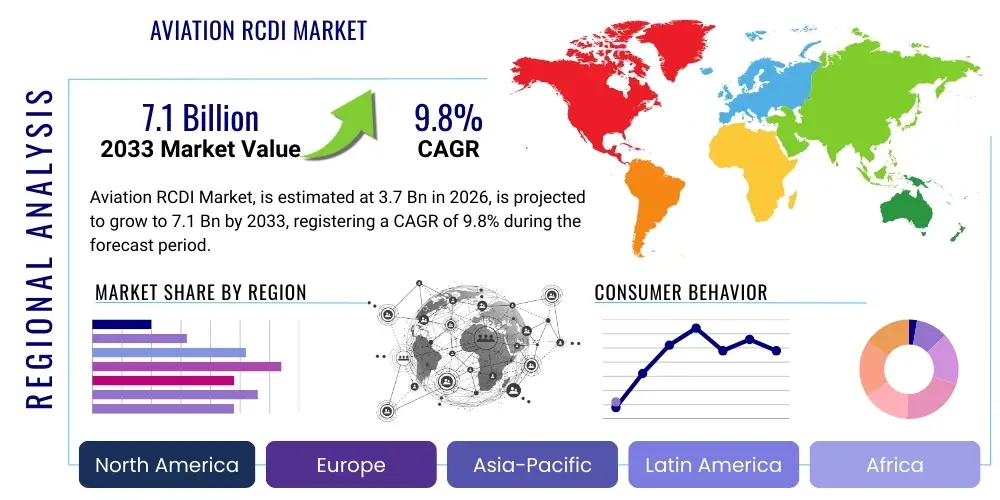

Aviation RCDI Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439426 | Date : Jan, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Aviation RCDI Market Size

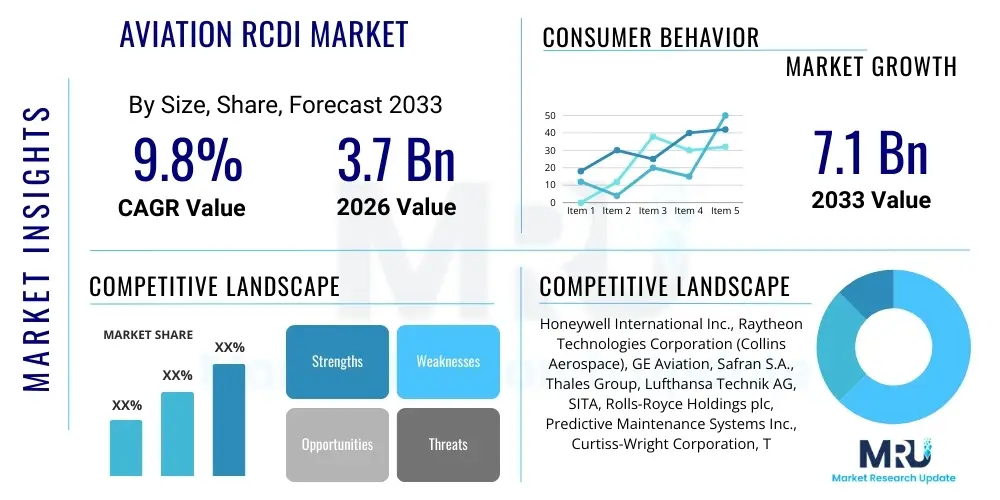

The Aviation RCDI Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 3.7 Billion in 2026 and is projected to reach USD 7.1 Billion by the end of the forecast period in 2033.

Aviation RCDI Market introduction

The Aviation Remote Control and Diagnostic Interface (RCDI) market encompasses a sophisticated array of technologies designed to facilitate real-time monitoring, control, and data exchange for various aviation systems and components from a remote location. This rapidly evolving market is central to modernizing aircraft operations, maintenance, and air traffic management by enabling seamless digital communication between ground control centers, maintenance hubs, and airborne systems. The core product offering includes integrated hardware and software solutions, advanced sensors, communication modules, and analytical platforms that process the vast amounts of data generated, transforming raw telemetry into actionable insights.

Major applications of Aviation RCDI systems span across aircraft health monitoring (AHM), predictive maintenance, in-flight entertainment and connectivity (IFEC), ground support operations, and air traffic management (ATM). These systems enhance operational efficiency by providing critical data on engine performance, structural integrity, avionics status, and environmental conditions, thereby enabling proactive decision-making. The inherent benefits derived from RCDI adoption are multi-faceted, including significant improvements in flight safety through early fault detection, substantial reductions in maintenance costs by shifting from scheduled to condition-based maintenance, and optimized fleet utilization due to minimized downtime.

Key driving factors propelling the growth of the Aviation RCDI market include the increasing demand for enhanced operational safety and efficiency across commercial and military aviation sectors. The rapid digital transformation within the aerospace industry, coupled with the proliferation of Internet of Things (IoT) devices and advanced sensor technologies, creates a fertile ground for RCDI expansion. Furthermore, stringent regulatory requirements for aircraft performance monitoring and a growing emphasis on predictive maintenance strategies are compelling airlines and MRO providers to invest heavily in these advanced remote interface solutions, fostering innovation and wider adoption.

Aviation RCDI Market Executive Summary

The Aviation RCDI market is experiencing robust growth, primarily fueled by the aviation industry's pervasive drive towards digital transformation and enhanced operational efficiencies. Current business trends indicate a strong move towards integrated solutions that combine advanced data analytics, artificial intelligence, and cloud computing with traditional RCDI functionalities, creating comprehensive platforms for aircraft management. There is an increasing focus on cybersecurity robustness within RCDI systems, as the heightened connectivity also introduces new vulnerabilities. Strategic collaborations between technology providers, OEMs, airlines, and MRO service providers are becoming more common, aiming to develop end-to-end, tailor-made solutions that address specific operational challenges.

Regionally, North America and Europe continue to dominate the market due to early adoption of advanced aviation technologies, substantial R&D investments, and the presence of major industry players and defense contractors. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market, propelled by significant expansion in air travel, substantial investments in new aircraft fleets, and a burgeoning demand for modern MRO services. Latin America and the Middle East & Africa (MEA) are also showing promising growth, albeit from a smaller base, driven by fleet modernization initiatives and the need to improve operational efficiencies in developing aviation infrastructures. Government support for aerospace innovation and infrastructure development in these regions further contributes to market uptake.

Segment trends within the Aviation RCDI market highlight the increasing prominence of software and services components over traditional hardware sales. This shift reflects a move towards subscription-based models and value-added services such as data analytics, predictive modeling, and system integration. The commercial aviation sector remains the largest end-user segment, with airlines heavily investing in RCDI for aircraft health monitoring and predictive maintenance to reduce operational costs and enhance safety. The military and defense sector also represents a significant segment, leveraging RCDI for mission-critical diagnostics and operational readiness. Furthermore, the rising adoption of RCDI in smaller aircraft types, including business jets and UAVs, is diversifying the market landscape, indicating a broadening application scope beyond large commercial carriers.

AI Impact Analysis on Aviation RCDI Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Aviation RCDI market frequently revolve around its potential to revolutionize predictive maintenance, enhance operational decision-making, and automate complex diagnostic processes. Users are keenly interested in how AI can move RCDI systems beyond mere data collection to proactive, intelligent insights, questioning the efficacy of AI in detecting subtle anomalies, predicting component failures with greater accuracy, and optimizing maintenance schedules to minimize unscheduled downtime. There is also significant curiosity about the integration challenges of AI with existing legacy RCDI infrastructure, the required data infrastructure for effective AI implementation, and the implications for human roles in aircraft maintenance and operations. Concerns regarding data security, algorithmic bias, and the regulatory framework for AI-driven autonomous decisions within safety-critical aviation systems are also prominent, underscoring a desire for robust, transparent, and certified AI solutions.

The integration of AI fundamentally transforms RCDI from a reactive or rule-based system into a highly intelligent, self-optimizing platform capable of learning from vast datasets. This enables unprecedented levels of precision in identifying potential issues long before they manifest as critical failures. AI algorithms can analyze correlations and patterns across millions of flight hours, environmental conditions, and maintenance records, uncovering insights that human analysts might miss. This proactive capability is crucial for enhancing safety, as it allows for preventative actions, reducing the likelihood of in-flight emergencies or costly groundings. Moreover, AI aids in the optimization of resource allocation for maintenance, ensuring parts and personnel are available precisely when and where they are needed, thereby streamlining operations and reducing logistical overheads.

However, the successful deployment of AI within the Aviation RCDI market is contingent upon addressing several key challenges, including the need for high-quality, labeled datasets, overcoming computational limitations for real-time processing, and developing robust validation and verification methods for AI models in safety-critical applications. The ethical implications of AI, particularly concerning accountability and transparency in autonomous decision-making, also require careful consideration and the establishment of clear industry standards. Despite these hurdles, the transformative potential of AI to unlock new levels of efficiency, safety, and cost-effectiveness makes it an indispensable component of the future Aviation RCDI landscape, driving innovation in diagnostics, prognostics, and autonomous operational support systems.

- Enhanced Predictive Maintenance: AI algorithms analyze sensor data to forecast equipment failures before they occur, optimizing maintenance schedules and reducing unscheduled downtime.

- Real-time Anomaly Detection: AI identifies subtle deviations from normal operating parameters in real-time, alerting operators to potential issues that could escalate.

- Optimized Operational Efficiency: AI assists in route optimization, fuel efficiency analysis, and resource allocation by processing complex operational data.

- Automated Diagnostics: AI-powered systems can perform initial diagnostics, pinpointing the root cause of malfunctions faster and more accurately.

- Improved Decision Support: AI provides insights and recommendations to pilots, air traffic controllers, and maintenance crews, aiding in complex decision-making processes.

- Adaptive Learning Systems: AI continuously learns from new data, improving the accuracy and effectiveness of RCDI systems over time.

- Enhanced Cybersecurity: AI can detect and respond to cyber threats in RCDI networks by identifying unusual patterns and behaviors.

- Reduced Human Error: Automation of routine monitoring and diagnostic tasks through AI minimizes the potential for human oversight.

DRO & Impact Forces Of Aviation RCDI Market

The Aviation RCDI market is subject to a complex interplay of Drivers, Restraints, and Opportunities (DRO) that collectively define its trajectory and the impact forces shaping its evolution. Key drivers include the relentless pursuit of enhanced safety standards within the aviation industry, which necessitates sophisticated monitoring and diagnostic capabilities to prevent incidents and ensure compliance with regulatory mandates. The increasing operational costs associated with traditional reactive maintenance approaches further compel airlines and operators to adopt RCDI systems for predictive maintenance, thereby reducing ground time, optimizing MRO expenditure, and improving aircraft availability. Moreover, the global surge in air passenger traffic and freight volumes places immense pressure on existing infrastructure and operational models, driving demand for RCDI solutions that streamline air traffic management and ground operations. The broader trend of digital transformation across industries, coupled with advancements in IoT, cloud computing, and sensor technologies, provides the technological backbone for RCDI market expansion.

Despite the compelling drivers, several significant restraints challenge the market's growth. The substantial initial capital investment required for implementing comprehensive RCDI systems, including advanced hardware, specialized software, and integration services, poses a barrier for many smaller airlines and MRO providers. The complex integration of new RCDI solutions with existing legacy systems, which often rely on disparate technologies and data formats, presents significant technical and operational hurdles. Furthermore, the highly sensitive nature of aviation data necessitates robust cybersecurity measures, and concerns over data privacy and the potential for cyberattacks on critical RCDI infrastructure represent a major restraint. The shortage of skilled personnel capable of managing, interpreting, and maintaining advanced RCDI systems, especially those integrating AI and complex analytics, also limits widespread adoption. Stringent regulatory approval processes for new technologies in aviation can further prolong deployment timelines and increase costs.

However, numerous opportunities are emerging that promise to unlock new growth avenues for the Aviation RCDI market. The escalating demand for predictive and prescriptive maintenance solutions, driven by their proven ability to significantly reduce operational disruptions and costs, offers a fertile ground for innovation and market penetration. The advent of 5G technology and satellite internet for airborne applications is set to dramatically enhance real-time data transmission capabilities, enabling more sophisticated RCDI applications and services. The development of autonomous aircraft and urban air mobility (UAM) platforms will inherently require highly advanced and reliable RCDI systems for safe and efficient operations, opening up entirely new market segments. Moreover, opportunities exist in the provision of data-as-a-service and analytics-as-a-service models, allowing smaller operators to leverage RCDI benefits without the heavy upfront investment. The continuous evolution of AI and machine learning will further refine diagnostic accuracy and predictive capabilities, creating new value propositions for RCDI solution providers and end-users alike.

Segmentation Analysis

The Aviation RCDI market is extensively segmented to reflect the diverse applications, technological components, and end-user needs within the global aviation ecosystem. This segmentation provides a granular view of market dynamics, enabling stakeholders to identify specific growth areas and tailor strategies effectively. The market can be broadly categorized by component, application, aircraft type, deployment model, and end-user, each offering unique insights into the demand landscape and technological adoption patterns. Analyzing these segments is crucial for understanding competitive landscapes, identifying niche markets, and forecasting future trends in this technologically advanced and rapidly evolving sector.

- By Component

- Hardware

- Sensors (Temperature, Pressure, Vibration, Acoustic)

- Transceivers and Communication Modules

- Data Acquisition Units (DAUs)

- Control Units

- Gateways and Routers

- Software

- Data Analytics and Visualization Software

- Predictive Maintenance Software

- Fleet Management Software

- Diagnostic Software

- Cybersecurity Software

- Services

- System Integration and Installation

- Consulting and Training

- Maintenance and Support

- Managed Services

- Data Management and Cloud Services

- Hardware

- By Application

- Aircraft Health Monitoring (AHM)

- Predictive Maintenance and Diagnostics

- Air Traffic Management (ATM)

- In-Flight Entertainment and Connectivity (IFEC)

- Ground Operations and Logistics

- Cockpit and Avionics Systems

- Remote Control of UAVs/Drones

- By Aircraft Type

- Commercial Aircraft (Narrow-body, Wide-body, Regional Jets)

- Military Aircraft (Fighters, Transports, Surveillance)

- Business Jets

- Helicopters

- Unmanned Aerial Vehicles (UAVs)/Drones

- By Deployment Model

- On-Premise

- Cloud-Based

- Hybrid

- By End-User

- Airlines

- MRO (Maintenance, Repair, and Overhaul) Providers

- OEMs (Original Equipment Manufacturers)

- Air Navigation Service Providers (ANSPs)

- Defense and Government Agencies

- Aircraft Leasing Companies

Value Chain Analysis For Aviation RCDI Market

The value chain for the Aviation RCDI market is a complex ecosystem involving various specialized entities, from raw material suppliers to end-users, each contributing to the creation and delivery of sophisticated remote control and diagnostic solutions. Upstream activities in this value chain primarily involve research and development of core technologies and the manufacturing of essential components. This includes semiconductor manufacturers providing microprocessors and memory, sensor technology developers offering highly precise data acquisition units for various parameters (e.g., vibration, temperature, pressure), communication module developers for robust data transfer, and specialized software firms creating foundational operating systems and development kits for RCDI platforms. These foundational elements are critical for the functionality and performance of any RCDI system, necessitating stringent quality control and innovation at this initial stage.

Midstream in the value chain, system integrators and RCDI solution providers play a pivotal role. These entities take the disparate hardware and software components from upstream suppliers and integrate them into cohesive, functional RCDI systems tailored for specific aviation applications. This involves custom software development for data analytics, user interfaces, and predictive modeling, as well as the integration of communication protocols to ensure interoperability across various aircraft systems and ground control infrastructure. Value-added services such as cloud hosting for data storage, cybersecurity solutions for data protection, and artificial intelligence/machine learning algorithm development for advanced prognostics are also significant midstream contributions, transforming raw data into actionable intelligence for operators.

Downstream activities involve the distribution, implementation, and ongoing support of RCDI systems to the end-users. Distribution channels can be both direct and indirect. Direct channels involve OEMs and large RCDI solution providers selling directly to airlines, MRO organizations, or defense agencies, often through long-term contracts for system procurement and maintenance. Indirect channels typically involve specialized aerospace distributors, value-added resellers (VARs), and channel partners who offer RCDI solutions alongside other aviation technologies, often providing localized support and integration services. Post-sales support, including training, technical assistance, software updates, and hardware maintenance, forms a critical part of the downstream value chain, ensuring the longevity and optimal performance of these complex systems throughout their operational lifecycle and directly impacting customer satisfaction and repeat business.

Aviation RCDI Market Potential Customers

The Aviation RCDI market serves a diverse range of potential customers, all seeking to enhance operational safety, efficiency, and cost-effectiveness through advanced digital interfaces. Airlines represent a primary segment of end-users, constantly seeking to optimize their fleet performance, reduce unscheduled maintenance events, and improve passenger experience through reliable connectivity and entertainment systems. For airlines, RCDI translates into significant savings by transitioning from time-based maintenance to condition-based or predictive maintenance, extending component life, and minimizing aircraft downtime, which directly impacts their profitability and schedule adherence. The ability to remotely monitor aircraft systems in real-time provides unprecedented visibility into fleet health, enabling proactive decision-making and preventing minor issues from escalating into major operational disruptions.

Maintenance, Repair, and Overhaul (MRO) providers constitute another critical customer base. These organizations leverage RCDI systems to streamline their diagnostic processes, improve repair turnaround times, and enhance the overall efficiency of their service offerings. RCDI data allows MROs to better anticipate parts requirements, pre-position resources, and execute targeted maintenance tasks, leading to faster service delivery and reduced operational costs. The integration of RCDI with their enterprise resource planning (ERP) systems enables a more holistic view of aircraft maintenance history and future needs. Original Equipment Manufacturers (OEMs), such as aircraft manufacturers and component suppliers, are also significant customers, integrating RCDI capabilities directly into new aircraft designs to offer value-added services and competitive differentiation, often bundling these solutions as part of their long-term service contracts.

Furthermore, Air Navigation Service Providers (ANSPs) utilize RCDI for improved air traffic management, enabling more precise tracking and communication with airborne assets, thus enhancing airspace safety and capacity. Defense and government agencies represent a robust and growing customer segment, employing RCDI for critical military aircraft diagnostics, surveillance drone operations, and maintaining operational readiness in highly demanding environments. For these entities, the reliability, security, and performance of RCDI systems are paramount for mission success. Lastly, aircraft leasing companies are increasingly interested in RCDI data to monitor the health and operational history of their leased assets, which assists in valuation, maintenance planning, and end-of-lease inspections, ensuring asset integrity and maximizing residual value across their portfolio.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.7 Billion |

| Market Forecast in 2033 | USD 7.1 Billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Honeywell International Inc., Raytheon Technologies Corporation (Collins Aerospace), GE Aviation, Safran S.A., Thales Group, Lufthansa Technik AG, SITA, Rolls-Royce Holdings plc, Predictive Maintenance Systems Inc., Curtiss-Wright Corporation, Teledyne Controls, Airbus S.A.S., Boeing Global Services, L3Harris Technologies, Inc., Embraer S.A., Dassault Aviation, BAE Systems plc, Meggitt PLC, Liebherr-Aerospace, Rockwell Collins (now part of Collins Aerospace) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aviation RCDI Market Key Technology Landscape

The Aviation RCDI market is underpinned by a dynamic and continuously evolving technology landscape, where innovation is driven by the need for greater efficiency, safety, and connectivity in aviation. At its core, the market leverages advanced sensor technologies, which are instrumental in collecting vast amounts of real-time data from various aircraft systems, including engines, avionics, landing gear, and structural components. These sensors, ranging from highly sensitive accelerometers and gyroscopes to temperature and pressure transducers, are designed for extreme operational environments and precision. Coupled with robust data acquisition units (DAUs), they form the foundation for converting physical parameters into digital signals that can be transmitted and analyzed, ensuring comprehensive monitoring of an aircraft's health and performance throughout its lifecycle.

Communication technologies form another critical pillar, facilitating the seamless exchange of data between airborne systems and ground-based infrastructure. This includes a mix of satellite communication (SATCOM), cellular networks (4G/5G), aircraft communication addressing and reporting system (ACARS), and secure Wi-Fi and Ethernet protocols. The emergence of 5G technology is particularly transformative, promising ultra-low latency and high-bandwidth connectivity essential for real-time data streaming and control applications, particularly for advanced air traffic management and autonomous operations. Cloud computing platforms play a crucial role in processing, storing, and analyzing the immense volumes of data generated by RCDI systems, offering scalable and flexible infrastructure that supports complex analytics and machine learning algorithms. Edge computing is also gaining traction, enabling localized data processing and faster decision-making directly on the aircraft, reducing reliance on constant cloud connectivity and mitigating latency issues for critical functions.

Furthermore, the integration of Artificial Intelligence (AI) and Machine Learning (ML) is rapidly redefining the capabilities of RCDI systems. AI algorithms are deployed for predictive maintenance, anomaly detection, and operational optimization, learning from historical data to identify patterns that indicate potential failures before they occur. This allows for a shift from reactive to proactive maintenance strategies, significantly improving aircraft availability and reducing costs. Cybersecurity solutions are paramount within this connected landscape, utilizing advanced encryption, intrusion detection systems, and secure protocols to protect sensitive aviation data and prevent unauthorized access or malicious attacks on critical control systems. Blockchain technology is also being explored for enhancing data integrity and traceability within the aviation maintenance record ecosystem, providing an immutable ledger for component history and repair actions. These technologies collectively enable the advanced remote monitoring, control, and diagnostic capabilities that define the modern Aviation RCDI market, continuously pushing the boundaries of what is possible in connected aviation.

Regional Highlights

- North America: North America stands as a dominant force in the Aviation RCDI market, largely attributed to its well-established aerospace industry, significant defense spending, and early adoption of advanced technologies. The region is home to major aircraft manufacturers, leading avionics suppliers, and prominent MRO service providers, fostering a robust ecosystem for RCDI innovation and deployment. Airlines in North America have been at the forefront of implementing predictive maintenance solutions and digital fleet management systems to enhance operational efficiency and comply with stringent regulatory standards. Heavy investment in R&D, particularly in areas like AI, IoT, and cybersecurity for aviation, further solidifies its market leadership. The presence of a highly skilled workforce and strong government support for aerospace technology advancements also contributes significantly to the region's strong market position, driving continuous growth in both commercial and military RCDI applications.

- Europe: Europe represents another substantial market for Aviation RCDI, characterized by a mature aerospace industry, a strong focus on safety and environmental regulations, and significant investments in research and development. Countries like France, Germany, and the UK are key players, housing major aircraft manufacturers, engine makers, and a network of advanced MRO facilities. The region's emphasis on harmonized air traffic management (ATM) systems, such as the Single European Sky (SES) initiative, drives the demand for sophisticated RCDI solutions that facilitate seamless data exchange and operational coordination across national borders. European airlines are proactive in adopting RCDI for enhancing fleet reliability and optimizing maintenance schedules, striving to reduce operational costs while maintaining high safety standards.

Innovation in sustainable aviation and the development of next-generation aircraft also fuel the RCDI market in Europe. There is a growing inclination towards cloud-based RCDI solutions and services, reflecting a broader digital transformation strategy among European aviation stakeholders. The regulatory environment, while stringent, also encourages the adoption of proven technologies that enhance safety and efficiency, thereby stimulating market growth. Collaboration between industry, academia, and governmental bodies is common, aimed at advancing RCDI capabilities, particularly in areas like AI-driven diagnostics and secure data networks. The continuous modernization of both civil and military fleets across Europe ensures a steady demand for cutting-edge remote monitoring and control interfaces.

- Asia Pacific (APAC): The Asia Pacific region is rapidly emerging as the fastest-growing market for Aviation RCDI, propelled by the booming air travel sector, extensive fleet expansion, and significant investments in aviation infrastructure. Countries such as China, India, Japan, and Australia are at the forefront of this growth, driven by a burgeoning middle class, increasing disposable incomes, and the expansion of low-cost carriers. This rapid growth necessitates advanced RCDI solutions to manage the complexity of larger fleets, ensure operational efficiency, and maintain safety standards in a rapidly expanding aviation ecosystem. Governments in the region are actively supporting the development of domestic aerospace capabilities and modernizing air traffic control systems, creating substantial opportunities for RCDI providers.

The APAC market is also characterized by a strong adoption of new technologies, with many airlines and MRO providers willing to invest in the latest digital solutions rather than being encumbered by legacy systems. There is a keen interest in leveraging RCDI for predictive maintenance to mitigate the high costs associated with unscheduled groundings and optimize the utilization of new aircraft. Furthermore, the increasing use of UAVs for various commercial and governmental applications in the region contributes to the demand for sophisticated remote control and diagnostic interfaces. Strategic partnerships between international RCDI solution providers and local aerospace companies are becoming more prevalent, facilitating technology transfer and localized market penetration, ensuring the region's continued strong growth trajectory.

- Latin America: The Aviation RCDI market in Latin America is witnessing steady growth, primarily driven by fleet modernization efforts, increasing air traffic, and the need for enhanced operational efficiency among regional airlines. Countries like Brazil, Mexico, and Chile are leading this expansion, as their aviation sectors strive to meet international safety standards and improve competitiveness. While the market size is smaller compared to North America or Europe, the potential for growth is significant, particularly as economic conditions stabilize and investments in aviation infrastructure increase. Airlines in the region are recognizing the tangible benefits of RCDI in reducing maintenance costs, improving aircraft availability, and optimizing operational performance, prompting gradual but consistent adoption.

Challenges such as economic volatility and, in some areas, less developed infrastructure can impact the pace of RCDI adoption. However, the pressing need to enhance safety and efficiency, coupled with a growing awareness of predictive maintenance benefits, continues to drive market expansion. Opportunities exist for RCDI solution providers to offer cost-effective and scalable solutions tailored to the specific needs of Latin American carriers and MROs, potentially leveraging cloud-based models to reduce upfront capital expenditure. As the region's aviation industry continues its recovery and modernization, RCDI solutions will play an increasingly vital role in supporting sustainable growth and operational excellence.

- Middle East and Africa (MEA): The MEA region presents a dynamic and growing market for Aviation RCDI, characterized by significant investments in new aircraft, the establishment of world-class aviation hubs, and a strong focus on technological innovation. The Middle East, in particular, is a global leader in airline fleet expansion and the development of state-of-the-art airports, necessitating advanced RCDI solutions for managing vast fleets and ensuring optimal operational performance. Major carriers in the UAE, Qatar, and Saudi Arabia are early adopters of cutting-edge RCDI technologies, integrating them into comprehensive digital strategies for predictive maintenance, operational intelligence, and enhanced passenger experience. The region's strategic geographical location also positions it as a critical transit hub, further driving the demand for highly efficient and reliable aviation operations.

In Africa, the RCDI market is in an earlier stage of development but holds considerable growth potential. As African airlines modernize their fleets and governments invest in aviation infrastructure, the demand for sophisticated remote monitoring and diagnostic capabilities is expected to rise. The adoption of RCDI in this sub-region is primarily driven by the need to improve flight safety, reduce high maintenance costs, and overcome logistical challenges associated with maintaining geographically dispersed operations. Local content development and partnerships with international technology providers are key strategies for market penetration. Across the entire MEA region, the emphasis on leveraging RCDI for improved cybersecurity, real-time asset tracking, and optimizing complex supply chains is particularly pronounced, reflecting a commitment to building resilient and technologically advanced aviation ecosystems.

The United States, in particular, leads the North American market, driven by its expansive commercial aviation sector, a large defense budget, and a vibrant ecosystem of technology startups and established aerospace giants. The emphasis on upgrading legacy systems, coupled with ongoing fleet modernization initiatives, ensures sustained demand for sophisticated RCDI solutions. Canadian aviation also contributes to regional growth, with a focus on integrating advanced digital systems into its diverse fleet and MRO operations. The trend towards integrating RCDI with broader digital twin initiatives and comprehensive data platforms for holistic aircraft management is particularly strong in this region, setting benchmarks for global adoption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aviation RCDI Market.- Honeywell International Inc.

- Raytheon Technologies Corporation (Collins Aerospace)

- GE Aviation

- Safran S.A.

- Thales Group

- Lufthansa Technik AG

- SITA

- Rolls-Royce Holdings plc

- Predictive Maintenance Systems Inc.

- Curtiss-Wright Corporation

- Teledyne Controls

- Airbus S.A.S.

- Boeing Global Services

- L3Harris Technologies, Inc.

- Embraer S.A.

- Dassault Aviation

- BAE Systems plc

- Meggitt PLC

- Liebherr-Aerospace

- Rockwell Collins (now part of Collins Aerospace)

Frequently Asked Questions

Analyze common user questions about the Aviation RCDI market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Aviation RCDI and why is it important?

Aviation RCDI (Remote Control and Diagnostic Interface) refers to technologies enabling remote monitoring, control, and data exchange for aircraft systems. It is crucial for enhancing flight safety, operational efficiency, and reducing maintenance costs by enabling proactive fault detection and predictive maintenance from ground-based operations.

How is AI impacting the Aviation RCDI market?

AI is transforming RCDI by enabling advanced predictive maintenance, real-time anomaly detection, and automated diagnostics. It allows systems to learn from vast datasets, leading to more accurate failure predictions, optimized operational efficiency, and improved decision support, fundamentally shifting RCDI towards more intelligent and proactive capabilities.

What are the primary drivers and restraints for the Aviation RCDI market?

Key drivers include the demand for enhanced safety, operational efficiency, and predictive maintenance, coupled with digital transformation trends. Restraints involve high initial investment costs, complex integration with legacy systems, cybersecurity concerns, and a shortage of skilled personnel for managing advanced RCDI solutions.

Which regions are leading the adoption of Aviation RCDI technology?

North America and Europe currently dominate the Aviation RCDI market due to advanced aviation infrastructure and high R&D investments. However, the Asia Pacific region is experiencing the fastest growth, driven by expanding air travel, new fleet acquisitions, and significant investments in aviation technology and infrastructure.

What are the future opportunities in the Aviation RCDI market?

Significant opportunities lie in the continuous advancements of AI/ML for prescriptive maintenance, the integration of 5G technology for real-time data, and the increasing demand from autonomous aircraft and urban air mobility. Additionally, the proliferation of data-as-a-service models and enhanced cybersecurity solutions present new avenues for growth and innovation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager