its global supply chain, which is vastly different from the requirements of a regional general aviation operator needing primarily hull and basic third-party liability coverage. The structure of these segments reflects the highly differentiated risk landscape within the broader aviation ecosystem. Analyzing these segments provides market participants with strategic insights into where capital should be deployed and which areas are driving the fastest premium growth, particularly as technologies like eVTOLs and commercial space missions introduce new complexity and exposure.

- By Type of Coverage:

- Aviation Hull Insurance (Physical Damage)

- Aviation Liability Insurance (Passenger, Cargo, Third-Party)

- Aviation Cargo Insurance

- Aviation Personal Accident Insurance

- Aviation Products Liability Insurance

- Grounding and Maintenance Insurance

- Hull War and Allied Risks

- By Application/End-User:

- Scheduled Airlines

- General Aviation (Private Jets, Helicopters)

- Aerospace Manufacturing and MRO

- Airports and Ground Operations

- Space Risks (Launch, In-Orbit, Satellite Manufacturing)

- Drones and Unmanned Aerial Systems (UAS)

- By Region:

- North America (U.S., Canada)

- Europe (UK, Germany, France)

- Asia Pacific (China, India, Japan)

- Latin America (Brazil, Mexico)

- Middle East and Africa (UAE, South Africa)

Value Chain Analysis For Aviation and Aerospace Insurance Market

The value chain for Aviation and Aerospace Insurance is highly specialized, beginning with the upstream providers who supply the necessary capital and risk data. Upstream activities are dominated by global reinsurers and retrocessionaires, such as Munich Re, Swiss Re, and Hannover Re, who provide the critical capacity required to underwrite catastrophic exposures, often structuring complex treaty and facultative reinsurance arrangements. Additionally, actuarial consultants, specialized risk modeling firms, and flight data analytics providers occupy the upstream space by supplying the proprietary data and analytical tools essential for accurate risk pricing and accumulation control. The capacity provided by these entities is non-negotiable, given the multi-billion-dollar exposures inherent in insuring large commercial aircraft fleets or space launches.

The core of the value chain involves the direct underwriting and brokerage functions. This middle layer includes insurance companies (carriers) and specialized insurance brokers (like Marsh McLennan, Aon, and Willis Towers Watson). Brokers act as crucial intermediaries, leveraging their deep industry knowledge to match the complex risks of airlines and manufacturers with appropriate carrier capacity across global markets, primarily London (Lloyd's), Zurich, and Bermuda. Direct underwriters analyze, assess, and price the risk, issuing policies and managing the portfolio. The nature of this market dictates that the distribution channel is predominantly indirect, utilizing specialized brokers who possess the technical expertise necessary to structure bespoke coverage packages that meet global regulatory and client-specific needs, unlike simpler personal or commercial lines.

Downstream activities involve the ultimate consumers of the insurance products—the airlines, general aviation operators, aerospace manufacturers, and space companies—along with the supporting infrastructure like MROs and airports. Post-incident, the downstream phase also includes claims adjusters and legal professionals who handle complex cross-border litigation and claims settlement. The distribution channel is heavily concentrated on specialized aviation insurance brokers, though some major airlines may deal directly with lead underwriters for certain high-volume lines. This reliance on highly skilled intermediaries ensures that the complex policies, often involving multiple international co-insurers and reinsurers, are correctly placed and serviced, maintaining the efficiency and stability of this highly technical market segment.

Aviation and Aerospace Insurance Market Potential Customers

The core potential customers for Aviation and Aerospace Insurance are segmented based on their operational domain and the scale of their physical and liability exposures. Scheduled commercial airlines, encompassing both passenger and dedicated cargo carriers, represent the largest customer base. These entities require comprehensive Hull All Risks coverage for their fleets, extensive Passenger and Third-Party Liability limits mandated by international conventions (like the Montreal Convention), and specialized coverage for ground risks and war exposures. Their constant need for high-limit policies, driven by continuous operations and high asset values, anchors the market demand.

The second major customer segment includes aerospace manufacturers, component suppliers, and MRO facilities. For this group, the critical insurance requirement is Products Liability, which protects them against claims arising from alleged defects in the design, manufacture, or repair of aircraft components that subsequently lead to an incident. Given the long lifespan of aircraft and components, this coverage must often extend decades beyond the initial sale, making it one of the most complex and long-tail liability exposures in the insurance market. This segment often demands global coverage capabilities to address international sales and regulatory obligations across multiple jurisdictions.

Emerging and high-growth customer groups include space launch service providers (e.g., private rocket companies) and satellite operators, requiring specialized Launch Insurance (covering assets from ignition through orbital insertion) and In-Orbit Insurance (protecting against operational failure or premature decay once operational). Furthermore, the rapidly expanding General Aviation sector, including business jet operators and corporate flight departments, represents a growing customer segment requiring tailored hull and liability coverages distinct from large commercial fleets, often involving specialized security and privacy considerations due to the nature of their clientele. Airports and Air Traffic Control organizations also constitute essential customers, requiring Public Liability and, increasingly, comprehensive Cyber Liability coverage to protect against system failures.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 23.8 Billion |

| Growth Rate | 6.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Allianz Global Corporate & Specialty, AIG, AXA XL, Starr Companies, Swiss Re, Munich Re, Hannover Re, Global Aerospace, Chaucer Syndicates, Tokio Marine Kiln, Beazley Group, Travelers, Sompo International, QBE Insurance Group, Liberty Mutual, Zurich Insurance Group, Lloyd's of London Syndicates, Generali Global Corporate & Commercial, Willis Towers Watson (Broker), Marsh McLennan (Broker) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aviation and Aerospace Insurance Market Key Technology Landscape

The technological landscape of the Aviation and Aerospace Insurance market is increasingly defined by data capture, advanced analytics, and digitalization aimed at enhancing risk quantification and operational efficiency. The adoption of telematics and Internet of Things (IoT) sensors within modern aircraft, engines, and ground equipment is providing insurers with unprecedented levels of real-time operational data. This data, including engine performance metrics, flight paths, pilot handling scores, and maintenance alerts, is crucial for moving away from historical loss ratios toward truly predictive underwriting models. This transition is essential for pricing complex and high-value risks accurately, allowing insurers to offer incentives for superior safety management and maintenance practices.

Advanced computing technologies, particularly Machine Learning (ML) and sophisticated Catastrophic (CAT) modeling software, are fundamentally improving the ability of reinsurers and major carriers to assess accumulation risk. Given that a single event can impact multiple carriers and reinsurers across different policy layers, the ability to model interdependencies, such as simultaneous groundings or supply chain disruptions following a regional crisis, is paramount. Furthermore, in the niche but growing space sector, high-fidelity modeling and simulation software are utilized to predict the success probability of a launch and the orbital environment risks (e.g., debris collisions), upon which premiums for launch policies are heavily dependent.

Furthermore, digitalization efforts are centered on improving the policy lifecycle. The use of blockchain technology is being explored to create immutable, transparent smart contracts for certain reinsurance treaties, reducing friction and counterparty risk in claims settlement. Automated claim processing systems utilizing AI-driven image analysis (for hull damage) and Natural Language Processing (NLP) are streamlining the often prolonged and complex claims procedures. These digital initiatives not only reduce administrative costs but also enhance the speed and transparency of interactions between carriers, brokers, and the insured, meeting the increasingly demanding operational requirements of global aviation entities.

Regional Highlights

- North America: This region represents the largest and most mature market for aviation insurance, driven by the presence of major global airlines, leading aerospace manufacturers (Boeing, Lockheed Martin), and a high concentration of sophisticated general aviation operations. The US market dictates many global standards in terms of policy limits and liability expectations. High adoption rates of advanced technology for risk management, coupled with substantial capital capacity from US-based primary carriers, solidify its dominant position. Growth is steady, focused on integrating new risks related to UAS and advanced military aerospace projects, requiring specialized government contract and liability coverage.

- Europe: Europe is characterized by significant capital depth and influence, largely centered around the Lloyd's of London market. Lloyd's syndicates are pivotal in writing the most complex, high-risk, and global aviation accounts, including excess liability and specialized war risk covers. Continental Europe hosts major manufacturers (Airbus) and large flag carriers, driving substantial premium volume. The region focuses heavily on stringent regulatory compliance (EASA) and is a leader in implementing sustainable aviation risk policies, addressing climate-related transition risks and associated coverage demands.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by massive demographic shifts, burgeoning middle-class air travel demand, and rapid fleet expansion across China, India, and Southeast Asia. The region is seeing substantial investment in airport infrastructure and MRO capabilities. While local insurance capacity is growing, major risks are still largely reinsured through Western markets. Key growth drivers include the establishment of new low-cost carriers (LCCs) and increased military/defense aviation modernization programs, creating urgent demand for capacity and technical expertise in underwriting.

- Latin America: This market faces challenges related to economic volatility and currency fluctuations, which impact premium stability and asset valuations. The demand for aviation insurance is steadily increasing, driven by domestic air traffic growth and modernization of regional carriers. Insurers often focus on providing tailored solutions to manage specific local political and operational risks, necessitating strong regional partnerships and co-insurance arrangements to mitigate exposure concentration.

- Middle East and Africa (MEA): Growth in the MEA region is concentrated around major hubs in the UAE and Qatar, home to some of the world's largest international carriers, demanding high-value hull and liability policies. The region also exhibits significant growth in defense and governmental aviation sectors. The geopolitical environment necessitates a high degree of specialization in war, political violence, and terrorism insurance, often requiring carriers to rely heavily on London market capacity for comprehensive coverage solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aviation and Aerospace Insurance Market.- Allianz Global Corporate & Specialty (AGCS)

- American International Group (AIG)

- AXA XL

- Starr Companies

- Swiss Re Corporate Solutions

- Munich Re

- Hannover Re

- Global Aerospace Inc.

- Chaucer Syndicates (A member of the China Re Group)

- Tokio Marine Kiln

- Beazley Group

- Travelers Companies Inc.

- Sompo International Holdings Ltd.

- QBE Insurance Group

- Liberty Mutual Insurance

- Zurich Insurance Group

- Marsh McLennan (Broker)

- Aon plc (Broker)

- Willis Towers Watson (Broker)

- Generali Global Corporate & Commercial

Frequently Asked Questions

Analyze common user questions about the Aviation and Aerospace Insurance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving premium increases in the Aviation Insurance Market?

The primary driver is the volatility associated with catastrophic losses (high-severity, low-frequency events), coupled with rising geopolitical risks necessitating costly Hull War coverage. Additionally, the increasing value of new generation aircraft and escalating liability claim settlements contribute significantly to premium hardening.

How does the commercial space industry influence the demand for specialized aviation insurance?

The burgeoning commercial space sector creates novel risk classes, specifically Launch Insurance (covering assets during flight until orbital insertion) and In-Orbit Insurance (covering operational satellites). This segment, while niche, requires massive underwriting capacity and is characterized by high, specialized premiums.

Which segmentation component generates the largest revenue share in the Aviation Insurance Market?

The Aviation Liability Insurance segment, encompassing passenger, cargo, and third-party liability coverage, consistently generates the largest revenue share due to the stringent international regulatory mandates requiring extremely high limits of indemnity to cover potential catastrophic injury and damage claims.

What role does telematics and flight data analytics play in modern aviation underwriting?

Telematics enables underwriters to move toward predictive risk modeling by analyzing real-time operational data (e.g., flight performance, maintenance status). This data helps insurers offer dynamic pricing, incentivize safer operations, and proactively mitigate risks, shifting focus from reactive claims management to preventative risk partnership.

Why is the Asia Pacific region projected to have the highest growth rate for aviation insurance?

The APAC region is experiencing accelerated growth driven by massive expansion of air passenger traffic, aggressive fleet modernization programs by regional carriers, and significant infrastructure investments in new airports and MRO facilities, all of which necessitate substantial new insurance capacity and technical expertise.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager